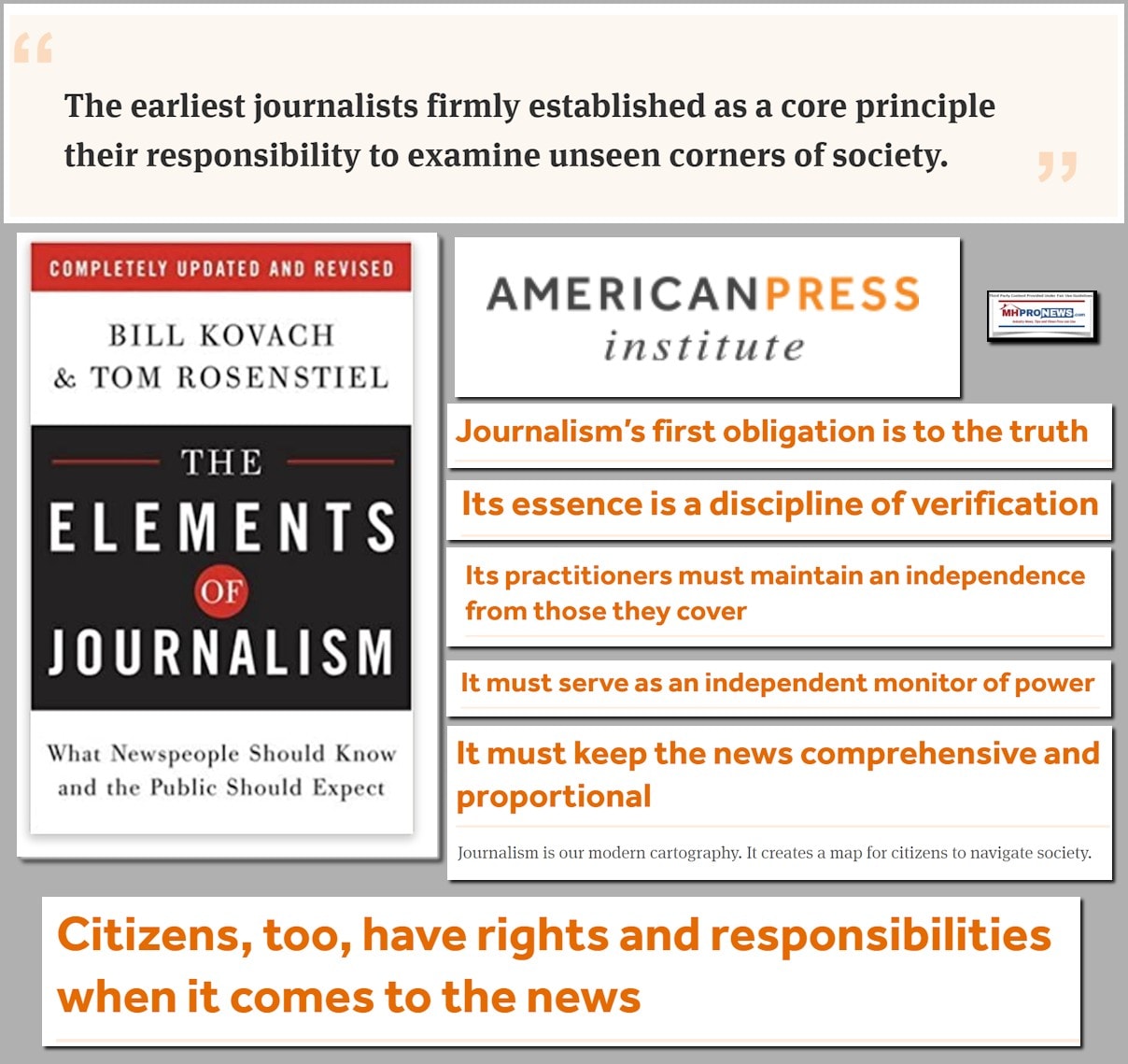

“Questioning an investing thesis — even one of our own — helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.” So said the Motley Fool (MF or Fool) investment news, advisory, and views website as part of their report on the Skyline Champion (SKY) Q1 2022 quarterly earnings call transcript, shown further below. That MF quote used to be a bedrock principle not only in investing, but in education, reporting, and American life itself. A healthy dose of skepticism should allow for well-reasoned evidence, competing facts and claims as well as proof. Thus a healthy skepticism – questioning a source’s claims “even one of our own” does help “all think critically” – meaning analytically. Critical thinking, be it about Skyline Champion or any other topic is necessary in order not to be taken in or “fooled.” The word critical has all too often lost the second part of its meaning, which Oxford Languages says is: “expressing or involving an analysis of the merits and faults of a work of literature, music, or art.” As the American Press Institute (API) says: “Journalism’s first obligation is to the truth.”

The authentic job of the journalist, be it a trade journalist or otherwise, it to seek, discern, and report what is the evidence reveals. While breaking news may obviously does not have the benefit of later insights and developments, most news and reporting in the U.S. and in dozens of other nations stands at relatively low ebb because readers doubt that what they are being told is true, authentic and real. Merely regurgitating what someone says is a form of marketing, advertising, or advocacy for the source that makes certain statements or claims. While ads or a pitch may have some value, it is not the same as authentic news and analysis. Anything that is broadcast or published that fails to consider competing information or data, or information that confirms what a source claims, could be a form of spin or propaganda that supports a source’s agenda. These were – and on paper – still are woven into what journalism is supposed to be, as the API website indicates. The insights about what makes for good journalism, per API, merits mention before proceeding with the factually- and evidence-based report, analysis and commentary into Skyline Champion’s quarterly statements will proceed further below.

- Its [journalism’s] first loyalty is to citizens.

- Its [journalism’s] essence is a discipline of verification.

- Its [journalism’s] practitioners must maintain an independence from those they cover.

- It [journalism] must serve as an independent monitor of power.

API says that these points are from the book, The Elements of Journalism, by Bill Kovach and Tom Rosenstiel.

- “Citizens, too, have rights and responsibilities when it comes to the news.”

There are MHProNews readers who ‘get that’ bullet above. They provide input when asked. Or they provide tips when they realize that they know about genuine news (as opposed to mere self-promotion, self-dealing, etc.) which others need to be aware of if they are engaged in affordable housing in general or manufactured homes in particular. Some provide documents and links that might otherwise be missed. That said, more doubtlessly could and should step up to the plate by providing tips and insights, be it on or off the record.

