Noteworthy headlines on – CNNMoney – U.S. dollar drops sharply after Trump calls it “too strong”. United CEO: Police won’t haul off passengers again. What worries small businesses about tax reform. Daily Mail pays first lady $2.9M to settle suit.

Some bullets from Fox Business – Trump: NATO will be more secure if members pay instead of relying on U.S. Tillerson: Low level of trust between U.S. and Russia. Trump’s budget chief to federal agencies: Time to Drain the Swamp. Trump on North Korea threats: We are sending an armada.

“We Provide, You Decide.” ©

Key Commodities

Crude Oil 52.89 –0.51 (-0.96%) Gold 1,288.30 14.10 (1.11%) Silver 18.49 0.24 (1.29%)

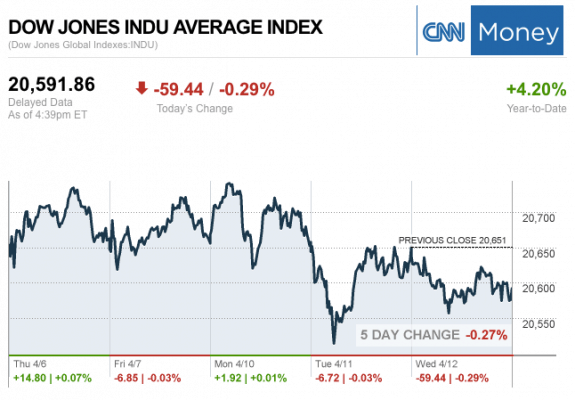

The markets at the Closing Bell Today…

S&P 500 2,344.93 –8.85 (-0.38%)

Dow 30 20,591.86 –59.44 (-0.29%)

Nasdaq 5,836.16 –30.61 (0.05%)

Russell 2000 1,359.20 –17.75 (-1.29%)

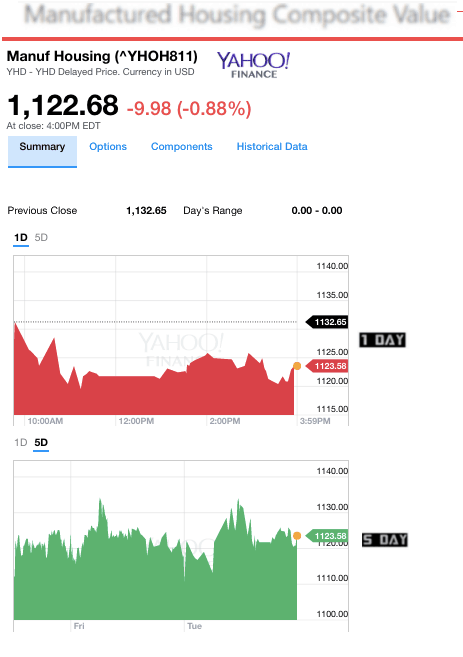

The MH Industry – Today’s Risers and Sliders

The top gainer for the day was Tricon Capital Group Inc. (TCN).

The top two sliders for the day were Patrick Industries Inc. (PATK) and Universal Forest Products Inc. (UFPI).

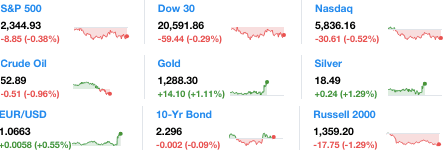

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.