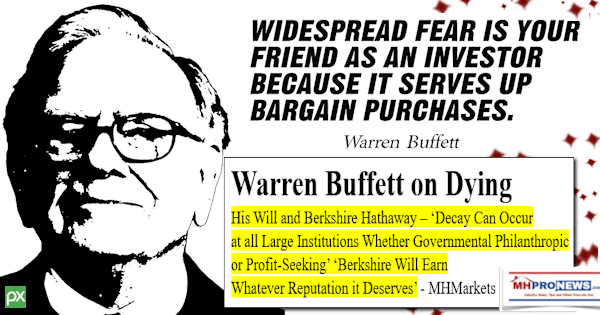

“You should write your obituary and then try to figure out how to live up to it,” said Warren Buffett, the chairman and CEO of Berkshire Hathaway (BRK) in a recent letter to his shareholders obtained by MHProNews. As informed industry professionals know, Berkshire Hathaway is the parent company to several brands involved in manufactured housing, including Clayton Homes, 21st Mortgage, Vanderbilt Mortage and Finance (VMF), Shaw, and others. That letter from Buffett led Berkshire about Buffett’s will and various ponderings about his nearing death are posted herein below and linked as a download. Berkshire Hathaway bluntly said about the letter, shown in Part I: “Mr. Buffett’s comments to his fellow shareholders follow.” Some Buffett related observations – like this pull quote: “being rich does not make you either wise or evil” and more analysis and commentary by MHProNews regarding these musings by the Berkshire chair will follow in Part II.

The donations mentioned in Buffett’s first paragraph will be shown in Part II.

Part I. From Buffett’s Letter to Shareholders About His Will and Thoughts About His Death

My three children are now – and this is hard for their father to believe – between 65 and 70 years of age. For some years, their foundations have distributed substantial sums, occasionally to the same donee. Usually, however, the three follow different paths.

My children, along with their father, have a common belief that dynastic wealth, though both legal and common in much of the world including the United States, is not desirable. Moreover, we have had many opportunities to observe that being rich does not make you either wise or evil. We also agree that capitalism – whatever its weaknesses, including the vast disparities in wealth and political influence that it delivers somewhat capriciously to its citizens – has worked wonders and continues to work wonders.

The United States is exhibit A for that belief, and the four of us feel lucky that we beat very long odds when we were born in the U.S.

My three children are the executors of my current will as well as the named trustees of the charitable trust that will receive 99%-plus of my wealth pursuant to the provisions of the will. They were not fully prepared for this awesome responsibility in 2006, but they are now.

In administering the testamentary trust, the three must act unanimously. Because of the random nature of mortality, successors must always be designated. The trust’s charter will be broad. Laws in respect to philanthropy will change from time to time, and wise trustees above ground are preferable to any strictures written by someone long gone. Whatever the rules – and rules are necessary – private philanthropy will always have an important place in America.

The testamentary trust will be self-liquidating after a decade or so and operate with a lean staff. To the extent possible, it will be funded by Berkshire shares. Berkshire – one of the largest and most diversified companies in the world – will inevitably encounter human errors in judgment and behavior. These occur at all large organizations, public or private. But these mistakes are unlikely to be serious at Berkshire and will be acknowledged and corrected. We have the right CEO to succeed me and the right Board of Directors as well. Both are needed.

In the short-term, Berkshire’s distinctive characteristics and behavior will be supported by my large Berkshire holdings. Before long, however, Berkshire will earn whatever reputation it then deserves. Decay can occur at all types of large institutions, whether governmental, philanthropic or profit-seeking. But it is not inevitable. Berkshire’s advantage is that it has been built to last.

After my death, the disposition of my assets will be an open book – no “imaginative” trusts or foreign entities to avoid public scrutiny but rather a simple will available for inspection at the Douglas County Courthouse.

At Thanksgiving I have much to be thankful for. And to all of my partners in ownership of Berkshire, I wish you and your families the best in health and happiness.” ##

Part II – Additional Information with More MHProNews Analysis and Commentary

Per Berkshire Hathaway and the text of the Buffett letter above are these statements dated 11.21.2023.

Mr. Buffett’s comments to his fellow shareholders follow:”

In no particular order of importance from the above are the following quotable remarks with a brief analysis of each.

