The year 2020 will soon be ending. It is a time of year that some assess results to see where adjustments or improvement can or should be made. So, what can the manufactured housing industry’s professionals and investors learn from the experience of the Florida Manufactured Housing Association (FMHA) and Bow Stern’s “Hand Built Home” promotion?

Objectively, it is important to note that:

- FMHA’s website is eye appealing.

- Bow Stern’s videos and that website are professionally produced.

- Both the website and videos share several useful thoughts for potential manufactured home buyers.

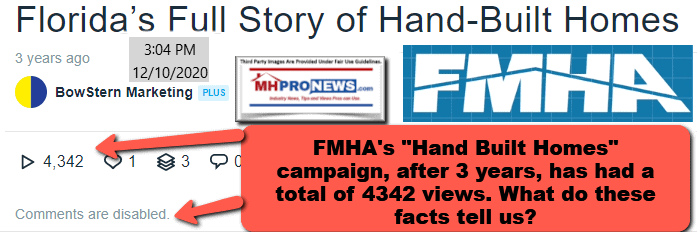

Here is an example of the fine-looking Bow Stern produced “Hand Built Home” video for the FMHA.

According to Vimeo, on 12.10.2020 as this article was being drafted, after reportedly being online for three years, there have been some 4,342 views. Not knowing the precise date the video was uploaded, but for discussion’s sake, if it were precisely 3 years, that would be about 1,095 days online. That works out to be slightly less than 4 views per day.

4 view per day.

To put that in context, there may have been more people working in the manufactured home profession collectively during those years in Florida than the total number of views of that slick Bow Stern-FMHA video.

Let’s dig deeper to bring this topic into sharper focus.

Per a Fox Business report, on September 8, 2020, 1,000 people are moving to Florida daily. The Daily Mail put the ‘moving into Florida’ figure – also during September, 2020 – at about 950. So, to be on the conservative side, let us use the lower daily move-in to Florida count of 950.

Presuming that same level of move-ins over the past 3 years, that would be about 1,040,250 new Florida residents. If every one of those 4,342 views on Vimeo of that FMHA-Bow Stern video were by a prospective new Florida resident, that would represent 0.004174 of the total move-ins.

That is less than ½ of .1 of 1 percent of the possible new Florida residents.

Keep in mind that 0.004174 figure does not factor in the millions of Sunshine State residents who during the past 3 years were moving within their state during that same timeframe.

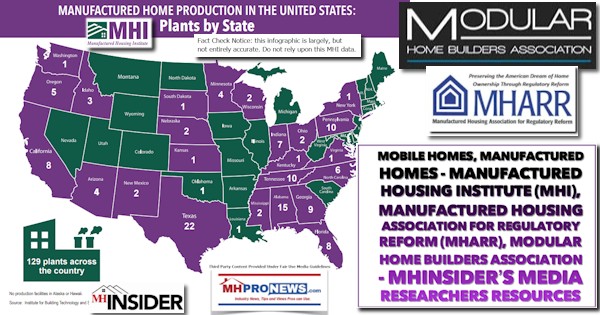

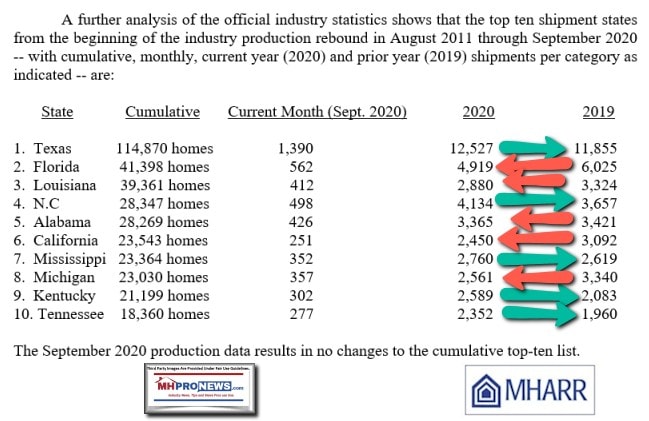

For some time, there were increasing numbers of new HUD Code manufactured homes being built and shipped into Florida. But in 2020, while the #1 manufactured home state Texas post-COVID19 lockdowns moved ahead in the Year Over Year (YoY) cumulative shipments into their state, #2 Florida retreated YoY in 2020. That is per the latest data from the Manufactured Housing Association for Regulatory Reform (MHARR), which in turn cities the Institute for Building Technology and Safety (IBTS). IBTS in turn collects that data officially for the U.S. Department of Housing and Urban Development (HUD). That is as official and reliable as it gets in manufactured housing.

