WTGS is among those mainstream media that are reporting that “trailer sales” are surging to record levels. While these ”trailers” are towable RVs – along with other forms of recreational vehicles that are motorized or not – there are several possible takeaways and lessons to learn for independents in the manufactured home industry that are seeking business growth as the economy opens back up.

Because post-lockdown “Covid Campers” are seeing a boom.

“The RV Industry Association says RV sales have increased 170 percent compared to this time last year,” says the WTGS report.

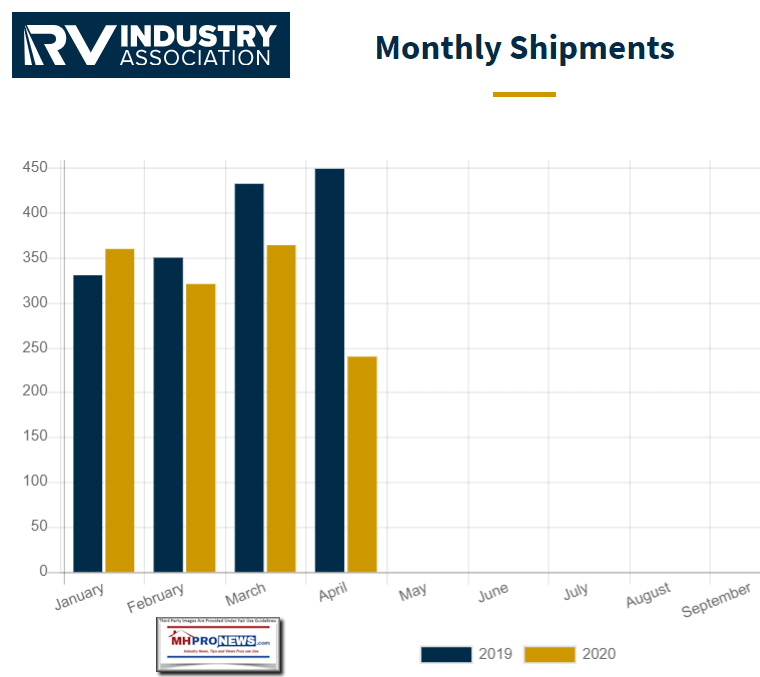

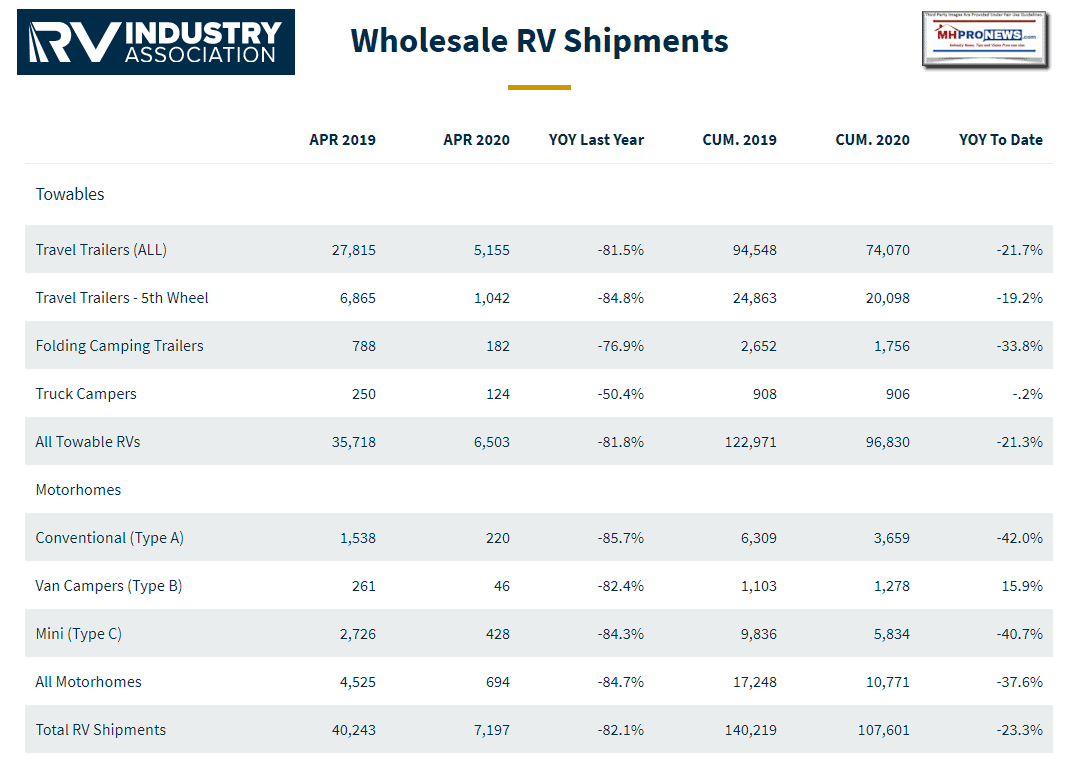

As a graphic that follows will indicate, there was initially a decline in RV shipments due to plant shutdowns during the growing peak in the Wuhan Virus pandemic, so that surge in sales is significant. Note that the dealer in the video interview says he is having a hard time keeping RVs in stock.

Note that sales and shipments are two different data points, as producers and retailers in manufactured housing well understand.

