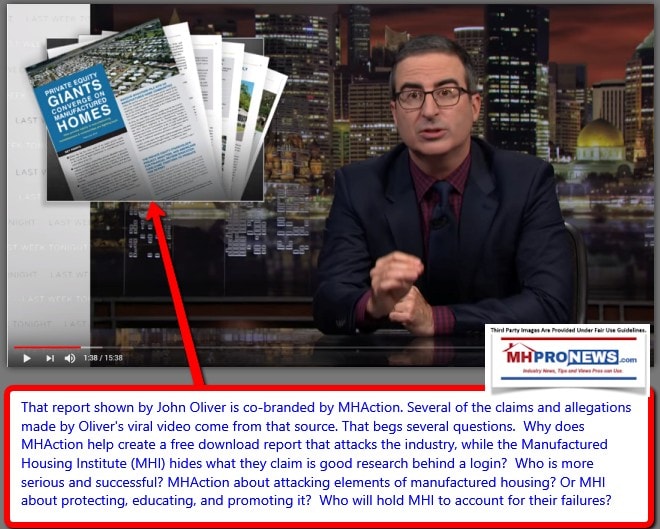

If someone called for more single-family housing to be built, or for more apartments, condo, or townhouse development in the U.S., it would hardly be news. Rather, it is an everyday event to see, read, or hear someone talking about the need for more of those types of housing. So, why should it be controversial when the Private Equity Stakeholder Project (PESP) made a similar call for more development of manufactured home communities as part of their formal testimony to the U.S. Senate? The PESP is a coalition of nonprofits that has included manufactured home community focused MHAction. As a reminder to long-time readers and for the insight of new MHProNews visitors is the following description: “The Private Equity Stakeholder Project along with MHAction and the Americans for Financial Reform Education Fund released a new report, “Private equity giants converge on manufactured homes: How private equity is manufacturing homelessness & communities are fighting back.” That report drew significant media attention. It included the viral video by HBO’s Last Week Tonight with John Oliver errantly named “Mobile Homes.” That viral video has been periodically referenced by lawmakers, advocates, and others in media since then. And PESP research was part of Oliver’s satirical lash at several companies that seem to be routinely connected to MHI membership. That noted, PESP provided testimony to the U.S. Senate last fall. Some of that research has made its way into a new reporting by mainstream media that will be the subject of a planned report here on MHProNews. Thus, this background report will be useful, and in some ways, necessary, to properly understand the information produced by national as well as local/regional news outlets on issues involving HUD Code manufactured homes and manufactured home land-lease communities.

Several Manufactured Housing Institute (MHI) member firms – including, but not limited to those operating in the land-lease community sector, production, retail, and finance – are among those previously named by the PESP and/or MHAction in their various research documents.

From the PESP website is the following category of their research and reporting.

“Housing

Post crisis, private equity firms aggressively invested in all parts of the US housing market (and increasingly globally as well), buying apartment buildings, single family homes, manufactured housing communities and mortgages. Aiming for double digit returns, private equity firms have at times led the market in rent increases and mortgage foreclosures.”

In fairness to the PESP testimony document to the U.S. Senate on 10.21.2021 hearing on Banking, Housing and Urban Affairs, they routinely produce well researched information. At times, the case could be made that they may use an extreme illustration. Some of their suggested solutions may require nuance, and the case could be made that they routinely miss certain possible solutions that logic and the evidence suggest would be useful. More specifically, PESP and/or MHAction seem to steer clear of certain possible responses by public officials that would not require new legislation. Those solutions, which could be summed up with the phrase – enforce existing laws – could in principle produce a more rapid response useful to residents who are the ‘victims’ of predatory brands.

For instance. In testimony that has over 8000 words, per WORD’s search tool, the following terminology is missing. In no particular order of importance are the following.

- Hobbs Act.

- Antitrust.

- Monopoly.

- Oligopoly.

- Sherman Act.

- Racketeering or the acronym RICO.

- Manufactured Housing Improvement Act of 2000.

That said, highlighted below by MHProNews will be a few items in the PESP text which were part of their testimony to the U.S. Senate. One of those highlighted items included this telling quotation.

- “Preserving affordability also requires local governments to use local zoning and regulatory powers to allow for the development of manufactured home communities and protect existing communities from closure and conversion.”

That’s economics 101 and is arguably spot on. That, some of those other MHProNews highlighted items, and more will be unpacked on the far side of the PESP written testimony to the U.S. Senate, which follows.

Private Equity Stakeholder Project (PESP) – Statement for the Record

October 21, 2021 Hearing of the Senate Committee on Banking, Housing, and Urban Affairs

How Private Equity Landlords are Changing the Housing Market

Chairman Brown, Ranking Member Toomey, and Members of the Committee, thank you for the opportunity to provide a statement for the October 21, 2021 hearing “How Private Equity Landlords are Changing the Housing Market” by the Senate Committee on Banking, Housing, and Urban Affairs.

My name is Mellissa Chang with the Private Equity Stakeholder Project. The Private Equity Stakeholder Project is a non-profit organization focused on tracking the impacts of investments by private equity firms and similar Wall Street firms on ordinary people, including residents of apartments, rental homes, and mobile homes.

We appreciate the opportunity to comment on how private equity landlords are changing the housing market. Our testimony focuses on a particularly important aspect of this issue, namely: private equity’s growing role in owning manufactured home communities. In our work, we’ve seen private equity firms and institutional investors exploit the unique ownership structure of manufactured homes to generate outsized profits.

It is important to ground any policy discussion in a fundamental understanding of manufactured home residents and the unique challenges they face. To that end, our comments will outline several recommendations to help guide policy as you consider ways to present the 22 million people living in manufactured homes across America.1

MANUFACTURED HOUSING IS A VITAL SOURCE OF UNSUBSIDIZED AFFORDABLE HOUSING.2

U.S. manufactured homes are sometimes casually referred to as “mobile homes” or “trailers,” but, in fact, they are a specific type of factory-built housing and must be constructed in accordance with the U.S. Department of Housing and Urban Development’s (HUD’s) Manufactured Home Construction and Safety Standards Code.3 Modern manufactured homes resemble single-family residences, often with multiple bedrooms, backyard patios or decks, and most are secured to a concrete foundation. They may be placed on the homeowners’ private land, or the homes may be placed on rented or leased land, oftentimes inside a manufactured home community.4

Approximately 2.9 million – or 43% – of the nation’s manufactured homes are in communities where tenants rent or lease plots of land.6 The Manufactured Housing Institute estimates that 31% of all new manufactured homes are placed in manufactured home communities.7 In these communities, residents pay site rent and additional fees for shared amenities, services, and utilities.

At an average price of $81,900, manufactured homes are a vital source of affordable housing for rural and low-income families.8 More than a quarter of manufactured-home owners earn less than $20,000 a year. For manufactured-home renters, more than a third earn less than $20,000 a year.9 The median net worth of households living in manufactured homes is one quarter that of households living in traditional homes. 10

Manufactured homes are a particularly important housing option for families who live on fixed incomes, like retirees and individuals unable to work due to disability. A 2018 survey by the Manufactured Housing Institute found that 33% of manufactured home residents were retired, and 18% cited disability payments as their primary source of income.11

While manufactured homes are sometimes thought of as mobile, manufactured homes are almost never moved once placed. Homes are often attached to a foundation and cannot stand a move. Furthermore, moving costs average $5,000 to $10,000, roughly five to seven years’ worth of the homes’ equity.12 Finding a new lot to place the home is also difficult, as community owners may prefer to place newly constructed homes.13

It is also difficult for homeowners to sell their homes because of home sale restrictions imposed by the community owner, such as exclusive agent arrangements.14 In addition, site rent increases hurt homeowners looking to sell – realtors estimate that for every $100 increase in space rent, a manufactured home loses $10,000 in value.15

The financial consequences of eviction are also more devastating for manufactured-home owners than residents in traditional rentals. When homeowners facing eviction cannot move or sell their home, the homeowners’ only option is to abandon their home or try to sell it to the community owner – usually for a fraction of what it’s worth – eroding any equity the home might have accrued. In some cases, homeowners must sell their homes for less than their mortgage, meaning they walk away from evictions saddled with even more debt. After evicting residents, community owners often rent out or re-sell these homes.16

With limited mobility and few alternative housing options, manufactured-home residents are vulnerable to exploitation by landlords looking to maximize profits. When site rent and fees are increased or communal maintenance issues ignored, homeowners often have no choice but to endure it.

This economic trap is not a side effect but a building block of the business model. Because of residents’ inability to move and a high demand for affordable housing, cash flows from the investments tend to be highly stable, even during economic downturns.

According to analyst Green Street Advisors, the manufactured home sector is the only major real estate asset class that has not experienced a year-over-year decline in net operating income in any year since 2000. Green Street views manufactured home communities as offering the most favorable return profile among all property sectors (including apartments, office buildings, retail, hotels, industrial, and self-storage).17

Although manufactured homes are significantly cheaper than site-built homes, many manufactured-home owners still seek loans to help finance their home purchase, which often carry higher interest rates than loans for site-built homes.18 This means that each month mobile home residents are on the hook for mortgage or rent payments on their home, rent payments on their plot, and fees. Furthermore, the type of loan often used to purchase manufactured homes has fewer protections against repossession.19

These data show that manufactured housing is a foundation in the structure of American housing. It supports some of the most precarious members of our society. Therefore, it is critical that our housing policy is structured to look after these residents wherever possible. And it’s for these reasons that the emergence of private equity firms and corporate real estate investors at a massive scale in the industry is cause for concern.

WHY ARE MASSIVE INVESTORS BUYING INTO MANUFACTURED HOMES NOW?

Over the past 20 years, manufactured home communities increasingly have gone from “mom and pop” enterprises to ownership by private equity firms and large, multi-state corporations that seek to capitalize on manufactured-home owners’ unique situation.

In 2017, private equity firm Apollo Global Management, with $270 billion in overall assets, bought Inspire Communities, a manufactured home community operator with 13,000 home sites.20

In mid 2018, Blackstone Group, one of the largest private equity and real estate firms in the world with $457 billion in assets, bought a portfolio of manufactured home communities in Arizona and California.21

In 2020, the Carlyle Group expanded its presence in manufactured home communities with a $230 million purchase of four manufactured home communities in Arizona. 22

The purchase of manufactured home portfolios rose significantly in 2020. In the one-year period between July 2020 and June 2021, investors purchased $2.6 billion worth of mobile homes communities through portfolio acquisitions.23

The outsized growth of private equity and institutional investment during this time period raises particular concern given the economic turmoil created by the COVID-19 pandemic. Research by the Urban Institute found that residents in manufactured home communities were more likely to be employed in the industries most affected by the pandemic.24 Loopholes and gaps in pandemic relief legislation also have made residents of manufactured homes easier to evict.25

In the last 24 months, institutional investors accounted for 23% of all manufactured home purchase volume – up from an average of 13% between 2017 and 2019. Four of the top 10 buyers in the last two years were institutional investors, with portfolio acquisitions comprising 83% of their purchases.26

The top 10 manufactured housing community owners own more than 540,000 home sites. Among the top ten are seven private equity firms and institutional investors, with control over at least 480,000 sites.27

Due to manufactured-home owners’ limited mobility, investors can increase site rent prices and fees with little effect on demand. Investors also have few incentives to invest in properties and community amenities. As a result, residents are trapped and can be squeezed for every dollar.

Residents report that elderly neighbors on fixed incomes are forced to choose between rent and medicine or food and working families struggle as rents dramatically increase but residents’ incomes do not.

And, unlike traditional rental properties, evicting residents that are unable to keep up with rising site rents can be lucrative, as residents who are forced to leave may abandon their homes or sell to the investor at a steep discount. With such devastating consequences for evictions, manufactured-home residents are often reluctant to raise concerns or challenge wealthy investors.

YES! COMMUNITIES: PANDEMIC EVICTOR

The case of YES! Communities – one of the nation’s largest owners of manufactured home communities – shows that the situation is dire. Policy intervention is a moral and economic imperative.