Additional Information, Big Company Context, MHProNews Analysis and Commentary

The manufactured home industry is underperforming during an affordable housing crisis.

Site builders can not keep up with the demand. As the NAHB research above reflects, there are several trends that ought to benefit manufactured home retailers and producers. Click that report above to learn more.

Furthermore, the inventory on existing homes sales are down nationally too. NAR’s Chief Economist Lawrence Yun, Ph.D., and his colleagues have likewise produced data that ought to point to numerous opportunities for manufactured housing to grow in a robust fashion.

Perhaps the argument can be made that manufactured home builders are having a hard time keeping up, based on the concerns raised by publicly traded companies that speak about labor and production issues. See that report linked below the quote that follows.

Cavco Industries owned brands are among those which have production centers in the state of Florida. The more business friendly, less COVID19 lockdown prone state government wants its people working and open for commerce.

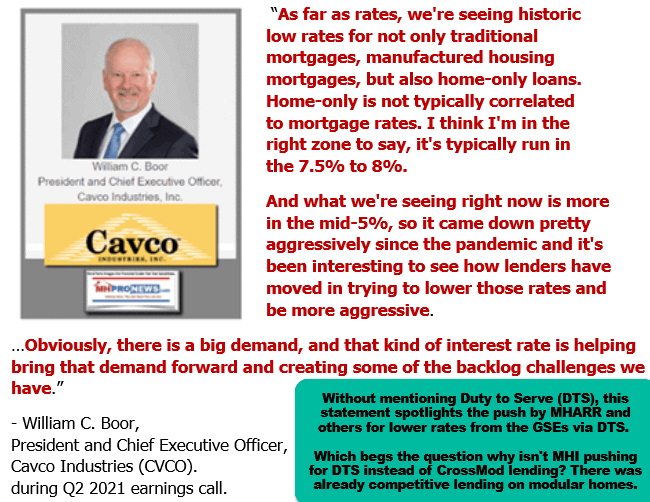

Despite that business-friendly stance, another disturbing data point has to be raised. Cavco’s President and CEO William “Bill” Boor not only obliquely confirmed the above report and analysis about Florida, but also arguably presaged what could be lower sales in Florida ahead. As sales professionals know, it is often easier to sell homes that are in stock, especially to “a snowbird,” than it is to order a new manufactured home when the lead time to getting one from the factory is routinely several weeks out.

The above from Boor brings up one more of the ugly secrets of manufactured home shipment data.

Roughly 1/3 of the new homes, per the Manufactured Housing Institute (MHI), are going into land-lease communities. Some manufactured home community portfolio operators buy hundreds of new HUD Code homes per year, and parcel those out to their individual properties as they deem best per a location’s need.

That noted, numbers of those new HUD Code manufactured homes are being purchased as rentals, not necessarily as ‘for sale’ homes.

While precise figures are not produced by MHI on this next point, it is possible that if rental units bound for various manufactured home communities are subtracted from the total shipment numbers, the bulk of the increase in HUD Code manufactured housing shipments since the industry hit bottom can be attributed to more rentals being produced rather than to increases in additional retail sales.

