According to the National Federation of Independent Business (NFIB) was the following results to their recent survey for April 2024. A source at the NFIB previously told MHProNews that apparently manufactured home related companies have constituted hundreds of the organization’s members. Their monthly survey tracks member feedback on a range of subjects including credit conditions, hiring plans, capital expenditures (a.k.a.: “CapEx”) plans, job openings, and other details. The NFIB about us page states: “NFIB is the voice of small business, advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is nonprofit, nonpartisan, and member-driven. Since our founding in 1943, NFIB has been exclusively dedicated to small and independent businesses, and remains so today.” Under the caption: “We Advocate” it says: “When a big issue affects small and independent businesses, NFIB is there.” Under the caption “We Influence” the organization stated: “When NFIB speaks, legislators listen. They know that we bring them the voice of small business. That voice, hundreds of thousands strong, comes directly from NFIB’s members and our research—combined, they make a powerful and influential case for our advocacy.”

That said, the latest report for April 2024 small business survey results are shown below.

Part I – Per NFIB Press Release – Inflation Continues to Hinder Small Business Operations

“Cost pressures remain the top issue for small business owners, including historically high levels of owners raising compensation to keep and attract employees,” said Bill Dunkelberg, NFIB Chief Economist. “Overall, small business owners remain historically very pessimistic as they continue to navigate these challenges. Owners are dealing with a rising level of uncertainty but will continue to do what they do best – serve their customers.”

Key findings include:

- The net percent of owners who expect real sales to be higher rose six points from March to a net negative 12% (seasonally adjusted).

- A seasonally adjusted net 12% of owners reported planning to create new jobs in the next three months, up one point from March’s lowest level since May 2020.

- A net 26% (seasonally adjusted) of owners plan price hikes in April, down seven points and the lowest reading since April of last year.

- Forty percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, up three points from March, which was the lowest reading since January 2021.

- The net percent of owners raising average selling prices fell three points from March to a net 25% seasonally adjusted.

As reported in NFIB’s monthly jobs report, 56% of owners reported hiring or trying to hire in April, and of those hiring or trying to hire, 91% of owners reported few or no qualified applicants for the positions they were trying to fill.

Fifty-six percent of owners reported capital outlays in the last six months, unchanged from March. Of those making expenditures, 38% reported spending on new equipment, 24% acquired vehicles, and 16% improved or expanded facilities. Eleven percent spent money on new fixtures and furniture and 6% acquired new buildings or land for expansion. Twenty-two percent (seasonally adjusted) plan capital outlays in the next few months.

A net negative 13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months. The net percent of owners expecting higher real sales volumes rose six points to a net negative 12% (seasonally adjusted).

The net percent of owners reporting inventory gains rose one point to a net negative 6%. Not seasonally adjusted, 12% reported increases in stocks and 17% reported reductions. A net negative 4% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in April. A net negative 6% of owners plan inventory investment in the coming months.

The net percent of owners raising average selling prices fell three points from March to a net 25% seasonally adjusted. Twenty-two percent of owners reported that inflation was their single most important problem in operating their business, down three points from March.

Thirteen percent of owners reported lower average selling prices and 41% reported higher average prices. Price hikes were the most frequent in the finance (54% higher, 7% lower), retail (49% higher, 8% lower), construction (48% higher, 7% lower), manufacturing (40% higher, 7% lower), and wholesale (40% higher, 10% lower) sectors. Seasonally adjusted, a net 26% of owners plan price hikes in April.

Seasonally adjusted, a net 38% reported raising compensation in April. A net 21% (seasonally adjusted) of owners plan to raise compensation in the next three months, unchanged from March.

Eleven percent of owners cited labor costs as their top business problem, up one point from March and two points below the highest reading of 13% reached in December 2021. Nineteen percent said that labor quality was their top business problem, remaining behind inflation as the number one issue.

The frequency of reports of positive profit trends was a net negative 27% (seasonally adjusted), two points better than March but still a very poor reading. Among owners reporting lower profits, 33% blamed weaker sales, 14% blamed the rise in the cost of materials, 13% cited usual seasonal change, and 12% cited labor costs. For owners reporting higher profits, 43% credited sales volumes, 26% cited usual seasonal change, and 11% cited higher selling prices.

