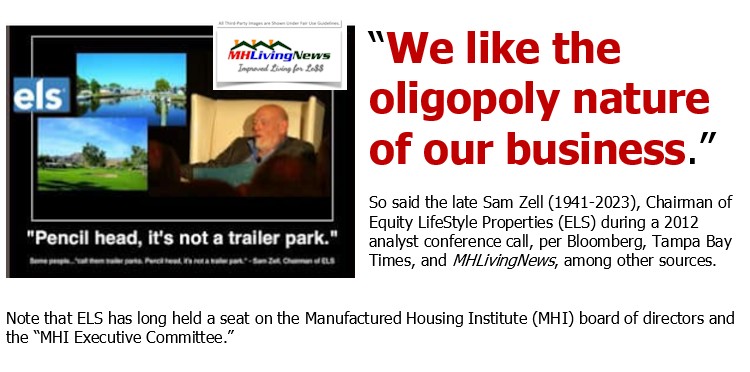

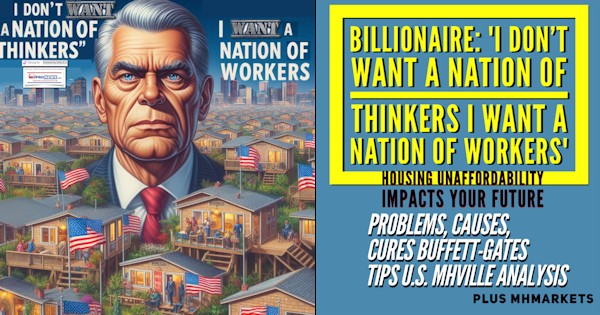

If you are a Millennial or Gen Z, you may be out of luck, as the remarks by Marguerite M. Nader, President and Chief Executive Officer (CEO) of Equity LifeStyle Properties, Inc. (ELS) in their most recent earnings call suggest. You need to be, per Nader, in an older age cohort: “We [ELS manufactured home (MH) and recreational vehicle (RV) communities] are in locations where active adults [55+] want to be. Our customer base is seeking a place to escape from the cold winter and lead an active lifestyle in locations such as Florida, Arizona and California.” “We are in states where there is outsized growth in seniors and we appeal to the right demographic. The population of people aged 55 and older in the U.S. is expected to grow 15% from now until 2039, with 10,000 baby boomers turning 65 each day for the near future.” So, Gen Alpha, Gen Zers, and millions of Millennials can expect to be out of luck, much as a recent report about the findings of a younger real estate agent linked here documented. As longtime, evidence, and detail-mined readers of MHProNews should know by now, we do not want to waste your time with meaningless trivia. Every report has a significant purpose. Patient, parasitical, slow-motion manipulation is viewed by some as more effective at screwing over tens of millions of Americans then sudden and obvious upheavals. Often older white men have made it plain that class warfare in an oligarchical and apparently feudalistic fashion is part of their game. Millions have been turned into what Merriam Webster would define as useful idiots. Insiders alone into their exclusive clubs those who demonstrate that they understand how the game is played. All others are outsiders, either willing to scratch or claw their way into that feudalistic moat-builders club, or they are effectively treated as canon fodder to be used up and dispensed with. If hundreds of thousands today, potentially millions in the years ahead, end up living on the streets, under bridges, in city parks, or squatting in people’s vacant properties, well, that is the price of this ‘modern’ form of feudalism. Who says? Ironically, often left-leaning sources such as the Financial Times and the Nation. A look at the links in this paragraph will reveal that these are not mere theories. These are routinely the remarks of the various insiders themselves. All that someone has to do is be willing to have the chutzpah or cojones to speak the truth with a bright enough light shining on the facts of the subject at hand. Yet ironically, these facts, quotes, and related insights are routinely not mentioned by the Manufactured Housing Institute (MHI), nor by MHI-linked trade media or bloggers. This despite the fact that MHI has a code of ethical conduct and antitrust related statements that are purportedly their ‘policy,’ perhaps better understood as window dressing. ELS has long had a seat on the board of directors of MHI.

Part I of this report is based on the Wednesday, Apr 24, 2024, Thomson Reuters (or other sources) which released their transcript of the Equity LifeStyle Properties, Inc. (NYSE:ELS) Q1 2024 Earnings Call.

Part II of this report is additional information with more MHProNews analysis and commentary. Newcomers, these ARE NOT superficial reports. Rather, these are deep dives into the actual statements of the parties involved. Those statements are then compared to others that the same source, and/or others exploring them, have pointed out. If you need a coffee, tea, power drink or something more relaxing, if you need a snack, grab it and let’s go as we dig into the headline remarks and others that reveal just how devastating the “monopolistic” “moat building” business practices of some are to tens of millions who are being robbed of their part of the American Dream, because a relatively few people believe that they can do so and get away with it.

The highlighting in what follows in Part I, which is provided under fair use guidelines, are added by MHProNews. Much of that is explored in Part II.

Let’s be blunt. In order to understand why the manufactured housing industry is so ‘soft‘ and why the industry’s production is so ‘weak‘ routinely boils down to a relatively few patterns of behavior that often includes key members of MHI, which includes ELS, but is not limited to that firm. Furthermore, and more in the niche that ELS primarily operates in, by allowing (tolerating, and in some ways by some apparently notorious players encouraging) the industry’s product to routinely be zoned out. In making that claim, MHProNews reminds new and longer-term readers that not all MHI members are ‘in on it.’ Firms are members of MHI for a variety of reasons, including because they were invited in by an MHI member, and then they may become the target for acquisition. Limited new development is part of the clearly stated business strategies deployed for ELS, Flagship, Sun Communities, and others.

Let’s continue to be blunt. There are obvious reasons why apparently thousands of employees are unhappy at several key MHI member firms, including, but not limited to, ELS.

Part I

Equity LifeStyle Properties, Inc. (NYSE:ELS) Q1 2024 Earnings Call Transcript

Q1 2024 Equity LifeStyle Properties Inc Earnings Call (yahoo.com) Reuters

Thomson Reuters StreetEvents

Wed, Apr 24, 2024, 2:36 AM EDT36 min read

Participants

Marguerite M. Nader; President, CEO & Non-Independent Director; Equity LifeStyle Properties, Inc.

Patrick Waite; Executive VP & COO; Equity LifeStyle Properties, Inc.

Paul Seavey; Executive VP, CFO & Principal Accounting Officer; Equity LifeStyle Properties, Inc.

