While several firms in MHVille are busy crafting excuses for their lack of growth, Duncan Bates – President, and Chief Executive Officer (CEO) of Legacy Housing (LEGH) – stated: “I am pleased with Legacy’s second quarter performance. According to Manufactured Housing Institute data, industry home shipments through May 2023 are down 29.0% year over year. However, housing affordability in the U.S. continues to deteriorate and retail traffic in our industry is accelerating. Loan applications at our company-owned retail stores hit a 12-month high in July 2023.” Bates said they are expanding their ability to tap into growth opportunities and explained how that and other steps are being approached. While Legacy reported that they also had a dip, their slip was significantly less than the industry’s average per the Manufactured Housing Association for Regulatory Reform data indicates for the first 6 months of 2023 and per Manufactured Housing Institute (MHI) data too.

Part I of this report is the Legacy press release for their 2nd Quarter 2023 corporate financial performance.

Part II is Legacy’s earnings call transcript, per Seeking Alpha. Highlighting in that below is added by MHProNews.

Part III – Additional Information with More MHProNews Analysis and Commentary.

With that plan of action for this article, let’s dive in.

Part I

Legacy Housing Corporation Reports Second Quarter 2023 Financial Results

August 9, 2023

BEDFORD, Texas, Aug. 09, 2023 (GLOBE NEWSWIRE) — Legacy Housing Corporation (“Legacy” or the “Company,” NASDAQ: LEGH) today announced its financial results for the second quarter ended June 30, 2023.

Financial Highlights

- Net revenue for the second quarter of 2023 was $52.6 million, a decrease of 18.0% from the second quarter of 2022.

- Income from operations for the second quarter of 2023 was $17.5 million, a decrease of 14.5% from the second quarter of 2022.

- Net income for the second quarter of 2023 was $15.0 million, a decrease of 13.0% from the second quarter of 2022.

- Basic earnings per share for the second quarter of 2023 was $0.62, a decrease of 12.7% from the second quarter of 2022.

- Book value for the second quarter of 2023 was $413.2 million, an increase of 8.1% from the fourth quarter of 2022.

- Book value per share for the second quarter of 2023 was $16.94, an increase of 8.0% from the fourth quarter of 2022.

Duncan Bates, President and Chief Executive Officer, stated: “I am pleased with Legacy’s second quarter performance. According to Manufactured Housing Institute data, industry home shipments through May 2023 are down 29.0% year over year. However, housing affordability in the U.S. continues to deteriorate and retail traffic in our industry is accelerating. Loan applications at our company-owned retail stores hit a 12-month high in July 2023. We continue to focus on sales and cost management, and we recently closed a new Revolving Credit Facility which provides additional flexibility to pursue growth opportunities.”

This shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Conference Call Information

Management will host a conference call to discuss the results at 10:00 a.m. Central Time on Thursday, August 10, 2023. To access the conference call, please pre-register using this link. Registrants will receive confirmation with dial-in details. A live webcast of the call can be accessed using this link.

About Legacy Housing Corporation

Legacy builds, sells, and finances manufactured homes and “tiny houses” that are distributed through a network of independent retailers and company-owned stores. The Company also sells directly to manufactured housing communities. Legacy is the fifth largest producer of manufactured homes in the United States as ranked by the number of homes manufactured based on the information available from the Manufactured Housing Institute and the Institute for Building Technology and Safety. With current operations focused primarily in the southern United States, we offer our customers an array of quality homes ranging in size from approximately 395 to 2,667 square feet consisting of 1 to 5 bedrooms, with 1 to 3 1/2 bathrooms. Our homes range in price, at retail, from approximately $33,000 to $180,000.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Securities and Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. As a result, our actual results or performance may differ materially from anticipated results or performance. Legacy undertakes no obligation to update any such forward-looking statements after the date hereof, except as required by law. Investors should not place any reliance on any such forward-looking statements.

