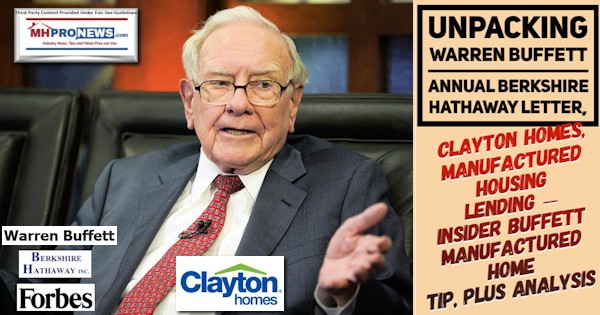

On February 27, 2021, Warren E. Buffett, Chairman of the Board for the Berkshire Hathaway conglomerate released his famed annual letter that accompanies their 2020 annual report. The report includes Clayton Homes and their associated units, but is of course not solely focused on that part of the conglomerates holdings.

This report will be part one with a planned follow up. To simplify, some notable distinctions occurred for those who are detailed minded. See the MHProNews report based on the 2019 annual letter linked below to begin to get a sense of the differences.

Following extended pull quotes from the 2020 annual letter and shareholders report will be additional information, plus initial MHProNews analysis and commentary. That segment of this report will include an exclusive tip by an insider that is Buffett, Berkshire, and manufactured housing focused.

Extended Quote from Buffett’s Annual Letter About Clayton Homes

“Let’s move somewhat east to Knoxville, the third largest city in Tennessee. There, Berkshire has ownership in two remarkable companies – Clayton Homes (100% owned) and Pilot Travel Centers (38% owned now, but headed for 80% in 2023).

Each company was started by a young man who had graduated from the University of Tennessee and stayed put in Knoxville. Neither had a meaningful amount of capital nor wealthy parents.

But, so what? Today, Clayton and Pilot each have annual pre-tax earnings of more than $1 billion. Together they employ about 47,000 men and women.

Jim Clayton, after several other business ventures, founded Clayton Homes on a shoestring in 1956, and “Big Jim” Haslam started what became Pilot Travel Centers in 1958 by purchasing a service station for $6,000. Each of the men later brought into the business a son with the same passion, values and brains as his father. Sometimes there is a magic to genes.

“Big Jim” Haslam, now 90, has recently authored an inspirational book in which he relates how Jim Clayton’s son, Kevin, encouraged the Haslams to sell a large portion of Pilot to Berkshire. Every retailer knows that satisfied customers are a store’s best salespeople. That’s true when businesses are changing hands as well.

When you next fly over Knoxville or Omaha, tip your hat to the Claytons, Haslams and Blumkins as well as to the army of successful entrepreneurs who populate every part of our country. These builders needed America’s framework for prosperity – a unique experiment when it was crafted in 1789 – to achieve their potential. In turn, America needed citizens like Jim C., Jim H., Mrs. B and Louie to accomplish the miracles our founding fathers sought.

Today, many people forge similar miracles throughout the world, creating a spread of prosperity that benefits all of humanity. In its brief 232 years of existence, however, there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking.

Beyond that, we retain our constitutional aspiration of becoming “a more perfect union.” Progress on that front has been slow, uneven and often discouraging. We have, however, moved forward and will continue to do so.

Our unwavering conclusion: Never bet against America.”

##

There is no mention of the loss of Jim Clayton’s brother, Joe Clayton.

Next, will be an extended quote from the Berkshire Hathaway 2020 Annual Report.

Building Products

Clayton Homes

Clayton Homes, Inc. (“Clayton”), headquartered near Knoxville, Tennessee, is a vertically integrated housing company offering traditional site-built homes and off-site built housing – including modular homes, manufactured homes, CrossModTM homes and tiny homes. In 2020, Clayton delivered 46,765 off-site built and 9,475 site-built homes. Clayton also offers home financing and insurance products and competes on price, service, location and delivery capabilities.

All Clayton Built® off-site homes are designed, engineered and assembled in the United States. As of December 2020, off-site backlog was $1.3 billion, up 237% from prior year. Clayton sells its homes through independent and company owned home centers, realtors and subdivision channels. Clayton considers its ability to make financing available to retail purchasers, a factor affecting the market acceptance of its off-site built homes. Clayton’s financing programs utilize proprietary loan underwriting guidelines, which include ability to repay calculations, including debt to income limits, consideration of residual income and credit score requirements, which are considered in evaluating loan applicants.

Since 2015, Clayton’s site-built division, Clayton Properties Group, has expanded through the acquisition of nine builders across 14 states with a total of 312 subdivisions, supplementing the portfolio of housing products offered to customers. Clayton’s site-builders currently own and control a total of 62,514 homesites, with a home order backlog of approximately $2.2 billion.”

##

Additional Graphics and Information from the 2020 Annual Report, Plus More MHProNews Analysis and Commentary

