Robert Reich was a U.S. Secretary of Labor during President William Jefferson “Bill” Clinton’s administration. Reich has for some years raised the issue of the problems caused by consolidation, market manipulation, ‘monopoly power,’ and the need for antitrust action. He is the author of books such as: “Saving Capitalism: For the Many, Not the Few” and his latest volume, “The System: Who Rigged It, How We Fix It.” Reich is a columnist for the Guardian where in a January 8, 2023 op-ed after making several factual and evidence based statements, the self-proclaimed antitrust advocate made the following pitch: “One possibility: any large corporation in an industry dominated by five or fewer giant corporations that raises its prices more than the Fed’s target of 2% should be presumed to have monopoly power, and slammed with an antitrust lawsuit.” Wittingly or not, that description would include manufactured housing giant Clayton Homes (subsidiary of BRK), plus Skyline Champion (SKY) and Cavco Industries (CVCO), all three of which are prominent Manufactured Housing Institute (MHI) members. According to various sources, Clayton, Skyline Champion, and Cavco Industries total production in HUD Code manufactured housing collectively have some 80 percent market share of all manufactured home production. “The annual inflation rate for the United States is 7.1% for the 12 months ended November 2022 after rising 7.7% previously, according to U.S. Labor Department data published Dec. 13” according to U.S. Inflation Calculator, which added: “The next inflation update is scheduled for release on Jan. 12, 2023, at 8:30 a.m. ET. It will offer the rate of inflation over the 12 months ended December 2022.” So, given the near certainty that Clayton Homes, Skyline Champion, and Cavco Industries are all raising their prices at greater than 2 percent over last year, the Reich plan would mean costly antitrust action should be filed against all three MHI member firms.

The Reich article in the Guardian reflects the evidence of antitrust, pro-competition and anti-consolidation (i.e: more smaller businesses, fewer larger ones) or ‘anti-monopoly’ desires expressed by leaders and pundits that span the left-right divide in the U.S. Those who track antitrust action internationally will note that the E.U., India, England and other countries routinely have reports about antitrust action. The fact that antitrust is a serious topic globally and in the U.S. and bridges the gap between numbers of Democrats, Independents, minor parties, and Republicans is a good clue that it is a root issue to what Reich and others call “a rigged system.”

Before unpacking and giving an analysis in Part II of this report of more of what Reich’s plan could mean for manufactured housing and insights into other aspects of the U.S. economic and politic scene, the full text of the Guardian op-ed found at this link here is provided below for purposes of MHProNews analysis and commentary. “We Provide, You Decide.” ©

The U.S. should break up monopolies – not punish working Americans for rising prices

The Fed is putting people out of work to reduce workers’ bargaining power and reduce inflation. They’ve got it all wrong

Sun 8 Jan 2023 06.19 EST Last modified on Sun 8 Jan 2023 16.05 EST

Average hourly wages rose by 4.6% in December, according to Friday’s report. That’s a slowdown from 4.8% in November.

All this is music to the ears of Federal Reserve chair Jerome Powell, because the Fed blames inflation on rising wages.

The Fed has been increasing interest rates to slow the economy and thereby reduce the bargaining power of workers to get wage gains.

At his press conference on 14 December announcing the Fed’s latest interest rate hike, Powell warned that “the labor market remains extremely tight, with the unemployment rate near a 50-year low, job vacancies still very high, and wage growth elevated”.

But aren’t higher wages a good thing?

The typical American worker’s wage has been stuck in the mud for four decades.

Most of the gains from a more productive economy have been going to the top – to executives and investors. The richest 10% of Americans now own more than 90% of the value of shares of stock owned by Americans.

Powell’s solution to inflation is to clobber workers even further. He says “the labor market continues to be out of balance, with demand substantially exceeding the supply of available workers”.

But if the demand for workers exceeds the supply, isn’t the answer to pay workers more?