Anthony Hau; Associate; Truist Securities, Inc., Research Division

Eric Wolfe

James Colin Feldman; Equity Analyst; Wells Fargo Securities, LLC, Research Division

John Joseph Pawlowski; MD of Residential and Health Care; Green Street Advisors, LLC, Research Division

John P. Kim; MD & Senior U.S. Real Estate Analyst; BMO Capital Markets Equity Research

Joshua Dennerlein; VP; BofA Securities, Research Division

Keegan Grant Carl; Research Analyst; Wolfe Research, LLC

Michael Goldsmith; Associate Director and Associate Analyst; UBS Investment Bank, Research Division

Samir Upadhyay Khanal; MD & Equity Research Analyst; Evercore ISI Institutional Equities, Research Division

Wesley Keith Golladay; Senior Research Analyst; Robert W. Baird & Co. Incorporated, Research Division

Presentation

Operator

Good day, everyone, and thank you for joining us to discuss Equity LifeStyle Properties’ First Quarter 2024 Results. Our featured speakers today are Marguerite Nader, our President and CEO; Paul Seavey, our Executive Vice President and CFO; and Patrick Waite, our Executive Vice President and COO. In advance of today’s call, management released earnings. Today’s call will consist of opening remarks and a question-and-answer session with management relating to the company’s earnings release. (Operator Instructions) As a reminder, this call is being recorded.

Certain matters discussed today on this conference call may contain forward-looking statements in the meanings of the federal securities laws. Our forward-looking statements are subject to certain economic risk and uncertainty. The company assumes no obligation to update or supplement any statements that become untrue because of subsequent events. In addition, during today’s call, we will discuss non-GAAP financial measures as defined by SEC Regulation G.

Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are included in our earnings release, our supplemental information and our historical SEC filings. At this time, I would like to turn the call over to Marguerite Nader, our President and CEO.

Marguerite M. Nader

Good morning, and thank you for joining us today. I am pleased to report the results for the first quarter of 2024. Quality of our cash flow, our in-demand location, the lack of new supply and the strength of our balance sheet continue to allow us to report impressive results. In Marguerite M. Nader;times of macroeconomic uncertainty, we continue to deliver strong revenue growth as well as expense control throughout our portfolio. Our core NOI for the quarter was strong with a 7.1% increase compared to last year, supported by MH and RV rate growth and controlling expenses.

Our results for the first quarter and our view for the continued strength for the remainder of 2024 support our guidance rates. Over a 10-year period of time, we have increased the dividend on average 14% compared to the REIT average of 5.5%. Our balance sheet is in great shape with an average term to maturity of 9 years, 18% of our debt is fully amortizing and not subject to refinance risk and our debt maturity schedule through 2026 shows only 11% of our debt coming due compared to the REIT average of 29%.

We have spent the last 30 years building a portfolio focused on high-quality coastal and Sunbelt retirement and vacation destinations. We are in locations where active adults want to be. Our customer base is seeking a place to escape from the cold winter and lead an active lifestyle in locations such as Florida, Arizona and California. We are in states where there is outsized growth in seniors and we appeal to the right demographic. The population of people aged 55 and older in the U.S. is expected to grow 15% from now until 2039, with 10,000 baby boomers turning 65 each day for the near future.

Our MH portfolio comprises approximately 60% of our total revenue and our properties are 95% occupied. The MH business is unique in that once an elevated level of occupancy is achieved at a property, the occupancy is sustainable for a long time. For ELS, the key to that stickiness is an elevated level of homeowners in the portfolio. Our portfolio is 96% occupied by homeowners. This composition of our resident base is important to protect an uninterrupted cash flow stream as new residents are welcome to our communities.

Our residents enjoy the community found in our properties and spend time focused on building new relationships with their fellow residents. We continue to engage our existing customers and attract new prospects through media outreach engaging in social media campaigns and targeted digital advertising. Our public relations strategy helps build awareness and credibility through coverage of the lifestyle offered at our properties and interesting stories about our customers who make a difference in the communities in which we operate.

Our social media strategy seeks to engage both customers and prospects in a wide variety of platforms so we can reach people where they spend time. We have almost 2 million fans and followers across social media networks. Over the past 10 years, we have grown our social media fans and followers by an average of 19% annually. Our property teams in the north are gearing up to open the summer season. This year, Thousand Trails will celebrate its 55th anniversary. Thousand Trails is one of America’s most well-known Camping brands, and we have earned strong customer loyalty with hundreds of thousands of our peers, making memories with families and friends throughout the camping through the company’s long history.

We have closed another successful quarter and our teams will now begin to focus on welcoming our residents to our northern locations as we kick off the summer season. I would like to thank all of our team members for their hard work in making this winter season so successful. I will now turn it over to Patrick to provide an operational overview.

Patrick Waite

Thank you, Marguerite. As we wind down the 2023, 2024 Sunbelt season and look forward to the 2024 summer season, I will provide color on the Sunbelt season results and a view into the summer season, including drivers of demand. Overall, we continue to see consistent demand across each of our lifestyle property types, reflecting the high quality of our property locations.

I will start by highlighting our MH business. Over my 30 years in the industry, my responsibilities have ranged from acquisitions to asset management to operations. And regardless of my area of focus, the consistency of our high-quality MH portfolio has been a constant. MH properties operate year-round and seasonality is not a consideration. Our MH portfolio maintains high occupancy, and each year, approximately 10% of our residents turns over.

This turnover results in an uninterrupted revenue stream for ELS as a current homeowner sells their home to an incoming home buyer and the new resident pays market rent. Year-to-date, we have seen an average rent increase of 5.6% to renewing residents. Our resident base generally consists of retired individuals who are cash buyers. Due to the high homeowner base in our portfolio, occupancy is resilient and the delinquency rate is very low, which is reflected in bad debt that is typically 40 to 45 basis points of revenue. This low level of delinquency has been consistent over the last 30 years in all economic cycles.

Moving to the RV portfolio. The Sunbelt season runs from December to April, peaking in February, and demand is largely comprised of snowbirds from the Northern U.S. and Canada, seeking out the temporary climate of Florida, California, Arizona and Texas. In Q1, annuals delivered steady occupancy and strong rate growth. Combined seasonal and transient increased in line with expectations, supported by demand with consistent rate growth. I’d also note that nearly 50% of our seasonal revenue for the full year comes to us in Q1 during the Sunbelt season, while Q1 transient represents less than 20% of the full year transient revenue.

We are now looking forward to the summer season, which is comprised of the 100 days of camping from Memorial Day to Labor Day and spans 14 weeks. This is the time that our annual customers at 125 summer resorts and campgrounds visit their getaways on weekends, holidays and summer vacations. Summer season annuals have a vacation or lakehouse basically their resort cottage or park model located on one of our properties.

The resorts are now active with customers focused on spring cleaning and getting their homes ready for summer activities. These customers are from the local or regional submarkets and are typically a 1 hour to 1.5 hour drive from their homes to their campgrounds. In contrast to the overweight of seasonal revenue in the Sunbelt season, during the summer season, approximately 2/3 of our transient revenue for the full year is earned in the second and third quarters. Our reservation pace is similar to last year with the holiday weekends in demand.

