Daily Business News Market Tracker:

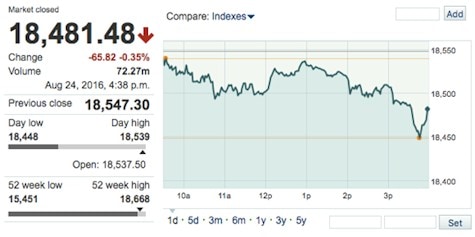

The Dow Jones Industrial Average lost -65.82 points to close at 18,481.48.

The S&P 500 dropped -11.46 points and closed at 2,175.44.

NASDAQ closed at 5,217.69.

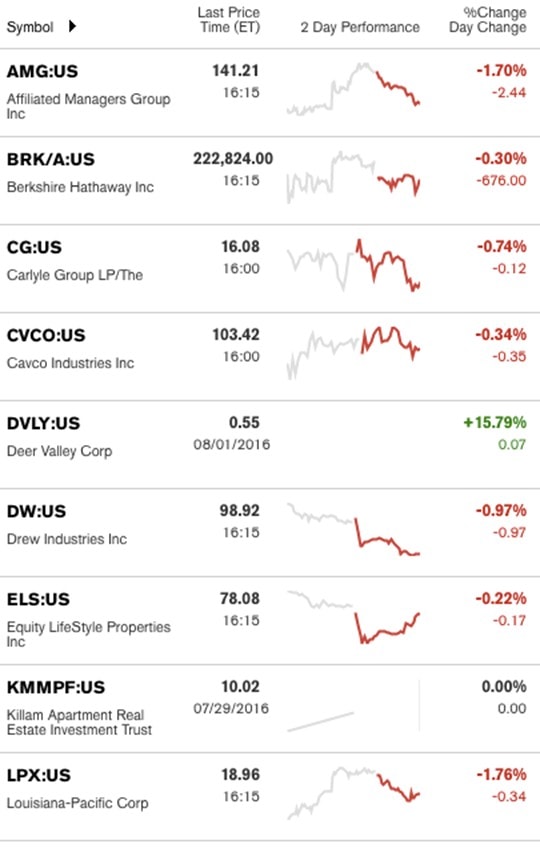

The Yahoo! Finance Manufactured Housing Composite Value (MHCV) lost -13.33 points and finally closed at $1,404.23.

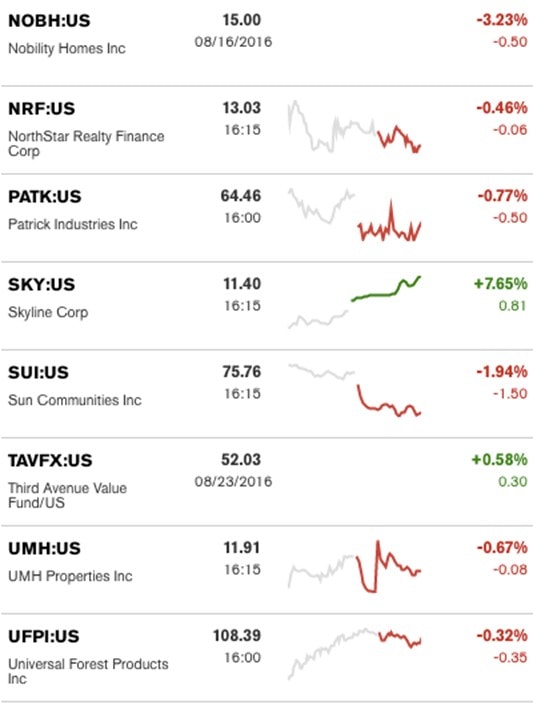

The MH-related stocks biggest loser was Sun Communities, closing at $75.76 due to a -1.94% drop. The biggest gainer was Skyline Corp., with a 7.65 percent climb to close at $11.40.

*Note: the chart below includes stocks not included in the MHCV

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits, MarketWatch, Bloomberg.)

MH Industry Market Report by Frank Griffin, to Daily Business News for MHProNews.