The reasons to provide this backdrop of what are supposed to be the standards of journalism are many. First, the case can be made that in our profession, other than MHProNews and MHLivingNews, other purported trade media sources are largely focused on selling stuff and specific perspectives. If something is critiqued, it is only because it opposes their own agenda. That’s not journalism. Who says? API.

With those notions in mind, the balance of this report will proceed as follows.

1). Following the preface above, there is the transcript per the Motley Fool (Fool) financial news and views website omits the “10 stocks we like better than Skyline Champion Corporation.” The original transcript is found at this link here.

2). Additional linked and related information provided by MHProNews, that includes the 5 year trendline for the stock’s performance.

3). Skyline Champion claims – based on evidence – that they are the number two producer of HUD Code manufactured homes. They naturally present their investor pitch with evidence of their performance. But a reasonable question that MF directly references by their ‘10 stocks they like more’ suggests a question. Are investors in Skyline Champion getting the most possible bang for their investment bucks? During a well-documented affordable housing crisis, why isn’t Skyline Champion – or other manufactured housing brands – growing faster, sustainably and more profitably?

These go to the heart of reporting that gets to the truth about this company, the association it is a sizable member of, and the industry it is working in.

4). A brief summary and conclusion by MHProNews will then wrap up this report.

To the Fool’s point that questioning the investment thesis helps all, that clearly depends on if those in leadership at Skyline Champion, their apparent allies at MHI, and their camp followers are willing to consider a contrarian viewpoint or not. Contrarians serve a valuable role, when done in balance.

Restated, if a better way to do business exists, then a publicly traded firm is obligated to give that due consideration. Who says?

Per the Nolo legal website said, “Officers and directors owe a duty of loyalty to a corporation and its shareholders.” They are supposed to act in the best interests of shareholders, said Nolo: “A breach of a fiduciary duty may result in personal legal liability for the director, officer, or controlling shareholder. State statutory law, judicial decisions, and corporate articles of incorporation and bylaws may also impact a person’s fiduciary obligations to a corporation.” Conflicts of interest, poor decision making, illegal and otherwise unethical behavior that impacts the potential for a company are issues that must be objectively examined.

With that plan of action for this report, let’s dive into #1.

1). Note that in the Fool’s transcript that follows the highlighting in yellow or aqua are by MHProNews. But the text is as in the original. MHProNews highlights specific parts not because others are irrelevant. Rather, those highlighted items merit follow up insights and analysis.

Skyline Champion Corporation (SKY) Q1 2022 Earnings Call Transcript

SKY earnings call for the period ending June 30, 2021.

Motley Fool Transcribers

(MFTranscribers)

Aug 4, 2021 at 6:00PM

Skyline Champion Corporation (NYSE:SKY)

Q1 2022 Earnings Call

Aug 4, 2021, 9:00 a.m. ET

Contents:

Prepared Remarks

Questions and Answers

Call Participants

Prepared Remarks:

Operator

Good morning, and welcome to Skyline Champion Corporation’s First Quarter Fiscal Year 2022 Earnings Call. The company issued an earnings press release yesterday after the close. I would like to remind everyone that yesterday’s press release and statements made during this call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations and projections. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Additionally, during today’s call, the company will discuss non-GAAP measures, which it believes can be useful in evaluating its performance. A reconciliation of these measures can be found in the earnings release.

I would now like to turn the call over to Mark Yost, Skyline Champion’s President and Chief Executive Officer. Please go ahead.

Mark Yost — President and Chief Executive Officer

Thank you for joining our earnings call, and good morning everyone. With me on the call is Laurie Hough, EVP and CFO. Today, I’ll start off with some highlights from our first quarter, then provide an update on the activity so far in our second quarter and wrap up with some thoughts on the balance of the year.

In the first quarter, we saw an acceleration of the favorable trends we highlighted on our year-end call. We are experiencing robust demand for affordable housing and are generating improved output levels as our strategic initiatives continue to drive production efficiencies. Demand is being driven by numerous factors including favorable financing, historically low levels of inventory, and rapidly growing base of customers looking to become first-time homeowners,.

Our affordable price point during these inflationary times contributed to strong order demand that resulted in backlogs growing by more than $341 million during the first quarter to $1.2 billion despite sequential unit production growth. As a result of the solid production increases, we delivered 6,757 homes, an improvement of 60% from the prior year and up 7% sequentially. When adjusting for the extra week of production in the fourth quarter of fiscal 2021 and for the ScotBilt transaction, sequential organic unit growth was 13%. Excluding ScotBilt, our U.S. manufacturing facilities continue to operate at capacity utilization levels near 80% for the quarter.

Utilization improved about 2% from the prior quarter’s rates. We achieved this despite facing ongoing operational challenges caused by supply chain disruptions across our manufacturing operations in the industry as a result of reduced raw material availability. Our improved production efficiencies allowed us to increase daily production rates over the levels achieved in this sequential fourth quarter, due in part to the progress made on streamlining product offerings. Labor availability has improved somewhat over the last quarter benefiting our production levels but is becoming more challenging as we experience the peak vacation months and — prior to the governmental unemployment assistance subsiding.

In Western Canada, we generated healthy results from our plans with home sales, volume doubling from the prior year. Volumes did decline on a sequential basis due to the product mix and extra weaker production in the sequential fourth quarter. In June, we completed the purchase of a two-plant campus of our previously idle manufacturing facility in Navasota, Texas. It is our expectation to have one of the plants operational by the end of this fiscal year. The addition of this facility will further strengthen our production capabilities in one of the most significant manufactured housing states in the country.

As mentioned on the previous call, with the recently acquired facilities and our product streamlining efforts to date, we are resetting our total capacity levels. Incorporating the additional production capabilities considering all of our idle facilities, our production capacity is now restated at 66% providing flexibility as we continue to grow our volumes.

We continue to expect that demand for affordable housing will be strong through the remainder of the second quarter and then stay elevated but moderate to more normal levels consistent with our outlook on last quarter’s earnings call. Raw material availability and supply chain challenges across the industry are expected to continue in the near term and will govern production levels in the upcoming quarters as demand outpaces supply. While we anticipate the challenges of supply chain in regional labor to cause sequential declines in our second and third quarters, we expect that these challenges will subside by our fourth fiscal quarter.

