Noteworthy headlines on CNNMoney – Get ready for $40 oil if OPEC deal collapses. Boeing tax package ruled illegal by WTO. Saudis believe Trump will unleash U.S. economy. These people are opting out of Obamacare.

Some bullets from MarketWatch – Dow, S&P 500 end 4-day win streak as stocks pull back. Russell 2000’s first drop in 16 sessions doesn’t mean the uptrend has ended. Bernanke tells Fed officials to clam up. Venezuelan currency crashes to all-time low on black market.

Oil up 1.82%. Gold up 1.24.

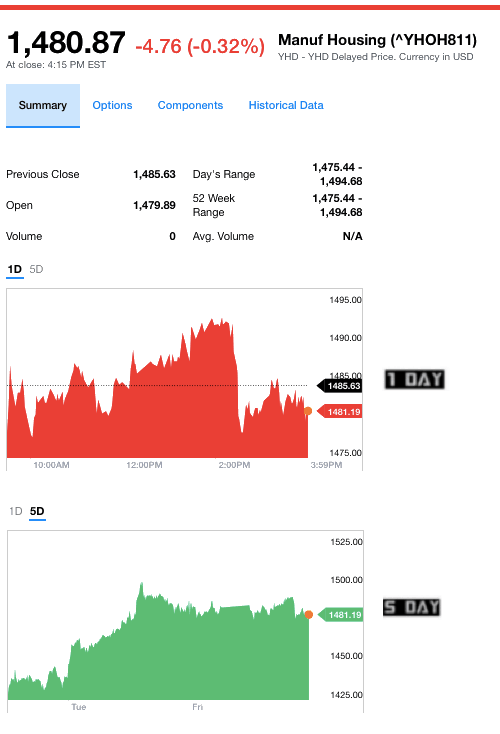

Under a barrage of media coverage in the wake of the Jill Stein/Hillary Clinton Campaigns pushing for a recount, the broader markets and the Manufactured Housing Composite Value retreated today. But most experts say that the odds against the recount push working are very slim.

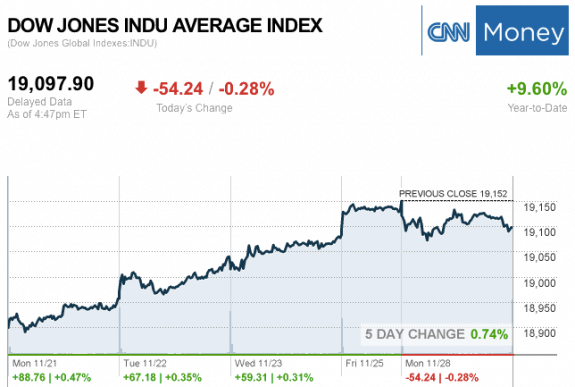

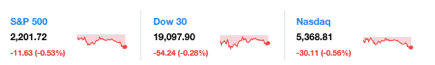

Three Major U.S. Market Tickers and closing numbers at the bell today…

S&P 500 2,201.72 –11.63 (-0.53%)

Dow JIA 19,097.90 -54.24 (-0.28%).

Nasdaq 5,368.81 –30.11 (-0.56%).

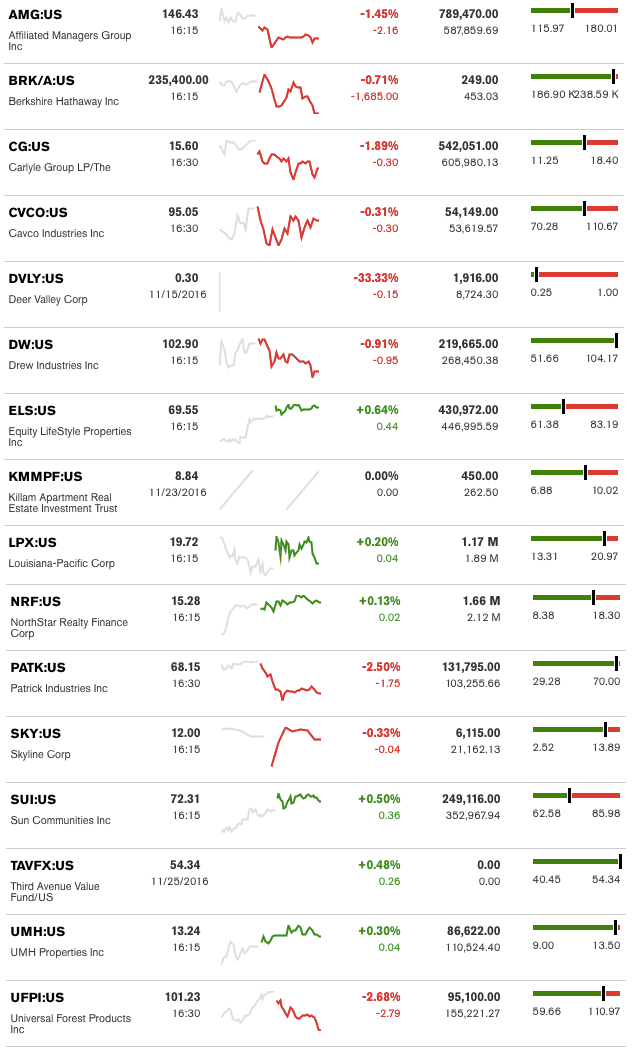

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Equity LifeStyle Properties Inc. (ELS) and Sun Communities Inc. (SUI). The top two sliders for the day were Universal Forest Products Inc. (UFPI) and Patrick Industries Inc. (PATK). Deer Valley and Killam held steady today, as the stocks are only being bought/sold periodically. (Notice: ALWAYS look at the date on the Bloomberg chart below, as some stocks aren’t traded daily, etc.).

Sun Communities is featured in a report here.

Manufactured Housing Composite Value Ticker (MHCV)

Note: the chart below covers several stocks NOT reflected in the Yahoo MHCV, shown above.

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. Drew, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.