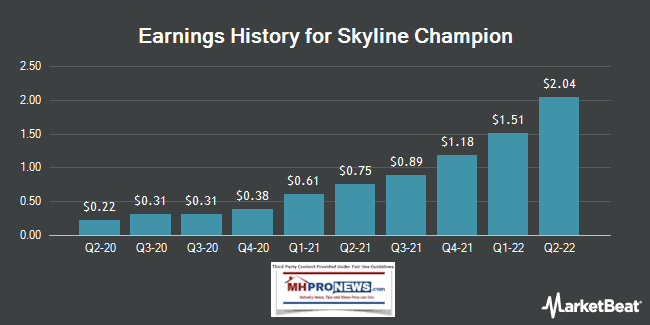

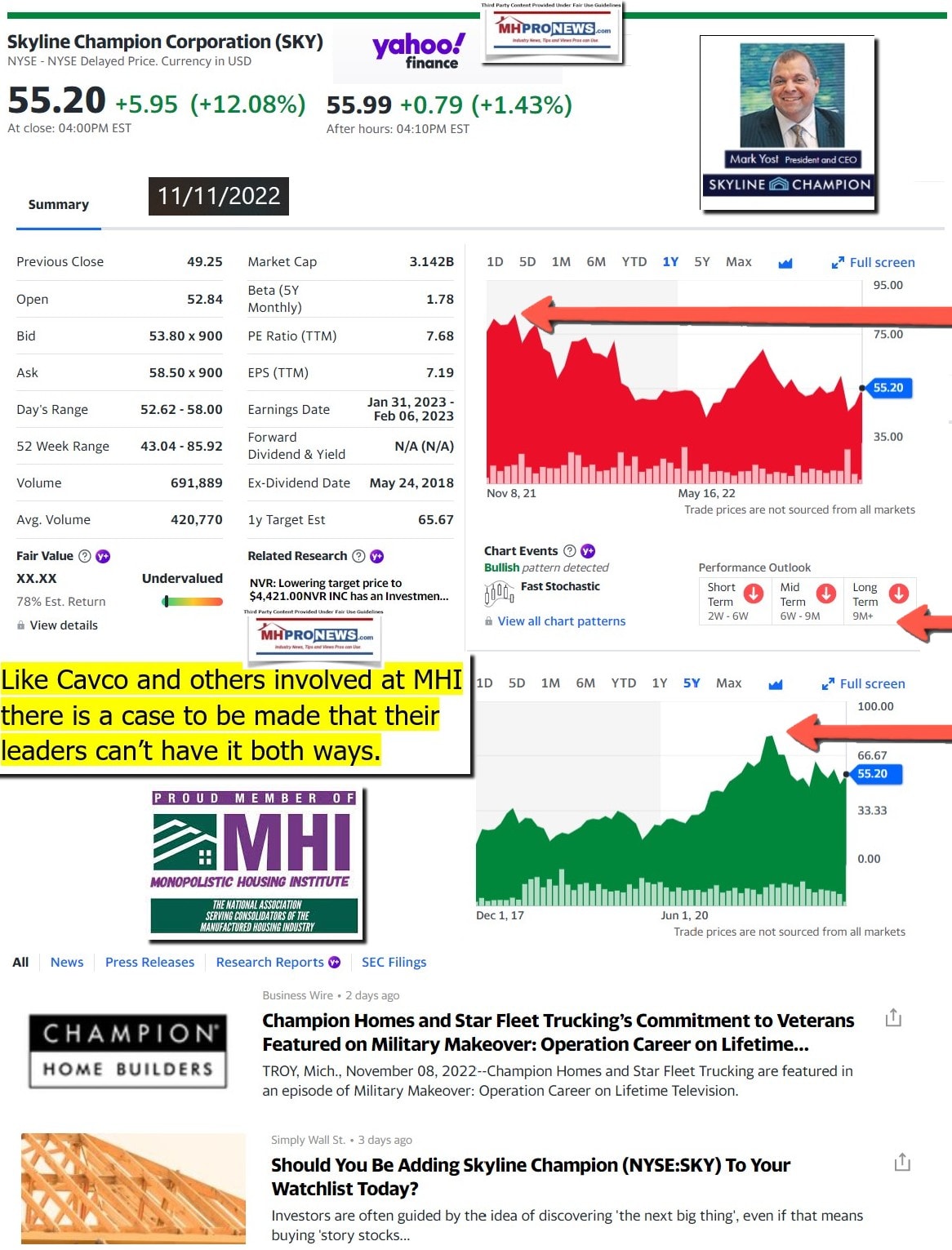

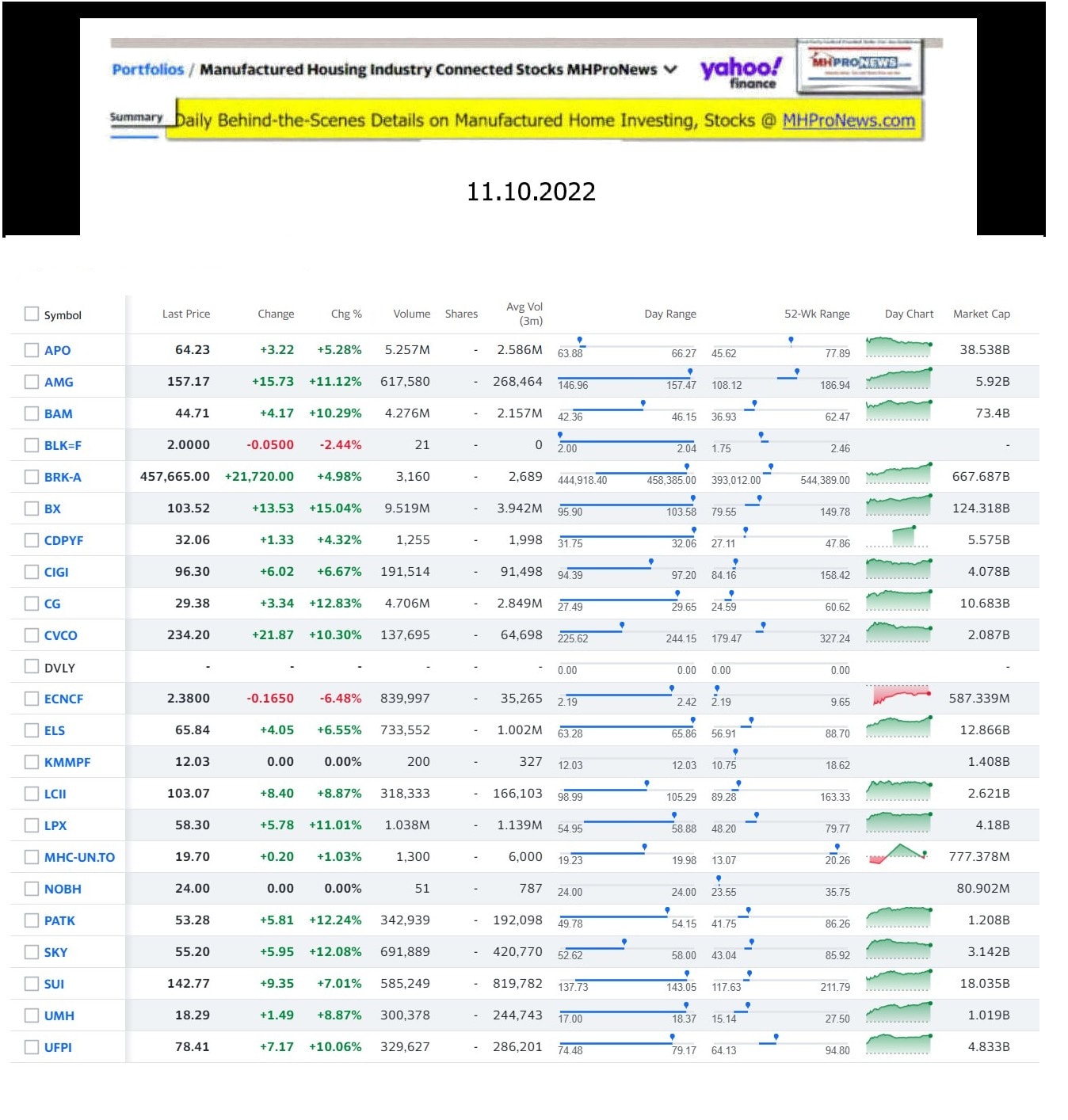

During the quarterly reporting season for publicly traded firms a steady stream of facts, figures, and fascinating comments are provided by companies such as Skyline Champion Corporation (SKY). The bulk of their media release, fascinatingly released through Berkshire Hathaway (BRK) owned Business Wire press release service, is provided below. Berkshire is the parent company to Clayton Homes, 21st Mortgage Corporation, and Vanderbilt Mortgage and Finance (VMF). They and Skyline Champion are all members of the Manufactured Housing Institute (MHI). Following the bulk of the information from Skyline Champion’s release will be more MHProNews analysis and commentary. The final segment of today’s report will provide the customary Daily Business News on MHProNews manufactured home communities Real Estate Investment Trusts (REITs) and manufactured home stock market recaps.

