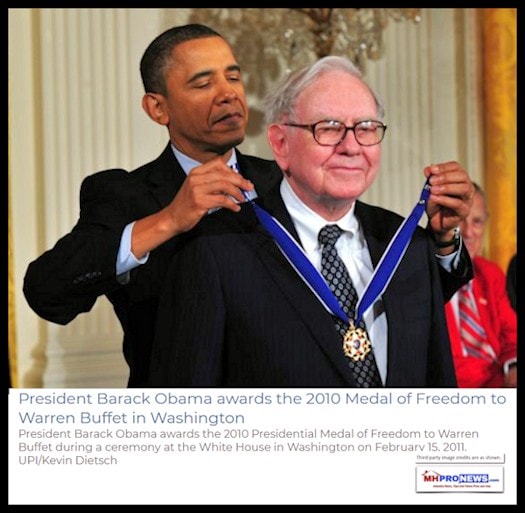

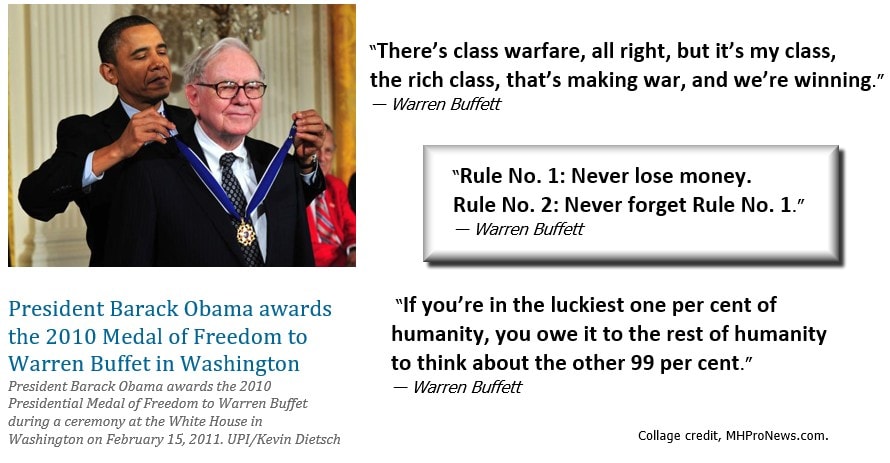

The “Oracle of Omaha” billionaire whose Berkshire Hathaway owns several manufactured housing (MH) brands, backed Barack Obama for the White House, twice.

Before looking at what that Warren Buffett support for Mr. Obama did for Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other Berkshire MH brands, let’s peek at what Buffett’s backing of President Obama earned Berkshire in a venture outside of the MH field.

Truth Hiding in Plain Sight (THIPS) – Buffett, Clinton, Obama and “Political Payoffs”

There are some things that analogies or parallel examples can clarify.

So, before turning to the affordable manufactured home MH industry, this report will begin by looking at how Warren Buffett profitably leveraged political relationships – outside of manufactured housing.

Specifically, Buffett’s Berkshire’s acquisition of the railroad giant, Burlington Northern, Sante Fe (BNSF).

Mother Jones noted that Warren Buffett supported the political career of Barack Hussein Obama some years before he ran for the presidency.

Buffett backed Mr. Obama’s successful run for the U.S. Senate seat in Illinois. He later twice supported Obama’s run for the Oval Office.

As POTUS Obama’s Secretary of State, Hillary Clinton’s State Department duly dragged their feet for years on the Keystone XL pipeline deal. The State Department had to authorize Keystone for it to proceed. As ThoughCo wrote last year, “The Department of State did not issue a permit for the Keystone XL pipeline while Clinton served as secretary of State.”

When oil isn’t moved by pipelines on land, it is commonly shipped by rail or trucks.

