From time to time state association executives or their staff send hot links into their members to select members. These are often about mainstream news stories that the executive or an association staffer at times fails to carefully check. We’re human, it happens.

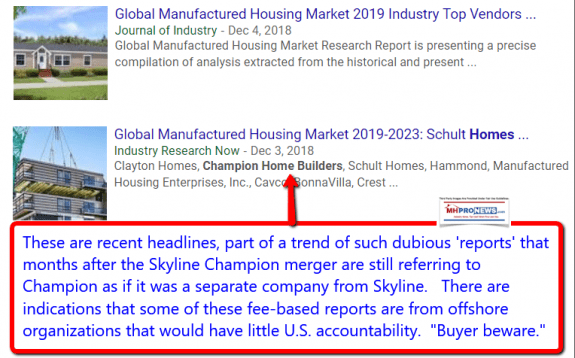

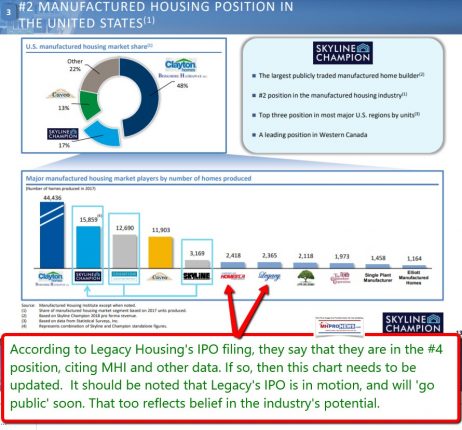

But as MHProNews reported last year, there are a growing number of often off-shore operations that claim to be doing market research on factory-built homes, including manufactured homes. They are doing what is often flawed, misleading, or outdated ‘research’ – and now that is apparent at-a-glance. Because Champion Home Builders or Skyline Corporation is now Skyline Champion (SKY). See a recent example, below.

Something similar happens in the modular housing field too, as MHBA’s Tom Hardiman has told MHProNews. See that related report, by clicking the linked box below.

Respectfully, it’s past time that associations do a better job of curating what they send out to their members, unless they come with commentary that explains the problems and errors, such as this “Global” report.

That clarification of faked, misleading or otherwise problematic reports about factory-built housing said, let’s dive into latest reporting on Skyline Champion (SKY), with analysis and commentary. Prior to the opening bell, here was some data from SKY, which is one of the tracked stocks on our evening market report. Last Friday’s manufactured housing connected stocks evening report on the Daily Business News is linked here.