While booking windows are similar to last year, the booking window was short, and therefore, we have limited visibility. More than 50% of transient reservations are booked within 10 days of arrival and are subject to short-term disruptors like weather. Finally, I would like to focus on our home sales efforts. Over the last 5 years, we’ve sold 4,500 new homes. Investing in these new homes is an upgrade for the community. The new homes construction quality meets stick-built construction standards, including primary bedrooms with walking closets, open floor plant kitchens with high-end, high-efficiency appliances and exterior finishes like gable roof and architectural shingles, and they remain affordable when compared to other housing options.

We’ve been able to . The aging trends from 70 million baby boomers who are currently moving through their retirement years to almost 140 million combined Gen Xs and Millennials who will follow the boomers into their own retirement years, all support generational demand for MH and all of our property offerings for decades to come. I’ll now turn it over to Paul.

Paul Seavey

Thanks, Patrick, and good morning, everyone. I will review our first quarter 2024 results and provide an overview of our second quarter and full year 2024 guidance. First quarter normalized FFO was $0.78 per share in line with our guidance. Strong core portfolio performance generated 7.1% growth in the quarter, also in line with our expectations. FFO was $0.86 per share and includes $14.8 million of insurance recovery revenue that has been deducted from normalized FFO.

Core community-based rental income increased 6.4% for the quarter compared to 2023, primarily as a result of noticed increases to renewing residents and market rent paid by new residents after resident turnover. We increased homeowners by 123 sites in the quarter. Rental homes currently represent 3.1% of our MH occupancy. First quarter core resort and marina-based rental income increased 5.8% compared to 2023. Rent growth from annuals in the first quarter was 8%.

As a reminder, 2024 is a leap year, which results in an additional day of revenue allocated to the first quarter, resulting in higher rate growth than we expect in the subsequent quarters of 2024. Our first quarter rent from core RV seasonal and transient generally performed in line with expectations. Seasonal rent increased 2.4% and transient rent increased 1.4% compared to first quarter 2023. For the first quarter, the net contribution from our membership business, which consists of annual subscription and upgrade sales revenues offset by sales and marketing expenses, was $14.9 million, an increase of 3% compared to the prior year.

The net deferral impact for the quarter was $3.2 million. Subscription revenues increased 2.7% as a result of rate increases effective for 2024. During the quarter, we sold just over 800 upgrades. Our average upgrade sale price increased 4% with the percentage of sales attributed to our adventure upgrade product, representing 28% of our first quarter 2024 sales. Core utility and other income increased 5.6%, which includes pass-through recovery of real estate tax increases from 2023.

Our utility income recovery percentage was 46.5%, about 70 basis points higher than the first quarter of 2023. First quarter core operating expenses increased 3.9% compared to the same period in 2023. Growth in real estate taxes and insurance reflect the run rate impact of increases that took effect after the first quarter of 2023. Repairs and maintenance decreased compared to 2023 when we incurred expenses to recover from several winter storms.

Utility expenses reflect moderating rate growth along with reduced gas consumption, particularly in California. We renewed our property and casualty insurance programs at April 1, and the premium increase was approximately 9%. We are pleased with the result, which reflects no change in our program deductibles and expansion of coverage limits for named wind storm damage. Core property operating revenues increased 5.8%, while core property operating expenses increased 3.9%, 50 basis points lower than the midpoint of our guidance, resulting in growth in core NOI before property management of 7.1%, 10 basis points higher than the midpoint of our guidance.

Our non-core properties contributed $5.3 million in the quarter, in line with our expectations. The press release and supplemental package provide an overview of 2024 second quarter and full year earnings guidance. The following remarks are intended to provide context for our current estimate of future results. All growth rate ranges and revenue and expense projections are qualified by the risk factors included in our press release and supplemental package.

Our guidance for 2024 full year normalized FFO is $2.89 per share at the midpoint of our guidance range of $2.84 to $2.94, an increase of $0.01 per share compared to prior guidance. We project full year core property operating income growth of 5.8% at the midpoint of our range of 5.3% to 6.3%. Full year guidance assumes core base rent growth in the ranges of 5.6% to 6.6% for MH and 4.5% to 5.5% for RV and Marina. We assume occupancy in our stabilized MH portfolio will be flat to the first quarter. Core property operating expenses are projected to increase 4.2% to 5.2%.

Our full year expense growth assumption includes the benefit of first quarter savings in repairs and maintenance and payroll expense as well as the impact of our April 1 insurance renewal for the rest of 2024. Our guidance model includes the impact of the fixed rate swaps we disclosed in our earnings release and supplemental package. The full year guidance model makes no assumptions regarding other capital events or the use of free cash flow we expect to generate in 2024.

Our second quarter guidance assumes normalized FFO per share in the range of $0.61 to $0.67. Core property operating income growth is projected to be 4.6% at the midpoint of our guidance range for the second quarter, which represents approximately 23% of our expected full year core NOI. In our core portfolio, property operating revenues are projected to increase 5.1% and expenses are projected to increase 5.6%, both at the midpoint of the guidance range.

I’ll now provide some comments on our balance sheet and the financing market. As noted in the earnings release and supplemental package, we executed fixed rate swaps on our $300 million unsecured term loan maturing in 2026. The swaps fixed the all-in borrowing cost at 6.05% through maturity. We are pleased with this execution as it eliminates floating rate exposure, except balances outstanding from time to time on our line of credit. Current secured debt terms vary depending on many factors, including lender, borrower sponsor and asset type and quality.

Current 10-year loans are quoted between 6% and 6.75%, 60% to 75% loan-to-value and 1.4x to 1.6x debt service coverage. We continue to see solid interest from life companies and GSEs to lend for 10-year terms. High-quality age qualified MH assets continue to command best financing terms. Regarding our liquidity position, we have approximately $470 million available on our line of credit and our ATM program has $500 million of capacity.

Our weighted average secured debt maturity is almost 10 years. Our debt to adjusted EBITDA is 5.1x, and interest coverage is 5.2x. We continue to place high importance on balance sheet flexibility and we believe we have multiple sources of capital available to us. Now we would like to open it up for questions.

Question and Answer Session

Operator

(Operator Instructions) Our first question comes from the line of Josh Dennerlein with Bank of America.

Joshua Dennerlein

I just wanted to dig into the guidance update a little bit. It looks like you lowered your RV and marina revenue range, midpoint by 40 basis points. I’m assuming there’s a corresponding like drop in expenses. Is that all transient related? Or is it somewhat Marina? I guess, how do you think about the mix here?

