Continuing today, the Daily Business News manufactured housing industry connected market report on MHProNews will add and tweak some features, in an ongoing effort to provide ever more useful and balanced information to readers.

“We Provide, You Decide.” ©

Noteworthy headlines on CNNMoney – Yellen: U.S. is near “maximum employment.” Banks begin moving thousands of jobs out of Britain. JPMorgan Chase accused of wage discrimination. Ross calls China “the most protectionist country.”

Some bullets from Fox Business – Target’s lackluster holiday sales signal broad industry changes ahead. Exxon bets big on American oil. Steve Moore to FBN: Expect two different tax bills from Trump. Alibaba’s Ma says no chance of U.S. trade war with China.

Key Commodities

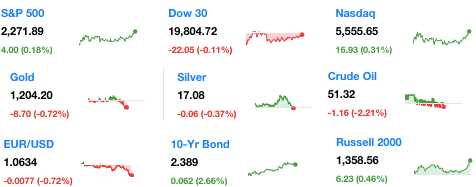

Crude Oil 51.32 –1.16 (-2.21%) Gold 1,204.20 –8.70 (-0.72%) Silver 17.08 –0.06 (-0.37%)

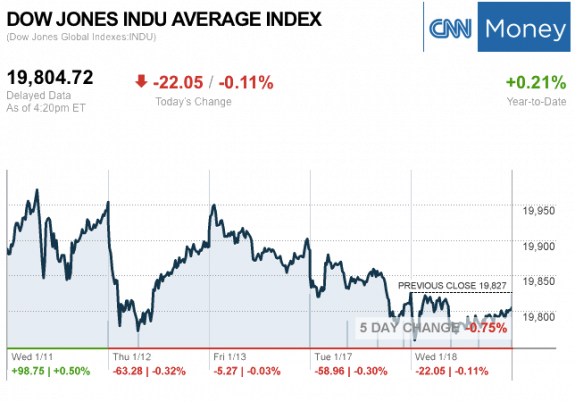

The markets at the Closing Bell Today…

S&P 500 2,271.89 4.00 (0.18%)

Dow 30 19,804.72 –22.05 (-0.11%)

Nasdaq 5,555.65 16.93 (0.31%)

Russell 2000 1,358.56 6.23 (0.46%)

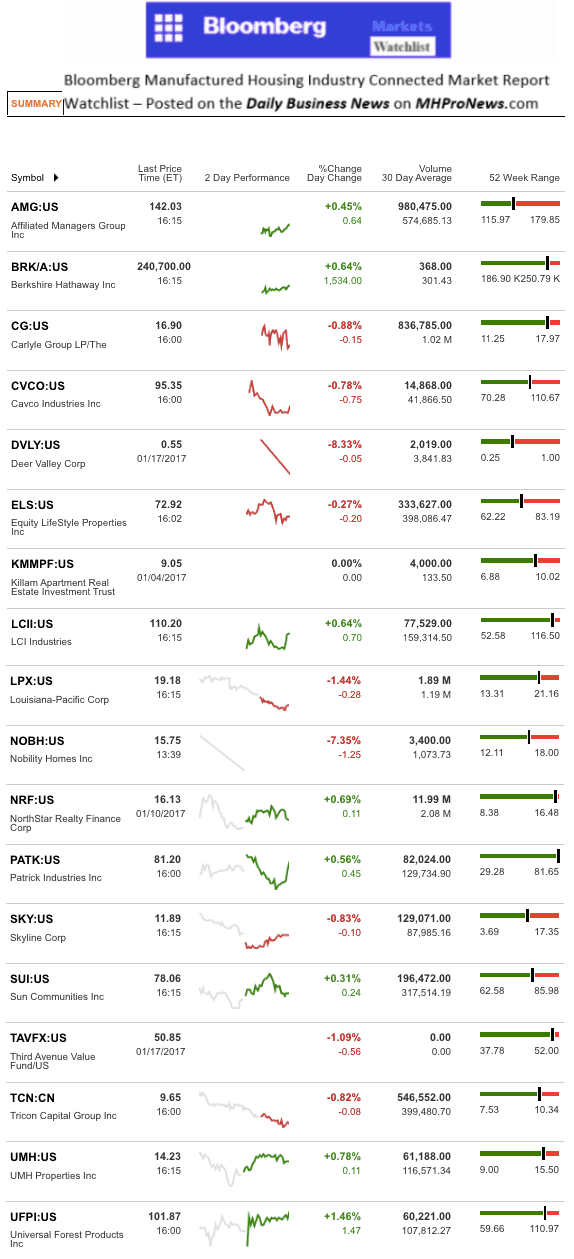

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were Universal Forest Products Inc. (UFPI) and UMH Properties Inc. (UMH).

The top two sliders for the day were Nobility Homes Inc. (NOBH) and Louisiana Pacific Corp. (LPX).

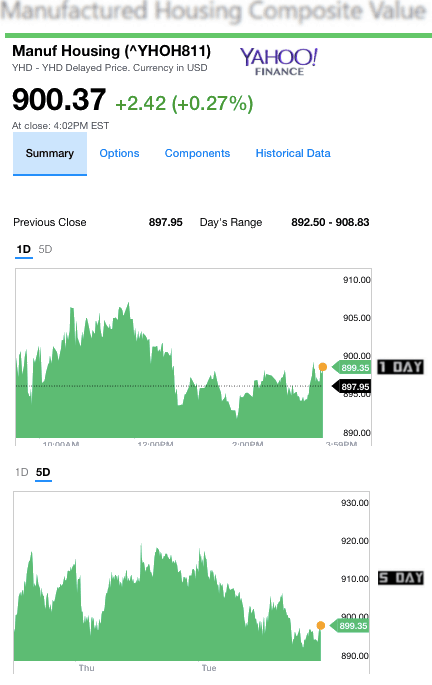

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.