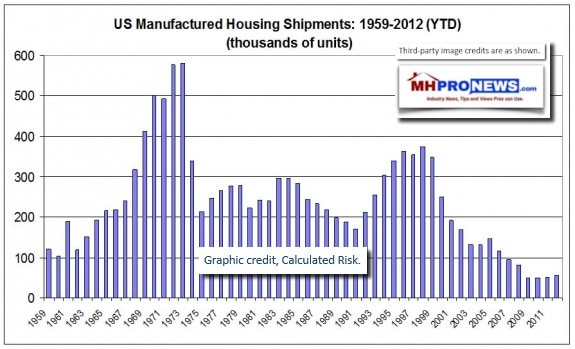

‘Capacity’ here means that the sizable numbers of orders to producers that have been placed in recent years – new homes being used to fill vacant sites – will drop off significantly. There will still be orders to replace those older units – or those damaged by nature or accident – that would cost less to replace then to repair.

Other communities that are encouraging upgrades from older to newer homes will also still be placing orders to producers of HUD Code manufactured homes. A few new properties and expansions are also in the pipeline.

But given the current large percentage of new home orders going into MH communities, and retail not yet recovered to anything like levels from 10 to 20 years ago, independent producers that fail to adapt could be hitting a looming wall in the next 3 to 5 years.

MH Retail

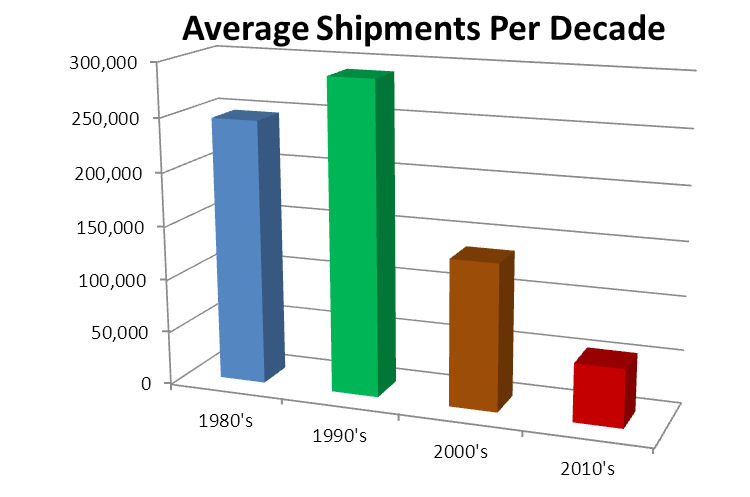

Manufactured home retailers have long been the majority of orders to HUD Code builders. But as prior Daily Business News reports have noted, there are several factors that have kept retailers from recovering to the kinds of production levels that were once common one to two decades ago.

The Masthead

When money is earned, it can be spent. So it may seem odd to discuss profits as “false.” As anyone who’s watched the movie Scarface knows, crime is a business. It may be illegal, but it’s business. The risk/reward equation for a criminal enterprise is different than for a legal business.

“The Two Cs”

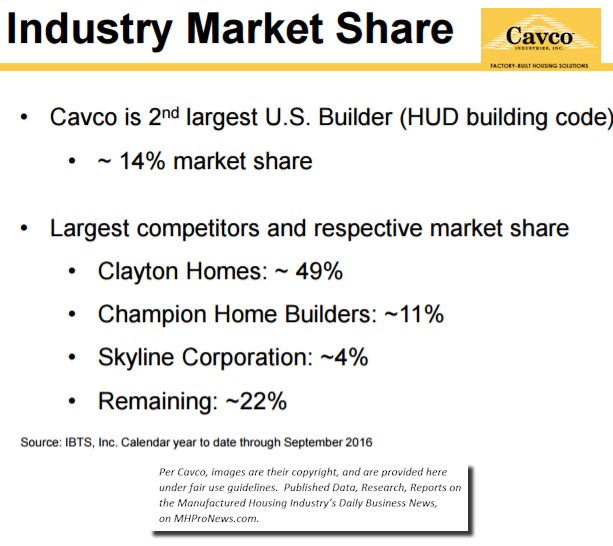

While one hears the expression the “3 Cs” of Clayton, Cavco and Champion home builders, some observers note that it is more accurate to say that Clayton and Cavco are still more closely aligned than Champion and the other two Cs.

Champion is not that far behind Cavco in production. And while the three have collaborated on the MHI’s so-called ‘story telling initiative,’ the jury is still out if that will prove to be effective or not. There are good reasons to doubt that it will be.

Why?

