Noteworthy headlines on – CNNMoney – What Wall Street wants to hear from Trump. Bidding war over Obamas’ book deal. NY Fed president: “Animal spirits have been unleashed.” Shamed retail baron pays $450M to protect pensions.

Some bullets from Fox Business – Dow halts record run, February was still mighty for markets. Trump plan to slash state, foreign aid spending has foes in Congress. Amazon’s cloud service partial outage affects certain websites. Private prison firms gain as Trump plans to crack down on crime, illegal immigration.

“We Provide, You Decide.” ©

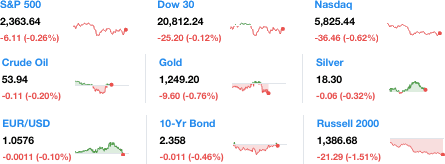

Key Commodities

Crude Oil 53.94 –0.11 (-0.20%) Gold 1,249.20 –9.60 (-0.76%) Silver 18.30 –0.06 (-0.32%)

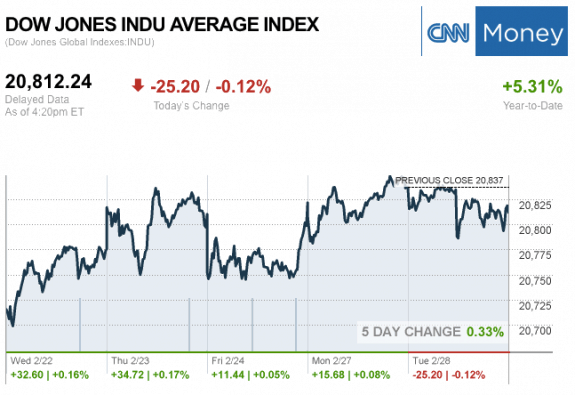

The markets at the Closing Bell Today…

S&P 500 2,363.64 –6.11 (-0.25%)

Dow 30 20,812.24 –25.20 (-0.12%)

Nasdaq 5,825.44 –36.46 (-0.62%)

Russell 2000 1,386.68 –21.29 (-1.51%)

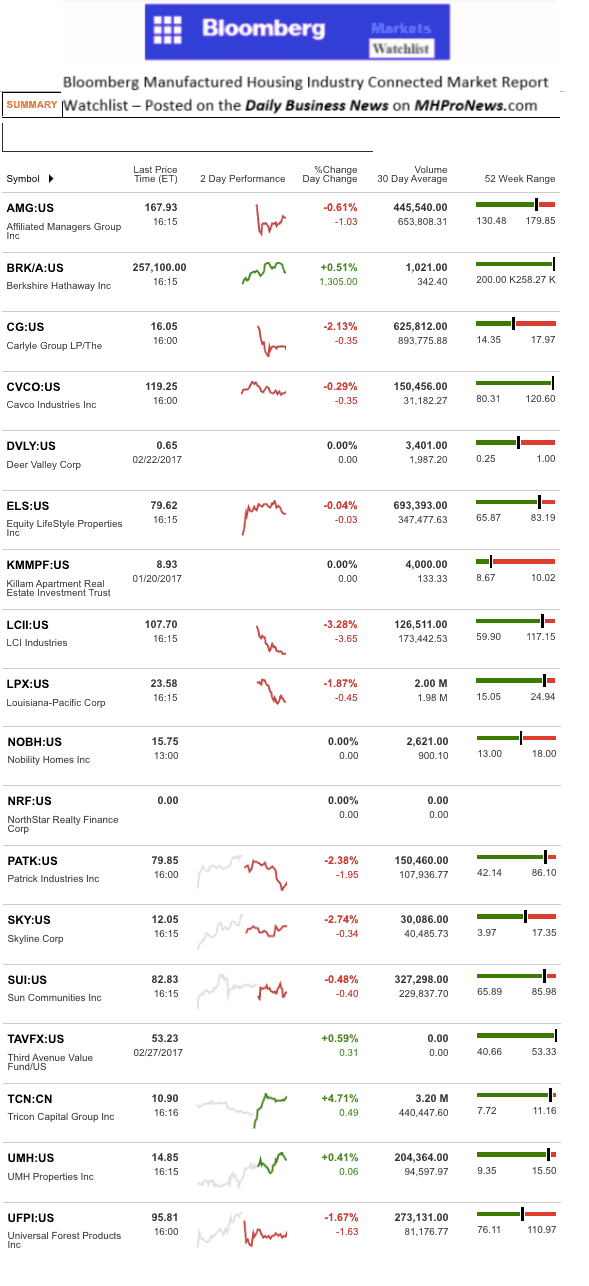

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Tricon Capital Inc. (TCN) and Berkshire Hathaway Inc. (BRK/A).

The top two sliders for the day were Skyline Corp. (SKY) and LCI Industries (LCII).

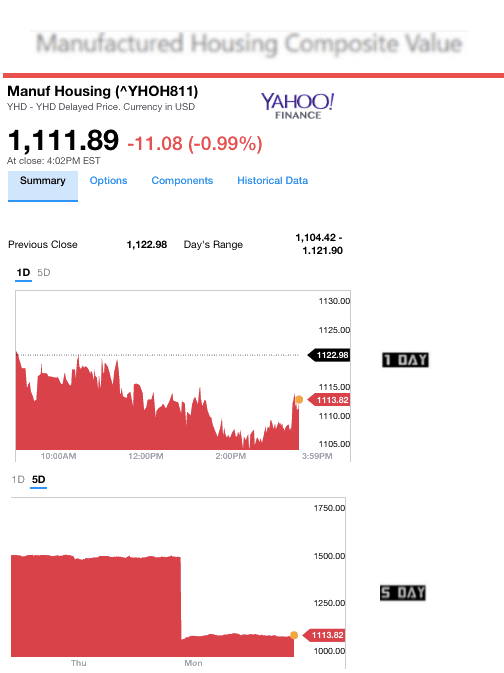

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.