1) “My children, along with their father, have a common belief …

“that capitalism – whatever its weaknesses, including the vast disparities in wealth and political influence that it delivers somewhat capriciously to its citizens – has worked wonders and continues to work wonders.”

“that dynastic wealth, though both legal and common in much of the world including the United States, is not desirable.”

Buffett is admitting that vast wealth creates vast “disparities in” “political influence.” This reinforces the similar points previously reported by MHProNews about Buffett and his vice chairman, Charlie Munger remarks about money and power.

2) “My three children are the executors of my current will as well as the named trustees of the charitable trust that will receive 99%-plus of my wealth pursuant to the provisions of the will.” One of those children is Peter Buffett, who has been quoted and referenced several times by MHLivingNews and MHProNews.

3) Still speaking of philanthropy, and Buffett and William “Bill” Gates III have spoken about it often for years, Buffett said in his Thanksgiving message above: “Whatever the rules – and rules are necessary – private philanthropy will always have an important place in America.”

Too many don’t realize much about Buffett’s “philanthropy.” The type of “philanthropy” Buffett engages in has been called examples of philanthro-feudalism, philanthro-capitalism, and the philanthro-industrial complex. They are routinely agenda-driven giving. Those agenda arguably support Buffett’s beliefs. For example. Agree or not, Buffett-linked foundations are reportedly among the largest funders of abortion in U.S. history, as but one example. Additionally, Buffett funded sources (i.e.: the Tides Center) have helped fund MHAction and the Sierra Club, which in turn sued the Department of Energy (DOE) which led in time to the Department of Energy rule that manufactured housing is facing today.

4) Said Buffett: “After my death, the disposition of my assets will be an open book – no “imaginative” trusts or foreign entities to avoid public scrutiny but rather a simple will available for inspection at the Douglas County Courthouse.” Time will tell, but that should be interesting. Related to that is this documentary that follows in the report linked below. Near the end of the documentary that Buffett took part in having made are a list of his philanthropic efforts. As was noted in Part II (3) above, these efforts routinely support causes that align with Buffett’s beliefs but may be wildly at odds with the thinking of large portions of the U.S. public.

Warren Buffett “Oracle of Omaha” HBO Documentary Berkshire Hathaway #Advexon Video

Buffett and Clayton Homes were central figures in the satirical blast by fellow left-leaning figure, John Oliver.