“And whatever is good for crude by rail, is good for railroads. Particularly those with a northern footprint, such as Burlington Northern Santa Fe. In 2010, Warren Buffett’s Berkshire Hathaway acquired BNSF for $26.5 billion,” reported right-of-center Forbes.

The Congressional Research Service estimates that transporting crude oil by pipeline is cheaper than rail, about $5/barrel versus $10 to $15/barrel, per the left-of-center NYTimes.

Lower oil and energy prices are better for most businesses and consumers. So why didn’t the arguably safer pipeline method prevail during the Obama years?

The data on transporting oil via various methods of delivery demonstrates that none of the methods are error-free. They all come with risks – environmental, and in terms of worker-injuries.

The left-of-center Huffington Post reported in 2013, “Using data from the U.S. Department of Transportation between 2005 and 2009, the study found the rates of injury requiring hospitalization in the U.S. were 30 times lower among pipeline workers than rail workers involved in shipping oil.

For truck transport, the difference is even more stark, with an injury rate 37 times higher than oil transport by pipeline.

When it comes to spills, road transport fared the worst, with nearly 20 incidents per billion ton-miles. Rail had just over two incidents per billion ton miles while pipelines had less than 0.6 per billion tonne [sic] miles.

The report notes that pipelines tend to release more crude per spill than rail, but much of that is often recovered quickly.

With pipelines such as the controversial Keystone XL pipeline — which would connect Canadian crude to Texas refineries — in regulatory limbo, producers have been increasingly turning to rail to get their crude to market.

But concern over the safety of using that mode of transport has intensified since a runaway crude-laden train derailed in Lac- Megantic, Que., this summer, killing 47 people and destroying much of the downtown area,” per HuffPo in Canada.

So, the Obama Administration’s “no” on the job creating Keystone XL pipeline – statistically-safer, said WaPo than trucking or rail – could certainly be viewed as a policy gift to Warren Buffett/Berkshire Hathaway, among others.

While often talking about the “Buffett Rule” on tax policy, heavy regulations and then-current tax policies were harming smaller players, in favor of big donors, during the Obama Administration.

The Buffett rule never became law during the Obama years. Rather, the Buffett Rule was a nice-sounding talking point, suitable for appeasing the growing numbers who don’t understand the distinctions between socialism and free markets. It was a way of appealing to a growing left-leaning base, while still rewarding big money “Wall Street” type donors. To rephrase, it was a head-fake to voters, while raking in money from billionaires and big business, like Buffett.

Warren Buffett, along with left-leaning George Soros and others, says the Chicago Tribune, are among the supporters for the Obama Foundation.

The foundation is raising money by the millions, from mostly politically left-leaning groups. It should be noted that Soros-backed groups have been heavily involved in organizing anti-President Donald J. Trump protests, and the related anti-POTUS Trump “resistance.”

The economy is demonstrably turning from tame to tiger since Mr. Trump became the winner of the 2016 presidential race. So, why would billionaires – such as Buffett or Soros – support anti-Trump efforts? While some prominent billionaires on the left claim to care about the poor or ‘income inequality,’ the still new Trump-era is already economically benefiting minorities, workers, and all other economic groups. So where is their beef?

Or is it because once you have plenty of money, political power is next?

Big brother governments are necessary for ‘crony capitalism.’ If Mr. Trump was the fascist that left-leaning protesters errantly claim, POTUS is showing it in odd ways. Because by rolling back regulations, the president is reducing executive power, not increasing it.

What President Trump’s policies are doing is helping American wage growth, should help public safety, and should benefit small to mid-sized businesses to compete more evenly with corporate giants. That’s why National Federation of Independent Businesses (NFIB) and other business groups have supported it.