Yellow highlighting in what follows is added by MHProNews, but the text is as in the original media release.

Skyline Champion Announces Second Quarter Year Fiscal 2023 Results

Second Quarter Fiscal 2023 Highlights (compared to Second Quarter Fiscal 2022)

- Net sales increased 53.9% to $806.8 million

- U.S. homes sold increased 23.2% to 7,274

- Total backlog decreased 40.5% to $0.8 billion

- Average selling price (“ASP”) per U.S. home sold increased 29.8% to $103,700

- Gross profit margin expanded by 930 basis points to 34.0%

- Net income increased by 184.1% to $144.1 million

- Earnings per share (“EPS”) increased to $2.51 from $0.89

- Adjusted EBITDA increased 169.6% to $197.1 million

- Adjusted EBITDA margin expanded by 1,050 basis points to 24.4%

- Net cash generated by operating activities of $231.1 million during the quarter

“I am pleased to report another quarter of strong sales and earnings growth,” said Mark Yost, Skyline Champion’s President and Chief Executive Officer. “ During the quarter we added retail distribution through our acquisition of 12 retail sales centers> and continued to drive our long-term strategic initiatives including enhancing the customer buying experience and streamlining product offerings which continues to drive efficiencies and improved profitability. In addition, our ongoing progress to deliver more homes combined with the retailer destocking and order rates, resulted in healthier backlog levels and improved delivery times to our customers. We believe Skyline Champion can continue to outperform the broader housing industry due to our attractive price points, product offerings, enhanced production capabilities and future growth opportunities as more people become buyers of our homes.”

Second Quarter Fiscal 2023 Results

Net sales for the second quarter fiscal 2023 increased 53.9% to $806.8 million compared to the prior-year period. The number of U.S. homes sold in the second quarter fiscal 2023 increased 23.2% to 7,274. Volume growth during the quarter was driven by increased capacity and improved production levels, resulting in a higher number of homes shipped. The ASP per U.S. home sold increased 29.8% to $103,700 due to the mix of units sold, including those sold to the Federal Emergency Management Agency (“FEMA”), and price increases to offset cost inflation. The number of Canadian factory-built homes sold in the quarter decreased to 303 homes compared to 358 homes in the prior-year period due to a shift in product mix to larger homes and reduced demand in certain markets. Total backlog for Skyline Champion was $0.8 billion as of October 1, 2022, compared to $1.4 billion as of October 2, 2021. Backlog decreased due to increased production and a moderation of order rates as retailer’s destock existing inventory.

Gross profit increased by 111.9% to $274.1 million in the second quarter fiscal 2023 compared to the prior-year period. Gross profit margin was 34.0% of net sales, a 930-basis point expansion compared to 24.7% in the second quarter fiscal 2022. Gross profit margin performance is being driven by increased volumes, pricing, lower commodity costs, operational efficiencies and product mix, including sales to FEMA during the quarter.

Selling, general, and administrative expenses (“SG&A”) in the second quarter fiscal 2023 increased to $83.9 million from $61.3 million in the same period last year. SG&A as a percentage of net sales decreased 130 basis points to 10.4%. Higher volumes, increased profitability, and fixed cost leverage during the quarter more than offset higher variable compensation expenses, and additional investments in new capacity.

Net income increased by 184.1% to $144.1 million for the second quarter fiscal 2023 compared to the prior-year period. The increase in net income was driven by the increase in sales volume, pricing, and operating leverage.

Adjusted EBITDA for the second quarter fiscal 2023 increased by 169.6% to $197.1 million compared to the second quarter fiscal 2022 driven by an increase in net sales and improved profitability. Adjusted EBITDA margin expanded by 1,050 basis points to 24.4% due to higher sales and continued operational improvements increasing the leverage of fixed costs.

As of October 1, 2022, Skyline Champion had $677.0 million of cash and cash equivalents.

…

About Skyline Champion Corporation:

Skyline Champion Corporation (NYSE: SKY) is the largest independent, publicly traded, factory-built housing company in North America and employs approximately 8,700 people. With more than 70 years of homebuilding experience and 42 manufacturing facilities throughout the United States and western Canada, Skyline Champion is well positioned with a leading portfolio of manufactured and modular homes, ADUs, park-models and modular buildings for the single-family, multi-family, and hospitality sectors.

In addition to its core home building business, Skyline Champion operates a factory-direct retail business with 31 retail locations across the United States, and Star Fleet Trucking, providing transportation services to the manufactured housing and other industries from several dispatch locations across the United States.

Skyline Champion builds homes under some of the most well-known brand names in the factory-built housing industry including Skyline Homes, Champion Home Builders, Genesis Homes, Athens Park Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, Titan Homes in the U.S. and Moduline and SRI Homes in western Canada.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) throughout this press release, Skyline Champion has provided non-GAAP financial measures, Adjusted EBITDA and Adjusted EBITDA Margin, which present operating results on a basis adjusted for certain items. Skyline Champion uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. Skyline Champion believes that these non-GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that Skyline Champion believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of Skyline Champion’s financial results in accordance with U.S. GAAP.

Skyline Champion defines Adjusted EBITDA as net income or loss plus, (a) the provision for income taxes, (b) interest income or expense, net, (c) depreciation and amortization, (d) gain or loss from discontinued operations, (e) restructuring charges and impairment of assets, (f) other non-operating income and costs, including those for the acquisition and integration or disposition of businesses. Adjusted EBITDA is not a measure of earnings calculated in accordance with U.S. GAAP, and should not be considered an alternative to, or more meaningful than, net income or loss, net sales, operating income or earnings per share prepared on a U.S. GAAP basis. Adjusted EBITDA does not purport to represent cash flow provided by, or used in, operating activities as defined by U.S. GAAP. Skyline Champion believes that Adjusted EBITDA is commonly used by investors to evaluate its performance and that of its competitors. However, Skyline Champion’s use of Adjusted EBITDA may vary from that of others in its industry. Adjusted EBITDA is reconciled from the respective measure under U.S. GAAP in the tables below. Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by net sales reported in the statement of operations.

Forward-Looking Statements

Statements in this press release, including certain statements regarding Skyline Champion’s strategic initiatives, and future market demand are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by use of words such as “believe,” “expect,” “future,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “could,” “should,” “will,” “potential,” “continue,” or other similar words or phrases. Similarly, statements that describe objectives, plans, or goals also are forward-looking statements. Such forward-looking statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of Skyline Champion. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, implied, or projected by such forward-looking statements. Risks and uncertainties include regional, national and international economic, financial, public health and labor conditions, and the following: supply-related issues, including prices and availability of materials; labor-related issues; inflationary pressures in the North American economy; the cyclicality and seasonality of the housing industry and its sensitivity to changes in general economic or other business conditions; demand fluctuations in the housing industry, including as a result of actual or anticipated increases in homeowner borrowing rates; the possible unavailability of additional capital when needed; competition and competitive pressures; changes in consumer preferences for our products or our failure to gauge those preferences; quality problems, including the quality of parts sourced from suppliers and related liability and reputational issues; data security breaches, cybersecurity attacks, and other information technology disruptions; the potential disruption of operations caused by the conversion to new information systems; the extensive regulation affecting the production and sale of factory-built housing and the effects of possible changes in laws with which we must comply; the potential impact of natural disasters on sales and raw material costs; the risks associated with mergers and acquisitions, including integration of operations and information systems; periodic inventory adjustments by, and changes to relationships with, independent retailers; changes in interest and foreign exchange rates; insurance coverage and cost issues; the possibility that all or part of our goodwill might become impaired; the possibility that our risk management practices may leave us exposed to unidentified or unanticipated risks; the COVID-19 pandemic, which has had, and could continue to have, significant adverse effects on us; and other risks set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section, and other sections, as applicable, in our Annual Reports on Form 10-K, including our Annual Report on Form 10-K for the fiscal year ended April 2, 2022 previously filed with the Securities and Exchange Commission (“SEC”), as well as in our Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, filed with or furnished to the SEC.

