If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Dow surges 669 points as trade war fears cool

- Slip-up almost keeps key government witness off stand in AT&T trial

- Check world markets now

- Apple fires on Facebook

- NFL cheerleader files complaint over ‘discriminatory’ measures governing conduct

- Privacy activist on a mission to find out what Facebook knows about him

- Don’t count out Microsoft in the race to $1 trillion

- Diversity is dominating the 2018 box office

- Wall Street’s head-spinning reaction to trade headlines

- An immigration bill you’ve never heard of will solve US’s labor shortage

- Buy high and keep buying? Analysts bullish on already hot stocks

- The US and China are in talks to try to avoid a trade war

- How Arianna Huffington’s mom inspires her to live a ‘thriving’ life

- Stormy Daniels interview draws highest ratings for ’60 Minutes’ in 10 years

- Supercar SUVs are hot, but don’t expect an SUV from Ferrari

- Zuckerberg: ‘I’m really sorry that this happened’

- India will be Uber’s last stand in Asia

- Rolling back Dodd-Frank could put big banks at risk

- Iceland is bringing geothermal heating to China

- Remington, founded in 1816, files for bankruptcy

- Arianna Huffington wants to help fix our ‘culture of burnout’

- US and South Korea revamp trade deal that Trump called ‘horrible’

Selected headlines and bullets from Fox Business:

- Microsoft will be worth $1T within year: Morgan Stanley

- Dow posts biggest one-day point gain since 2008

- Connecticut faces vote on $550M bailout for Hartford

- Yeti IPO canceled: $1,300 cooler seller cites market

- Trump exempts South Korea from steel import tariff

- Wall Street bonuses approached record highs in 2017

- Buffett offers German company its full stake in US building products maker USG

- Work email ban after hours in New York City may become law

- Snap shares sink after Chrissy Teigen leaves app

- ObamaCare premiums to rise before midterm elections

- Uber pedestrian spotted with Mobileye software, company says

- Texas steel company’s Indian parent invests $500M

- California teacher fired for calling military service members ‘lowest of our low’

- Meet Boeing’s newest 787 Dreamliner

- Trump tariffs will keep China from ‘screwing’ American workers, Kellyanne Conway says

- Retail renaissance? These companies are launching new locations

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

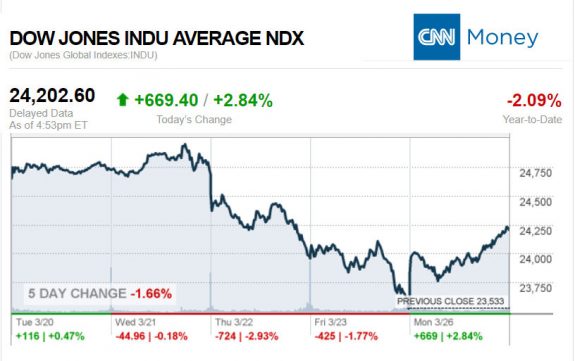

Today’s markets and stocks, at the closing bell…

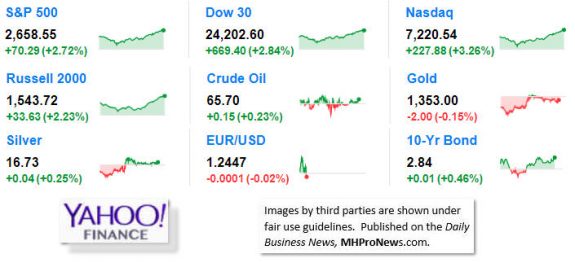

S&P 500 2,658.55 +70.29(+2.72%)

Dow 30 24,202.60 +669.40(+2.84%)

Nasdaq 7,220.54 +227.88(+3.26%)

Russell 2000 1,543.72 +33.63(+2.23%)

Crude Oil 65.70 +0.15(+0.23%)

Gold 1,353.00 -2.00(-0.15%)

Silver 16.73 +0.04(+0.25%)

EUR/USD 1.2446 -0.0002(-0.01%)

10-Yr Bond 2.84 +0.01(+0.46%)

