Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- What Amazon’s Whole Foods deal means for you.

- Jeff Bezos is the smartest guy in business.

- Amazon-Whole Foods deal: What happens to Instacart?

- Roger Stone to Trump: Fire Mueller and Rosenstein.

- Millions are drowning in housing costs.

- Best cities for first-time homebuyers.

- GM bringing about 600 jobs back from Mexico.

- Bonobos fans aren’t happy about the Walmart takeover.

- Amazon deal is ‘potentially terrifying.’

- Sandy Hook family members send legal threat to NBC.

- Top luxury hotel suites for business travelers.

Selected headlines and bullets from Fox Business:

- Amazon’s Whole Foods deal could spark bidding war.

- Amazon, Whole Foods shares rally as deal pressures broader market.

- Oil prices edge up; still near 2017 lows on stubborn glut.

- Trump’s Cuba rollback to spare airlines but could hurt demand.

- Trump rolls back Obama-era Cuba policy.

- White House tackles drug costs.

- Amazon CEO Bezos has billions more to give away thanks to Whole Foods deal.

- Amazon vs. Walmart: Grocery wars.

- Is Costco cheaper than Amazon?

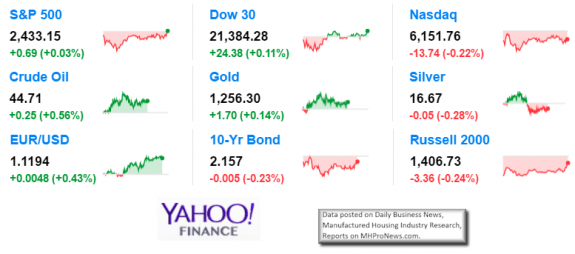

9 key market indicators, ‘at the closing bell…’

S&P 500 2,433.15 +0.69 (+0.03%)

Dow 30 21,384.28 +24.38 (+0.11%)

Nasdaq 6,151.76 -13.74 (-0.22%)

Crude Oil 44.71 +0.25 (+0.56%)

Gold 1,256.30 +1.70 (+0.14%)

Silver 16.67 -0.05 (-0.28%)

EUR/USD 1.1193 +0.0047 (+0.43%)

10-Yr Bond 2.157 -0.005 (-0.23%)

Russell 2000 1,406.75 -3.33 (-0.24%)