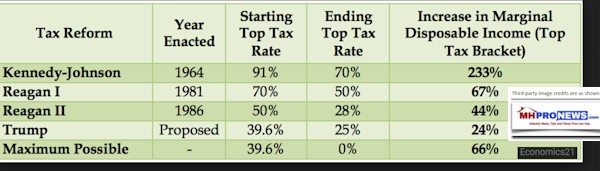

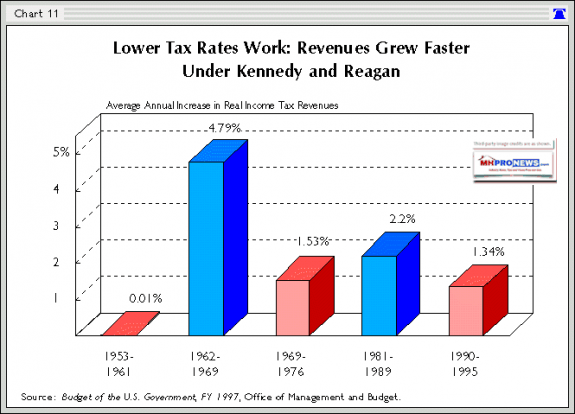

As the Daily Business News has previously reported, Democratic President John F. Kennedy and GOP President Ronald Reagan both cut taxes, and watched revenues briefly, dip, then soar as the economy took off both times.

Surely, a genius who enjoys history, as Buffett does, knew about those historic events and outcomes. Then why even pay lip service to support policies that harm small business, and the middle class?

Buffett’s Crony Capitalism, Heavy Regulations, and Manufactured Housing

Crony capitalism isn’t new.

But how media, messaging, and narratives are forged today as powerful tools of influence can create an impression that is different than the reality.

As right-of center Townhall’s Guy Benson said, “propaganda works.” Part of the essence of propaganda is repeating a message over and over, until that message is accepted as true, even if it may be a half-truth, or is an outright lie.

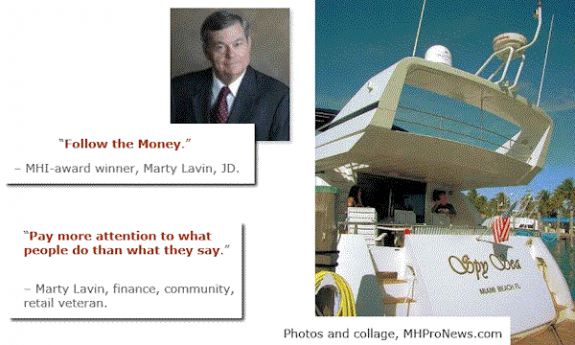

Buffett has, as fellow Democrat Maxine Waters said, cast himself as a folksy billionaire. Buffett’s politics have clearly benefited from those he has backed. Words said one thing, realities meant another.

In the matter of allegations of racism and steering, it is interesting to note that Charlie Munger, Buffett’s right-hand man at Berkshire Hathaway admitted in a generic way during an interview that there is a likelihood that someone has done something wrong in their manufactured housing units.

“I have no doubt that somebody, somewhere that’s cheated some poor person,” Munger said in response to a question about the allegations against Clayton Homes and their related lending units, per the video from left-of-center, CNN Money.

The Buffett Way?

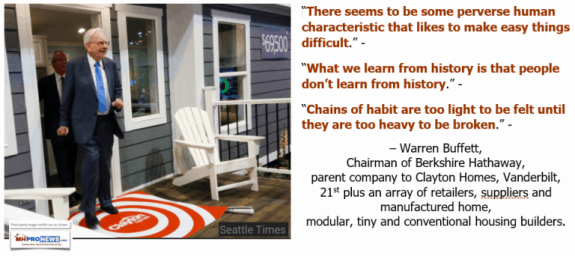

As the Daily Business News previously reported, applying Buffett’s words to his actions reveals an apparent pattern.

That pattern?

Using the power of the government, leveraged by political support, plus capital that gives his operations an advantage.

Combined with Buffett’s “the moat” principle – heavily underscored by Kevin Clayton in the video interview found at the link below –

- heavy regulations,

- control over financing and capital,

yields a powerful pattern that people across the political spectrum believe is monopolistic in nature, when it comes to manufactured housing.