Part II – Q2 Earnings Call Transcript

Legacy Housing Corporation (LEGH) Q2 2023 Earnings Call Transcript

Aug. 10, 2023 4:19 PM ET Legacy Housing Corporation (LEGH)

Legacy Housing Corporation (NASDAQ:LEGH) Q2 2023 Earnings Call Transcript August 10, 2023 11:00 AM ET

Company Participants

Duncan Bates – President & CEO

Max Africk – General Counsel

Conference Call Participants

Alex Rygiel – B. Riley

Mark Smith – Lake Street Capital

Tim Moore – EF Hutton

Operator

Good morning, ladies and gentlemen. Thank you for standing by. Welcome to Legacy Housing Corporation Second Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] Please note that today’s conference is being recorded.

I will now hand the conference over to your speaker host, Mr. Duncan Bates, President, Chief Executive Officer. Please go ahead, sir.

Duncan Bates

Good morning. This is Duncan Bates, Legacy’s President and CEO. Thanks for joining our second quarter 2023 conference call. Max Africk, Legacy’s General Counsel will read the safe harbor disclosure before getting started. Max?

Max Africk

Thanks, Duncan. Before we begin, may I remind our listeners that management’s prepared remarks today will contain forward-looking statements, which are subject to risks and uncertainties, and management may make additional forward-looking statements in response to your questions. Therefore, the company claims the protection of the Safe Harbor for forward-looking statements that is contained in the Private Securities Litigation Reform Act of 1995. Actual results may differ from management’s current expectations and therefore, we refer you to a more detailed discussion of the risks and uncertainties in the company’s Annual Report filed with the Securities and Exchange Commission.

In addition, any projections as to the company’s future performance represent management’s estimates as of today’s call. Legacy Housing assumes no obligation to update these projections in the future, unless otherwise required by applicable law.

Duncan Bates

Thanks, Max. I will run through our prepared remarks, then open the call for Q&A. Product revenue decreased to $42.3 million or 23.2% in the second quarter of 2023, compared to the second quarter of 2022. The decrease primarily resulted from a 14.6% decrease in products sold and a 10.1% decrease in net revenue per product as customer demand shifted toward the lower end of our product line. Also, we did not convert any independent dealer consignment arrangements to floor plan financing agreements during this quarter as we did in the second quarter of 2022.

According to Manufactured Housing Institute data, industry home shipments through May 2023 were down 29% year-to-date. However, housing affordability in the US continues to deteriorate and retail traffic in our industry is accelerating. One of the leading indicators that we track on the retail or dealer side of our business is loan applications.

A few recent data points. Loan applications at Heritage Housing, our company-owned retail stores, hit a 12 month high in July 2023. Loan applications at Federal Investors, our consumer lending arm were up 17.6% in the second quarter of 2023, compared to the second quarter of 2022. Also, applications surged 60.8% in July 2023, compared to July of 2022. On the community or park side of our business, sales to existing customers remain stable. Like other manufacturers, we have battled delayed shipments due to setup-related issues. Our quote activity for new projects beginning late 2023 and early 2024 is strong. We rarely discuss Legacy’s commercial product portfolio. Legacy has an extensive line of workforce housing solutions. Inquiries for our commercial products from customers in the energy, agriculture, film and disaster relief industries are the highest I’ve seen since joining Legacy.

Consumer and MHP loan interest income increased $8.5 million or 13.2% during the three months ended June 30, 2023, as compared to the same period in 2022. This increase was driven by increased balances in the MHP and consumer loan portfolios. Our financing businesses generate predictable recurring revenue and we continue to invest in them.

Between June 30, 2023, and June 30, 2022, our MHP note portfolio increased by $43.9 million and our consumer loan portfolio increased by $15.1 million. This is net of principal payments and loan loss allowances. Also this does not include floor plan financing or development loans.

I frequently field questions from investors about loan performance. The accountants figures are in the filing, but the way that I think about delinquent accounts is over 30 days with no payments. At June 30, 2023, over 99.5% of MHP notes and 98.5% of consumer loans were current. We monitor these numbers closely and are confident in the strength of our loan portfolios.

Other revenue, primarily consists of dealer financed fees and commercial lease rents, which increased to $1.8 million or 13.4% in the second quarter of 2023, compared to the second quarter of 2022. Selling, general and administrative expenses decreased 6.3% during the three months ended June 30, 2023, as compared to the same period in 2022. This decrease was primarily due to decrease in consulting and professional fees and a decrease in warranty costs.