As we navigate through short-term supply side challenges during fiscal ’22, we remain focused on our long-term growth opportunities. With entry-level housing supply hitting a five-decade low and millennial household formations increasing, we continue to gain confidence into our move into digital and turnkey offerings. Inflationary and interest rate pressures will only hasten the transition away from site-built housing to more modern production practices. Therefore, we are focused at expanding our capacity and investing in automation to enhance our processes, ultimately boosting the supply to our channel partners and our customers who are seeking a more attainable home.

I’m exciting — excited that we recently added Roland Menassa, our VP of Manufacturing Technology. His experience at developing and deploying automation solutions with General Motors, General Electric, and most recently with Amazon will help us accelerate our solutions.

The growth in orders during the past few quarters has been driven by demand for affordable housing solutions and our ability to enhance the customers’ buying experience through our digital efforts. In fiscal ’22, we plan to accelerate our investments in the platforms to drive continued growth. Today’s consumers reward brands that they can trust and that deliver a simple and seamless experience digitally and at retail.

Our recent investments in our platform and our team have resulted in early success and it is our expectation that we will see continued success with the consumer as leading and the most innovative manufactured home builder.

I will now turn the call over to Laurie to discuss our quarterly financials in more detail.

Laurie Hough — Executive Vice President, Chief Financial Officer and Treasurer

Thanks, Mark, and good morning, everyone. I will begin by reviewing our financial results for the fiscal first quarter of 2022 followed by a discussion of our balance sheet and cash flows. I will also briefly discuss our expectations for the second quarter as well as the longer-term outlook.

Before reviewing our numbers, I would like to remind everyone that our results in the year-ago quarter were negatively impacted by COVID-related government restrictions causing some of our plants to be shut down and other disruptions throughout the value chain.

Net sales increased by 87% to $510 million in the first quarter of fiscal 2022 versus the same quarter last year. We generated revenue growth of $208 million in the U.S. factory-built housing segment as well as growth in our Canadian factory-built housing segment of $23 million. The increase in U.S. factory-built revenue was driven by an increase in the number of homes sold and an increase in average selling price. The increase in the number of homes sold was 58% or 2,344 units for a total of 6,372 homes, compared to the same quarter last year. The average selling price per U.S. homes sold increased by 16% to $71,800 due to product mix and price increases in response to rising material costs.

We are pleased with the sequential growth in revenue in the U.S. factory-built segment, which increased 15% in the first quarter compared to the fourth quarter of fiscal 2021. This increase was driven by an 8% increase in homes sold and a 7% increase in average selling price. When adjusting the fourth quarter to a normalized 13-week fiscal quarter and adjusting for the ScotBilt transaction, organic revenue grew by 20% with U.S. factory-built homes sold increasing 13%.

Canadian revenue increased 149% to $38 million compared to last year, driven primarily by a 100% increase in the number of homes sold to 385 units. The average home selling price in Canada of $98,300 increased 24% versus the same quarter last year, driven primarily by pricing actions enacted in response to rising material costs. Consolidated gross profit increased to $112 million up 107% versus the prior-year quarter due to increased sales volume and higher pricing.

Our U.S. housing segment gross margins were 21.7% of segment net sales, up 220 basis points from the first quarter last year due to improved operating leverage and efficiencies more than offsetting the deterioration in margin from material price increases. [Indecipherable] in the first quarter increased to $54 million from $40.8 million in the same period last year, primarily due to higher variable compensation and travel expenses as well as our continued investment in the company’s online customer experience and other platform enhancements. We expect these investments to continue to accelerate throughout the remainder of this fiscal year and into fiscal 2023.

Net income for the first quarter was $42.9 million or $0.75 per diluted share, compared to net income of $11.9 million or earnings of $0.21 per diluted share during the same period last year. The increase in EPS was driven by a combination of higher revenue and gross profit. The company’s effective tax rate for the quarter was 24.6% versus an effective tax rate of 27.7% for the year-ago quarter. The company’s effective tax rate decreased primarily as a result of greater pre-tax income while non-deductible items remained constant, the proportion of U.S. versus Canadian income and a one-time benefit for vested equity compensation.

Adjusted EBITDA for the quarter was $62.7 million, an increase of 178% over the same period a year ago. The adjusted EBITDA margin expanded by 410 basis points to 12.3% due to higher sales growth, gross margin improvement, and leverage of fixed costs. The prior year’s EBITDA included $4.2 million of wage subsidies provided by government-sponsored financial assistance programs that were enacted in response to the pandemic and did not reoccur in fiscal 2022.

While we’ve seen the prices for certain forest products declined during the first quarter, inflation on other building products remains persistent and is expected to continue for the remainder of the year due primarily to the widespread supply chain challenges combined with high levels of demand. We expect that labor will be challenging in the near term impacted by government incentives in the peak vacation months. As a reminder, there are several levers we utilize in response to increasing material and labor costs including price adjustments, product standardization, raw material substitutions, and further operational improvements.

Despite our efforts to continue to pass on inflation and make operational improvements, our production may be impacted by the availability of raw materials due to supply chain challenges, the availability of qualified labor, and the home buyer’s ability to qualify for financing at the higher inflationary rates.

As of July 3, 2021, we had $288 million of cash and cash equivalents and long-term borrowings of $39 million with no maturities until June 2023. We generated $32 million of operating cash flow during the quarter in line with the prior-year quarter. On July 7, 2021, subsequent to the end of our fiscal quarter, Skyline Champion entered into a $200 million revolving credit facility replacing our existing $100 million facility.

As a part of the refinancing, we paid off our outstanding revolver balance totaling $26.9 million using the company’s cash on hand. The new credit facility expands the company’s available liquidity for strategic initiatives and opportunistic acquisitions. We remain focused on executing on our growth and operational initiatives and given our favorable liquidity position, plan to utilize our cash to reinvest in the business and to support strategic growth.

I’ll now turn the call back to Mark for some closing remarks.

Mark Yost — President and Chief Executive Officer

Thanks, Laurie. I’m encouraged with the solid momentum in our business and the results we delivered during the quarter. Our strong backlog and efforts to expand our capacity and increase our productivity have us well-positioned to respond to the growing demand for our homes. I am even more confident in our ability to execute our strategy going forward after this extraordinary quarter. And with that operator, you may now open the lines for Q&A.

Questions and Answers:

Operator

Thank you. We will now begin the question-and-answer session. [Operator Instructions] Our first question comes from Matthew Bouley of Barclays. Please go ahead.

