Noteworthy headlines on – CNNMoney – What the Fed rate hike means for homebuyers. Trump might ease fuel economy rules. 700 laid-off GM workers will get their jobs back. German prosecutors raid Volkswagen and Audi HQs.

Some bullets from Fox Business – Wall Street higher as Fed raises rates. Oil rebounds as U.S. crude inventories ease off record high. Trump starts review of Obama-era fuel-economy rules, putting electric cars in doubt. Regulation of Monsanto’s “Roundup” called into question.

“We Provide, You Decide.” ©

Key Commodities

Crude Oil 48.89 1.17 (2.45%) Gold 1,220.80 18.20 (1.51%) Silver 17.34 0.42 (2.46%)

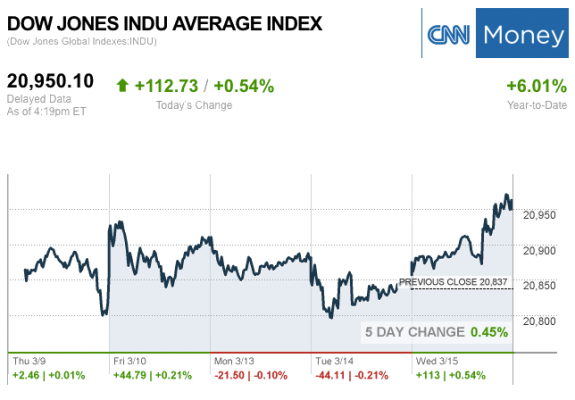

The markets at the Closing Bell Today…

S&P 500 2,385.26 19.81 (0.84%)

Dow 30 20,950.10 112.73 (0.54%)

Nasdaq 5,900.05 43.23 (0.74%)

Russell 2000 1,382.83 20.45 (1.50%)

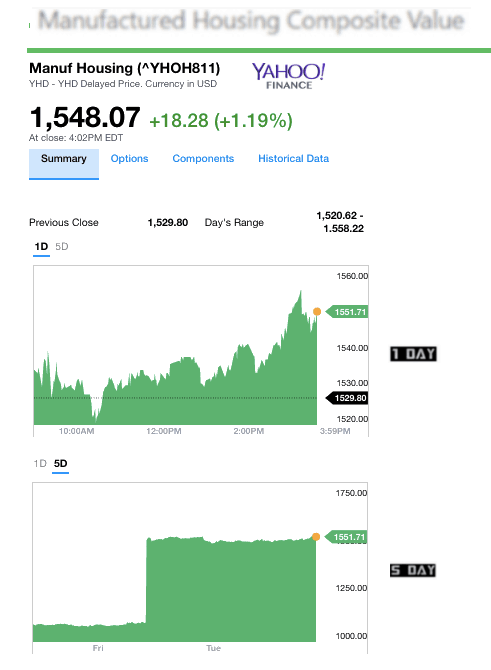

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Universal Forest Products Inc. (UFPI) and UMH Properties Inc. (UMH).

The top two sliders for the day were Berkshire Hathaway (BRK/A) and Skyline Corp. (SKY).

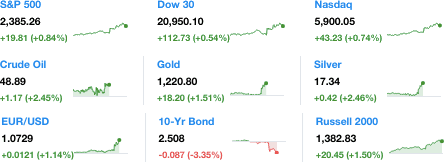

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.