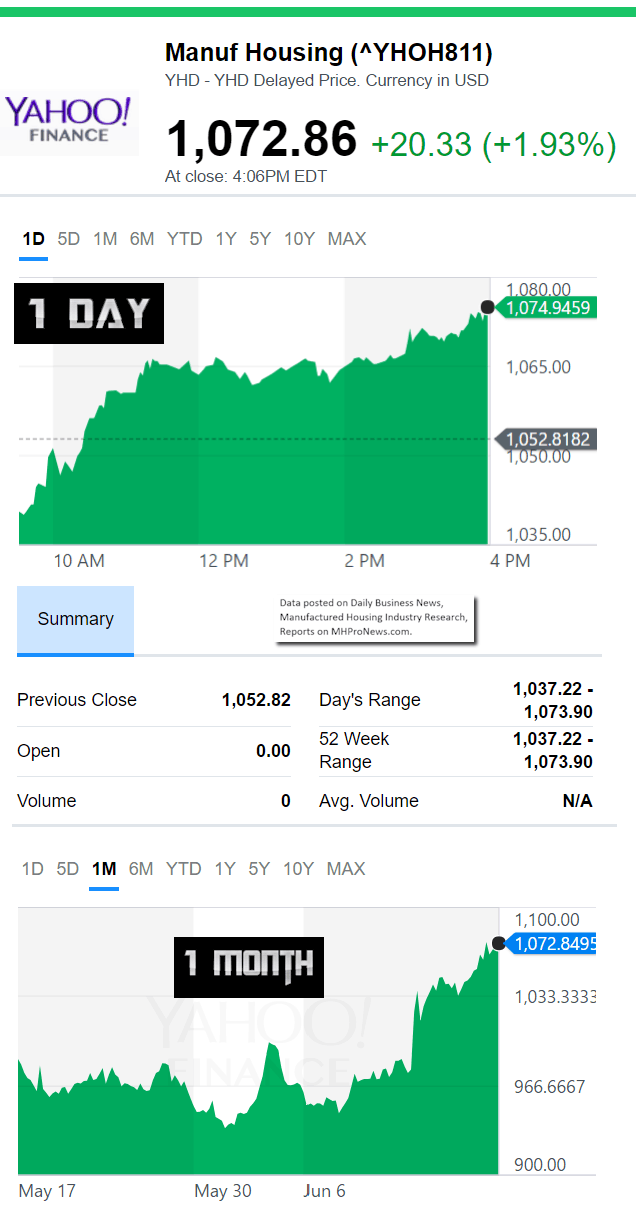

Manufactured Housing Composite Value 6.16.2017

Manufactured Housing Connected Stocks

Today’s Big Movers

Killam and UFPI lead the gainers. Patrick and Skyline lead the decliners. See below for all the ‘scores and highlights.’

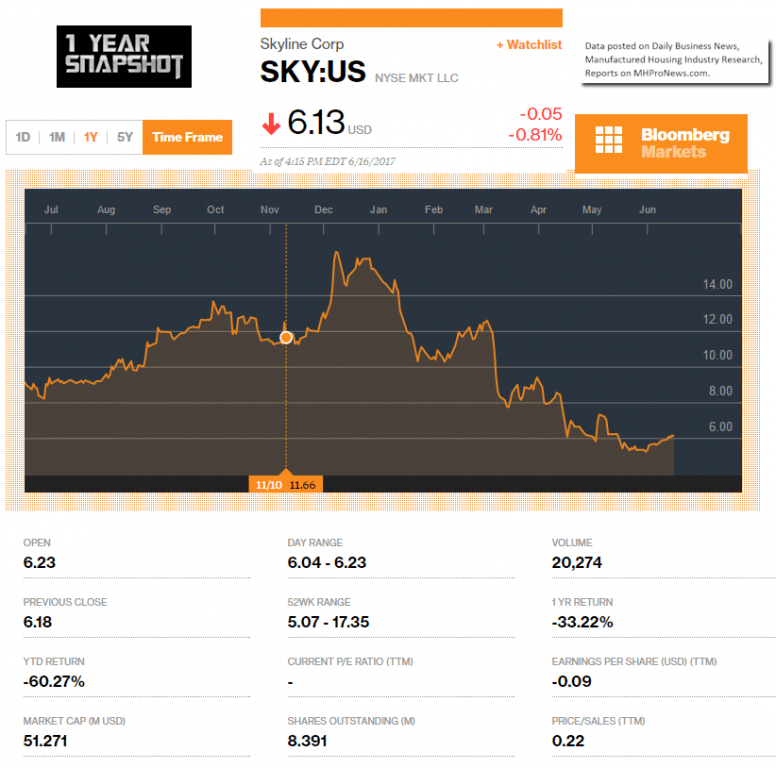

Today’s MH Market Spotlight Report – Skyline Homes

In a news release, Skyline tells MHProNews the following.

June 14, 2017 Skyline Corporation (NYSE MKT: SKY)

(“Skyline” or the “Company”) today announced that three long-time members of the Company’s Board of Directors, Jerry Hammes, William H. Lawson, and David T. Link, each have notified the Company of their respective intent to retire from the Board. Messrs. Hammes and Link will not stand for reelection to the Board at the Company’s upcoming 2017 Annual Meeting of Shareholders. Mr. Lawson will retire as of July 24, 2017. Their decisions to retire and not stand for reelection to the Board are not a result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

Mr. Hammes, age 85, has served on the Board since 1986, Mr. Lawson, age 80, has served on the Board since 1973, and Mr. Link, age 80, has served on the Board since 1994. Each of the directors currently serves as a member of the Board’s Audit, Nominating and Corporate Governance, and Compensation Committees.

Per Sports Perspectives:

“Gendell Jeffrey L boosted its stake in Skyline Co. (NYSEMKT:SKY) by 1.0% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC).