Paul Seavey

Yes. I think, Josh, maybe it’ll help if I just walk through the process. So just when we think about our budget and reforecast process for seasonal and transient rent overall, I’ll start by framing the timing and the composition of those revenue streams. During the first quarter, we earned approximately 50% of our anticipated full year seasonal rent and almost 20% of our full year transient rent.

And then by the end of the second quarter, we’ve earned almost 2/3 of our anticipated full year seasonal rent and close to 45% of our full year transient. The last thing on that is just in the third quarter, we earned almost 40% of our transient rent. So we’ve talked often about the impact of weather on those variable rental income streams, both seasonal and transient, particularly considering the short booking window for the transient customers.

I mentioned on the call in January that when we prepared our 2024 budget, we focused on reservation pacing at that time for rent that we anticipated earning in the first quarter, and we had expectations for modest rates of growth in subsequent quarters. We’re pleased with our first quarter results for seasonal and transient, particularly to seasonal, which, as I mentioned, represents half of the seasonal ramp we expect in the year.

Our guidance update for the second quarter and full year employs the same methodology we use for the budget. We focused on reservation pacing for rent, we anticipate earnings in the second quarter, and we didn’t assume any change to our original budget assumptions for the third and fourth quarters. Our current view on second quarter reservation pacing reflects some softness, mainly as a result of weather in April. And I think Patrick can provide a little bit more color on that.

Patrick Waite

Yes. During the first half of April, precipitation was significantly above average in California, the Midwest and the Northeast, but especially so in California, where the RV portfolio experienced precipitation around 300% of average. California has experienced more precipitation in the first half of April than in the entirety of April last year. So that’s been a headwind to the business. Some markets in the Midwest and the Northeast have also experienced above-average rainfall by about 200%.

I’d also point out that the relatively cool and wet Sunbelt season in Florida and the relatively mild winter in the Northern U.S. resulted to a difficult year-over-year comparison regarding seasonal guests extending from Q1 and the Q2. So these are seasonals that are down for the winter season, extending their reservations into April. The winter of 2023 was very cold and those extensions were pretty robust just with respect to the current period of headwinds, again, really weather related.

Joshua Dennerlein

Okay. I appreciate that color. And then maybe just on the Thousand Trails membership. It looks like it dipped in the quarter. Just curious just what’s driving that? Is this just like normal seasonality? Or any kind of color would be helpful?

Marguerite M. Nader

Sure, Josh. And certainly, there is some seasonality to that. At the end of the quarter, we had — I think, 119,000 members. Those members are made up of really both dues paying members and then the free trial members. And the drivers of the decrease is a reduction in free trials and a reduction in the sales activity. At the property level, really, you see a lot of that happening in the first quarter in other years. I think there are a few things to focus on regarding the membership line.

If you go back kind of to the beginning when we started operating the Thousand Trails properties, which I think was in 2008, you’ll see some years where there’s been a drop in a member count. But even with that decrease in those various times, we’ve really been able to grow the dues revenue base meaningfully through rate increases and additional product offerings. And so I think you’ll continue to see us do that.

Operator

Our next question will come from the line of Jamie Feldman with Wells Fargo.

James Colin Feldman

So I guess just to start, I just want to follow up on the insurance renewal of 9%. Can you talk about the assumption that was originally embedded in your guidance? And then also how much the full year decrease in property expense growth — operating expense growth results of the lower insurance premium than expected? And are there other areas on the expense line where you’re seeing more relief than you expected in your initial numbers?

Paul Seavey

Yes. I think, generally, Jamie, we’re pleased with the 9% premium increase on renewal. I’d say that in terms of the other line items, we saw in the first quarter a reduction in our repairs and maintenance that was in-place savings on R&M. We did have some portion of that, that was timing related, and we’ve included that in the reforecast going forward, but there was a meaningful savings compared to our budget that we consider permanent in R&M.

James Colin Feldman

Okay. And then on the insurance side, how did the 9% compared to your initial guidance?

Paul Seavey

It was favorable.

James Colin Feldman

Yes, as we all know that. I mean, can you ballpark it? I think a lot of people were thinking like 20% to 30%. Will you that high or maybe not?

Paul Seavey

We didn’t have an assumption as high as 30% in our budget, no.

James Colin Feldman

Okay. All right. And then, I guess, second question is just — I know you guys have said in the past not a ton happening on the distressed acquisition front. But maybe if you could provide an update as we’re kind of further into the cycle and the banks seem to be working through more loans. Is anything starting to look more promising or interesting to you that we might be able to get your hands on?

Marguerite M. Nader

Sure. Yes, we continue to have discussions with owners. But really, the overall market has been slow as you point out. There’s really little distress in the market as far as owners of our assets. The owners have generally been conservative over the years with their balance sheet and they have really the luxury of taking the time to transact. I think it’s a good idea, Jamie, to think about a longer-term perspective on how we’ve grown as a company from 41 properties 30 years ago to 450 properties today the acquisition — that acquisition environment has been episodic.

And I think there’s been a few times in our history where we’ve had a very low level of acquisition volume, followed by a year of outsized growth. So we really work on planting the seeds for that growth over the years and then are ready to act when it makes sense for us.

James Colin Feldman

Okay. I mean are you foreshadowing that it could get better soon? Or just we know just the flag that you keep working on it?

Marguerite M. Nader

Yes. I mean I think that we continue to be in conversations with owners. And to the extent we have closings, we’ll certainly let everyone know as soon as we have information to talk about.

James Colin Feldman

Do you think there are opportunities to get involved in the capital stack, like debt investments? Or do you think anything you do would be straight equity?

Marguerite M. Nader

No. I mean we have looked at it in the past, certainly a debt structure where we have the ability to own the asset at some point. Also, we’ve looked at management along those same lines. So we have looked at things over the years and continue to look at unique structures that could make sense for us.

Operator

Our next question will come from the line of Eric Wolfe with Citi.

Eric Wolfe

If I look at your other income and ancillary services, it’s about 9% of your revenues. I know a lot of it is just utility income, but I was curious whether you’re sort of implementing any new initiatives to grow the other piece of it because I would assume that annual RV members and MH tenants might want things like bundled Internet or smart home equipment, but just curious if there’s an opportunity to grow that side of the business more quickly?

Paul Seavey

I guess before, Eric, we talk about maybe some new initiatives, which I would characterize as kind of modest in terms of generating incremental revenue. I would point to a couple of things. First, utility income, as you said, we’ve continued to segregate utility charges from rents and build customers for those. We also have the impact of the real estate tax pass-throughs that you see driving some of that growth in ’24 compared to ’23.

And then we do also have the business interruption insurance proceeds impacting that line item year-over-year.

