The headline paraphrase above is a quote from Part IV below that said in part: “a few large companies can tarnish the entire industry’s image.” To tee that up, and according to UMH Properties’ (UMH) press release that follows, they have been in business since: “1968, is a public equity REIT that owns and operates 136 manufactured home communities containing approximately 25,800 developed homesites.” Unlike Equity LifeStyle Properties (ELS) or Sun Communities (SUI), UMH Properties has largely stayed clear of many of the controversies that have enveloped their larger rivals. In this report with analysis are three different press releases by UMH Properties will make up Parts I, II, and III. Part IV will be a focused analysis with additional MHProNews commentary related to this Manufactured Housing Institute (MHI) member company. A Blue Orca follow up is also provided.

Part I – From the UMH Properties (UMH) Press Release

UMH PROPERTIES, INC. Q3 2024 OPERATIONS UPDATE

October 03, 2024 16:15 ET| Source: UMH Properties, Inc.

FREEHOLD, NJ, Oct. 03, 2024 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE: UMH) (TASE: UMH), a real estate investment trust (REIT) specializing in the ownership and operation of manufactured home communities, is providing investors with an update on our third quarter 2024 operating results:

- As of quarter end, UMH achieved an equity market capitalization of over $1.5 billion.

- During the third quarter, UMH converted 179 new homes from inventory to revenue generating homes. UMH now owns approximately 10,300 rental homes with an occupancy rate of 94.4%.

- During the third quarter, UMH sold 100 homes of which 32 were new home sales. Gross home sales revenue for the third quarter was $8.7 million as compared to $7.9 million last year, representing an increase of approximately 10%.

- Year to date, overall occupancy increased by 235 units to 87%. During the third quarter, overall occupancy increased by 39 units. Year over year, overall occupancy increased by 271 units.

- Our occupancy gains and rent increases achieved throughout 2023 and 2024 have increased our September 2024 rental and related charges by approximately 8%, resulting in our annualized monthly rent roll generating $206 million.

- We issued and sold approximately 5.7 million shares of Common Stock through our At-the-Market Sale program at a weighted average price of $18.93 per share, generating gross proceeds of $108.4 million.

Samuel A. Landy, President and CEO of UMH Properties, Inc., stated “UMH’s operating results continue to meet our expectations. Our communities are experiencing strong demand for sales and rental homes as demonstrated by our increased occupancy rates and our 10% increase in sales of manufactured homes. We currently have 284 homes on site that are ready for occupancy or being set up and another 240 homes expected to be delivered soon. This inventory will allow us to continue our organic growth through our sales and rental programs. With the unfortunate widespread loss of homes resulting from Hurricane Helene, we expect the demand for low cost, affordable housing to only increase.

“We opportunistically raised approximately $108 million through our common ATM at share prices close to our 52-week high. This capital was used in part to pay down our line of credit, which should result in a reduction of interest expense. Additionally, we are actively deploying this capital into our rental home program, the financing of home sales, expansions and capital improvements which should generate accretive returns.

“We have positioned the company with a strong balance sheet so that we can continue to invest in our communities and be prepared to acquire new communities when accretive investment opportunities become available.”

It should be noted that the financial information set forth above reflects our preliminary estimates with respect to such information, based on information currently available to management, and may vary from our actual financial results as of and for the quarter ending September 30, 2024. UMH’s full Third Quarter 2024 results will be released on Wednesday, November 6, 2024, after the close of trading on the New York Stock Exchange and will be available on the Company’s website at www.umh.reit, in the Financials section. Senior management will discuss the results, current market conditions and future outlook on Thursday, November 7, 2024, at 10:00 a.m. Eastern Time.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 136 manufactured home communities containing approximately 25,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Contact: Nelli Madden

732-577-4062

Part II – From UMH Properties (UMH) Press Release Reporting the Impact of Hurrican Helene

UMH PROPERTIES, INC. REPORTS ON THE IMPACT OF HURRICANE HELENE

October 02, 2024 17:55 ET| Source: UMH Properties, Inc.Follow

FREEHOLD, NJ, Oct. 02, 2024 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE: UMH) (TASE: UMH) reported today on the impact of Hurricane Helene on its portfolio of manufactured housing communities.

Samuel A. Landy, President and Chief Executive Officer, commented, “Our communities in Florida, Alabama, South Carolina and Georgia experienced high winds and heavy rain which resulted in minor damage to these communities. Additionally, several of our communities in Tennessee and Ohio had trees down and other minor damage. The limited damage to our homes and our communities demonstrates the quality and durability of our homes. Most importantly, all of our residents and employees are safe. We are taking appropriate measures to clean up and repair any marginal damages sustained at our communities. We do not expect the effects of the storm to have a material impact on our operations or financial results. While our damage was minimal, others were not as fortunate. We stand ready to provide support as requested by the local, state and federal government.”

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 136 manufactured home communities containing approximately 25,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.

Contact: Nelli Madden

732-577-4062

Part III – MHProNews Note: At the time this Article was Drafted the Q3 Financial Results were Not Yet Available, So Q2 Financials Are Provided Below.

