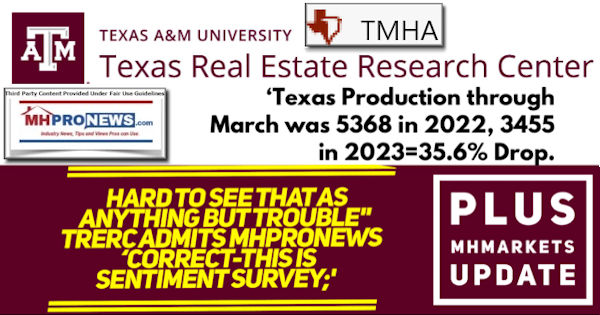

The Texas Manufactured Housing Association (TMHA) and the Texas Real Estate Research Center (TRERC) have been collaborating for some time on a monthly report on the manufactured housing industry in Texas. Several, but not all, of their reports have upon closer examination proven to be controversial. For example, there are times that the TRERC monthly reports have provided “sentiments” that were apparently contradicted by actual manufactured home production or shipment data. In fairness to TRERC, they have at various times admitted there is a validity to such factual concerns, which they said they would attempt to clarify in future reports. So, fact checks and analysis, like this one, may have proven to be useful in causing stakeholders and observers to approach TRERC information more carefully. But it may also cause some to realize that if questionable information is being produced about manufactured housing industry occurrences in Texas – the number one production and shipment state for HUD Code manufactured housing in the country – it may be occurring in other states or with the Manufactured Housing Institute (MHI) ‘news’ too.

With those thoughts in mind, Part I of today’s report will be the TRERC-TMHA report for October.

Part II will provide more information with MHProNews analysis and commentary in brief.

Part III is our Daily Business News on MHProNews macro-markets and MHVille connected equities report, along with left (CNN) and right (Newsmax) headlines news. The headline news feature gives ‘at a glance’ insights that can shed light on economic, political, social or other events that are impacting equities and the manufactured home industry.

Part I

Texas manufactured housing production up but still outpaced by demand

COLLEGE STATION, Tex. (Texas Real Estate Research Center) – After adjusting to last year’s monetary-policy tightening, manufactured housing activity has accelerated through the first three quarters of 2023, according to the September edition of the Texas Manufactured Housing Survey (TMHS).

Production increased for the sixth straight month but failed to keep pace with new orders, leading to higher backlogs.

“Although mortgage interest rates continue to climb, they don’t seem to be dampening retail manufactured housing sales,” said Dr. Harold Hunt, research economist at the Texas Real Estate Research Center at Texas A&M University (TRERC). “However, the impact of higher rates may be felt in manufacturers’ cost of capital and restrain new investment.”

The TMHS capital-expenditures index has hovered above zero this year, but the forward-looking measure decelerated after spiking in August.

“One benefit of debt capital is that interest payments are usually tax deductible, so the cost of higher rates is partially offset by the reduction in taxable income,” said Hunt.

“It’s too early to tell how retail sales of manufactured housing did in September, but the hard data through August has retailers’ placement of homes outpacing shipments received for every month thus far in 2023,” according to Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association. “The September TMHS indicates continued growth in new orders, suggesting retail demand has remained strong and that inventory levels have been reduced from their peaks one year ago.”

Labor constraints and material shortages may be contributing to manufacturers’ inability to keep up with new orders.

“While still subdued relative to pandemic disruptions, global supply chain pressure is showing signs of picking up,” said TRERC Senior Research Associate Wes Miller. “Survey respondents, however, expect conditions to smooth as we head into next year.”

The six-month outlook remains favorable for Texas’ manufactured housing industry with a consensus of elevated activity and decreased uncertainty propping up optimism for the start of next year. ##

Part II – Additional Information with More MHProNews Analysis and Commentary

The hard numbers for manufactured housing production and shipments nationally, including the specific totals for the month and year-to-date in the state of Texas, are found in the reports linked below.

We will further unpack the TRERC remarks by topics of interest. In no particular order of importance, the first subject will be the DOE energy rule, followed by interest rates and other issues.