The RV Industry Association (RVIA) said that “As expected, due to nationwide retail and manufacturing shutdowns during the month related to the COVID-19 pandemic response, the RV Industry Association’s April 2020 survey of manufacturers found that total RV shipments were reduced significantly, ending the month with 7,197 units.

Towable RVs, totaled 6,503 units, motorhomes totaled 694 units, and Park Model RVs totaled 240 wholesale shipments for the month.”

Among the RV Dealers Association (RVDA) news items is this: “The national RV and campground associations have formed an RV Industry Relaunch Task Force to develop a coordinated plan to increase dealer sales and campground stays nationwide in the wake of COVID-19.” Also, “Following an extensive review process, Go RVing has named FCB-Chicago as its official Agency of Record, responsible for building upon Go RVing’s strong brand identity across all consumer platforms.”

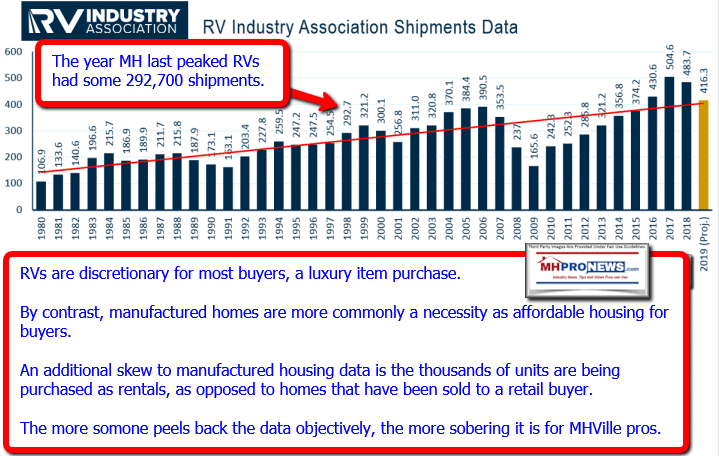

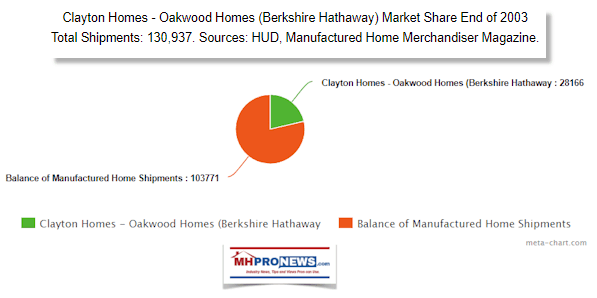

As MHProNews has previously reported, when the manufactured home industry hit its last peak in 1998, manufactured homes (MH) outsold recreational vehicles (RVs) by a ratio of 3 to 2. In that year, manufactured homes topped 372,000 new homes produced. But for over a decade, manufactured housing has failed to hit even 100,000 new units per year.

