To properly understand any given report involving the sadly underperforming manufactured housing industry, probing readers should keep in mind what is and isn’t said. Skyline Champion (SKY) Q4 2023 Financial Results and Earnings Call Transcript, shown below, covers the first calendar quarter for 2023. In theory, according to federal law and regulations, sufficient material information is supposed to be provided by publicly traded firms so that a potential or actual investor is properly informed about risks and opportunities. The case has been made by legal minds that manufactured housing is underperforming, that zoning and finance are among the causes for that underperformance, that the three largest manufactured home producers are colluding to control the market, and that the “Big Three” manufactured housing builders’ preferred national association is part of the problem. With that backdrop, the Skyline Champion transcript has that follows offers numerous interesting statements and revelations, including those noted in the headline, and more. But a partial list of what is and isn’t mentioned may make the transcript a more eye-opening experience.

Among the items that are mentioned in this earnings call transcript.

- Genesis modular homes.

- Street retail sales channel is down.

- Retail ‘financing’ (said Mark Yost) ‘isn’t really an issue.’

- Strong retail lead generation.

- Retail traffic is down.

- Purported placement slowdowns in the communities sector.

Among the items that aren’t mentioned by Skyline Champion in their most recent quarterly transcript include the following.

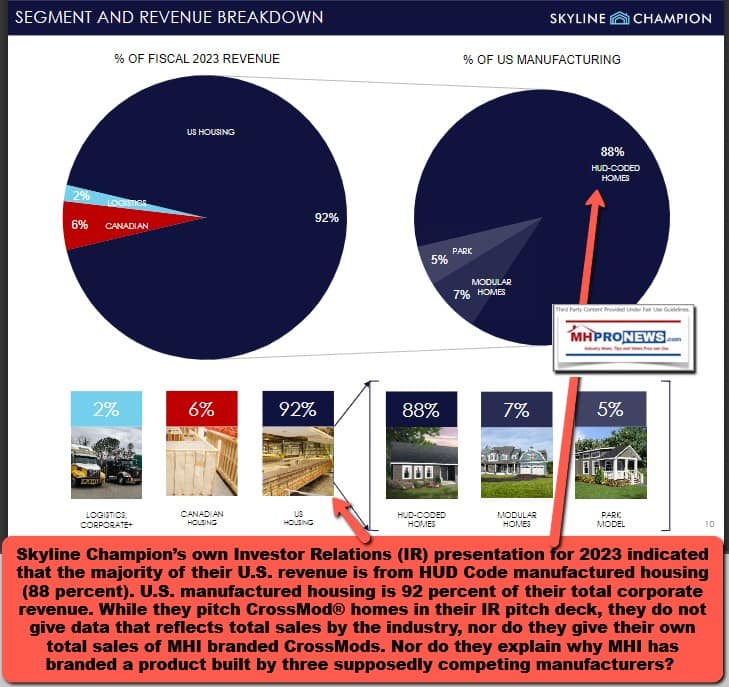

- CrossMod™ homes. If Skyline Champion and Cavco Industries aren’t talking CrossMods, why is Kevin Clayton, the Manufactured Housing Institute (MHI) still trying to talk it up on their home page and beyond?

- What is the explanation for lead generation being up and retail traffic is still reportedly down?

- No mention of zoning issues as barriers for sales.

- No mention of the Manufactured Housing Improvement Act of 2000 or enhanced preemption.

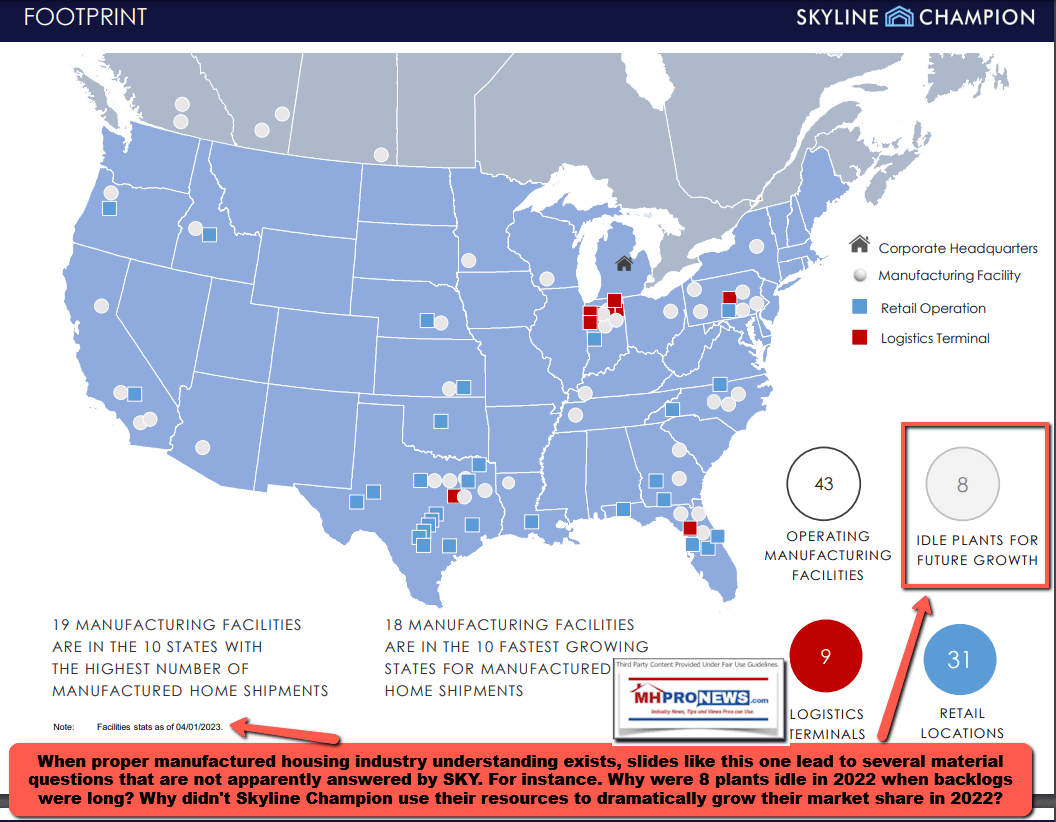

- Why weren’t all of Skyline Champion’s (SKY) idled plants brought online earlier, while manufactured housing backlogs were long? Couldn’t SKY have captured a bigger market share by doing so?