DOE

The Texas Manufactured Housing Association (TMHA) and the Manufactured Housing Institute (MHI) teamed up in the legal action that delayed the implementation of the Department of Energy’s (DOE) ‘harmful and destructive’ manufactured housing energy rule. Yet, TMHA and TRERC didn’t mention the latest on that case in the October 2023 monthly report above. More information about that case is found in the report linked below.

In the MHI ‘news’ emailed to their members about William Bill Boor’s remarks to Congress on July 14, 2023, MHI said the following, quoting their association’s then vice chairman.

“The typical cost-benefit analysis looks at whether that money will get paid back to the homebuyer over 10 years,” Boor said. “Using DOE’s analysis which we do think is somewhat flawed, but we didn’t change it, we just updated it for current costs, for the vast majority of our homes, it would not get paid back, and the bigger point is that $7,000 for a customer [would be cost prohibitive].” Given that the context for Boor’s remarks on behalf of MHI was framed against DOE and other federal regulatory challenges, why didn’t TMHA or TRERC mention the still-pending DOE rule at all? After all, Boor is the CEO of Cavco, and Cavco has production and shipments into the Lone Star State.

Again, quoting MHI’s statement to their own members about Boor’s remarks to Congress.

“We’re really uncertain where we’re going to be heading from the requirements, given two overlapping but very different regulators if the DOE process continues,” Boor said.

He noted that the industry will continue to move the ball forward on energy efficiency. “We’re talking about doing it in a holistic fashion where the impacts are thought through,” he said. “And we can make great strides. I think they are on a path right now where they’re going after ‘E’ at the expense of ‘S.’”

In June 2023, TMHA said: “The industry had to navigate through most of May with the uncertainty of whether the Department of Energy’s (DOE) Energy Conservation Standards for Manufactured Housing were going to take effect on the last day of the month as scheduled,” according to Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association. “The DOE published a proposed rule back in March asking for input on delaying the implementation, but confirmation of a later compliance date was not announced until May 19th, just 12 days before the changes were supposed to take effect.”

The attorneys for MHI and TMHA previously mused that there would be “irreparable harm” if the DOE energy rule proceeds. Again, the oddity is if there is such harm poised to hit the industry, then why didn’t TMHA and TRERC update that topic?

Financing and Interest Rates

Quoting the above from TRERC’s October 2023 report, with bold emphasis added. “Although mortgage interest rates continue to climb, they don’t seem to be dampening retail manufactured housing sales,” said Dr. Harold Hunt, research economist at the Texas Real Estate Research Center at Texas A&M University (TRERC).

From the September 2023 TRERC report, Wes Miller, TRERC senior research associate said: “The industry’s optimistic outlook outweighed these obstacles, prompting preparations to increase capital expenditures despite the higher interest rate environment.”

From the August TRERC 2023 report: “Wes Miller, senior research associate at the Texas Real Estate Research Center at Texas A&M University (TRERC). “Business activity has rebounded despite ongoing interest rate increases that shocked demand last year. In addition to new hiring, average employee workweeks have picked up over the last few months.””

Also from the August 2023 report: “Retailers sold more homes than they received during the first half of the year,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association, “and that trend should extend into July as manufacturing plants typically close for a week to celebrate Independence Day. Last year there wasn’t a single month when retail sales beat shipments. Solid consumer demand for affordable housing continues to drive new orders and has brought manufacturing production rates back to where they were during the last calendar quarter of 2022.”

July 2023: “There was real concern from manufacturers about overstocked inventory on retail lots and the headwind of rising interest rates throughout the back half of 2022,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association. “Demand for housing, however, remained resilient, and retailers posted strong sales so far this year.”

June 2023: “Higher interest rates impact industries differently,” explained Dr. Harold Hunt, senior research economist at the TRERC. “For example, higher mortgage rates reduce housing affordability, and some prospective buyers leave the site-built market and enter the manufactured-housing sphere.”

Put bluntly, the monthly TRERC-TMHA reports have been inconsistent at best in how they have described the impact of rising interest rates. For instance. While it is true that rising rates reduces conventional housing affordability, there is little sign based on state or national numbers that manufactured housing has benefited from the rising interest rate environment, even though historically, there often was such a benefit.

Recall the exchange from last May 2023 between Boor and stock analyst Gregory Palm. Palm politely but pointedly questioned the narrative on why the manufactured housing industry production wasn’t performing better?