Ashley Kim — Barclays — Analyst

Hi, this is Ashley Kim on for Matt today. Last quarter, you indicated only seeing enough raw materials to maintain, I think it was similar revenue levels to 4Q, but 1Q actually saw a sequential improvement. So, could you just give us some color on what drove this? Was there simply more material or labor availability or maybe better pricing that allowed that uptick?

Mark Yost — President and Chief Executive Officer

Yes. Good morning, Ashley. I think the first quarter benefited from our ability to source additional materials from a supply chain. I think there was additional stock that we were able to get. So, I think the same vision that we had in the last earnings call is what we see now as that there’s a de-stocking of the supply chain, especially on the freight side currently happening. So, we were able to get a little bit extra material fortunately during the quarter and it allowed us to outpace our quarterly estimates.

Ashley Kim — Barclays — Analyst

Great, that’s helpful. And then just on the backlogs. Have you put any measures in place to restrict orders going forward just to better align with production to control that from swelling any further?

Mark Yost — President and Chief Executive Officer

No. Actually, I think backlogs are very encouraging. It really shows the demand for affordable and attainable housing, is significantly strong and also to our investments in technology making it easier for people to buy homes. It really gives me frankly confidence in the future strategic direction that we’re going to. So, we’re not putting in controls. We’re still at 36 weeks in terms of delivery time, which is very manageable currently, for our customers. I anticipate backlogs to continue to grow throughout the calendar year as supply chain is still challenged, which is in line with what we said last earnings call.

So, I think we are seeing what we expected, but I think orders were very strong, little stronger than we anticipated, really driven by just I think the need that the customers have for a good quality attainable home.

Ashley Kim — Barclays — Analyst

Thanks very much. I will leave it there.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

Our next question comes from Dan Moore of CJS Securities. Please go ahead.

Brendan Popson — CJS Securities — Analyst

Hey. Good morning. This is Brendan Popson on for Dan. You guys spent some time talking about automation. And I’m just wondering if you could provide some specific examples. And then if you could speak to how much incremental capacity you hope to achieve, and how long it will take to get there.

Mark Yost — President and Chief Executive Officer

Yes. Good morning, Brendan. I think — very excited about automation with Dr. Menassa coming on board in his experience at Amazon and GE and GM and what he’s been able to automate and drive at those companies with their technology. Very excited about where we can head with that. I think it’s too early to understand really what the capabilities are. Many companies have, as I mentioned on the last call, have tried automation in our industry, but there were certain limitations of the off-the-shelf solutions.

So, I think over the next 12 to 24 months, we’re going to start automating and testing some of the automation pilots that we already have in process and further developing those, which will really lead to solving the labor challenges that we have, making it a better place to work and also to doing things to really drive more attainable housing for the end customer, which is really what is in such high demand now. So, we look forward to it.

Brendan Popson — CJS Securities — Analyst

Great. And then just if you could speak to lumber prices, it seems that they’ve reversed course some in recent weeks. And just wondering how much of an opportunity there is to hold the line on pricing and drive margins higher.

Mark Yost — President and Chief Executive Officer

Yes, we saw actually margin compression during the quarter materials. We actually were not able to cover inflationary pressures with pricing. So, we actually took a margin hit during the quarter from materials. I think overall, lumber has come down, but really what we’ve seen is other commodities and other materials increase in price. Transportation and freight is increasing the cost of frankly, all the goods across the country. So, that transportation is coming to fruition.

In the shipping industry, the forwarders have started to compress and take away credit lines from certain shipping companies and other things that are going to limit supply. So, I think the cost of freight is going to be something that we see across the board. And then we’ve seen inflationary pressures on resins and steel and other goods that have actually offset the lumber declines that we’ve seen.

So, I expect prices to remain high for the foreseeable future just because many of these inflationary increases we foresee happening and staying in place for at least the next six to 12 months.

Brendan Popson — CJS Securities — Analyst

Okay. Great. Thank you.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

Our next question comes from Mike Dahl of RBC Capital Markets. Please go ahead.

Mike Dahl — RBC Capital Markets — Analyst

Hi. Thanks for taking my questions. I wanted to go back to the conversation around backlogs and I understand that’s a good problem to have. But I’m curious when you think about — of capacity, you outlined what you are doing in Texas and your new recalculation of production capacity. I know there are some practical limitations around geographies and product mix, but with backlogs at these levels and expect it to grow further, why aren’t you acting more aggressively to bring on new capacity?

Mark Yost — President and Chief Executive Officer

Yes. Mike, it really comes down to supply chain, I think. Overall, as we have looked at it if we had available materials or more supply in the marketplace to run more effectively. And frankly, labor is a part of that as well today. I think right now we’re seeing a — an uptick in labor challenges, I think, in part due to the — July and August are the peak summer months and holiday months in the U.S. primarily. That combined with the government incentives that are out there are kind of creating a situation where it’s very difficult during these two-month period to find labor.

So, I think that will subside as we get into the fall, people head back to school, vacation and holidays start to wane down. But overall supply chain continues and freight challenges continue to limit the ability to increase output. So, I actually expect backlog to continue to grow at least through the rest of the calendar year and then hopefully look to moderate them. So, I expect actually backlogs to continue to grow.

And what I meant by encouraging is the fact that some of the opportunities to provide affordable housing is making it easier for people to buy. It is playing out the way we thought it would. So, I think that’s an encouraging sign for long term and our ability to add more capacity and grow further.

Mike Dahl — RBC Capital Markets — Analyst

Got it. Okay. And then my second question is around the buyer profile. And Laurie, I think you made a comment about some limitations, one being the supply chain comments and then one being buyer qualification. I didn’t know if that was boilerplate disclosure or risk factor or if there’s something specific that you’re seeing.

So, I wanted to follow up and ask about what you’re seeing in terms of buyer qualifications. How you — what metrics are you tracking to help you gauge what the buyer can bear right now and anything like that?

Laurie Hough — Executive Vice President, Chief Financial Officer and Treasurer

Yes, Mike. So, it’s more anecdotal information than any specific metrics that we’re tracking. So, we can see how the buyers are qualifying and the demographic of the buyers at our captive retail more than anywhere else. And really, what we’re seeing and I think what drove the comment primarily is the fact that on land/home purchases, appraisals aren’t keeping pace with the increase in price. And it’s really more just a delay because you have to have a certain number of camps for land/home purchases and qualification from a financing standpoint than anything else.

So, in order to have those comps at the higher prices for an extended period of time, I think in the last 12 months or whatever the qualification is. They just haven’t caught up. So, that’s really what it’s more about rather than the demographic of the buyer. The buyer are — is still able to qualify for the home.