- No mention of the Department of Energy (DOE) manufactured housing energy rule or related litigation. Isn’t that material to the industry’s progress, and thus of importance to Skyline Champion too?

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

With that evidence-based preface, Part I of today’s report is the Earnings Call Transcript per Seeking Alpha. Highlighting is the transcript is provided by MHProNews, but should not dissuade readers from reading every word. There is plenty more to unpack than what is shown in Part II, or in this preface.

Part II is additional information, including from Skyline Champion, but also from other sources, with more MHProNews analysis and manufactured housing expert commentary.

Part I

Skyline Champion Corporation (SKY) Q4 2023 Earnings Call Transcript

May 30, 2023 11:42 AM ET Skyline Champion Corporation (SKY)

Skyline Champion Corporation (NYSE:SKY) Q4 2023 Earnings Conference Call May 30, 2023 9:00 AM ET

Company Participants

Mark Yost – President and Chief Executive Officer

Laurie Hough – Executive Vice President and Chief Financial Officer

Conference Call Participants

Greg Palm – Craig-Hallum Capital Group

Daniel Moore – CJS Securities, Inc.

Matthew Bouley – Barclays

Philip Ng – Jefferies

Christopher Kalata – RBC Capital Markets

Jay McCanless – Wedbush Securities

Operator

Good morning and welcome to Skyline Champion Corporation’s Fourth Quarter and Full Year Fiscal 2023 Earnings Call. The company issued an earnings press release this morning. I would like to remind everyone that today’s press release and statements made during this call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations and projections. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Additionally, during today’s call, the company will discuss non-GAAP measures, which it believes can be useful in evaluating its performance. A reconciliation of these measures can be found in the earnings release.

I would now like to turn the call over to Mark Yost, Skyline Champion’s President and Chief Executive Officer. Please go ahead.

Mark Yost

Thank you for joining our earnings call, and good morning, everyone. I’m pleased to be joined on this call by Laurie Hough, EVP and CFO. Today, I will briefly talk about our full year and fourth quarter highlights and then provide an update on activities so far in our first quarter of fiscal 2024 and conclude with thoughts about the balance of the year.

I’m pleased with the results of Skyline Champion achieved in fiscal 2023 as we continue to grow our top line while expanding our profitability and expanding our capacity and capabilities to better serve our customers. Our performance during the year reflects our innovative product offerings, affordable price points, strategic positioning, and the success of our core initiatives.

For the year, we were able to provide 25,910 customers and families with a place to call home. Over the past two years, we’ve delivered more than 50,000 homes, growing net sales by 83% and adjusted EBITDA by over 300%.

Our results were driven by the need for affordable housing and our ability to increase output at higher profitability levels while continuing to invest in our business to deliver future growth. From an industry standpoint, end consumer demand remains healthy as supply side housing shortages, a growing base of home buyers, and higher interest rate pressures increase the need for attainable housing solutions.

The current economic environment and our investments in enhancing the home buying experience has increased awareness of our housing solutions. For the quarter, we delivered 5,146 homes as softness from retail inventory destocking was partially offset by expansion in other key channels such as builder developer and tiny home distribution.

In the fourth quarter, the industry experienced delays in setting and finishing homes in certain markets, causing a backlog of inventory, resulting in the postponement of production of existing orders and the placement of future orders.

Margins continued to normalize during fiscal ’22 levels, reflecting lower volumes and a product mix shift as customers look to maintain affordable monthly payments in the current interest rate environment. We remain steadfast on our key areas of focus that of enhancing the customer experience, streamlining our product offering and transforming the way homes are built and bought.

Over the course of the year, our backlog normalized because of increased production capabilities and the dealer destocking of inventory. Backlog finished the year at $308 million and has reverted to more customary normal seasonal lead times. Normal backlog levels of 4 to 12 weeks helped the home buyer lock in both pricing and financing and benefits our direct sales channels to better meet the needs of their customers.

While retailer walk-in traffic was down, leads grew over 20% from the prior year in the fourth quarter, driving good credit quality customers to our retail stores. We also saw strong increases in quoting activity at our plants quarter-over-quarter and a substantial increase in plant orders versus the sequential third quarter.

During the quarter we announced our inaugural build-to-rent modular subdivision through our partnership with an industry leading provider of sustainable modular housing. This collaboration drives the modular industry forward by serving as a blueprint for increased modular adoption in the home building space.

This innovation in community development will demonstrate the full benefits of modular construction in a build-for-rent residential application, providing developers a turnkey solution at a price point, quality and speed for today’s market.

Moving to the first quarter outlook, order activity at our manufacturing operations is trending up in May, but was slower than expected in April, given the set and finishing delays. Most industry retailers are through the destocking process and are beginning to order more retail sold units, while many of the community REITs are pausing orders for a short-term as they catch up on setting existing inventory.

Additionally, one of our builder developer partners has shifted expected orders to the second and third quarters due to permitting timing. Accordingly, our plants have moderated production rates and reduced staffing levels in line with the timing of these incoming orders. As a result, we anticipate a sequential decline in first quarter revenue in the mid-single digit range.

Mid-term strong end consumer demand for affordable housing, positive REIT channel outlook and stable retail placements, combined with the near finalization of retail destocking, support our confidence in continuing to invest in ramping up our plants in Decatur, Indiana; Bartow, Florida; and Pembroke, North Carolina.

This additional capacity will help us serve the upcoming needs from the impacts of Hurricane Ian and the builder developer channel, which is starting to sprout as our pipeline has been expanding rapidly. We continue to drive digital transformation in homebuilding and have made great progress on this journey in fiscal 2023. We made strides in executing our digital product development plan and are making the journey of personalizing a home simpler and more transparent to end consumers.

