Making matters worse, there remain 61 regulations under Dodd-Frank that have yet to be implemented. For an economy still trying to recover from the Great Recession, the law has resulted in a 14.5 percent decline in revolving consumer credit.

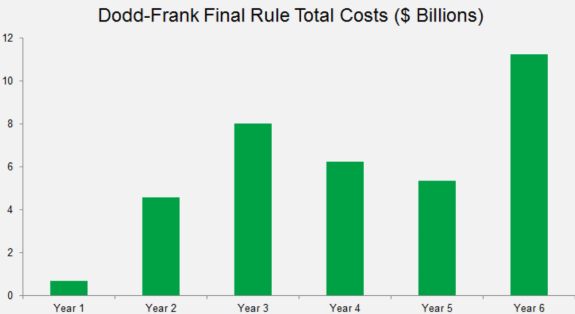

On a chart examining costs of imposing Dodd-Frank over the six years since it was first voted in, year one was under $1 billion, but mushroomed to over $4 billion the next year, hitting $8 billion in year three, $6 billion in the fourth year, slipping to about $5 billion the following year, and shooting up to $10.4 billion of economic burdens in the sixth year.

The 533 final rule documents produced by Dodd-Frank have slowly declined since year two, but 61 rulemakings remain to be implemented which could add another $3.3 billion to the cost of Dodd-Frank plus almost a million paperwork hours. The most prominent is the Requirements for Systemically Important Financial Institutions (SIFIs) at $1.5 billion. Proposed last year by the Federal Reserve, its goal is to improve capital standards at the largest, interconnected financial institutions.

The second rule, and second largest, at $1.3 billion in costs, requiring 242,321 paperwork hours, is the Disclosure of Payments by Resource Extraction Issuers. It requires companies “to provide information on payments to foreign governments and corporations on the commercial development of oil, natural gas, or minerals.” Expected to be complete by June 2016, the SEC continues to work on this rule.

The third rule, banning arbitration agreements from particular consumer financial products has created controversy, remains under comment with no date for finalization. Its cost is set at $379.7 million, requiring 500 paperwork hours.

The fourth proposed rule, from the SEC, Security-based Swap Repositories, is estimated to cost some $104 million with over 676,000 paperwork hours notched. The final rule of these five, SEC’s other Swap Repository rule, would mandate new record keeping and reporting requirements on repositories to share specific date with regulators. It would cost an estimated $103.8 million and require 36,120 paperwork hours, involving SEC employees monitoring swap information.

Some of the remaining federal rulemakings related to Dodd-Frank are shown below with their expected completion dates (some are overdue), although many are so complicated it may take years to finalize.

| Rule | Expected Publication Date |

| Incentive-Based Compensation Agreements | May 2016 |

| Annual Stress Test | May 2016 |

| Clearing Requirement | May 2016 |

| CFPB’s Arbitration Rule | May 2016 |

| Margin Requirements for Swap Entities | May 2016 |

| Incentive Compensation | May 2016 |

| Resource Extraction Issuers | June 2016 |

| Amendments to Regulations X and Z | July 2016 |

| Regulatory Capital Rules | October 2016 |

| Reporting of Proxy Votes | April 2017 |

| End-User Exception | April 2017 |

| Stress Tests for Large Investment Firms | April 2017 |

| Pay Versus Performance | April 2017 |

| Disclosure of Hedging by Officers and Directors | May 2017 |

| Covered Broker Dealer Provisions | N/A |

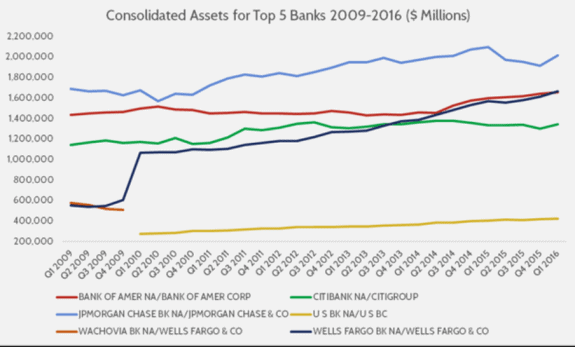

Finally, one of Dodd-Frank’s main objectives was to prevent the “Too Big to Fail” phenomenon, but as the graph below shows, the five largest commercial banks have enjoyed slow but steady growth in the years since the housing bubble.

However, as MHProNews has learned, it is not the actual growth that matters, but how that growth affects the market’s structure. The top five banks have been responsible for a majority of that market in 13 out of the 23 quarters that Dodd-Frank has been in effect.

While a straight line cannot be drawn that directly connects the six-year-old regulations to increased concentration of the banking industry, the data certainly indicate that Dodd-Frank contributed to what it had intended to prevent at a cost of $36 billion and 73 million paperwork burdensome hours.

AAF concludes: “As time passes, the law becomes more expensive as regulatory agencies like CFPB and FHFA grow with the mission to implement burdensome rules. Meanwhile, small financial services firms continue to struggle as the law restricts the availability of financial products. With dozens of regulations still left to implement, one can only expect the costs to continue to rise.”

As MHProNews knows, Dodd-Frank is directly responsible for impeding the financing of manufactured homes, especially low cost homes. ##

(Graphs and chart credit: American Action Forum;

Dodd-Frank’s breezy banner:bloombergbusinessweek)