Noteworthy headlines on – CNNMoney – Terror alert: Central London on lockdown. AT&T, Verizon halt Google ads over extremist videos. Sears has “substantial doubt” that it can survive. Starbucks to add 240,000 jobs worldwide by 2021.

Some bullets from Fox Business – Surveillance findings raise concern about spying on Trump Campaign: Nunes. Choppy day on Wall Street; all eyes on Trump and health care. Four dead, at least 20 injured in UK Parliament attack. About 17,000 AT&T workers in California and Nevada go on strike.

“We Provide, You Decide.” ©

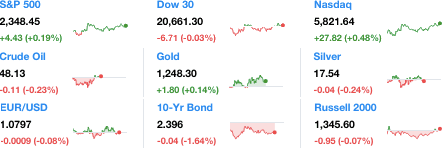

Key Commodities

Crude Oil 4813 –0.11 (-0.23%) Gold 1,248.30 1.80 (0.14%) Silver 17.54 –0.04 (-0.24%)

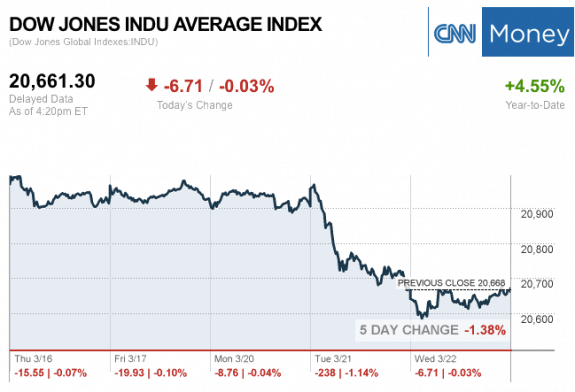

The markets at the Closing Bell Today…

S&P 500 2,348.45 4.43 (0.19%)

Dow 30 20,661.30 –6.71 (-0.03%)

Nasdaq 5,821.64 27.82 (0.48%)

Russell 2000 1,345.60 –0.95 (-0.07%)

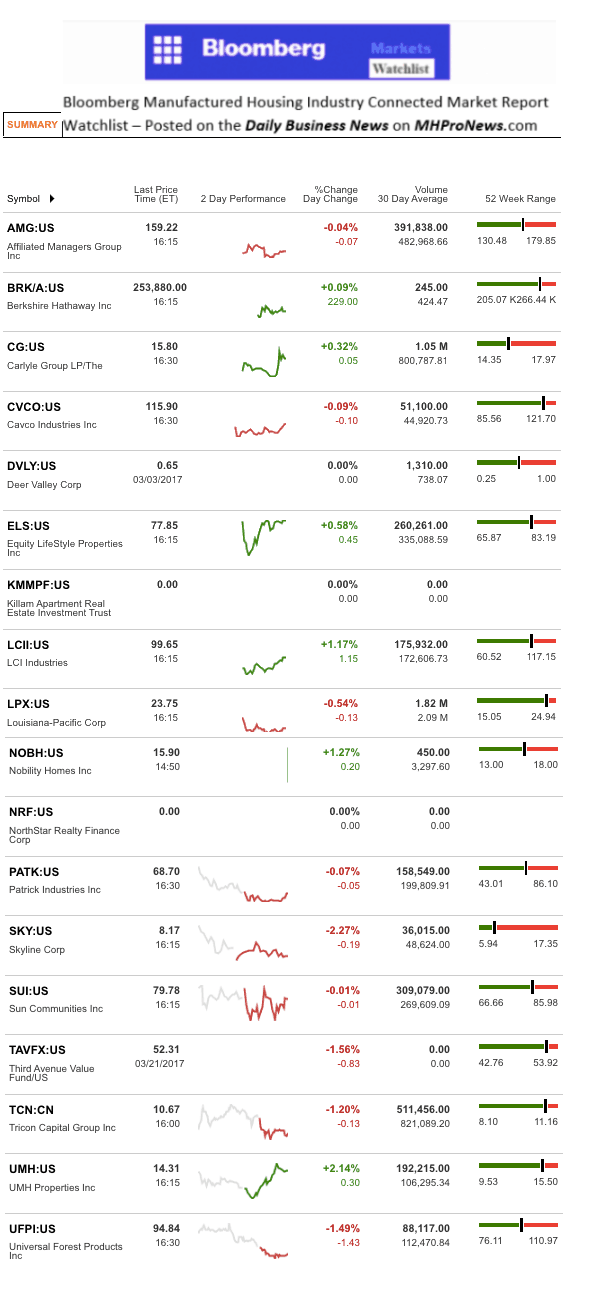

The MH Industry – Today’s Risers and Sliders

The top two gainers for the day were UMH Properties Inc. (UMH) and Nobility Homes Inc. (NOBH).

The top two sliders for the day were the Skyline Corp. (SKY) and Universal Forest Products Inc. (UFPI).

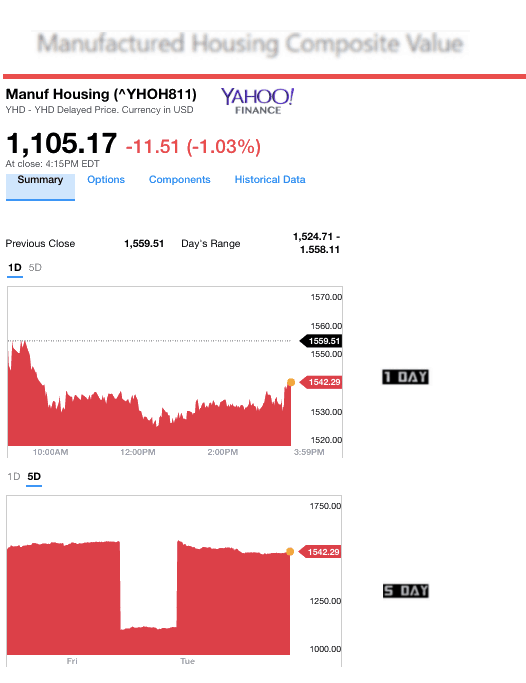

Manufactured Housing Composite Value (MHCV) Ticker

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew has changed their name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.