We have seen excellent traction with the consumer since launching our digital tools and home configurator experience. Our social media presence has grown to 875,000 followers and we have passed over a quarter of a million vetted leads onto our retail partners. Our lead generation platform continues to scale and is up 40% sequentially in April from the month of March.

While it will take time to continue to develop and refine these new capabilities for our customers, the initial momentum we have seen gives us the confidence to continue to expand our investment in our digital strategy. It allows us a tighter integration with both the end consumer and our channel partners. The tighter integration will allow us to better utilize our future production automation investments.

We will have completed the design and order of our next phase of automation components and await the delivery, installation and optimization of that equipment. As we do so, we are digitizing the elements of our engineering for automation readiness and advancing the material handling and plant configuration for the process changes that automation will drive.

These long-term investments into digital will not only be a better experience for the end consumer, but will drive greater efficiency in our operations and make us the preferred channel partner as we drive more engaged homebuyers to our customers.

I will now turn the call over to Laurie to discuss our quarterly financials in more detail.

Laurie Hough

Thanks, Mark, and good morning, everyone. I’ll begin by reviewing our financial results for the fourth quarter, followed by a discussion of our balance sheet and cash flows. I will also briefly discuss our near-term expectations.

During the fourth quarter, net sales decreased 23% to $492 million compared to the same quarter last year. US factory-built housing revenue decreased 21% quarter-over-quarter, which was driven by a decrease in home sales volume, partially offset by an increase in average selling price per home.

We sold 4,900 homes in the US during the quarter compared to 6,580 in the prior year period. US home volume during the quarter was supported by additional retail and manufacturing capacity resulting from the acquisitions earlier this year, as well as the opening of our Pembroke, North Carolina facility this quarter.

However, volumes were down year-over-year due to reduced production schedules at plants located in certain markets where demand softened or retailer inventory destocking. The average selling price per US home sold increased by 6% to $92,700 due to product mix and year-over-year price increases on our core products to offset material, labor and transportation inflation.

On a sequential basis, revenue in the US factory-built segment decreased 16% in the fourth quarter compared to the third quarter of fiscal 2023. The decrease was due to a 15% decline in the number of homes sold and a 2% decrease in average selling price per home. In the current environment, we continue to see a decrease in our core product ASPs sequentially due to a shift in product mix to smaller homes and a reduction in our material surcharges on a per home basis.

As mentioned earlier, some markets experienced softening demand because of retailer destocking during the quarter, resulting in reduced production, which caused our capacity utilization levels to decrease to 59% during the quarter compared to 66% in the prior quarter. Capacity utilization was negatively impacted by the newly opened Pembroke, North Carolina facility as well.

Canadian revenue decreased 37% to $29 million compared to the fourth quarter last year, driven by a 39% decline in the number of homes sold, partially offset by an increase in the average selling price per home. The average home selling price in Canada increased 2% to $116,600 and was driven by previously enacted price increases in response to inflation. The decline in volume was caused by softening demand.

Consolidated gross profit decreased 26% to $141 million in the fourth quarter and gross margins contracted by 120 basis points versus the prior year quarter as lower sales volume was partially offset by higher average selling prices. Our US housing segment gross margins were 28.4% of segment net sales down 120 basis points from the fourth quarter last year, primarily due to the decrease in volume and a mix shift to smaller, less optioned homes.

SG&A in the fourth quarter decreased to $72 million from $75 million in the same period last year due to lower incentive compensation expense and reduced sales activity, partially offset by additional SG&A costs from plant start-ups and acquisitions closed earlier this year.

Net income for the fourth quarter decreased 33% to $58 million or $1 per diluted share compared to net income of $87 million or earnings of $1.51 per diluted share during the same period last year. The decrease in EPS was driven by the decline in sales and reduced operating leverage on lower volume.

The company’s effective tax rate for the quarter was 24.5% versus an effective tax rate of 24.8% for the year ago period. The decrease in the effective tax rate was primarily due to lower state tax expense and results of foreign operations. EBITDA for the quarter was $76 million compared to $121 million in the prior year period.

The EBITDA margin normalized to 15.5% compared to 19.0% in the prior year period. The structural improvements in our business over the last few years have strengthened our operational capabilities leading to increased profitability. These improvements also enhance our ability to navigate periods of economic uncertainty while continuing to service our customers, protect our margin profile and generate strong free cash flow.

As we move further into fiscal 2024, we reiterate our expectations of margins landing near fiscal 2022 levels as we face headwinds to our product mix, with consumers moving to smaller homes with less option to offset inflation and interest rate increases and to maintain more affordable monthly payments.

In addition, we continue to expect some margin compression from the ramp of three new manufacturing facilities in North Carolina, Indiana and Florida. We are closely monitoring fixed G&A spend and have identified several levers to pull if order volume does not continue its recent trend upward.

As of April 1st, 2023, we had $747 million of cash and cash equivalents and long-term borrowings of 12 million with no maturities until 2029. We generated $52 million of operating cash flows for the quarter compared to $60 million for the prior year period.

The decrease in operating cash flows is primarily due to the decrease in net income, partially offset by favorable net working capital changes versus the prior year fourth quarter. We remain focused on executing on our operational initiatives and given our favorable liquidity position plan to utilize our cash to reinvest in the business and for opportunities that support strategic long-term growth.

I’ll now turn the call back to Mark for some closing remarks.

Mark Yost

Thanks, Laurie. As we managed through the rebalancing of our channels, we believe Skyline Champion is well positioned to outperform the broader housing market due to our affordable price points, strategic positioning and our core initiatives.

The outlook for demand is supported by the channel opportunities, with community REITs manufactured to rent and builder developer growth, as well as helping our retail partners adapt to the changes in consumer demographics. In addition, the need for affordable housing continues to grow, and we believe that the elevated cost of housing will drive more traditional site built buyers to our homes.

Before we open the lines for Q&A, I want to take a moment to thank our entire Skyline Champion team as our consistently strong performance is a result of our focus, hard work and ability to take care of our customers.

