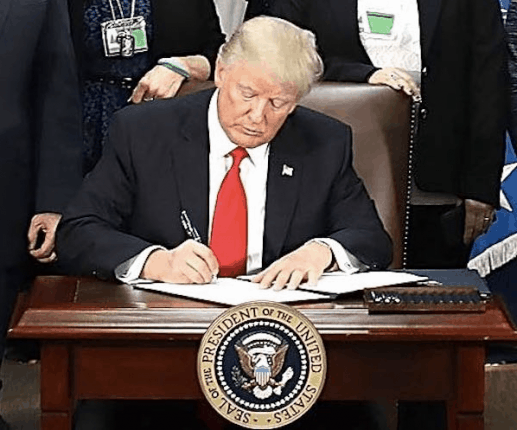

A busy day for President Donald Trump, as he signed orders to implement additional sanctions on Iran, met with his CEO executive council and signed an Executive Order that is significant to the manufactured housing industry.

According to the Daily Mail, the Executive Order to be signed by President Trump will direct the Treasury secretary to review the 2010 Dodd-Frank financial oversight law, which reshaped financial regulation after the 2008-09 financial crisis.

During the campaign, President Trump pledged to repeal and replace the Dodd-Frank law, which also created the Consumer Financial Protection Bureau (CFPB), and administration officials argue that Dodd-Frank did not achieve what it set out to do, instead seeing it as an example of massive government over-reach.

“Dodd-Frank is a disaster,“ said Trump, during a meeting this week with small business owners, including NFIB President and CEO Juanita Duggan.

“We’re going to be doing a big number on Dodd-Frank.”

While the Executive Order is not expected to have an immediate impact, it directs incoming Treasury Secretary Steven Mnuchin to consult with members of different regulatory agencies and the Financial Stability Oversight Council and report back on potential changes.

MH Industry Impact

As industry professionals know, Dodd-Frank and the CFPB have had a significant impact on affordable housing, in essence creating a “Renter’s Nation”.

The sweeping 2,000-page Dodd-Frank regulations were never meant to apply to factory-built homes at all, according to a letter written by the law’s co-sponsor, Barney Frank. In a response to a constituent, Frank said, “I do not think it is necessary to include manufactured housing as part of our effort to prevent abusive mortgage practices, and I am now working with my staff to see if we can find a way to make a change that would deal with the problem you correctly point out… “

Nevertheless, industry professionals say MH financing has been so profoundly impacted, it is hurting the people who can least afford it — low- to moderate-income buyers trying to make the transition from renting to owning their own homes.

“Our compliance costs have quadrupled in the past three years alone,” says Don Glisson, CEO of Triad Financial Services, another leading MH lender in the “A” credit market for more than half a century.

Triad and CU Factory Built rank third and fourth in the MH finance market for buyers with FICO scores above 650.

In our “A Cup of Coffee With…” segment with Glisson, he discussed in detail the challenges with those in government understanding manufactured housing.

“I would love to think that MH is considered mainstream housing, but the truth is we are still the red-headed stepchild in the eyes of many, especially the ‘elites’ who supposedly know what’s good for everyone, and of course many of these elites work in government,” said Glisson.

“We are the answer to the country’s affordable housing issues, but we don’t get fair treatment at the federal level. There are no MH dwellers inside the Beltway, so we must not be a good housing choice in their eyes.

Government is taking sides and it’s harming the very middle-class they profess to want to help.”

For more on Dodd-Frank’s impact on the manufactured housing industry, click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.