Kevin Clayton Interview-Warren Buffett’s Berkshire Hathaway, Clayton Homes CEO

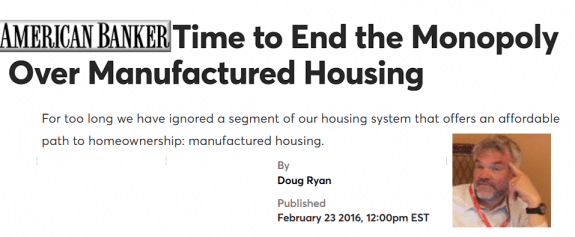

Monopolies – also known as ‘trusts’ – are harmful to free enterprise, and that is why anti-trust (anti-monopoly) laws can come with both civil, and criminal penalties.

Lawsuits for Triple Damages – Anti-Trust, Anti-Monopoly Law, Manufactured Housing, and You

It must be noted that Clayton said in this video interview that Buffett told him they have ‘plenty of money.’

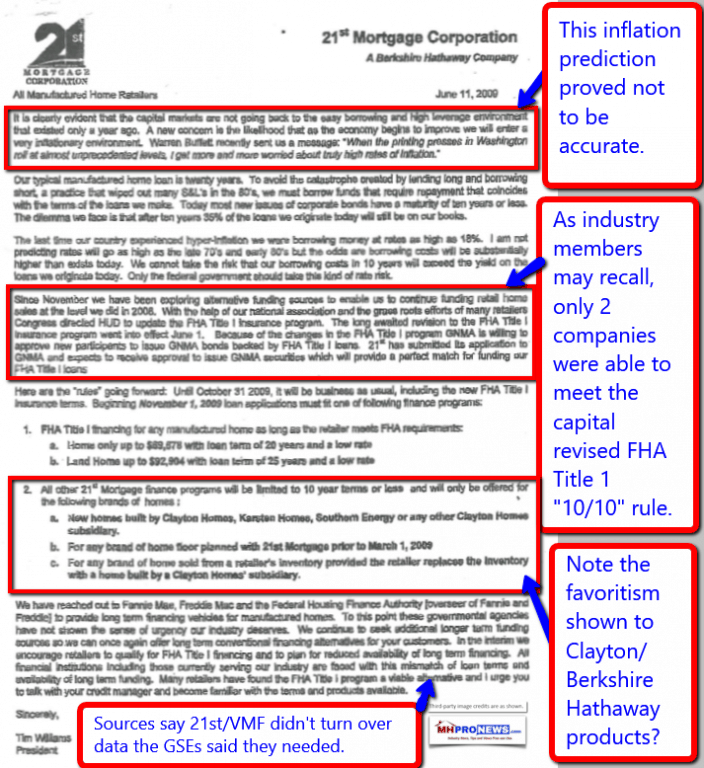

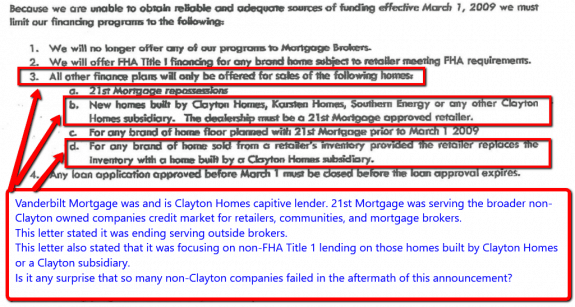

Yet, Tim Williams of 21st Mortgage, in the two “smoking gun” letters previously reported on the Daily Business News, claimed that capital had to be restricted.

That restriction of Berkshire’s capital tilted clearly toward Clayton Homes. See it on 21st letterhead, with Tim William’s signature at the bottom. What more do regulators or attorneys need?