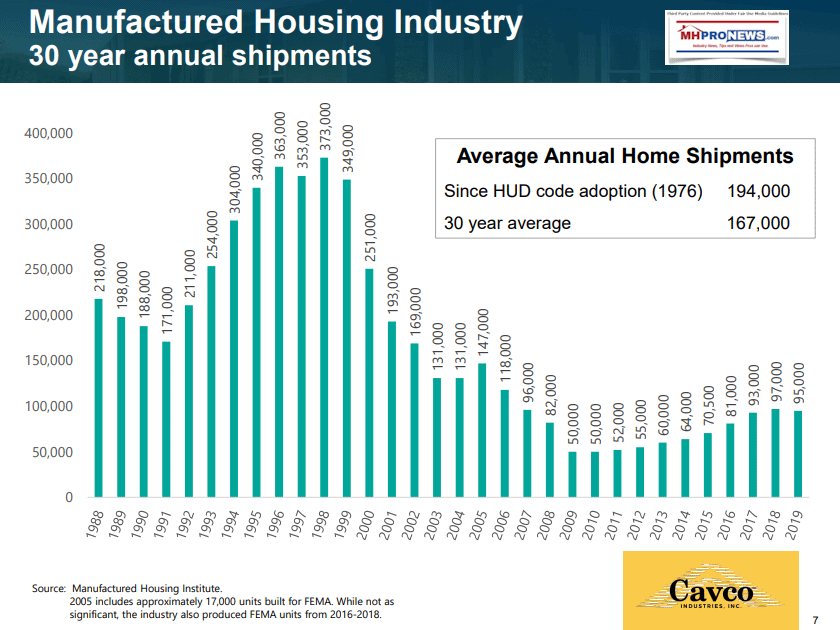

As an arbitrary guestimate, which MHI could and should refine if they only cared enough to do so, of the 95,000 new manufactured homes in 2019, the actual total retail sold may be closer to roughly 70,000 (+/-). Why does that matter? Isn’t it the same for the factory either way if the units are going to be rentals or for retail sales?

Yes and no. As Boor from Cavco said, they are seeing a dip in orders from communities. It may not impact one of the big three as much as an independent. But community orders suddenly dropping could well impact the wholesale production of a more marginal independent.

Additionally, while MHI is claiming to be “promoting” manufactured housing – and their surrogates in lock-step tout the industry’s ‘recovery’ from the historic two years near 50,000 annual units – that rental unit influence on total production/sales should be considered. No less a figure that Sam Zell, the billionaire chairman of Equity LifeStyle Property and other interests, said at an MHI function in Chicago that rental units should be kept marginal. Overly relying upon rentals, Zell publicly implied to an MHI/NCC audience, was to be avoided.

Back to the FMHA and Bow Sterns…Takeaways?

This should not be taken as a slam on FMHA or Bow Stern. As what follows will underscore, they have served a useful purpose, albeit not what they may have intended when they launched their efforts a few years ago.

Among the most important takeaways from this look at FMHA’s promotional effort with Bow Stern is that the failure to robustly grow the market only underscores several concerns raised by MHProNews and MHLivingNews in recent years.

- There is scant penetration into the mainstream housing market occurring in Florida, a tiny fraction of all housing transactions and moves.

- The combination of MHI and FMHA efforts to promote has failed to grow the market while conventional housing and the resale of existing housing is surging.

- As MHLivingNews previously noted, this analysis confirms what third-party Zillow documented. Namely, that, the interest in manufactured homes is declining.