YES! Communities has 263 manufactured home communities in 22 states with major concentrations in Florida, Georgia, Iowa, Michigan, North Carolina, Oklahoma, South Carolina, Tennessee, and Texas.28

YES! was a portfolio company owned by Stockbridge Capital, a private equity real estate manager.29 In August 2016, Stockbridge sold more than two-thirds (71%) of its investment in YES! Communities to two institutional investors, the sovereign wealth fund Government of Singapore Investment Company (GIC) and the Pennsylvania Public School Employees Retirement System (PSERS), the pension fund for teachers and other school employees in Pennsylvania.30

In June 2016, prior to the deal closing, the Wall Street Journal reported that the deal valued YES! at more than $2 billion. The Journal reported that GIC would get an initial yield from the company of slightly more than 6%, in addition to any appreciation in value of the underlying real estate.31 US government sponsored housing lender Fannie Mae provided financing for the transaction.32

YES! Communities quickly became a very lucrative investment. By the end of 2017, Pennsylvania PSERS reported that its investment in YES! Communities had increased in value by 26% since the pension fund invested in August 2016. In just over a year YES! Communities had already returned $13.5 million in cash to Pennsylvania PSERS.33

PSERS’ investment in YES! Communities, valued at $226 million at the end of 201734, was worth $628 million as of September 2021.35 Between July 2019 and June 2020, the investment outperformed the FTSE NAREIT Equity REIT TR index by almost 25%.36

YES! Communities charges site rent to all residents, regardless of whether the resident rents or owns the home. In a 2018 memo to investors, YES! Communities reported an average home site rental rate of $415 a month for October 2017 – a 4% increase over the previous year. Site rent accounted for 60% of the company’s revenue in 2016, according to the memo. YES! Communities’ home site rental business accounted for 60% of the company’s revenues in 2016.37

Home rentals and sales are also a meaningful source of revenue for YES! Communities. In 2017, almost a third of YES! Communities’ residents rented their home, in addition to renting the land underneath the home. In October 2017, home rentals were an average $474. In 2016, YES! Communities sold 1,800 manufactured homes to new and existing residents. But even after a sale, YES! Communities continues to collect site rent from residents.38

YES! Communities has made headlines multiple times in recent years for its eviction practices. A 2018 report by the Atlanta Journal-Constitution, found that YES! Communities had filed evictions at almost twice the rate of other landlords in the metro Atlanta area. The investigation found that in 2016, YES! Communities had filed about 1,000 evictions for roughly 1,800 units.39

YES! Communities has also been a top eviction filer during the COVID-19 pandemic.

Since March 2020, YES! Communities has filed more than 386 eviction actions. 90% of all YES! Communities’ evictions were filed while the Centers for Disease Control’s eviction moratorium was still in effect. A list of eviction actions by YES! Communities follows at the end of this testimony.

In November 2020, YES! Communities filed to evict a family in Jacksonville, Florida that was behind on rent. The resident provided a copy of a CDC Hardship Declaration on December 3.

Nonetheless, on December 21, 2020 a Duval County judge ordered the family to vacate the premises by the end of the month.40

In July 2021, YES! Communities filed an eviction action against a recently-deceased resident whose adult son still lived in the home. At the time of the filing, the resident owed less than $600 to YES! Communities. The resident and his son, who had lived in the community since 1988, owned their home and only paid monthly site rent.

In a handwritten note to the judge, the resident’s son asserts that YES! Communities staff refused to accept two money orders as payment for July rent and explains that “it would take 30 days to obtain a refund.” On July 3 and July 14, YES! Communities sent the resident two notices on non-payment. On July 27, YES! Communities filed to evict him and his father from their home and remove their home from the site. The case was dismissed in September after YES! Communities received the son’s payments through a court registry transfer and the court learned that the father had died.41

In August of 2021, YES! Communities filed to evict a resident for $600 in unpaid rent. In her response to the eviction summons, the resident states:

“…I currently owe no funds for rent…On 15 July 2021…the collector for Woodland Estates…advised that if I turned over the property and keys or if I could pay the past due balance by 3 August 2021, no eviction would be filed. Going by her word, all funds were paid when I returned from out of state on 2 August 2021.”

On August 3, YES! Communities filed to evict the resident. It took YES! Communities two weeks to file its withdrawal from the eviction action.42

The statements above cannot fully capture the harm that was done to these families. At a time when compassion and mercy are needed more than ever, YES! Communities appears to have little.

There is a moral imperative to intervene and repair the immediate and long-term harms created by YES! Communities, as these evictions were filed while the CDC eviction moratorium remained in effect.

PROTECTING RESIDENTS OF MANUFACTURED HOME COMMUNITIES

Even in the face of multi-billion-dollar, multinational investors, residents are joining together and fighting to protect their communities. Across the country, manufactured home residents are organizing, researching the real estate and private equity investors that have bought their communities, engaging their public officials and allies, and building coalitions with tenants.

They are demanding their homes, economic security, and health be protected from the impacts of short-term speculative investment and that private equity firms and institutional investors take steps to minimize the negative impacts of their investments on manufactured home residents.

They also believe that local, state, and federal governments play a critical role in protecting manufactured home residents from exploitative community owners and stemming predatory investments. They call for the following intervention:

PRESERVE AFFORDABILITY

The critical mechanism for protecting residents from exploitation and preserving affordability is stabilizing rent and fees, including lot fees, rents paid by tenants, and utility costs. Corporate owners determine rent and fee levels and should work directly with residents to ensure that rents are reasonable.

Local and state governments should establish rent regulations to stabilize rents and protect against unconscionable rent hikes. Such regulations allow for reasonable and gradual rent increases. Government regulations should protect against other abusive rent and fee practices, including demanding transparent, itemized billing, limits on passing on communal utility costs, and ensuring moratoriums on rent collections when homes are destroyed in disasters.

Preserving affordability also requires local governments to use local zoning and regulatory powers to allow for the development of manufactured home communities and protect existing communities from closure and conversion.

PROHIBIT UNJUST EVICTIONS

In addition to rent hikes, a key strategy of corporate community owners is aggressive eviction. If evicted, manufactured-home owners can often only resell their home for a fraction of what they paid for it or cannot resell at all and hand it over to the corporate owner. The residents leave the community with no equity – and, in many cases, no other home.

Renters of manufactured homes face a similar fate, some after investing in their home through a rent to own contract. Further, without protections against unjust eviction, residents may hesitate to register complaints about maintenance problems or to negotiate rent hikes out of fear of losing their homes.

States must enact good cause eviction laws to prohibit such manufactured home eviction mills. Good cause eviction laws enumerate allowable reasons for evicting a resident, such as nonpayment of rent or criminal activity, and mandate a notice period, an opportunity for the resident to cure the cause for eviction, and due process for eviction proceedings. And, critically, when there is no good cause for eviction, the community owner is required to offer the resident a renewal lease when the existing lease expires.

ENSURE SAFE AND HEALTHY COMMUNITY MAINTENANCE

As the owner of the land and all common spaces, the corporate community owner is responsible for keeping the community habitable, safe, and healthy. Another mechanism for extracting short term profits out of these communities is limited or even decreased maintenance. This leads to health and safety risks for residents, from sewer system failures to unplowed roads. Community owners, especially those with deep pockets, must invest in community infrastructure and safety and on-site managers.

Local, state, and federal government must ensure that community owners are held to a strong code of maintenance, implement transparent systems for residents to have input on maintenance, and have on-site managers. Basic standards include safe walkways and roads, well-maintained water and sewer systems, tree clearing, elimination of standing water, and accommodations for people with disabilities.

ENSURE RESIDENTS FAIR AND EQUAL TREATMENT

To feed their business model, corporate community owners also use their power to push vulnerable residents into exploitative arrangements and discriminate and retaliate against residents. Through consumer protection and civil rights laws and meaningful private and public enforcement of those laws, local, state, and federal governments must ensure residents are protected from:

- Retaliation for organizing their neighbors, speaking up, complaining about community conditions, or otherwise attempting to enforce their rights or protect their community;

- Discrimination at the hands of corporate investors on the basis of race, national origin, familial status, gender, sexual orientation, gender identity, disability, religion, age, or other protected classes, including exploiting residents based on their language proficiency or immigration status;

- Fraudulent or exploitative lease terms, such as rent to own contracts that deny residents basic tenant protections and force them to lose the investments they made in the home;

- Corporate community owners serving as exclusive real estate agents and controlling homeowners’ right to sell their home, which often leaves residents with no choice but to abandon their homes, while corporate community owners benefit at their expense.

INSTITUTE TRANSPARENT, MEANINGFUL COMPLAINT PROCEDURES FOR RESIDENTS

Residents need a clear path to report problems with health and safety risks, mismanagement, lease provisions, invoices, and any other problems in their communities. This is especially true when the owner of their community is an out-of-state investor that they do not know and cannot contact. Community owners need to institute transparent, meaningful complaint procedures and states should require them.

PROVIDE A MEANINGFUL PATH FOR RESIDENT OR PUBLIC COMMUNITY OWNERSHIP

A critical step to protecting the affordability, viability, and safety of manufactured home communities is creating a path for residents or non-profit or public agencies to own them. Around the country, cooperative ownership of manufactured home communities has proven to work. When residents own their community, families and seniors can afford to stay and they invest in their community, its buildings, amenities, and infrastructure.43

State government can provide a meaningful path for resident or public ownership.

- Effective laws: Require the community owner to notify the residents, including but not limited to resident associations, as well as local and state governments, whenever the owner receives an offer to buy the community, is putting the community on the market, or intends to change the use;

- Give residents a sufficient waiting period to decide if they want to purchase the community and make an offer;

- Require seller to negotiate in good faith with the residents and offer them the right to purchase the community if they can match the existing offers;

- Provide public resources to help the residents, public agency, or non-profit finance the purchase; and

- Enforce residents’ rights and penalize non-compliance by community owners.

STEM PREDATORY INVESTMENTS

We believe that the federal government and the government-sponsored enterprises (GSEs) play a key role in developing and sustaining affordable housing and healthy communities. We must ensure that the government is using its powers to protect low-income people from predatory investments and is not pressured by investors to support wealth extraction from low-income communities.

Manufactured housing is one of the three underserved markets that Fannie Mae and Freddie

Mac are required to serve as part of their obligations under the Duty to Serve Program. Fannie Mae and Freddie Mac must increase financing opportunities for residents, government entities, and nonprofit organizations to purchase manufactured home communities. By reducing the housing quality and increasing the expenses for manufactured housing residents, private equity investors are decreasing access to manufactured housing for those who rely on it.

Fannie Mae and Freddie Mac should also take steps to prevent their other investments from undermining their duty to serve the manufactured housing market by requiring all purchasers to commit to the following as a condition for their financing:

- Implement and comply with FHFA’s pad lease protections for tenants, including one year renewable leases, 30-day written notice of rent increases, the right to cure defaults on rent payments, the right to sell the manufactured home without relocating it and assigning the pad lease to the new owner, and 60-day written notice of a planned closure or sale of a community;

- Preserve affordability with gradual rent increases and prohibit unfair lease terms like rent to own contracts and excessive fees; and

- Maintain safety and habitability with regular property maintenance and responsiveness to resident

CONCLUSION

Private equity investments striving for short-term gains and a quick exit are not intended to create a sustainable housing system or community. “Well-capitalized private-equity and publicly traded REITs are eager to acquire these properties, invest capital on cosmetic or deferred maintenance items, and realize improved performance [of] the properties typically within the first two years of ownership,” Paul Adornato, an analyst with BMO Capital Markets, told the Wall Street Journal in 2016.44 They will leave behind low-income residents who cannot afford the rent hikes and are pushed to homelessness, and communities that suffer from limited maintenance and frayed infrastructure.