If any of these risks or uncertainties materializes or if any of the assumptions underlying such forward-looking statements proves to be incorrect, then the developments and future events concerning Skyline Champion set forth in this press release may differ materially from those expressed or implied by these forward-looking statements. You are cautioned not to place undue reliance on these statements, which speak only as of the date of this release. We anticipate that subsequent events and developments will cause our expectations and beliefs to change. Skyline Champion assumes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, unless obligated to do so under the federal securities laws.

| SKYLINE CHAMPION CORPORATION | ||||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||||||||||||

| (Unaudited, dollars in thousands) | ||||||||||||||||||

| October 1, 2022 | April 2, 2022 | |||||||||||||||||

| ASSETS | ||||||||||||||||||

| Current assets: | ||||||||||||||||||

| Cash and cash equivalents | $ | 677,004 | $ | 435,413 | ||||||||||||||

| Trade accounts receivable, net | 82,662 | 90,536 | ||||||||||||||||

| Inventories, net | 240,451 | 241,334 | ||||||||||||||||

| Other current assets | 26,220 | 14,977 | ||||||||||||||||

| Total current assets | 1,026,337 | 782,260 | ||||||||||||||||

| Long-term assets: | ||||||||||||||||||

| Property, plant, and equipment, net | 156,971 | 132,985 | ||||||||||||||||

| Goodwill | 196,574 | 191,970 | ||||||||||||||||

| Amortizable intangible assets, net | 51,262 | 51,283 | ||||||||||||||||

| Deferred tax assets | 14,696 | 17,750 | ||||||||||||||||

| Other noncurrent assets | 61,778 | 58,371 | ||||||||||||||||

| Total assets | $ | 1,507,618 | $ | 1,234,619 | ||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||||||

| Current liabilities: | ||||||||||||||||||

| Floor plan payable | $ | 38,487 | $ | 35,460 | ||||||||||||||

| Accounts payable | 70,981 | 92,159 | ||||||||||||||||

| Other current liabilities | 253,103 | 222,493 | ||||||||||||||||

| Total current liabilities | 362,571 | 350,112 | ||||||||||||||||

| Long-term liabilities: | ||||||||||||||||||

| Long-term debt | 12,430 | 12,430 | ||||||||||||||||

| Deferred tax liabilities | 5,424 | 5,124 | ||||||||||||||||

| Other | 41,450 | 41,840 | ||||||||||||||||

| Total long-term liabilities | 59,304 | 59,394 | ||||||||||||||||

| Stockholders’ Equity: | ||||||||||||||||||

| Common stock | 1,580 | 1,573 | ||||||||||||||||

| Additional paid-in capital | 511,250 | 502,846 | ||||||||||||||||

| Retained earnings | 587,720 | 327,902 | ||||||||||||||||

| Accumulated other comprehensive loss | (14,807 | ) | (7,208 | ) | ||||||||||||||

| Total stockholders’ equity | 1,085,743 | 825,113 | ||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 1,507,618 | $ | 1,234,619 | ||||||||||||||

| SKYLINE CHAMPION CORPORATION | ||||||||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||||

| (Unaudited, dollars and shares in thousands, except per share amounts) | ||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||

| October 1, 2022 | October 2, 2021 | October 1, 2022 | October 2, 2021 | |||||||||||||||

| Net sales | $ | 806,825 | $ | 524,225 | $ | 1,532,706 | $ | 1,034,422 | ||||||||||

| Cost of sales | 532,719 | 394,898 | 1,029,265 | 793,565 | ||||||||||||||

| Gross profit | 274,106 | 129,327 | 503,441 | 240,857 | ||||||||||||||

| Selling, general, and administrative expenses | 83,915 | 61,340 | 156,197 | 115,363 | ||||||||||||||

| Operating income | 190,191 | 67,987 | 347,244 | 125,494 | ||||||||||||||

| Interest (income) expense, net | (1,974 | ) | 845 | (1,884) | 1,494 | |||||||||||||

| Other expense (income) | — | 11 | (634) | (43) | ||||||||||||||

| Income before income taxes | 192,165 | 67,131 | 349,762 | 124,043 | ||||||||||||||

| Income tax expense | 48,073 | 16,408 | 88,519 | 30,419 | ||||||||||||||

| Net income | $ | 144,092 | $ | 50,723 | $ | 261,243 | $ | 93,624 | ||||||||||

| Net income per share: | ||||||||||||||||||

| Basic | $ | 2.53 | $ | 0.89 | $ | 4.59 | $ | 1.65 | ||||||||||

| Diluted | $ | 2.51 | $ | 0.89 | $ | 4.55 | $ | 1.64 | ||||||||||

| SKYLINE CHAMPION CORPORATION | ||||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||||||||||||||||||

| (Unaudited, dollars in thousand) | ||||||||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||||||

| October 1, 2022 | October 2, 2021 | |||||||||||||||||||||||||

| Cash flows from operating activities | ||||||||||||||||||||||||||

| Net income | $ | 261,243 | $ | 93,624 | ||||||||||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||||||||||||||||

| Depreciation and amortization | 12,557 | 10,283 | ||||||||||||||||||||||||

| Amortization of deferred financing fees | 175 | 509 | ||||||||||||||||||||||||

| Equity-based compensation | 7,753 | 4,213 | ||||||||||||||||||||||||

| Deferred taxes | 3,318 | 6,421 | ||||||||||||||||||||||||

| (Gain) loss on disposal of property, plant, and equipment | (85 | ) | 686 | |||||||||||||||||||||||

| Foreign currency transaction loss | 974 | 35 | ||||||||||||||||||||||||

| Change in assets and liabilities: | ||||||||||||||||||||||||||

| Accounts receivable | 7,633 | (15,351) | ||||||||||||||||||||||||

| Inventories | 11,540 | (14,138) | ||||||||||||||||||||||||

| Prepaids and other assets | (14,489 | ) | (17,934) | |||||||||||||||||||||||

| Accounts payable | (21,000 | ) | 407 | |||||||||||||||||||||||

| Accrued expenses and other liabilities | 8,947 | 20,132 | ||||||||||||||||||||||||

| Net cash provided by operating activities | 278,566 | 88,887 | ||||||||||||||||||||||||

| Cash flows from investing activities | ||||||||||||||||||||||||||

| Additions to property, plant, and equipment | (25,613 | ) | (15,105) | |||||||||||||||||||||||

| Acquisitions, net of cash acquired | (6,810 | ) | (207) | |||||||||||||||||||||||

| Proceeds from disposal of property, plant, and equipment | 132 | 66 | ||||||||||||||||||||||||

| Net cash used in investing activities | (32,291 | ) | (15,246) | |||||||||||||||||||||||

| Cash flows from financing activities | ||||||||||||||||||||||||||

| Changes in floor plan financing, net | 3,027 | 5,107 | ||||||||||||||||||||||||

| Payments of deferred financing fees | — | (1,130) | ||||||||||||||||||||||||

| Payments on revolving debt facility | — | (26,900) | ||||||||||||||||||||||||

| Stock option exercises | 596 | 377 | ||||||||||||||||||||||||

| Tax payment for equity-based compensation | (1,363 | ) | (3,007) | |||||||||||||||||||||||

| Net cash provided by (used in) financing activities | 2,260 | (25,553) | ||||||||||||||||||||||||

| Effect of exchange rate changes on cash, and cash equivalents | (6,944 | ) | (411) | |||||||||||||||||||||||

| Net increase in cash and cash equivalents | 241,591 | 47,677 | ||||||||||||||||||||||||

| Cash and cash equivalents at beginning of period | 435,413 | 262,581 | ||||||||||||||||||||||||

| Cash and cash equivalents at end of period | $ | 677,004 | $ | 310,258 | ||||||||||||||||||||||

| SKYLINE CHAMPION CORPORATION | ||||||||||||||||||||||||||

| RECONCILIAITON OF NET INCOME TO ADJUSTED EBITDA | ||||||||||||||||||||||||||

| (Unaudited, dollars in thousand) | ||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||

| October 1, 2022 | October 2, 2021 | Change | October 1, 2022 | October 2, 2021 | Change | |||||||||||||||||||||

| Reconciliation of Adjusted EBITDA: | ||||||||||||||||||||||||||

| Net income | $ | 144,092 | $ | 50,723 | $ | 93,369 | $ | 261,243 | $ | 93,624 | $ | 167,619 | ||||||||||||||

| Income tax expense | 48,073 | 16,408 | 31,665 | 88,519 | 30,419 | 58,100 | ||||||||||||||||||||

| Interest (income) expense, net | (1,974 | ) | 845 | (2,819 | ) | (1,884 | ) | 1,494 | (3,378) | |||||||||||||||||

| Depreciation and amortization | 6,941 | 5,138 | 1,803 | 12,557 | 10,283 | 2,274 | ||||||||||||||||||||

| EBITDA | 197,132 | 73,114 | 124,018 | 360,435 | 135,820 | 224,615 | ||||||||||||||||||||

| Transaction costs | — | — | — | 338 | — | 338 | ||||||||||||||||||||

| Other | — | — | — | (973 | ) | — | (973) | |||||||||||||||||||

| Adjusted EBITDA | $ | 197,132 | $ | 73,114 | $ | 124,018 | $ | 359,800 | $ | 135,820 | $ | 223,980 | ||||||||||||||

Dated November 1, 2022.