In stark contrast to manufactured housing’s decline is what occurred with the RV Industry. By 2018, that ratio of RVs sales to MH had more that flipped. RVs were outselling manufactured homes (MH) by some 5 to 1. Total numbers of RVs dwarfed the 1998 high point of total MH produced and sold. What accounts for the difference?

A good part of that has been attributed to the RV industry’s Go RVing campaign, which steadily built acceptance of the RV lifestyle. Where is the manufactured home industry’s equivalent effort?

Keep in mind that RVs are commonly used for getaway or a secondary ‘destination’ residence. RVs are routinely a discretionary purchase, while housing is a necessity. Obviously, towing a manufactured home is not practical. But there is room for manufactured home retailers to penetrate the destination RV market share, as well as the vacation, second or third home that some households want or may even need due to work, education, health, or other requirements.

By contrast to the wildly successful Go RVing campaign, when the Manufactured Housing Institute (MHI) touted in 1998 their ‘promotional’ efforts of manufactured home living, sales in 2019 declined vs. 2018.

Given the affordable housing crisis, on its face that statistical decline should bring an outcry of protests from professionals who want to see industry grow.

Back to the RV Surge Post Pandemic Lockdown

Mike McLaughlin, the general manager at TravelCamp in Savannah says it has a lot to do with the coronavirus pandemic, said WGTS.

“(In May) we’re going to double or triple the sales that we were doing right before this outbreak even took place,” he said.

He says his dealership is having a hard time keeping their lot full.

“Business is pretty busy at the moment. A lot of it has to do people just wanting to get out of the house, especially with this pandemic that is happening. People are getting cabin fever,” said McLaughlin.

His sales are at an all-time high right now.

“As soon as the non-essentials were able to open back up, is when we started to get a big fluctuation of traffic. We could see the traffic doubling, tripling coming through the doors, which was great,” said McLaughlin.

The story is quite similar in Wisconsin, as this other mainstream news video reflects.

>

The Savannah South KOA campground in Richmond Hill has been full every weekend this month from travelers around the country.

MHProNews Fact-Checks, Analysis and Commentary

As MHProNews exclusively reported, there are producers and retailers that are reporting increased sales for their businesses. So, there is ample evidence that what is occurring in the RV could also be mirrored – or perhaps outdone – in manufactured housing. After all, the need for affordable housing will be greater, as the fallout from some 40 million Americans who have filed for unemployment in about 2 months begins to hit the housing market.

AEI and other data is showing that there is a healthy recovery taking place in mainstream conventional housing, at least as measured by mortgage applications. The AEI portion of the report linked below indicates a ‘surprising surge’ in housing applications. State-by-state data is found in that report.

Prior to the economic impact of the Wuhan Virus on the U.S. and world economies, MHProNews was essentially alone in pointing out that there were several historic and economic reasons why manufactured housing should be doing far better than it has been, especially in the post-Berkshire Hathaway era of the industry.