Eric Wolfe

Got it. Yes. I guess, it takes so much conversation on some of the apartments and SFR call is adding like 50 basis points sustained extra revenue per year. But I guess, it just doesn’t sound like there’s probably something that’s going to be needle moving there. So I guess second question, you mentioned the collection of property taxes. I was just curious how that is going so far? And if you could just share what you sort of baked into your forecast this year for that specifically?

Paul Seavey

Yes. So in terms of the recovery, we have noticed those customers for the amount they’ve been paying it. So no issues with respect to that. And it was — it represented about 95% of the increase that we realized in the MH portfolio, the amount that we build back to the customers.

Eric Wolfe

Got it. There’s just a way for us to think about the aggregate amount that could it be other income, right? I don’t know if there’s a deal like a $1 million number that’s sort of embedded in there?

Paul Seavey

It’s a little bit tricky when you think about it quarter-to-quarter. But for the full year because of the timing of the leases and when those pass-throughs might start. But on a full year basis, it’s a couple of million dollars in recovery.

Operator

Our next question will come from the line of Michael Goldsmith with UBS.

Michael Goldsmith

Can you hear me?

Marguerite M. Nader

We can hear you.

Michael Goldsmith

In the prepared remarks, you talked a little bit about the reservation piece being similar to last year. Is that less encouraging than you’re expecting at this point in the year? Or was the base case kind of in line with last year?

Paul Seavey

I think it’s in line. I mean when we think about the reservation pacing that we used for seasonal and transient, certainly, the seasonal is tracking in line with reserve for almost 80% of that second quarter rent, which is consistent. And I mean we talk often about the variability in the transient, but the current pacing is in line with our expectations. No surprises there.

Michael Goldsmith

Got it. And then my second question relates to the last couple of years, demand transient has been choppy, but I think what has been a pleasant surprise has been the ability to kind of match expenses to the choppiness in demand. So as you think about the outlook for this year, what have been the learning from matching payroll to transient demand? And are there already preparations in place to flex up or flex down payroll depending on how that piece of reservations plays out through the kind of peak transient year?

Patrick Waite

There is a great deal of focus on matching the resources we have on site, particularly with that transient customer flow to, as an example, seasonal employees that are there to provide services and activities for those transient customers. And literally, this morning, I was talking to one of my SVPs about exactly that as we’re moving through ramping up for the summer season. And what that plan looks like in the next couple of weekends.

Operator

Our next question will come from the line of Keegan Carl with Wolfe Research.

Keegan Grant Carl

Maybe first, just your non-core portfolio outlook was increased. Just curious what’s driving that?

Paul Seavey

Yes. Keegan, I mean, the non-core, primarily, it’s the mix of performance. The non-core is a little bit tricky, frankly, because of the business interruption proceeds and the restoration of the properties that were impacted by the hurricane. So there’s a bit of an uptick just in terms of the return to normalized business operation.

Keegan Grant Carl

Got it. And then bigger picture. If I take a look at your rental loan portfolio, pretty material decline on a year-over-year basis and down over 100 units sequentially. I guess I’m just curious what’s driving this and how we should think about this relative to the mix of home sales versus the potential for you to add homes that you don’t sell to your rental portfolio this year?

Marguerite M. Nader

Yes. Certainly, what’s driving that activity is people buying the home. So they’re either in the home and renting it and want to buy it or there is somebody else that is interested maybe inside of the community that wants to buy that home. So you’ve seen over the last few years a significant conversion of the rental homes to owned homes. And I think we’ve been very successful in reducing our rental program from a high of about 9% to down to now 3%. So I think that’s really a function of the demand for our properties and for people wanting to enjoy that lifestyle.

Operator

Our next question will come from the line of Samir Khanal with Evercore ISI.

Samir Upadhyay Khanal

Maybe expand on the property and casualty insurance renewals. I know it was up 9%. And I guess to a question earlier, I mean, it is less than what you were sort of maybe baking in. Maybe walk us through the process and conversations you had to maybe get sort of a lower increase in the premium because it is surprising based on kind of what the peers have been sort of reporting. So maybe walk us through that process.

Marguerite M. Nader

Sure. I think we have a pretty robust disclosure included in our filings about what makes up our insurance program. It’s difficult to determine and see what others in the REIT space or in general, have for coverage because there isn’t as much detail. So I think we have a pretty detailed analysis of where we end up. And the process is really a buildup of a lot of time and effort focused on making sure the carriers appreciate our properties, understand what we have to offer at the property level.

And then, of course, the experience and the claim experience is a big part of the discussions as we head over to London to have the discussions. And we had a very good year from a claims perspective. And that certainly helps us as we go into the discussions with the carriers.

Samir Upadhyay Khanal

Okay. Got it. And I guess my second question is around the transient business. I guess, Paul or Patrick, what are you expecting for transient to be down this year? I mean how much — I know the combined number, seasonal and transient, because you can do the math and maybe that sort of flat to down. But I’m trying to understand if you were to break down seasonal and transient sort of what is that projection for this year?

Paul Seavey

Yes. I think, Samir, as we think about those revenue streams and the volatility associated with them, we’ve adopted a practice over the last couple of years of combining for guidance purposes, those two. And we think that the value in that is that it helps to kind of reduced to a degree some of the volatility that we see from quarter-to-quarter. So we don’t have a transient number to quote independent of the seasonal.

Operator

Our next question comes from the line of John Kim with BMO Capital Markets.

John P. Kim

Just had one question on expansion sites. I know, historically, you’d like to guide or deliver about 1,000 per year. Last year, it was a little bit lower than that. But I was wondering if you could talk about the constraints to doing more as far as delivering expansion sites.

Patrick Waite

Yes, sure. As you pointed out, last year, we were just shy of 1,000 and that’s been a goal of ours. But noting that there are going to be some timing constraints on any particular calendar year, for the current year, we’re expecting the number of sites to be developed in the neighborhood of 700 to 800. And one of the variables that get some pressure on the delivery time line is just the cadence of getting plans through approval, which can also frequently be a multistep process.

You submit plans for development, you need to pull a permit to the extent that there are comments, you need to resubmit. That is happening frequently, and the time line for the review of each one of those submittals is also running long. We’re finding that, in particular, in the higher activity markets where we’re doing expansions. Florida has continued to see some pressure with respect to those approvals and working through those agencies. That’s in part due to continued build back from Ian in the state overall, but also just the high level of construction activity initiative.

John P. Kim

And do you think that’s a structural headwind? In other words, are you going to be delivering in the number you said 700, 800 going forward? Or is it some — is it just timing in the next year?

Patrick Waite

I would say it’s probably largely timing. We’ll work our way through those headwinds. I would expect those headwinds to subside. For perspective, we have over 1,000 sites — over 1,100 sites currently in construction. So the timing of completion and then getting a shovel in the ground on the pipeline, those 2 things are going to play out over time. And I would expect we’re going to be in the neighborhood of 1,000 sites on a run rate basis. But as evidenced by the current year, there may be some headwinds from time to time.