Thank you,

Mellissa Chang

Private Equity Stakeholder Project

mellissa.chang@PEstakeholder.org

Private Equity Stakeholder Project

2513 N Central Park Ave

Chicago, IL 60647

##

Partial list of YES! Communities’ eviction filings during the COVID-19 pandemic

| Plaintiff | County | State | Filed | Case Number |

| YES HIDDEN OAKS LLC et al – | Alachua | FL | 8/30/21 | 2021 CC 002970 |

| YES HIDDEN OAKS LLC et al – | Alachua | FL | 8/30/21 | 2021 CC 002969 |

| YES COMPANIES FRED LLC AND YES HOMESALES LLC DBA WOODLAND ESTATES | Duval | FL | 8/27/21 | 162021CC008879XX XXMA |

| YES PALMS OF ARCHER LLC et al – | Alachua | FL | 8/27/21 | 2021 CC 002956 |

| YES COMPANIES FRED LLC et al – | Alachua | FL | 8/26/21 | 2021 CC 002933 |

| YES WOODLAND ESTATES FL LLC D/B/A WOODLAND ESTATES | Duval | FL | 8/24/21 | 162021CC008747XX XXMA |

| Yes Communities DBA Meadow Glen | Tarrant | TX | 8/20/21 | JP03-21-E00067846 |

| Yes Communities DBA Meadow Glen | Tarrant | TX | 8/20/21 | JP03-21-E00067837 |

| YES COMMUNITIES DBA MEADOW GLEN | Tarrant | TX | 8/20/21 | JP03-21-E00067841 |

| YES COMMUNITIES DBA MEADOW GLEN | Tarrant | TX | 8/20/21 | JP03-21-E00067840 |

| Yes Communities DBA Meadow Glen | Tarrant | TX | 8/20/21 | JP03-21-E00067839 |

| YES COMMUNITIES DBA MEADOW GLEN | Tarrant | TX | 8/20/21 | JP03-21-E00067845 |

| Yes Communities DBA Meadow Glen | Tarrant | TX | 8/20/21 | JP03-21-E00067838 |

| YES PALMS OF ARCHER LLC – | Alachua | FL | 8/19/21 | 2021 CC 002845 |

| Yes Communities DBA Meadow Glen | Tarrant | TX | 8/18/21 | JP03-21-E00067822 |

| Yes Communities DBA Meadow Glen | Tarrant | TX | 8/17/21 | JP03-21-E00067817 |

| YES COMMUNITIES DBA MEADOW GLEN | Tarrant | TX | 8/17/21 | JP03-21-E00067811 |

| YES COMMUNITIES DBA MEADOW GLEN | Tarrant | TX | 8/17/21 | JP03-21-E00067815 |

| YES COMMUNITIES DBA MEADOW GLEN | Tarrant | TX | 8/17/21 | JP03-21-E00067818 |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 8/17/21 | 162021CC008507XX XXMA |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 8/17/21 | 162021CC008509XX XXMA |

| YES COMMUNITIES WFC LLC D/B/A THE BRAKERS | Duval | FL | 8/16/21 | 162021CC008450XX XXMA |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 8/16/21 | 162021CC008415XX XXMA |

| YES COMMUNITIES WFC LLC DBA THE BREAKERS | Duval | FL | 8/16/21 | 162021CC008313XX XXMA |

| YES COMPANIES FRED LLC DBA WOODLAND ESTATES | Duval | FL | 8/3/21 | 162021CC007944XX XXMA |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 8/2/21 | 162021CC007849XX XXMA |

| YES COMPANIES WFC, LLC | Hillsboro ugh | FL | 7/27/21 | 21-CC-080948 |

| YES HOMESALES LLC DBA SLEEPY HOLLOW | Tarrant | TX | 7/27/21 | JP04-21-E00061114 |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 7/21/21 | 162021CC007448XX XXMA |

| YES COMPANIES KEY LLC | Duval | FL | 7/21/21 | 162021CC007468XX XXMA |

| YES COMPANIES KEY LLC | Duval | FL | 7/21/21 | 162021CC007464XX XXMA |

| YES COMMUNITIES WFC LLC | Duval | FL | 7/20/21 | 162021CC007411XX XXMA |

| YES COMPAINES KEY LLC D/B/A CRYSTAL SPRINGS ESTATES | Duval | FL | 7/19/21 | 162021CC007329XX XXMA |

| YES COMPANIES FRED LLC | Duval | FL | 7/19/21 | 162021CC007320XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATE | Duval | FL | 7/19/21 | 162021CC007310XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 7/19/21 | 162021CC007303XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 7/19/21 | 162021CC007306XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 7/19/21 | 162021CC007304XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 7/19/21 | 162021CC007305XX XXMA |

| YES COMPANIES WFC, LLC | Hillsboro ugh | FL | 7/16/21 | 21-CC-078019 |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 7/15/21 | 162021CC007250XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 7/2/21 | 162021CC006695XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 7/1/21 | 162021CC006627XX XXMA |

| Yes Communities- El Lago | Tarrant | TX | 6/25/21 | JP08-21-E00104264 |

| YES COMPANIES KEY, LLC | Polk | FL | 6/25/21 | 2021CC-0029450000-LK |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 6/23/21 | 162021CC006253XX XXMA |

| YES COMPANIES KEY LLC D/B/A OCEANWAY VILLAGE | Duval | FL | 6/23/21 | 162021CC006257XX XXMA |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/23/21 | 2021 CC 002074 |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 6/22/21 | 162021CC006207XX XXMA |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/22/21 | 2021 CC 002075 |

| YES COMPANIES FRED LLC | Alachua | FL | 6/21/21 | 2021 CC 002040 |

| YES COMPANIES FRED LLC | Alachua | FL | 6/21/21 | 2021 CC 002038 |

| YES COMPANIES FRED LLC | Alachua | FL | 6/21/21 | 2021 CC 002042 |

| YES COMPANIES FRED LLC | Alachua | FL | 6/21/21 | 2021 CC 002037 |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 6/21/21 | 162021CC006145XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 6/21/21 | 162021CC006147XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 6/21/21 | 162021CC006140XX XXMA |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/21/21 | 2021 CC 002055 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/21/21 | 2021 CC 002036 |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 6/18/21 | 162021CC006050XX XXMA |

| YES MOUNTAIN GATE LLC | Maricopa | AZ | 6/18/21 | CC2021099514 |

| YES MOUNTAIN GATE, LLC | Maricopa | AZ | 6/18/21 | CC2021099519 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/18/21 | 2021 CC 002033 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/17/21 | 2021 CC 002011 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/17/21 | 2021 CC 002012 |

| MEADOW GLEN | Tarrant | TX | 6/15/21 | JP03-21-E00067571 |

| MEADOW GLEN | Tarrant | TX | 6/15/21 | JP03-21-E00067572 |

| MEADOW GLEN | Tarrant | TX | 6/15/21 | JP03-21-E00067573 |

| MEADOW GLEN | Tarrant | TX | 6/15/21 | JP03-21-E00067574 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/15/21 | 2021 CC 001993 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/15/21 | 2021 CC 001994 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 6/14/21 | 2021 CC 001995 |

| MEADOW GLEN | Tarrant | TX | 6/11/21 | JP03-21-E00067543 |

| MEADOW GLEN | Tarrant | TX | 6/11/21 | JP03-21-E00067544 |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 6/9/21 | 162021CC005692XX XXMA |

| MEADOW GLEN | Tarrant | TX | 6/7/21 | JP03-21-E00067519 |

| MEADOW GLEN | Tarrant | TX | 6/7/21 | JP03-21-E00067522 |

| MEADOW GLEN | Tarrant | TX | 6/7/21 | JP03-21-E00067517 |

| MEADOW GLEN | Tarrant | TX | 6/7/21 | JP03-21-E00067518 |

| MEADOW GLEN | Tarrant | TX | 6/7/21 | JP03-21-E00067520 |

| MEADOW GLEN | Tarrant | TX | 6/7/21 | JP03-21-E00067521 |

| YES COMPANIES KEY LLC DBA CRYSTAL SPRINGS ESTATES | Duval | FL | 6/7/21 | 162021CC005642XX XXMA |

| YES COMPANIES KEY, LLC | Polk | FL | 5/28/21 | 2021CC-0024650000-LK |

| YES MOUNTAIN GATE LLC | Maricopa | AZ | 5/27/21 | CC2021087517 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 5/27/21 | 2021 CC 001813 |

| YES COMPANIES KEY, LLC | Polk | FL | 5/26/21 | 2021CC-0024330000-LK |

| YES PALMS OF ARCHER LLC | Alachua | FL | 5/20/21 | 2021 CC 001700 |

| YES PALMS OF ARCHER, LLC | Alachua | FL | 5/17/21 | 2021 CC 001672 |

| YES MOUNTAIN GATE LLC | Maricopa | AZ | 5/11/21 | CC2021078068 |

| MEADOW GLEN | Tarrant | TX | 5/6/21 | JP03-21-E00067423 |

| MEADOW GLEN | Tarrant | TX | 5/6/21 | JP03-21-E00067424 |

| MEADOW GLEN | Tarrant | TX | 5/6/21 | JP03-21-E00067420 |

| MEADOW GLEN | Tarrant | TX | 5/6/21 | JP03-21-E00067422 |

| MEADOW GLEN | Tarrant | TX | 5/6/21 | JP03-21-E00067421 |

| YES COMMUNITIES WFC LLC D/B/A THE BREAKERS | Duval | FL | 5/5/21 | 162021CC004735XX XXMA |

| YES COMPANIES WFC LLC D/B/A OAKS OF ATLANTIC BEACH | Duval | FL | 5/4/21 | 162021CC004654XX XXMA |

| YES PALMS OF ARCHER LLC | Alachua | FL | 4/21/21 | 2021 CC 001377 |

| YES COMPANIES FRED LLC | Alachua | FL | 4/20/21 | 2021 CC 001345 |

| YES COMPANIES FRED LLC | Alachua | FL | 4/20/21 | 2021 CC 001343 |

| YES COMPANIES FRED LLC DBA HIDDEN OAKS | Alachua | FL | 4/20/21 | 2021 CC 001361 |

| YES COMPANIES FRED LLC | Duval | FL | 4/19/21 | 162021CC004196XX XXMA |

| YES COMPANIES FRED LLC | Duval | FL | 4/16/21 | 162021CC004149XX XXMA |

| YES COMMUNITES WFC LLC | Duval | FL | 4/14/21 | 162021CC004086XX XXMA |

| YES COMPANIES FRED LLC D/B/A WOODLAND ESTATES | Duval | FL | 4/14/21 | 162021CC004093XX XXMA |

| YES COMPANIES FRED LLC | Duval | FL | 4/13/21 | 162021CC004020XX XXMA |

| Yes Communities | Tarrant | TX | 4/8/21 | JP07-21-E00097425 |

| YES COMPANIES WFC LLC | Maricopa | AZ | 3/25/21 | CC2021051406 |

| YES COMMUNITIES WFC LLC DBA THE BREAKERS | Duval | FL | 3/24/21 | 162021CC003525XX XXMA |

| YES COMPANIES FRED LLC | Duval | FL | 3/24/21 | 162021CC003524XX XXMA |

| YES HOME SALES DBA SLEEPY HOLLOW | Tarrant | TX | 3/22/21 | JP04-21-E00060400 |

| YES COMMUNITIES WFC LLC DBA THE BREAKERS | Duval | FL | 3/19/21 | 162021CC003317XX XXMA |

| YES COMMUNITIES WFC LLC DBA THE BREAKERS | Duval | FL | 3/18/21 | 162021CC003245XX XXMA |

| YES PALMS OF ARCHER LLC | Alachua | FL | 3/18/21 | 2021 CC 000963 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 3/18/21 | 2021 CC 000962 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 3/17/21 | 2021 CC 000954 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 3/17/21 | 2021 CC 000960 |