Not according to Powell and the Fed. Their answer is to continue to raise interest rates to slow the economy and put more people out of work, so workers can’t get higher wages. That way, “supply and demand conditions in the labor market [will] come into better balance over time, easing upward pressures on wages and prices,” says Powell.

Putting people out of work is the Fed’s means of reducing workers’ bargaining power and the “upward pressures on wages and prices”.

The Fed projects that as it continues to increase interest rates, unemployment will rise to 4.6% by the end of 2023 – resulting in more than 1m job losses.

But fighting inflation by putting more people out of work is cruel, especially when America’s safety nets – including unemployment insurance – are in tatters.

As we saw at the start of the pandemic, because the US doesn’t have a single nationwide system for getting cash to jobless workers, they have to depend on state unemployment insurance, which varies considerably from state to state.

Many fall through the cracks. When the pandemic began, fewer than 30% of jobless Americans qualified for unemployment benefits.

The problem isn’t that wages are rising. The real problem is that corporations have the power to pass those wage increases – along with record profit margins – on to consumers in the form of higher prices.

If corporations had to compete vigorously for consumers, they wouldn’t be able to do this. Competitors would charge lower prices and grab those consumers away.

Corporations aren’t even plowing their extra profits into new investments that would generate higher productivity in the future. They’re buying back their shares to boost stock prices. Through the end of 2022, American firms announced stock buybacks exceeding $1tn.

A rational response to inflation, therefore, would not increase unemployment in order to reduce the bargaining power of workers to get higher wages.

It would be to reduce the pricing power of corporations to pass those costs along to consumers along with rising profit margins, by making markets more competitive.

Corporate pricing power is out of control because corporations face so little competition.

Worried about sky-high airline fares and lousy service? That’s largely because airlines have merged from 12 carriers in 1980 to four today.

Concerned about drug prices? A handful of drug companies control the pharmaceutical industry.

Upset about food costs? Four giants now control over 80% of meat processing, 66% of the pork market, and 54% of the poultry market.

Worried about grocery prices? Albertsons bought Safeway and now Kroger is buying Albertsons. Combined, they would control almost 22% of the US grocery market. Add in Walmart, and the three brands would control 70% of the grocery market in 167 cities across the country.

And so on. The evidence of corporate concentration is everywhere.

It’s getting worse. There were over a thousand major corporate mergers or acquisitions last year. Each had a merger value of $100m or more. The total transaction value was $1.4tn.

The government must stop putting the responsibility for fighting inflation on working people whose wages have gone nowhere for four decades.

Put the responsibility where it belongs – on big corporations with power to raise their prices.

One possibility: any large corporation in an industry dominated by five or fewer giant corporations that raises its prices more than the Fed’s target of 2% should be presumed to have monopoly power, and slammed with an antitrust lawsuit.” ##

Part II. Additional Information with More MHProNews Analysis and Commentary in Brief

MHProNews has spotlighted Democrat Robert Reich’s calls for antitrust action to break up industry consolidation before. On the surface, Reich has made similar arguments to what the Biden White House did in the summer of July 2021 when it spotlighted the problems of consolidation in industry. Put differently, Democrat Biden, Democrat Reich, and Democrats in the Biden Administration on paper have said several similar things. See the report linked below for examples.

🚨WATCH: House Democrat Whip Jim Clyburn claims Democrats KNEW their wasteful spending would cause inflation — but they did it anyway. pic.twitter.com/ojiMf41MTj