UMH PROPERTIES, INC. REPORTS RESULTS FOR THE SECOND QUARTER ENDED JUNE 30, 2024

08/06/2024

FREEHOLD, NJ, Aug. 06, 2024 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE:UMH) (TASE:UMH) reported Total Income for the quarter ended June 30, 2024 of $60.3 million as compared to $55.3 million for the quarter ended June 30, 2023, representing an increase of 9%. Net Income Attributable to Common Shareholders amounted to $527,000 or $0.01 per diluted share for the quarter ended June 30, 2024 as compared to a Net Loss of $4.4 million or $0.07 per diluted share for the quarter ended June 30, 2023. Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), was $16.8 million or $0.23 per diluted share for the quarter ended June 30, 2024, as compared to $13.0 million or $0.21 per diluted share for the quarter ended June 30, 2023, representing a 10% per diluted share increase.

A summary of significant financial information for the three and six months ended June 30, 2024 and 2023 is as follows (in thousands except per share amounts):

| Three Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Total Income | $ | 60,328 | $ | 55,290 | ||||

| Total Expenses | $ | 49,307 | $ | 46,371 | ||||

| Net Income (Loss) Attributable to Common Shareholders | $ | 527 | $ | (4,418 | ) | |||

| Net Income (Loss) Attributable to Common Shareholders per Diluted Common Share | $ | (0.01 | ) | $ | (0.07 | ) | ||

| FFO (1) | $ | 16,182 | $ | 12,043 | ||||

| FFO (1) per Diluted Common Share | $ | 0.23 | $ | 0.19 | ||||

| Normalized FFO (1) | $ | 16,807 | $ | 13,049 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.23 | $ | 0.21 | ||||

| Basic Weighted Average Shares Outstanding | 71,418 | 61,236 | ||||||

| Diluted Weighted Average Shares Outstanding | 71,884 | 61,760 | ||||||

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Total Income | $ | 118,008 | $ | 107,897 | ||||

| Total Expenses | $ | 97,715 | $ | 91,611 | ||||

| Net Loss Attributable to Common Shareholders | $ | (5,737 | ) | $ | (9,715 | ) | ||

| Net Loss Attributable to Common Shareholders per Diluted Common Share | $ | (0.08 | ) | $ | (0.16 | ) | ||

| FFO (1) | $ | 30,228 | $ | 22,683 | ||||

| FFO (1) per Diluted Common Share | $ | 0.43 | $ | 0.37 | ||||

| Normalized FFO (1) | $ | 31,824 | $ | 24,769 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.45 | $ | 0.41 | ||||

| Basic Weighted Average Shares Outstanding | 70,291 | 60,186 | ||||||

| Diluted Weighted Average Shares Outstanding | 70,700 | 60,844 | ||||||

A summary of significant balance sheet information as of June 30, 2024 and December 31, 2023 is as follows (in thousands):

| June 30, 2024 | December 31, 2023 | |||||||

| Gross Real Estate Investments | $ | 1,574,196 | $ | 1,539,041 | ||||

| Marketable Securities at Fair Value | $ | 28,673 | $ | 34,506 | ||||

| Total Assets | $ | 1,441,295 | $ | 1,427,577 | ||||

| Mortgages Payable, net | $ | 491,030 | $ | 496,483 | ||||

| Loans Payable, net | $ | 77,367 | $ | 93,479 | ||||

| Bonds Payable, net | $ | 100,479 | $ | 100,055 | ||||

| Total Shareholders’ Equity | $ | 743,980 | $ | 706,794 | ||||

Samuel A. Landy, President and CEO, commented on the results of the second quarter of 2024.

“We are pleased to announce another solid quarter of operating results. During the quarter, we:

| ● | Increased Rental and Related Income by 9%; | |

| ● | Increased Sales of Manufactured Homes by 7%; | |

| ● | Increased Community Net Operating Income (“NOI”) by 11%; | |

| ● | Increased Same Property NOI by 11%; | |

| ● | Increased Same Property Occupancy by 130 basis points from 86.4% to 87.7%; | |

| ● | Improved our Same Property expense ratio by 110 basis points from 40.4% in the second quarter of 2023 to 39.3% at quarter end; | |

| ● | Amended our unsecured credit facility to expand available borrowings by $80 million from $180 million to $260 million syndicated with BMO Capital Markets Corp., JPMorgan Chase Bank, NA and Wells Fargo, N.A; | |

| ● | For the fourth time since 2020, raised our quarterly common stock dividend by $0.01 representing a 4.9% increase to $0.215 per share or $0.86 annually; | |

| ● | Issued and sold approximately 2.4 million shares of Common Stock through our At-the-Market Sale Program at a weighted average price of $15.46 per share, generating gross proceeds of $36.9 million and net proceeds of $36.1 million, after offering expenses; | |

| ● | Issued and sold approximately 29,000 shares of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $23.18 per share, generating gross proceeds of $670,000 and net proceeds of $659,000, after offering expenses; | |

| ● | Subsequent to quarter end, issued and sold approximately 765,000 shares of Common Stock through our At-the-Market Sale Program at a weighted average price of $16.94 per share, generating net proceeds of $12.8 million, after offering expenses; and | |

| ● | Subsequent to quarter end, issued and sold approximately 150,000 shares of Series D Preferred Stock through our At-the-Market Sale Program at a weighted average price of $23.01 per share, generating net proceeds of $3.4 million, after offering expenses.” | |

