Noteworthy headlines on CNNMoney – 170,000 gas stoves recalled because of explosion risk. Credit card giants sued over chip readers. Biggest one-day drop for gold since 2013. Google unveils new smartphone.

Some bullets from MarketWatch – Gold ends near post-Brexit vote low as dollar rallies. U.S. stocks retreat on specter of ECB QE tapering. Bill Clinton calls Obamacare ‘the craziest thing in the world’. Inside tonight’s VP debate.

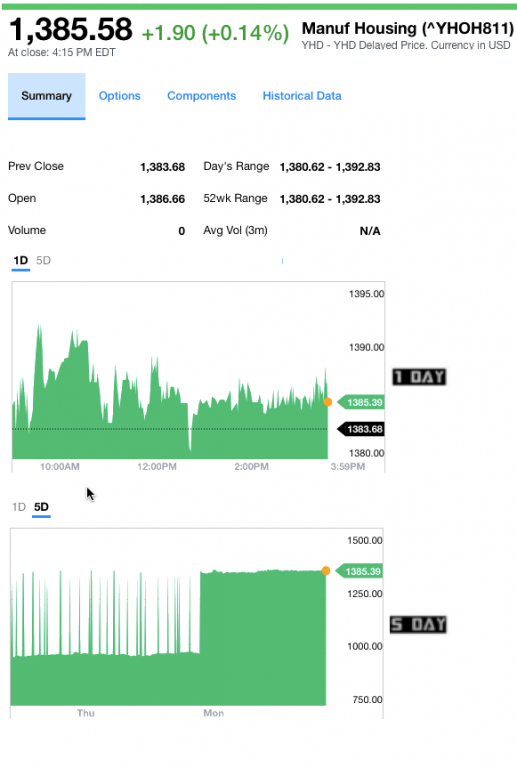

The MHCV – see below – beat the broader markets, as the tickers and charts reflect.

Gold down over 3%. Oil down 0.34.

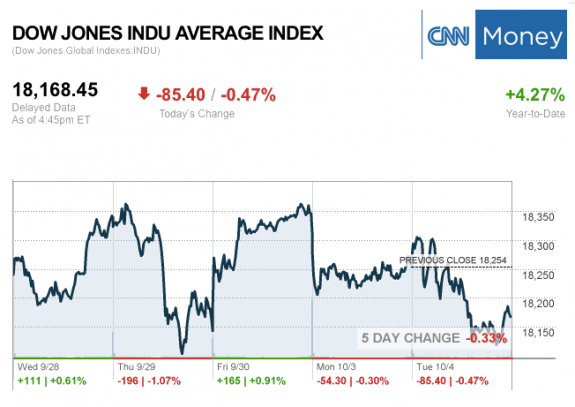

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2,150.49 -10.71 (-0.50%)

Dow JIA 18,168.45 -85.40 (-0.47%).

Nasdaq 5,289.66 -11.22 (-0.21%)

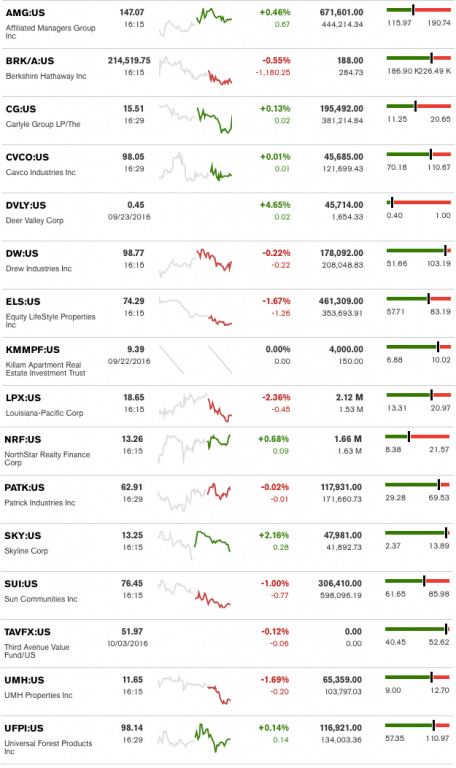

The MH Industry – Today’s Risers and Sliders

Top two gainers for the day were Skyline Corp. (SKY) and NorthStar Realty Finance (NRF). The top two sliders for the day were Louisiana-Pacific Corp (LPX) and UMH Properties (UMH). Killam and Deer Valley held steady, as those stocks are only being bought/sold periodically, (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

ELS spotlighted in the latest report linked here.

Skyline spotlighted in the new report linked here.

Manufactured Housing Composite Value (MHCV) Ticker

Note: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.