Mike Dahl — RBC Capital Markets — Analyst

Okay. And is that leading you to slow play your price increases a little bit or given the length of backlog and when your next customer in the door is looking at 36 weeks by that time, maybe the comps have caught up for the appraisals. How do you balance your price increases against that?

Laurie Hough — Executive Vice President, Chief Financial Officer and Treasurer

Yes, no, we really look — price increases are really about our input cost and demand.

Mike Dahl — RBC Capital Markets — Analyst

Got it. Okay. Thank you.

Operator

Our next question comes from Craig Paul of Craig-Hallum Capital Group. Please go ahead.

Craig Paul — Craig-Hallum Capital Group — Analyst

All right. I’m going to assume that’s me. I guess, first off, congrats on the really good results. I’m curious, can you comment on what the daily production rates have been in July? And when thinking about the quarter and the sequential decrease in volumes, are you thinking mid-single digits, high single digits? What’s going to be the — maybe the key lever that drives this either better or worse relative to what you’re currently expecting?

Mark Yost — President and Chief Executive Officer

Good morning, Greg. Yes, I think that in July — first off, we have our typical seasonal shutdown in July. So, the early July week or slight weeks I guess, depending on the plant location will take part of the month down for maintenance for refurbishment and frankly, just for holiday purposes. So, we’ll definitely see a weak outage for those maintenance and holiday periods in this current quarter, which is very normal. So, we’ll definitely see that. But overall, I think it’s going to be very dependent on the supply chain.

So, I don’t think the decline in volumes or revenues will be larger than we — I think it will be better than we anticipated. On the last call, if you remember last call, I mentioned, I think we thought 5%, 5%. I think we’ll mitigate that a little bit. But I think we’ll just see a weak outage will impact us for the quarter.

Craig Paul — Craig-Hallum Capital Group — Analyst

Got it. And what’s surprised you? I mean in terms of supply chain maybe not being — is worse. I look at your volumes and they’re vastly outpacing what the industry is doing. So, are you doing anything differently or are you just getting better stocking orders relative to some of your peers?

Mark Yost — President and Chief Executive Officer

Yes. I actually think, Greg, to be honest, that our people at the plant level are really making things happen and solving problems. The innovation happening is just — it’s blowing me away, to be honest. I’m just — I’m amazed at our people. I think that coordination, communication, problem-solving, working with multiple suppliers to make sure we can get what we need when there is a disruption, that resourcefulness and innovation is really what’s driving, I think, some of the performance we saw this quarter.

So, it’s very encouraging. I do think we’re seeing a shift in the outage related for the supply chain from more supply chain disruptions from the actual materials, moving now to more freight and timing-related shortages along with major shortages in certain commodities in areas. But we’re seeing improvements in some areas and tightening in others.

Craig Paul — Craig-Hallum Capital Group — Analyst

Makes sense. And then just last one in terms of the demand levels and what you’re seeing out there. Anything to note in terms of the channel, whether it’s still dominated by retail versus community? And I don’t know I mean looking back on the last six, nine, 12 months, do you have any further insights on where these buyers are coming from? Who are they? Are they renters? Are they coming from site-build? Just be — curious to get some high-level thoughts on really what the demand drivers are out there?

Mark Yost — President and Chief Executive Officer

Yes, Greg, I think we have our own captive retail, which we have insight to. And then we also have conversations with our independent retailers with the financing entities and community operators as well. I think all of that points to the fact that people are looking for an attainable home. I think the price of site-built homes have gotten out of reach for many first-time home buyers. You’ve seen that from multiple reports that starter homes are a five-decade low at the time that many millennials are looking to create household formations.

So, there’s not enough available supply for them to move into. And the pricing for that supply is very high. At the same time, many people are moving geographies from urban to rural, kind of work from home or a hybrid-type model. So, I think all of those factors are playing into it. That are really driving the demand in volume for attainable housing. So, I just think all of those factors are really good tailwinds.

Craig Paul — Craig-Hallum Capital Group — Analyst

Okay. Good. Alright. Thanks for the color. Best of luck going forward.

Operator

[Operator Instructions] Our next question comes from Jay McCanless of Wedbush. Please go ahead.

Jay McCanless — Wedbush — Analyst

Thanks. Good morning. Thanks for taking my questions. The first one I had for copper-driven goods as well as steel. Could you talk about where pricing is going on those? And are you seeing that flatten out yet or price is still going up for those goods?

Mark Yost — President and Chief Executive Officer

No, I think material inflation in the metals in those goods are still elevated, still strong. I think we’ve seen a majority of the jump already. But we haven’t really seen any reductions as of yet. So, I think it’s just across the board with material inflation.

Jay McCanless — Wedbush — Analyst

And the second question I had, a hypothetical, but what if this is the new normal and you see these type of large backlogs for the next two to three years? Supply chain hopefully gets a little bit better. What steps do you take as the management team to grow and get more share in this type of — not frenetic, but I guess very positive demand-driven market?

Mark Yost — President and Chief Executive Officer

Yes, I think we’ve got idle facilities across the U.S. that we would start to reopen when supply chain allows us to feasibly do so. So, I think we’d definitely open up more factories to supply capacity and increase our output. Our investments in automation will only enhance our capacity utilization and our ability to scale our production at our existing facilities. In combination with the fact that we’ve actually streamlined some product offerings and other things during this quarter. And with the capacity additions and those streamlining of products, we’ve actually freed up and given another 11% of capacity utilization this quarter.

So, I think it’s really those debottlenecking efforts, the automation efforts, the opening up of additional capacity because we have several plants that we’re excited to open at the right point in time as soon as the supply chain… We feel confident in that supply chain.

Jay McCanless — Wedbush — Analyst

Great. Thanks for taking my question.

Mark Yost — President and Chief Executive Officer

Thank you.

Operator

This concludes the question-and-answer session. I would like to turn the conference back over to Mr. Yost for any closing remarks.

Mark Yost — President and Chief Executive Officer

Thank you for participating in today’s call. We appreciate the time and your continued interest. We look forward to updating you on our continuous progress and our innovation on our next call. Take care and be safe.