And with that operator, you may now open the lines for Q&A.

Question-and-Answer Session

Operator

Thank you. We’ll now be conducting a question-and-answer session. [Operator Instructions] Thank you. Our first question comes from the line of Greg Palm with Craig-Hallum Capital. Please proceed with your questions.

Greg Palm

Hey, good morning, everyone. Thanks for taking the questions here. I guess I want to start with the current quarter outlook. Mark, I know you rattled off a lot of reasons maybe why you’re seeing a little bit of softness here. And I guess relative to maybe a few months ago, what’s having the biggest impact, whether that’s the some of the supply chain issues, the setting crews, whether it’s communities pausing its and maybe you can confirm the order rate shifting on the builder developer channel was that with that top 100 builder win that you referenced last year?

Mark Yost

Yes. Thanks, Greg. I’ll unpack those. I think to answer the last one first, the top 100 builder is the one who’s got a permit timing. So he’s moving or that builder is moving their orders to kind of August, September time period of this year just due to permitting timing. So that’s the timing shift. The good news is they’re actually starting to break ground on other subdivisions ahead of plan. So I think there’s kind of a short-term delay, but long-term win with that top 100 builder.

As far as the order environment, the order environment has been actually good lately. I’d say right now, the main delay is in set and finish crews. Across the country, we’ve got a lot of inventory in the community’s hands that are kind of getting set and finished or provided electricity to.

So the community orders have been very strong. If you look at UMH and Sun, I think their new home demand has been very, very strong overall, and we’re hearing the same from most of our community partners, but they’re dealing with getting orders set, finished and delivered. And I think we did have a very, I’ll call it, wet and icy period in the first quarter — first calendar quarter of the year.

And so I think that put some of the crews behind, especially in places like California with the bomb cyclone, I know some of our customers delayed their purchases by three to four months just due to timing of getting things set given the flooding out in some of the regions. So I’d say set and finish is the primary driver of everything happening. The retail inventory destocking is behind us. And so right now we’re just going through kind of a wave of community destocking as they’re trying to get things set and finished.

Greg Palm

Got it. Okay. That’s helpful. Can you just give us some sense of at least kind of how order rates have trended from retail maybe over the last month or two? And can you quantify, give us any sense of where they are relative to a year ago relative to, I don’t know, three months ago? Just a little bit more color would be helpful.

Mark Yost

Yes. I think a few things there, Greg. One is, I think, our quoting activity, this calendar year-to-date is up 32% versus prior year and up 45% versus 2021. So we’re seeing very high levels of quote activity and demand.

On the order front, our orders in the fourth quarter of fiscal ’23 about doubled from where they were in the second and third quarter of fiscal ’23. And since that time, orders are actually up year-to-date this fiscal year, over 50% with strengthening in April and May from where they were.

So I think we’ve seen definitely orders picking up pretty consistently. And that’s meaningful because it’s mainly coming from the retail channel as community activity has paused. So very good strong pickup in orders given that many of the communities are in the destocking period. As far as – I’m sorry, go on, Greg.

Greg Palm

Well, sorry, those order numbers you referenced those were total or were those retail only?

Mark Yost

No, those were total orders.

Greg Palm

Okay. Perfect. And I’ll let you finish up. I think you were going to say one more thing.

Mark Yost

Yes, you had asked about retail demand. And I think if you look at stat surveys and retail placement data, retail placement data has been very resilient. So I think the retail activity and the end consumer demand for retail has actually been quite resilient year-over-year. So we’ve seen good steady traction from that pointing to that de-stocking.

Greg Palm

Okay. Perfect. All right. I’ll hop back in the queue. Thanks.

Mark Yost

Thanks, Greg.

Operator

The next question is from the line of Daniel Moore with CJS Securities. Please proceed with your questions.

Daniel Moore

Thank you, Mark and Laurie. Thanks for the color. Maybe you can talk a little bit about the cadence of production through the quarter. What kind of your expectations for that cadence of production through the fiscal Q1 where you expect shipments to be down mid-single digits sequentially? What kind of backlog do you expect to end the quarter with based on that outlook? And do you see production ramping beyond fiscal Q1? Or is that the new normal level near term waiting and seeing how that community demand returns into the summer? Thanks.

Mark Yost

Yes, Dan. Thank you. I think part of the community demand was soft or production of demand was soft in April. It started to pick up since then a little bit. I think we’re kind of moderating it, waiting for the communities to finalize when that inventory can get set in place for reorder. We’re seeing some of that reordering starting to happen in certain pockets, but it’s not consistent across the board.

So I’d say that pause is kind of in effect for certain regions of the country, especially where weather was heaviest, but I think we’re seeing it start to pick up. But I would expect July, August is when the communities will start to resume back to, I’ll call it, normal ordering cadence in most of the country.

As far as production ramp, I think, we’ll continue to ramp up production kind of in the May, June period. Overall, we just don’t want to get too aggressive and ahead of ourselves. We want to smooth out production so that we can produce efficiently and hold margins. I think that’s a more optimal path versus trying to draw down backlog too much and create inefficiencies in the production schedule, which would hamper margin. So it’s really a balancing act between margin and volume, speed and efficiency.

Daniel Moore

And do you expect, based on that outlook for Q1 about backlogs could be down, but maybe much less so sequentially or you know relatively flattish as we sort of think about exiting Q1?

Mark Yost

I would expect flattish. Yes.

Daniel Moore

Yes. Okay. Perfect. Any more granularity. Appreciate the color, Laurie, there on gross margin. I think you again referenced fiscal ’22 as sort of a guidepost for fiscal ’24. You see a little bit more of a kind of a gradual ramp down from fiscal Q4 levels toward that 26%, 27% range? Or is that more we should be thinking about for the next few quarters here?

Laurie Hough

Yes, Dan, I think we’re going to see those margins come in, in the next couple of quarters, more than a gradual ramp down through the end of the year. We are definitely seeing a shift to smaller, less option homes, which is going to impact margins. So I do expect to see a decrease in margins in the second quarter to those levels.