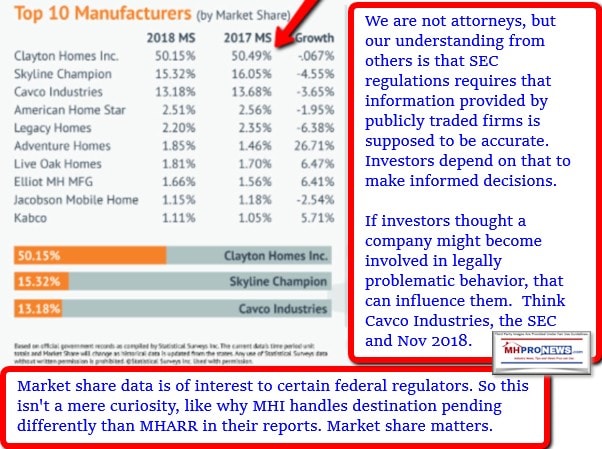

The data from Patrick Industries shown above reflects a sharp drop in the total percentage of manufactured home shipments as a percentage of the overall conventional housing market. Publicly traded Patrick (PATK) is a MHI member company. Their graphic makes several important points. One is that the population keeps growing. And as the demand for affordable housing grows, so too should manufactured home sales. The fact that the growth has been tepid to negative alone bears scrutiny.

By contrast to declines in new manufactured housing shipments, RVs overall grew steadily. MHI and other sources continue to ‘leak’ troubling tips about the inner machinations at the Arlington, VA based trade group.

Manufactured Housing Institute Insider’s Keith Ellison Revelation, “Anti-Consumer” Bias, Other Leaks

There are certainly reasons why sources with apparent ties to MHI are leaking information that routinely point to the top of their leadership, which logically helps explain why the industry is failing to grow.

After all, how could any group of individuals be so incompetent for so long, unless failure to perform was intentional? Meanwhile, they posture with photo opportunities or make other claims that don’t change the underlying facts.