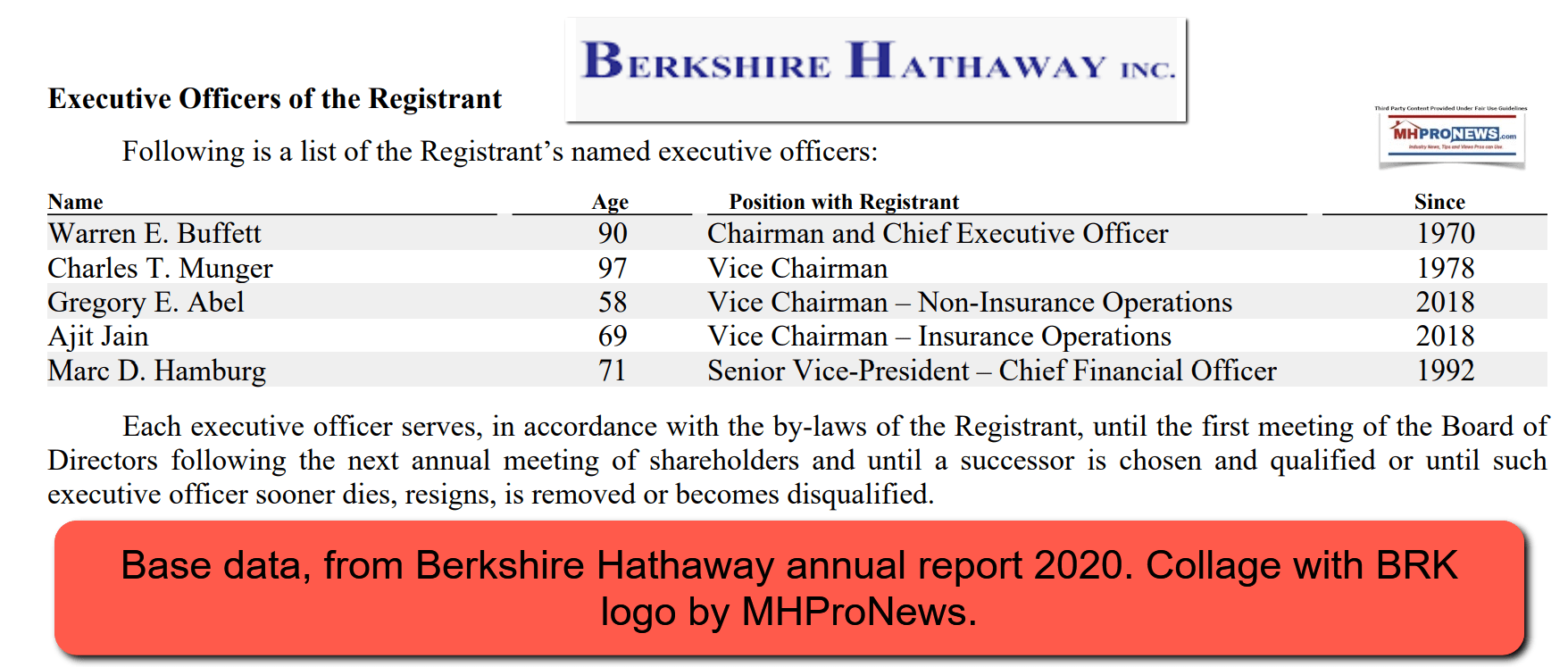

The age of senior Berkshire management is shown in the graphic below. Chairman Buffett at the time was 90, and his vice chair Charlie Munger 97.

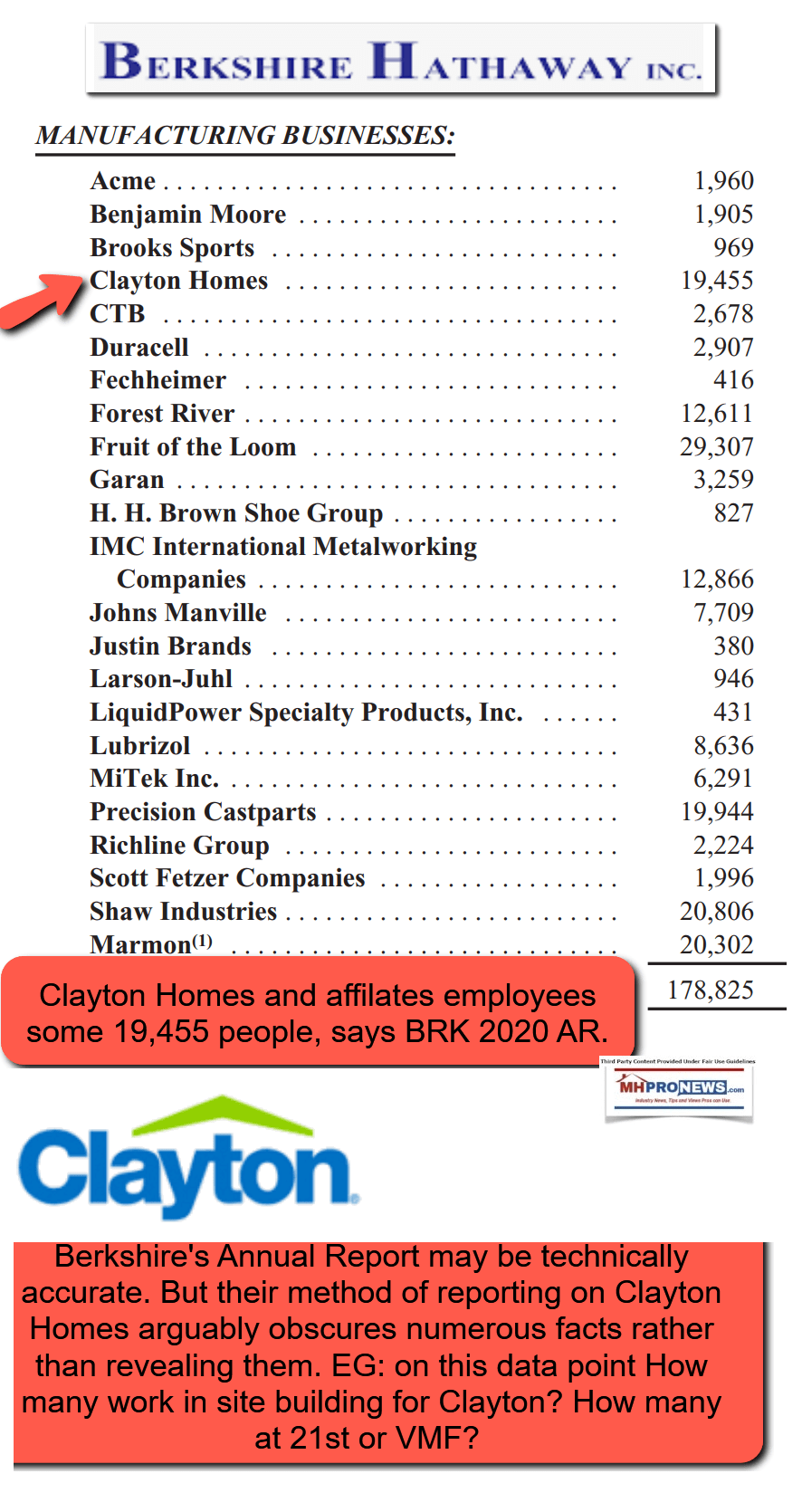

Clayton’s employment count, per the Berkshire (BRK) annual letter is as shown.