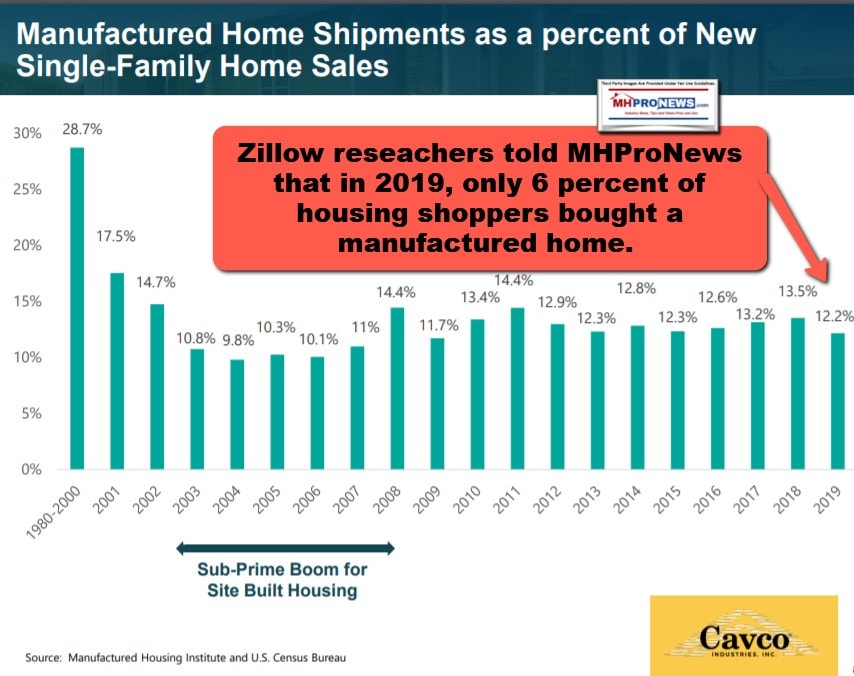

That is also confirmed obliquely by Cavco’s own investor relations graphic shown below.

What explains this outcome? To oversimplify, it can be broken into three components, which this report – objectively understood – clearly demonstrated.

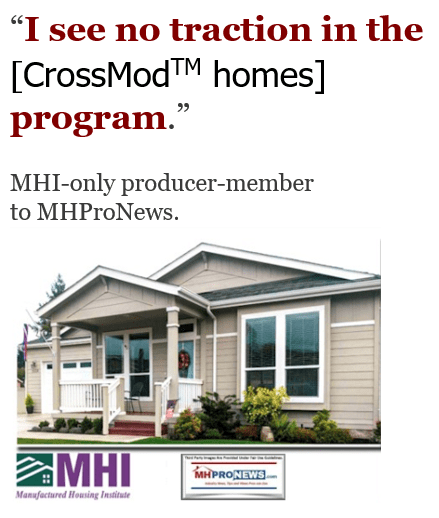

A) Zoning/placement issues must be robustly addressed. Not only because land-lease communities are approaching or reaching capacity, but for other reasons too, more placement options are needed. As MHProNews – or for that matter, MHARR – has said for years, this points to a need to robustly promote the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform Law). Cavco obliquely raised this too when they mentioned using manufactured homes for “urban infill.” Quite so. NIMBYism has harmed manufactured housing. Which begs the question, why hasn’t Cavco or other public firms pushed MHI into engaging that pursuit vs. the “on life support” market failure of the CrossModTM homes project?