Appealing Manufactured Housing Institute (MHI) Marketing, Finance Booklet Reviewed

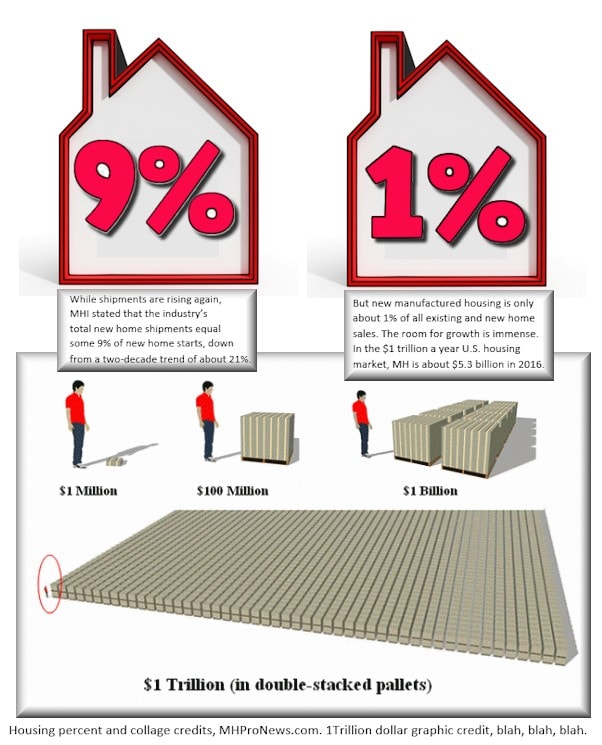

Because Clayton’s and Cavco’s own data reflects the fact that they are not growing at the overall average rate of the industry as a whole.

At various levels, isn’t it apparent from date points like the graphic above, that the 2 Cs are not yet executing in a way that the mainstream housing market is embracing?

So in spite of their larger respective scales, there isn’t yet any compelling evidence for the data and trends to reflect the 2 Cs proven ability to grow at sufficient pace to make up for the 3 to 5 year drop in orders from MHCs.

Couple that with the slide-treading water-or modest growth in several states, and there is a potential for industry growth to hit a wall in that 3 to 5 year time frame. All of these factors – and others – suggest that adjustments are needed by independents, who have no reason to rely on MHI and their dominating companies.

While Manufactured Housing Overall Rises, Some Slip Sliding Away

MHI has proven their ability to influence the industry’s members more than the home buying public at large. Nor have they proven an ability to achieve success on their own agenda with politicos.

Manufactured Housing Institute VP Revealed Important Truths on MHI’s Lobbying, Agenda

They have somewhat successfully dazzled enough industry members with data about Facebook likes and emails to Congress that their failure to actually perform has not fully sunk into many. Others realize, but may not be in a position to publicly admit MHI’s clear inability to achieve their own stated goals.

The ‘housing of the future’ hasn’t taken off yet, and many of the reasons point back to actions/inactions related to MHI.

Thus, it is no surprise that MHI ducks the hard questions on issues ranging from HUD, to financing, lack of industry growth, consolidation, NIMBY, MHIA 2000, and more.

Manufactured Housing Institute (MHI) SVP Rick Robinson Ducks Serious Industry Questions in Deadwood

So in spite of the promise by then Chairman Nathan Smith that their MHI association would become more proactive than reactive in the future, the case can be made that they are still being led by Berkshire Hathaway in whatever direction their Powers That Be decide.

Barring anti-trust action which could take years, the largest companies can weather these 3 to 5 year looming storms, as they have previous ones.

President Raises the M-Word, “Monopoly,” Plus Manufactured Housing Industry Market Update$

Full communities of whatever size can survive and thrive.

Financial Choice Act, with MHI Bill, Heading to Floor Vote, Outlook, Analysis

But what will the smaller-to-mid-sized retail and production operations do?

These kinds of trends, outlined above and below, are the reason that some have decided to take their future into their own hands.

The Cutting Edge of Manufactured Home Marketing & Sales

Home > Content Marketing, Email Marketing, Events, Internet Marketing, Local Business Marketing, Manufactured Home Marketing, Manufactured Home Sales, Media, Search Engine Optimization, Videos > Dominating Your Local Market, The Manufactured Housing Revolution “Nothing is changed until it is challenged.” – Soheyla Kovach, co-founder of MHProNews.com and MHLivingNews.com.

Others are exploring a new post-production association, suggested by MHARR.

Look for a follow up MHProNews on the impacts, drivers, and proven strategies that are being pursued by those in the industry who are looking ahead, and growing their operations in a sustainable fashion, instead of going along with the tide.

Only 2 Choices – Media Engagement, Manufactured Homes, & You – Monday Morning Sales Meeting

Look too for the solutions to these current trends and looming challenges, which are hiding in plain sight. ## (News, analysis, commentary.)

2 Week Notice: MHProNews will be on a somewhat modified publication schedule from now through January 2nd, resuming normal scheduling in 2018. More details, click here.

Note 2: Looking for our emailed MH Industry headline news updates? Click here to sign up in 5 seconds. You’ll see in the first issue or two why big, medium and ‘mom-and-pop’ professionals are reading them by the thousands, typically delivered twice weekly.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Managing Member, LifeStyle Factory Homes, LLC – parent company to MHLivingNews, MHProNews and the business development and expert professional services provided to the MH industry, and investors.