Operator

[Operator Closing Remarks]

Duration: 35 minutes

Call participants:

Mark Yost — President and Chief Executive Officer

Laurie Hough — Executive Vice President, Chief Financial Officer and Treasurer

Ashley Kim — Barclays — Analyst

Brendan Popson — CJS Securities — Analyst

Mike Dahl — RBC Capital Markets — Analyst

Craig Paul — Craig-Hallum Capital Group — Analyst

Jay McCanless — Wedbush — Analyst ##

##

As was noted above, the Fool has this disclaimer at the end of the transcript: This article represents the opinion of the writer, who may disagree with the “official” recommendation position of a Motley Fool premium advisory service. We’re motley! Questioning an investing thesis — even one of our own — helps us all think critically about investing and make decisions that help us become smarter, happier, and richer.”

2). Additional related and linked information provided by MHProNews, that includes the 5 year trendline for the stock’s performance.

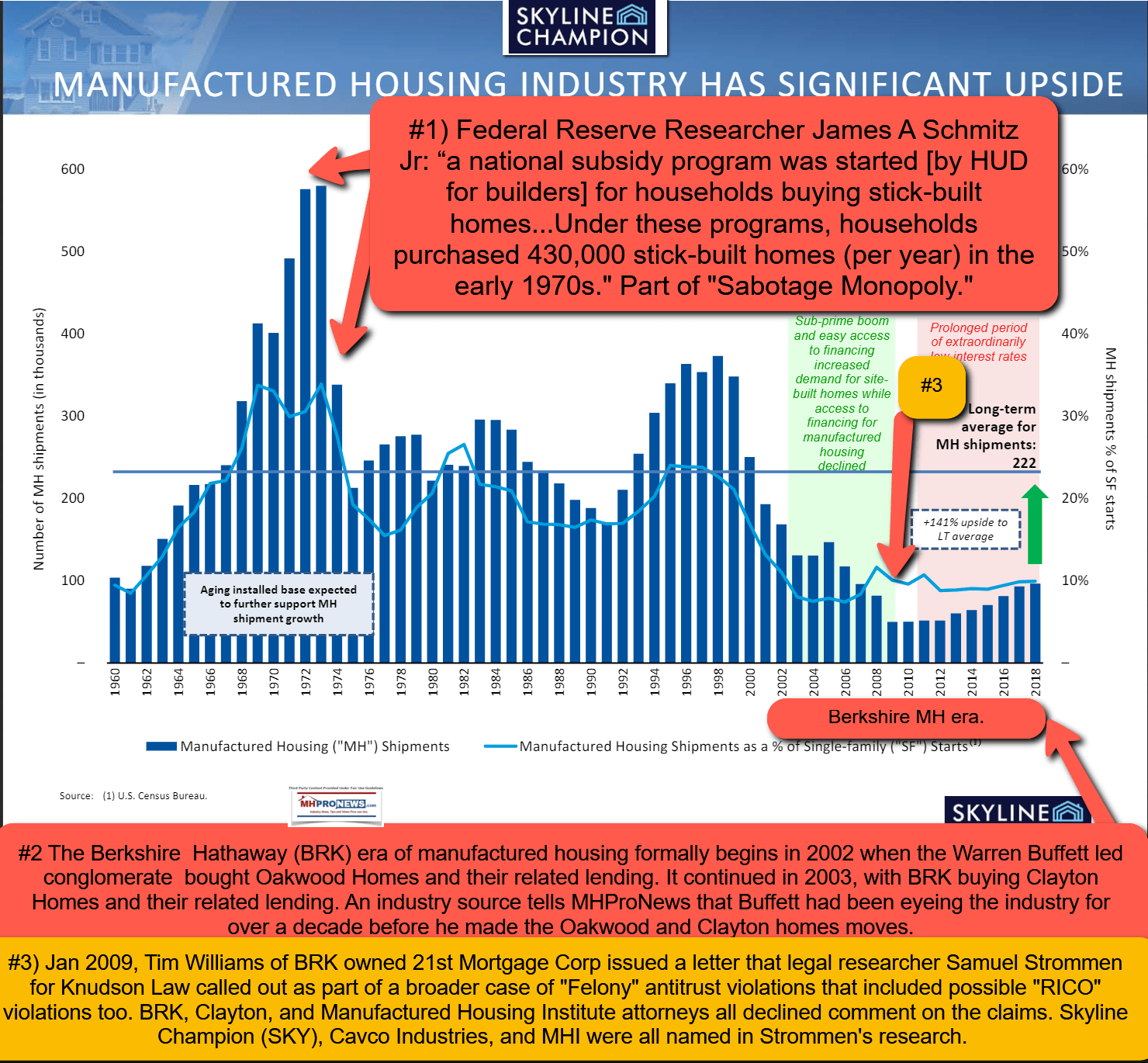

There are various segments to the manufactured housing industry. For instance, there is production and retail, both of which Skyline Champion has a presence in as a ‘vertically integrated’ company. There is the community sector, financing, suppliers, brokers, installers, transporters, professional service providers, etc. To fully understand the performance of Skyline Champion a look at the bigger industry picture is necessary. That includes a look at what is occurring in the communities sector, where the Manufactured Housing Institute (MHI) says that roughly 1/3rd of all shipments are going. If a placement wall occurs in the community sector, that’s a looming problem for manufactured home producers.