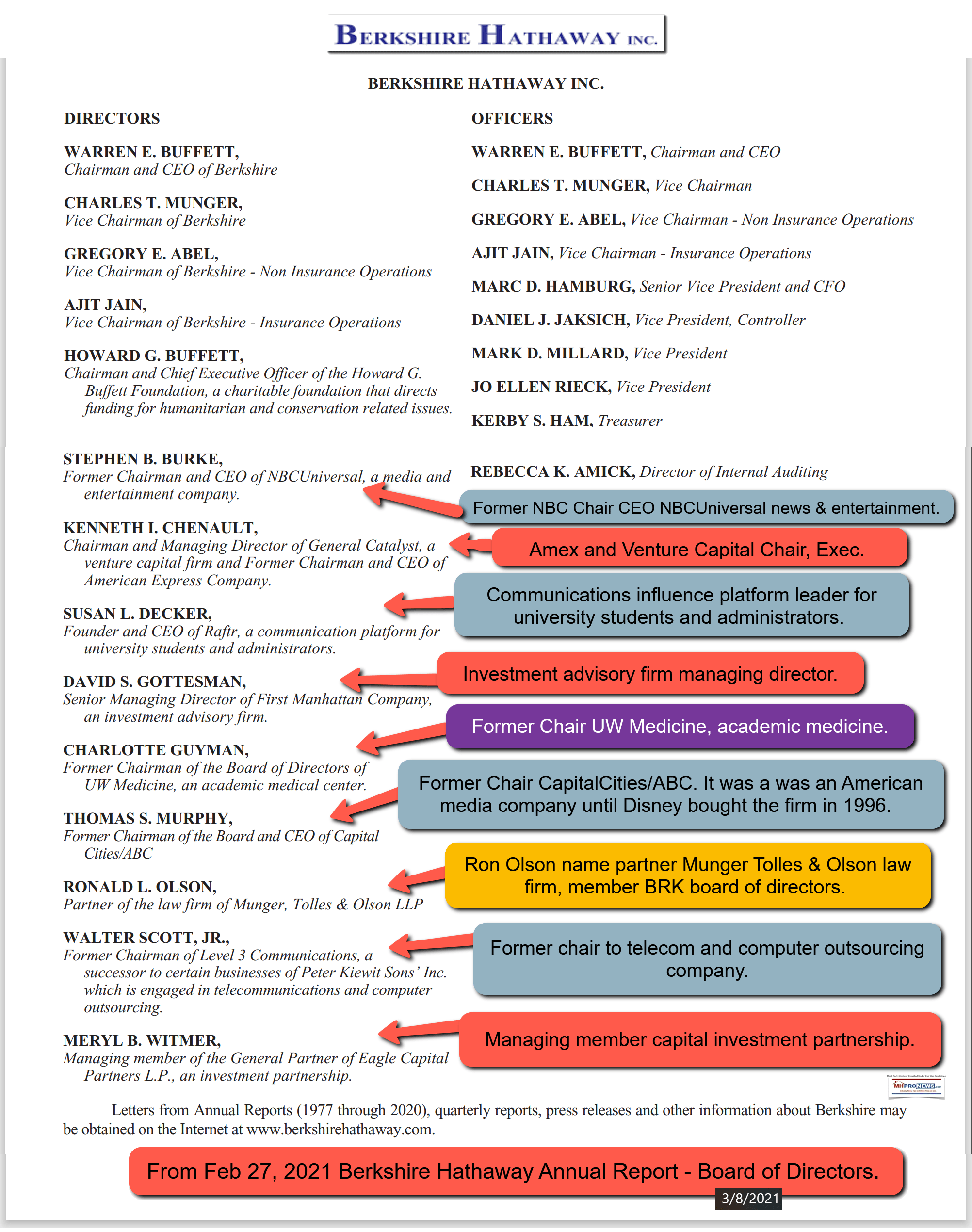

There are changes in the Berkshire board of directors – notably the departure of Bill Gates from their board – since the 2019 annual letter to this one in 2020. See our initial spotlight of the various economic sectors represented as shown below.

Additional items about Clayton related from the 2020 Annual Letter and Report by Berkshire are as follows.

Item 3. Legal Proceedings Berkshire and its subsidiaries are parties in a variety of legal actions that routinely arise out of the normal course of business, including legal actions seeking to establish liability directly through insurance contracts or indirectly through reinsurance contracts issued by Berkshire subsidiaries. Plaintiffs occasionally seek punitive or exemplary damages. We do not believe that such normal and routine litigation will have a material effect on our financial condition or results of operations. Berkshire and certain of its subsidiaries are also involved in other kinds of legal actions, some of which assert or may assert claims or seek to impose fines and penalties. We believe that any liability that may arise as a result of other pending legal actions will not have a material effect on our consolidated financial condition or results of operations.

—

From the top of K 51

Management’s Discussion and Analysis (Continued)

Manufacturing, Service and Retailing (Continued)

Building products

The building products group includes manufactured and site-built home construction and related lending and financial services (Clayton Homes), flooring (Shaw), insulation, roofing and engineered products (Johns Manville), bricks and masonry products (Acme Building Brands), paint and coatings (Benjamin Moore), and residential and commercial construction and engineering products and systems (MiTek).

2020 versus 2019

Revenues of the building products group increased $917 million (4.5%) in 2020 compared to 2019 and pre-tax earnings increased $222 million (8.4%) over 2019. Pre-tax earnings as percentages of revenues were 13.5% in 2020 and 13.0% in 2019.

Clayton Homes’ revenues were approximately $8.6 billion in 2020, an increase of $1.3 billion (17.1%) over 2019. The increase was primarily due to increases in home sales of $1.0 billion (18.4%), driven by increases in units sold and revenue per home sold and by changes in sales mix. Unit sales of site-built homes increased 28.6% in 2020 over 2019, while revenue per home increased slightly. Manufactured home unit sales increased 2.8% in 2020. Financial services revenues, which include mortgage services, insurance and interest income from lending activities increased 13.7% in 2020 compared to 2019, attributable to increased loan originations and average outstanding loan balances. Loan balances, net of allowances for credit losses, were approximately $17.1 billion at December 31, 2020 compared to $15.9 billion as of December 31, 2019.

Pre-tax earnings of Clayton Homes were approximately $1.25 billion in 2020, an increase of $152 million (13.9%) compared to 2019. The earnings increase reflected higher earnings from home sales, partly offset by higher materials costs, which lowered manufactured housing gross margin rates. Earnings in 2020 also benefitted from increased interest income, lower interest expense and higher earnings from mortgage services, partly offset by increased provisions for credit and insurance losses.

2019 versus 2018

Revenues of the building products group in 2019 increased $1.65 billion (8.8%) compared to 2018, while pre-tax earnings increased 12.8% over 2018. Pre-tax earnings as percentages of revenues were 13.0% in 2019 and 12.5% in 2018.