Before the time that the Manufactured Housing Institute (MHI) was dominated by Berkshire Hathaway, MHI pointed to Eric Belsky from Harvard, claiming manufactured homes would dominate over conventional housing.

Before Berkshire’s dominance, MHI was promoting mortgages over chattel lending. What happened?

Appealing Manufactured Housing Institute (MHI) Marketing, Finance Booklet Reviewed

Kevin Clayton, in the video above, noted the affordable housing crisis right from the outset of his video. But he also noted that Buffett would not mind losing money for even 5 years, so long as it would build their “moat.”

Clayton said Buffett told his corporate CEOs very few things, but among them, was to push “the moat,” and to use every competitive advantage they could to beat their competitors.

All of that and more, is found in Kevin Clayton’s own words, in the video and related report, above.

Seen in that light, the Manufactured Housing Institute – whose revenues and executive committee structure are both dominated by Clayton Homes/21st and related Buffett brands – isn’t it clearly acting in ways that are, as Mark Weiss, JD, President and CEO of MHARR recently put it, ‘a pure gift’ to Berkshire Hathaway?

The Masthead

The Manufactured Housing Institute has finally provided a series of written responses to concerns raised by a number of industry members. MHI did so to via an email to their members, as they ask them to renew their annual membership dues. Let’s make this hyper-simple.

Bullets

By cutting off capital to lending that was available, as Kevin Clayton said in the video from that same time-frame, that action over-time forced hundreds of manufactured home independent companies to:

- sell out for less,

- close their doors,

- or struggle for survival and dramatically reduced levels of competition.

That in turn put several manufacturers out of business, at the very time that Belsky projected that manufactured housing would overtake site built housing.

Big business is widely seen as more able to endure heavier regulations.

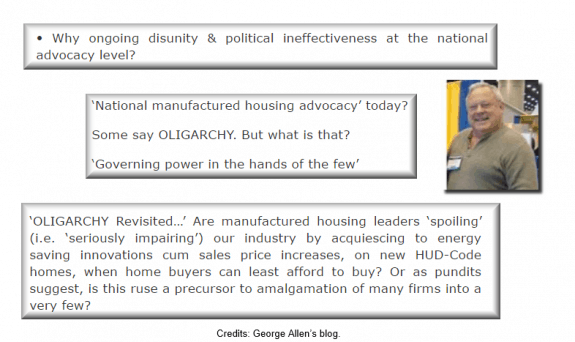

In manufactured housing – the following MHI u-turns and policy failures become more clear, in the light of the patterns reported and linked herein. The four examples below make the point.

- CFPB/Preserving Access to Manufactured Housing Act

- HUD

- DOE

- DTS

NAHB Report – High Cost of Regulations Impact Housing – and Manufactured Housing

Manufactured Housing Institute VP Revealed Important Truths on MHI’s Lobbying, Agenda

The Top Twelve Questions for Manufactured Housing Institute (MHI) CEO, Richard “Dick” Jennison

All of this points to a troubling pattern of MHI taking positions that were contrary to common sense, and/or contrary to the interests of the small- to mid-sized industry players.

Yet, each of these stances obliquely beneficial to Berkshire Hathaway, Clayton Homes and their lending and other divisions.

How so?

Because they tended to increase, or maintain, or failed to mitigate, heavy regulations which in turn harms smaller competitors.

What the National Association of Manufacturers (NAM) reports could be applied to manufactured housing producers too.

A combination of problematic actions – perhaps in violation of anti-trust or other laws – can explain why MHI, as a tool of Berkshire Hathaway, has routinely failed to perform in ways that benefited the majority of manufactured home industry members.

The big players, however, do benefit from MHI’s behavioral pattern, say sources, many from within MHI.

Isn’t that in keeping with Kevin Clayton calling Buffett a genius in the video?

Or in applying Buffett’s words about long-term strategic thinking, vs. short term thinking that has plagued the industry for years?

Warren Buffett supported Mr. Obama and then Ms. Clinton.