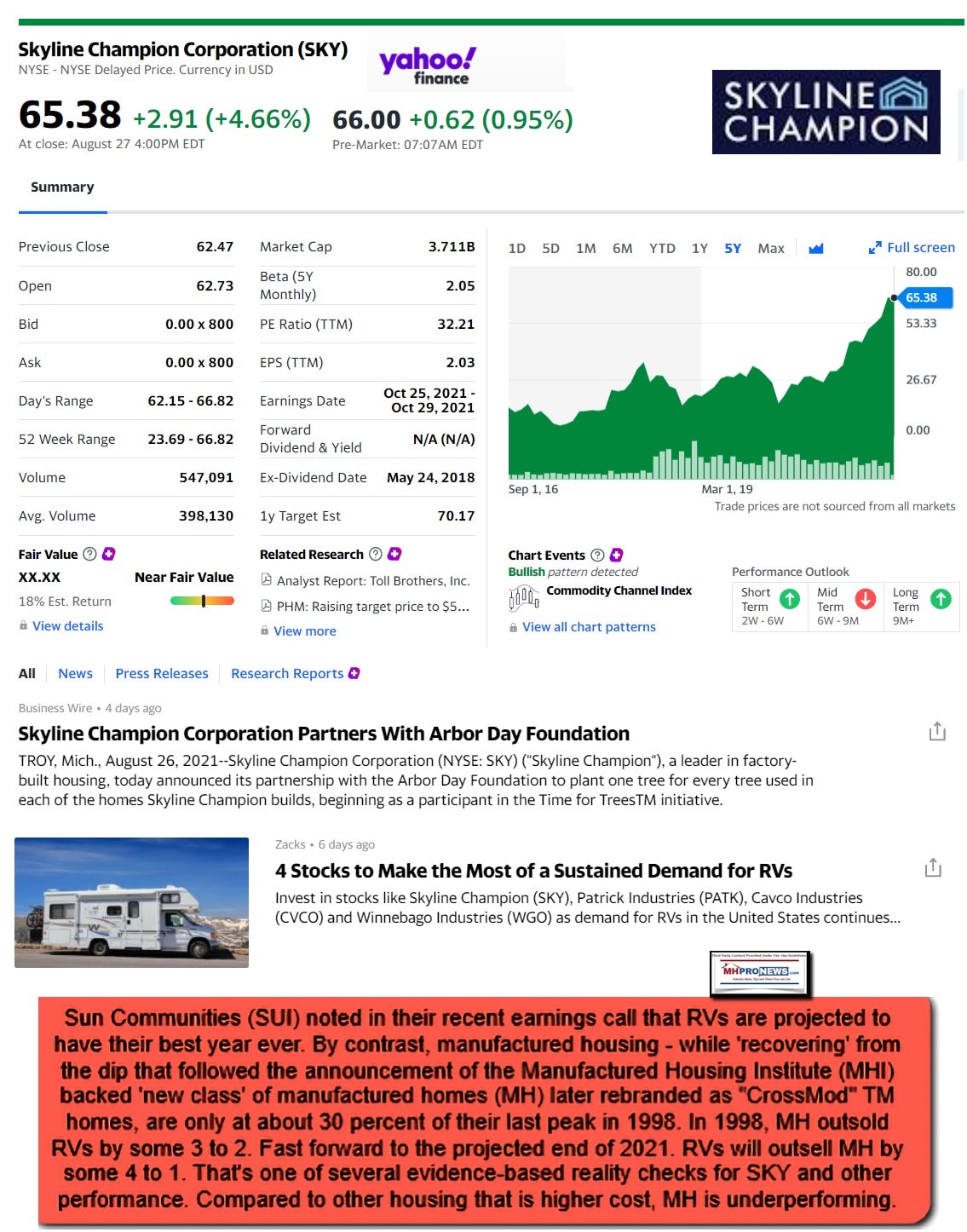

With that in mind, Sun Communities (SUI) noted in their recent earnings call that RVs are projected to have their best year ever.

By contrast to RVs, manufactured housing – while ‘recovering’ from the dip that followed the announcement of the Manufactured Housing Institute (MHI) backed ‘new class’ of manufactured homes (MH) later rebranded as “CrossModTM” homes, are only at about 30 percent of their last peak in 1998. In 1998, MH outsold RVs by some 3 to 2. Fast forward to the projected end of 2021. RVs will outsell MH by some 4 to 1. That’s one of several evidence-based reality checks for SKY and other performance. Compared to other housing that’s higher cost, MH is underperforming.

The June 2021 data and analysis are found below. August 2021 data is due in about a week. Watch for that here on MHProNews, because MHI abandoned publicly sharing their economic data some time ago. Nor do our rivals in publishing provide such factual information. Here at MHProNews, as the manufactured home industry’s documented largest and most-read trade publisher, facts, evidence, and rationale analysis all still matter. This report is an example of that which won’t be found anywhere else in MHVille.

Manufactured housing has been up since the spring, due in large part to the hyper demand for any housing. But the 2½ year record of slide – instead of unfulfilled claims for new markets and more growth that the Clayton-Cavco-Skyline Champion supported CrossMods were supposed to deliver – is documented and examined in the related report linked below.

Speaking of CrossModTM, Skyline Champion’s Mark Yost is on record promoting this apparently failed concept. See the reports linked above.

That noted, perhaps near the top of the questions that demanded a response from Skyline Champion leadership was the following.

RBC Capital Markets Managing Director Mike Dahl asked what might have been she sharpest questions. This is the question that should be asked by everyone in our profession that wants to see authentic, robust, and sustainable growth.

While that inquiry begged a follow up – because the response by Yost was tepid, incomplete, and perhaps deceptive at best – at least Dahl asked it. Good on him for that probing inquiry.

Frankly, Dahl’s question reveals one of the problems with such earnings calls with ‘analysists.’ Perhaps the analysists are not fully informed on manufactured housing. Perhaps in some instances they are part of the kabuki theater. There are numerous questions that could have been asked, but where not. That and more will be explored in a follow up to this report.

But briefly, Dahl’s question revealed that Yost and Laurie Hough may have provided some factually accurate information that was nevertheless incomplete. A close look at what they are doing or saying in some areas reveals what they are failing to do or say about others.

For instance. When “skilled” labor shortages are mentioned, what production insiders have told MHProNews is that labor can be trained faster on the factory floor than they can be by a site building contractor on a building site. When RVs and conventional builders are navigating several similar issues as well or better than manufactured home producers, that ‘unmasks’ some of the hidden or obscured problems that exist.

Long backlogs, as has been noted in our analysis with Cavco Industries, undermines a classic advantage of manufactured homes over conventional builders. See that and more in our read-hot report linked below.

3). To MF’s point that there are 10 stocks that they like better…are investors in Skyline Champion getting the most possible bang for their investment bucks? During a well-documented affordable housing crisis, why isn’t Skyline Champion – or other manufactured housing brands – growing faster, sustainably and more profitably?

That question is related to Dahl’s inquiry. The short answer must, based on the evidence and logic, is apparently NO.

- When several other Skyline Champion, Cavco, or other HUD Code producers factories can be successfully staffed, are objective people to believe that others can’t be too?

- When site builders and RV producers can staff well enough to produce record numbers of units, doesn’t that clearly mean that Skyline Champion could too?