Additional Information with More MHProNews Analysis and Commentary

While Skyline Champion’s forward-looking statements generically cautions against “the extensive regulation affecting the production and sale of factory-built housing and the effects of possible changes in laws with which we must comply,” the formulaic claim that they are “difficult to predict and are generally beyond the control of Skyline Champion” is arguably misleading at best. How so?

- There is no specific mention of the looming Department of Energy manufactured housing regulations. These are not difficult to predict at all, if MHI member brands like Skyline Champion fail to act to stop them. See the focused and time-sensitive discussion of that topic linked below.

- Next, zoning and placement barriers are also not at all difficult to predict. Yet they limit Skyline Champion’s ability to perform. What explains the firm’s apparent failures to fix a problem that could cause this segment of the affordable housing industry to blossom and flourish?

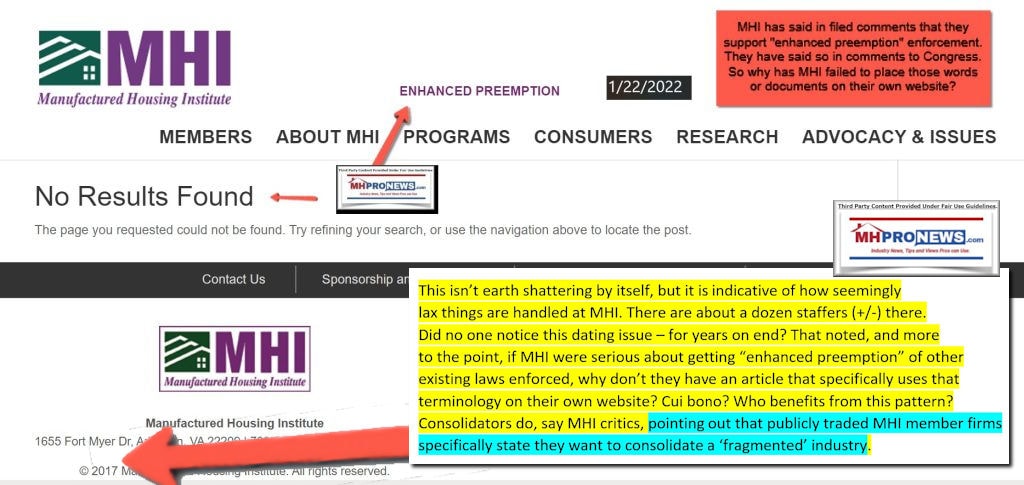

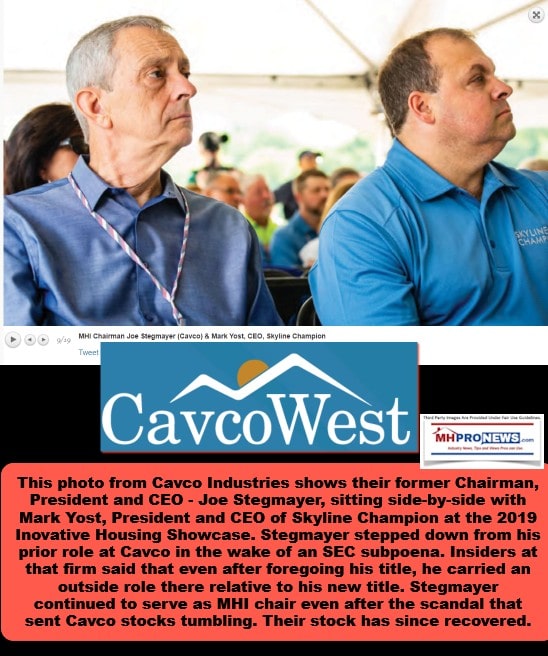

- SKY CEO Yost had available face time with federal officials at the Innovative Housing Showcase (IHS) last June, which included HUD Secretary Marcia Fudge. Skyline Champion holds a board position at MHI. As the Biden-Harris campaign website proclaimed in 2020, access in Washington, D.C. is a form of currency. Yet there is no known push by Yost, the company he leads, nor MHI at the public venue to get Fudge to change HUD’s stance on the proper implementation of the Manufactured Housing Improvement Act (MHIA) of 2000’s so-called “enhanced preemption” provisions. If those federal “enhanced preemption” provisions for manufactured housing were properly implemented, the industry could soar during this affordable housing crisis.

- Secretary Fudge didn’t hide her thoughts on enhanced preemption. Nor did she hide that ‘until we start to address this we are going to be perpetually in this kind of situation.’ Restating and summing up on this topic, Skyline Champion is correct in asserting, as Yost said: “We believe Skyline Champion can continue to outperform the broader housing industry due to our attractive price points, product offerings, enhanced production capabilities and future growth opportunities as more people become buyers of our homes.” That is similar to what fellow MHI member Cavco’s William “Bill” Boor said.

