Noteworthy headlines on – CNNMoney – Wells Fargo fallout: Execs reshuffled, 3 managers out. Mnuchin warns Congress on debt ceiling. Engineers say fixing infrastructure will take $4.6 trillion. Staples to close 70 more stores.

Some bullets from Fox Business – Andrew Puzder: Democrats afraid we will succeed. EPA Chief Scott Pruitt: Eyeing fuel economy standards. RadioShack files for chapter 11, once again. Trump, community bankers team up to boost lending to small business.

“We Provide, You Decide.” ©

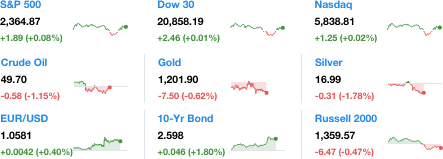

Key Commodities

Crude Oil 49.70 –0.58 (-1.15%) Gold 1,201.90 –7.50 (-0.62%) Silver 16.99 –0.31 (-1.78%)

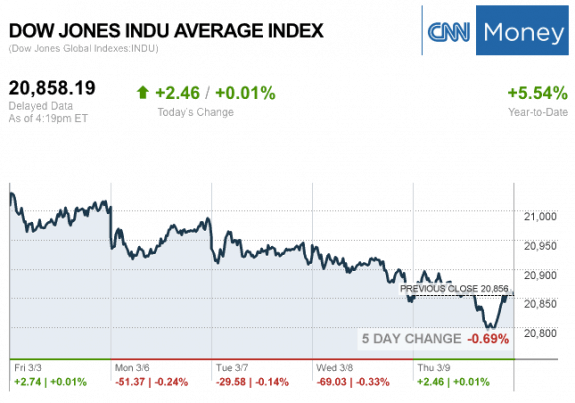

The markets at the Closing Bell Today…

S&P 500 2,364.87 1.89 (0.08%)

Dow 30 20,858.19 2.46 (0.01%)

Nasdaq 5,838.81 1.25 (0.02%)

Russell 2000 1,359.57 –6.47 (-0.47%)

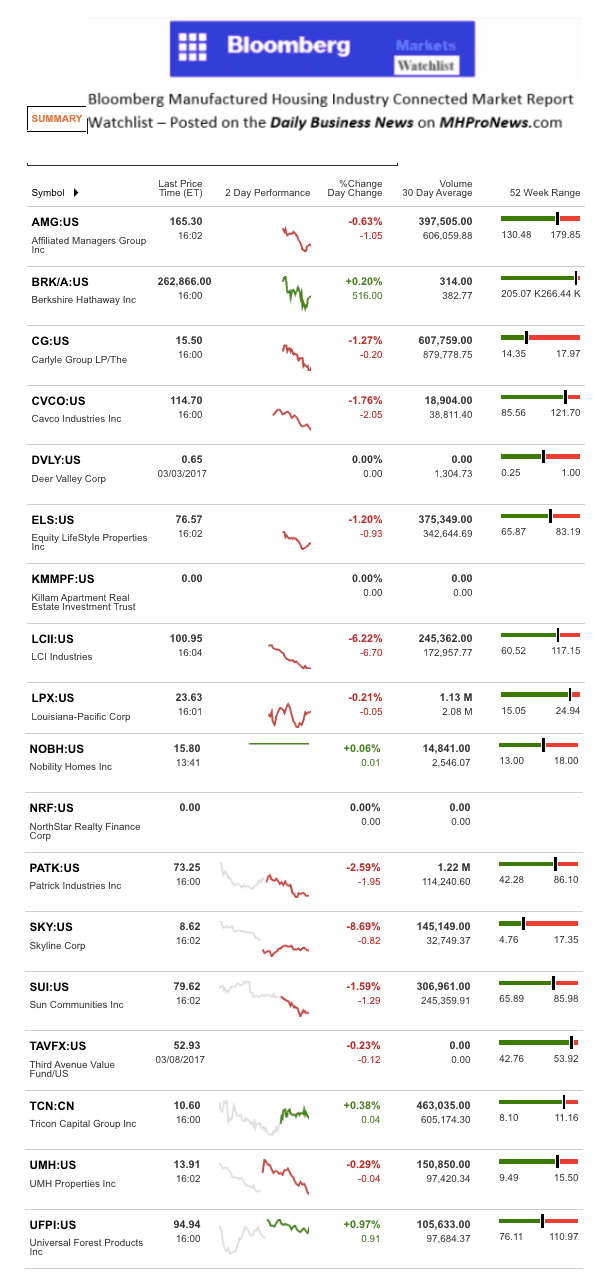

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Universal Forest Products Inc. (UFPI) and Tricon Capital Group Inc. (TCN).

The top two sliders for the day were Skyline Corp. (SKY) and LCI Industries (LCII).

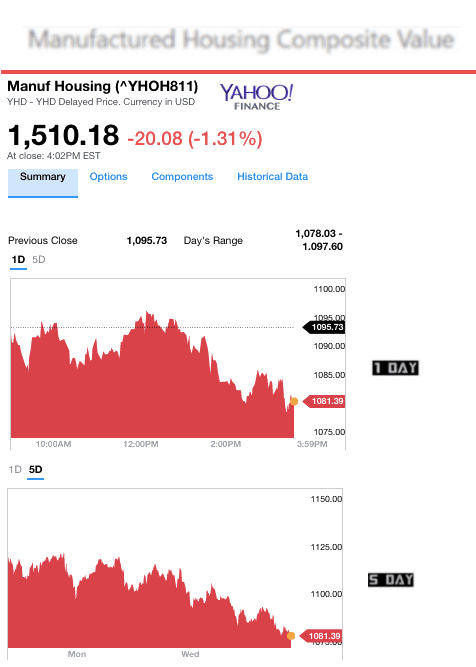

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.