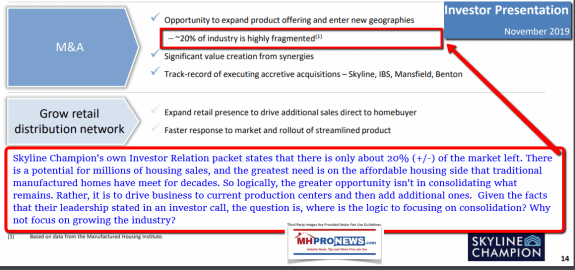

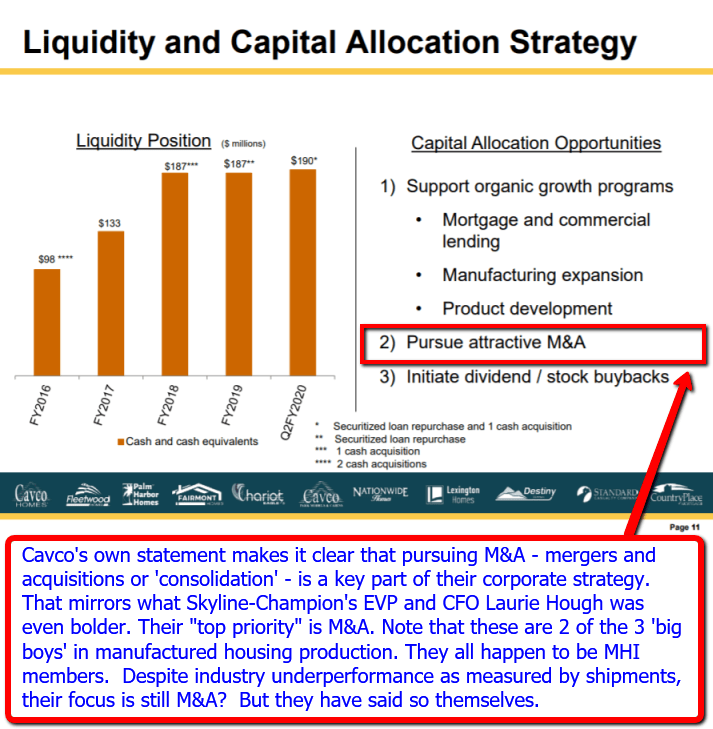

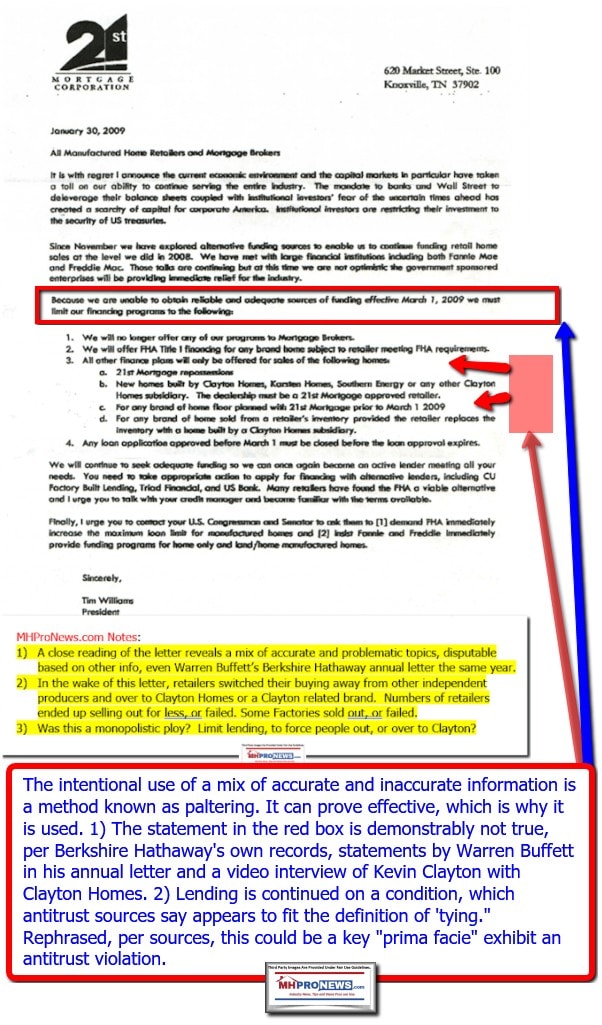

But even absent news tips – as valuable as they are – the facts and statements from key MHI members speak volumes.

The above are all MHI members, speaking without pressure in their own words. Industry underperformance has yielded consolidation. The need to understand the history of the industry so as to set the facts in their proper context has been stressed by former MHI VP turned Manufactured Housing Association for Regulatory Reform’s (MHARR) founding president, Danny Ghorbani.

In conjunction with that is the need to press FHFA and the GSEs to fully implement competitive financing that is already law.

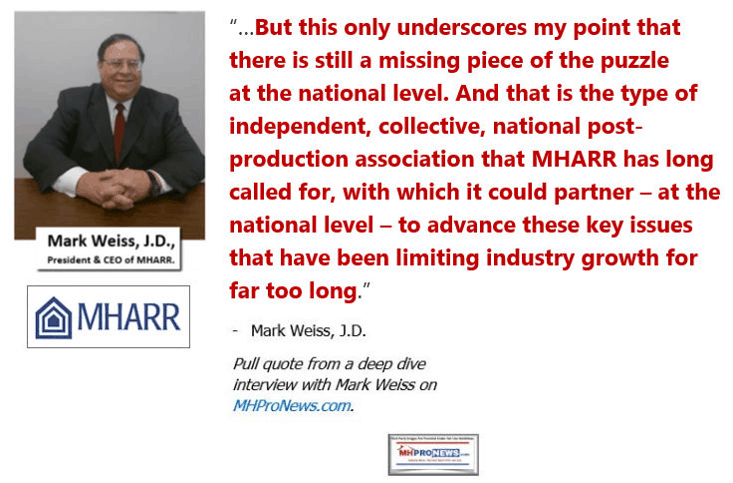

When As MHARR’s second and current president and CEO, Mark Weiss, J.D. has said, facts are stubborn things. Those facts routinely point to MHI “Illusion of Motion” and a pressing need for a post-production association that MHARR can collaborate with to implement good existing laws.