Net income decreased 13% to $15 million in the second quarter, compared to the second quarter of 2022. Legacy delivered a 17.3% return on equity over the last 12 months. At the end of the second quarter of 2023. Legacy’s book value per basic share outstanding was $16.94, an increase of 18.6% from the same period in 2022. We continue to hold pricing, reduce our raw material inventory and reduce our SG&A. Legacy has not missed one production day at any manufacturing facility in 2023.

Legacy’s balance sheet is strong. We ended the quarter with $1.5 million in cash and $4.7 million drawn on our line of credit. On July 28, 2023, we closed a new revolving credit facility with Prosperity Bank. The facility is for $50 million, with a $25 million accordion feature. It is secured by our consumer loan portfolio.

Our team has been focused this quarter on internal strategic projects. A few examples, we are updating and adding more modern features to our products, we are revamping our sales processes, and hiring additional talented sales professionals. We made a big push on social media and digital advertising of Heritage Housing and are beginning to see results. We also believe there is significant value to unlock on the land development side of our business. We are committed to these projects and are hiring additional team members to prioritize and accelerate progress.

In addition to internal projects, we are consistently evaluating inorganic growth opportunities. The new bank line gives us the flexibility to pursue these opportunities, if they hit our return threshold.

Operator, this concludes our prepared remarks. Please begin Q&A.

Question-and-Answer Session

Operator

[Operator Instructions] And our first question coming from the line of Alex Rygiel with B. Riley Securities. Your line is open.

Duncan Bates

Hey, Alex.

Alex Rygiel

Good morning, Duncan. How are you?

Duncan Bates

I’m good. How are you?

Alex Rygiel

Doing well. A couple of quick questions here. So, do you have any sales remaining to be booked from a — transitioning from that consignment program?

Duncan Bates

Yes. We have about 120 or so houses that are still in the old consignment program.

Alex Rygiel

And what is the timeframe or timeline look like for converting those?

Duncan Bates

I think we’d like to do it by year-end. There’s some — these are kind of the final holdout of dealers. So, it’s taken a little bit of time to work through this.

Alex Rygiel

And then you brought up an interesting point as it relates to inquiries for commercial product being very, very high. Can you remind us when these commercial orders come in. I suspect they’re kind of fairly large in size from time-to-time. So, maybe talk about how big some of these could be.

Duncan Bates

Yes, you know, there’s two pieces. I mean, we’ve got some dealers in Texas that’ll — that have relationships with, say, larger oilfield services or E&P companies or agricultural businesses. And they’re selling lower volume. Just two here, three there, four there. But there is — we are seeing some inquiries from larger products that I would say, are closer to sales that we would see on the community or park side of our business. So, they range from us selling a couple of these things to potentially selling hundreds of these things and we’ve got a lot of quotes out now, we’re trying to reel people in and it’d be great if something hits.

Alex Rygiel

And lastly, where’s the Georgia plant as it relates to production levels? And is that an opportunity to utilize that facility for these commercial opportunities?

Duncan Bates

We have built this product in Georgia. We didn’t — I didn’t comment on Georgia in our prepared remarks, because, frankly we feel great about where that plant spend — where it sits today. We’ve made a tremendous amount of — we’ve implemented a tremendous amount of changes there. We’ve got new Sales Manager, new General Manager, we’ve shifted people around, we’ve hired a lot of people. Right now, we’re running three to four a day at Georgia and our hope is to continue to ramp that up, as you know — depending on demand. So Georgia is in a good spot. And now we’ve just got to get out and keep selling.

Alex Rygiel

That’s, great. Thank you.

Duncan Bates

Thanks, Alex.

Operator

Thank you. And our next question coming from the line of Mark Smith with Lake Street Capital. Your line is now open.

Mark Smith

Hey, Duncan. First off, can you just walk us through a little bit more in depth of sales mix, both channel and kind of price points, kind of where things changed, where the headwinds are? Maybe where emphasis is to drive maybe better sales in different channels?

Duncan Bates

Yes, sure. I’ll try to take that a couple pieces of time. I mean, if you look at the Q, the price or the revenue per product sold is down and that contributes to the decline in sales, in addition to just lower volume. And I think what — what’s happened is, we have — we built a great park model home, we’ve got some large customers that continue to take a lot of these. And so, they’re just — we’re selling lower. We’re selling park model homes and we’re selling less option homes to dealers as they start to build inventory again.