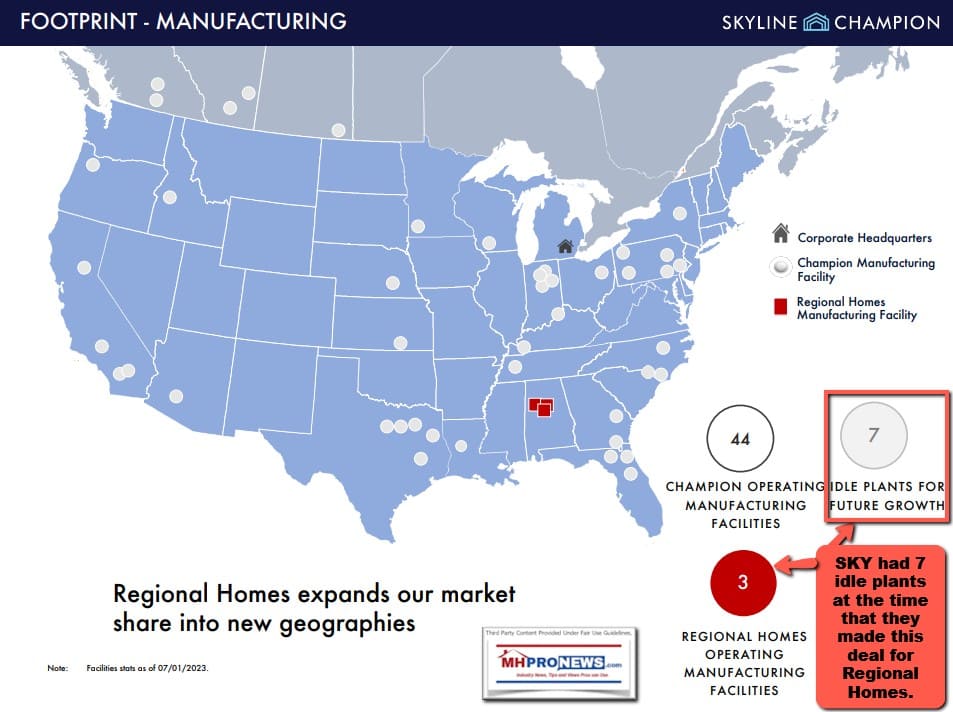

There is also no mention of the fact that some manufacturers have idle plants that may be able to ship into Texas. For instance.