Daniel Moore

Got it. That’s helpful. All right. And then in terms of similar question on ASPs. It sounds like we continue to trend back a little bit given mix and maybe you can unpack what’s left in terms of surcharges kind of on a per home basis to roll off versus what type of decline we might see from mix? Thanks.

Laurie Hough

Yes. I think most of the material surcharges have been adjusted for. So really, at this point, we’re just going to see mix shifts impacting ASP. I do expect because of that, we’ll see more of a decrease in ASP sequentially.

Daniel Moore

All right. Last for me and I’ll jump back. But obviously, a significant and growing cash balance talked about the holding for continued reinvestment and potential M&A opportunities, given the sort of pause near term and pretty compelling valuation. Is there any thought to revisiting and maybe adding buybacks as another hour in the quiver in terms of capital allocation? Thanks.

Laurie Hough

Dan, we don’t have a buyback plan in place today, but it’s obviously a number off the table. We are continuing to focus on our strategic initiatives, enhancing the customer buying experience, other enterprise-wide technology upgrades and production automation as well as M&A.

Operator

Thank you. Our next question comes from the line of Matthew Bouley with Barclays. Please proceed with your questions.

Matthew Bouley

Hey, good morning, everyone. Thanks for taking the question. Just a question on the orders versus revenues. So if I heard you correctly, I think, you said orders were up greater than 50% year-to-date, but then obviously, you’re guiding revenues sort of down 35%, give or take, year-over-year in Q1. I know ASP is part of that, as Laurie just mentioned. But I mean should we think that kind of ex-FEMA, given these order trends that you could kind of return to year-over-year shipment growth beyond the first quarter? Or how do we think about that kind of converting into shipments? Thank you.

Mark Yost

Yes. Thanks, Matt. I think last year, we did have FEMA in the — I think our first quarter of $83 million in that first quarter. So part of that, I think, you have to adjust the FEMA revenue that’s in the quarter.

As far as orders being up year-to-date, 50%, that’s sequentially from our fourth quarter. So what we want to do is as orders come in, we want to make sure to kind of smooth out and balance the production lines effectively to make sure the mix of product is good, so we can maintain margins and our workforce in an optimal way.

So I think we’re going to see orders fill in this quarter, orders pipeline has been picking up steadily. As that ramps, we will kind of lag production behind that to make sure we kind of have a building backlog into the, I’ll call it, second through third quarter and kind of ramp up backlog a little bit as we go through to make sure we have a good production schedule going forward.

Matthew Bouley

Got it. Okay. Yeah, thanks for that Mark, and thanks for the clarification that orders were actually up sequentially. So I guess shifting to the margin side on the comment that margins or gross margin can hold fiscal ’22 levels. Are you able to achieve that even if shipment volumes are below that of fiscal ’22? And is that to say that if and when volumes recover to something like that, you would actually be able to like-for-like your margins would actually be higher than fiscal ’22? How do you just kind of think about how the volumes are interplaying into that comment? Thank you.

Laurie Hough

Yes. I do think that even with declining margins because of our structural changes to our product offerings, Matt, we can maintain those fiscal ’22 margins.

Matthew Bouley

Got it. Okay. And then just last one for me back on the Genesis side. I know you mentioned you’ve got the delay with the one builder there. But just as you kind of look around the market and you’re hearing from smaller builders that there might be a need to sort of monetize their land quicker in this macro and given everything going on in the lending side, what are you guys hearing from the developer channel more broadly around sort of the outlook for Genesis demand?

Mark Yost

Yes. I think Genesis demand, Matt, actually, I would say the doubling of orders in the fourth quarter and then the pickup sequentially from that are good things. But I would say, actually, the developer activity outshines all of that in my mind. We have seen kind of the seeds of builder developer that we’ve been planting start to kind of germinate a little bit and our pipeline has escalated rapidly here in the last 90 days in terms of the Genesis pipeline.

So it will take a little bit of time for them to get through the pipeline and into orders. So it’s a long-term process for builders. The lead time is very different than our retail partners and our community partners. But I think the pipeline of builder developer maybe one of the biggest — it’s actually matured to where we’re actually seeing real, real traction in builder developer now, which is very exciting.

Matthew Bouley

Got it. Well, thank you, Mark. Thanks, Laurie. Good luck guys.

Operator

Our next question is from the line of Phil Ng with Jefferies. Please proceed with your questions.

Philip Ng

Hey, guys. I appreciate the handholding on 1Q sales trends. But Mark, any more color on the shape of the year since you’re having some timing-related changes in orders for your community customers in that large builder. I mean, should we expect sales to be up sequentially in 2Q?

Mark Yost

Yes. Yes, I would expect that. Definitely. I think we’re seeing good traction, Phil. On the call, I think I mentioned that our lead activity, which is also another driver for us over the last 60 days has been up 20-ish percent. But in the last 30 days, our lead activity is up 46%. So we’re seeing increase.

And so that’s kind of a leading indicator going forward to, it takes about probably, I don’t know, a few months for that lead to translate into an order into production. But I think we’re seeing good traction on that. And so that digital capability that we’ve launched with the traction has really started to benefit our customers and our retail partners in getting lead down into the retail centers that will translate the orders.

Philip Ng

Okay. So Mark, it sounds like certainly some noise in 1Q, you’re going to build off of 1Q to 2Q, some of these headwinds normalizing, and we should expect momentum building in the back half. Is that the takeaway that we should walk away?

Mark Yost

Yes.

Philip Ng

Okay. Super. And then any color on the spread for channel loans versus the 30-year fixed rate mortgage? Rates are obviously moving all around, the site builders have been buying down mortgages. Is that something you’re looking to partner up with the lender to kind of further stimulate demand? How should we think about that dynamic?

Mark Yost

I mean I think we’re always working with our financing partners in terms of looking at opportunities to help our end consumer and our retail partners in any way we can. Right now, channel rates are about a 200 basis point spread for traditional mortgages. I think we’re seeing good traction and good activity. We’re seeing more cash buyers in terms of the financial capability that are out there.