John P. Kim

And Patrick, can you just remind us on the stabilized yields that you expect and how that’s trended over time?

Patrick Waite

Yes. They’ve been in the 8% to 10% — 7% to 10% range recently. When we started really building our pipeline, those yields were higher single digits and low double digits. We’ve been able to continue to grow the top line revenue as we’ve been developing out these sites, but there have been some pressures on construction costs. But I guess part of the good news is, in recent quarters, the pressure on some of the construction activity has started to subside somewhat.

Operator

Our next question will come from the line of Wes Golladay with Baird.

Wesley Keith Golladay

What drove the decline in the seasonal sites? It looked like there was some 12,500 to 11,800. And do you think it stays at this level?

Paul Seavey

Yes. I think the seasonal site count, essentially, the adjustment reflects a change in occupancy across the seasonal footprint. It’s primarily driven by locations in California and the South and represents the transient workers. We have traveling nurses and construction workers that stay in our properties for longer periods of time and qualify as seasonal. So that’s the driver of that.

Wesley Keith Golladay

Okay. And then are you seeing any pushback on the price increases for your various Thousand Trails upgrade options? And do you notice any members moving up the tiers or more moving down?

Marguerite M. Nader

With respect to the membership upgrades, we haven’t seen any issues relative to the price of the product. I think the members are very excited to be able to upgrade and get the additional benefits. I think what you see is that during COVID, we had an outsized number of memberships upgrade — memberships upgraded. You’re seeing that kind of go back down to a pre-COVID level.

Operator

Our next question will come from the line of Anthony Hau with Truist Securities.

Anthony Hau

Maybe it’s a bit too early to tell, but have you guys seen — are you guys seeing any benefits from the recent changes to the increase of the loan limits of Title 1 manufactured housing?

Paul Seavey

I think a couple of things on that. A, it is early to tell, Anthony. But b, I would also just remind you that the vast majority, over 95% of our customers are paying cash for the homes in our communities. So there’s not tremendous reliance on financing in our portfolio.

Anthony Hau

I would think that will probably help your — help you guys sell those homes, right? Or just because I think some of those loans can go up to $195,000?

Paul Seavey

Right, right. And customers are coming and they’re buying homes $100,000 plus homes in our communities and paying cash for them.

Marguerite M. Nader

And that’s consistent with our long history of our customers paying cash, which adds to just the ability at the property level for people to really feel ownership at the community.

Anthony Hau

Got you. And also, do you guys expect the membership to start growing again since RV shipments is up 15% this year?

Marguerite M. Nader

Certainly, having predictions for RV shipments to be up is a positive overall for our business, including the membership side.

Operator

Our next question will come from the line of John Pawlowski with Green Street.

John Joseph Pawlowski

Paul, are the revenue declines for the seasonal and transient business over the balance of the year that’s implied in your guidance solely driven by the rainy April and tough seasonal RV comp in 2Q? Or are there additional signs of price sensitivity popping up from customers?

Paul Seavey

The adjustment is limited to Q2 and is driven by the April activity that Patrick talked about.

John Joseph Pawlowski

Okay. And then I would love to just hear you guys talk through shifts in the transaction market. I know the volumes quiet right now. But very quickly, we’re looking at pretty deeply negative leverage here given the secured financing costs you alluded to. So if you assume interest rates stay — staying in a similar range right now, where would you expect, call it, MH cap rates to settle out for ELS quality product in the coming quarters once we do see more transaction volume come in?

Marguerite M. Nader

I think it’s a little bit difficult to say kind of where the cap rates will end up being in the future. But over the past 18 to 24 months, there have been very few deals. So it’s difficult to say kind of pinpoint cap rates. I think you really need more robust market with many data points to be able to quote that. But what we have seen is continued demand, and it’s really still very high for our asset class. People want to own these properties. People don’t want to get — sell the property.

So there is a lot of demand for even new people coming into the space one-off owners are interested in buying. So I think that we’ll continue to see that — those levels of demand. Certainly, where we’re at in the debt markets are an important discussion. But as I kind of pointed out, I think, earlier in this call, there’s not a lot of leverage on these assets that we’re interested in. So that discussion falls a little flat on the — to the owners who haven’t put their — put a lot of debt on their property.

So the movement in the rates isn’t as big of a concern for them, but certainly is something that we look at. So our acquisition department is very focused on continuing the conversations that we’ve had with the owners that we’ve had for a long time now and we’ll continue to do that. But we have seen times where there’s not a lot of activity and then all of a sudden, there’s — you tend to see deals popping up. So hopefully, that is something that we’ll see this year.

Operator

Since we have no more questions on the line, at this time, I would like to turn it back over to Marguerite Nader for closing comments.

Marguerite M. Nader

Thank you for joining us today. We look forward to updating you on the second quarter call. Take care.

Operator

This concludes today’s conference call. Thank you for participating. You may now disconnect.

Part II – Additional Information with More MHProNews Analysis and Commentary

In no particular order of importance are the following.

