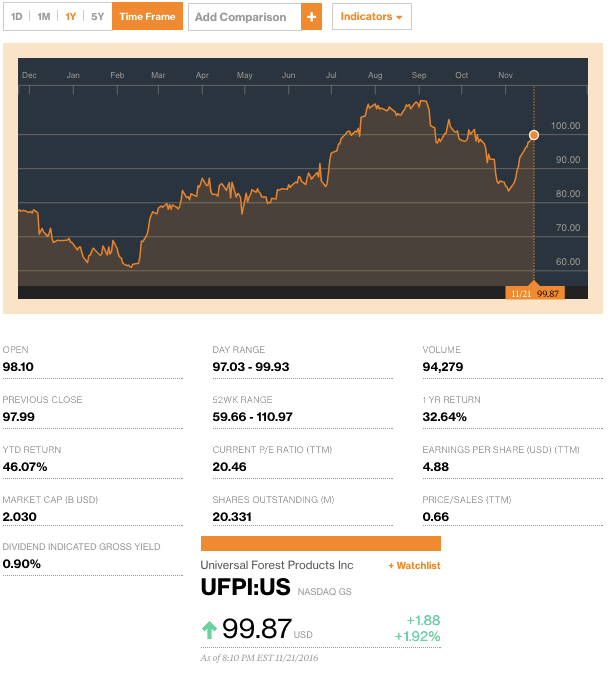

Universal Forest Products Inc. (NASDAQ:UFPI) has announced its Q3 2016 earnings results, including record revenues.

The company reported $1.36 earnings per share (EPS) for the quarter, beating analysts’ estimates of $1.35.

UPFI earned a record $826.70 million during the quarter, with a net margin of 3.27 percent and a return on equity of 12.38 percent. The firm’s quarterly revenue was up 8.5 percent compared to the same quarter last year. During the same period in the previous year, the business posted $1.26 earnings per share.

“The employees of Universal are working hard to top the records they achieved during the last half of 2015, and we are pleased once again to report record results and growth,” said CEO Matthew J. Missad. “We grew sales significantly in two key markets and continue to increase our sales of new products.”

UFPI year-to-date new product sales were $247.9 million, a 16 percent increase over the $213.3 million reported for the same period of last year.

“We are continuing to make investments in our business and people to promote and enhance our continued success,” said Missad.

“We have added staff and are investing in their training to support our growth. We also are investing in several significant initiatives, including new international and e-commerce groups, and a research and design center, all of which we believe will contribute to our success in 2017 and beyond.”

Missad added that the UFPI continues to look for strategic acquisitions. Its purchase of idX Corp. closed near the end of the third quarter. idX is an international provider of highly customized merchandising solutions. Based in St. Louis, Missouri, it has a network of more than 20 facilities across North America, Europe and Asia, with sales in 2015 of $303 million.

A number of hedge funds have recently added to their stakes in UFPI:

- State Street Corp. increased its position by 28.8 percent in the second quarter and now owns 556,128 shares valued at $51,552,000.

- Riverhead Capital Management LLC increased its position by 2,918.5 percent in the second quarter and now owns 106,402 shares valued at $15,023,000.

- AQR Capital Management LLC increased its position by 31.0 percent in the second quarter and now owns 170,455 shares of the company’s stock valued at $15,799,000.

- BlackRock Fund Advisors increased its share by 2.1 percent in the second quarter.

UFPI is one of the various industry-connected stocks monitored each business day on the industry’s only daily market report, featured exclusively on the Daily Business News. For the most recent closing numbers on all MH industry-connected tracked stocks, please click here. ##

(Image credits as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.