| YES PALMS OF ARCHER, LLC DBA THE PALMS OF ARCHER | Alachua | FL | 3/17/21 | 2021 CC 000959 |

| YES COMPANIES FRED LLC | Duval | FL | 3/15/21 | 162021CC003165XX XXMA |

| Yes Communities | Tarrant | TX | 3/11/21 | JP07-21-E00097284 |

| YES PALMS OF ARCHER, LLC DBA THE PALMS OF ARCHER | Alachua | FL | 3/11/21 | 2021 CC 000904 |

| CHALET CITY | Tarrant | TX | 3/10/21 | JP06-21-E00070787 |

| CHALET CITY | Tarrant | TX | 3/10/21 | JP06-21-E00070788 |

| CHALET CITY | Tarrant | TX | 3/9/21 | JP06-21-E00070762 |

| CHALET CITY | Tarrant | TX | 3/9/21 | JP06-21-E00070763 |

| YES HOMESALES LLC, DBA SLEEPY HOLLOW | Tarrant | TX | 3/3/21 | JP04-21-E00060309 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 2/23/21 | SC-2021-604 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 2/23/21 | SC-2021-603 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 2/23/21 | SC-2021-606 |

| YES COMPANIES EXP KY LLC | Cleveland | OK | 2/23/21 | SC-2021-602 |

| YES COMPANIES KEY LLC | Cleveland | OK | 2/23/21 | SC-2021-605 |

| YES MOUNTAIN GATE LLC | Maricopa | AZ | 2/23/21 | CC2021031781 |

| YES MOUNTAIN GATE LLC | Maricopa | AZ | 2/23/21 | CC2021031778 |

| YES MOUNTAIN GATE LLC | Maricopa | AZ | 2/23/21 | CC2021031767 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 2/22/21 | SC-2021-2690 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 2/22/21 | SC-2021-2688 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 2/22/21 | SC-2021-2691 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 2/22/21 | SC-2021-2689 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 2/22/21 | SC-2021-2687 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 2/22/21 | SC-2021-2685 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 2/19/21 | 2021 CC 000596 |

| YES PALMS OF ARCHER, LLC DBA THE PALMS OF ARCHER | Alachua | FL | 2/19/21 | 2021 CC 000594 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 2/17/21 | 2021 CC 000544 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 2/11/21 | SC-2021-2265 |

| YES COMPANIES KEY LLC | Cleveland | OK | 2/9/21 | SC-2021-518 |

| YES COMPANIES KEY, LLC | Polk | FL | 2/9/21 | 2021CC-0007110000-LK |

| CHALET CITY | Tarrant | TX | 2/8/21 | JP06-21-E00070627 |

| CHALET CITY | Tarrant | TX | 2/8/21 | JP06-21-E00070628 |

| CHALET CITY | Tarrant | TX | 2/8/21 | JP06-21-E00070629 |

| YES COMPANIES WFC LLC dba ROSEWOOD ESTATES | Maricopa | AZ | 2/8/21 | CC2021022491 |

| YES COMPANIES KEY LLC | Cleveland | OK | 2/4/21 | SC-2021-476 |

| YES COMPANIES KEY LLC | Cleveland | OK | 2/2/21 | SC-2021-440 |

| Yes Companies EXP KEY, LLC | Oklahoma | OK | 2/1/21 | SC-2021-1951 |

| Yes Companies EXP KEY, LLC | Oklahoma | OK | 2/1/21 | SC-2021-1953 |

| Yes Companies EXP KEY, LLC | Oklahoma | OK | 2/1/21 | SC-2021-1950 |

| Yes Companies EXP KEY, LLC | Oklahoma | OK | 2/1/21 | SC-2021-1952 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 2/1/21 | SC-2021-1949 |

| YES COMPANIES KEY, LLC | Hillsborough | FL | 1/28/21 | 21-CC-008589 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 1/26/21 | SC-2021-382 |

| Yes Communities El Lago II | Tarrant | TX | 1/25/21 | JP08-21-E00103543 |

| YES COMPANIES EXP KEY, LLC D/B/A BURNTWOOD MOBILE HOME – OKC | Cleveland | OK | 1/22/21 | SC-2021-324 |

| YES COMPANIES EXP KEY, LLC D/B/A BURNTWOOD MOBILE HOME-OKC | Cleveland | OK | 1/22/21 | SC-2021-323 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 1/21/21 | SC-2021-127 |

| YES COMPANIES EXP LLC | Canadian | OK | 1/21/21 | SC-2021-126 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 1/21/21 | SC-2021-1379 |

| Yes Companies Exp WFC, Llc | Oklahoma | OK | 1/21/21 | SC-2021-1381 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 1/21/21 | SC-2021-1378 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 1/21/21 | SC-2021-1380 |

| YES WESTLAKE LLC | Canadian | OK | 1/21/21 | SC-2021-122 |

| YES WESTLAKE LLC | Canadian | OK | 1/21/21 | SC-2021-125 |

| YES WESTLAKE LLC | Canadian | OK | 1/21/21 | SC-2021-121 |

| YES WESTLAKE LLC | Canadian | OK | 1/21/21 | SC-2021-124 |

| YES WESTLAKE LLC | Canadian | OK | 1/21/21 | SC-2021-123 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 1/20/21 | 2021 CC 000209 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 1/20/21 | 2021 CC 000207 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 1/20/21 | 2021 CC 000210 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 1/20/21 | 2021 CC 000211 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 1/20/21 | 2021 CC 000208 |

| Yes Communities | Tarrant | TX | 1/15/21 | JP07-21-E00097069 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-802 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-801 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-803 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-804 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-798 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-799 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-807 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-800 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-795 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 1/15/21 | SC-2021-806 |

| CHALET CITY | Tarrant | TX | 1/14/21 | JP06-21-E00070511 |

| Yes Companies EXP Key, LLC | Oklahoma | OK | 1/14/21 | SC-2021-681 |

| Yes Companies EXP Key, LLC | Oklahoma | OK | 1/14/21 | SC-2021-682 |

| Yes Companies EXP Key, LLC | Oklahoma | OK | 1/14/21 | SC-2021-680 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 1/14/21 | 2021 CC 000139 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 1/14/21 | 2021 CC 000138 |

| Yes Companies Wfc Llc | Oklahoma | OK | 1/11/21 | SC-2021-251 |

| Yes Companies EXP Key, LLC | Oklahoma | OK | 12/30/20 | SC-2020-15555 |

| YES COMPANIES KEY, LLC | Polk | FL | 12/30/20 | 2020CC-0052170000-LK |

| Yes Companies Exp Key LLC | Oklahoma | OK | 12/29/20 | SC-2020-12827 |

| Yes Companies Exp LLC | Oklahoma | OK | 12/29/20 | SC-2020-14649 |

| YES HOME SALES DBA, SLEEPY HOLLOW | Tarrant | TX | 12/21/20 | JP04-20-E00060022 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 12/18/20 | SC-2020-1335 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 12/18/20 | SC-2020-1334 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 12/18/20 | SC-2020-1336 |

| YES WESTLAKE LLC | Canadian | OK | 12/18/20 | SC-2020-1337 |

| MOUNTAIN GATE MOBILE HOME PARK | Maricopa | AZ | 12/17/20 | CC2020183591 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 12/17/20 | SC-2020-16230 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 12/17/20 | SC-2020-14206 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 12/17/20 | SC-2020-14759 |

| Yes Communities | Tarrant | TX | 12/16/20 | JP07-20-E00096935 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 12/16/20 | SC-2020-3930 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 12/16/20 | SC-2020-3932 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 12/16/20 | SC-2020-3931 |

| Yes Companies WFC LLC | Oklahoma | OK | 12/16/20 | SC-2020-12460 |

| Yes Companies WFC LLC | Oklahoma | OK | 12/16/20 | SC-2020-15554 |

| Yes Companies Wfc Llc | Oklahoma | OK | 12/16/20 | SC-2020-17573 |

| Yes Companies Exp Fred LLC | Oklahoma | OK | 12/15/20 | SC-2020-15739 |

| Yes Companies Exp Fred LLC | Oklahoma | OK | 12/15/20 | SC-2020-15742 |

| Yes Companies Exp Fred LLC | Oklahoma | OK | 12/15/20 | SC-2020-17533 |

| Yes Companies Exp Fred LLC | Oklahoma | OK | 12/15/20 | SC-2020-17531 |

| YES COMPANIES FRED LLC | Alachua | FL | 12/15/20 | 2020 CC 003589 |

| Yes Companies EXP Key, LLC | Oklahoma | OK | 12/8/20 | SC-2020-14645 |

| YES COMPANIES WFC LLC | Maricopa | AZ | 12/4/20 | CC2020175390 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 12/2/20 | SC-2020-3723 |

| YES COMPANIES WFC LLC | Maricopa | AZ | 11/30/20 | CC2020172522 |

| YES WESTLAKE LLC | Canadian | OK | 11/24/20 | SC-2020-1205 |

| YES WESTLAKE LLC | Canadian | OK | 11/24/20 | SC-2020-1204 |

| YES WESTLAKE LLC | Canadian | OK | 11/24/20 | SC-2020-1206 |

| MOUNTAIN GATE MOBILE HOME PARK | Maricopa | AZ | 11/23/20 | CC2020169332 |

| Yes Companies Exp WFC LLC | Oklahoma | OK | 11/23/20 | SC-2020-11449 |

| Yes Companies Exp WFC LLC | Oklahoma | OK | 11/23/20 | SC-2020-18368 |

| Yes Companies Exp WFC LLC | Oklahoma | OK | 11/23/20 | SC-2020-16233 |

| Yes Companies Exp WFC LLC | Oklahoma | OK | 11/23/20 | SC-2020-16232 |

| Yes Companies Exp WFC LLC | Oklahoma | OK | 11/23/20 | SC-2020-16231 |

| YES COMPANIES FRED LLC | Alachua | FL | 11/23/20 | 2020 CC 003317 |

| YES PALMS OF ARCHER LLC | Alachua | FL | 11/23/20 | 2020 CC 003318 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 11/19/20 | SC-2020-1174 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 11/19/20 | SC-2020-3611 |

| Yes Companies EXP Key, LLC | Oklahoma | OK | 11/18/20 | SC-2020-14648 |

| Yes Companies EXP Key, LLC | Oklahoma | OK | 11/18/20 | SC-2020-11452 |

| YES WESTLAKE LLC | Canadian | OK | 11/18/20 | SC-2020-1154 |

| Yes Companies EXP Fed LLC | Oklahoma | OK | 11/17/20 | SC-2020-13021 |

| Yes Companies EXP Fed LLC | Oklahoma | OK | 11/17/20 | SC-2020-16411 |

| Yes Companies EXP Fed LLC | Oklahoma | OK | 11/17/20 | SC-2020-15741 |

| Yes Companies EXP Fed LLC | Oklahoma | OK | 11/17/20 | SC-2020-15737 |

| Yes Companies EXP Fed LLC | Oklahoma | OK | 11/17/20 | SC-2020-15740 |

| Yes Companies EXP Fed LLC | Oklahoma | OK | 11/17/20 | SC-2020-15736 |

| Yes Companies EXP Fed LLC | Oklahoma | OK | 11/17/20 | SC-2020-15738 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 11/17/20 | SC-2020-3525 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 11/17/20 | SC-2020-3524 |

| YEX COMPANIES EXP KEY LLC | Cleveland | OK | 11/17/20 | SC-2020-3526 |

| Yes Companies Exp Key LLC | Oklahoma | OK | 11/16/20 | SC-2020-12829 |

| Yes Companies Exp Key LLC | Oklahoma | OK | 11/16/20 | SC-2020-15556 |

| Yes Companies EXP KEY, LLC | Oklahoma | OK | 11/16/20 | SC-2020-15978 |

| Yes Companies EXP KEY, LLC | Oklahoma | OK | 11/16/20 | SC-2020-14647 |

| Yes Companies LLC | Oklahoma | OK | 11/16/20 | SC-2020-17779 |

| Yes Communities | Tarrant | TX | 11/9/20 | JP07-20-E00096758 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 11/2/20 | SC-2020-3310 |

| YES COMPANIES KEY LLC | Cleveland | OK | 11/2/20 | SC-2020-3311 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 10/29/20 | SC-2020-17777 |

