Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- CNN sends sketch artist to White House briefing.

- What’s in the Senate Republican health care bill.

- Silicon Valley rocked by sexual harassment claims – again.

- How the GOP health care bills help the rich.

- Store closings have tripled so far this year.

- Coolest hotel bars for business travelers in 2017.

- Senate health care bill: Who it hurts, who it helps.

- Facebook CEO: ‘We have a responsibility to do more.’

- Here’s how much it costs to be a wedding guest.

- 15 years after ‘Minority Report’: A cautionary film, ignored.

- Must-have gadgets for business travelers.

Selected headlines and bullets from Fox Business:

- Joe Biden’s beef with Bill Ackman sparks heated exchange and presidential chatter.

- Rand Paul is wrong on health care bill: Andy Puzder.

- Wall Street ends higher on technology, energy boost.

- Oil creeps up from 10-month low, down nearly 4 percent on week Trump signs ‘historic’ bill to overhaul VA, hold employees accountable.

- Target removes ‘Just Mayo’ and Hampton Creek products from store shelves.

- Older Americans can’t afford health care bill’s ‘Age Tax’: AARP.

- Kroger, Walmart have time to bid for Whole Foods, but is it worth it?

- Cash-strapped universities rent out dorm rooms for profit.

- Sears to close more stores amid retail industry tumult.

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

9 key market indicators, ‘at the closing bell…’

S&P 500 2,438.30 +3.80 (+0.16%)

Dow 30 21,394.76 -2.53 (-0.01%)

Nasdaq 6,265.25 +28.56 (+0.46%)

Crude Oil 43.17 +0.43 (+1.01%)

Gold 1,257.80 +8.40 (+0.67%)

Silver 16.67 +0.16 (+0.98%)

EUR/USD 1.1183 +0.0031 (+0.28%)

10-Yr Bond 2.144 -0.009 (-0.42%)

Russell 2000 1,414.78 +10.24 (+0.73%)