Mr. Landy stated, “UMH is pleased to report that Normalized FFO for the second quarter increased to $0.23 from $0.21 last year, representing an increase of approximately 10%. Sequentially, Normalized FFO increased from $0.22 to $0.23, representing an increase of approximately 5%. UMH has intentionally acquired value-added communities with vacant sites over the past 10 years. We have been improving the communities through our capital improvements, adding approximately 800 homes per year and selling 200 homes per year. These investments have added to the supply of affordable housing and generated best-in-class operating results.

“Our same property operating results continue to demonstrate the effectiveness of our business plan. Same property NOI increased by 11.0% for the quarter and 13.2% for the first six months, compared to the corresponding prior year periods. UMH has now increased same property NOI by double digits for four consecutive quarters. This increase was driven by an increase in rental and related income of 9.0% and 9.7% for the three and six months, respectively, partially offset by an increase in same property expenses of 6.1% and 4.8%, respectively. The growth in rental and related income is primarily attributed to a strong increase in occupancy of 380 units and rental rate increases of 4.9%.

“Our sales for the quarter increased from $8.2 million to $8.8 million, representing an increase of 7%. Notably, our gross margin increased from 30% last year to 38% this year. Sales demand remains strong, and we anticipate another solid quarter of profitable home sales in the third quarter.

“We are initiating guidance for the remainder of 2024, with Normalized FFO in a range of $0.91-0.95 per diluted share for the full year, or $0.93 at the midpoint. This represents approximately 8% annual normalized FFO growth at the midpoint over full year 2023 Normalized FFO of $0.86 per diluted share.

“UMH continues to execute on our long-term business plan of acquiring communities. Our high-quality communities continue to experience strong demand for our products, which is translating to growing occupancy, net operating income and property value. Our 3,300 vacant sites and 2,200 acres of vacant land give us a runway to generate earnings growth for years to come. We maintain a strong balance sheet to ensure that we can execute our organic growth plan and be prepared when external acquisition opportunities become available. This strategy has allowed us to build a first-class portfolio of manufactured housing communities that deliver shareholders a resilient and growing dividend, greater scale, and improved net asset value per share.”

UMH Properties, Inc. will host its Second Quarter 2024 Financial Results Webcast and Conference Call. Senior management will discuss the results, current market conditions and future outlook on Wednesday, August 7, 2024, at 10:00 a.m. Eastern Time.

The Company’s 2024 second quarter financial results being released herein will be available on the Company’s website at www.umh.reit in the “Financials” section.

To participate in the webcast, select the webcast icon on the homepage of the Company’s website at www.umh.reit, in the Upcoming Events section. Interested parties can also participate via conference call by calling toll free 877-513-1898 (domestically) or 412-902-4147 (internationally).

The replay of the conference call will be available at 12:00 p.m. Eastern Time on Wednesday, August 7, 2024, and can be accessed by dialing toll free 877-344-7529 (domestically) and 412-317-0088 (internationally) and entering the passcode 7242441. A transcript of the call and the webcast replay will be available at the Company’s website, www.umh.reit.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 136 manufactured home communities containing approximately 25,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama, South Carolina and Georgia. UMH also has an ownership interest in and operates two communities in Florida, containing 363 sites, through its joint venture with Nuveen Real Estate.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Note:

(1) Non-GAAP Information: We assess and measure our overall operating results based upon an industry performance measure referred to as Funds from Operations Attributable to Common Shareholders (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (loss) attributable to common shareholders, as defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, the change in the fair value of marketable securities, and the gain or loss on the sale of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper – 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities, and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the adoption of the FFO White Paper – 2018 Restatement, for all periods presented, we have elected to exclude the gains and losses realized on marketable securities investments and the change in the fair value of marketable securities from our FFO calculation. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating performance. We define Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), as FFO excluding certain one-time charges. FFO and Normalized FFO should be considered as supplemental measures of operating performance used by REITs. FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which have a different cost basis. However, other REITs may use different methodologies to calculate FFO and Normalized FFO and, accordingly, our FFO and Normalized FFO may not be comparable to all other REITs. The items excluded from FFO and Normalized FFO are significant components in understanding the Company’s financial performance.

FFO and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as alternatives to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. FFO and Normalized FFO, as calculated by the Company, may not be comparable to similarly titled measures reported by other REITs.