Clayton Homes’ revenues were approximately $7.3 billion in 2019, an increase of $1.3 billion (21.5%) over 2018. The comparative increase was primarily due to a 26% increase in home sales, reflecting a net increase in units sold and changes in sales mix. Unit sales of site-built homes increased 84% in 2019 over 2018, primarily due to business acquisitions, while average prices declined 5%. Manufactured home unit retail sales increased 5% and wholesale sales were 9% lower in 2019. Interest income from lending activities increased 6.7% in 2019 compared to 2018, attributable to increased originations and average outstanding loan balances. Aggregate loan balances outstanding were approximately $15.9 billion at December 31, 2019 compared to $14.7 billion as of December 31, 2018.

Clayton Homes’ pre-tax earnings were $1.1 billion in 2019, an increase of $182 million (20.0%) compared to 2018. The increase was attributable to home building activities, which benefitted from the increases in home sales, and to financial services activities. Pre-tax earnings from lending and finance activities increased 12%, primarily due to an increase in interest income attributable to higher average loan balances, increased earnings from other financial services and lower credit losses, partially offset by higher interest expense, attributable to higher average borrowings and interest rates, and by higher other operating costs.

Aggregate revenues of our other building products businesses were $13.0 billion in 2019, an increase of 2.8% versus 2018. Revenues increased for paint and coatings, hard surface flooring and roofing products, attributable to a combination of increased volumes, product mix changes and increased average selling prices, while sales of brick products declined.

The effectiveness of our internal control over financial reporting as of December 31, 2020 has been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report which appears on page K67.

Berkshire Hathaway Inc.

February 27, 2021.”

##

Compare 2020 with 2019’s report and analysis at the link below.

Now, let us introduce part one of what may be a more extended report in the near term that is manufactured housing specific.

An Official Buffett-Berkshire Clayton Acquisition Lie?

The comments that follow comes from an industry insider source. While they fly in the face of an ‘official’ narrative spun by Jim and Kevin Clayton – or Warren Buffett himself – it is to some extent corroborated by assertions made by Jennifer Reingold in Fast Company which claimed that the Buffett-Jim Clayton book story was a fine fable.

The broad brush strokes of the claim to MHProNews about Warren Buffett is this. Buffett, per this insider, was spying entry into manufactured housing over a decade before he made his move with Oakwood and then Clayton Homes.

Per Market Watch on Nov. 23, 2002, Buffett-led Berkshire did as follows.

“Oakwood Homes OKWH said that Buffett’s Berkshire Hathaway BRK.A, 1.62%, along with two other firms, have agreed to provide $215 million in debtor-in-possession financing to the troubled company, bringing its new liquidity facilities to a total of $415 million.

Oakwood announced it would take the Chapter 11 route on Nov. 15, citing “the continued poor performance of loans we originated in 2000 and before, as well as the deteriorating terms in the manufactured housing asset-backed securitization market into which we sell our loans.”

The company also said it was suffering from a declining recovery rate in the repo world, with all factors combining to result in its “loan servicing income being substantially eliminated,” while increasing the rates it has to pay for guarantees on paper it has previously issued.

Oakwood has been busily shuttering various manufacturing operations and turning out the lights on some retail operations in an attempt to stanch its losses, which totaled $119.8 million, or $12.61 per share, in its fiscal third quarter — wider than a loss of $50.2 million and $5.33 per share it recorded for the same period of 2001.

The credit infusion will buy the company more time in its restructuring efforts and CEO Myles E. Standish pronounced himself “delighted” with the new arrangements…

…Under terms of the deal, when and if the company crawls out of Chapter 11, Berkshire Hathaway will become its largest shareholder. Current investors, meanwhile, will “receive a nominal value, consisting solely of out-of-the-money warrants for approximately 10 percent of the post-restructuring common shares.””

Put differently, it was a classic Buffett value acquisition. That acquisition arguably alone should have shed light similar to what Jennifer Reingold stated in Fast Company. Even Kevin Clayton, who backed the official story in the video interview with transcript, linked below, made it plain that there was an ugly battle with stockholders. Several stockholders felt they were being misled on the valuation, and perhaps, more. See Reingold and Clayton’s statement for details.

This video from a Berkshire annual meeting has Warren Buffett telling his version of the official story. While some of those details fit what Kevin said, there are seemingly some minor differences too. Those distinctions may be more than the method or style of the speaker. It should also be noted that the tip from the insider, which MHProNews is still developing, is mildly corroborated by this video, as well as parts of what Reingold indicated.

The precise significance of this purported ‘official lie’ or official cover story may seem to be obscure. But it may well have to do with something quite simple. If Clayton Homes shareholders, prior to the Berkshire buyout felt that they were somehow played, that might have re-opened the can of worms legally that had already occurred when Berkshire fought legally to obtain Clayton.

As the New York Times framed it on July 31, 2003: “Berkshire Hathaway won a protracted battle yesterday to take over Clayton…” Kevin said it was perhaps the ugliest legal battle to that point that Berkshire had engaged in, per Buffett to Clayton.

The relevance?

There are several indicators that Buffett had long eyed an entry into manufactured housing. That insider tells MHProNews that it was over a decade of observations and probing by Buffett into the manufactured home market.

Clearly, Buffett must be keen on manufactured housing’s potential.

One must keep in mind that Buffett’s favorite holding period is ‘forever,’ but that he does make a change when he thinks it is warranted, as he did with IBM, the GSEs, or the airlines. A decade or more eyeing an industry, or specific units in an industry, would not be such a surprise for those who grasp Buffett’s mindset.

But alongside that, one must be mindful of Buffett and the moat that he preaches.

A close listen to that video posted above has Buffett speaking about manufactured housing. That video sheds light on several points that will be more closely examined in a follow up.

But for now, note that Buffett plainly says in that video that the ratio of manufactured housing’s market share versus conventional housing was higher then than it is today. So too was the total production and shipments since 2003.

MHProNews has asked numerous times over the years a rhetorical question. Are thinking people seriously supposed to believe that with Berkshire Bucks, Buffett’s nonprofit interests, and their mutual extensive ties to major media – who would believe that over 16 years later, the number of manufactured home sales would be lower now than then?