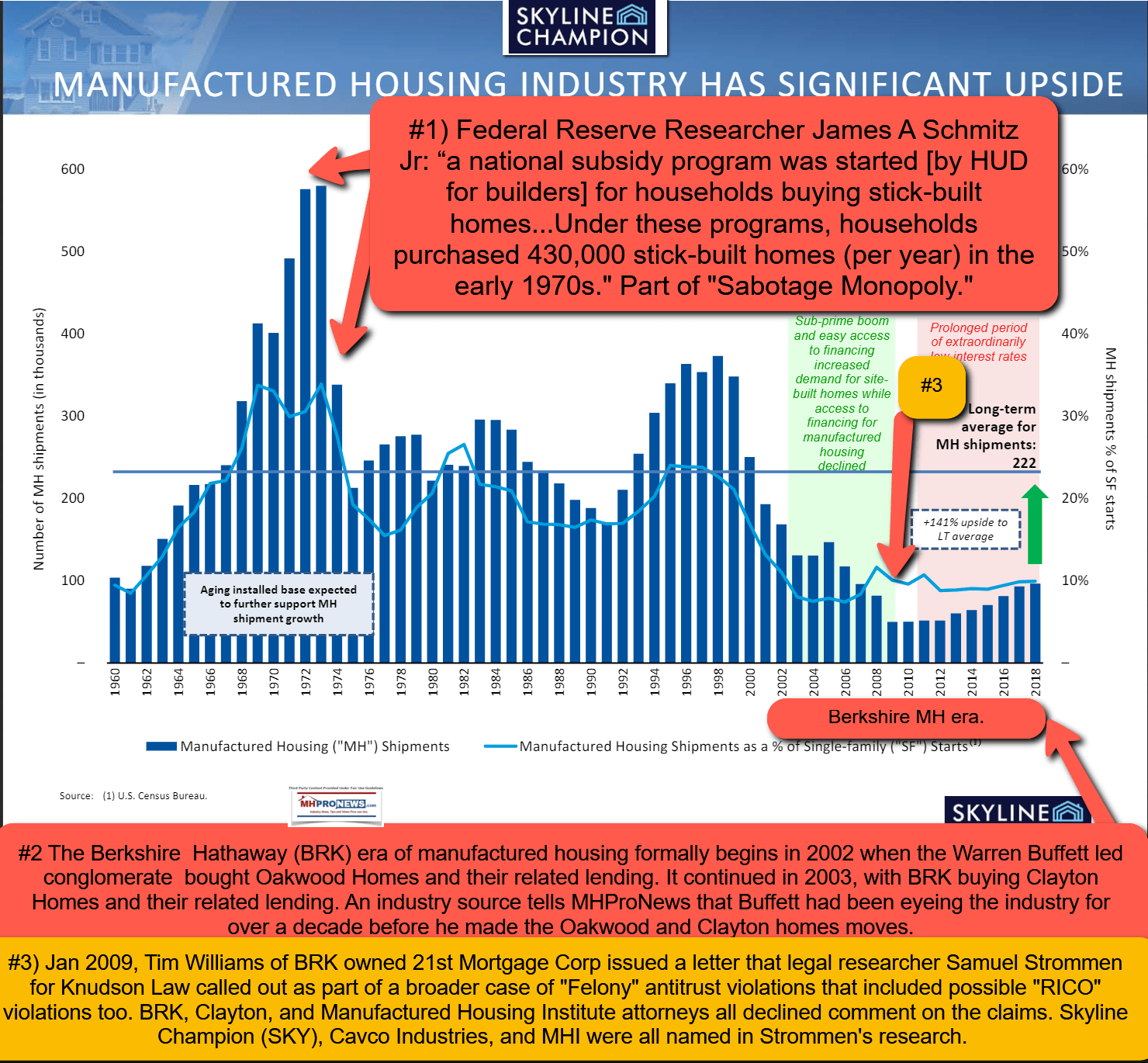

1) ELS COO Patrick Waite, who sits on the MHI executive committee, said: “Over the last 5 years, we’ve sold 4,500 new homes.” In just social media, ELS says they have some 2 million followers. They talk about a robust digital engagement and 95 percent occupancy at their manufactured home properties. They pitch having an appealing lifestyle. But the obvious question is, why are there such a tiny sliver of potential customers actually buying at an ELS property? That 4500 purchases in 5 years is only 900 new homes sold per year. Given that ELS has some 200 plus manufactured home communities (MHCs), diving that into 900 new home sales, that is a paltry 4.5 sales per property per year. Imagine if a new conventional housing development only sold 4.5 new houses per development per year? It would be viewed as a disaster. Or imagine if a new multifamily housing construction project, once opened, only filled 4.5 units per year. That would be a seen as an embarrassment. Yet, due to their arguably problematic business model that seems to encourage very little new development and very few new manufactured home sales, ELS turns the facts on their head and touts it as some kind of success story?

2) It is important to look at what Eugene and Sam Landy at UMH Properties had to say about Sam Zell’s and ELS’ business model. The UMH leaders questioned the fundamental claims of ELS. The Landy’s say thousands of new MHCs need to be developed and rapidly filled.

3) Waite said: “The aging trends from 70 million baby boomers who are currently moving through their retirement years to almost 140 million combined Gen Xs and Millennials who will follow the boomers into their own retirement years, all support generational demand for MH and all of our property offerings for decades to come.” They are making an intriguing yet embarrassing argument when it is dissected. If there are 70 million potential residents for ELS properties, why is there any vacancy whatsoever? And the fact that 140 million “Gen Xs and Millennials” may only be able to buy a manufactured home or they will be stuck renting at increasingly higher costs ought to shock the conscience of thinking Americans of whatever age, background, or whatever category one wants to consider. These are arguably not brilliant corporate leaders to be celebrated. They are rather builders of moats that are parasitic in nature. The logical consequence or result of this projected out will be what economist E.J. Antoni called more Bidenvilles.

4) When CFO Paul Seavey said: “Core property operating revenues increased 5.8%” there is case to be made that income is lagging behind actual inflation as opposed to the questionable inflation calculation method used by the federal government. So, once more, even given the accuracy of ELS’ remarks, they may not prove what they purport to demonstrate.

5) Besides, ELS has admitted to errors in prior reporting. Those admissions have resulted in legal probes and related actions on behalf of investors.

6) When leading Democratic Congressman James “Jim” Clyburn (SC-D), considered a key figure in getting Joe Biden the 2020 Democratic nomination, admitted to left-leaning MSNBC that his party knew that they were fueling inflation, he justified that decision. ELS, and other MHI members, could be exposing how that is harmful to the interests of the vast majority of the population. But there is little evidence for that notion. So, millions of people who often don’t follow the news and don’t realize what Clyburn and others have said is reality, they are marching toward a future that they are manipulated into supporting, though it is contrary to their own interests.

7) Nader did not directly answer the inquiry about cap rates. She also said that deal volume is down, which while it may be true for part of the time frame she cited, may not hold for all of it. For more on that see the detailed reports linked below.

8) Like their fellow oligopolists Sun Communities, ELS cut back on developing new sites, new communities, and closed fewer deals for acquisitions.

9) When ELS points to the purchase of rental units by residents and others, that arguably supports some of the contrarian-to-ELS assertions made by UMH Properties.

