If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline report is found further below, after the newsmaker bullets and major indexes closing tickers.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets. Headlines – at home and abroad – often move the markets. So, this is an example of “News through the lens of manufactured homes, and factory-built housing.” ©

Part of this unique evening feature provides headlines – from both sides of the left-right media divide – which saves busy readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

This is an exclusive evening or nightly example of MH “Industry News, Tips and Views, Pros Can Use.” © It is fascinating to see just how similar, and different, these two lists of headlines can be.

Want to know more about the left-right media divide from third party research? ICYMI – for those not familiar with the “Full Measure,” ‘left-center-right’ media chart, please click here.

Select bullets from CNN Money…

- Papa John’s blames Papa John for big sales decline

- Snap earnings: First take

- Plastic straws are out. These companies are cashing in

- Read Elon Musk’s email to Tesla employees

- Employers are finding new ways to cut health care costs

- Zillow buys a mortgage lender and the stock tanks

- China is building a big advantage in the race for 5G

- What’s next for MoviePass?

- Disney, Fox and Viacom: A big week for media earnings

- How Indra Nooyi built Pepsi for the future

- Daimler abandons its Iran plans over US sanctions

- Why the Dow is misleading

- Investors may be overreacting to Weight Watchers’ subscriber dip

- Grocery stores will end up winning the meal kit wars

- India’s biggest ride-hailing firm is heading to the UK

- Summers off? Yes, please! This company lets you pick your own perks

- Forget the ‘glass ceiling.’ The ‘concrete ceiling’ is so much worse

- West Virginia’s decision to allow smartphone voting sparks outcry

- Voting in the US is hard. Here’s why

- Depression in the C-suite

- At 18, she launched a startup. At 22, she’s blazing a trail in the VC world

- MoviePass has a new plan. Again.

- The best way to boost retirement income

- Jared Kushner deleted ‘critical’ stories at his newspaper, software developer claims

- Why Goodyear and Delta Faucet are doing research in space

- Facebook: We’re not ‘actively’ asking for people’s banking data

- PepsiCo CEO Indra Nooyi is stepping down

- Justice Department lays out roadmap to appeal of AT&T-Time Warner deal

- YouTube, Apple and Facebook remove content from InfoWars and Alex Jones

- SeaWorld makes a big splash: Attendance up, stock soars

- Will Harley-Davidson divide bikers from the president?

- Avis will start providing rental cars to Lyft drivers

Select Bullets from Fox Business…

- Tesla shares resume trading, Musk posts blog on why company should go private

- Saudi Arabia invests $2B in Tesla: report

- Tesla short-sellers pounded as Musk tweets about going private

- Elon Musk claims he’s taking Tesla private: Some takeaways

- GM inks innovative deal to cut employee health care costs

- Stocks rise as Iran sanctions take effect

- Inside monthly spending habits of a millennial

- Amazon has yet to tackle these two trillion dollar markets

- Venezuela’s oil production turning a corner?

- This is the best state to invest in a vacation home

- Democrat leaders need to step up, tell violent supporters to knock it off: Varney

- $1 million can last retirees anywhere from 11 to 26 years

- Home prices soar in these cities, states

- Tax deductible rent could soon become reality in New York

- Holding too much cash vs. investing could hurt your bottom line

- AI technology powers online college degrees

- Billy Joel’s agent makes history – standing beside the ‘Piano Man’

- Dennis Arfa, CEO of Artist Group International brings history to Madison Square Garden.