Mark Smith

And I think you said in your prepared remarks that as we look at kind of a standard consumer home, are you seeing more demand at those lower price points and/or the higher price points?

Duncan Bates

Yes, absolutely. I think, the — this consumer with inflation has been hit pretty hard. And although chattel rates have not gone up as much as traditional mortgages, just with inflation and every other aspect of their lives, they are looking at a little bit lower end or less optioned homes than they were 12 months ago.

Mark Smith

Got it. And that leads to my next question. As we think about both loan portfolios, consumer and MHP, any thoughts around rates? It looks like it came up a little bit here in the quarter. Can you take more or what is this — can you reach at a breaking point where you just can’t raise rates anymore?

Duncan Bates

Yes. Our strategy for the past little over 12 months has been hold price firm and hold rates firm. Now that said, there’s some nuances on either side of the business. On the consumer loan portfolios, I mean, we’ve held our base rates, but the rates are subject to our underwriting process. And so, that really depends on the consumer’s credit quality. On the MHP side of the business, our financing program has a base rate and then it flips to variable. And so, we’ve held the base rates consistent. Over the next, say 24 months, you’re going to see a lot of these flip to variable and you’ve got community customers that when that flip happens, we’ll be inclined to refi their projects and pay us off.

Mark Smith

Okay. And the last question for me, you said that kind of the park and land development projects are something that you’re focused on now. Any update on where these projects stand today? Any goalposts we should be looking for over the next couple of quarters?

Duncan Bates

Yes, we’ve had so much going on over the last 12 months, where I feel like, we’ve finally got the foundation stable and we’ve had issues at the Georgia plant with obviously the markets slow down. I mean, we are spending all of our time focused on the business. And as we move forward, we’ve got to accelerate these legacy projects. And so, a big topic internally was land development this quarter and actually putting together a plan on — for what we’re going to do going forward.

So, right now, we’re in the process of assembling a team. We’re committed to these projects. They haven’t stalled. I think, we just feel like they’re not moving as quickly as they need to. We’re primarily focused on the kind of the, I’d say, the crown jewel of this portfolio which is Bastrop County, and we are making good progress now on Phase 1. And I’d hope — I think I need another, say another month or two to put out some actual goalpost, but that certainly is the game plan.

Mark Smith

Okay. Thank you.

Duncan Bates

Thanks, Mark.

Operator

Thank you. And our next question coming from the line of Tim Moore with EF Hutton. Your line is open.

Tim Moore

Thanks. Duncan, a few of my prepared questions already asked, but I actually have four remaining ones.

You mentioned that Legacy and it’s pretty obvious, the great attribute you’ve held kind of the base interest rate pretty much the same unlike the steep 3% rise in single — single-family mortgage rates over the past year and a half or so. You mentioned the green shoots and loan applications in July and it was terrific. Sounds like walk-in traffic is better at the retail locations and up a lot. My question is, I’m just trying to pinpoint, the possible conversion of timing for, how many months it might take from loan applications to convert to an order to ship lead time when you can actually book revenues? Is that something like three months? In other words, if there is an inflection point and I’m not putting words in your mouth for July and maybe that’s continuing in August. Does that convert something like October and November sales?

Duncan Bates

Yes, I wish I had a crystal ball and could tell you exactly when that is happening. The dealer channel of our business has been pretty slow for a few quarters and the consumer backed off you had dealers that were — had a lot of inventory and install their consignment or floor plan financing arrangements or interest rates go up pretty significantly. And — but what we’re hearing from our customers now and what we’re seeing with our own stores is, there does seem to be a pickup in that channel. You have dealers that are selling homes, reordering homes, and you’ve got a lot of foot traffic at the dealer level. And obviously, we’re seeing it in the loan applications.

I don’t — I think it’s going to be a steady progression like, I don’t think you just overnight there is this huge boom on the dealer side of the business, but it does feel like we’re getting some momentum, dealers are clearing out their inventory, they’re starting to reorder and we’ve seen an uptick in applications, but we’ve also seen an uptick in the credit quality of those applications. It seems like there’s consumers out there that maybe are dropping down into this category and are able to put up larger down payment than we’ve seen historically. So, we’re monitoring it closely. We’ll — we hope it continues and obviously, we’ll keep the market updated quarterly as we see things.