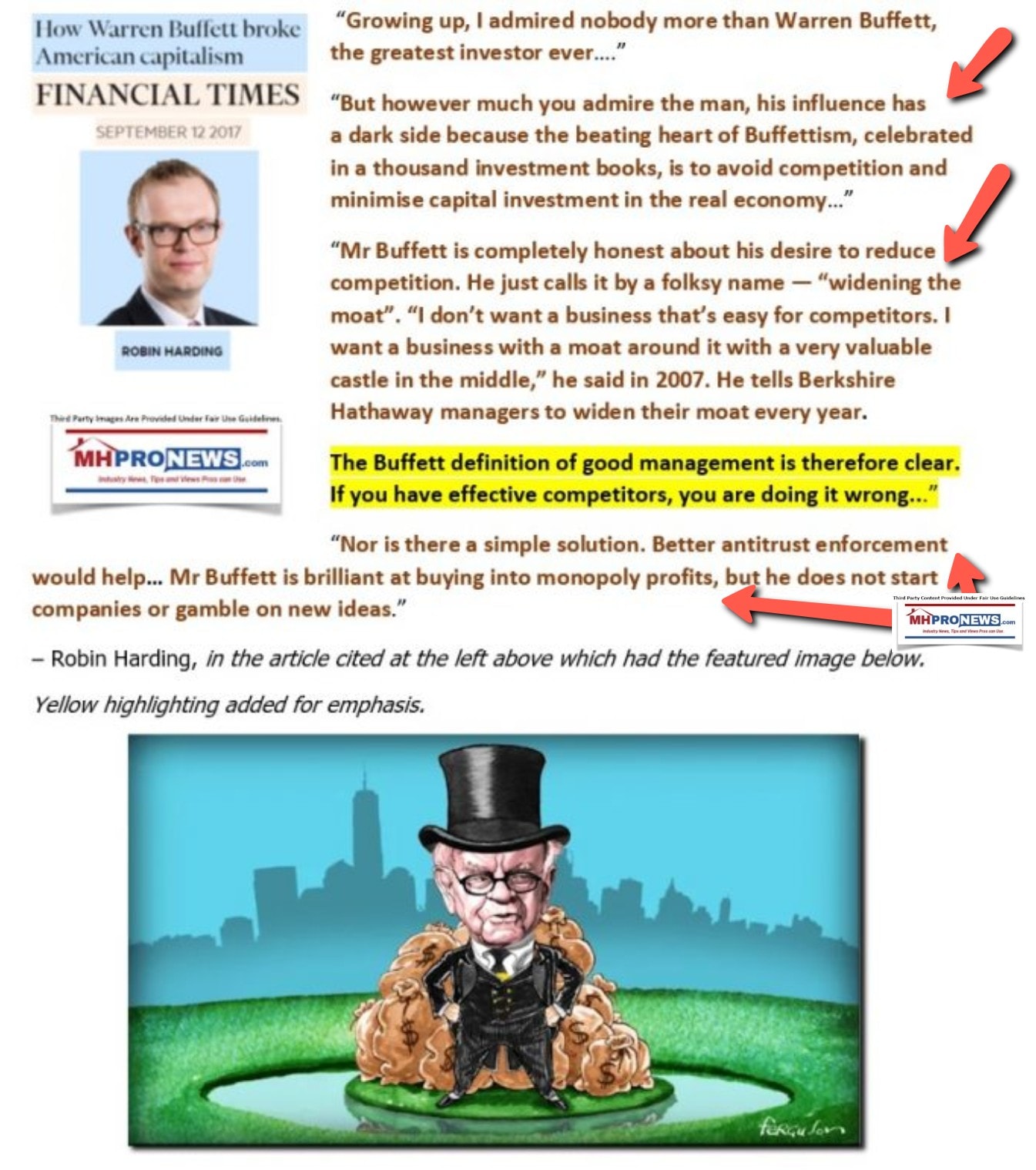

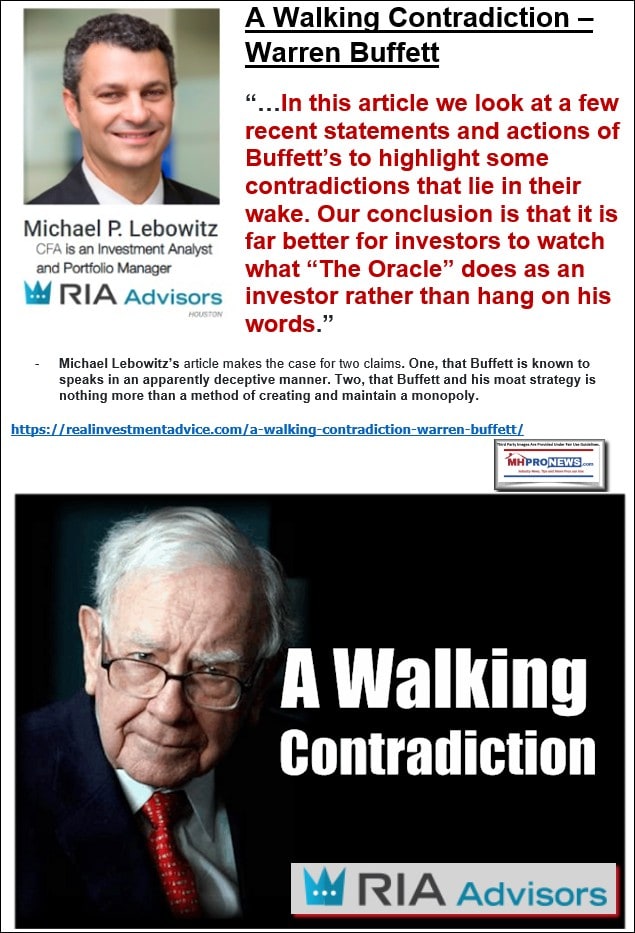

Buffett, said Robin Harding, a self-described longtime admirer of him and Berkshire Hathaway, has ‘broken’ the capitalism that Buffett seems to champion. From admiration to recognizing that “his [Buffett’s] influence has a dark side.” That dark side, says Harding and other critics, “is to avoid competition and minimise capital investment in the real economy.” Note that Harding came to the conclusion (last two orange arrows) that “Better antitrust enforcement would help…” because “Buffett is brilliant at buying into monopoly profits, but he does not start companies or gamble on new ideas.”