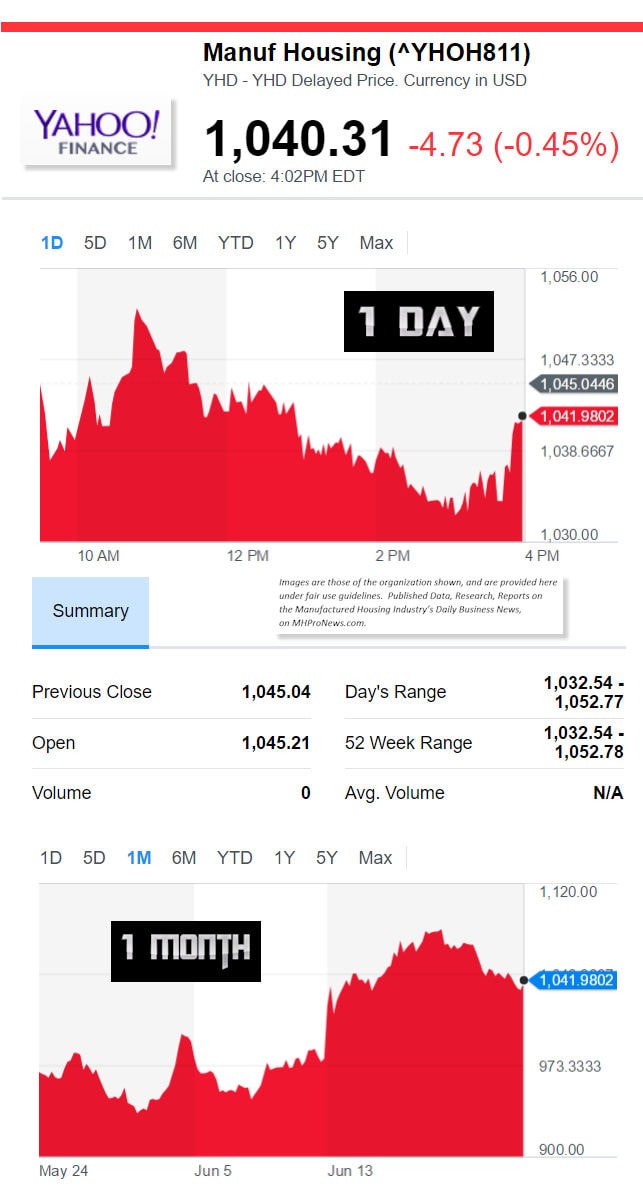

Manufactured Housing Composite Value 6.23.2017

Manufactured Housing Connected Stocks

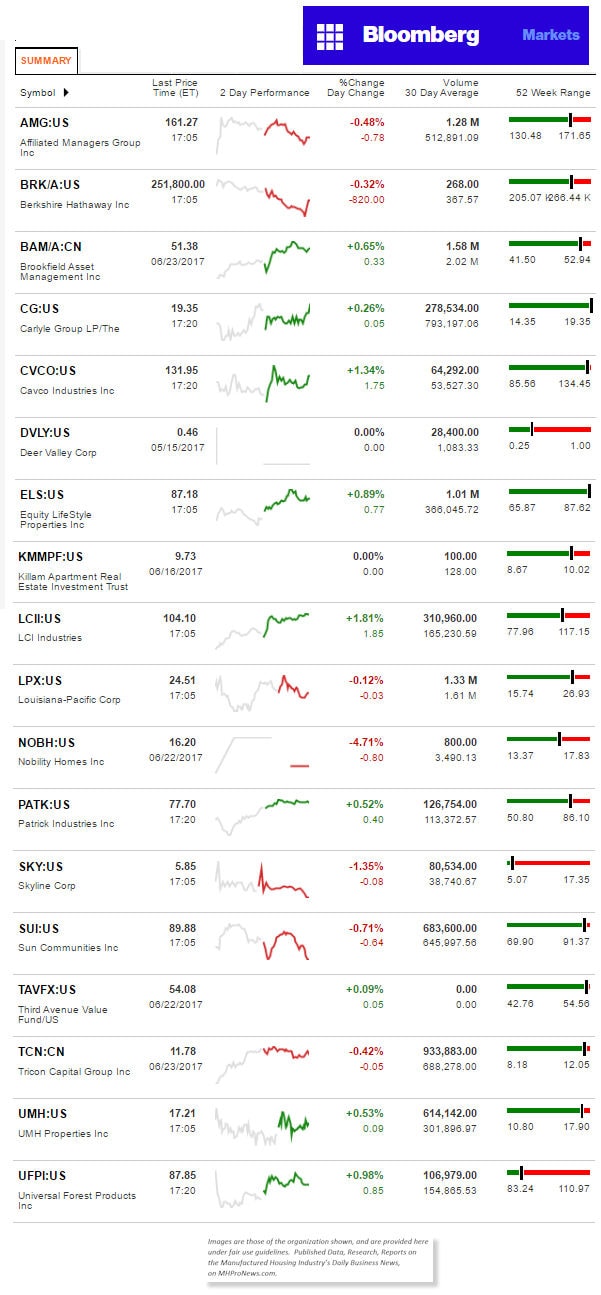

Today’s Big Movers

LCI, UFPI lead gainers. Meanwhile, Skyline Homes and Sun Communities lead retreaters.

See below for all the ‘scores and highlights.’

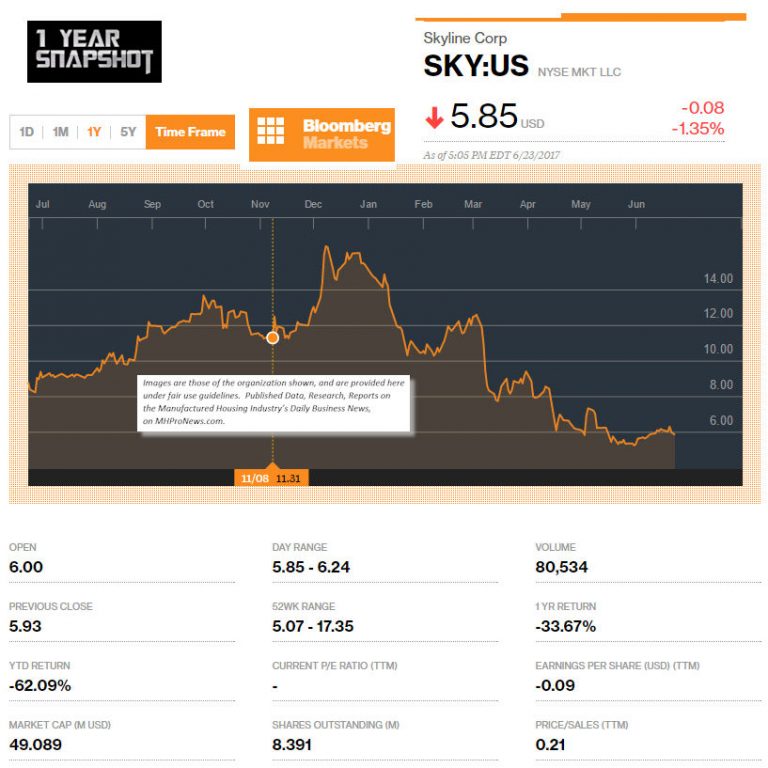

Today’s MH Market Spotlight Report – Skyline Homes

Per the Cerbat Gem’s market watch and reports, “Oxford Asset Management Takes Position in Skyline Co. (SKY)

“Oxford Asset Management bought a new position in shares of Skyline Co. (NYSEMKT:SKY) during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC).

The institutional investor bought 20,567 shares of the construction company’s stock, valued at approximately $194,000. Oxford Asset Management owned about 0.25% of Skyline as of its most recent SEC filing.”

Other large investors recently modified their holdings of the stock.

“Renaissance Technologies LLC raised its position in shares of Skyline by 51.6% in the fourth quarter. Renaissance Technologies LLC now owns 324,200 shares of the construction company’s stock valued at $5,002,000 after buying an additional 110,300 shares in the last quarter.

Wells Fargo & Company MN increased its stake in Skyline by 2.5% in the first quarter. Wells Fargo & Company MN now owns 1,192,533 shares of the construction company’s stock valued at $11,233,000 after buying an additional 29,631 shares during the last quarter.”

Note that Wells Fargo has as a major stock holder, Berkshire Hathaway. One of the rumors about Skyline has been that Clayton had its eyes on it, though antitrust concerns were an issue.

“GSA Capital Partners LLP purchased a new stake in Skyline during the fourth quarter valued at $447,000. Dimensional Fund Advisors LP increased its stake in Skyline by 3.3% in the fourth quarter. Dimensional Fund Advisors LP now owns 277,645 shares of the construction company’s stock valued at $4,292,000 after buying an additional 8,823 shares during the last quarter.

Teton Advisors Inc. increased its stake in Skyline by 1.5% in the first quarter. Teton Advisors Inc. now owns 48,500 shares of the construction company’s stock valued at $457,000 after buying an additional 704 shares during the last quarter.”

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII)

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)