| Yes Communities El Lago I | Tarrant | TX | 10/27/20 | JP08-20-E00103022 |

| YES COMPANIES FRED LLC | Alachua | FL | 10/27/20 | 2020 CC 002928 |

| MOUNTAIN GATE MOBILE HOME PARK % YES COMPANIES FRED LLC | Maricopa | AZ | 10/26/20 | CC2020153138 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 10/26/20 | SC-2020-3294 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 10/22/20 | SC-2020-18369 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 10/22/20 | SC-2020-18441 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 10/22/20 | SC-2020-15620 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 10/22/20 | SC-2020-15621 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 10/22/20 | SC-2020-11451 |

| YES COMMUNITIES EXP LLC | Canadian | OK | 10/21/20 | SC-2020-1060 |

| YES COMMUNITIES EXP LLC | Canadian | OK | 10/21/20 | SC-2020-1059 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 10/21/20 | SC-2020-12458 |

| YES COMPANIES LLC | Canadian | OK | 10/21/20 | SC-2020-1058 |

| Yes Companies WFC, LLC | Oklahoma | OK | 10/21/20 | SC-2020-17570 |

| Yes Companies WFC, LLC | Oklahoma | OK | 10/21/20 | SC-2020-12347 |

| MOUNTAIN GATE | Maricopa | AZ | 10/20/20 | CC2020150197 |

| MOUNTAIN GATE MOBILE HOME PARK | Maricopa | AZ | 10/20/20 | CC2020150199 |

| MOUNTAIN GATE MOBILE HOME PARK % YES COMPANIES FRED LLC | Maricopa | AZ | 10/20/20 | CC2020150190 |

| MOUNTAIN GATE MOBILE HOME PARK C/O YES COMPANIES FRED LLC | Maricopa | AZ | 10/20/20 | CC2020150192 |

| MOUNTAIN GATE MOBILE PARK % YES COMPANIES FRED LLC | Maricopa | AZ | 10/20/20 | CC2020150193 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 10/19/20 | SC-2020-3180 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 10/19/20 | SC-2020-3179 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 10/19/20 | SC-2020-12461 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 10/19/20 | SC-2020-14205 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 10/19/20 | SC-2020-14554 |

| Yes Companies WFC, LLC | Oklahoma | OK | 10/19/20 | SC-2020-14555 |

| YES COMPANIES WFC LLC | Maricopa | AZ | 10/15/20 | CC2020148004 |

| YES COMPANIES WFC LLC | Maricopa | AZ | 10/14/20 | CC2020147124 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-17532 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-12832 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-12824 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-13869 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-12814 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-13880 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-12818 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-12816 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-13874 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-13872 |

| Yes Companies EXP Fred, LLC | Oklahoma | OK | 10/13/20 | SC-2020-12828 |

| YES COMPANIES KEY LLC | Cleveland | OK | 10/8/20 | SC-2020-3042 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-17534 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-12823 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-13881 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-12834 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-12830 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-13877 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-13878 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-13870 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-13879 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-12819 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-13876 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-12821 |

| Yes Companies Exp Fred, LLC | Oklahoma | OK | 9/23/20 | SC-2020-13875 |

| MOUNTAIN GATE MOBILE HOME PAK % YES COMPANIES REED LLC | Maricopa | AZ | 9/22/20 | CC2020135510 |

| Yes Communities El Lago I | Tarrant | TX | 9/22/20 | JP08-20-E00102829 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 9/22/20 | SC-2020-2843 |

| CHALET CITY | Tarrant | TX | 9/21/20 | JP06-20-E00069901 |

| Yes Communities DBA Meadow Glen | Tarrant | TX | 9/21/20 | JP04-20-E00059524 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 9/21/20 | SC-2020-937 |

| YES COMPANIES FRED LLC – | Alachua | FL | 9/21/20 | 2020 CC 002468 |

| YES COMPANIES FRED, LLC D/B/A WOODLAND ESTATES | Duval | FL | 9/21/20 | 16-2020-CC-007177XXXX-MA |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 9/18/20 | SC-2020-16209 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 9/18/20 | SC-2020-12459 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 9/18/20 | SC-2020-11658 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 9/18/20 | SC-2020-12462 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 9/18/20 | SC-2020-14207 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 9/17/20 | SC-2020-2740 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 9/17/20 | SC-2020-2739 |

| Yes Companies WFC, LLC | Oklahoma | OK | 9/17/20 | SC-2020-17572 |

| YES PALMS OF ARCHER LLC -vs- | Alachua | FL | 9/17/20 | 2020 CC 002430 |

| Yes Communities | Tarrant | TX | 9/16/20 | JP07-20-E00096548 |

| YES COMPANIES KEY, LLC D/B/A CRYSTAL SPRINGS ESTATES | Duval | FL | 9/16/20 | 16-2020-CC-007073XXXX-MA |

| MOUNTAIN GATE MOBILE HOME PARK | Maricopa | AZ | 9/15/20 | CC2020132120 |

| YES COMPANIES WFC, LLC DBA CHAFFEE PINES | Duval | FL | 9/15/20 | 16-2020-CC-007018XXXX-MA |

| YES PALMS OF ARCHER LLC -vs- | Alachua | FL | 9/15/20 | 2020 CC 002411 |

| MOUNTAIN GATE MOBILE HOMES PARK % YES COMPANIES FRED | Maricopa | AZ | 9/10/20 | CC2020129953 |

| MOUNTAIN GATE MOBILE HOMES PARK % YES COMPANIES FRED | Maricopa | AZ | 9/10/20 | CC2020129955 |

| MOUNTAIN GATE MOBILE HOMES PARK % YES COMPANIES FRED | Maricopa | AZ | 9/10/20 | CC2020129947 |

| CHALET CITY | Tarrant | TX | 9/8/20 | JP06-20-E00069851 |

| MOUNTAIN GATE MOBILE HOME PARK C/O YES COMPANIES FRED, LLC | Maricopa | AZ | 9/3/20 | CC2020126759 |

| Yes Companies EXP WFC, LLC | Oklahoma | OK | 9/3/20 | SC-2020-17776 |

| YES WESTLAKE LLC | Canadian | OK | 9/2/20 | SC-2020-855 |

| MOUNTAIN GATE MOBILE HOME PARK % YES COMPANIES FRED LLC | Maricopa | AZ | 9/1/20 | CC2020125282 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 9/1/20 | SC-2020-17003 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 9/1/20 | SC-2020-11450 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 9/1/20 | SC-2020-11448 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 9/1/20 | SC-2020-15979 |

| Yes Companies Exp Key, LLC | Oklahoma | OK | 9/1/20 | SC-2020-14646 |

| YES COMPANIES FRED, LLC D/B/A WOODLAND ESTATES | Duval | FL | 9/1/20 | 16-2020-CC-006509XXXX-MA |

| YES COMPANIES WFC LLC | Maricopa | AZ | 9/1/20 | CC2020125357 |

| Yes – Summit Oaks | Tarrant | TX | 8/28/20 | JP01-20-E00092365 |

| YES COMPANIES WFC, LLC D/B/A OAKS OF ATLANTIC BEACH | Duval | FL | 8/27/20 | 16-2020-CC-006349XXXX-MA |

| YES COMPANIES WFC, LLC D/B/A OAKS OF ATLANTIC BEACH | Duval | FL | 8/27/20 | 16-2020-CC-006362XXXX-MA |

| YES COMPANIES KEY, LLC D/B/A OCEANWAY VILLAGE | Duval | FL | 8/25/20 | 16-2020-CC-006177XXXX-MA |

| YES COMPANIES KEY, LLC D/B/A OCEANWAY VILLAGE | Duval | FL | 8/25/20 | 16-2020-CC-006175XXXX-MA |

| MOUNTAIN GATE MOBILE HOME PARK % YES COMPANIES FRED LLC | Maricopa | AZ | 8/7/20 | CC2020114078 |

| YES COMMUNITIES WFC, LLC | Duval | FL | 8/4/20 | 16-2020-CC-005393XXXX-MA |

| YES COMPANIES EXP WFC, LLC DBA WESTMOOR | Oklahoma | OK | 5/28/20 | SC-2020-6991 |

| MOUNTAIN GATE MOBILE HOME PARK | Maricopa | AZ | 5/22/20 | CC2020084124 |

| mountain gate mobile home park c/o compnaies fred llc | Maricopa | AZ | 5/21/20 | CC2020083345 |

| MOUNTAIN GATE MOBILE HOME PARK c/o YES COMPANIES FRED LLC | Maricopa | AZ | 5/20/20 | CC2020082604 |

| YES COMPANIES KEY, LLC D/B/A CRYSTAL SPRINGS ESTATE | Duval | FL | 3/24/20 | 16-2020-CC-003707XXXX-MA |

| YES COMPANIES WFC, LLC D/B/A OAKS OF ATLANTIC BEACH | Duval | FL | 3/24/20 | 16-2020-CC-003709XXXX-MA |

| Yes Companies LLC | Maricopa | AZ | 3/20/20 | CC2020057456 |

| Yes Companies LLC | Maricopa | AZ | 3/20/20 | CC2020057454 |

| Yes Companies LLC | Maricopa | AZ | 3/20/20 | CC2020057470 |

| Yes Companies LLC | Maricopa | AZ | 3/20/20 | CC2020057449 |

| Yes Companies LLC | Maricopa | AZ | 3/20/20 | CC2020057464 |

| YES COMPANIES WFC, LLC D/B/A OAKS OF ATLANTIC BEACH | Duval | FL | 3/20/20 | 16-2020-CC-003691XXXX-MA |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 3/19/20 | SC-2020-491 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 3/19/20 | SC-2020-492 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 3/19/20 | SC-2020-490 |

| YES COMPANIES EXP KEY LLC | Canadian | OK | 3/19/20 | SC-2020-489 |

| YES WESTLAKE LLC | Canadian | OK | 3/19/20 | SC-2020-494 |

| YES WESTLAKE LLC | Canadian | OK | 3/19/20 | SC-2020-496 |

| YES WESTLAKE LLC | Canadian | OK | 3/19/20 | SC-2020-493 |

| YES WESTLAKE LLC | Canadian | OK | 3/19/20 | SC-2020-497 |

| YES WESTLAKE LLC | Canadian | OK | 3/19/20 | SC-2020-495 |

| YES WESTLAKE LLC | Canadian | OK | 3/19/20 | SC-2020-498 |

| YES COMMUNITIES WFC, LLC D/B/A THE BREAKERS | Duval | FL | 3/18/20 | 16-2020-CC-003654XXXX-MA |

| YES COMMUNITIES WFC, LLC D/B/A THE BREAKERS | Duval | FL | 3/16/20 | 16-2020-CC-003630XXXX-MA |

| YES COMPANIES EX P KEY LLC | Cleveland | OK | 3/16/20 | SC-2020-1509 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 3/16/20 | SC-2020-1511 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 3/16/20 | SC-2020-1510 |

| YES COMPANIES EXP KEY LLC | Cleveland | OK | 3/16/20 | SC-2020-1512 |

| YES COMPANIES KEY LLC | Cleveland | OK | 3/16/20 | SC-2020-1507 |

| YES COMPANIES WFC, LLC D/B/A OAKS OF ATLANTIC BEACH | Duval | FL | 3/16/20 | 16-2020-CC-003510XXXX-MA |

- Manufactured Housing Institute. 2021. “2021 Manufactured Housing Facts.” pg. 2. https://www.manufacturedhousing.org/wpcontent/uploads/2021/05/2021-MHI-Quick-Facts-updated-05-2021.pdf.

- Innovations in Manufactured Homes and National Consumer Law Center. 2017. “First Steps Toward a Resident Purchase Opportunity.” pg. 1. https://1to1fund.org/sites/default/files/resources/FirstSteps_Toward_a_Resident_Purchase_Opportunity.pdf.