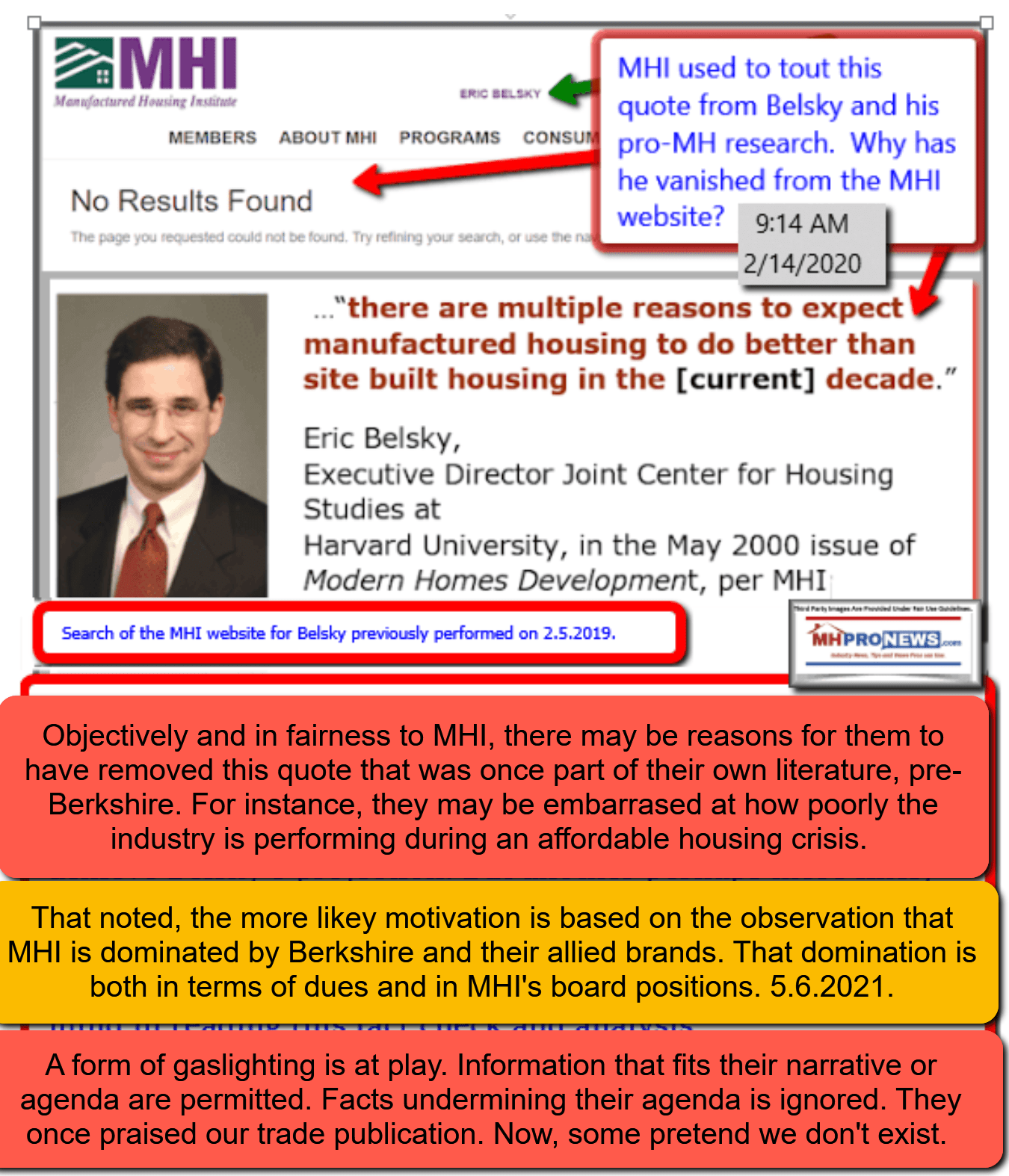

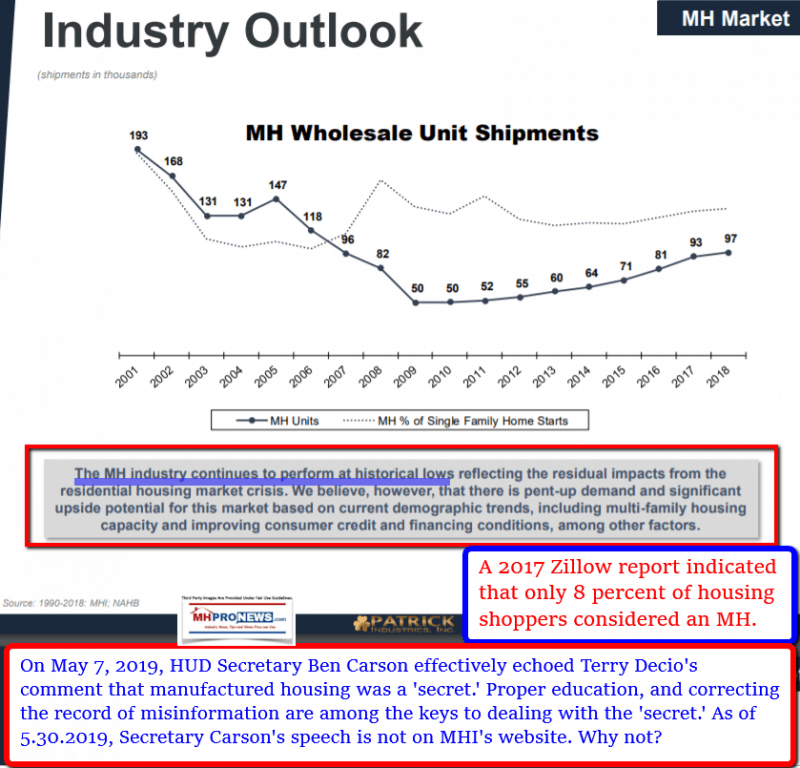

- But the technical ability to grow significantly in an organic fashion – by investing in new plants/production centers and helping develop more retail distribution rather than merely buying up competitors is apparently being thwarted by the de facto policies of Skyline. Something similar could be applied historically to Cavco, Berkshire/Clayton Homes, and others involved in MHI. This pattern of the manufactured housing industry’s ability to grow, but the failure to actually do so is underscored by the following third-party quoted example of then Harvard researcher Eric Belsky. His words are now over 2 decades old. The HUD Code manufactured home industry’s market share of the total single-family housing production has only slid since then.

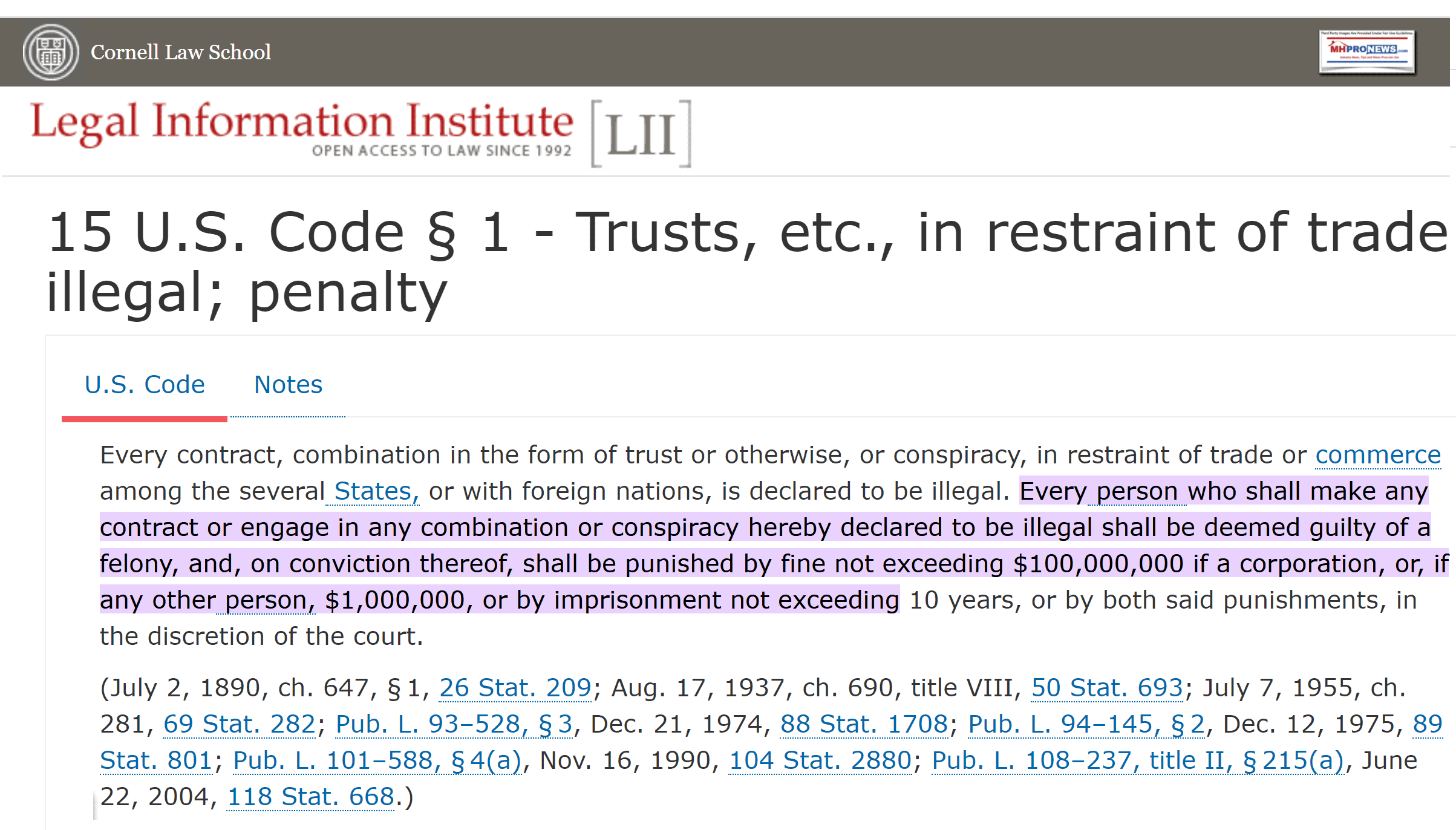

- A fact and evidence-based argument can thus be made that Skyline Champion and others involved at MHI are seemingly violating antitrust laws. They do so in a fashion that could be costing shareholders greater earnings capacity.

- Such quotes and evidence get little to no explanation from Skyline Champion officials, including Yost. Note too that there are those in manufactured housing that say they can open a new production center for a lower cost than to buy out an existing producer. Instead of buying production capacity, they could develop it. The retail demand for affordable housing is there. MHI’s own people, like Jennison, made it clear that far greater sales levels are possible.

- FHFA and FHA regulations could have similarly factual and evidence-based arguments made. Indeed, they have been by MHARR’s President and CEO Mark Weiss and their senior advisor, Danny Ghorbani.

Cavco recently announced it’s purchase of the vertically integrated manufactured home producer/retailer Solitaire Homes. Specifically, CVCO’s comments said the buyout “including its four manufacturing facilities, twenty-two retail locations and its dedicated transportation operations” and “The purchase price totals $93 million, before certain adjustments that will be determined upon close of the transaction.” Skyline Champion’s cash on hand/cash equivalents could hypothetically complete 6 such acquisitions, if there were enough independents remaining to do so.

But as noted herein, there are manufactured home producers who have told MHProNews that they can bring online new production centers for a lower cost than is necessary to acquire existing capacity through Merger and Acquistion (M&A) style of growth. This is another example of how capital deployment by Skyline Champion is questionable at best, and possibly illegal at worst.