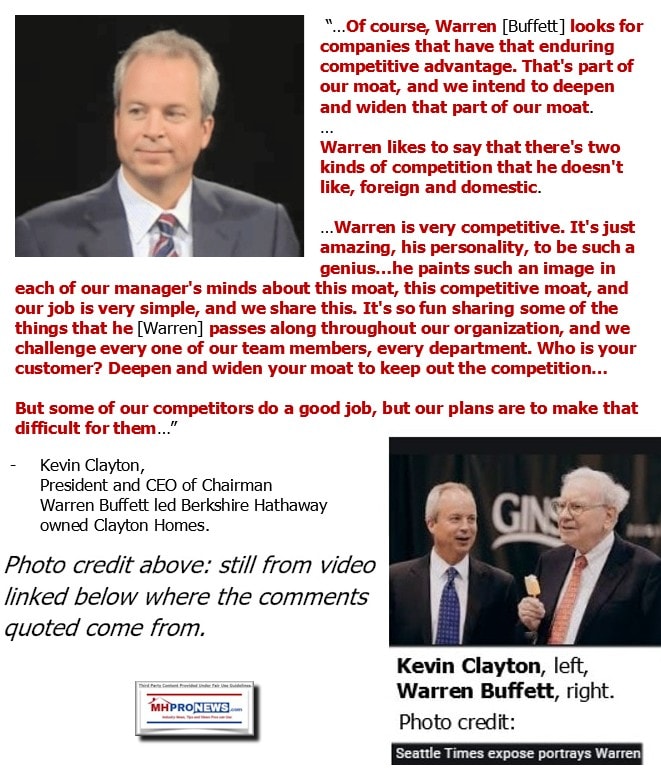

Fellow ultra-billionaire, ally, and ‘partner’ in philanthro-feudalism, philanthro-capitalism, and the philanthro-industrial complex is Buffett’s buddy William “Bill” Gates III. Gates said something similar in the quote that follows that echoes parts of Harding’s analysis. “I didn’t even want to meet Warren [Buffett] because I thought ‘hey, this guy buys and sells things and so he found imperfections in terms of markets, that’s not value added to society, that’s a zero-sum game that is almost parasitic.” What those two sets of quotes about Buffett, one from a former admirer, the other from a now longtime ally, indicate is this. Buffett hates competition and what he seeks is “monopoly profits” without necessarily having a formal monopoly in the sense that many are used to thinking (i.e.: one big company that dominates a given industry). The kind of monopoly that Buffett appears to exercise in manufactured housing is oligopoly style monopolization, where a few companies jointly dominate an industry.

![DidntWantToMeetWarren[Buffett]BecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews](http://www.manufacturedhomepronews.com/wp-content/uploads/2020/07/DidntWantToMeetWarrenBuffettBecauseGuyBuysSellsFoundImperfectMarketNotValueAddSocietyZeroSumGameParasiticBillGatesPhotoMicrosoftLogoGatesFoundationLogoQuoteQuotableQuoteMHproNews.jpg)

Ironically, that video interview with Kevin Clayton was set as part of the context of who Buffett’s successor for the leadership of Berkshire would be and was later named as Greg Abel. Abel is that guy Buffett picked, not Kevin.

So, Buffett became wealthy, say his fans and critics, by finding weaknesses in markets and exploiting those weaknesses. In the case of manufactured housing, and a good reason for MHProNews to do an article on Buffett and his “philanthropy” in the first place, is because of how the man operates his businesses and ‘his giving.’

It takes about 6 minutes to read 1800 words. In less than 6 minutes of average reading time to this point of this article, a good introduction to how Buffett operates is provided. ‘Giving’ is arguably a way of keeping the pitchforks from coming after Buffett and others like him. Who says? That is the implied point made by fellow billionaire Nick Hanauer.