- “Manufactured-housing consumer finance in the United States,” US Consumer Financial Protection Bureau, Sept 2014, p. 8

4. “Manufactured-housing consumer finance in the United States,” US Consumer Financial Protection Bureau, Sept 2014, p. 9

5. Zahalak, Tanya. 2020. “Manufactured Housing Landscape 2020.” Fannie Mae. https://multifamily.fanniemae.com/newsinsights/multifamily-market-commentary/manufactured-housing-landscape-2020.

6. Innovations in Manufactured Homes and National Consumer Law Center. 2021. “Promoting Resident Ownership of Communities.” pg. 9. https://www.nclc.org/images/pdf/manufactured_housing/cfed-purchase_guide.pdf.

7. Manufactured Housing Institute. 2021. “2021 Manufactured Housing Facts.” pg. 2. https://www.manufacturedhousing.org/wpcontent/uploads/2021/05/2021-MHI-Quick-Facts-updated-05-2021.pdf.

8. Ibid

9. Zahalak, Tanya. 2020. “Manufactured Housing Landscape 2020.” Fannie Mae. https://multifamily.fanniemae.com/newsinsights/multifamily-market-commentary/manufactured-housing-landscape-2020.

10. Durst, Noah J., and Esther Sullivan. 2019. “The Contribution of Manufactured Housing to Affordable Housing in the United States:

Assessing Variation Among Manufactured Housing Tenures and Community Types.” Housing Policy Debate, (Jun), pg. 3.

https://nlihc.org/sites/default/files/The-Contribution-of-Manufactured-Housing.pdf.

11 Manufactured Housing Institute. 2019. “2018 Consumer Research: Key Findings.” pg. 7.

https://www.manufacturedhousing.org/wp-content/uploads/2019/03/MHI-2018-Consumer-Research-Key-Findings.pdf.

12 Innovations in Manufactured Homes and National Consumer Law Center. 2021. “Promoting Resident Ownership of Communities.” pg. 9. https://www.nclc.org/images/pdf/manufactured_housing/cfed-purchase_guide.pdf.

13. Ibid

14. Ibid , pg. 6

15. Lien, Tracey. 2017. “In Silicon Valley, even mobile homes are getting too pricey for longtime residents.” Los Angeles Times, May 4, 2017. https://www.latimes.com/business/technology/la-fi-tn-silicon-valley-mobile-homes-20170504-htmlstory.html.

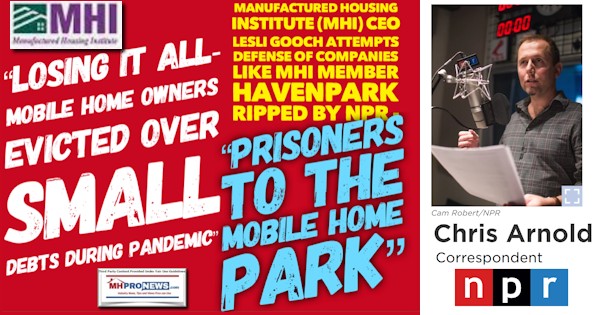

16 Arnold, Chris. 2021. “Losing It All: Mobile Home Owners Evicted Over Small Debts During Pandemic.” NPR, April 16, 2021.

https://www.npr.org/2021/04/16/986559295/losing-it-all-mobile-home-owners-evicted-over-small-debts-during-pandemic. Innovations in Manufactured Homes and National Consumer Law Center. 2010. “Protecting Fundamental Freedoms in Communities.” https://prosperitynow.org/sites/default/files/resources/groundwork.pdf.

17. William P. Stalter, IV to PSERS Investment Committee. 2018. “PSERS Yes Holdings LP.” pg. 4.

https://www.psers.pa.gov/About/Board/Resolutions/Documents/2018/res01.pdf

18. Zahalak, Tanya. 2020. “Manufactured Housing Landscape 2020.” Fannie Mae. https://multifamily.fanniemae.com/newsinsights/multifamily-market-commentary/manufactured-housing-landscape-2020.

19. Consumer Financial Protection Bureau. 2021. “Manufactured Housing Finance: New Insights from the Home Mortgage Disclosure Act Data.” pg. 10. https://files.consumerfinance.gov/f/documents/cfpb_manufactured-housing-finance-new-insightshmda_report_2021-05.pdf.

20. Mergr. n.d. “Apollo Global Management Acquires Inspire Communities.” Accessed October, 2021. https://mergr.com/apollo-globalmanagement-acquires-inspire-communities.

21. Wilcox, Don. 2020. “Blackstone makes $395M equity investment in Tricon.” Real Estate News Exchange, August 27, 2020. https://renx.ca/blackstone-395m-equity-investment-triconresidential/#:~:text=In%202018%2C%20Blackstone%20made%20its%20first%20foray%20into,chairman%20and%20CEO%20of%2 0BREIT%2C%20in%20the%20release.

22. Burks, Steve. 2020. “Carlyle Group acquires 4 Mesa mobile home parks for $230M.” AZ Big Media, June 15, 2020. https://azbigmedia.com/real-estate/carlyle-group-acquires-4-mesa-mobile-home-parks-for-230m/.

23. Crimmins, Haley. 2021. “Spotlight on Manufactured Housing Acquisitions, Pricing.” Real Capital Analytics.

https://www.rcanalytics.com/spotlight-manufactured-housing-2021/.

24. Choi, Jung Hyun, and Laurie Goodman. 2020. “22 Million Renters and Owners of Manufactured Homes Are Mostly Left Out of Pandemic Assistance.” The Urban Institute. https://www.urban.org/urban-wire/22-million-renters-and-owners-manufactured-homesare-mostly-left-out-pandemic-assistance.

25. Miranda, Leticia. 2021. “Mobile home dwellers hit even harder when facing eviction.” NBC News, February 14, 2021.

https://www.nbcnews.com/business/business-news/mobile-home-dwellers-hit-even-harder-when-facing-eviction-n1257497. Consumer Financial Protection Bureau. 2021. “Manufactured Housing Finance: New Insights from the Home Mortgage Disclosure Act Data.” pg. 9. https://files.consumerfinance.gov/f/documents/cfpb_manufactured-housing-finance-new-insightshmda_report_2021-05.pdf.

26. Crimmins, Haley. 2021. “Spotlight on Manufactured Housing Acquisitions, Pricing.” Real Capital Analytics.

https://www.rcanalytics.com/spotlight-manufactured-housing-2021/.

27. Petosa, T., Bertino, N., Herskowitz, M., and Edwards, E. 2020. “Manufactured Home Community Financing Handbook.” Wells Fargo. https://www08.wellsfargomedia.com/assets/pdf/commercial/financing/real-estate/mhc-handbook.pdf.

28. YES! Communities. n.d. “Our Communities.” Accessed October 10, 2021. https://www.yescommunities.com/About/OurCommunities.

29. YES! Communities. 2016. “YES! Communities Announces Sale of Equity Interest and Consolidation of Portfolios.” PR Newswire.

https://www.prnewswire.com/news-releases/yes-communities-announces-sale-of-equity-interest-and-consolidation-of-portfolios300313383.html.

30. Whoriskey, Peter. 2019. “A billion-dollar empire made of mobile homes.” The Washington Post, February 14, 2019.

https://www.washingtonpost.com/business/economy/a-billion-dollar-empire-made-of-mobile-homes/2019/02/14/ac687342-2b0b11e9-b2fc-721718903bfc_story.html.

31. Grant, Peter. 2016. “Singapore Fund GIC Is in Talks to Buy Owner of Manufactured-Home Communities.” The Wall Street Journal, Jun 28, 2016.

https://www.wsj.com/articles/singapores-sovereign-wealth-fund-is-in-talks-to-buy-manufactured-home-owner-1467106203.

32 YES! Communities. 2016. “YES! Communities Announces Sale of Equity Interest and Consolidation of Portfolios.” PR Newswire. https://www.prnewswire.com/news-releases/yes-communities-announces-sale-of-equity-interest-and-consolidation-of-portfolios300313383.html.

33. “PSERS Real Estate Data as of 12/31/2017.” n.d. PSERS. Accessed October, 2021.

https://www.psers.pa.gov/About/Investment/Documents/performance/PMREreports/2017%204Q%20%20Real%20Estate%20FINAL.pdf.

34. Ibid.

35. Stockbridge Capital Group. Form ADV (filed September 27, 2021). pg. 35. Accessed October 10, 2021. https://sec.report/AdviserInfo/Firms/149002/Form-ADV-149002.pdf.

36 2020. “Investment Expenses Report FY 2020.” https://www.psers.pa.gov/FPP/Presentations/Documents/Investment%20Expenses%20Report%20FY19-20%20Final.pdf.

37. William P. Stalter, IV to PSERS Investment Committee. 2018. “PSERS Yes Holdings LP.” pg. 2.

https://www.psers.pa.gov/About/Board/Resolutions/Documents/2018/res01.pdf

38. Ibid, pg.3

39. Mariano, Willoughby. 2018. “Evictions: landlord says tough love helps tenants stay put.” August 3, 2018. https://www.ajc.com/news/local/evictions-landlord-says-tough-love-helps-tenants-stay-put/FNYJhU8GrYoeBSltFDzGFK/.

40. YES COMPANIES KEY, LLC V. ROBERT STEWART, JENNIFER JONES, AND SHASTA ALLEN (Duval County Court,, 2020).

41. YES COMPANIES KEY, LLC, D/B/A CRYSTAL SPRINGS ESTATES V. CHARLES A. PERRI (Duval County Court, 2021).

42. YES COMPANIES FRED, LLC DBA WOODLAND ESTATES V. PORSHA LATRICE WILLIAMS (Duval County Court, 2021).

43 Innovations in Manufactured Homes and National Consumer Law Center. 2010. “Protecting Fundamental Freedoms in Communities.” 2.

https://prosperitynow.org/sites/default/files/resources/groundwork.pdf.

44 Grant, Peter. 2016. “Singapore Fund GIC Is in Talks to Buy Owner of Manufactured-Home Communities.” The Wall Street Journal, Jun 28, 2016.

https://www.wsj.com/articles/singapores-sovereign-wealth-fund-is-in-talks-to-buy-manufactured-home-owner-1467106203.

###

Additional Information, More MHProNews Analysis and Commentary

In no particular order of importance, let’s begin by noting that several of the reports mentioned by researcher Mellissa Chang for the Private Equity Stakeholder Project (PESP) have been previously published in MHProNews and/or in MHLivingNews (see partial list, further below).