While the fine assessed against Cavco Industries for SEC claimed violations of federal law was ‘only’ some $1.5 million dollars, apparently much more was spent by that company and its former leaders in that legal battle that also included shareholders litigation.

When these various puzzle pieces of facts, evidence, and common sense are assembled what apparently emerges is a troubling case that reflects harm and avoidable risk for Skyline Champion investors.

Shareholder plaintiffs’ attorneys who may handle such cases on contingency may, due to the Cavco and Equity Lifestyle Properties (ELS) cases, be coming to realize that manufactured housing is fertile ground for litigation. Either public officials, or shareholders attorneys, could press public companies and MHI for their apparent roles that are harming access to affordable housing while the industry is being limited by the failure of those inside the industry to do what logic and common-sense dictates.

Like some, not all, other firms involved at MHI, there is a case to be made that Skyline Champion’s own remarks could come back to haunt them legally.

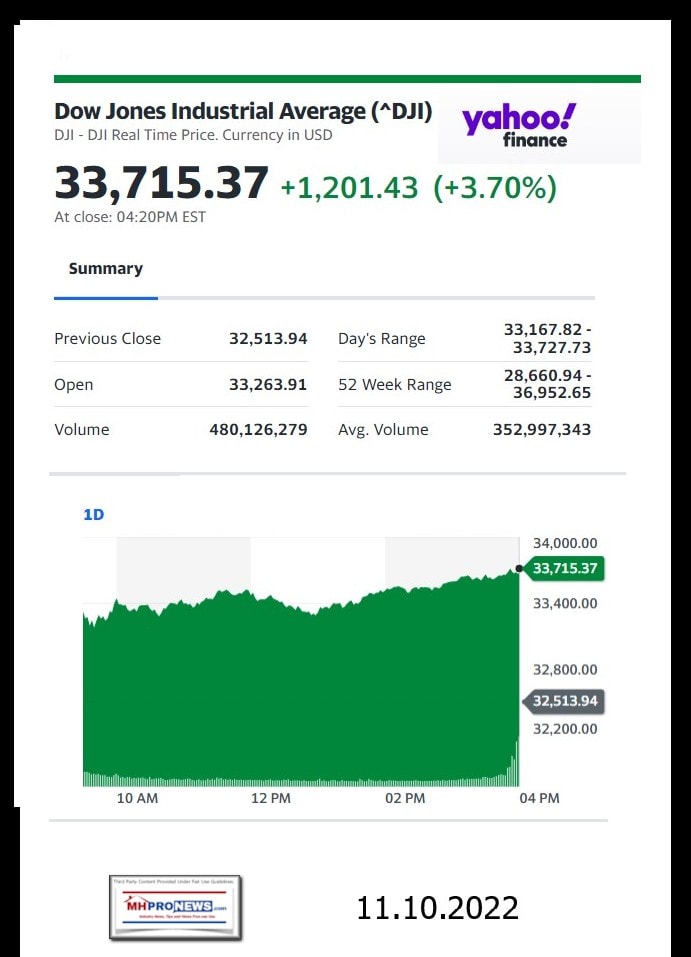

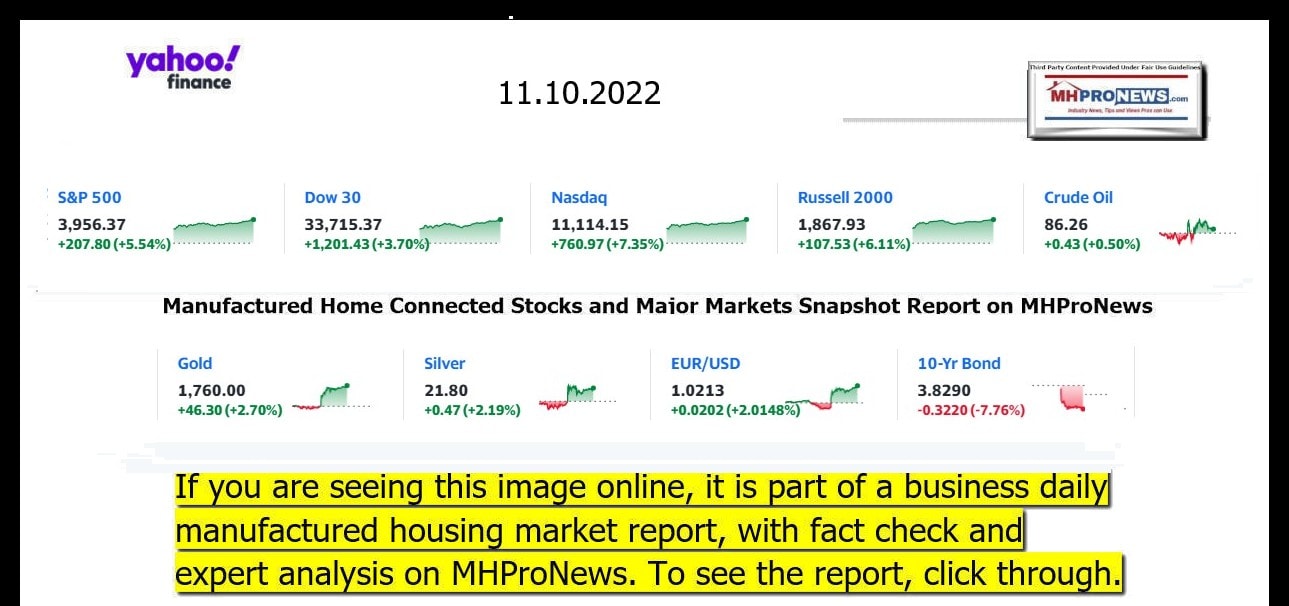

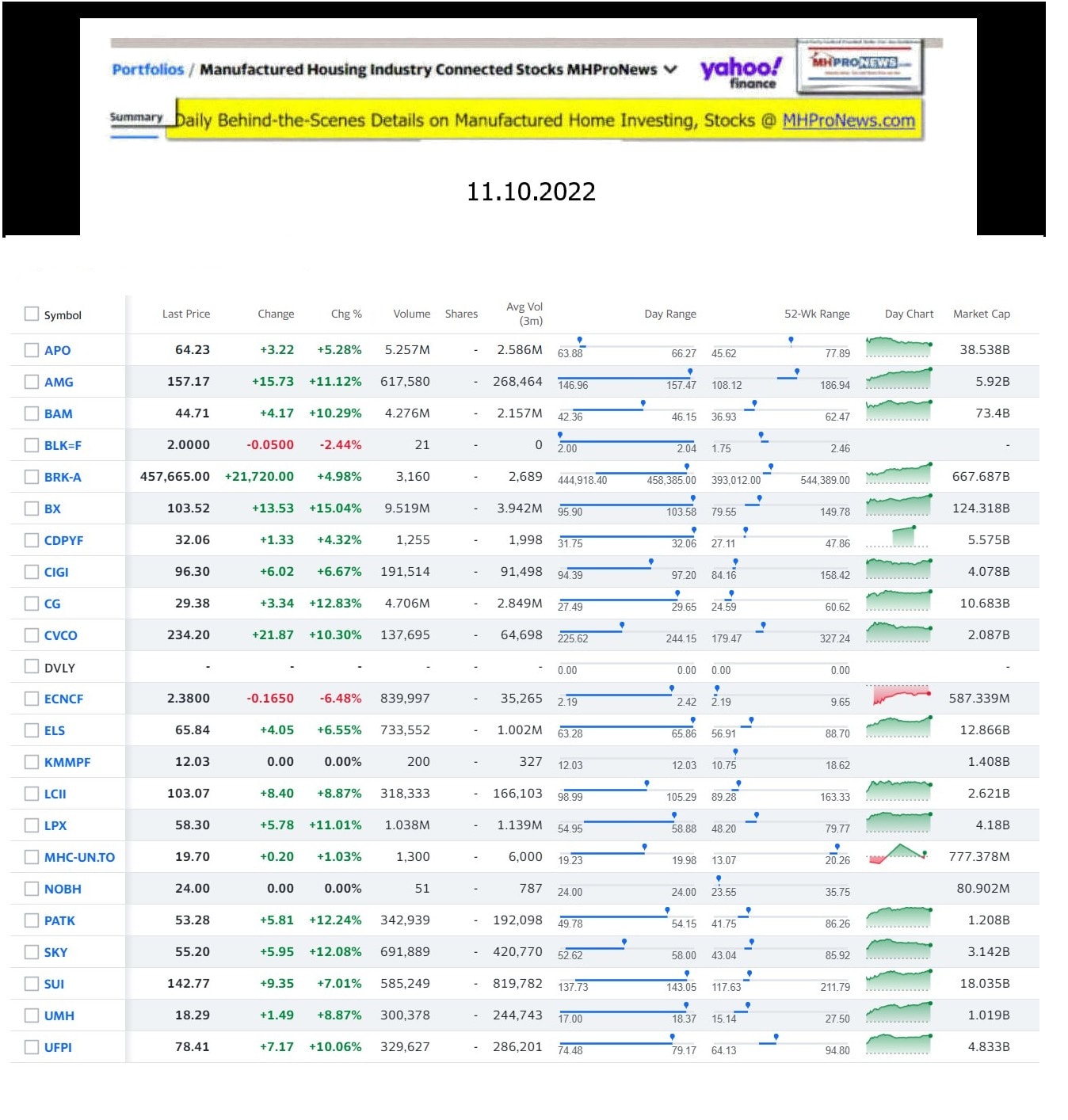

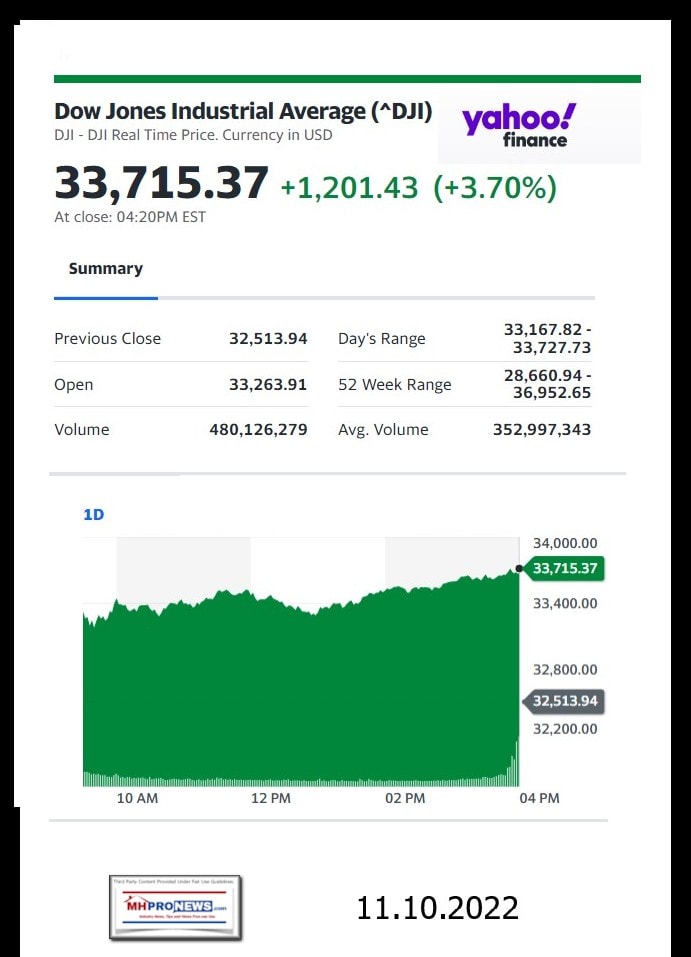

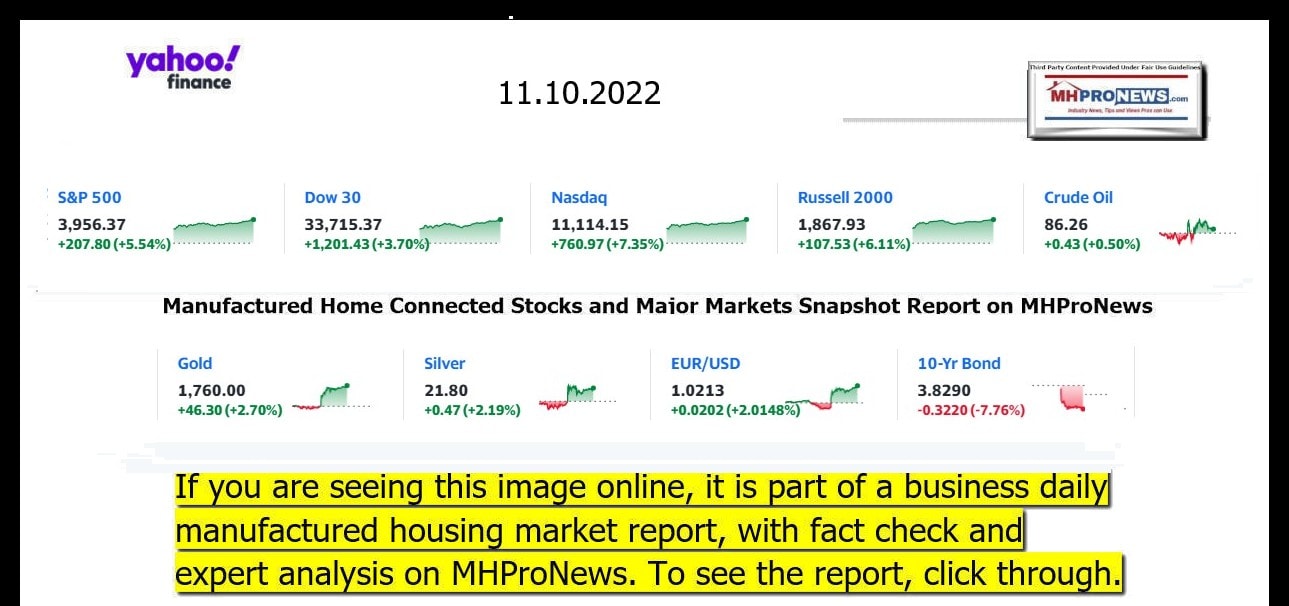

Daily Business News on MHProNews Markets Segment

The modifications of our prior Daily Business News on MHProNews recap of the recap of yesterday evening’s market report are provided below. It still includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines. The macro market moves graphics will provide context and comparisons for those invested in or tracking manufactured housing connected equities.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 11.10.2022

- Best day since 2020

- Traders work on the floor at the New York Stock Exchange in New York, Thursday, Nov. 10, 2022.