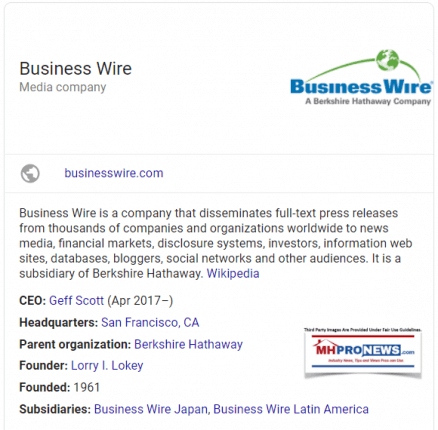

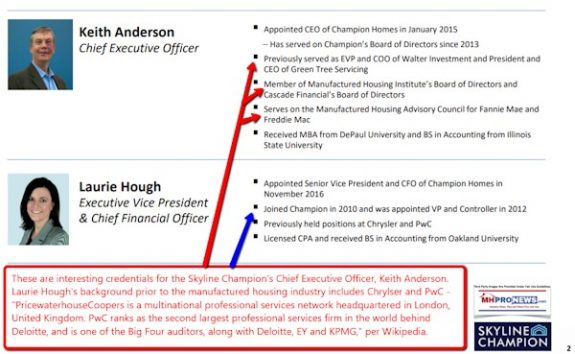

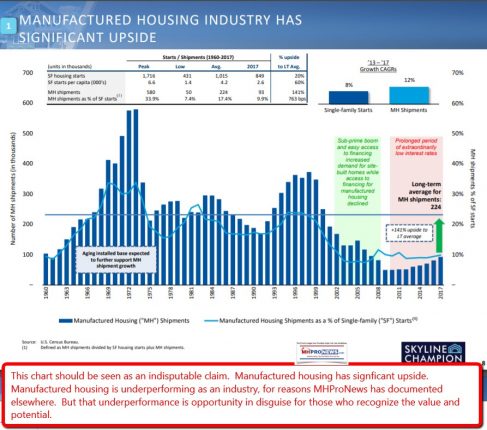

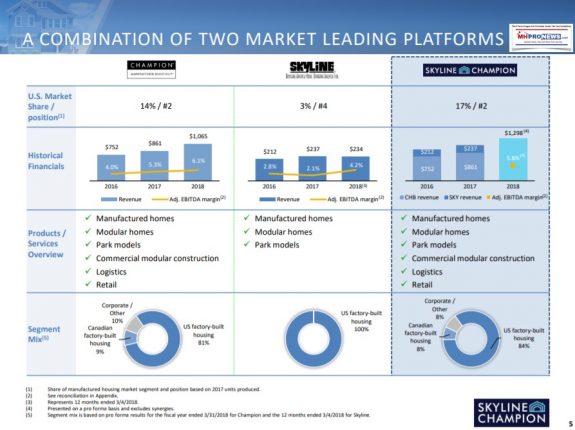

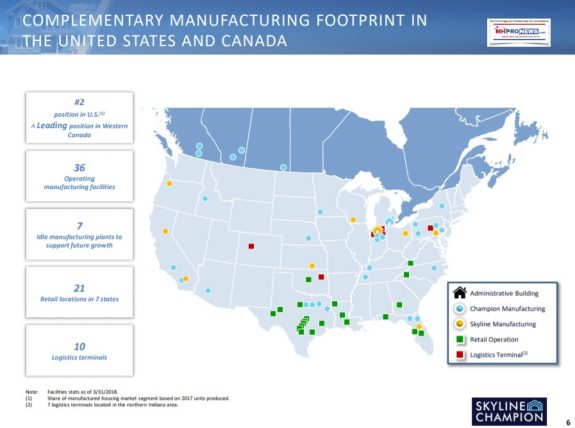

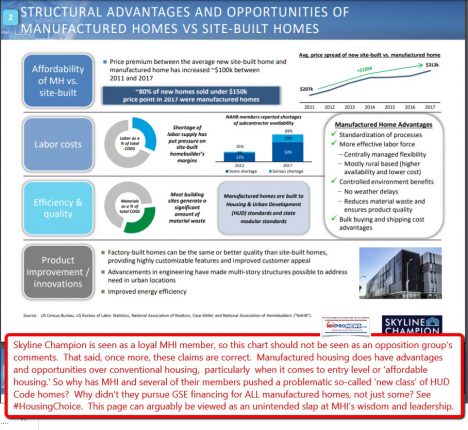

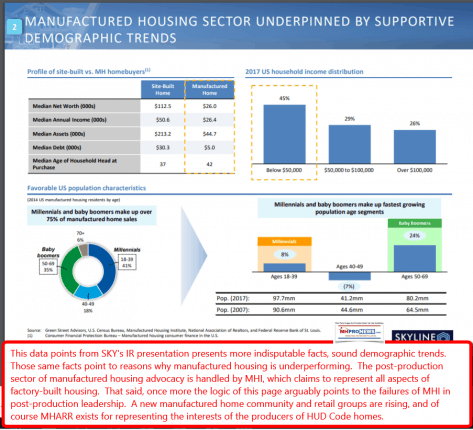

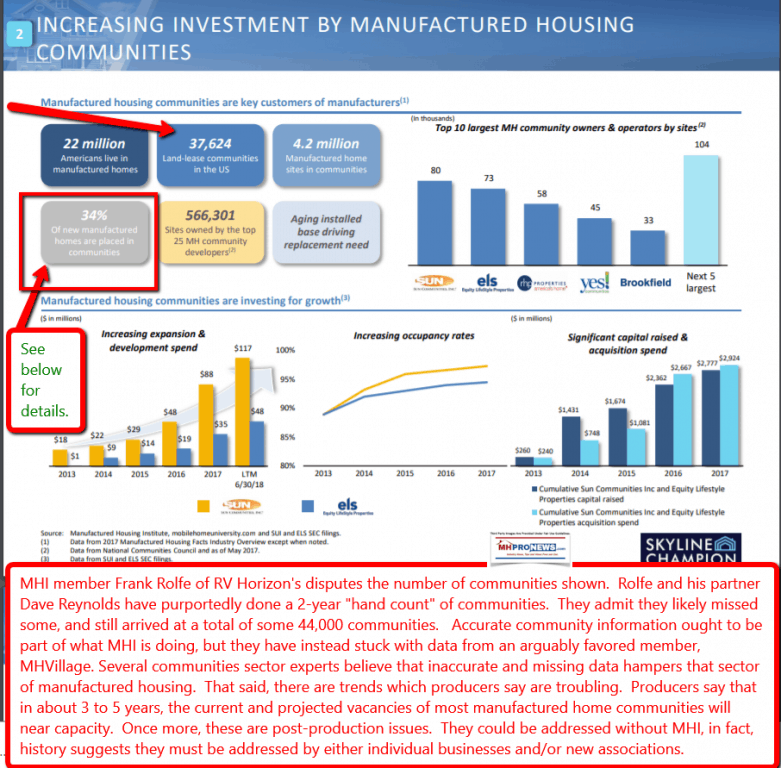

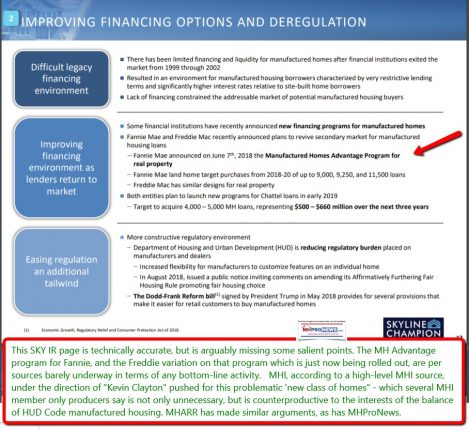

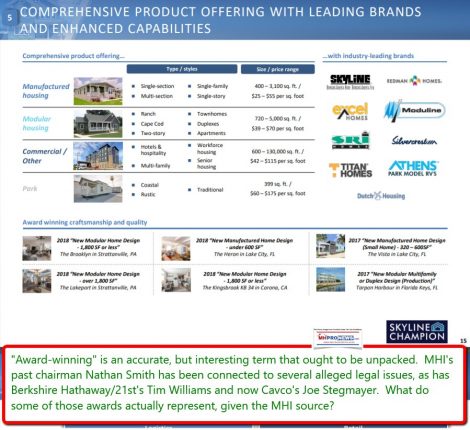

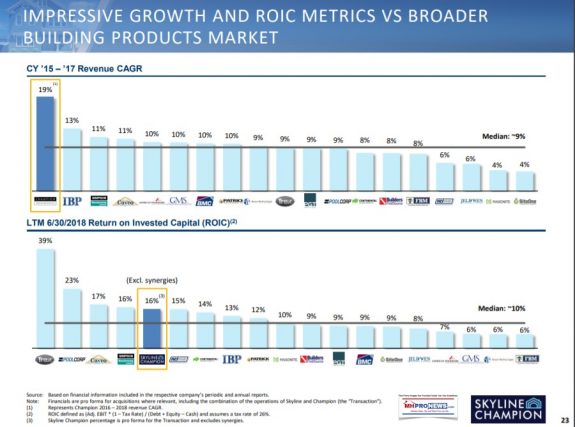

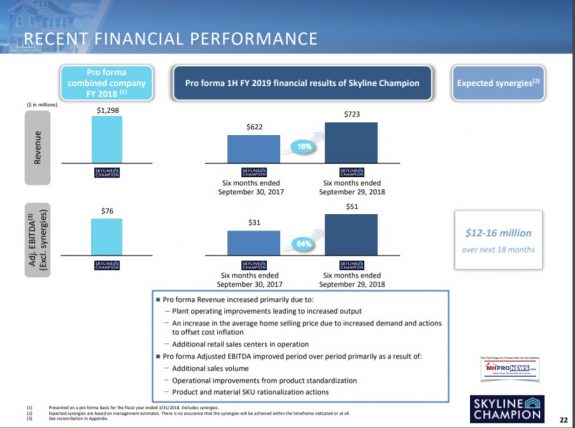

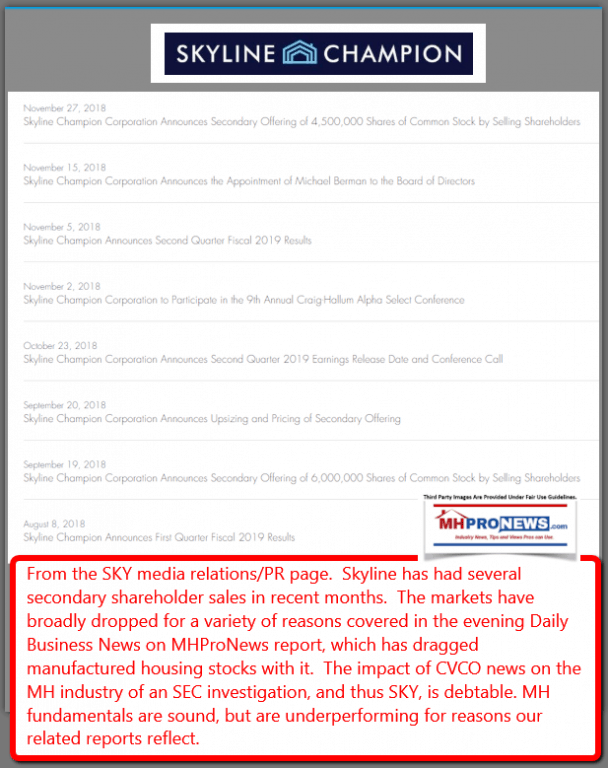

The images provided are inserted by MHProNews. None were part of the Skyline Champion Corp. press release, but often come from the firm’s most recent investor relations page, so are a useful complimentary information.

ELKHART, Ind.–(BUSINESS WIRE)– Skyline Champion Corporation (NYSE:SKY) (“Skyline Champion”), today announced financial results for its second quarter ended September 29, 2018 of the fiscal year ending March 30, 2019 (“fiscal 2019”).