Further, with years of opportunities to educate the public – which Kevin on camera said they were planning an educational marketing campaign, and that was a decade ago – are objective minds to seriously question that Clayton is unable to advance manufactured housing sales?

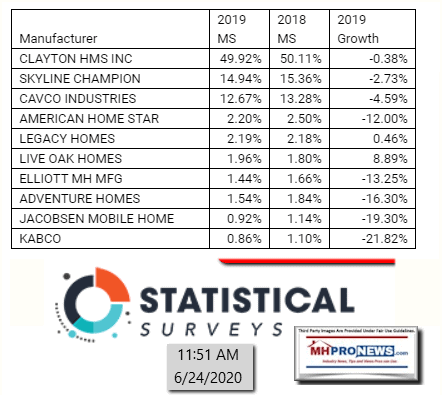

With that initial look, glance back at one pull quote from the Berkshire Annual Letter with respect to Clayton Homes: “Unit sales of site-built homes increased 28.6% in 2020 over 2019, while revenue per home increased slightly. Manufactured home unit sales increased 2.8% in 2020.”

Note that the claimed increased of conventional ‘site built’ housing sold by Clayton soared 10 times faster than manufactured homes?

- That “Unit sales of site-built homes increased 28.6% in 2020 over 2019, while revenue per home increased slightly. Manufactured home unit sales increased 2.8% in 2020.” should have banners and stars as one more signal to regulators or those who are pondering possible Clayton and Berkshire’s vulnerability to antitrust and possibly RICO legal action.

Why?

- Because if Clayton’s conventional housing sales can grow at such a brisk clip,

- if Clayton’s manufactured home sales can grow while the industry at large is in a slight dip,

- these are arguably further indicators from within Berkshire and Clayton itself that they are manipulating the market.

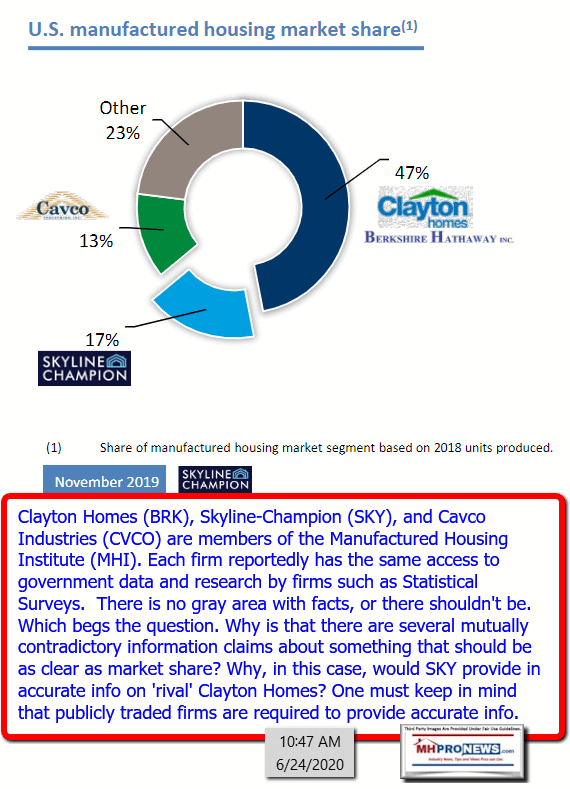

- Further, there is evidence that Clayton has purportedly colluded with others in the industry to conceal their actual market share.

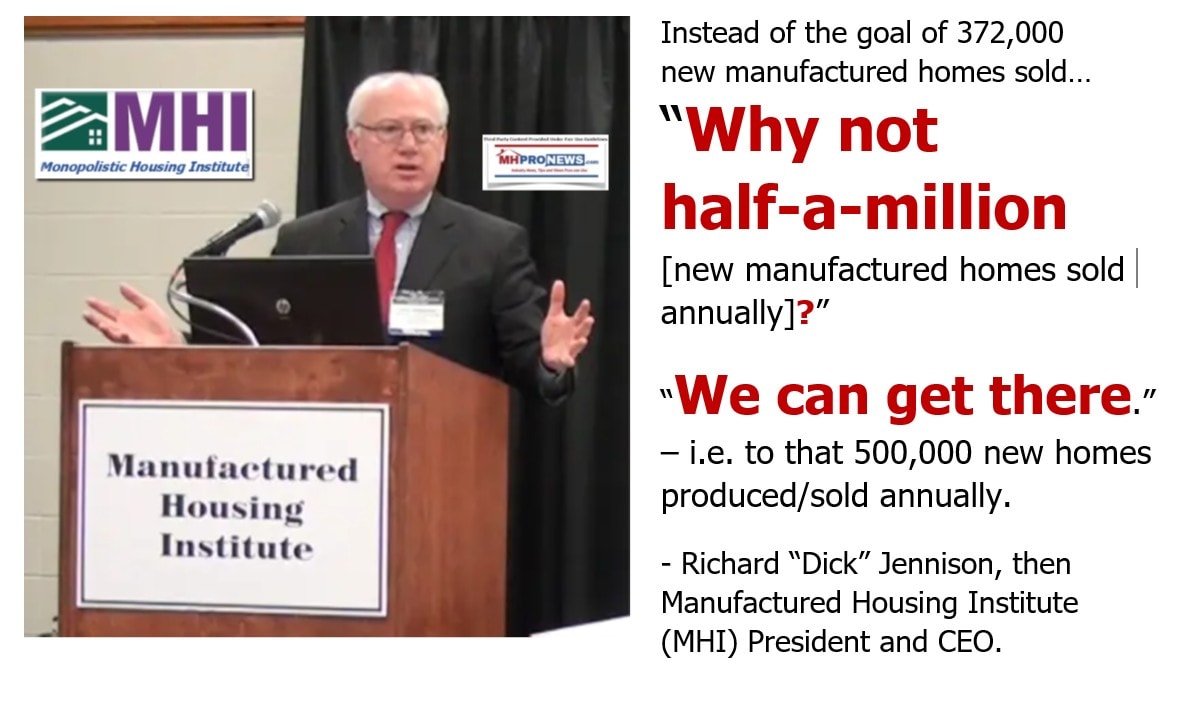

Indeed, as MHProNews and/or our MHLivingNews sister site has carefully documented by published comments as well as video statements, Tim Williams/21st arguably authorized – indeed pushed – Manufactured Housing Institute (MHI) President and CEO Richard “Dick” Jennison into saying that the industry should have a goal of 500,000 new HUD Code manufactured home sales.

