Affordable housing is the name of the game, and modern HUD Code manufactured homes are the runaway most proven type of affordable type of home. That is one possible takeaway from the data that follows. But there are other insights that the facts below, which comes from the U.S. Census Bureau’s ongoing periodic study of manufactured home retail sales prices, reveals.

Manufactured Home Professional News (MHProNews) will first look at the data, then we will unpack its meaning for the industry, housing seekers, investors, advocates, public officials, taxpayers, and others.

Average Sales Price of New Manufactured Homes by Region and Size of Home

By Month of Shipment

| United States | |||

| Total1 | Single | Double | |

| 2019 | |||

| May | 78,100 | 53,800 | 98,100 |

| April | 78,900 | 55,700 | 100,700 |

| March | 78,900 | 50,400 | 102,100 |

| February | 85,000 | 52,600 | 107,600 |

| January | 81,800 | 53,400 | 103,400 |

| 2018 | |||

| December | 82,400 | 52,100 | 106,000 |

| November | 79,900 | 55,400 | 100,500 |

| October | 82,400 | 54,500 | 106,000 |

| September | 83,600 | 54,400 | 105,400 |

| August | 81,500 | 55,100 | 100,900 |

| July | 78,900 | 52,000 | 99,300 |

| June | 85,400 | 54,900 | 101,300 |

| May | 81,200 | 57,100 | 99,100 |

| April | 74,900 | 50,600 | 98,700 |

| March | 70,600 | 49,800 | 91,400 |

| February | 73,400 | 47,900 | 93,800 |

| January | 69,000 | 47,300 | 92,100 |

| Northeast | |||

| Total1 | Single | Double | |

| 2019 | |||

| May | 76,400 | 49,200 | 105,200 |

| April | 82,000 | 59,300 | 109,000 |

| March | 74,500 | 48,000 | 98,400 |

| February | 74,100 | 52,300 | 97,500 |

| January | 86,600 | 60,100 | 109,000 |

| 2018 | |||

| December | 79,600 | 57,500 | 93,600 |

| November | 81,400 | 52,300 | 104,700 |

| October | 81,600 | 59,300 | 96,200 |

| September | 78,800 | 57,600 | 97,300 |

| August | 82,900 | 58,400 | 113,000 |

| July | 73,600 | 33,900 | 100,600 |

| June | 82,400 | 52,900 | 97,500 |

| May | 81,700 | 62,400 | 104,300 |

| April | 87,300 | 54,900 | 109,900 |

| March | 70,900 | 50,400 | 96,600 |

| February | 80,400 | 50,800 | 98,200 |

| January | 79,500 | 52,400 | 106,000 |

| Midwest | |||

| Total1 | Single | Double | |

| 2019 | |||

| May | 72,300 | 56,000 | 98,100 |

| April | 70,800 | 56,700 | 91,900 |

| March | 71,300 | 49,900 | 96,300 |

| February | 72,500 | 56,000 | 97,200 |

| January | 68,000 | 54,200 | 98,000 |

| 2018 | |||

| December | 74,300 | 53,800 | 96,400 |

| November | 74,100 | 56,200 | 101,900 |

| October | 73,100 | 56,700 | 94,300 |

| September | 76,700 | 58,300 | 105,500 |

| August | 73,600 | 54,500 | 97,800 |