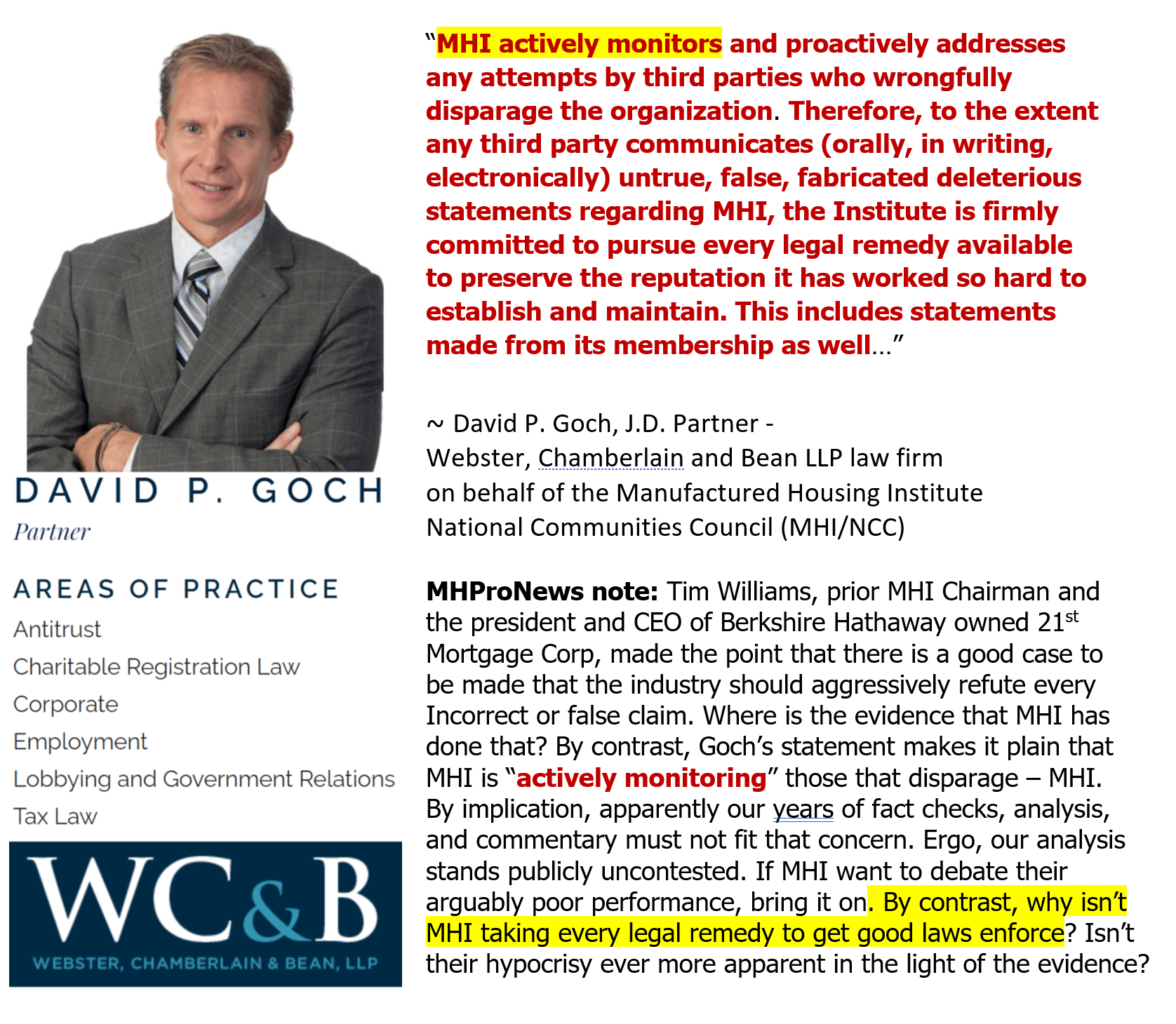

Additionally, MHProNews has called attention to the seemingly oddity of Manufactured Housing Institute (MHI) award winners – such as Yes! Communities – getting MHI ‘awards,’ despite the fact that the firm seems to have a problematic reputation that may appear to violate MHI’s Code of Ethical Conduct.

Some additional examples of MHI members that appear to have an aggressive or predatory reputation include those linked further below. Those firms are routinely MHI members and/or are members of an MHI connected state affiliate.

Note that researchers like Chang are often given certain guidelines that help frame the scope and content of what is included in their research reports. What those guardrails that guided her research and writing might in the above may have been for Chang is not known at this time.

That said, as was previously noted above, PESP routinely does a good job of documenting their various claims. That still leaves open to question the accuracy of the original source. No report is better than the source(s) of that content.

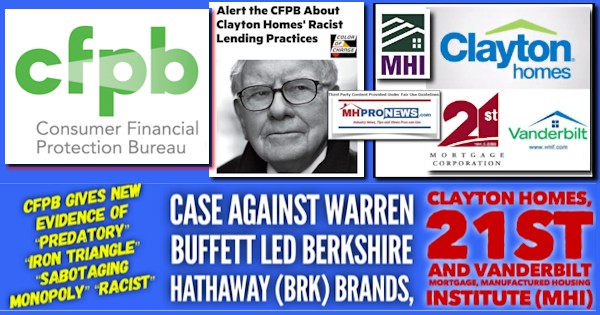

For instance, data or research errors have apparently occurred with the Manufactured Housing Institute (MHI). A periodically referenced and documented example of MHI’s apparent errors including making claims that later proved to be of dubious value if not misleading in nature. One example is the item below. There has been plenty of hype by MHI of the Clayton Homes (BRK) backed CrossMods project, which for whatever reasons have never come close to living up to the claims made by their so-called focus groups and research.

So, Chang citing MHI ‘research’ should not be construed as an indication that such MHI ‘research’ was properly conducted. To that point, a prominent MHI National Communities Council (NCC) member has made a statement that itself indicates the same concern, albeit obliquely. Said publicly traded Sun Communities (SUI) Gary Shiffman, there is ‘no national repository of information’ about manufactured home communities. From the vantagepoint of MHI’s office, ouch.

Before diving into a specific example of that concern, in fairness to Chang and the PESP, some of the issues that are noted above are not routinely – or ever – found in other media beyond MHProNews/MHLivingNews, though some are raised by the Manufactured Housing Association for Regulatory Reform (MHARR) on a periodic basis. Among those are something as basic as an accurate count on the number of land-lease communities. Per the PESP testimony, as was highlighted in pink above, was this statement.

- “Approximately 2.9 million – or 43% – of the nation’s manufactured homes are in communities where tenants rent or lease plots of land.6“

Footnote 6 had a link that didn’t work properly, but the referenced document is hereby provided by MHProNews at this link here. It includes the reference which Chang cited, which is quoted below. It was indeed found on page 9, as her footnote 6 indicated.

- “Approximately 43% (2.9 million) of existing occupied manufactured homes are located in manufactured home communities. Although the definition of a manufactured home community varies from state to state, at minimum it is a parcel of land that accommodates two or more manufactured homes. Most communities are located in suburban, rather than rural areas. Research data on the number of manufactured home communities existing on a state or national level are limited. Experts estimate that there are 50,000 to 60,000 communities nationwide.”

The Community Count Question

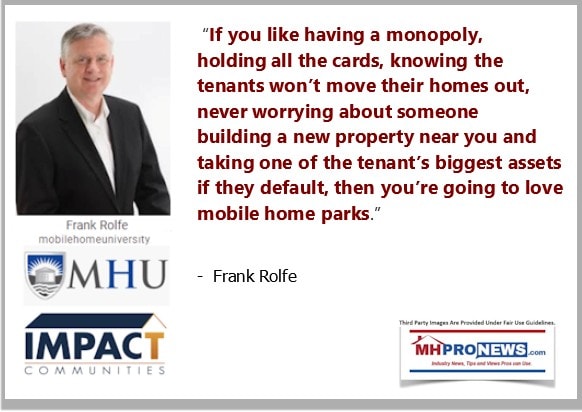

What a researcher who lacks manufactured housing industry experience may not realize is that the estimate cited by PESP above was far higher than many industry pros think is the actual manufactured home community (MHC) count. While Frank Rolfe has earned a notorious reputation in manufactured housing, particularly among MHC residents and resident-advocates, he may be correct in saying that there are about 45,000 communities nationally.

The community count issue noted, Chang’s point about the need for more manufactured home communities is arguably a crucial one that is all too often overlooked. The illustration of two relevant Google searches makes the point how relatively seldom this topic is raised in the news (twice, per Google) or in general (a couple of thousand times, numbers of which would be on one of our websites, i.e.: MHProNews/MHLivingNews).