The diluted weighted shares outstanding used in the calculation of FFO per Diluted Common Share and Normalized FFO per Diluted Common Share were 71.9 million and 70.7 million shares for the three and six months ended June 30, 2024, respectively, and 61.8 million and 60.8 million shares for the three and six months ended June 30, 2023, respectively. Common stock equivalents resulting from stock options in the amount of 409,000 for the six months ended June 30, 2024, were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive. Common stock equivalents resulting from employee stock options to purchase 4.0 million shares of common stock amounted to 466,000 shares, for the three months ended June 30, 2024, were included in the computation of Diluted Net Income per Share. Common stock equivalents resulting from stock options in the amount of 524,000 and 658,000 shares for the three and six months ended June 30, 2023, respectively, were excluded from the computation of the Diluted Net Loss per Share as their effect would be anti-dilutive.

The reconciliation of the Company’s U.S. GAAP net income (loss) to the Company’s FFO and Normalized FFO for the three and six months ended June 30, 2024 and 2023 are calculated as follows (in thousands):

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, 2024 | June 30, 2023 | June 30, 2024 | June 30, 2023 | |||||||||||||

| Net Income (Loss) Attributable to Common Shareholders | $ | 527 | $ | (4,418 | ) | $ | (5,737 | ) | $ | (9,715 | ) | |||||

| Depreciation Expense | 15,001 | 13,751 | 29,742 | 27,124 | ||||||||||||

| Depreciation Expense from Unconsolidated Joint Venture | 204 | 166 | 401 | 325 | ||||||||||||

| (Gain) Loss on Sales of Depreciable Assets | 10 | (5 | ) | 13 | (37 | ) | ||||||||||

| (Increase) Decrease in Fair Value of Marketable Securities | (3,338 | ) | 2,548 | 2,031 | 4,943 | |||||||||||

| Loss on Sales of Marketable Securities, net | 3,778 | 1 | 3,778 | 43 | ||||||||||||

| FFO Attributable to Common Shareholders | 16,182 | 12,043 | 30,228 | 22,683 | ||||||||||||

| Amortization of Financing Costs | 607 | 538 | 1,163 | 1,056 | ||||||||||||

| Non-Recurring Other Expense (a) | 18 | 468 | 433 | 1,030 | ||||||||||||

| Normalized FFO Attributable to Common Shareholders | $ | 16,807 | $ | 13,049 | $ | 31,824 | $ | 24,769 | ||||||||

(a) Consists of non-recurring one-time legal fees ($18 and $51, respectively), and costs associated with the liquidation/sale of inventory in a particular sales center ($0 and $382, respectively) for the three and six months ended June 30, 2024. Consists of special bonus and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing, which are being expensed over the vesting period ($431 and $862, respectively) and non-recurring expenses for the joint venture with Nuveen ($3 and $50, respectively), one-time legal fees ($30 and $50, respectively), fees related to the establishment of the OZ Fund ($4 and $37, respectively), and costs associated with an acquisition that was not completed ($0 and $31, respectively) for the three and six months ended June 30, 2023.

The following are the cash flows provided by (used in) operating, investing and financing activities for the six months ended June 30, 2024 and 2023 (in thousands):

| 2024 | 2023 | |||||||

| Operating Activities | $ | 37,605 | $ | 53,002 | ||||

| Investing Activities | (58,758 | ) | (94,396 | ) | ||||

| Financing Activities | 7,598 | 49,706 | ||||||

| (2) | The following are the assumptions used in the 2024 Normalized FFO guidance: |

| – | Rent increases of 5%; | |

| – | Occupancy of 400 rental units in the second half of 2024; | |

| – | Overall capital needs to fund rental home purchases, notes, expansions, and improvements of approximately $110-$120 million for the year; | |

| – | Includes the opportunistic sales of common and preferred stock through our ATM programs; and | |

| – | Excludes any potential acquisitions, dispositions, and development projects. |

Contact: Nelli Madden

732-577-9997

# # # #

Part IV – Additional Information with a Focused MHProNews Analysis and Commentary