These various factors, including what follows below, makes it very difficult for Clayton, 21st, Berkshire, MHI, or others in their legal and allied orbit to deny what their own people and surrogates have said.

What is entirely unmentioned in the Buffett letter or annual report, perhaps for good reasons, is any concern about possible antitrust action with respect to Berkshire and Clayton. There is a generic notice about legal issues, but nothing specific.

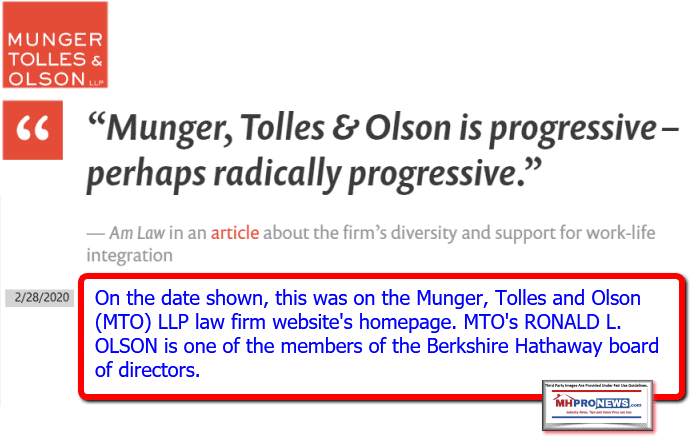

As our MHLivingNews sister site and MHProNews has previously reported, Buffett partner Charlie Munger and Munger’s MTO law firm has a named partner who is also a Berkshire board member. That is Ronald “Ron” Olson.

Olson was contacted about the report from Samuel Strommen at Knudson Law. See the below.

The MTO law firm for some time has proudly displayed on their law firm website the claim that MTO are “progressive – perhaps radically progressive.”

Why “Radically Progressive” Is an Interesting – and Disturbing Insight – on Several Levels

Indeed, in the common political sense of the term, MTO, Munger, and Buffett are progressive. Meaning, as “progressives” MTO supports leftist causes normally associated with the left-side of Democratic politics. Buffett, for instance, is said to be one of the largest financial supporters of abortion in the U.S. That lines up with Democrats pro-abortion stance. Buffett has referred to his partner Mungers as his partner in crime. They reportedly launched their own church to help promote abortion.

Per sources, the data reflects that a disproportionate number of those abortions are of blacks and minorities. Margret Sanger, the founder of what became Planned Parenthood was a eugenics supporter and a blatant racist.

As MHProNews previously reported in a news-analysis-commentary linked below, even before abortion was supported by the Roe v. Wade court decision, Buffett – a self-proclaimed atheist – and Munger set up their own church to provide support for abortion from what might appear to the uninformed to be coming from the Christian faith community. But of course, the vast majority of Christians have decried both abortion – and even artificial contraception – until 1930 and the Anglican church’s Lambeth Conference. “The London Times of June 30, 1930, predicted that the Lambeth Conference would change the “social and moral life” of humanity.” In retrospect, it did.

The support for contraception and eugenics fits the purportedly racist support of racial animus advanced by several others sources lodged against Clayton Homes. In the broader context of Buffett and Munger’s actions, doesn’t it seem to fit?

Indeed, a close look at how Buffett uses his money reveals that he has weaponized several nonprofits in a fashion that has arguably harmed the manufactured housing industry’s independents and consumers. So, there are not only racial concerns, there are broader ethical concerns that can be traced back to Buffett, his ‘charities,’ and how that has been deployed in the manufactured home industry.

That is not what true liberals might think of as “progressive.” But it fits much of what black professor and former Democratic party member Carol Swain has had to say about the true history of the Democratic Party.

Allegations of racial targeting and racial bias against Buffett-led Berkshire and their Clayton Homes and related 21st Mortgage Corp/Vanderbilt Mortgage and Finance (VMF) lending has cropped up from a variety of sources.

The evidence from company employees, past and present, suggests that these are people who are denounced for deception and other problematic tactics by their own team members.

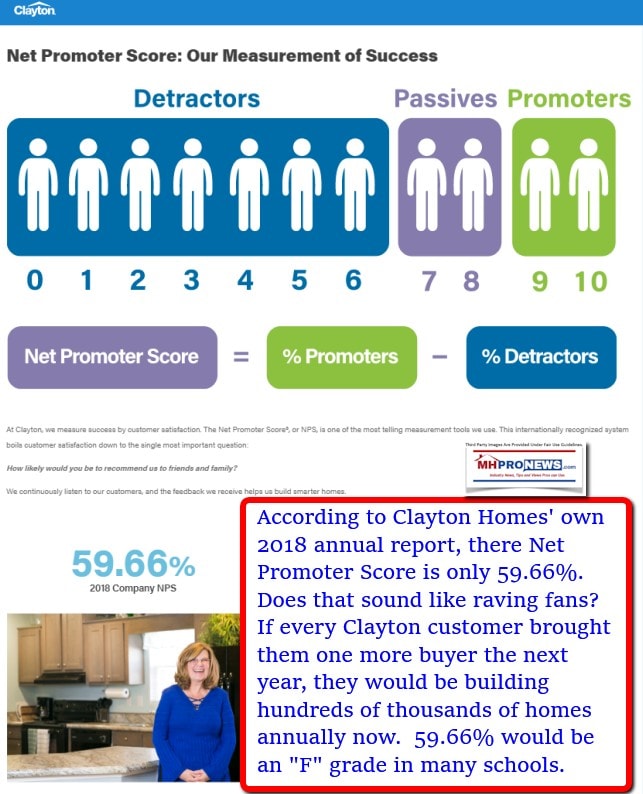

Clayton postures concern for costumers, gives something away now and then for the apparent PR value, but meanwhile some of their own data suggests significant numbers of unhappy customers.

