There are several ways to understand people and organizations. One method, is to listen to what they say.

Another is to see how what they claim compares to what they actually do.

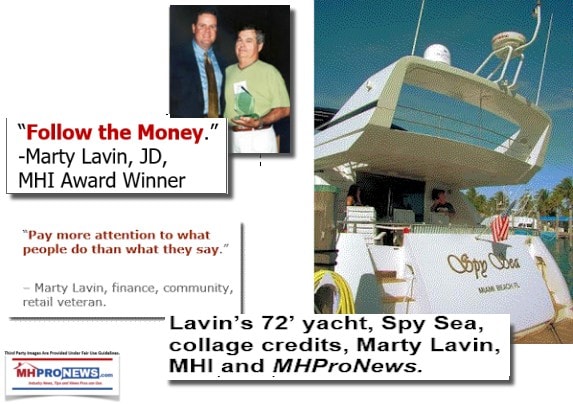

Yet another is the investigator’s method, which is “follow the money.”

A classic variation on the above is the question: Cui Bono? Who benefits?

Toadies and lemmings will simply follow mindlessly, even if they are following a ‘leader’ over a cliff.

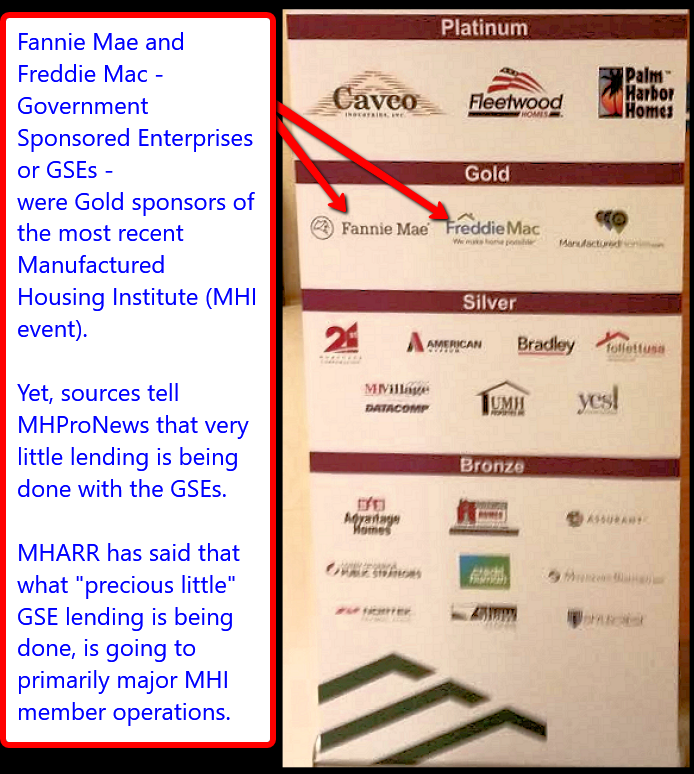

The Manufactured Housing Association for Regulatory Reform (MHARR) has been pushing, prodding, and calling for action, not words by the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac with respect to their congressionally mandated Duty to Serve (DTS) manufactured housing.

By contrast, the Manufactured Housing Institute (MHI) has taken money from the GSEs to sponsor events that have failed to deliver DTS.

Who benefits from that, other than the largest corporate players that are trying to consolidate manufactured housing into ever fewer hands?

With that introduction, let’s dive into MHARR’s release, which follows below. That will be followed by some additional comments, links, insights, and information.

MHARR REITERATES CALL FOR DTS INVESTIGATION

Washington, D.C., June 18, 2019 – The Manufactured Housing Association for Regulatory Reform (MHARR), in a June 13, 2019 communication to Fannie Mae Vice President Jonathan Lawless (copy attached), has reiterated its call for a congressional investigation into the failure of both Fannie Mae and Freddie Mac to implement the statutory Duty to Serve Underserved Markets (DTS) in relation to manufactured home personal property (or “chattel”) loans. Those loans, which provide consumers with the most affordable access to the nation’s most affordable non-subsidized homes, comprise nearly 80% of the manufactured consumer lending market. Nearly 11 years after the enactment of DTS as part of the Housing and Economic Recovery Act of 2008 (HERA), however, neither Fannie Mae nor Freddie Mac have purchased any manufactured housing personal property loans pursuant to that mandate – which expressly includes such personal property loans – let alone provided the type of market significant securitization and secondary market support that Congress envisioned. Indeed, even an extremely limited and highly restricted “pilot program” for such loans has yet to materialize after nearly two years of empty promises, and is referred to by Fannie Mae as only a “potential” pilot program.