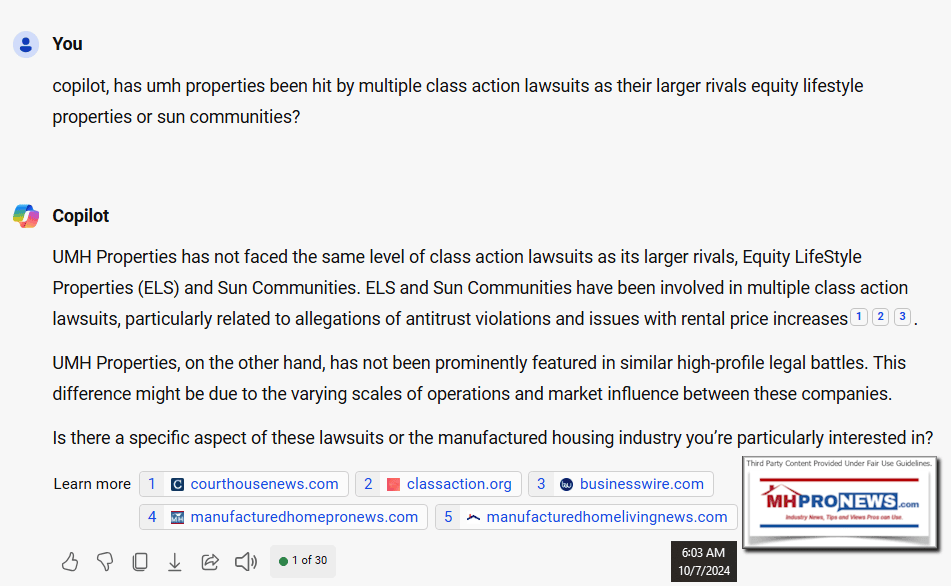

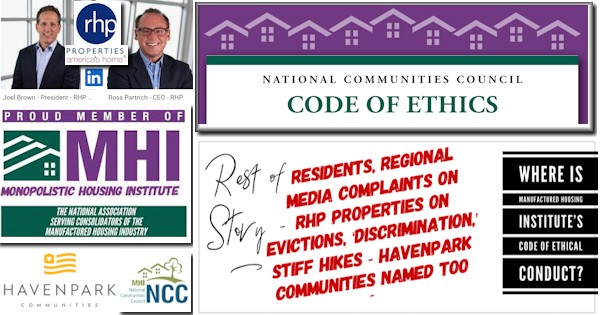

1) Unlike Sun and ELS, UMH Properties has not been hit by multiple national class action lawsuits. Consider the following Q&A with left-leaning Bing’s AI powered Copilot on its blue or balanced setting on this date (10.7.2024). This will be relevant now, and potentially for years to come for reasons that will be shown as this focused analysis evolves.

Copilot, has UMH Properties been hit by multiple class action lawsuits as their larger rivals Equity Lifestyle Properties or Sun Communities?

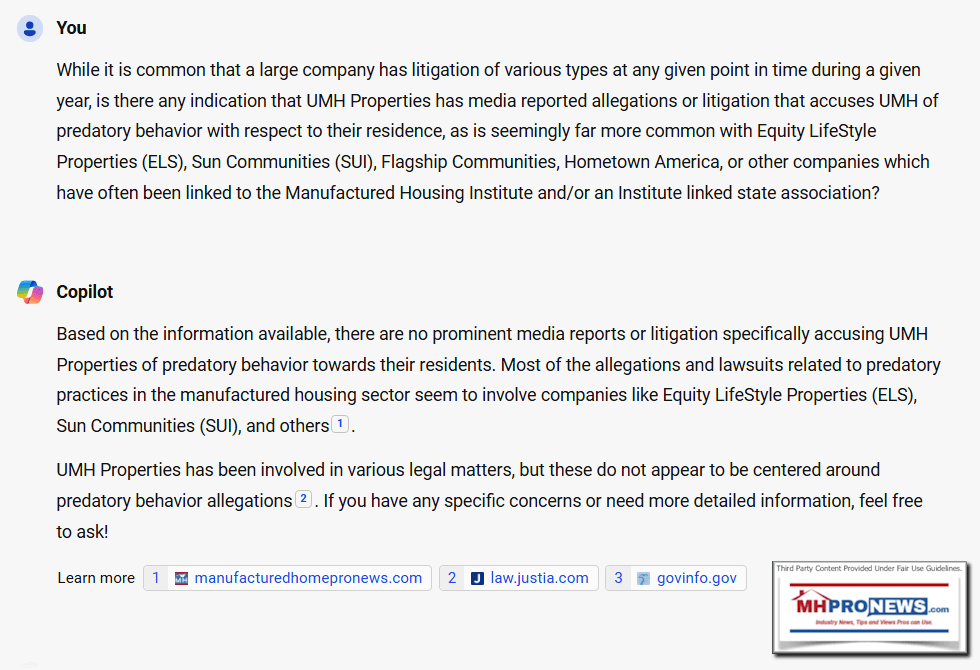

While it is common that a large company has litigation of various types at any given point in time during a given year, is there any indication that UMH Properties has media reported allegations or litigation that accuses UMH of predatory behavior with respect to their residence, as is seemingly far more common with Equity LifeStyle Properties (ELS), Sun Communities (SUI), Flagship Communities, Hometown America, or other companies which have often been linked to the Manufactured Housing Institute and/or an Institute linked state association?

Learn more

While it is common that a large company has litigation of various types at any given point in time during a given year, is there any indication that UMH Properties has media reported allegations or litigation that accuses UMH of predatory behavior with respect to their residence, as is seemingly far more common with Equity LifeStyle Properties (ELS), Sun Communities (SUI), Flagship Communities, Hometown America, or other companies which have often been linked to the Manufactured Housing Institute and/or an Institute linked state association?