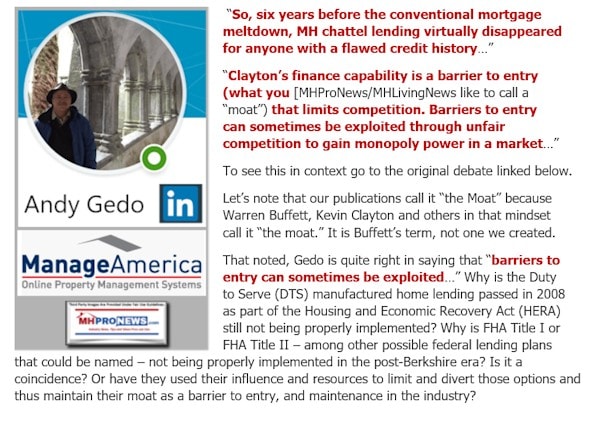

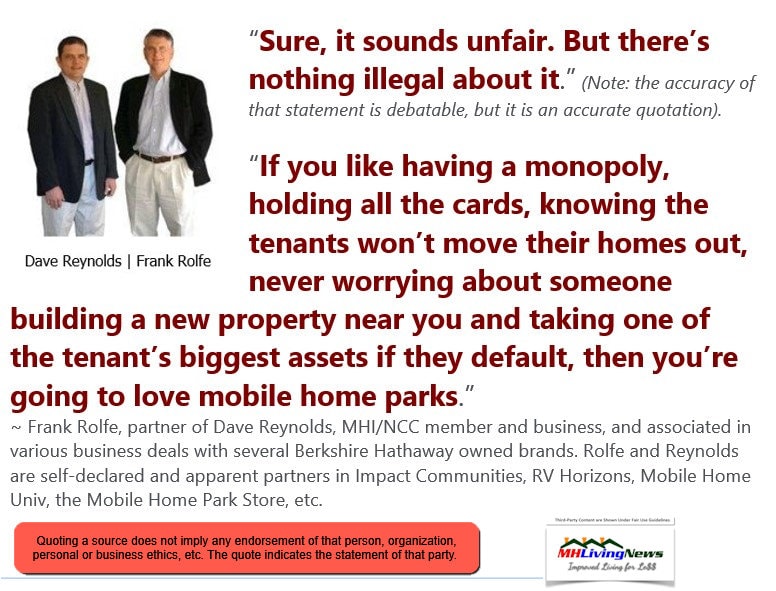

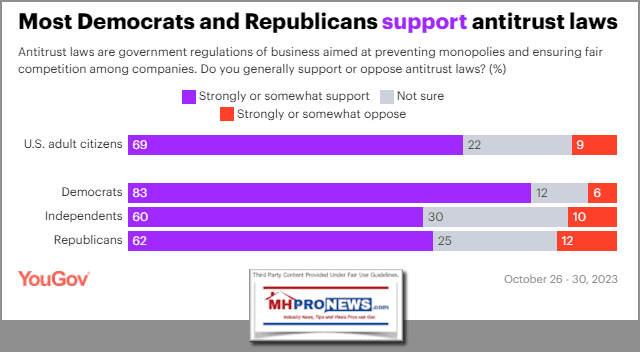

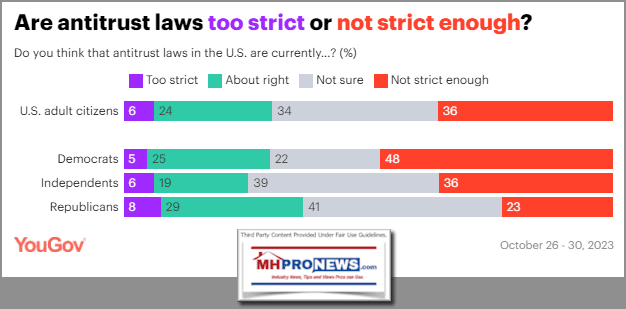

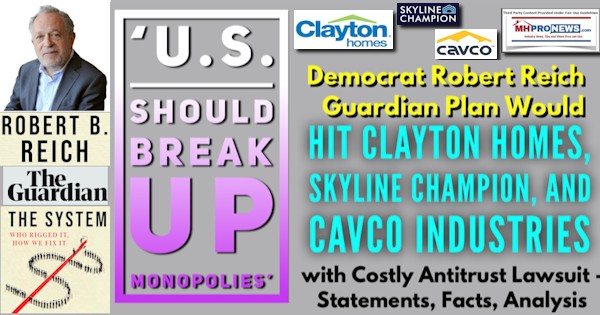

10) When you see the word “moat” being deployed by insiders in a business or professional field, it is not merely some curious reference to the waters that surrounded a medieval castle. A “moat” in the Warren Buffett popularized usage among investors is a description and strategy for slowly but steadily pushing out competitors from a field by using some ‘advantage(s)’ and that advantage may include the lack of understanding of competitors and even many team members as to just how pernicious this is for consumers, employees, taxpayers, and arguably even for investors. A new feudalism is, and has been, demonstrably rising for years. Antitrust law was created to deal with monopolistic economic threats. By keeping most people ignorant of what is occurring, they become “useful idiots” for the powerful and their surrogates.

11) This combination of factors yields a dramatically reduced performance for the production side of the manufactured housing industry.

12) It is no surprise that unlike the gas industry, which swiftly moved into action to contest the Department of Energy (DOE) rules for their industry, that MHI – in conjunction with the Texas Manufactured Housing Association (TMHA) – moved slowly and arguably duplicitously to act with respect to stopping the DOE energy rule that has been described a harmful to the future of manufactured housing.

13) ELS is involved in both RVs and manufactured homes (MHs). It is thus worth pointing out that the RV industry has done quite well compared to manufactured housing in the past 25 years. In fact, RVs blew past MH in production, while manufactured housing declined sharply.

14) When ELS talks about a thirty-year history and looking back to see what the consequences of policies are, they have a point. Indeed, that is a point that MHLivingNews and MHProNews have both made repeatedly.

15) In summary, when carefully examined, almost every aspect of ELS’s methods rely in part on moat-building methods and various illusions. They rely on what they see as ‘useful idiots’ who don’t pay sufficient attention to the details to see what is actually occurring all around them. They want ill-educated people working for them. That means that they don’t want professionals who question their business models or the status quo.

16) As a disclosure, MHProNews admits that early on in our publishing adventure in manufactured housing, several of these factors regarding moats and throttling of the industry from within were overlooked or misunderstood. MHI appears superficially to take stances similar to what the Manufactured Housing Association for Regulatory Reform (MHARR) does. MHARR has hammered away at facts and evidence that all that is needed to grow the industry is to press for the proper enforcement of existing federal laws. MHProNews would add to their analysis that antitrust and proper educational/image building efforts should be part of the plan. But once the connection between moat-building and related strategies were properly understood based on the evidence and remarks of those involved, no one in MHVille has invested more time or effort to systematically reveal how these methods work in practice.

― Frédéric Bastiat, What Is Money?

17) Left-leaning Bing’s AI powered Copilot said it is “crucial” to understand the moat to properly understand the underperformance of the industry.

How long as MHProNews and MHLivingNews been reporting on the Warren Buffett style moat method and how important is understanding the moat to grasping why manufactured housing as an industry is unperforming compared to their historic levels of production or development?

Let’s note that the Q&A above was a fresh thread using the blue or balanced setting on Bing’s Copilot. That has been the MHProNews/MHLivingNews typical settings for what is now called Copilot in now almost 1 year of testing.

18)

Useful, thanks, but can you identify the earliest examples of when MHProNews and MHLivingNews began to probe concerns about monopolization and the moat method? Was it circa 2017? And who besides MHProNews and MHLivingNews, if anyone, has similarly addressed the moat deployment as an important point in understanding the relatively modest level of manufactured housing performance since the far more robust and headier days of the mid-to-late 1990s?

Learn more

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’