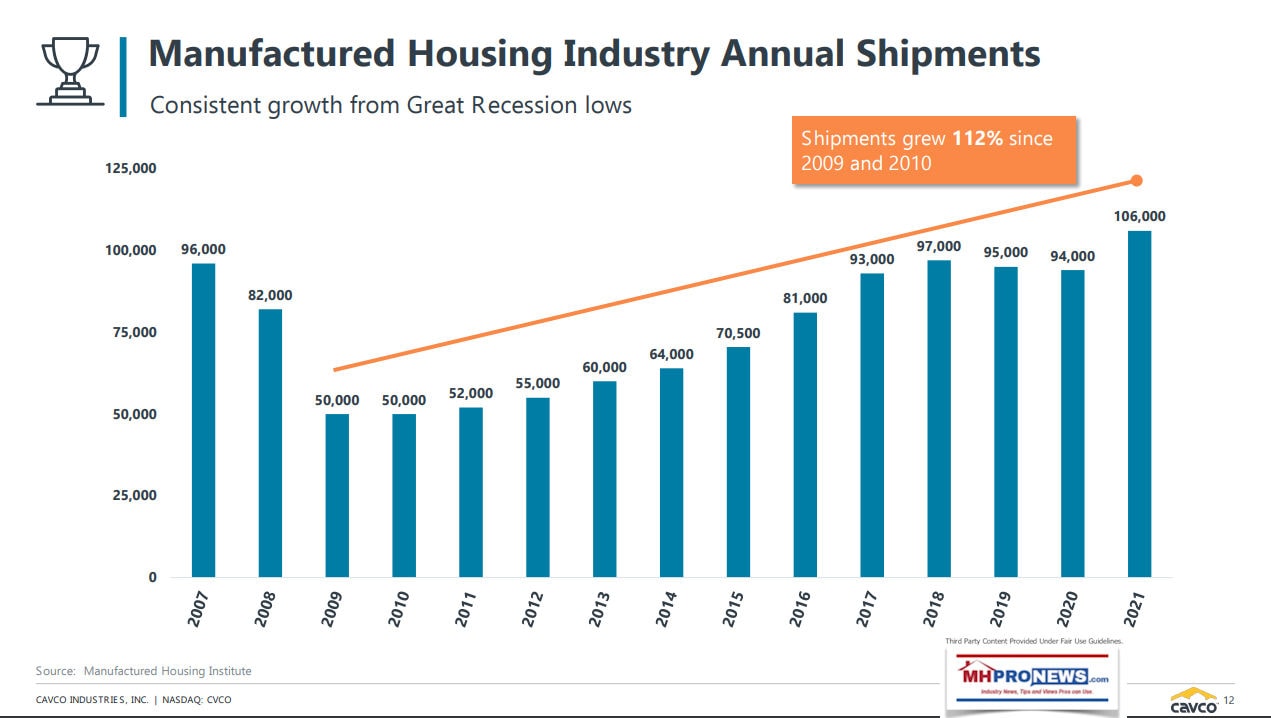

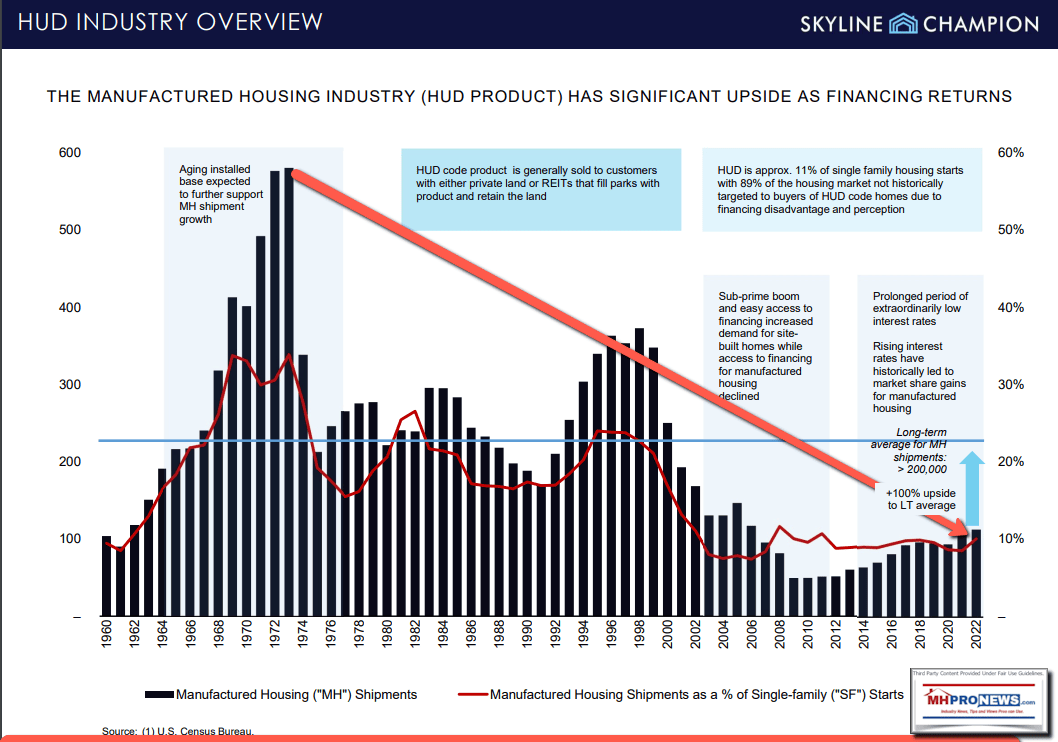

When it comes to apparent disconnects between the various narratives (e.g.: TMHA-TRERC, MHI, Cavco) and more sobering realities, there is this page from a Cavco 2023 investor relations pitch deck page. While the information below is broadly ‘true,’ it leaves out the important point that manufactured housing in the 21st century has by historic standards been badly underperforming.