Tim Moore

Great. Duncan, that’s really a good color and nice to see the credit quality increase on the applications. How are — how is the demand and the interest levels from the park operators? I know that’s held up pretty good. How’s that been doing the last few months?

Duncan Bates

Yes, it’s slower than we’d like. It seems like a lot of these guys are facing pretty serious delays on the setup side. And I don’t know, if it’s — it doesn’t seem like it’s as much setup crews, it’s like getting the utility operators to cooperate, or the counties to cooperate with certificate of occupancies, and things like that. We tend to serve a — I think a different — a little bit different customer base in our larger competitors. I mean, most of our customers on the park side are regional entrepreneurs. And a lot of these guys sold portions of their portfolios when the prices really went crazy last year.

So we’ve got some big customers that are deploying capital now, they’re ordering houses fairly consistent — consistently. But, we are like — and we are making a sales push for new customers, but it’s a little bit slower than we’d like. And so, we’re — I think, just based on our quote activity, it feels like end of the year, early next year, these like that channel will gain traction, like the dealer channel is now.

Tim Moore

And that’s helpful color, Duncan. So, I have two more questions.

Duncan Bates

Sure.

Tim Moore

How are the labor constraints of the three plants compared to maybe last summer? You mentioned, you haven’t missed one production day this year so far, which is phenomenal. And you’re hiring more with a social media push. Do you think this just theoretically — I’ll throw it out there that maybe volume start coming back pretty good in November, December, that you’ll have enough labor in place and routines?

Duncan Bates

Yes, geez labor has been a challenge for a while, all the way back through COVID. And I think, for us and for our — for the other manufacturers, the constraint is not how much space you have, or how big your yard is, or how big your plant is, it really is a labor constraint. And what — I mentioned this, I think, on another call, but this is a very simple parameter that we use to think about the labor market is. At our Fort Worth plant, there’s a waiting room on the front. And if you talk to Curt and Kenny, they’ll tell you, through COVID they didn’t have a single person show up looking for a job and we’re consistently getting three, four or five people that come in each day and apply. So it does feel like the labor markets loosening up a little bit and I feel much better about ramping up production now or over the next couple of quarters, then I would during COVID.

Tim Moore

Great, that’s helpful. It’s funny, you mentioned that because I remember, recall seeing three people filling out an applications in your Fort Worth lobby, when I was there doing a tour last August, so…

Duncan Bates

Exactly, exactly. And if there’s nobody out there, that’s a problem.

Tim Moore

No, no, there was a line that was a good barometer that was — made me feel better, although then Georgia happened. But just one last question. Given that $50 million availability that you mentioned, and the possible accordion option feature, if you take that up, should we read into that at all that maybe now that some of the operational pickups are well behind you, Georgia’s firing on all cylinders, the plants are doing well operationally, that there could be an acquisition or a vertical integration target on the near term horizon.

Duncan Bates

We’re looking hard. The new bank line is, we’ve been working on it for a little while. I don’t care what size business you’re operating. Banks can be difficult to deal with now. And so it’s actually, it’s a $50 million line with a $25 million accordion future, so we can take that up to $75 million. So we’ve got some firepower.

The other thing that’s interesting is, it’s only secured by our consumer loan portfolio. And so, we’ve got other assets out there unencumbered. We’re really — we’re looking, I just — we’re — we’ve been focused internally, there’s still a lot of work to do internally. And — but with — if the right opportunity comes up, we’re ready to go. I mean, we’ve been looking at all types of things. So I think we’re not going to chase something that’s expensive, or risky. We’re going to stay patient, continue to invest in our own business at high rates of return. And if something comes up that we really like, we were positioned to be aggressive on it.

Tim Moore

Great, that’s very helpful color. And I always remember your ROI hurdle. I mean, you’ve done a great job reinvesting back in the business and maybe you’ll have some other external options. But that’s it for my questions. And I hope that you, Curt, Kenny and the rest of the team have a wonderful summer.

Duncan Bates

Thank you, Tim. Appreciate it. You too.