Both promised no changes to the CFPB.

Without a GOP super-majority, with those Democrats in power, it is clear in hindsight that the Preserving Access to Manufactured Housing Act was a fool’s mission.

MHI’s own vice-president said that in his own words, in the report linked below.

Prominent MHI member Frank Rolfe, and others inside and outside of MHI said similarly. In Rolfe’s case, he did so, until his own ties to Berkshire Hathaway’s 21st Mortgage, et al could have led to his ‘self imposed’ silence since he torched MHI’s failures.

Frank Rolfe: Pressured into Silence? Manufactured Housing Industry, and Journalism

And just days before the tight 2016 election, MHI had not one, but two paid speakers who were pro-Clinton, even though her stated policies were inferior when compared to those of Donald Trump.

So why did Buffett back Clinton? Wouldn’t Clinton’s election be like stopping Dodd-Frank reform, yet again? Isn’t it now obvious that MHI has been duping hundreds of honorable, smaller companies to the advantage of a few bigger firms that could consolidate them?

The Truth Hiding in Plain Sight (THIPS)

While in a technical, legal sense there may be conspiratorial/anti-trust/RICO aspects to the Buffett/Berkshire Hathaway/Clayton Homes, et al actions, the bulk of the evidence is now hiding in plain sight.

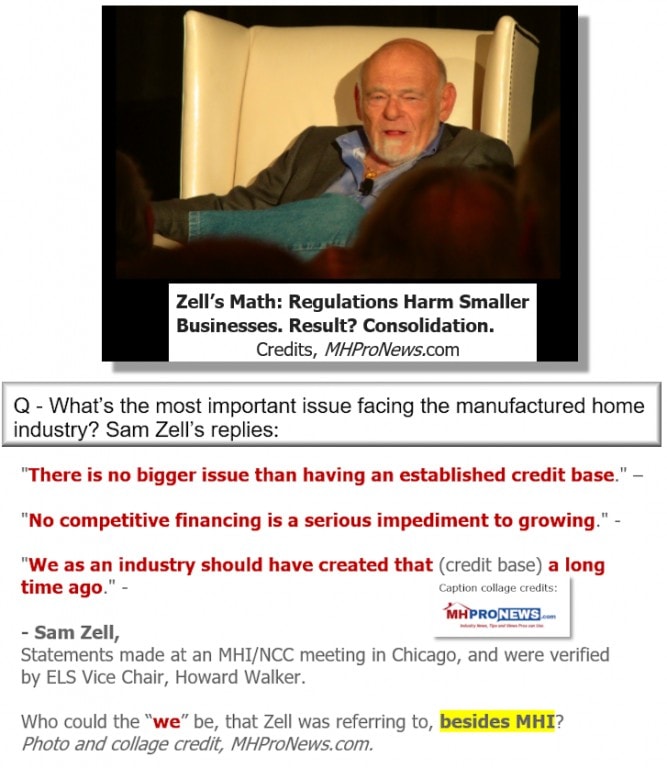

Using Sam Zell’s ‘math,’ it was a combination of leveraging their capital/lending, with their considerable political influence. Let regulations, and a lack of capital, force independents out of business.

It’s simple yet brilliant, just as Buffett himself – or Kevin Clayton said – in the linked reports and video.

MHProNews has offered numerous opportunities for MHI and Berkshire Hathaway brands to explain and/or defend these actions, if they could. Silence, ducking, dodging, and other tactics have followed instead of a sensible explanation.

In an upcoming Daily Business News on MHProNews report on Richard “Dick” Jennison, HUD Code manufactured home industry readers will see how Jennison’s words and behavior complete the picture painted in the report above.

Readers will also see a reason why Jennison did as asked. Stay tuned.

“We Provide, You Decide.” © (News, analysis, and commentary.)

Related: The problems above point to opportunities in disguise for those willing to pivot, based upon the evidence.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.