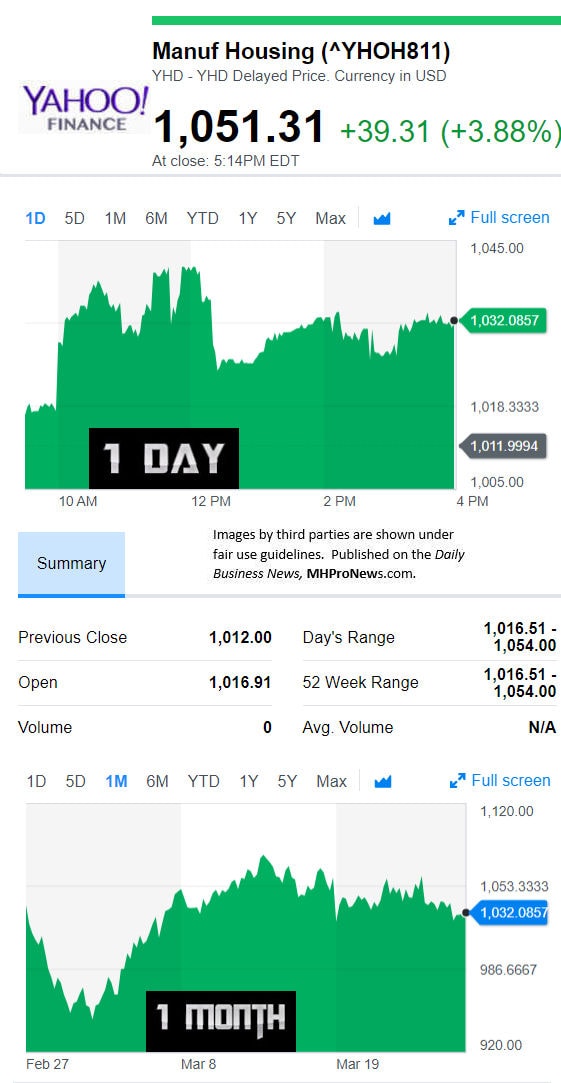

Manufactured Housing Composite Value

Today’s Big Movers

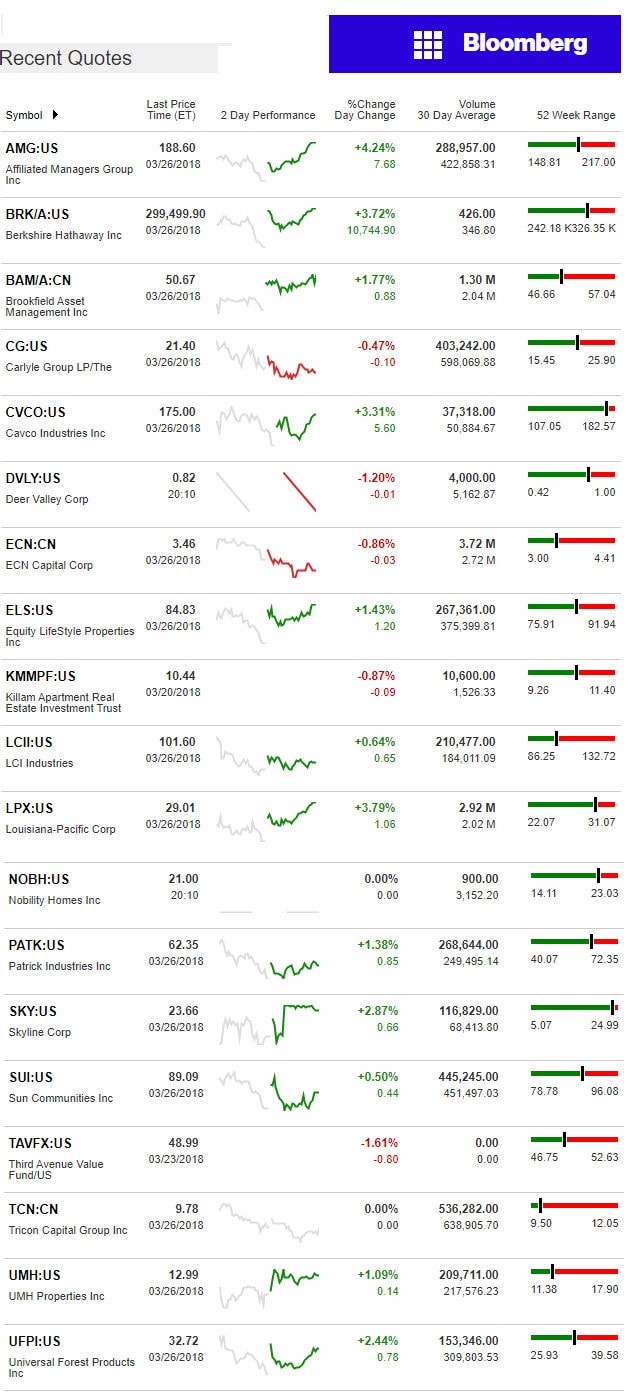

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

What you don’t read here is any credit being given by CNBC’s left-of-center report to the idea that President Trump’s tariff gambit may be paying off.

After decades of Republicans and Democratic administrations alike punting on China, President Trump has taken action. While the outcome is not yet clear, the early signals are positive.

Per CNBC:

- The Dow Jones industrial average closed 669 points higher, as trade worries ease and with Microsoft as the best-performing stock in the index.

- The move higher comes after the major averages posted their worst week since January 2016 amid fears of a trade war between China and the U.S.

- Earlier, the Financial Times reported China has offered to buy more semiconductors from the U.S. to help cut its trade surplus with the U.S.

- Stocks closed sharply higher on Monday, bouncing back from strong losses in the previous session as trade tensions between the U.S. and China appeared to ease.

- The Dow Jones industrial average surged 669.40 points to 24,202.60, with Microsoft as the best-performing stock in the index. The Dow also had its biggest one-day percentage gain since August 2015. The S&P 500 gained 2.7 percent to close at 2,658.55 — bounce off its 200-day moving average— with technology and financials leading all sectors higher. The Nasdaq composite advanced 3.3 percent to 7,220.54 with Apple and Amazon both rising.

- Financials rose sharply, with the Financial Select Sector SPDR S&P Fund (XLF) up 3.3 percent. The XLF posted its biggest one-day gain since November 2016.

- The Financial Times reported China has offered to buy more semiconductors from the U.S. to help cut its trade surplus with the U.S. Shares of Qualcomm and Intel rose 4.6 percent and 6.3 percent, respectively, on the news.

- The Wall Street Journal also reported that U.S. and Chinese officials are working to improve U.S. access to China’s markets.