Put differently, when the TRERC-TMHA information is compared to other sources that have interconnected ties, and information from those sources are laid out ‘side by side’ or even with respect to the same source’s prior remarks, inconsistencies begin to emerge. There appears to be an effort to create illusions of industry performance that if taken at face value from TMHA-TRERC, MHI, and corporate (for example, Cavco) information yields disconnects. Analyst Palm’s remarks to Cavco’s Boor mentioned above underscore that point. Comparing information between publicly traded companies’ pitches further illustrates disconnects in how corporate presentations to investors may differ in a manner that could be described as “paltering.” A look at Cavco’s page (the first of the two graphics above) vs. the graphic below from Skyline Champion (MHProNews has added the orange arrow below) highlights the ‘spin’ on information that should cause investors and stakeholders to lean in.

Zoning and Placement

There is an odd silence in the TRERC and TMHA monthly reports for at least a year on the harms caused to the manufactured housing industry by zoning challenges. Yet Texans have sounded off publicly on this issue, including TMHA executive director D. J. Pendleton.

To illustrate that point about zoning and TMHA’s Pendleton, MHProNews asked Bing AI tool this question. The highlighting in the AI response from Bing is added by MHProNews for emphasis.

> “What has TMHA’s D. J. Pendleton said about zoning hurdles for manufactured housing?”

According to Pendleton, zoning hurdles are one of the biggest barriers to the growth and development of manufactured housing in Texas. He says that many local governments have outdated or discriminatory ordinances that restrict or prohibit manufactured homes from being placed in certain areas, or impose higher standards or fees than site-built homes23. He argues that these regulations are not based on objective criteria, but rather on negative stereotypes or misconceptions about manufactured housing and its residents.

Pendleton believes that manufactured housing can provide a viable and affordable solution to the housing shortage and affordability crisis in Texas, as well as contribute to the economic and environmental sustainability of the state. He says that manufactured homes are built to high quality and safety standards, offer a variety of design and customization options, and can be energy-efficient and resilient13. He also says that manufactured housing can create jobs, generate tax revenues, and support local businesses and communities1.

To overcome the zoning hurdles, Pendleton advocates for a more balanced and fair approach to land use regulation that recognizes the benefits and potential of manufactured housing. He says that TMHA works with its members, stakeholders, policymakers, and consumers to educate them about the facts and myths of manufactured housing, and to promote best practices and policies that support the industry’s growth and development. He also says that TMHA collaborates with other organizations and coalitions that share similar goals and values, such as the Texas Association of Builders, the Texas Association of Realtors, and the Texas Affiliation of Affordable Housing Providers13.

Pendleton hopes that by raising awareness and understanding of manufactured housing, he can help create a more favorable environment for his industry and its customers. He says that he is optimistic about the future of manufactured housing in Texas, as he sees more opportunities and demand for this type of housing in the market. He says that he is proud of his industry’s achievements and contributions, and he looks forward to continuing his advocacy and leadership role for TMHA13.

Learn more:

In the follow up inquiry by MHProNews to Bing AI, the bold is added for the sake of our readers. Highlighting is added by MHProNews in Bing AI’s response. Keep in mind that Pendleton is an attorney.

> “Useful. But can you find any record of the TMHA’s D. J. Pendleton making mention of the Manufactured Housing Improvement Act (MHIA) of 2000, and its enhanced preemption provision as a means of getting local zoning boards to comply with federal law that could benefit the industry by opening up new placement opportunities?”

Learn more:

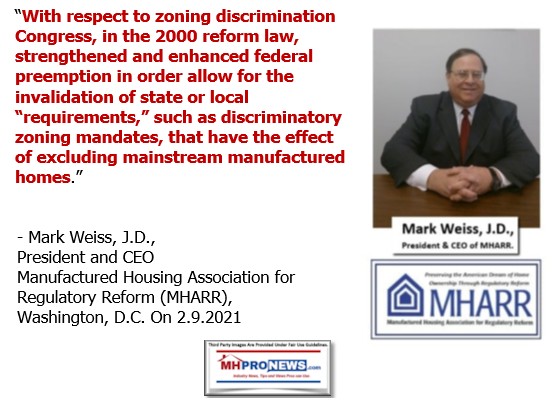

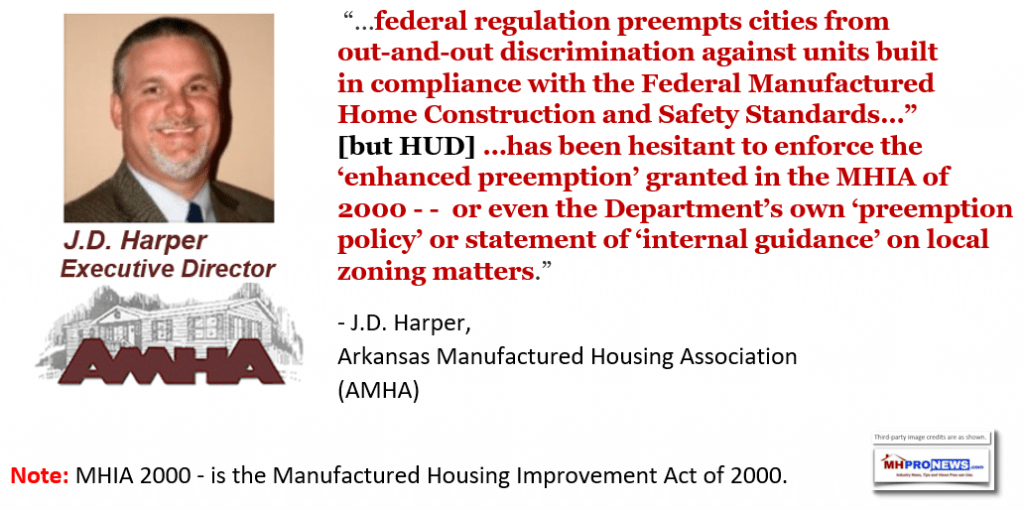

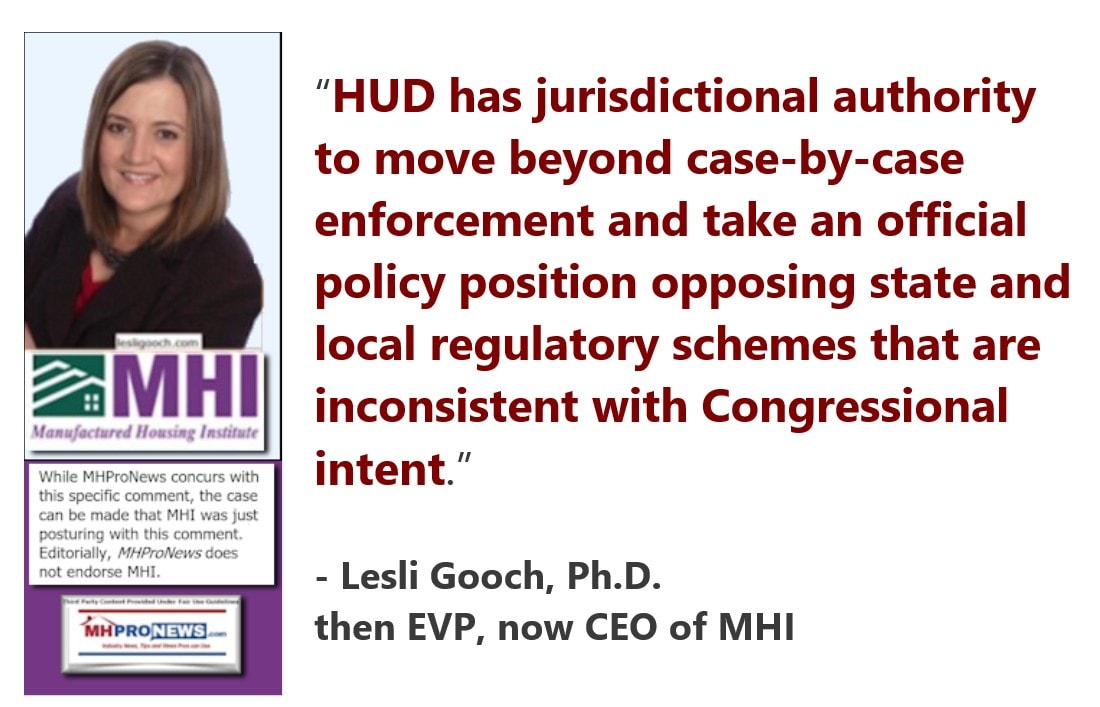

Weiss has been colorful yet pointed in his descriptions of the lack of serious effort by MHI, which claims responsibility for post-production issues, like zoning and financing.