- LIVE UPDATES Stocks post massive gains after new data shows inflation eased

-

Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, X out (close) the window, or depending on the device, you may need to use your back key, escape key (Esc), or follow the prompts. The moment Wall Street has been waiting for

- FTX founder issues public apology as company verges on collapse

- Crypto crash and gold sell-off show there’s no place for investors to hide

- Twitter’s cybersecurity chief quits amid company turmoil

- Inflation cools much more than expected in October

- New car prices are finally coming down. But not by much

- KFC Germany apologizes for advertising a Kristallnacht promotion

- Alex Jones ordered to pay nearly half a billion dollars to Sandy Hook families in additional damages

- Home prices rose almost everywhere in the US this summer

- Prices on a few grocery items are actually coming down

- Here’s what’s getting more expensive at the grocery store

- Gap launches its store on Amazon

- How crypto’s golden boy lost billions, the end of quiet quitting, and the biggest mistake the Powerball winner can make

- The Facebook logo reflected in a puddle at the company's headquarters in Menlo Park, California, U.S., on Monday, Oct. 25, 2021.

- ‘I got this wrong’: Why thousands of tech workers are losing their jobs

- The US Treasury Department in Washington, DC, US, on Wednesday, Nov. 9, 2022.

- US monthly budget deficit dropped to $88 billion in October

- MARKETS

- A Twitter headquarters sign is shown in San Francisco on Friday November 4, 2022.

- Twitter rolled out gray ‘official’ check marks. Then Musk changed his mind

- Why Musk just sold nearly $4 billion worth of Tesla stock

- A beginner’s guide to Twitter alternative Mastodon

- Twitter founder apologizes after Musk lays off staff

- Musk said Twitter has seen a ‘massive drop in revenue’

- WORKERS’ RIGHTS

- From left to right: Naomi Martinez, Tori Tambellini, Nabretta Hardin, Michelle Eisen.