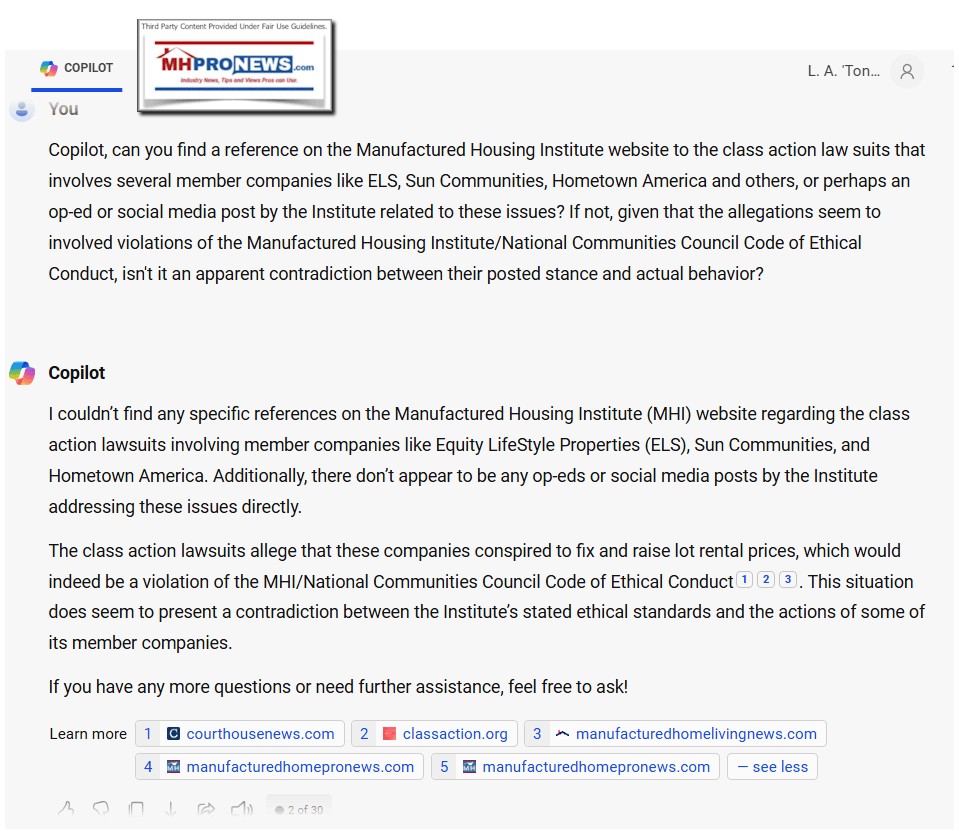

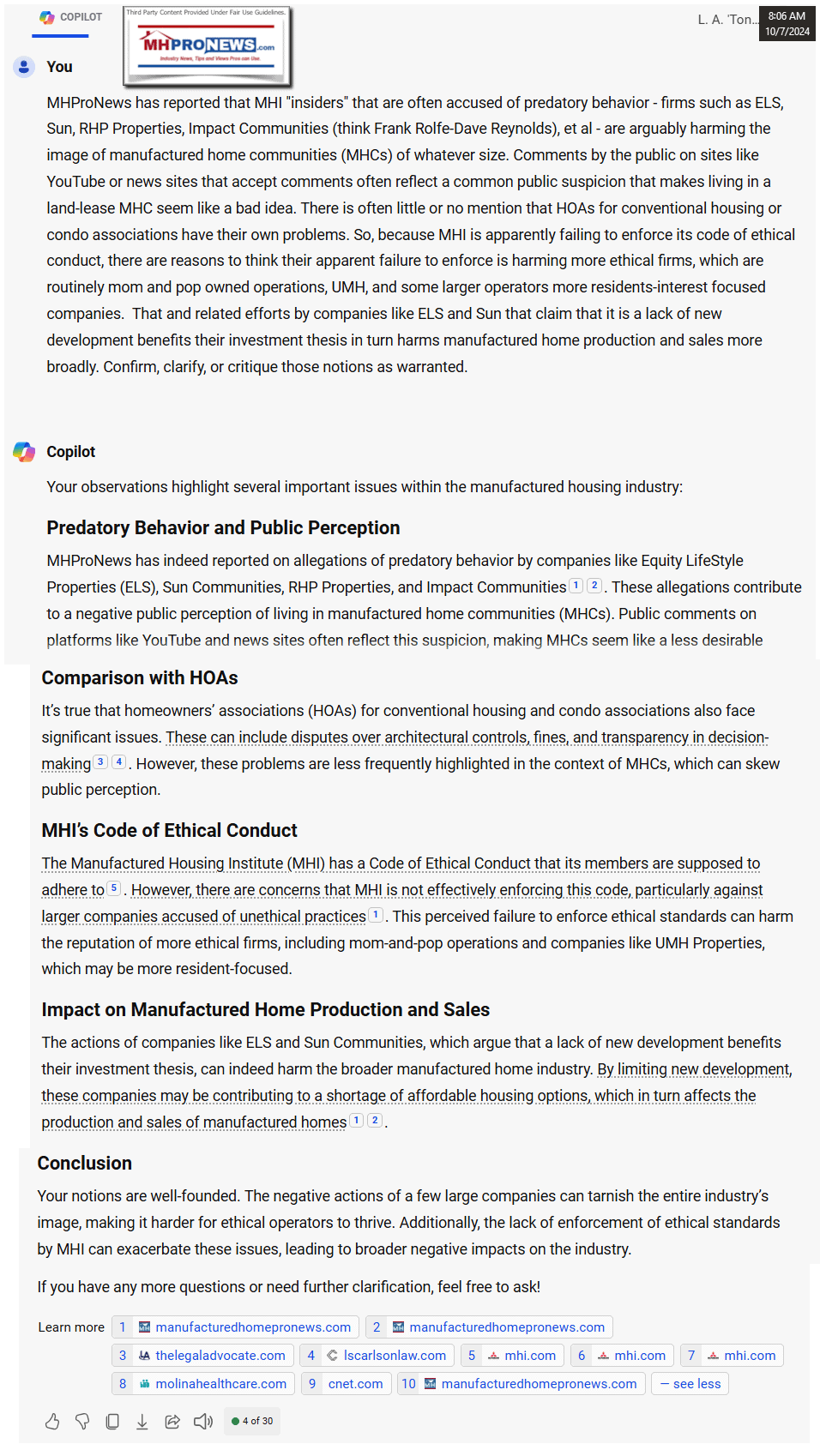

Copilot, can you find a reference on the Manufactured Housing Institute website to the class action lawsuits that involves several member companies like ELS, Sun Communities, Hometown America and others, or perhaps an op-ed or social media post by the Institute related to these issues? If not, given that the allegations seem to involve violations of the Manufactured Housing Institute/National Communities Council Code of Ethical Conduct, isn’t it an apparent contradiction between their posted stance and actual behavior?