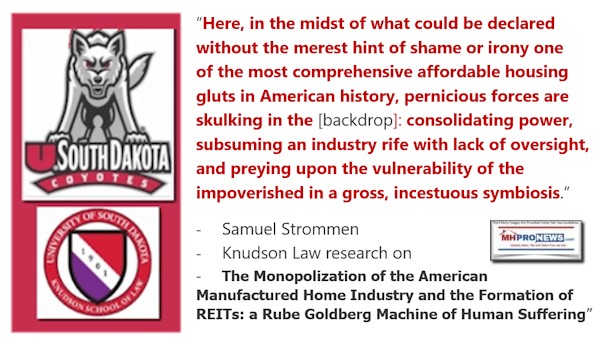

- The case can be made that there is apparent double-talk and ducking in what Skyline Champion has said above. Who says? Among others, third-party researchers like Samuel Strommen with Knudson Law. There has been little to no accountability by Skyline Champion leadership to investors for the unmasked realities found in revealing research such as those cited in the fact-packed and accountability focused reports linked below.

4). MHProNews Summary and Conclusion.

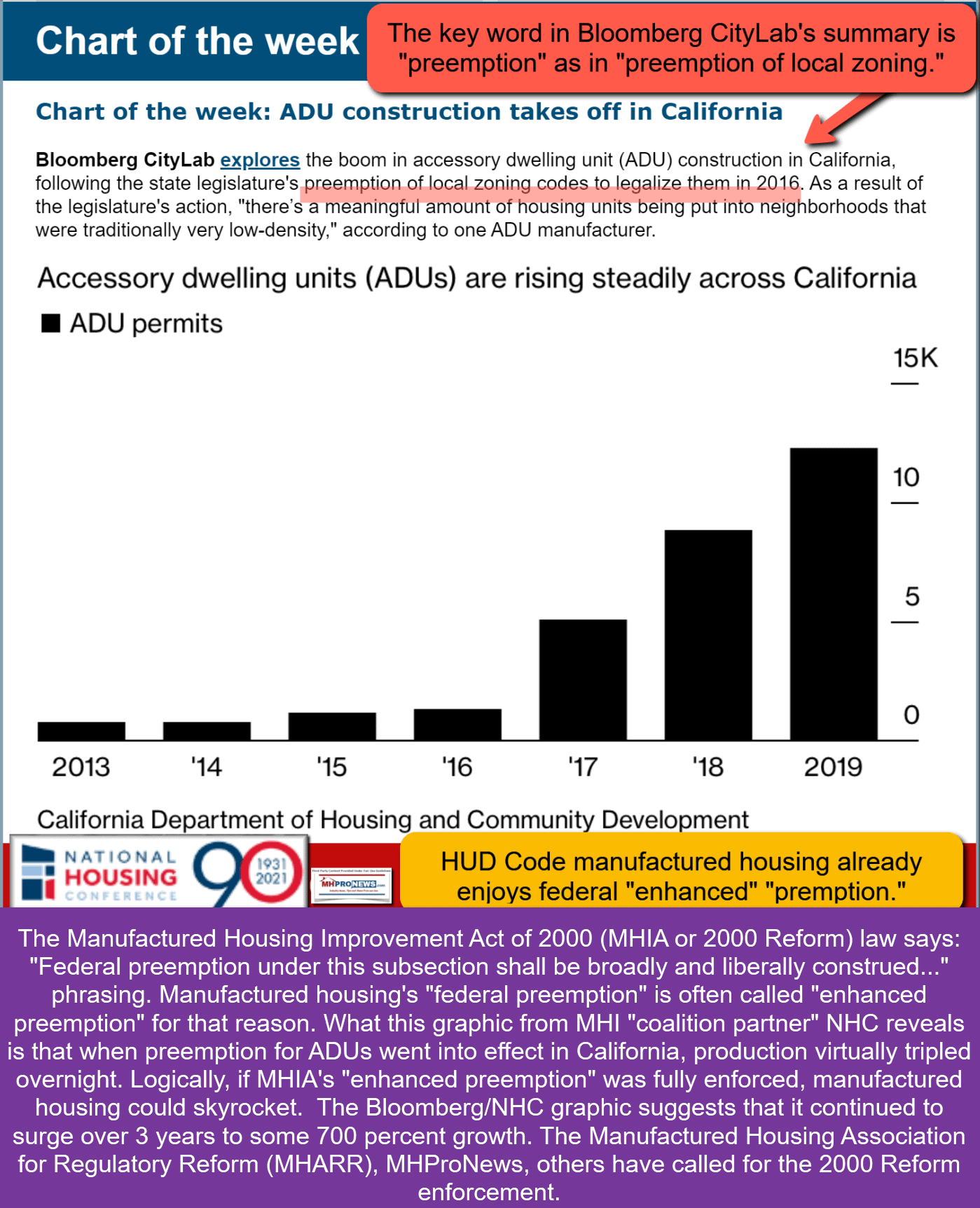

The role of media, we saw at the top, is not to be a stenographer for the connected and more powerful. It is utterly clear to those who have a deep grasp of the facts in manufactured housing that the industry has been manipulated from outside and within. The roaring growth of Accessory Dwelling Units (ADUs) in California point to the potential for manufactured housing too.

So, what might be the thought process behind getting some growth vs. far more growth? In no specific order of importance, consider the following.

- A). Corporate locations can better afford to weather the storm of long backlogs than an independent retailer can.

- B). There are multiple sources, inside and outside of manufactured housing, which have pointed to problems associated with MHI and their dominating brands working in a fashion that acts as a barrier for entry, persistence, and exit.

- C). This is underscored by the routine statement by big companies that are publicly traded that say they are more consolidation focused. When Skyline Champion or others clearly has the ability to buy a factory, they also have the ability to open a new one. When backlogs are long, that means there exists opportunities for re-opening or opening plants.

- D). All of this points to risks and short- to medium-term (perhaps long term too) lost return on investment by investors if such convoluted machinations were not being deployed.

To dot the i’s and cross the t’s of our analysis above, ponder this reply to MHProNews earlier today 8.30.2021: “I’ve not been contacted by either organization.” so said Kris Collins, Sr. Vice President for Economic Development for the Greater Waco Chamber when asked about any engagement, or lack therefor, by MHI and the Texas Manufactured Housing Association (TMHA) regarding the news report linked below.

While factory-builder S2A is planning dozens of new plants in the next 2 to 3 years, Skyline Champion’s leadership dares claim to their investor base that they can’t do similarly? That is arguably outrageously illogical.

As a closing programming notice, watch for an upcoming exclusive on Skyline Champion, planned for the near term. It will reveal more corporate information and then unpack it against other known and reason-based evidence, thinking, and objecting data.

Because at MHProNews, we take our role as a watchdog for white hats and the public seriously. ##

###

Our thanks to you, our sources, and sponsors for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.