- Investors “have apparently recognized that a trade war is in no one’s best interests and therefore extremely unlikely,” said Jeremy Klein, chief market strategist at FBN Securities, in a note. “Specifically, the President merely wants to fulfill a campaign promise while China will only enact token countermeasures to appease its citizens.”

- Markets overseas also jumped on Monday. In Asia, some indexes rose after news surfaced that the U.S. had agreed to excuse South Korea from steel levies. Meantime in Europe, stocks were lower as investors failed to shake off trade war worries.

- Wall Street finished Friday’s session deep in the red on Friday, with the Dow dropping more than 400 points by the close — closing at its lowest level since November and finishing in correction territory, as it was 11.6 percent down from its 52-week high. The S&P 500 ended Friday’s session just outside of correction territory.

- Last week, President Donald Trump signed an executive memorandum that would inflict tariffs on Chinese imports — of up to $60 billion. China retaliated with their own set of levies, drawing up a list of 128 U.S. products that could be possible retaliation targets.

- Social media firms continue to be under fire, as abuse of people’s data remains a key topic of discussion. Last week, reports emerged alleging that Cambridge Analytica, an analytics company, had gathered data from 50 million Facebook profiles without the permission of its users. The stock tanked more than 10 percent last week, pressuring the broader tech sector.

- While Facebook have since come out to apologize and try to rectify the matter, concerns remain.

- Facebook shares for most of the session after the Federal Trade Commission announced it was investigating the company’s data practices. Shares of Google-parent Alphabet also declined on the news, before rebounding to close 2.7 percent higher.

- Microsoft led the way for tech stocks, rising 7.6 percent after Morgan Stanley said the company could reach $1 trillion in market cap because of its cloud adoption.

Bloomberg Ticker Closing Data

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)