An irony in this is that MHARR has consistently credited Will Earle, a prior TMHA leader, for his role in supporting the enactment of the MHIA of 2000, in order to obtain enhanced preemption. The late Earle was also an attorney.

To frame this discussion, MHProNews asked Bing AI the following interconnected questions.

> “Was the Texas Manufactured Housing Association’s (TMHA) Will Earle an attorney? Did Earle play a role in the enactment of the Manufactured Housing Improvement Act of 2000 (MHIA)? Is there information on the TMHA or Manufactured Housing Institute (MHI) website about enhanced preemption under the MHIA?”

One must keep in mind that umbrella trade group’s (like the TMHA or MHI) are supposed to do three things, summed up by the acronym P.E.P.

Protect (the manufactured housing industry and its members). Educate (about the industry). Promote (the industry).

MHI’s recently refreshed website puts it this way on the home page.

That’s P.E.P. in TMHA’s own words.

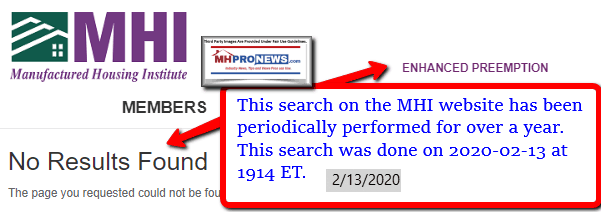

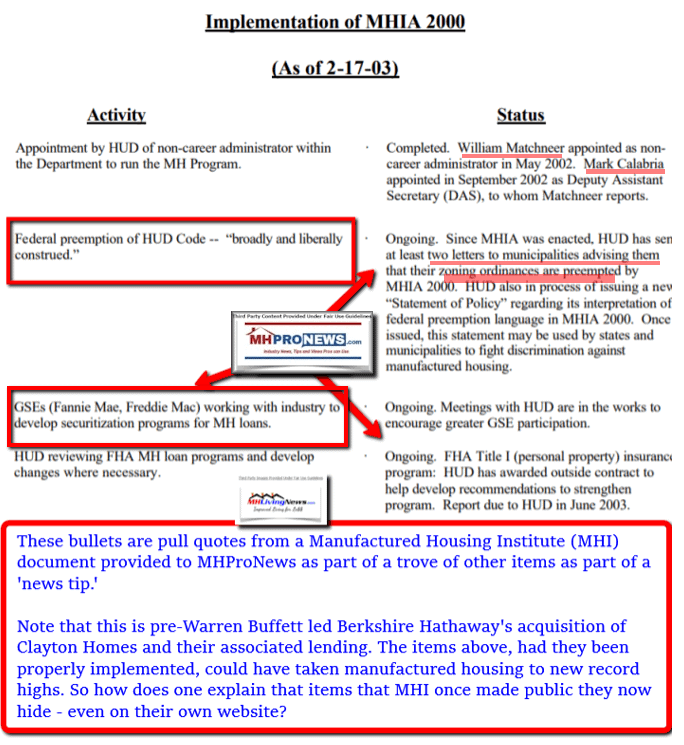

Yet, oddly, a key law that MHI and TMHA were keenly involved in with MHARR to get the MHIA of 2000 and its enhanced preemption provision enacted are not mentioned by MHI? Nor is it mentioned by the TMHA, which MHI considers to be an MHI affiliate?

To go back to this article’s headline point, isn’t it rather wacky to go to all the trouble and expense of getting a new law passed (i.e.: the MHIA with its enhanced preemption provision over local zoning), spending more time and money trying to get that law enforced, and then you don’t even mention it on your own website? How wacky is that?

MHProNews, in its engagement with TRERC has raised these issues and topics. So, they too, along with the TMHA, MHI, and their corporate leaders, ought to be aware of such matters.

Wacky Wednesday?

What this exercise in unpacking past and more recent remarks by TMHA and TRERC, or MHI and their prominent publicly traded members like is this. It is almost as if comments are made without reference to past remarks, often by the same organization or personality. It is also as if these organizations are posturing for their intended audiences certain stances. But when the bigger picture is reviewed, what emerges are apparent errors. Again, how wacky is it to spend over a year to get a new federal law passed, spend over 20 years trying to get that federal law enforced, and then fail to mention it on their own websites?