Operator

Thank you. And I’m not showing any further questions in the queue at this time. I will now I’d like to turn the call back over to you, Mr. Bates for any closing remarks.

Duncan Bates

Sure. A couple of final remarks. I want to thank everybody who joined today’s earnings call. We appreciate your interest in Legacy Housing. And then next, our annual fall show, which is Legacy’s largest sales event is October 1st through the third in Fort Worth, Texas. It’s a great opportunity to see our new products and meet the team and a link to the RSVP is on our website. Operator, this concludes our call.

Operator

Ladies and gentlemen, that does conclude our conference for today. Thank you for your participation. You may now disconnect. ##

Part III – Additional Information with More MHProNews Analysis and Commentary

Legacy is being embraced by analysts as showing short- and long-term upside. Contrast that to larger Cavco Industries (CVCO), which analysts thought of as having low short- and medium-term prospects, both per Yahoo Finance.

While it may or may not be an apples-to-apples comparison, note that Duncan acknowledged set up delays in manufactured home communities (MHCs), but nevertheless said: “On the community or park side of our business, sales to existing customers remain stable.” By contrast, William “Bill” Boor for Cavco said: “And best estimates, we’ve heard are that this issue will start to ease up by the end of the calendar year, and we’ll expect to see community orders improve,” “So they’re not going to be ordering.” Stable community orders with later upside at Legacy vs. Cavco’s “not going to be ordering” until near the end of the year certainly sounds different and appears to do so in Legacy’s favor. Either way, there are arguably several unanswered questions about what Cavco pitched investors vs. what Boor told Congress.

Legacy’s previously quarterly remarks are found below. One of the gems from that report was this pull quote.

Their previous quarterly report made the point that Legacy experienced a “record year” in 2022.

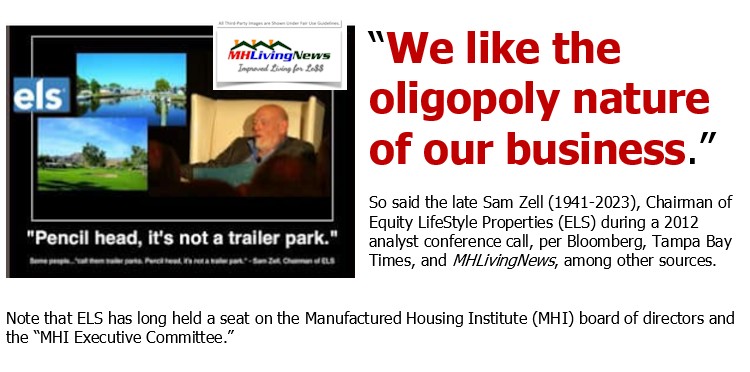

A close look at remarks by MHI and some of the leading publicly traded companies at various times reveals significant disconnects.

While there are obvious differences between companies, there are also times that remarks made by publicly traded firms reveals further disconnects in statements made between the various firms as they describe market conditions and policies that reflect on MHI remarks. With that in mind, the remarks from other publicly traded companies can be found in the reports linked herein above and below.

There appears to be firms that are going along with their colleagues at MHI, and others that may or may not be MHI members that are willing to buck the system, and thus, buck the trends. Much of these details points to what Bates said that the underlying need for more affordable housing continues and is arguably growing. Per Bates: “However, housing affordability in the U.S. continues to deteriorate and retail traffic in our industry is accelerating.” The need is there. The product is available. There is evidence of external factors are “holding back” the manufactured housing industry, as attorney and housing policy analyst Alexander Justus said just a few months ago. Then, there is evidence that those external factors are being slyly utilized by insiders to keep the industry underperforming so as to foster more consolidation.

As Legacy’s Curt Hodgson put it, “our industry is full of people that don’t think very far out.” “And Legacy’s view is, we have to address those concerns [that are limiting manufactured housing] and more to be effective in the affordable housing market.” Legacy’s apparently turning a corner. What about others? ##

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’

https://www.manufacturedhomepronews.com/masthead/true-tale-of-four-attorneys-research-into-manufactured-housing-what-they-reveal-about-why-manufactured-homes-are-underperforming-during-an-affordable-housing-crisis-facts-and-analysis/