- These baristas are leading the campaign to unionize Starbucks

- Getting laid off? Know your rights

- Railroad unions push back threatened strike date

- British nurses to hold first ever strike over pay

- Workers vote against first unionizing effort at Home Depot

Headlines from right-of-center Newsmax 11.10.2022

- GOP’s Kari Lake: Arizona ‘Slow Rolling the Results’ to ‘Delay Inevitable’

- Arizona elections officials are “slow rolling the results” to “delay the inevitable” outcome of her win, Republican gubernatorial candidate Kari Lake tells Newsmax. [Full Story]

- The 2022 Elections

- Dems Spending $7M on Field Organizing Before Ga. Runoff

- GOP +7 in House, Needs to Seat 8 More for Majority | video

-

“In the business world, the rear-view mirror is always clearer than the windshield.” – Warren Buffett. That begs a key question. Why don’t more people LOOK at the rearview mirror so they can learn more about the patterns that influence what’s ahead? Note: depending on your browser or device, many images in this report can be clicked to expand. or example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts. David Shafer to Newsmax: Big Names Will Back Herschel Walker in Runoff

- Kari Lake: Arizona ‘Slow Rolling the Results’ to ‘Delay Inevitable’ | video

- Boebert Up 386 Votes in Tight Colo. Reelection Bid

- Y. Rep.-Elect Lawler: Gerrymandering Sank Maloney | video

- GOP Rep. Herrell’s New Mexico Loss Flips House Seat

- Fmr Interior Secretary Ryan Zinke Wins Montana House Seat

- Conservative Deposes Iowa’s 40-Year ‘Eternal General’

- Beto O’Rourke’s Political Future in Question After 3 Failed Runs

- More The 2022 Elections

- Newsmax TV

- Austin Scott ‘Georgia Is a Red State’

- Comer: Evidence on Hunter Biden Revealed Soon | video

- Cline: ‘Rough Winter’ Ahead Due to Energy Costs | video

- Florida CFO: DeSantis Wanted in ‘Broken’ Washington | video

- AG: DeSantis’ ‘Freedom’ Mantra Resonates | video

- Ron Johnson to Newsmax: How Bad Does It Have to Get to Vote Dems Out? | video

- Newsfront

- Alex Jones Ordered to Pay $473M More to Sandy Hook Families

- Infowars host Alex Jones and his company were ordered by a judge Thursday to pay an extra $473 million for promoting false conspiracy theories about the Sandy Hook school massacre, bringing the total judgment against him in a lawsuit filed by the victims’ families to $1.44 billion…. [Full Story]

- Tweets With Racial Slurs Soar Since Musk Takeover: Report

- Instances of racial slurs have soared on Twitter since Elon Musk [Full Story]

-

In instances such as Apollo, Berkshire Hathaway, Blackstone or others, manufactured housing may only be part of their corporate interests. Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts. Ukraine Says Russians Will Take One Week to Withdraw From Kherson

- Ukrainian troops pushed towards Kherson on Thursday, after Moscow [Full Story]

- Related

- Video Report: Ukraine Questions Whether Russia is Withdrawing From Kherson |video

- Zelenskyy, Bush to Chat Publicly in Dallas

- Milley: 200,000 Killed or Wounded in Ukraine War

- Russian President Vladimir Putin Will Not Attend G-20 Summit

- Russian Ambassador: Ukraine Dirty Bomb Would Cause ‘Radiation Disaster’

- Justice Sotomayor Defends N.Y. Vaccine Mandate

- Supreme Court Justice Sonia Sotomayor rejected a challenge to prevent [Full Story]

- 6 Committee’s True Intentions Behind Trump Subpoena

- Legal experts say that the House Jan. 6 select committee issued a [Full Story] | Platinum Article

- Newsmax Draws 5-Plus Million Viewers On Election Night!

- Newsmax’s comprehensive 2022 election night coverage drew over 5 [Full Story]

- Video Report: Hurricane Nicole Damages South Florida Pier

- Hurricane Nicole made landfall in Florida as a Category 1 storm [Full Story] | video

- Biden to Nominate Daniel Werfel to Head Up IRS: Report

- President Joe Biden will nominate Daniel Werfel to be the next [Full Story]

- Iran Rocket Test Boosts Odds of Israeli Strike, Middle East War

- The odds of a war breaking out between Israel and Iran have increased [Full Story] | Platinum Article

- Dow Soars 1,026 Points on Cooling Inflation Data

- The Dow was up 1,026 points, or 3.16%, and the tech-heavy Nasdaq, up [Full Story]

- FTC Monitoring Twitter’s Top Executives Resignations

- The Federal Trade Commission threatened to again probe Twitter after [Full Story]

- DC AG Filing Civil Suit Vs. Commanders, Snyder, NFL, Goodell

- The attorney general for the District of Columbia said Thursday his [Full Story]

- Microsoft Founder Paul Allen’s Artwork Sells for $1.5 Billion

- Works by artists including Czanne, Seurat, and van Gogh sold for a [Full Story]

- AOC ‘Complains About Twitter … on Twitter,’ Musk Trolls

- Alexandria Ocasio-Cortez, D-N.Y., took to Twitter to sound off [Full Story]

- Repeat COVID Increases Risk for Complications, Hospitalization, Death

- The risk of death, hospitalization and serious health issues from [Full Story]

- Millions Still Await Tax Refunds Due to IRS Backlog

- Millions of Americans continue to wait for 2021 tax year refunds due [Full Story]

- Poll: Nearly Half Say Media’s Midterm Coverage Favored Dems

- Only 37% of likely voters rate the media coverage of the midterm [Full Story]

- ‘SNL’ Staff ‘Boycotting’ Dave Chappelle-Hosted Episode

- News that Dave Chappelle will be hosting “Saturday Night Live” has [Full Story]

- Amazon Reviewing Alexa, Retail to Cut Costs

- com Inc. is reviewing unprofitable business units, including [Full Story]

- Xi Stresses ‘Combat Readiness’ With Chinese Military

- Chinese President Xi Jinping told his military to “devote all its [Full Story]

- Related

- Biden Seeks ‘Rules of the Road’ for China Relations in Xi Meeting

- Man Facing 5 Years for Threatening Jews, Synagogues

- Omar Alkattoul, 18, of Sayreville, New Jersey, was arrested Thursday [Full Story]

- Dems’ Campaign Chief Maloney: I Let People Down in N.Y. House Defeat

- The fallout of Rep. Sean Patrick Maloney, D-N.Y., losing his [Full Story]

- Marine Corps Celebrates 247 Years

- The Marine Corps commandant used the Corps’ annual birthday message [Full Story] | video

- Video Report: Europe Wants US to Change Inflation Reduction Act

- European officials are demanding the U.S. make drastic changes to the [Full Story] | video

- Luke Combs Tops CMA Awards; Loretta Lynn, Lewis Honored

- Luke Combs was crowned entertainer of the year at Wednesday’s Country [Full Story]

- US Weather Satellite, Test Payload Launched Into Space

- A satellite intended to improve weather forecasting and an [Full Story]

- Consumer Inflation Slows, but Still High at 7.7 Percent

- Price increases moderated in the United States last month in the [Full Story]

- FDA Recalls Hand Sanitizer Over Possible Toxin

- A batch of hand sanitizer was recalled after it was found to contain [Full Story]

- Biden: Investigation, Impeachment Threats ‘Almost Comedy’

- President Biden on Wednesday called threats of potential impeachment [Full Story]

- Cruz to Campaign for Herschel Walker in Georgia Runoff

- Ted Cruz, R-Texas, is throwing his gravitas behind Republican [Full Story]

- CDC Investigating Multistate Listeria Outbreak That Includes 1 Death

- A multi-state listeria outbreak, tied to deli meats and cheeses, has [Full Story]

- Finance

- Dow Soars 1,026 Points on Cooling Inflation Data

- The Dow was up 1,026 points, or 3.16%, and the tech-heavy Nasdaq, up 6.26%, led a rally on Wall Street’s main indexes on Thursday as of 2:10 p.m. EST, on signs of cooling consumer prices…. [Full Story]

- Treasury Yields Dive as October Inflation Cools

- Coinbase Cuts Jobs Again as Cryptos Extend Fall

- Rent, Gas, Food Continue to Surge

- Dollar on Track for Biggest Plunge Since 2015

- More Finance

- Health

- New Study Finds Highly Processed Food Linked to Premature Death

- New Study Finds Highly Processed Food Linked to Premature Death

- A new study from Brazil offers more evidence that eating a diet of highly processed foods is dangerous to your health. Ultra-processed foods such as hot dogs, chips, soda, and ice cream not only trigger obesity and high cholesterol, but they may also cause premature…… [Full Story]

- Study: Mindfulness Program as Effective as Antidepressants at Treating Anxiety

- Smartphones Harbor Irritating Allergens

- FDA Authorizes Arthritis Drug to Treat COVID-19 in High-risk Patients

- Best Surgery Option to Prevent Amputation From Leg Artery Disease

===================================

- NOTE 1: The 3rd chart above includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE 2: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE 3: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

- Note 4: some recent or related reports to the equities named above follow.

2022 …Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory-built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.

Tony earned a journalism scholarship along with numerous awards in history. There have been several awards and honors and also recognition in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.