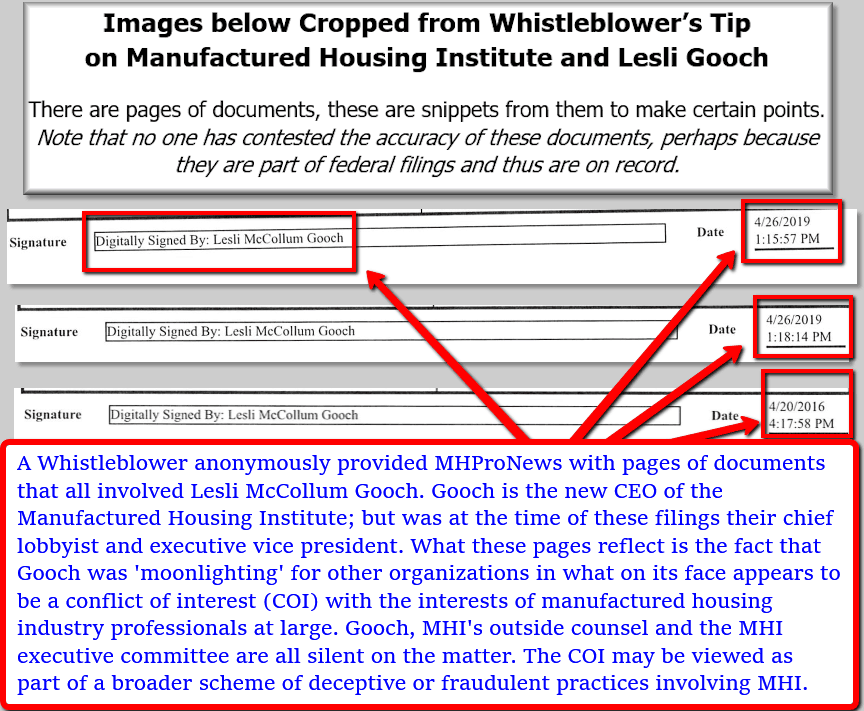

They nod yes on hiring and keeping people like Lesli Gooch, even after conflicts of interest or problematic history are revealed.

Who are these people?

There is no lack of evidence of problematic behavior by Buffett, Berkshire, or Clayton. Rather, once someone understands what they are looking for, and where to look, there may be too much evidence against them – if that is possible?!?

Summing Up This Initial Berkshire Letter Related Report?

One could spend days unpacking the clues and indicators in this report that will be part of the planned next part of this periodic series.

But in brief, a few things arguably become clear.

- Buffett and Clayton have been accused of paltering, deception, and misdirection many times. There are indicators that historically and more recently that pattern continues to fit Clayton Homes, their affiliated lending, nonprofit, and media-related behavior.

- Not to be missed is that the topside potential for manufactured housing is strong. After 2 decades of underperformance by historic standards, many in the industry today do not even realize what the industry’s potential is, unless they happen to be regular, attentive, and thoughtful readers of this site.

- While some have wrongfully accused MHProNews shedding light on what Ishbel Dickens, J.D. called the dark side of the industry in a fashion that harms the industry, the opposite is true. Only by spotlighting the causes of underperformance can the cures be applied. While our reports and those of the Manufactured Housing Association for Regulatory Reform (MHARR) differ significantly in style, much of the bottom line conclusions are similar.

All of that matters. But strategically, the case can be made that despite a Democratic regime in the White House and dominating Congress, these various factors could noted above and linked herein and further below could be the basis for a serious challenge to Clayton, Berkshire, their allies in MHI, MHAction, Prosperity Now, RV MH Hall of Fame, et al.

Just as Buffett has thought and acted long-term, so too those who want to challenge their purportedly illicit moat and predatory practices must do the same. Much of the industry – and large portions of the national population – could be brought to support such a move, based upon a solid series of evidence-based reports that their own attorneys and leaders have declined to even try to debunk.

As the late Robert F. Kennedy said, “Don’t get mad. Get even.” Does that sound anti-Christian? Or even anti-Jewish or Muslim?

As Scripture, says, “Woe to those who call evil good and good evil, who substitute darkness for light and light for darkness, who substitute bitter for sweet and sweet for bitter.” Isaiah 5:20 ASV.

“But if you do wrong, be afraid, for rulers do not bear the sword for no reason.” Romans 5:20. The Apostle Paul said that after the Resurrection of Jesus and Paul’s conversion. In a biblical commentary by What’s Wrong with the World, “Paul is referring to the civil government’s power to force” good behavior or punish wrongdoing.

“Jesus said, for truly I tell you, until heaven and earth disappear, not the smallest letter, not the least stroke of a pen, will by any means disappear from the Law until everything is accomplished.” – Matthew 5:18 NIV. Let’s be clear. In almost any major world religion, wrongdoing is to tried, judged, and punished. It is a false narrative designed to hobble those who would do good and avoid evil to try to water down the truth of faith.

From the days centuries before Christ when Moses came down from Mount Sinai with the Ten Commandments in hand, punishment has existed for theft, lies, deception, and more. Jesus said none of that was changed. Other world religions treat it the same.

One reason MHProNews has dipped into the thinking of Robert F. Kennedy Jr., a lifelong Democrat, is because he has called to account people like Bill Gates, Jeff Bezos, Warren Buffett, and others.

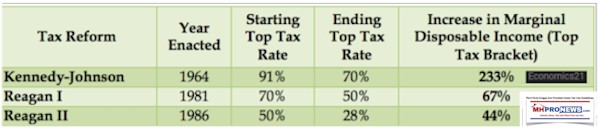

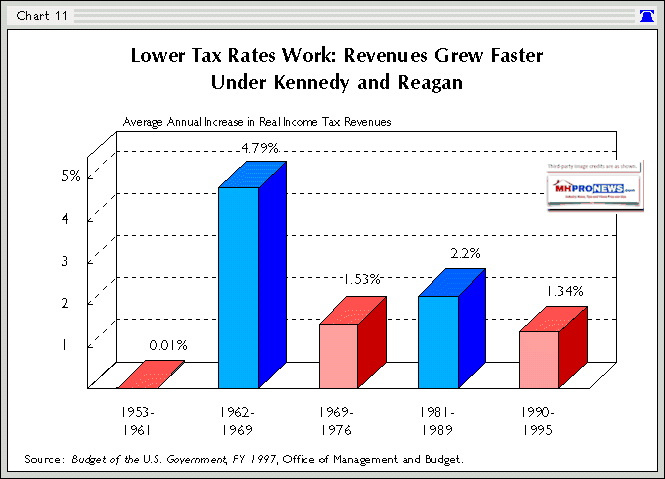

This manipulation of politics and business is not about sincere Democrats or sincere Republicans. For example, if one looks at President John F. “Jack” Kennedy (D), and then compares his tax plan with Ronald Reagan (R), there are clear similarities. Both plans worked.

