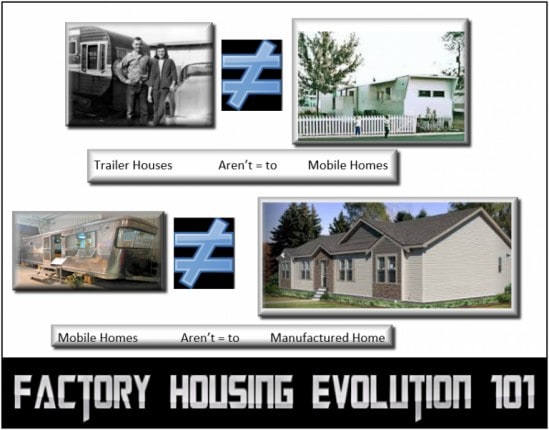

Starting with the featured image, which may have been provided by a Forbes staffer, and moving on to terminology errors, it must be noted that Kori Hale’s allegations against Warren Buffett led Berkshire Hathaway’s Clayton Homes and related lending units includes inaccuracies. But that doesn’t mitigate the fact that the thrust of Hale’s comments are devastating, especially coming from the black-female CEO of CultureBanx.

Here is the link to her column on Forbes, entitled Warren Buffet’s Exploitative Mobile Home Investment, which is being reproduced below under fair use guidelines for commentary and analysis.

Warren Buffett’s Exploitative Mobile Home Investment

Kori Hale Forbes Contributor – I’m the CEO of CultureBanx, redefining business news for minorities.

TWEET THIS

Warren Buffett’s company Clayton Homes, the biggest mobile home manufacturer in the U.S. has continued to profit from high interest rate loans. The Oracle of Omaha has sold low-income Americans the dream of ownership for nearly 20 years, and his investment company Berkshire Hathaway makes money on the loans, since they own the company that Clayton urges its buyers to go through. Many of the people buying these homes are minorities and have helped to fuel Clayton’s $13.7 billion mortgage portfolio.

The Breakdown You Need to Know

Clayton operates the two biggest mobile home lenders, 21st Mortgage Corporation along with Vanderbilt Mortgage. Clayton finances more mobile home loans than any other lender by a factor of more than seven. CultureBanx noted that in 2105, 72% of black borrowers got their loans from Clayton’s Vanderbilt Mortgage and 21st Mortgage, according to FFEI federal data.

They have outsized dominance in the manufactured home market with a 49% share, and where profit margins are greater. Buffet’s Clayton company brought in $765 million in revenue, in 2017.

Mobile home loans are similar to car loans because they’re typically classified as personal property, instead of real estate. Interest rates can be as high as 13.5% or more, and like a vehicle, lose as much as half its value in three years. These rates make it hard for mobile-home owners to leverage equity from their purchase in order to buy a traditional home.

Capitalizing on Trailer Debt

Families who are able to get a loan for their mobile homes generally lease the land on which it sits, a common practice in this industry that can trap people in a cycle of debt. The national monthly average to rent a space in a trailer park is around $250 and can be as high as $600. Trailer parks tend to be built in warmer climates, with Mississippi and Alabama having some of the highest rates of mobile homeownership.

If you’re thinking mobile homes are perhaps only for an older demographic you would be wrong. The majority of mobile-home residents, 23% are between the ages of 18 to 29 and have an average household income of $28,400. If that’s not alarming enough, in 2015, the average sales price for a new manufactured double-wide home was around $110,000.

There are some mobile home communities attempting to rezone trailer parks, to prevent owners from selling the land to developers that may raise the rent even higher. If residents are able to pool their resources together and buy the park, it would give them the opportunity to run it as a co-op.

###

Once more, the point of sharing this Forbes column to MHProNews readers isn’t to confirm, challenge, or corroborate this or that claim made by Hale’s, the author of the above published Op-Ed this morning. Rather, it is to raise the related point that is often at the core of the industry’s image challenges.

The bad news that often harms the industry’s image routinely comes from Manufactured Housing Institute (MHI) connected firms, the largest of which is Clayton Homes, and their Berkshire Hathaway related lending and other brands. consider this Google search screen capture, done this morning.

The first steps to organize independents into a new post-production trade group are underway. To learn more contact us in confidence via the link here. Use the words New Association Inquiry in the subject line.

See the related reports to learn more, found further below the byline, offers, and notices. That’s another episode of manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

HBO’s John Oliver on Last Week Tonight Mobile Homes Video, Manufactured Home Communities Fact Check – manufacturedhomelivingnews.com

” Mobile homes were perfected by humans, but invented by snails,” John Oliver on HBO’s Last Week Tonight, per Time. ” The homes of some the poorest people in America are being snapped up by some of the richest people in America.” Really?

Bridging Gap$, Affordable Housing Solution Yields Higher Pay, More Wealth, But Corrupt, Rigged Billionaire’s Moat is Barrier – manufacturedhomelivingnews.com

America woke up today to division. But perhaps 75 percent (+/-) of the nation’s people could come together on a plan that demonstrably could do the following. Increase the U.S. Gross Domestic Product (GDP) by some $2 Trillion Annually, without new federal spending.

Why is Seattle Dying? Affordable Housing, Misplaced Compassion, and Manufactured Homes – manufacturedhomelivingnews.com

In just over three weeks, this video below entitled ” Seattle is Dying ” by KOMO, a local ABC TV affiliate there, has broken 2.1 million views. It is an hour-long and compelling documentary that ends with hope based upon some promising solutions. But it first lays out one troubling fact and example after another.

HUD Study, Analysis of Zoning Discrimination Against Manufactured Housing Sought | Manufactured Housing Association Regulatory Reform

MHARR SEEKS HUD STUDY AND ANALYSIS OF ZONING DISCRIMINATION AGAINST MANUFACTURED HOUSING Washington, D.C., April 8, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR), in an April 4, 2019 meeting with HUD policy, analysis and research officials, called on the Department to conduct nationwide research – and follow-up analysis – concerning local zoning mandates that discriminatorily exclude or drastically restrict the placement of federally-regulated manufactured homes to the detriment of lower and moderate-income American families in large areas of the country.

HUD Code Manufactured Home Production Decline Continues | Manufactured Housing Association Regulatory Reform

Washington, D.C., April 5, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), year-over-year HUD Code manufactured home production declined once again in February 2019.

“The Illusion of Motion Versus Real-World Challenges” | Manufactured Housing Association Regulatory Reform

Motion – or, more accurately, activity – in and of itself, is not necessarily synonymous with, or equivalent to, realprogress, or, in fact, any progress at all.