Noteworthy headlines on CNNMoney – Industry eyes Meredith as Time Inc. suitor. Mnuchin promises biggest tax overhaul since Reagan. Kellogg pulls ads from Breitbart. India’s boom continues but for how much longer?

Some bullets from MarketWatch – Bank stocks keep climbing as data, oil price surge boosts rates. Russell 2000 sees strongest month since October 2011. Oil posts 9% gain as OPEC agrees to cut output for first time in 8 years. Trump just unleashed the stock market’s “animal spirits.”

Oil up 8.38% on OPEC agreement news. As Daily Business News readers are aware, the MH industry has been the beneficiary of gains in oil in the past, seeing its own “booms.”

Gold down 1.34.

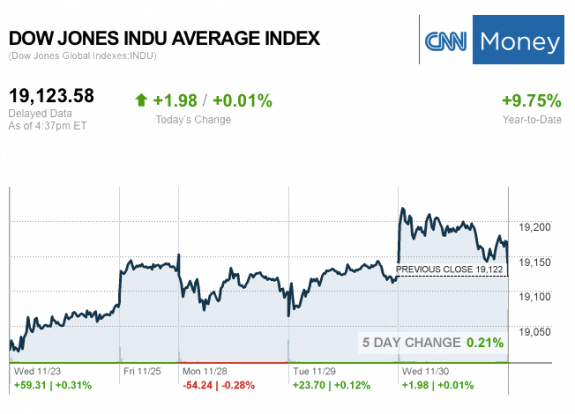

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2,198.91 -5.85 (-0.27%)

Dow JIA 19,123.58 1.98 (0.01%).

Nasdaq 5,323.68 –56.24 (-1.05%).

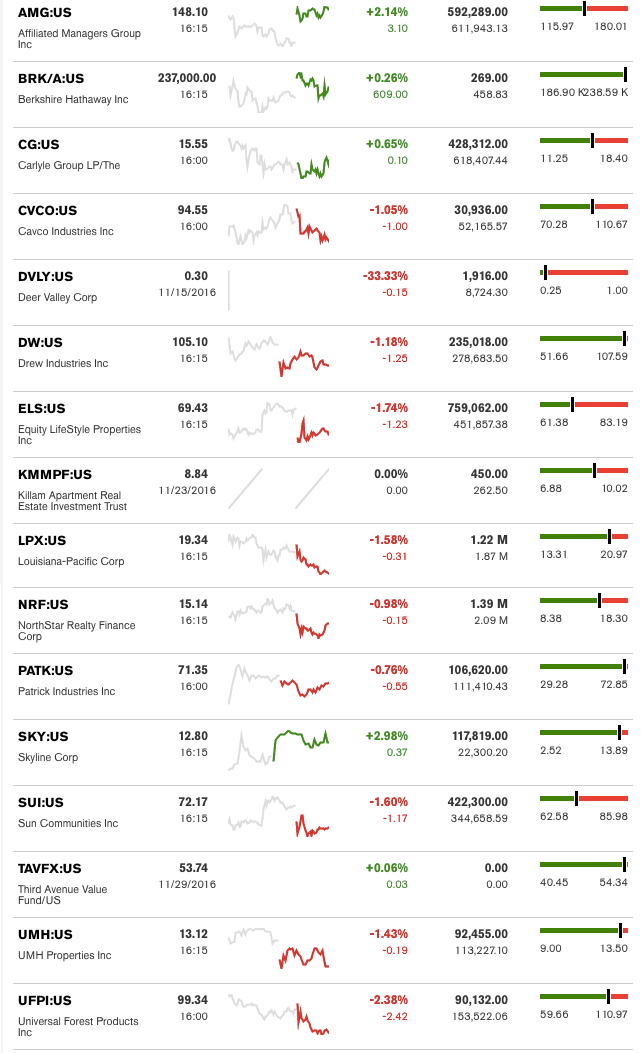

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Skyline Corp. (SKY) and Affiliated Managers Group Inc. (AMG). The top two sliders for the day were Universal Forest Products Inc. (UFPI) and Equity LifeStyle Properties Inc. (ELS). Deer Valley and Killam held steady today, as the stocks are only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

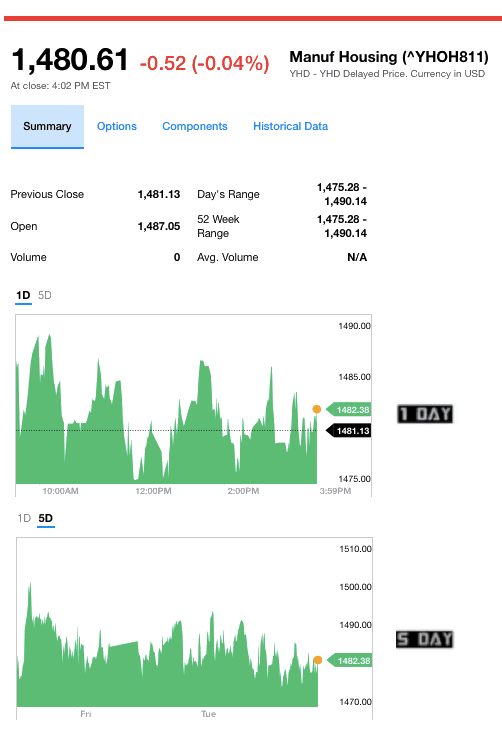

Manufactured Housing Composite Value Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.