— Senate Republican Communications Center (@SRCC) October 20, 2022

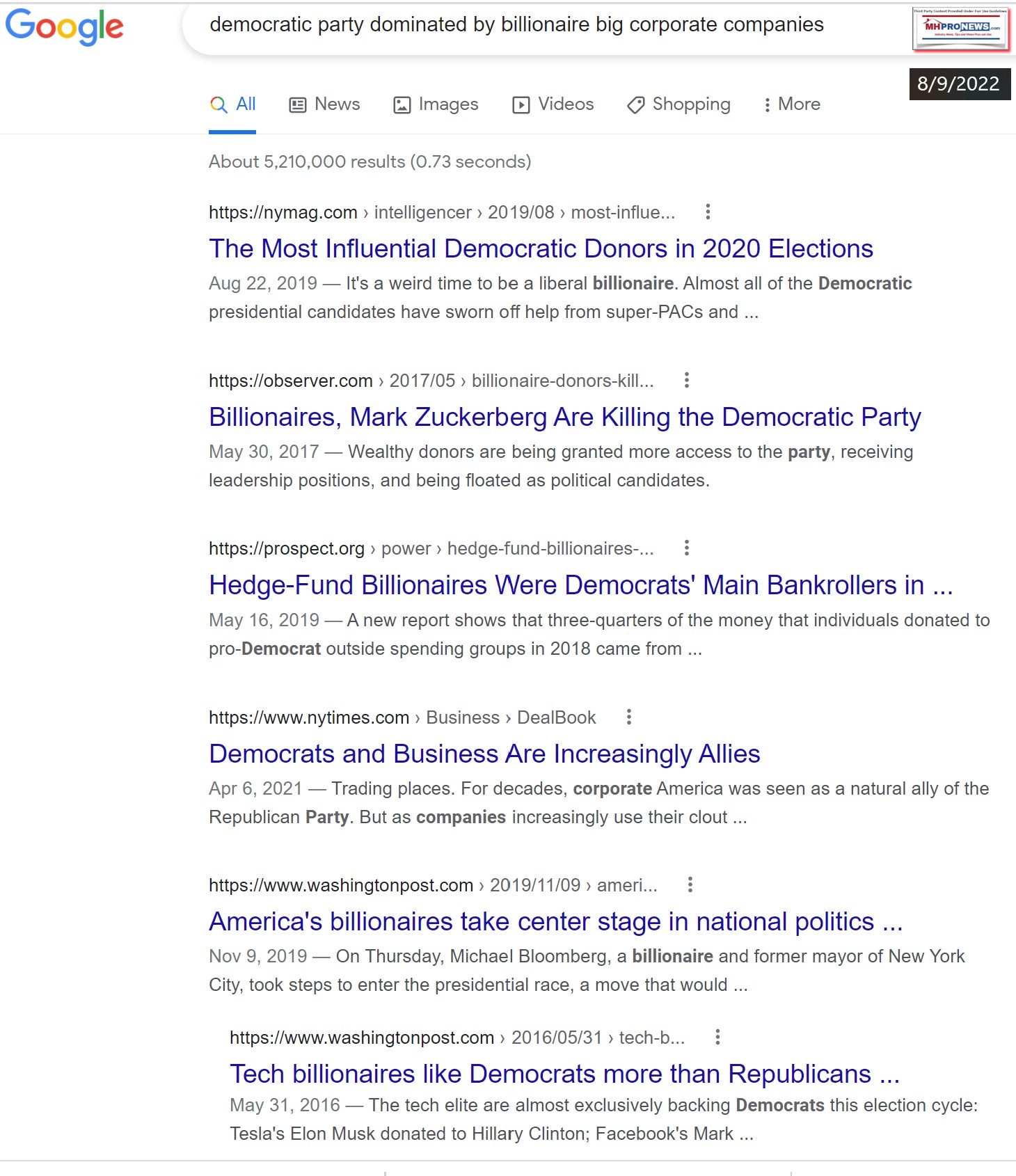

That noted, after two years of controlling both houses of the U.S. Congress, and still wielding control over the federal bureaucracy – which includes the Federal Trade Commission (FTC) and the Department of Justice (DoJ), that has an antitrust division – Democrats have – quoting Reich allowed:

- “The evidence of corporate concentration is everywhere. It’s getting worse. There were over a thousand major corporate mergers or acquisitions last year. Each had a merger value of $100m or more. The total transaction value was $1.4tn.”

Additionally, Reich’s claimed data made this point.

