Some bullets from MarketWatch – Restaurant traffic suffers first decline in five years as fear of recession takes hold. Dow notches new high, 11th record close since Election Day. Fitbit to maintain commanding lead over smartwatches through holidays. 10 REITs that look like big winners for 2017. Chicago Cubs players awarded nearly $370,000 apiece after World Series win.

Gold closed at 1,171.20, down -5.30 and -0.45%.

Oil closed at 50.72, down -1.07 and -2.07%.

For more on President-elect Trump’s 50 billion dollar deal, click here.

S&P 500 2,212.23 7.52 (0.34%).

Dow 19,251.78 35.54 (0.18%).

Nasdaq 5,333.00 24.11 (0.45%).

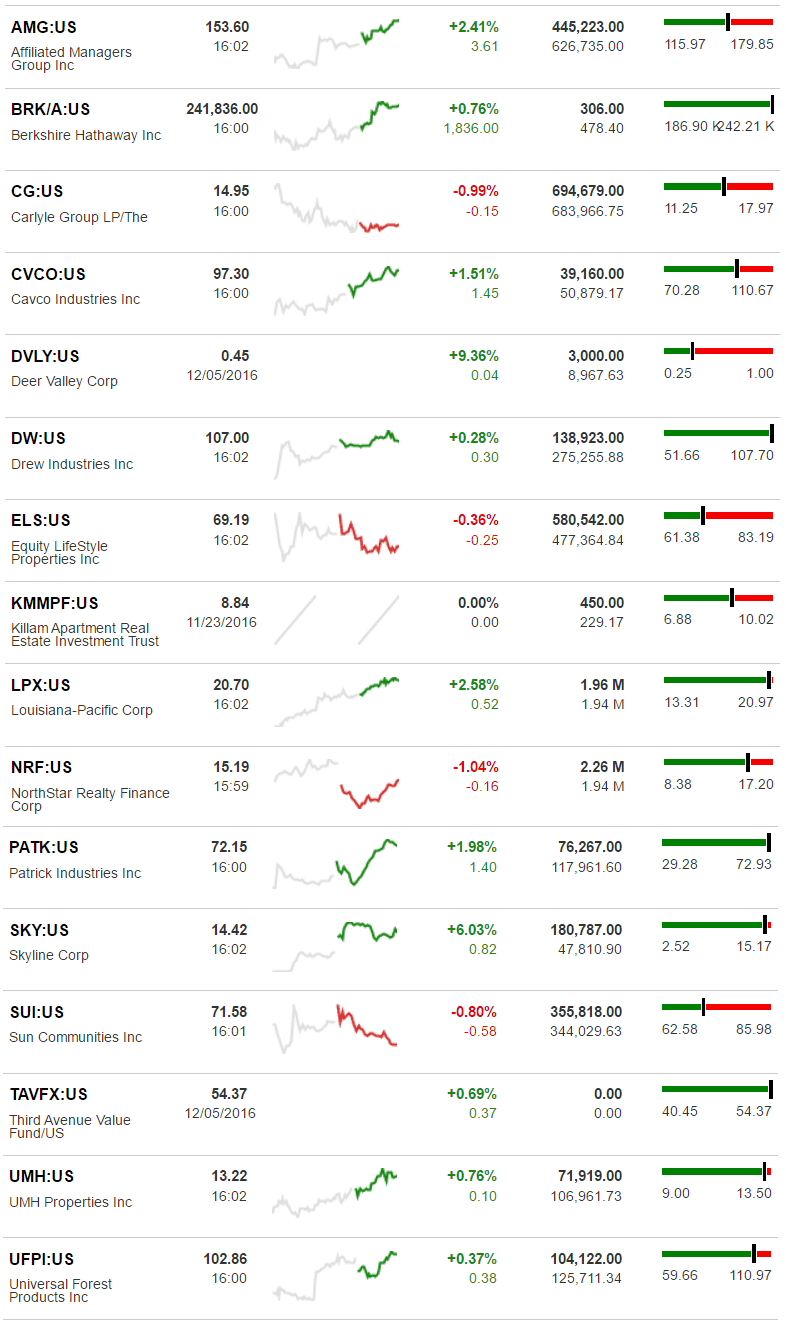

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Skyline Corp. (SKY) and Affiliated Managers Group (AMB). The top two sliders for the day were The Carlyle Group (CG) and NorthStar Realty Finance Corp. (NSF). Killam held steady today, as the stock is only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

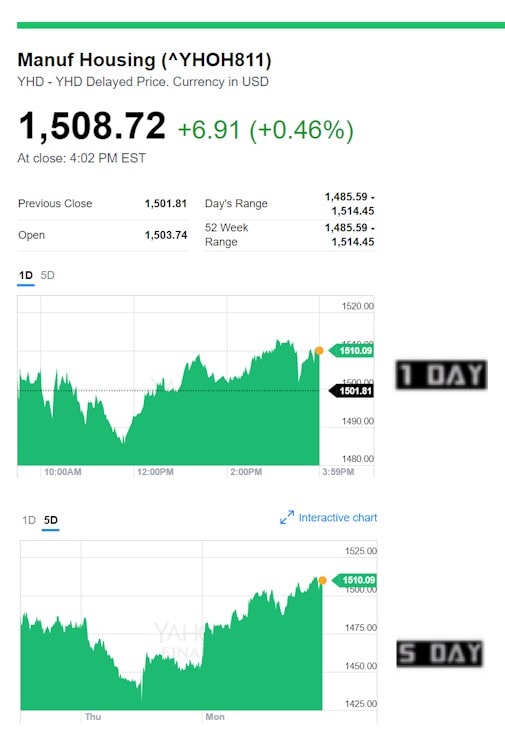

Manufactured Housing Composite Value (MHCV) Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by L. A. ‘Tony’ Kovach to the manufactured housing industry’s Daily Business News market report, for MHProNews.