The institutional investor owned 824,302 shares of the construction company’s stock after buying an additional 8,052 shares during the period. Skyline makes up about 0.8% of Gendell Jeffrey L’s holdings, making the stock its 29th largest position. Gendell Jeffrey L owned about 9.82% of Skyline worth $7,765,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the company.

- Oxford Asset Management bought a new stake in shares of Skyline during the first quarter valued at approximately $194,000.

- GSA Capital Partners LLP bought a new stake in shares of Skyline during the fourth quarter valued at approximately $447,000.

- Teton Advisors Inc. increased its stake in shares of Skyline by 1.5% in the first quarter. Teton Advisors Inc. now owns 48,500 shares of the construction company’s stock valued at $457,000 after buying an additional 704 shares during the period.

- Robotti Robert increased its stake in shares of Skyline by 5.3% in the first quarter.

- Robotti Robert now owns 80,300 shares of the construction company’s stock valued at $756,000 after buying an additional 4,022 shares during the period.

- Finally, Dimensional Fund Advisors LP increased its stake in shares of Skyline by 3.3% in the fourth quarter. Dimensional Fund Advisors LP now owns 277,645 shares of the construction company’s stock valued at $4,292,000 after buying an additional 8,823 shares during the period.”

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

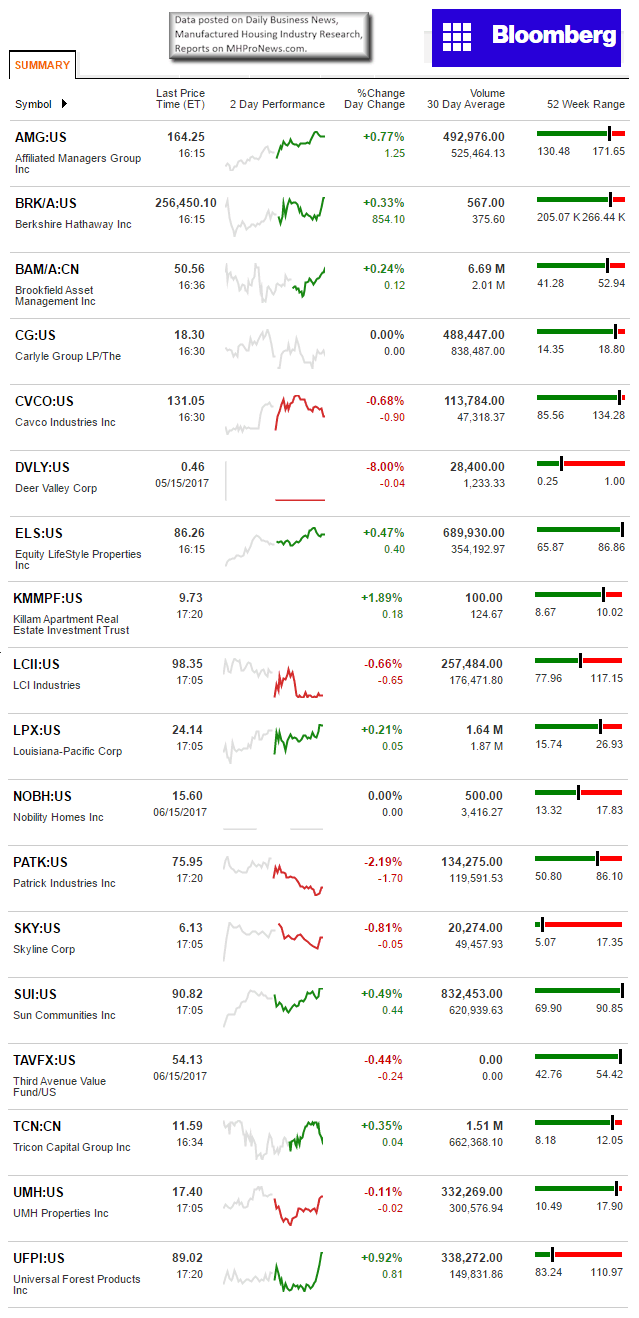

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII)

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)