- You don’t have to retire broke, help is closer than you think

- Facebook wants banks to share your personal finances: Report

- NASCAR head takes leave of absence after arrest

- US workers get biggest pay hike in almost a decade

- Hologic CEO on innovating in women’s health

- Nestle USA CEO: We continue to grow in the US

- Small business owners favor more China tariffs: Survey

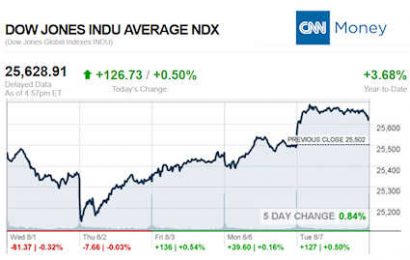

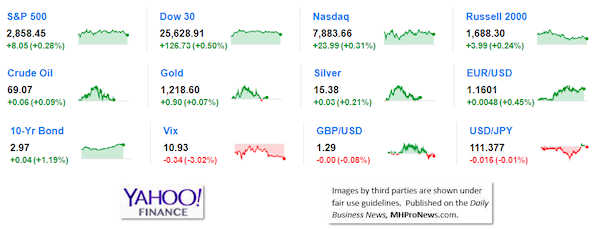

Today’s markets and stocks, at the closing bell…

Today’s Big Movers

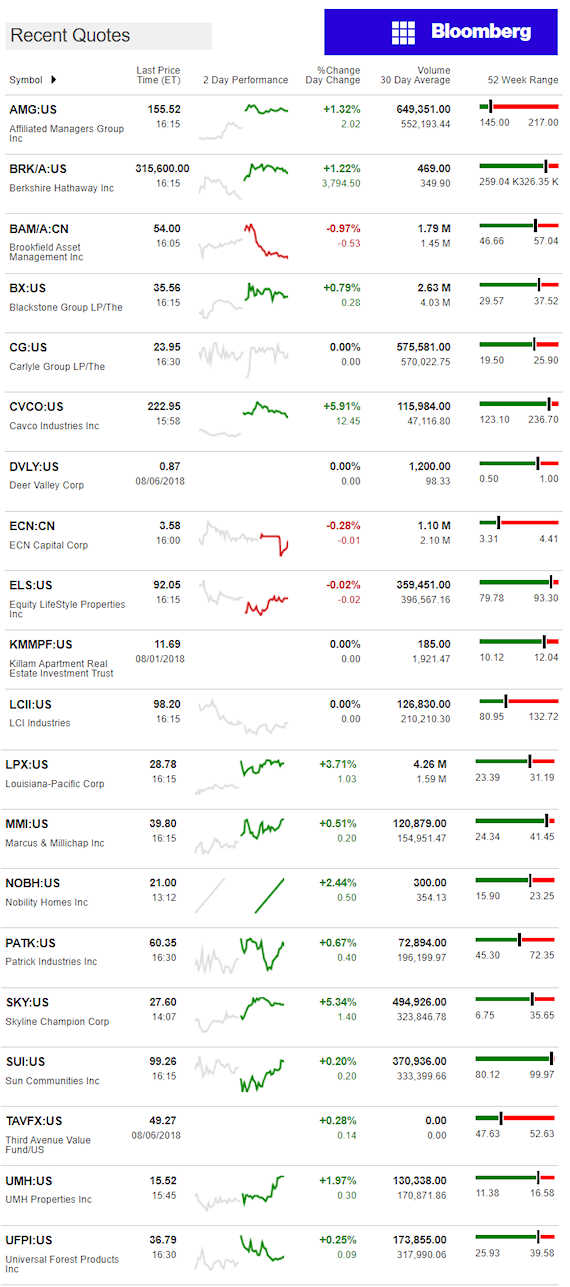

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

Fox Business Networks’ spotlighted this discussion about the emerging reactions on Wall Street to trade and tariff disputes.

Markets closed up, even though the Iranian sanctions have now kicked in.

President Trump tweeted that “The Iran sanctions have officially been cast. These are the most biting sanctions ever imposed, and in November they ratchet up to yet another level. Anyone doing business with Iran will NOT be doing business with the United States. I am asking for WORLD PEACE, nothing less!”

There’s speculation that Germany may be moving to work with Washington, but limiting access of Iranian assets moving through their banks.

FBN says that Iran shipped out almost 3 million barrels of crude per day in July. Sanctions on Iranian oil exports will take effect in November. That would send oil prices higher.

Unrest in Iran is on the rise, and while the Trump Administration has said they are not seeking regime change, there are numerous unknowns about what President Trump and Russia’s leader, Vladimir Putin discussed. Would it be a surprise if the Islamic state was part of the calculus for that meeting?

If they’re playing poker, senior Trump Administration officials are playing it like Cool Hand Luke. The signals are they expect a few weeks to months of tariff and trade tensions. But the Oval office has said and signaled that they expect to win at the end of this process. With markets rising again, investors seem to be gaining confidence that the White House is getting it right.

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.