So I would say financing is not really a huge limiting factor today. It’s really about repositioning the product in a way that meets the affordable price point and payment point for our customer base. And I think that’s really the — making sure we have the right products and price points to meet their payment needs.

Philip Ng

Got you. And just one last one. Laurie, you called out ASP having an impact via mix. But from a margin standpoint, given the different dynamics in terms of demand from your different end markets and customers, any impact that we should be mindful from a margin standpoint?

Laurie Hough

So it’s more about the number of features and actions that the consumer adds because those have a tendency to come at a higher margins than the base price of the house. So it’s not really channels that vary by margin or a house type, but more really the mix of the features and options.

Philip Ng

Okay. Appreciate all the color.

Operator

Our next question is from the line of Mike Dahl with RBC Capital Markets. Please proceed with your questions.

Christopher Kalata

Hi. This is actually Chris Kalata for Mike. Thanks for taking our questions. Just going back to the builder permitting delay. Could you provide more specific color on what’s driving that and if it has anything to do with the Genesis product?

Mark Yost

No, it actually has nothing to do with the Genesis product whatsoever. It’s actually related to the — of all things a clubhouse, to be honest, for the subdivision. So until they get — the clubhouse needs to be Hurricane Shelter for the development. So you’re not allowed to put homes in until you have Hurricane Shelter in place. And so the timing of the Hurricane Shelter and approval for that is what’s causing the delay. So it’s really has nothing to do with the Genesis product whatsoever.

Christopher Kalata

Got it. Appreciate that. And then for the first quarter, the sales guide, the mid-digit sequential guide implies down 35% year-on-year. And then I think you said $83 million for FEMA so call it, down 24%, adjusting for that. What is price mix and volume kind of look like for drivers for year-over-year declines there? Could you help us flesh out the split?

Laurie Hough

It’s going to be probably hold. Year-over-year, it’s going to be volume and price, probably equally.

Christopher Kalata

Got it. And if I could just sneak one last one in. In terms of the gross margin PAT, I think you said you expect some more meaningful normalization in the next quarter or two but for first quarter, is there a sense you could give us in terms of magnitude of step-down from this last quarter?

Laurie Hough

Okay. Yes, not going to give you specific numbers, but we’re definitely going to see some margin compression sequentially because of the product mix shift that I mentioned earlier with the change in fewer options and futures.

Christopher Kalata

Understood. Appreciate all the color.

Mark Yost

Thank you.

Operator

The next question comes from the line of Jay McCanless with Wedbush Securities. Please proceed with your questions.

Jay McCanless

Good morning, everyone. So my first question, Laurie, when you’re talking about fiscal ’24 gross margin in line of fiscal ’22, I’m assuming you’re talking about full year versus full year, correct?

Laurie Hough

Yes.

Jay McCanless

Okay. Just because there’s a lot of variability in the quarterly gross margin fiscal ’22. So I want to clarify that. The second question on SG&A dollars, should we expect — or what should we expect maybe for baseline quarterly SG&A dollars, given the new plants or three plants in process, is that likely to move higher from here? Maybe some help on that?

Laurie Hough

I would expect the fixed component of SG&A to remain relatively flat, but the variable component is going to fluctuate, obviously, with revenue. Normally, SG&A is 35% to 40% variable.

Jay McCanless

Okay. And then could you talk about what your mix either in backlog or in what you sold in 4Q ’23 with single section versus multi-section homes? And how did that compare to the prior year?

Mark Yost

I don’t think we’d break that out, Jay. I don’t think it was a meaningful shift. It really depends on the geography. The builder developer product is generally more double sections. We’re seeing certain regions where single sections are more prevalent based on affordability. But I don’t think it hasn’t moved the needle too greatly for us either way.

Jay McCanless

Okay. And then the last question I had, just one of your competitors recently on their conference call discussed being at the level now of productivity to where — whether they’re manufacturing single section or multi-section homes, they were achieving the same level of operating profitability. I guess, how would you respond to that? And how far do you think Skyline is away from being able to have that same type of stable operating profitability regardless of what you’re manufacturing?

Mark Yost

We got there several years ago.

Jay McCanless

So if that’s case, then why, I guess, are you thinking that margin and margin is going to come down with this mix shift? Can you walk us through that?

Laurie Hough

It really has more to do with the features and options, Jay. So the base price of the homes regardless of what we’re building, the margins through the plant are based on the time it takes to get the floor for the base model through the plant. The option dollars are usually at a higher margin because of the additional labor and materials that go into it. So as the buyer decides to take out options to reach their monthly price target or monthly payment target, we’re going to see less features and options in the house.

Jay McCanless

Okay. That’s great color. Thank you. Appreciate it.

Operator

Our next question is from the line of Daniel Moore with CJS Securities. Please proceed with your questions.

Daniel Moore

Thanks, again. Just one or two more quick housekeeping items. Now that we’re actually earning some interest on your growing cash balances that $8 million a quarter range in interest income, a reasonable expectation, at least based on current rates and we’re still thinking taxes in the kind of 24%, 25% range for fiscal ’24. Thanks.

Laurie Hough

Yes. Both of those are true, Dan.

Daniel Moore

Okay. Thank you.

Operator

The next question is from the line of Greg Palm with Craig-Hallum. Please proceed with your questions.

Greg Palm

Yes, thanks for taking the follow-ups. I guess just going back to some of the commentary on the remainder of the year. Just can you help us out with how you’re thinking about the remainder of the year, normal seasonality would usually suggest revenues that come down in fiscal Q3 and fiscal Q4. But I’m just wondering if maybe the cadence is a little bit different just given everything we’re talking about in terms of timing. So maybe you could provide a little bit more clarity on how you’re thinking about the cadence of the entire year on a quarterly basis.

Mark Yost

Yes. I mean I think Q3, Greg, generally, I think we would see a fairly good Q3. Obviously, Q4 would be dependent a little on weather and timing in that first — in that fourth quarter or first calendar quarter of next year. But no, I would expect we’re seeing pickups in demand, destocking should be behind us. And so as that picks up and as we see the continued progress on retail and then once community starts chiming in, I think both of those will pick up in that third and fourth quarter generally speaking.