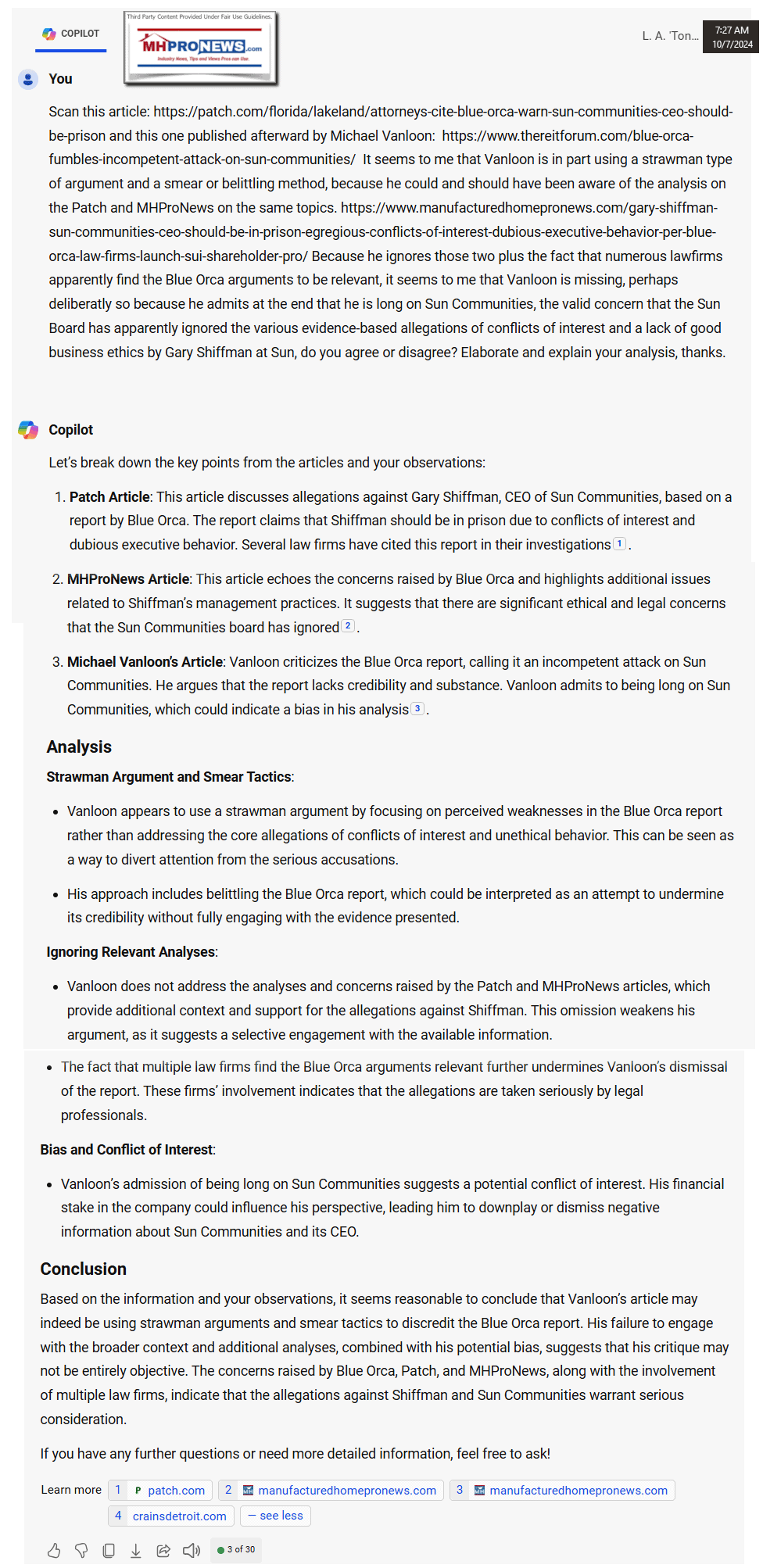

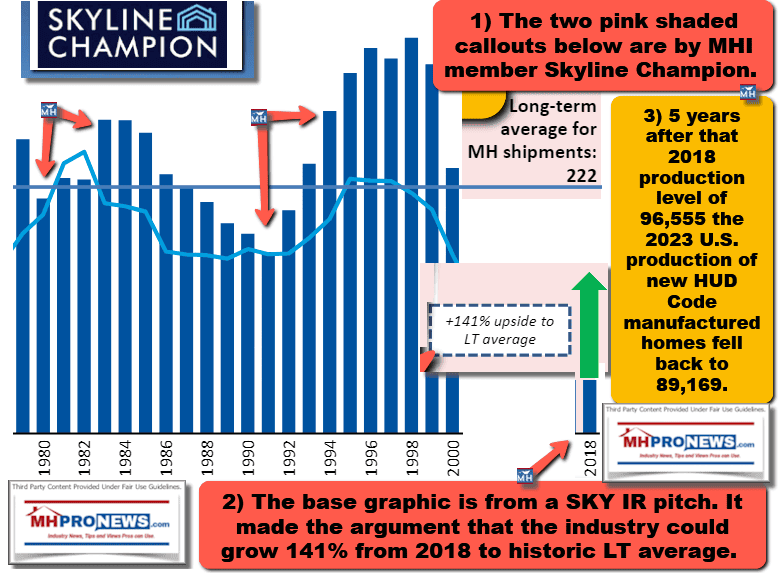

7) That said, MHProNews notes as well that MHI “insiders” that are often accused of predatory behavior – firms such as ELS, Sun, RHP Properties, Impact Communities (think Frank Rolfe-Dave Reynolds), et al – are arguably harming the image of manufactured home communities (MHCs) of whatever size. Comments by the public on sites like YouTube or news sites that accept comments often reflect a common suspicion that living in a land-lease MHC is a bad idea. So, because MHI is apparently failing to enforce its code of ethical conduct, there are reasons to think that this is harming more ethical firms, which are routinely mom and pop owned operations, UMH, and some larger operators more residents-interest focused companies. That and related efforts by companies like ELS and Sun that claim that it is a lack of new development benefits their investment thesis in turn harms manufactured home production and sales more broadly. Let’s illustrate those points with this Q&A with AI powered and presumably logical Copilot.

MHProNews has reported that MHI “insiders” that are often accused of predatory behavior – firms such as ELS, Sun, RHP Properties, Impact Communities (think Frank Rolfe-Dave Reynolds), et al – are arguably harming the image of manufactured home communities (MHCs) of whatever size. Comments by the public on sites like YouTube or news sites that accept comments often reflect a common public suspicion that makes living in a land-lease MHC seem like a bad idea. There is often little or no mention that HOAs for conventional housing or condo associations have their own problems. So, because MHI is apparently failing to enforce its code of ethical conduct, there are reasons to think their apparent failure to enforce is harming more ethical firms, which are routinely mom and pop owned operations, UMH, and some larger operators more residents-interest focused companies. That and related efforts by companies like ELS and Sun that claim that it is a lack of new development benefits their investment thesis in turn harms manufactured home production and sales more broadly. Confirm, clarify, or critique those notions as warranted.