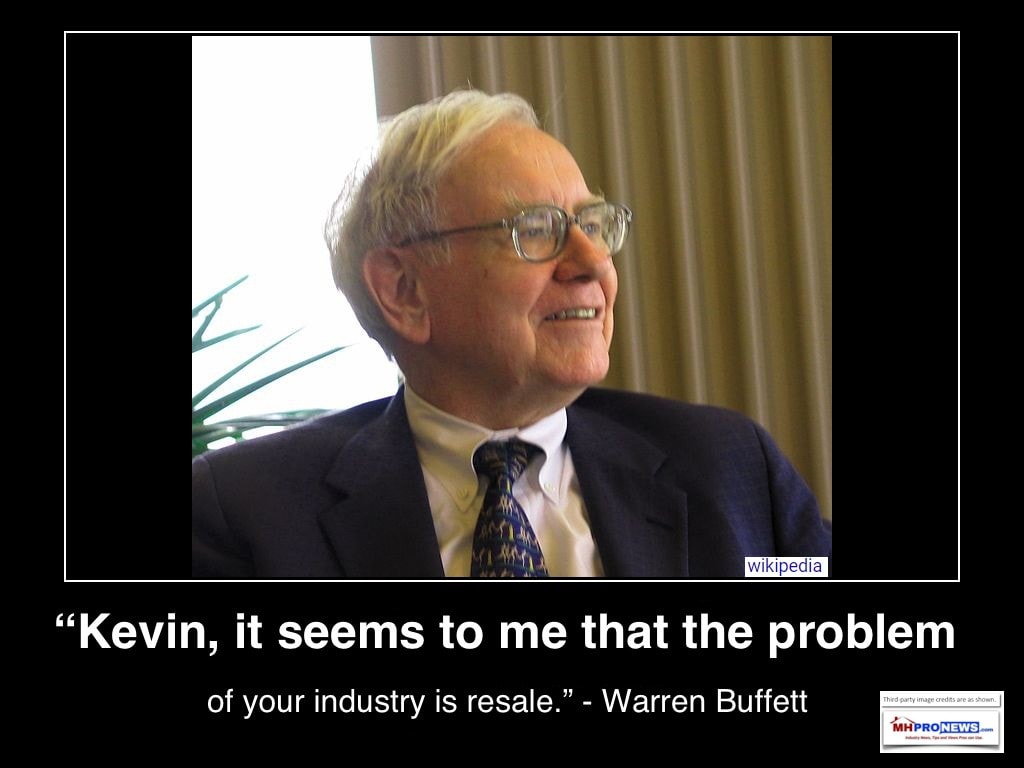

2. The need for more competitive financing options, which points to the need for reforming the implementation of the Duty to Serve (DTS) program mandated for Fannie Mae and Freddie Mac, and overseen by the Federal Housing Finance Administration (FHFA). Additionally, other federally-back lending options such as FHA Title I and more, artificially hampered for years by their restrictive 10/10 rule for lenders, must also be explored and opened-up. No less a party than the Minneapolis Federal Reserve’s researcher Donna Feir, Ph.D., said that the manufactured housing lending market needed to be investigated. Feir pointed to the Seattle Times series of articles on Clayton Homes, 21st Mortgage and Vanderbilt Mortgage and Finance (VMF) in her footnotes.

3. “The Image Issue.” In some ways, A, B, and C each influence the other. Because manufactured housing has an image issue, there is less interest or open hostility from NIMBYites to new manufactured housing placements. Perhaps in part because of A and C, the GSEs and others apparently feel able to ‘get away with’ largely ignoring mainstream manufactured housing.

The GSEs paying MHI to co-sponsor events, arguably a conflict of interest, may also be contributing to that dynamic. The net result? Among other apparent impacts, Berkshire-owned lenders get to originate more higher rate loans. But the trend-lines since Berkshire Hathaway entered manufactured housing are apparent. By accident and/or design, all of the historically low performance years in half-a-century of mobile homes and manufactured housing have occurred during the Berkshire era. Coincidence? As the GSEs may be poised to exit FHFA conservatorship, will it be a surprise if Berkshire once again plays a direct role in capitalizing Fannie and/or Freddie in that exit?

But the bottom line in the image issue is that neither FMHA, Bow Stern’s, nor MHI’s efforts have made any appreciably measurable positive impact on manufactured housing market penetration.

The Bottom Lines?

All three of the issues above,

- zoning/placement,

- access to more affordable financing options,

- and the image issue,

these items have combined to limit manufactured housing for most of the 21st century.

The tragic irony is that federal laws were enacted – in both A&B’s case, with MHARR’s direct efforts – that were supposed to address those two points. Once enacted, it became MHI’s ‘post-production’ role to make sure they were implemented.

There is a dark grace to the FMHA/Bow Stern, and MHI videos and promotion. They have served to underscore what MHProNews and MHLivingNews have said for years. Namely, that the manufactured home industry must get to the root issues. Those issues often revolve around problems caused by MHI member companies that attract negative media. To put that in a different framework, individual firms and locations can do this. There is no need to wait for a sudden aha moment by thousands of industry independents.

Without hubris or hoopla, perhaps no one else is better poised to make this case that addressing the causes of bad news is the path to growth than MHProNews and MHLivingNews. Why can that be said with a straight face? Because in manufactured home trade media, ONLY MHProNews and MHLivingNews routinely report on such issues, which include the sadly negative news topics published that pro-MHI bloggers or trade publications routinely duck – because they may/or do not reflect well on a favored brand.