Three percent of owners reported that all their borrowing needs were not satisfied, up one point from March. Twenty-eight percent of owners reported all credit needs met and 60% said they were not interested in a loan. A net 8% reported their last loan was harder to get than in previous attempts.

Four percent of owners reported that financing was their top business problem in April. A net 21% of owners reported paying a higher rate on their most recent loan, up four points from March.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in April 2024.” The NFIB’s Small Business Optimism Index (SBOI) asks a range of questions from their surveyed members. Plans to increase employment, plans to make capital outlays (CapEx), Plans to Increase (or decrease) Inventories, Expectations about Economy to Improve, Expectations on Real Sales Increasing, Current Inventory Levels (Up or Down), Current Job Openings, Credit (think access and costs) Conditions, Good Time to Expand, and Earnings Trends.

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following insights.

1) Per a Q&A with Bing’s Artificial Intelligence powered Copilot was the following response.

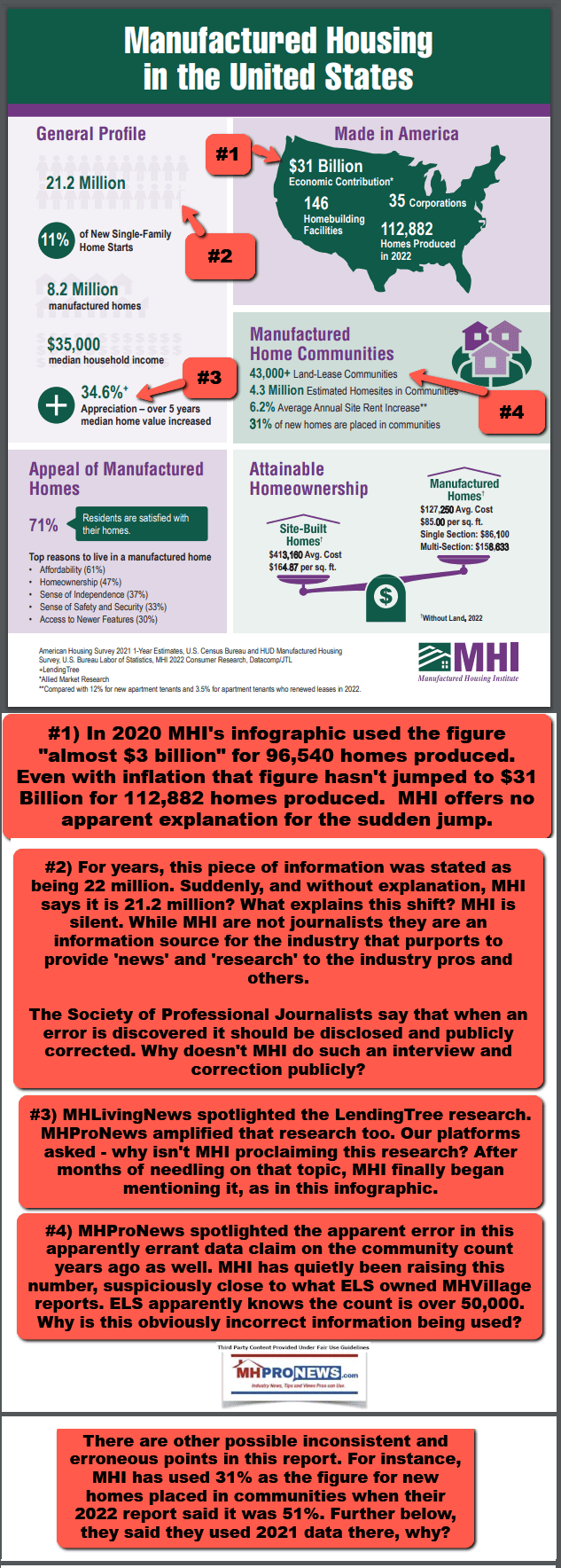

2) On 5.23.2024 and according the Manufactured Housing Institute (MHI or “the Institute”) website is the following “directory” information.

Manufacturer and Lender Directory

AL, AK, AZ, AR, CA, CO, CT, DE, DC, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VT, VA, WA, WV, WI, WY