Nor is this a recent discovery. MHProNews has been documenting this vexing pattern of behavior for some years now. With respect to MHI, for instance, see this prior website search for enhanced preemption on the previous version of the MHI website.

That lack of use of enhanced preemption by MHI is from 2022. The screen capture below by MHProNews is from 2020.

So, this pattern of missing information on a key issue could have several practical and legal ramifications. MHI and TMHA are both pitching to current and potential members that they are a ‘trusted partner’ seeking to grow the industry in the U.S. and Texas respectively. Yet, a key piece of information is missing from their websites?

To further illustrate how ‘wacky’ this revelation is, MHI about 2 decades ago had this item on their website. Apparently, as some point in time, they removed it and/or hid it behind a member only login. Note that neither MHI, TMHA, or their attorneys have responded to multiple inquiries about these and other vexing issues.

Like Houdini, industry members are told via email about certain things (the monthly TRERC-TMHA report above is emailed). But when the details are carefully examined, key information is missing. Now you see it, now you don’t. But that implies that deception appears to be the goal. Or as MHARR’s attorney and CEO, Weiss put it in an Issues and Perspectives, it is an “illusion of motion.” Members here their leaders talking about or emailing about certain issues, but then, those same issues – financing, DOE/energy rule, enhanced preemption to overcome zoning and placement barriers – poof! The evidence of that on their own MHI or TMHA websites are gone.

It is a bit reminiscent of the “memory hole” in George Orwell’s classic dystopian novel, 1984 (or Nineteen Eighty Four). With that in mind, the following question to Bing AI.

> “Bing, explain what the memory hole was in George Orwell’s 1984.”

Learn more:

Some prior fact checks of TRERC items are found linked below.

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 10.24.2023

- Microsoft, Google post strong quarterly sales growth as Big Tech continues its comeback

- Tesla Cybertruck

- Federal document reveals Tesla Cybertruck won’t be cheap, but it will be heavy

- Apple CEO Tim Cook stands next to a display of newly redesigned MacBook Air laptop during the WWDC22 at Apple Park on June 06, 2022 in Cupertino, California.

- Apple announces ‘scary fast’ October event

- An M&T Bank branch in downtown Hartford, Connecticut, US, on Wednesday, April 12, 2023.

- Big banks had a strong Q3. What about regional banks?

- Kayaking in John W. Weeks Bridge and clock tower over Charles River in Harvard University campus in Cambridge, Boston Massachusetts.

- Harvard and UPenn donor revolt raises concerns about big money on campuses

- A Cruise, which is a driverless robot taxi, is seen during operation in San Francisco, California, on July 24, 2023.

- California revokes GM self-driving car subsidiary permit, citing ‘unreasonable risk to public safety’

- Google Maps and Waze temporarily disable live traffic data in Israel

- The New York Times walks back flawed Gaza hospital coverage, but other media outlets remain silent

- A woman lies on a sofa and watches a video on the social media platform Instagram on her cell phone.

- Dozens of states sue Instagram-parent Meta over ‘addictive’ features and youth mental health harms

- The New York Stock Exchange (NYSE) in New York, US, on Friday, Oct. 20, 2023.

- The Israel-Hamas war hasn’t set off market panic. That doesn’t mean investors aren’t concerned

- Taco Bell’s battle to free the ‘Taco Tuesday’ trademark is officially over

- Lukoil chairman dies suddenly, second in just over a year

- London’s bankers can make unlimited bonuses again as UK axes cap

- UAW strikes GM’s largest plant that makes its very profitable full-size SUV

- GM earnings rise, sparking another plant to go on strike

- Sony’s PlayStation Access controller offers a new social lifeline for gamers with disabilities

- Shares in one of London’s biggest IPOs this year have crashed 82%

- This executive has a unique return-to-office strategy. Here’s how it’s going

- Why bitcoin is surging again

- The Fed is losing control

- Jamie Dimon and other top bankers visit Saudi Arabia as Israel-Hamas war rages

- This Moroccan startup is growing crops in the desert

- ‘Unstoppable’ energy transition means demand for oil, gas, and coal set to peak by 2030