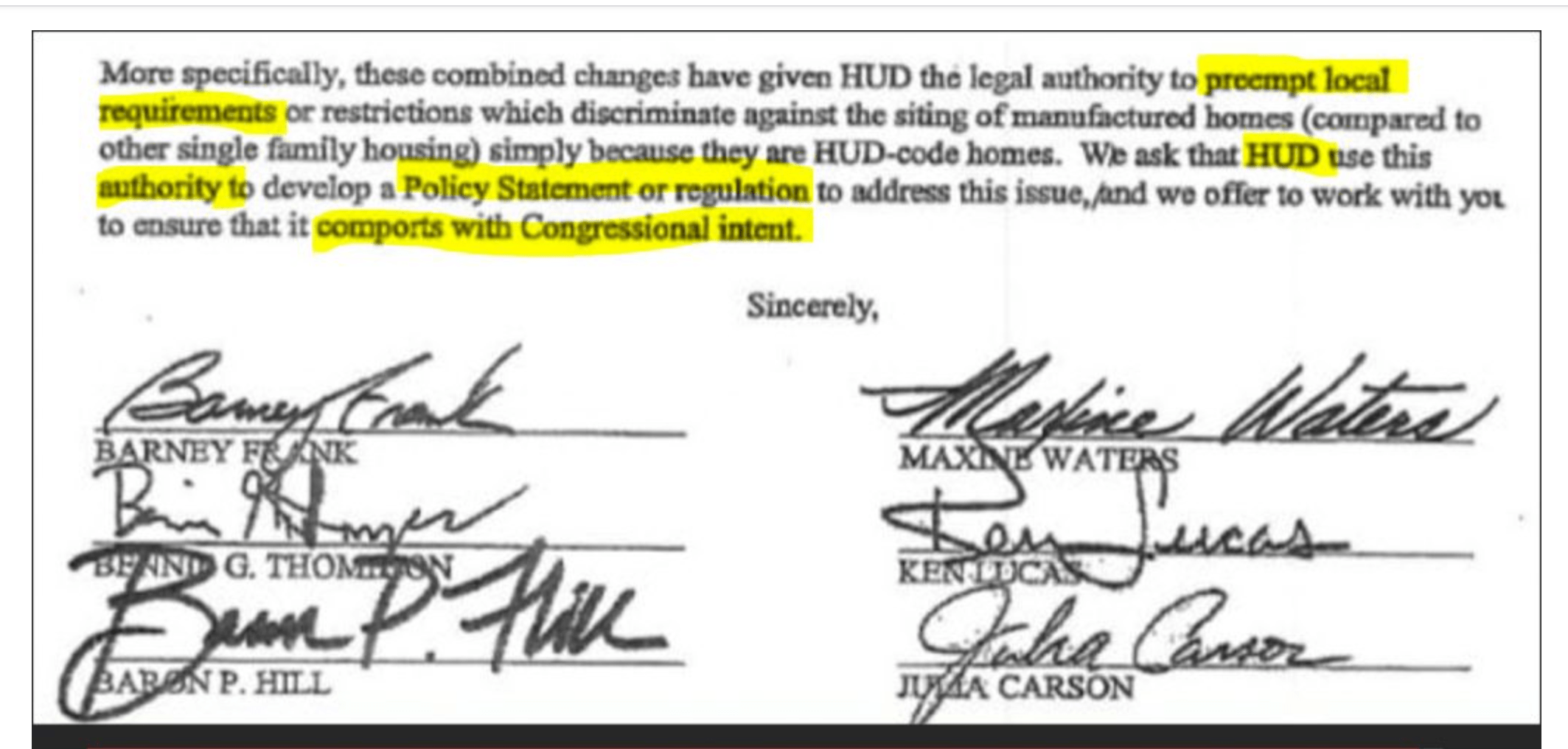

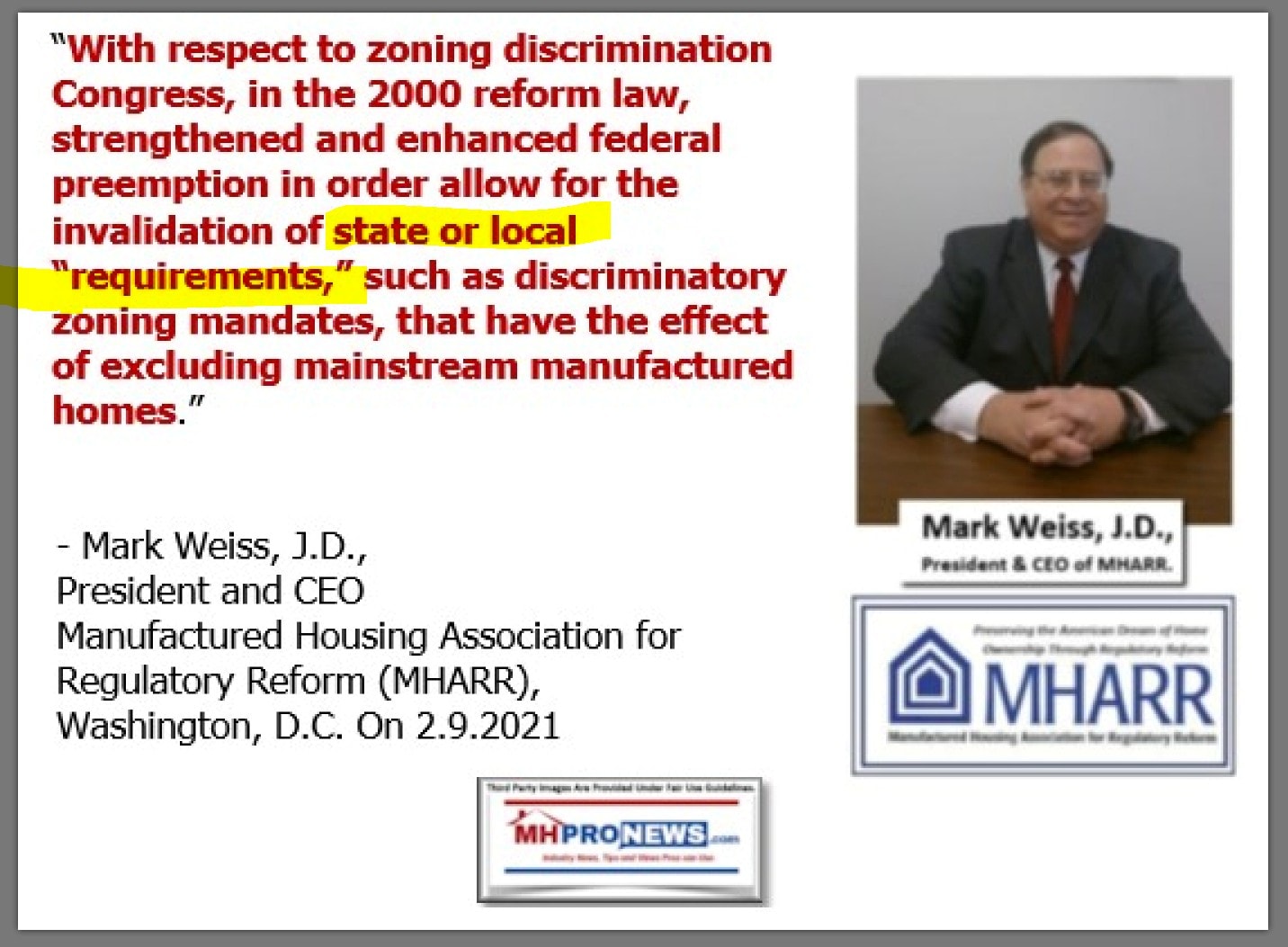

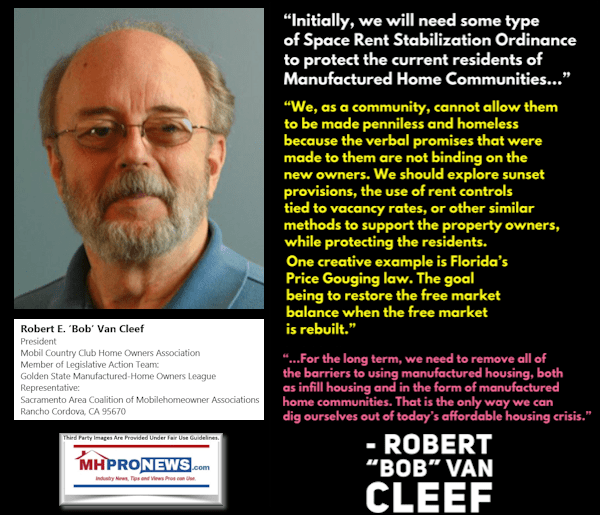

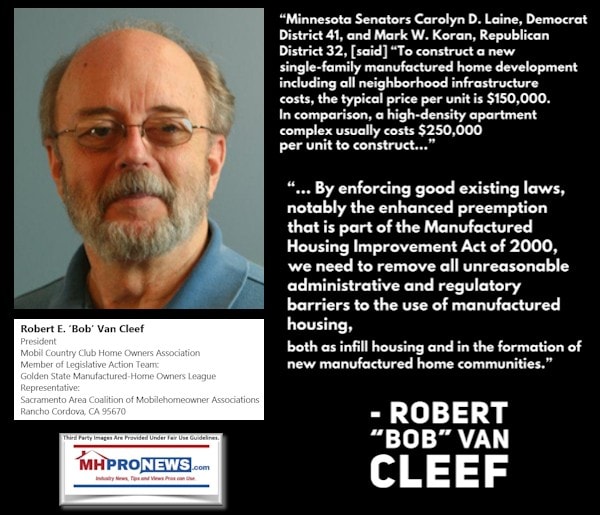

The development of more manufactured home communities could be accelerated if existing federal law was being properly enforced.

But for whatever reason(s), MHI has failed to press the issue in court. MHI leaders have written about it, or occasionally mentioned the need to enforce “enhanced preemption,” which the Democratic lawmakers quoted above who were part of the enactment of the Manufactured Housing Improvement Act (MHIA) of 2000 asked HUD to enforce.

Those points noted, these are possible approaches that the PESP’s document above, as was noted above, does not specifically mention.

Nor were the other possible legal concepts that follow.

Yet, these could be possible paths to advocates, public officials, and others to have federal and/or state laws deployed which may offer residents avenues for more rapid possible relief from predatory behaviors.

- Hobbs Act.

- Antitrust

- Monopoly

- Oligopoly

- Sherman Act.

- Racketeering or the acronym RICO.

- Manufactured Housing Improvement Act of 2000 and its so-called ‘enhanced preemption’ clause.

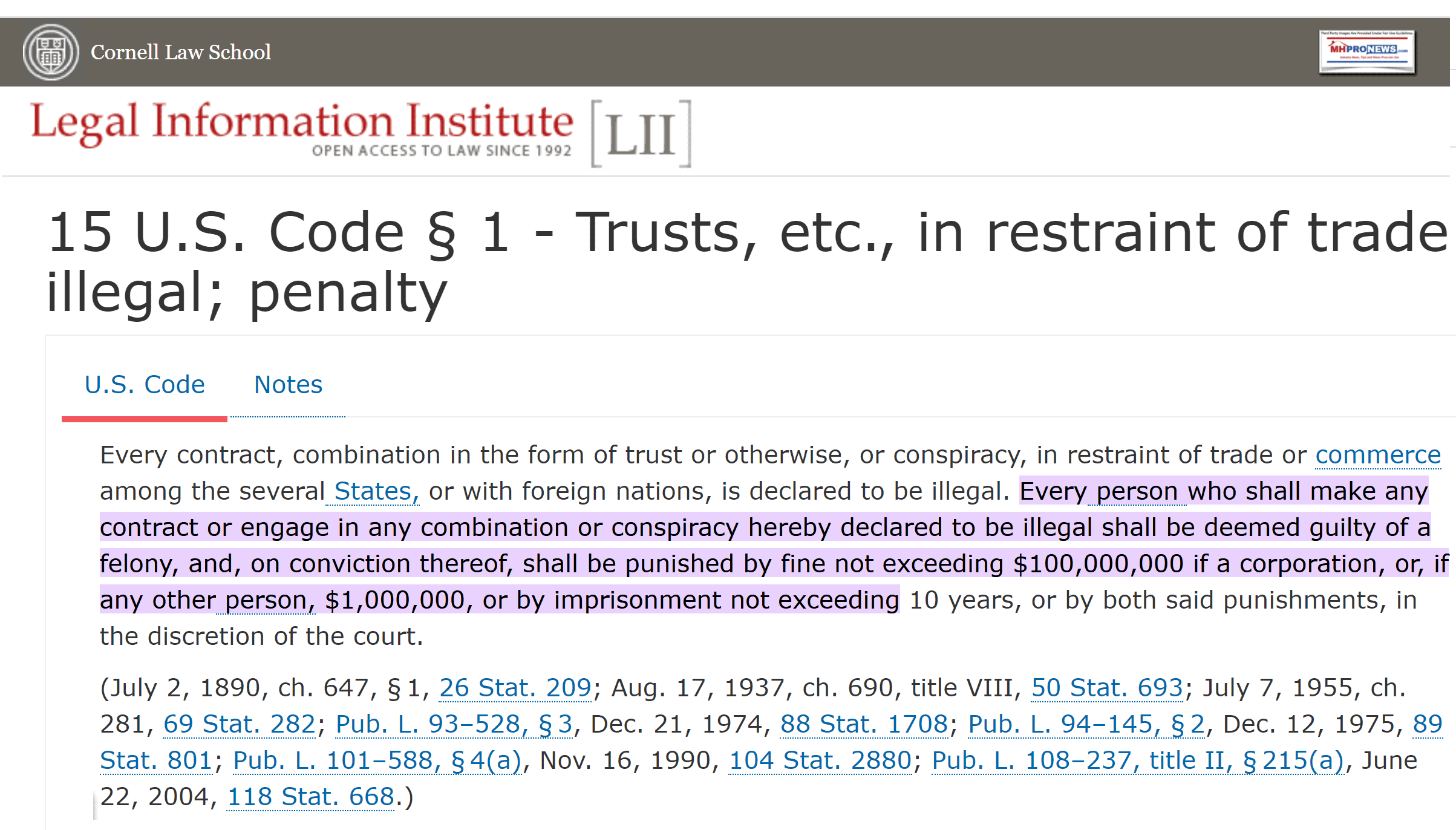

Antitrust laws, for instance, often have criminal as well as civil components. There are criminal as well as civil aspects to RICO laws too. While the quote below is referring to tech giants, the argument can be made that something similar could apply to the types of abuses that Chang and PESP has documented.

Other than MHProNews/MHLivingNews, where are the resident-advocates that are consistently – if ever – calling for anti-trust and/or RICO action to occur against predatory manufactured home community operators? Yet, an evidence-based case for such could be crafted. Elements of such a case could be crafted based on public statements, as the reports linked below illustrate.

The point here is not to per se fisk Chang or the PESP’s overall insightful and routinely useful work.

Rather, it is to clean up a few factual and advocacy issues, and underscore others. Chang, as an outsider looking into manufactured housing, perhaps should not be expected to know about how the MHIA and federal “enhanced preemption” could be used to pave the way to more manufactured home community development.

That noted, the same excuse can’t be used by MHI CEO Lesli Gooch, Ph.D. She herself has been quoted saying that HUD needed to enforce preemption. Then why hasn’t MHI deployed their attorneys to press the case legally with HUD? Or why hasn’t MHI used their attorneys to press the matter at the local level, when someone like the Rev. Ivory Mewborn, Mayor Pro-Tem of Ayden, NC is asking MHI and Gooch to get involved legally in their controversy?

MHI can’t have it both ways. They can’t be the experts who claim to represent “all segments’ of manufactured housing who then fail to use their expertise.

Nor can MHI claim ignorance about an issue that MHI CEO Gooch personally addressed with Mewborn.

Why does that matter? Potentially, several reasons. Among them are the various legal actions that are bubbling in MHVille.

It is an open question when MHI, and some of their dominating brands, will be publicly pressed to account for their apparent failures to do what is well within their self-proclaimed mission. Those MHI failures and fumbles happen to have the effect of fueling the pressures on manufactured home community residents. Given that MHI corporate board members praise the trade group, isn’t it obvious that those brands which make up the MHI board overall approve of their policies? That happens to include MHI members such as Equity LifeStyle Properties (ELS), which is embroiled in a class action case with a firm that claims antitrust expertise (see report above). Will the FeganScott lawfirm broaden their case at some point?

Time will tell.

need to wait years for legislation that in the past has often led to little or no discernable benefit. https://www.wnd.com/2021/05/solution-big-tech-oligarchs/

But what seems apparent is that several 21st century corporate scandals and regulatory failures operated for years before public pressure finally caused officials to act. Examples of some of the reports that Chang referenced that have also been previously reported on MHProNews/MHLivingNews are shown below. Also see the WND letter linked above and the other linked reports to learn more.