- “Corporations aren’t even plowing their extra profits into new investments that would generate higher productivity in the future. They’re buying back their shares to boost stock prices. Through the end of 2022, American firms announced stock buybacks exceeding $1tn.”

Reich is saying some $2.4 trillion dollars has been invested in 2022 alone for stock buybacks and to effect over 1000 major corporate mergers. That total does not include those which occurred in manufactured housing, because they were under $100 million dollars.

Reich’s arguments are broadly correct. But ironically Reich has effectively ‘damned’ the Biden regime and the Democratic Party (of which Reich is a longtime member) via this Guardian op-ed because despite much talk in 2021 and 2022 about antitrust action to boost competition – using Reich’s views – there was no substantive evidence of it in mentioned for 2022. In fairness, there is only so much someone can pack into a roughly 850-word column.

That said, by accident and/or design, Reich failed to connect the dots between his own party’s fingerprints on the economic woes inflicted upon wage earners that he is describing.

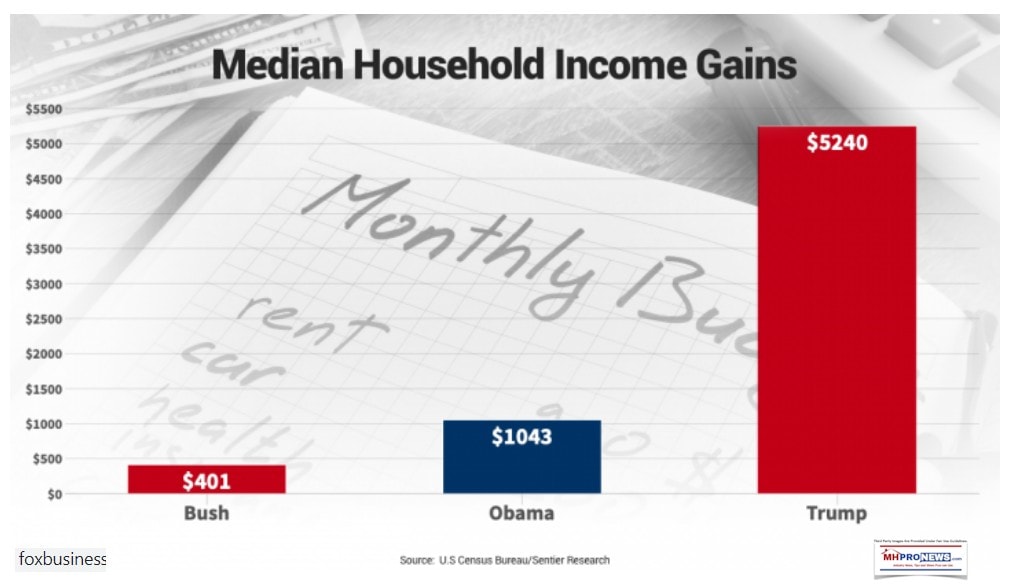

Real growth in purchasing power for most Americans are in retreat, as Reich observed.

While imperfect under the last administration, that reversed the Trump era rise in the purchasing power of Americans.

It remains to be seen if Republicans or the Trump 2024 campaign will make the case by using facts like those referenced. But the rate of homeownership was rising again under Trump. The working- and middle-class buying power were rising again under Trump’s term in office. Inflation was low under Trump. Inflation spiked under Biden at some 40-year record highs, which followed the record spending by Democrats aided by defections among Establishment (RINO) Republicans that led to borrowing and spending at rates some experts and pundits have said haven’t been seen since World War II.

Yet despite the big talk about housing programs – that supposedly included gimmies to manufactured housing – CNN and the National Association of Realtors (NAR) data revealed that first time homebuyers have crashed to a record low.

As the Manufactured Housing Association for Regulatory Reform (MHARR) White Paper claimed, based on specific examples they provided, MHI has touted announcements of this or that initiative which has in hindsight not provided the great results they claimed would follow.

That MHARR White Paper was unpacked in the Masthead linked below.