Greg Palm

And the timing of revenues associated with the builder developer, I think, you had mentioned that orders in the August, September time frame. Does that mean that you should start seeing that revenue recognized in the fiscal Q3?

Mark Yost

Yes. Maybe Q4, Greg, depending on the timing of shipments. So we don’t recognize revenue until it ships. So once we receive the orders, depending on how quickly they get through the production cycle in there, it could flow over into Q4.

Greg Palm

Okay. Makes sense. And then just a little bit more, I mean, broadly speaking, on the builder developer opportunity. You talked about Genesis and some of the increased demand for that product. But what are you seeing in terms of new customer demand, new projects? I mean, you talked about a robust pipeline, but maybe you can give us a little bit more details on exactly what you’re seeing and kind of how that sort of opportunity plays out over the coming years?

Mark Yost

Yes. I mean I think that pipeline plays out very well over the coming years. I think I’m not going to disclose exactly what our pipeline is, but I will say that it’s been maturing. And I would say, over the past 90 days, it’s really started to take off. And I think that’s in conjunction with people getting comfortable with the solution of Genesis and how it solves their challenges as a builder in conjunction with other things and solutions and tools we can bring to builder developers.

With the home configurator launch that we’ve done and allowing people to personalize their home and design and configure and place in a subdivision as we start to roll those kind of tools out to expand the capabilities of builder developers. I think they’re seeing the benefits of not only just the products we offer, but the digital solutions that can aid them in the sales process of doing this.

So the fact that we’re driving leads that we are to our partners, along with our home configurator now has 100 or 281,000 unique users configuring homes. And so I think I think those kind of numbers start to get builders excited about using our solutions because we can not only help them solve their skilled labor challenges, but their sales front-end arm challenges and opportunities as well.

So I think it’s picked up greatly. So I expect that to take off in the upcoming years and be a significant portion of our overall revenue.

Greg Palm

Okay. Great. Best of luck. Thanks.

Operator

At this time, we’ve reached the end of our question-and-answer session. Now I’ll hand the floor back to Mark Yost for closing remarks.

Mark Yost

Thank you very much for participating in today’s call. We appreciate the time and your continued interest. We look forward to updating you on our progress at the end of our upcoming quarter. Thank you and have a great day.

Operator

This will conclude today’s conference. You may disconnect your lines at this time. Thank you for your participation. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

There is no doubt that publicly traded companies have come to expect that MHProNews is likely at some point to unpack their investor relations (IR) presentation and that MHProNews will also explore some or all of their earnings call remarks. Thanking God for the gift of memory, and having a sense of the industry’s history – having worked and lived it through much of the 1980s into the 2020s, several observations ought to be made. Among them is what may be construed as an increase in paltering by Skyline Champion, but also by Cavco Industries and some others that happen to be viewed as MHI ‘insider’ brands. If so, that’s problematic for investors, industry professionals, public officials, and others. Let’s unpack a few possible examples of apparently rah rah, ‘razzle dazzle,’ self-contradictory double-talk.

As noted in today’s preface above, Genesis got oxygen in this earnings call, CrossMods got none. Yet CrossMods still get home page exposure on MHI’s website. Given that Skyline Champion has a board seat on the MHI board of directors, what explains these conflicting signals? How is a retail investor supposed to navigate the apparent promotion of CrossMods by MHI, and by Skyline Champion in their IR pitch for May 2023, unless they pour over hours’ worth of research on MHProNews? That may not even be the most egregious double talk.

C-suite level remarks above indicate that more qualified buyers are supposedly coming into the domain of manufactured housing because they can no longer buy a conventional house. But if that is so, then why is the product mix moving more toward single section homes? Single section homes are typically more of the traditional ‘manufactured home’ buyer’s market, rather than the typical conventional single family home buyers market.

While it is true that there is a lag-time between lead generation and an actual purchase, in conventional housing, that lead time may be measured in hours or days for a motivated and qualified buyer. There are still markets and reports in 2023 which indicate that multiple offers are being made on the same existing (resale) home in the conventional real estate market. Real estate site HomeLight said in April 2023 that: “As of March 2023, homes spent an average 54 days on the market. This is up from a low of 30 days set in May 2022…” And that is despite the fact that ValuePenguin claims that: “It takes approximately 47 days to close on a conventional mortgage loan in accordance with Fannie Mae’s qualified lending standards.”

CEO Mark Yost said above: “I mean I think we’re always working with our financing partners in terms of looking at opportunities to help our end consumer and our retail partners in any way we can.” Seriously? If so, then why is there no mention of getting Fannie Mae, Freddie Mac, or the FHFA to push for the long-awaited Duty to Serve (DTS) manufactured housing for chattel lending?

How is it possible that Skyline Champion tell investors (Page 19 of their May 2023 investor relations pitch deck):

HUD is actively assisting the industry by including support for production of manufactured housing in its strategic plans to update safety standards to improve efficiency of production, and is reducing the regulatory burden placed on manufacturers and dealers by updating the code and regulatory requirements.”

In contrast to that, consider what MHARR leaders have told their members and the industry.

Per that same page from Skyline Champion’s IR presentation.

But if Biden era economic and policy measures were truly leading to improvements, then why is manufactured housing production down? Or for that matter, why did conventional housing slump in 2022? Why is manufactured housing still sliding, while conventional housing is rising recently? None of these topics are properly asked or answered in the earnings call, nor are they arguably addressed in a straightforward fashion by SKY’s IR pitch deck.

Per page 19 from Skyline Champion’s IR presentation is the following.

That happens to be true, but then, why is MHI now apparently pushing Senator Tim Scott to push for new reforms of Dodd Frank that include an item (referenced above and in the report below) that have apparently already been dealt with in 2018?