Instead of providing such crucial support for the largest single segment of the manufactured housing consumer lending market and mainstream, inherently affordable manufactured homes, as MHARR’s communication notes, both Fannie and Freddie have instead prioritized pilot programs for much higher-cost manufactured homes, as well as a supposed “new class” of manufactured homes with retail purchase prices as high as $220,000.00 – as contrasted with an average purchase of $71,900.00 for all types of existing, mainstream, HUD Code manufactured homes. Consequently, instead of expanding access to the industry’s most affordable mainstream homes, as DTS was designed to do, both Fannie and Freddie continue to discriminate against mainstream manufactured housing and mainstream manufactured housing purchasers, effectively forcing them into higher-interest loans offered by the finance subsidiaries of the industry’s largest corporate conglomerates, while stifling the recovery and market growth of the manufactured housing industry during a prolonged affordable housing crisis. Indeed, this type of sustained institutional resistance to the full and proper implementation of DTS and the resulting ongoing discrimination against lower and moderate-income consumers of manufactured housing is, in substantial part, an outgrowth of the continuing failure of the industry’s post-production sector – dominated by the industry’s largest corporate conglomerates – to demand full compliance with DTS for manufactured housing.

Based, therefore, on the lack of any significant progress toward the market-significant implementation of DTS with respect to the vast bulk of the manufactured housing consumer financing market and apparent diversion of DTS activity into new, higher-cost types of hybrid manufactured homes, MHARR has called for a congressional investigation of Fannie Mae, Freddie Mac and their federal regulator, the Federal Housing Finance Agency (FHFA), with respect to unconscionable and unnecessary delays in the implementation of DTS for mainstream, HUD Code manufactured housing.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based

national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

— 30 —

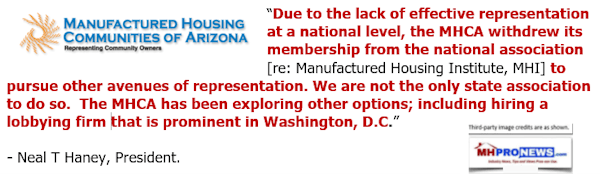

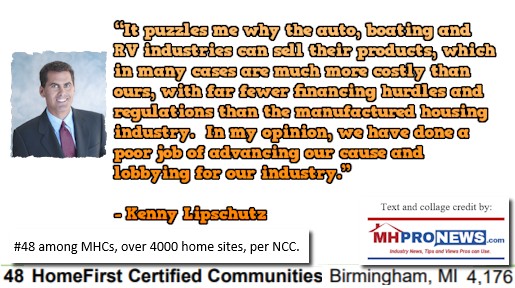

Think about what these MHI past and present members have said, and ask yourself, who side is MHI on?

Then, ask yourself, why hasn’t MHI done what MHARR is doing?

That’s tonight’s final installment of manufactured housing “Industry News, Tips, and Views Pros Can Use,” © here “We Provide, You Decide.” © ## (News, commentary, and analysis.) ##

(See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them. Third-party images and content are provided under fair use guidelines.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two browsers do.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Views From Trenches of Manufactured Housing – Factories, Retailers, MHCs, Others Sound Off

Washington Leak – Justice Department Prepares Major Antitrust Investigation

“Time to Investigate Fannie And Freddie’s Mishandling Of DTS” | Manufactured Housing Association Regulatory Reform

It’s been more than ten years since Congress enacted the Housing and Economic Recovery Act of 2008 (HERA) and its “Duty to Serve Underserved Markets” (DTS) mandate. DTS directs both Fannie Mae and Freddie Mac to “develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low, low and moderate-income families.”

“We as a Nation Can Solve the Affordable Housing Crisis,” Says Secretary Ben Carson, Spotlighting Manufactured Homes, Other Emerging Housing Technologies – manufacturedhomelivingnews.com

” Let’s make sure people understand what’s available,” said HUD Secretary Ben Carson about affordable housing, as he spotlighted manufactured homes as a key part of the Innovations in Housing display on the National Mall in Washington, D.C. ” You can get one of these manufactured houses, for instance, for 30 percent less, and they are very, very resilient.