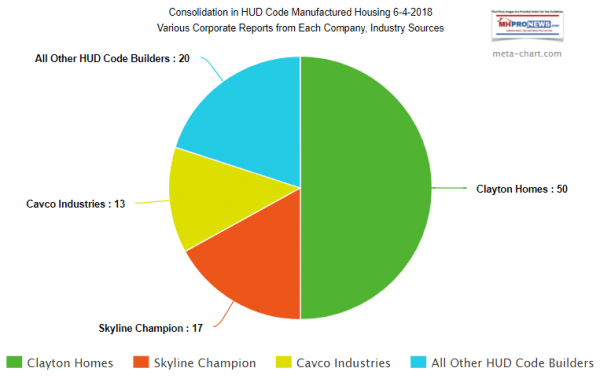

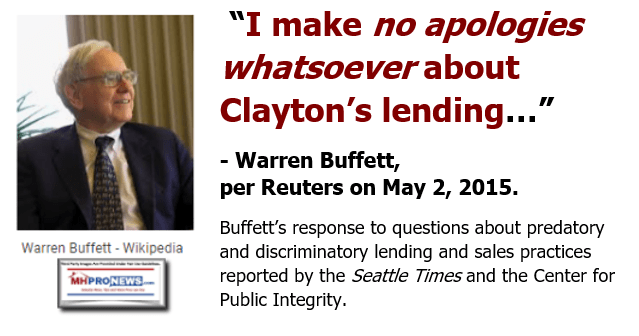

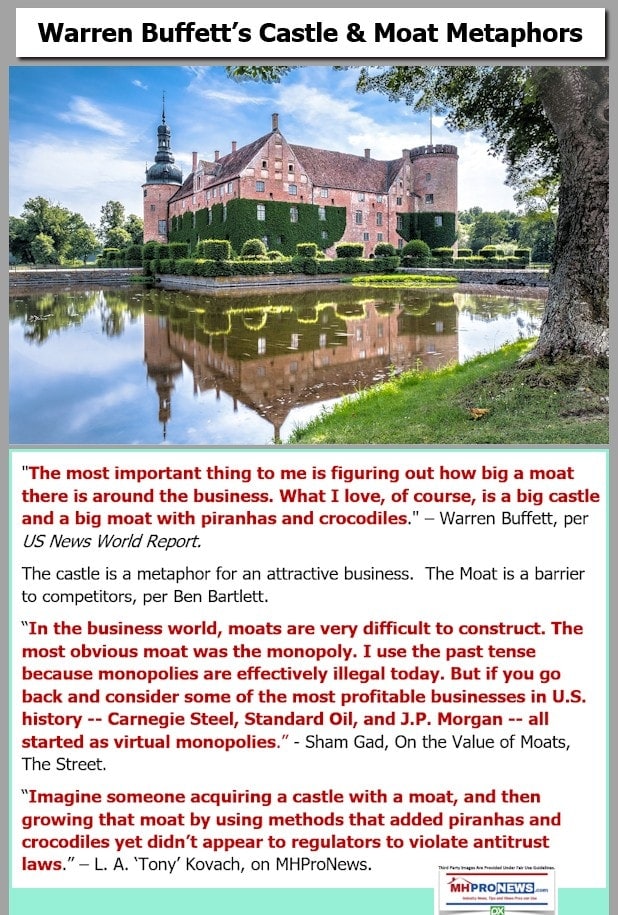

But when several top firms indicate that consolidation and ‘moat building’ are their focus, is it any wonder that shipments are not growing? Additionally, when key MHI members are behaving in a publicly admitted monopolistic fashion, is it any wonder that consolidation continues at a steady clip?

The data from the RV industry – as well as from several independents in MHVille shows that much is possible. But systemic changes are necessary in order to tap the industry’s true potential.

That’s a wrap on this installment of manufactured housing industry “News, Tips and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

/

“MHI Lies, Independent Businesses Die” © – True or False? – Berkshire’s Joanne Stevens Strikes Again

Prosperity Now, Nonprofits Sustain John Oliver’s “Mobile Homes” Video in Their Reports