On June 1, 2018, Skyline Corporation (“Skyline”) and Champion Enterprises Holdings, LLC (“Champion”), the parent company of Champion Home Builders, Inc., completed the previously announced combination of their operations (the “Combination”). The combined company operates as Skyline Champion Corporation and is traded on the New York Stock Exchange under the ticker symbol “SKY”. The second quarter of fiscal 2019 includes a full quarter of results for both the Skyline and Champion businesses while the six-month period ended September 29, 2018 includes only four months of results from the Skyline operations. Results for the three and six months ended September 30, 2017 of the fiscal year ended March 31, 2018 (“fiscal 2018”) include only the results of Champion.

Second Quarter Fiscal 2019 Highlights (compared to Second Quarter Fiscal 2018)

· Net sales increased 37% to $355.4 million

· Total homes sold increased 26% to 5,350

· Gross profit as a percent of sales expanded by 70 basis points to 16.6%

· Net loss of $77.0 million, compared to net income of $7.4 million, the year-over-year decline includes $85.8 million in non-cash, equity-based compensation expense

· EPS was a net loss of $1.42; excluding non-recurring expenses, Adjusted EPS was net income of $0.23

· Adjusted EBITDA increased 58% to $23.8 million

· Adjusted EBITDA margin expanded by 90 basis points to 6.7%

“The second quarter fiscal 2019 was another strong period for Skyline Champion as we continued to benefit from a healthy market and increased demand for our products,” said Keith Anderson, Skyline Champion’s Chief Executive Officer. “I am encouraged by the results we are seeing and the progress that we have made toward achieving synergies from the combined businesses. As we look forward, demand for manufactured homes remains healthy and Skyline Champion is strategically adding capacity to meet the needs of the market.”