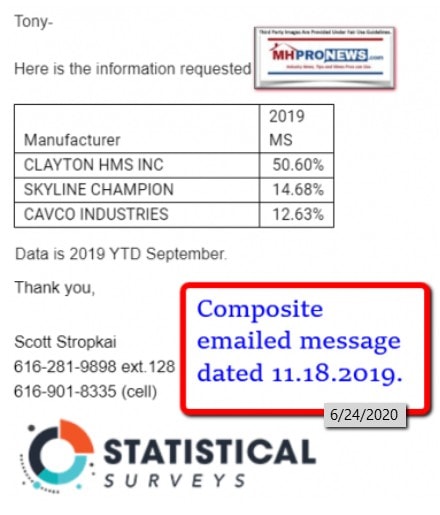

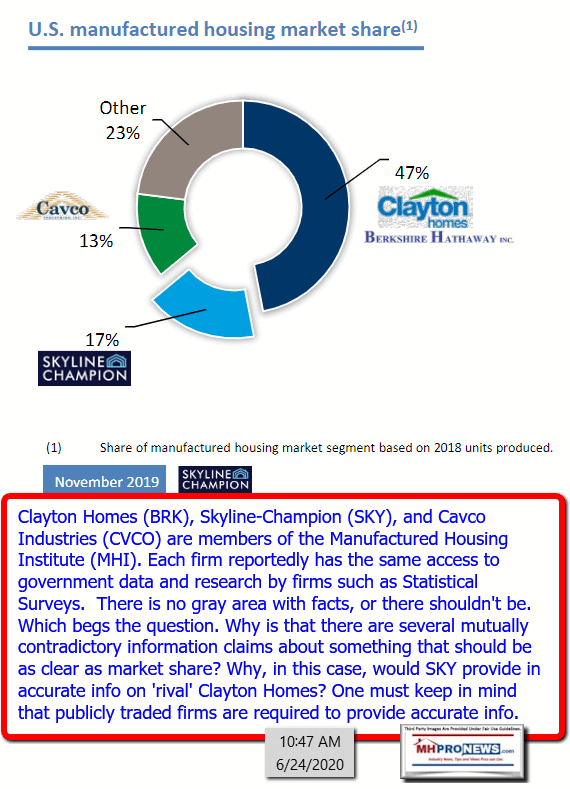

Arguably, there is something seriously wrong from the vantage point of a retail investor if they have to become a manufactured housing expert simply to sort out the various contradictions between the remarks made by C-suite level executives, their own IR presentation, and the trade group (MHI) which appears to have a pattern of unreliable information and claims. Recall that Skyline Champion previously published information that appeared to mask the true size of Clayton Homes market share. The significance is that there appears to be a pattern of activity that involves collusion. As the SEC and other public officials have remarked (see report, linked below), indirect evidence of collusion can be sufficient to establish possible antitrust or other illegal actions.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

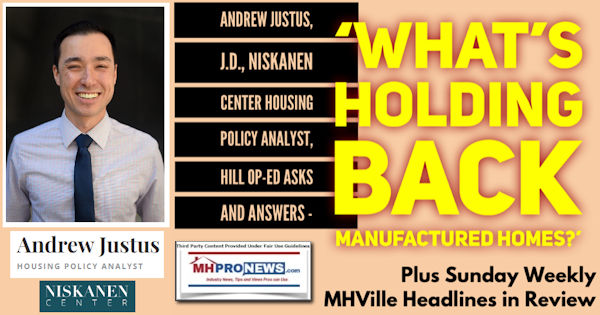

While Skyline Champion is busily trying to have it both ways, making various claims about why there has been a slowdown, yet still trying to claim, per CEO Mark Yost: “Skyline Champion is well positioned to outperform the broader housing market” then why is it that the industry keeps underperforming? Where is the clear cut answers from Yost or Hough that shed light on the recent remarks from outside attorney and manufactured home industry researcher’s remarks, shown below? Attorney Justus, J.D., says the problems include financing and zoning/placement issues. That tends to support concerns raised by MHARR for years.

When the puzzle pieces are lined up, a problematic picture emerges. Why? Because the various claims and remarks don’t all fit. That may raise legal issues for Skyline Champion, but perhaps also for MHI staff and some of their ‘amen corner’ of promoters. For instance:

- Remarks by Skyline Champion that appear to be self-contradictory, or are contradicted by credible sources;

- If financing is not a problem, as Yost said above, then why are some buyers selecting a single section home and skipping options in order to qualify for payments, as Hough said?

Pages of such analysis are possible. But this is sufficient to make the simple point that the legal concerns raised in the report below are apparently once more confirmed.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

To grasp the nuances of the legal issues, see the report linked here, which cited state and federal sources, among others.

Summary and Conclusion

Skyline Champion admits they have sold fewer homes but blames factors that may be exaggerated in order to cover up concerns that this downturn is yet the latest example of collusion by major players to drive more marginal firms out of business or into consolidation with one of the Big Three. Every initiative that is mentioned above by Yost or Hough ought to have been questioned simply. Why did this (digital investments, plant ramp ups, etc.) occur months or years before? When Skyline’s CEO remarks, similar to what Cavco’s Bill Boor said (see quote below) that: “Skyline Champion is well positioned to outperform the broader housing market,” it means that there is a broad gap between potential and realization. That speaks to either problematic execution or perhaps to more evidence of collusion to cause underperformance. MHProNews stands by its reports and analysis in recent years that several of the key MHI members are colluding to cause underperformance so that consolidation is the outcome. The fact that plants have been sitting idle raises other concerns, which ought to be the subject of inquiries by investors, regulators, and public officials. More on the Skyline Champion IR pitch is planned for the near term. Watch for it. ###

PS: If Skyline Champion really wanted to do all it can for its ‘retail partners’ then why hasn’t the firm devoted some cash to pressing the enhanced preemption provisions of the Manufactured Housing Improvement Act of 2000?

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

Notice: the graphic below can be expanded to a larger size.

See the instructions below the graphic below or click the image and follow the prompts.

PPS: Recall that Skyline Champion was implicated in the scheme exposed by this SEC litigation.

PPPS: To get a more complete picture of what is and isn’t possible, the reports linked below should be compared to Skyline Champion and Cavco Industries statements.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’