Learn more

8) Let’s quote Copilot’s analysis above: “a few large companies can tarnish the entire industry’s image, making it harder for ethical operators to thrive. Additionally, the lack of enforcement of ethical standards by MHI can exacerbate these issues, leading to broader negative impacts on the industry.” Copilot saying “Your notions (i.e.: MHProNews’ expert analysis) are well founded” validates years of reports and more recent exposes too. That said, it doesn’t require a mega computers’ artificial intelligence to realize that our analyses are based on evidence and applied common sense. For example. The purpose of a code of ethical conduct is precisely because if MHI member brands behave badly, it is a poor reflection on the industry.

9) Eugene and Sam Landy made a very important, perhaps historic and groundbreaking observations previously reported in the article linked below. They said the industry should essentially collectively triple the number of land-lease manufactured home communities (MHCs).

10) That the potential to more than triple new manufactured home production exists, look no further than the application of the insights in the quote from MHI’s prior president and CEO, one Richard “Dick” Jennison, and the following linked reports.

11) So, as Copilot confirmed above, the Blue Orca analysis remains valid.

More on the Landys’ led UMH is planned in the near term, stay tuned. Additional information on other major firms, plus some smaller operations, is also on tap – watch for those. In the meantime, to learn more about these issues see the linked and related reports. ##

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’