Note that in quoting Hanauer, that doesn’t mean we endorse each and every thought that the man has expressed. There is an argument to be made that Hanauer is in some ways a kind of Buffett and Gates light. Hanauer’s infamous letter in left-leaning Politico was entitled as follows. “The Pitchforks Are Coming… For Us Plutocrats” What did Hanauer say? As was quoted above, if a society is highly unequal, either a police state will rise or the pitchforks (the revolt of the oppressed lower and middle classes) will occur.

These issue matter to everyone who works at a Berkshire owned brand. They also matter to those who work for employers who may share Buffett’s thinking and behavior. Why? Because research from both the political left and right has made clear that consolidation of businesses results in lower wages. Several of the policies that Buffett and his allies have backed at the federal level have arguably made life for working- and middle-class Americans more difficult.

To begin to close the loop between what Buffett said to CNBC and how it relates to his more recent behaviors, the reports linked herein and below are useful.

Philanthro-feudalism, philanthro-capitalism, and the philanthro-industrial complex are ways of shielding wealth from taxation while still having some ability to deploy that money in support of efforts that Buffett – and others like him – find useful. The points being made herein are difficult to logically deny, because Buffett, a member of his family, and others that know the man have said these things.

In order to break up this powerful stranglehold on the U.S. political, economic, communications, and nonprofit sector, there has to be a level of understanding of the problem. That is the purpose of articles like this one, which systematically lays out the facts and evidence so people can see the truth for themselves. The analysis we provide hopefully helps readers connect the dots more quickly than we did as we began to better understand these vexing realities.

The Usual Suspects?

There are risks to oversimplification. But broad truths are often useful to identify so that better public understanding can grow. Behind a range of problematic business, political, trade, communications, and other policies are those like Buffett who are fostering a society where they steadily gain more power and money while the vast majority of people steadily lose power and money. In order to protect themselves and foster a good guy image, they wrap themselves in philanthropy and the impression of supporting ‘good causes.’ To protect themselves even further, the oligarchs and plutocrats attempt to throttle those sources that tend to out such truths. To learn more, follow the links in the reports with analysis as shown.

“You should write your obituary and then try to

figure out how to live up to it.”

– Warren Buffett

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from the evening of 11.24.2023

- The surprising history of America’s biggest holiday shopping blitz

- Best Buy says its strategies to deter shoplifting are working.

- Best Buy’s simple strategy for beating shoplifting: More workers in stores

- ‘This is insane.’ Swedish workers are getting under Elon Musk’s skin

- Terry Gou, Foxconn founder and presidential candidate, speaks during a press conference in Taipei, Taiwan November 23, 2023. REUTERS/Carlos Garcia Rawlins

- Billionaire Foxconn founder drops out of Taiwan’s presidential race

- Company logos are seen at the Nissan car factory in Sunderland, England, Friday, Jan. 9, 2009.

- Nissan leads $2.5 billion investment to build two more EVs in UK

- ‘Moment of truth’ for oil industry: Deepen the climate crisis or help fix it

- In an aerial view, Tesla cars recharge at a Tesla charger station on February 15, 2023 in Corte Madera, California.

- Solid state batteries promise to radically change EVs. But they may not be the only answer

- Chinese shadow bank says it has ‘huge’ debt and can’t pay its bills

- Jack Ma backs off on plans to sell Alibaba shares after stock plunge

- Award-winning Kashmir journalist in press freedom case released after nearly two years behind bars

- OpenAI had a confusing week. Who came out on top? And who lost out?

- Here are the dozen brands that have paused ads on X amid ongoing crisis for Elon Musk’s platform

- Democrats accuse X of profiting from Hamas propaganda

- OpenAI’s wild week. How the Sam Altman story unfolded

- Spotify to slash royalties for rain sounds, white noise and other non-music tracks

- The NFL, Washington Post, and Walmart: Here are the major companies still advertising on X despite Elon Musk’s antisemitic endorsement

- Economist Larry Summers joins the board of OpenAI as ousted CEO Sam Altman returns

- Mortgage rates fall for fourth week but stay above 7%

- 5 takeaways from America’s biggest crypto crackdown in history

- OpenAI: The cast of characters of Silicon Valley’s latest, juiciest upheaval

- Gas prices could fall further as oil drops 4% on OPEC meeting delay

- Sam Altman returns to OpenAI in a bizarre reversal of fortunes

- EU stops advertising on X over hate speech. Fines could follow next yearHeadlines at 1:18 PM ET.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.