Millions of young adults moving back in with mom and dad in 2022 alone. The data, evidence, and implications are examined in the report linked below.

USA Today, a left-leaning – or more pro-Democratic – publication, said that young adults are saying that the housing market has become “a scam.”

When the money trail is followed, near the core of these issues is a so-called “rigged” economy. The so-called “leech class” – the financial elites and their allies that Reich says are accumulating more wealth under this rigged scheme – are profiting while retirees, the working- and middle-class are suffering.

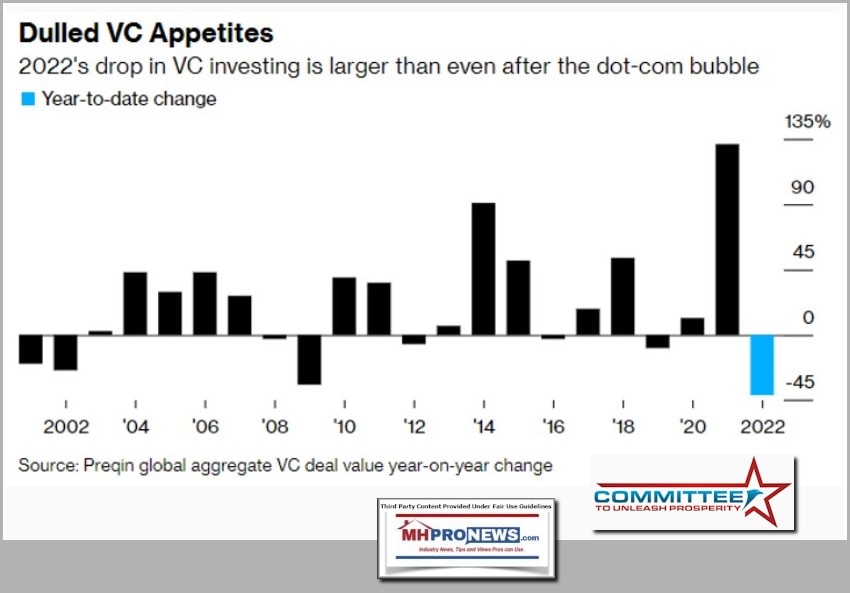

To the point made by Reich about a lack of investing occurring – vs. the focus on mergers and acquisitions (M&A) – is this from Stephen Moore and the Committee to Unleash Prosperity from this past weekend’s report.

The problems in the U.S.A. today are similar to what they were decades ago when so-called trust busting was deployed to reign in the issues that Reich also says requires antitrust efforts in order to resolve.

Reich on several levels is broadly correct in saying that antitrust action is necessary. His reasoning on the trigger for antitrust action should be aimed at companies in consolidated industries that raised prices more than 2 percent is arguably more akin to Kabuki theatrics than a serious policy proposal. The problems in our industry and in much of the economy is often related to the outsized market power these firms in consolidated industries wield. Among the possible tactics that could be deployed, per an antitrust law experts’ firm (that will be the focus of a planned report on MHProNews), is to ‘unwind’ mergers that have already occurred. That law firm cited specific examples of how the feds have done precisely that in several cases.

The reality that Reich and others have been ‘talking’ or writing about the problems associated with consolidation and industry concentration is good to a point. But the next step must be authentic action.

MHProNews and our MHLivingNews sister site has documented through third-party reports the so-called “Walmart Effect” and the harm done to employees by giant firms such as Amazon.

Perhaps the bottom-line solution needs to be that talk or written words are useful to the point of encouraging the need for action. But at some point, public officials must take the antitrust action that is required.

As our 2022 year in review data revealed, the typical reader on MHProNews clicks on numbers of the linked articles, because the typical reader on our site visits about 3x more pageviews per visit than a visitor to CNN or Fox News. ##

need to wait years for legislation that in the past has often led to little or no discernable benefit. https://www.wnd.com/2021/05/solution-big-tech-oligarchs/

Again, our thanks to free email subscribers and all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’