“Since 2010, UMH has tripled the size of the company by acquiring 107 communities containing approximately 18,800 developed homesites. These communities were acquired with a blended occupancy rate of 73% for a total purchase price of $616 million or $33,000 per site.” So states the UMH Properties 55th Anniversary presentation found at this link here. Their report also said: “In 2023, UMH completed the financing of eight communities that were acquired in 2012 and 2013. We have a total investment, including capital improvements of $52 million, or approximately $41,000 per site, in these communities. This financing valued the communities at $108 million representing a $56 million increase in value, resulting in an increase of 107%. UMH is proud to achieve excellent returns while providing high-quality affordable housing.” Some additional information from UMH Properties will be provided in Part II, but next up are some data points from SkyView Advisors in Part I, which gave this national snapshot. “$159,340,500 Manufactured Housing Sales Volume” in “44 Manufactured Housing Communities Sold” with “$94,300 Average Price per Site” and “38 Average Sites per Community.”

In Part III will be some additional inform and commentary along with our Sunday Weekly MHVille Headlines in Review.

Part I – per UMH Properties on Page 13

VACANT LAND EXPANSIONS

In 2023, we completed the construction of 216 sites. These expansion sites are well-located in markets with strong sales demand. Expansions create operating efficiencies in which each site generates additional revenue without an increase in fixed operating costs. The average development cost is approximately $75,000 per homesite. We expect to develop 300 or more sites in 2024. Home sales in expansions should generate sales profits of $30,000 or more per home, which reduces the cost to develop the site and increases our yield. Once stabilized, expansion sites yield more than what is available in the acquisition market.

We have an additional 2,100 vacant acres, which can potentially be developed into 8,500 homesites. This vacant land adjoining our properties and our vacant sites give us the ability to internally grow the company for the foreseeable future.

Part II – Per SkyView Pulse for November 2024

MHProNews notes that some of the properties shown in SkyView’s “Comps” report below do not list key details, such as sales price. That will clearly skew the value of the data somewhat.

Friday 1.3.2025

Thursday 1.2.2025

Wednesday 1.1.2025

Tuesday 12.31.2024

Monday 12.30.2024

Sunday 12.29.2024

Postscript

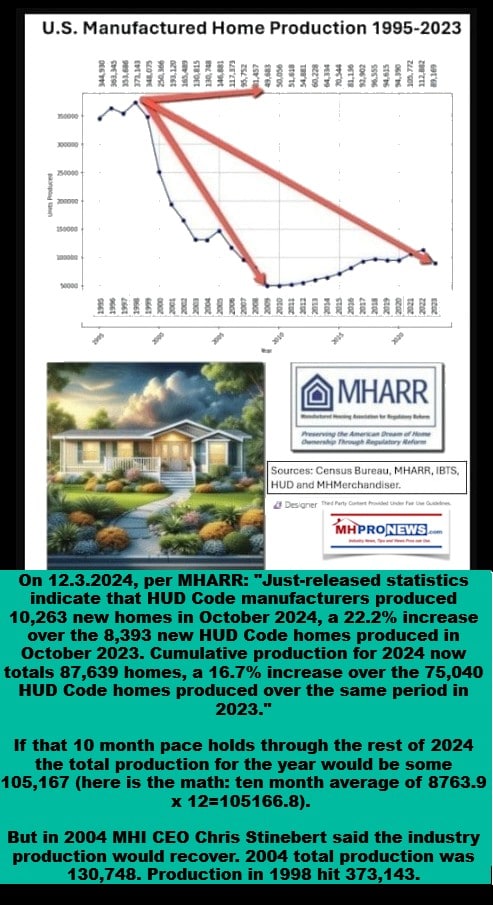

Facts and history can and do matter. It should be recalled that Marketplace.org, in a report spotlighted by MHProNews on 11.5.2021, stated that site builders were throttling the production of new conventional housing. Multifamily housing have reportedly been brisk, reportedly hitting record levels (see below) of some 450,000 multifamily units completed in 2023, “which was more than in any other year in the previous 36 years.” Yet manufactured home community (MHC) has been so low that it apparently may not meet replacement levels in developing new communities and sites? The absurdity and hypocrisy revealed in that contrast is an apparently embarrassing reflection on the Manufactured Housing Institute (MHI) claim that they represent “all segments” of the industry when closer to the truth is that they have members from all segments of the industry, but MHI is representing special interests with deeper pockets while paying lip service to all others. If you have been a believer in the sincerity of 100 percent of what MHI has said in the past decade, you are likely either a new readers or haven’t been paying close enough attention to the scores of times MHI’s official statements have been flawed, and sometimes deeply flawed. Over 200 pages of reports that reference MHI and their claims are linked here, and several of those may go into depth. Executive summary? The evidence reflects that MHI is working for the consolidators of the manufactured home industry.