Second Quarter Fiscal 2019 Results

Net sales for the second quarter fiscal 2019 increased by 37% to $355.4 million compared to the prior-year period. The increase in net sales was driven by an increase in the number of homes sold as well as an increase in average selling price (“ASP”) per home sold. The number of U.S. factory-built homes sold by Skyline Champion in the second quarter fiscal 2019 increased by 29% to 5,038 with U.S. ASPs increasing by 16% to $60,900. Unit volume increased due to additional manufacturing capacity as well as plant operating improvements. Home sales prices increased primarily in order to offset rising material cost inflation while remaining price competitive and continuing to offer affordable housing alternatives to our customers. The number of Canadian factory-built homes sold declined to 312 homes compared to 345 homes in the prior-year period with the decrease concentrated in the Alberta and Saskatchewan provinces where housing demand remains soft. Looking forward, overall demand for manufactured housing remains strong and Skyline Champion is well positioned with $252 million in backlog as of September 2018.

Gross profit increased by 43% to $59.0 million compared to the prior-year period. Gross profit was 16.6% of net sales for the second quarter fiscal 2019, a 70-basis point improvement compared to 15.9% in the second quarter fiscal 2018. Gross profit expansion was driven by an increase in the average selling price of homes sold in addition to plant operating improvements which led to increased output and an increased number of homes sold.

Selling, general and administrative expenses (“SG&A”) in the second quarter fiscal 2019 increased to $128.1 million from $27.8 million in the same period last year, primarily due to non-cash, equity-based compensation expense of $85.8 million resulting from the vesting of restricted shares issued to Champion employees and directors in connection with the Combination, which was triggered by the secondary offerings which closed during the second quarter of fiscal 2019. In addition, SG&A includes the Skyline operations for the entire second quarter of fiscal 2019 as well as continued integration and restructuring costs associated with the Combination.

The net loss for the second quarter fiscal 2019 was $77.0 million, compared to net income of $7.4 million during the same period from the prior year. The decline in net income was driven by an increase in SG&A expenses related to the Combination, equity compensation expense and higher tax expense. Skyline Champion’s effective income tax rate for the second quarter fiscal 2019 was impacted by the non-deductibility of certain transaction-related expenses and non-cash equity compensation.

Adjusted EBITDA for the second quarter fiscal 2019 increased by 58% to $23.8 million compared to the second quarter fiscal 2018. The increase was primarily driven by higher sales volumes, improved gross profit and leveraging of fixed costs. The Adjusted EBITDA margin expanded by 90 basis points to 6.7%.

As of September 29, 2018, Skyline Champion had $102.9 million of cash and cash equivalents and $32.1 million of unused borrowing capacity under its revolving credit facility.

Six Months Ended September 29, 2018 Financial Highlights

For the six months ended September 29, 2018 net sales were $677.7 million, which represents growth of 34%, or $173.6 million, compared to the six months ended September 30, 2017.

Gross profit increased $36.8 million or 48% to $114.2 million compared to $77.4 million for the prior year period. Gross profit was 16.8% of net sales for the six months ended September 29, 2018, compared to 15.3% in the six months ended September 30, 2017.

SG&A increased to $173.2 million for the six months ended September 29, 2018, compared to $54.6 million in the prior year period, driven by $93.9 million of non-cash, equity compensation expense, as well as transaction and integration related expenses and added capacity from the Skyline operations.

The net loss for the six months ended September 29, 2018 was $77.9 million, compared to net income of $12.7 million for the prior year period.

Adjusted EBITDA for the six months ended September 29, 2018 increased by 79% to $46.5 million compared $26.0 million for the six months ended September 30, 2017.

### End of Daily Business News on MHProNews portions of the SKY PR. Other recent headlines are as shown below. ###

Facts, figures, independent analysis, and misleading ‘global’ reports questioned – as promised by the headline. That’s this afternoon’s “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

NOTICE: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two browsers.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if your comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports: Click the Boxes Below to Read More...

Nathan & Mary Lee Chance Smith, Leaders in ‘Anti-Trump Resistance,’ Manufactured Housing Impact?

#$2Trillion U.S. GDP Growth via Affordable Housing Plan Few Discuss – Introducing #YimbyVictory2020

The American Dream, Arguably Among the Most Profitable, But Least Understood Stories in the USA Today

The American Dream is more than housing that someone owns, but that is a key element to it. Properly understood, this story could bridge much of the left-right divide. Properly told, and it would likely need to be a series, it could win a Pulitzer or other prize for reporting.