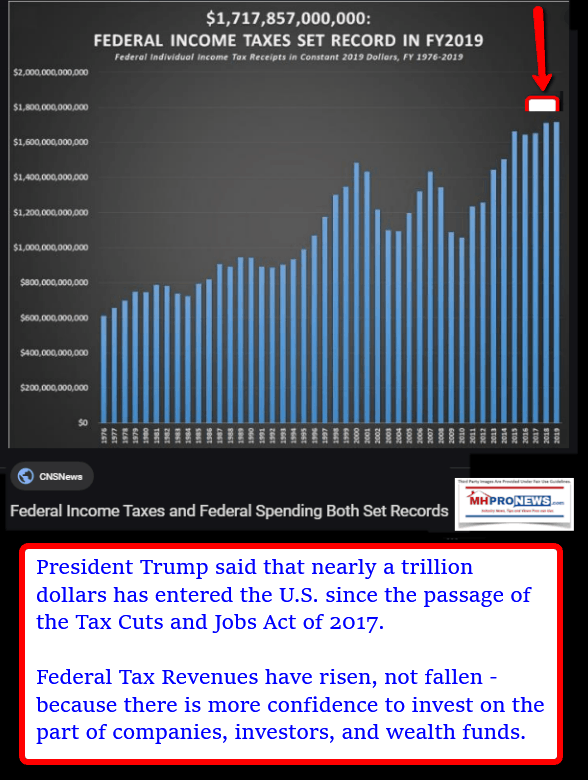

Before the COVID19 pandemic was declared, in a similar fashion, the Trump tax cutes were generating more revenue to the Treasury then before the tax cuts.

A pro-Democratic industry leader recently told MHProNews that he favored many of President Trumps policies and outcomes, it was his personality that he was not keen about. That is not an uncommon perspective. But it is serious voices from the left – one might call them ‘true liberals’ – that are decrying what is occurring during this Biden-Harris regime.

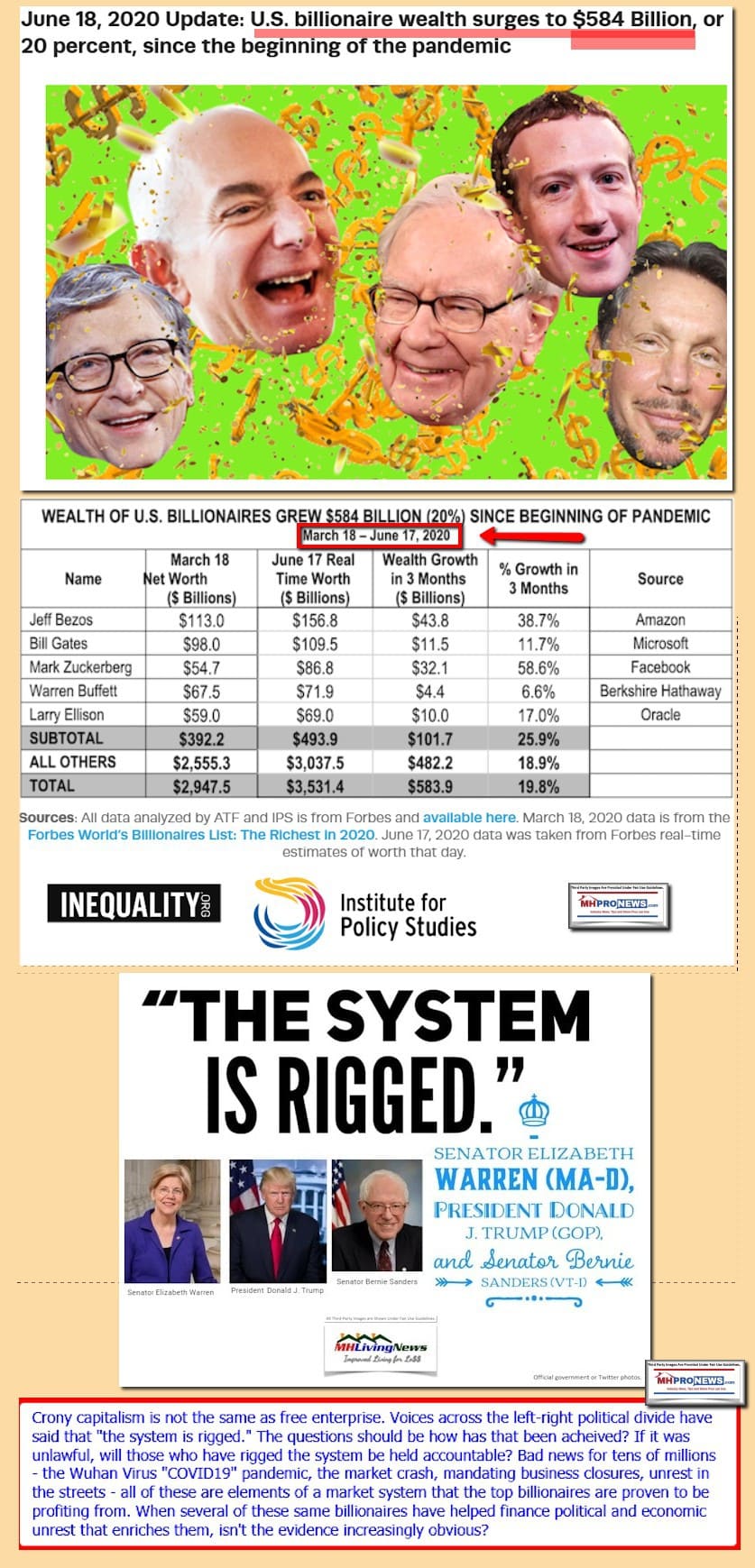

The case can be made that Buffett and his billionaire buddies are part of a long-line of market manipulators. Who says? How about his own ally, Bill Gates?

The value of history, nay, the critical need for authentic history to look into what was said vs. what has in fact occurred in our profession and several others that are steadily consolidating must be dispassionately viewed. One does not need to be a Democrat to agree with the keen insight from House Majority Whip James Clyburn (SC-D), who was and is a historian before entering Congress, who made the keen point about how history tells us how we got to where we are.

Anything that has happened before can happen again.

Clayton, their parent company, and their allies have not tried to dispute the ‘case’ against them.

The time to start acting on that ever-growing case is arguably approaching. More on that in the days ahead.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)