Site data tells MHProNews that it is the controversial topics that routinely attracts the larger audiences. For example, on MHLivingNews, it is the “Case Against Clayton Homes” that has led for months as the runaway most read report. Based upon known data, that one article outperforms all of the others in manufactured housing media. MHProNews and our MHLivingNews sister-sites outperform due in part because we dare to explore issues in an authentic, evidence-based manner that doesn’t kiss the derrière of some insider. By contrast, ‘positive’ articles get traffic, but often not at the same clip as those which are focused on some legal, ethical, or other controversial issue.

As a multi-decade industry veteran told this writer some time ago, our coverage of the issues has no doubt caused us to fall off numerous Christmas card lists. Indeed, it is true that someone may lose ‘friends’ by critiquing some of the manufactured home industry’s best known brands or largest trade group.

That noted, only dispassionate and evidence-based looks at what is harming the industry will point the way for the industry’s recovery. That is the bottom line.

Even MHI, indirectly, acknowledged the harm done by their big boy brands when they issued a Code of Ethical Conduct. Sadly, neither MHI nor state associations, per MHI/state level sources, have enforced those items. They are thus window dressing.

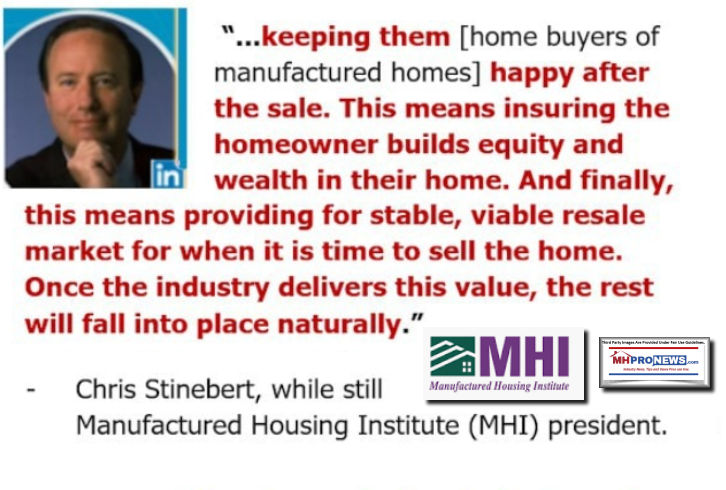

But that window dressing makes the point that former MHI President and CEO Chris Stinebert made in his exit message, before he was muzzled by his purported non-disclosure agreement (NDA) with MHI.

If 3D home tours, slick websites, and fine videos were the key to unlock more sales – due to the demand for affordable housing – mainstream manufactured home sales should be at historically high levels. MHARR routinely makes the point that HUD data on the tiny numbers of cases that go to dispute resolution that quality is high. If warm and fuzzy articles and social media posts were the key to more sales, then why is manufactured housing still under 100,000 new home sales instead of over 500,000?

Only by resolving the underlying issues will manufactured home sales recover and soar. The “Hand Built Home” campaign is only the latest evidence that running away from the names “manufactured homes” or “manufactured housing” are not the solution. Trying to ‘rebrand’ costlier CrossModTM homes clearly hasn’t worked in the marketplace either.

Ironically, almost a year ago, Tom Hardiman from the Modular Home Builders Association (MHIA), in his slam against CrossModTM homes, made several absolutely apt points.

Like it or not, Hardiman was arguably correct when he said that MHI should ‘own’ their own industry. The solution for sustainable growth in manufactured homes is NOT to run away from the industry with other terminology. There is a time and place to do that, but the focus should be to properly promote the manufactured home industry in a fashion that causes people to take a fresh look at manufactured housing under the moniker of manufactured housing.

FMHA, Bow Sterns, and MHI are all among the proof that failing to embrace the industry’s own product and caring properly for its millions of existing customers are a constant drag on potential manufactured housing industry growth. It is common sense that someone who sees the Bow Stern video on FMHA’s website is already looking for a manufactured home. They certainly did not do a search for ‘hand built homes.’

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Long-Time HUD Attorney’s Formal Statement on Manufactured Housing Enhanced Preemption