| July | 79,600 | 57,300 | 104,500 |

| June | 77,400 | 52,700 | 99,700 |

| May | 72,500 | 57,600 | 92,900 |

| April | 67,300 | 51,600 | 92,800 |

| March | 67,700 | 50,600 | 93,800 |

| February | 72,100 | 49,700 | 98,000 |

| January | 59,300 | 44,900 | 85,600 |

| South | |||

| Total1 | Single | Double | |

| 2019 | |||

| May | 75,800 | 53,600 | 95,000 |

| April | 77,100 | 54,000 | 99,300 |

| March | 77,800 | 50,900 | 101,600 |

| February | 84,800 | 52,600 | 106,600 |

| January | 81,100 | 51,400 | 101,700 |

| 2018 | |||

| December | 80,100 | 51,500 | 104,900 |

| November | 77,100 | 54,600 | 97,800 |

| October | 79,800 | 53,500 | 105,900 |

| September | 81,600 | 51,900 | 104,500 |

| August | 79,800 | 54,500 | 98,100 |

| July | 74,900 | 51,300 | 94,000 |

| June | 83,200 | 55,100 | 97,100 |

| May | 79,000 | 56,300 | 97,000 |

| April | 71,100 | 48,600 | 95,300 |

| March | 68,900 | 50,000 | 88,900 |

| February | 70,600 | 46,700 | 91,200 |

| January | 64,400 | 46,300 | 85,900 |

| West | |||

| Total1 | Single | Double | |

| 2019 | |||

| May | 96,300 | 55,000 | 106,800 |

| April | 95,400 | 63,600 | 109,100 |

| March | 92,900 | 49,100 | 108,500 |

| February | 103,100 | 43,500 | 119,400 |

| January | 95,800 | 59,000 | 110,400 |

| 2018 | |||

| December | 101,400 | 51,600 | 120,400 |

| November | 99,300 | 62,600 | 107,800 |

| October | 105,100 | 57,300 | 116,500 |

| September | 102,600 | 62,000 | 111,600 |

| August | 97,400 | 57,600 | 110,300 |

| July | 102,800 | 59,300 | 118,200 |

| June | 105,000 | 57,600 | 122,900 |

| May | 104,000 | 60,300 | 108,900 |

| April | 103,100 | 67,400 | 113,400 |

| March | 82,900 | 45,800 | 98,700 |

| February | 87,100 | 53,900 | 100,600 |

| January | 98,900 | 59,400 | 114,200 |

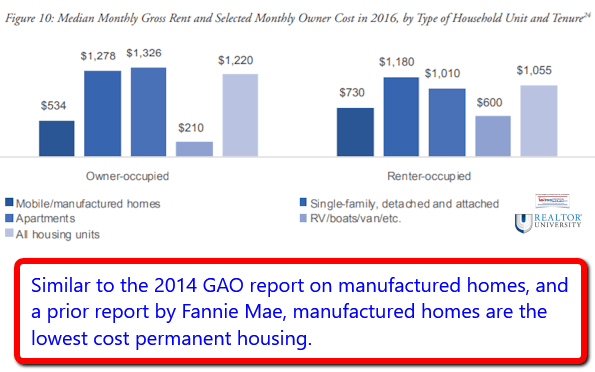

Now, let’s compare that data with what the U.S. Census Bureau, in association with the Department of Housing and Urban Development (HUD), said on October 24, 2019.

Per HUD and the Census Bureau: “New Home Sales of new single‐family houses in September 2019 were at a seasonally adjusted annual rate of 701,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.7 percent (±16.1 percent)* below the revised August rate of 706,000, but is 15.5 percent (±20.2 percent)* above the September 2018 estimate of 607,000. Sales Price The median sales price of new houses sold in September 2019 was $299,400. The average sales price was $362,700. For Sale Inventory and Months’ Supply The seasonally‐adjusted estimate of new houses for sale at the end of September was 321,000. This represents a supply of 5.5 months at the current sales rate.”

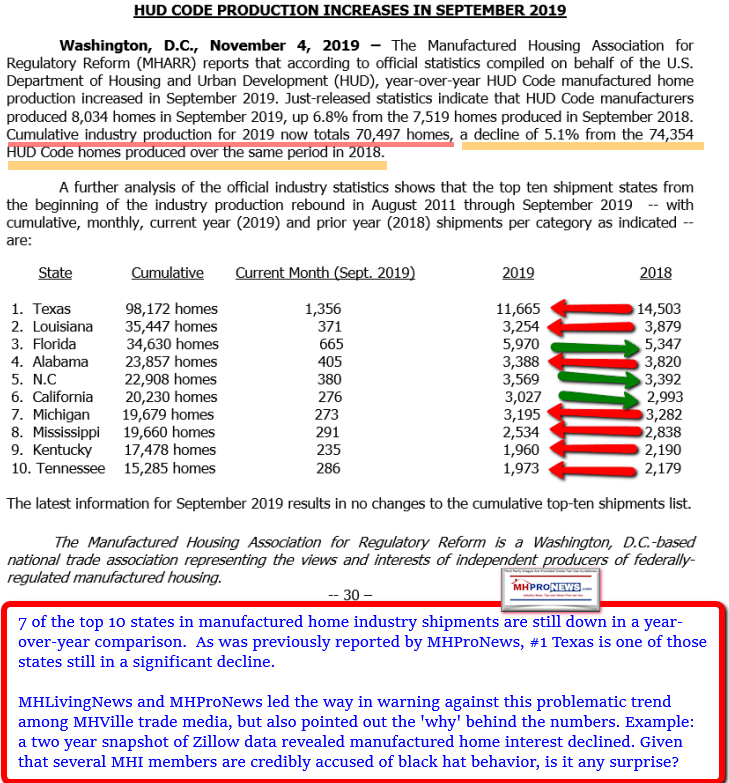

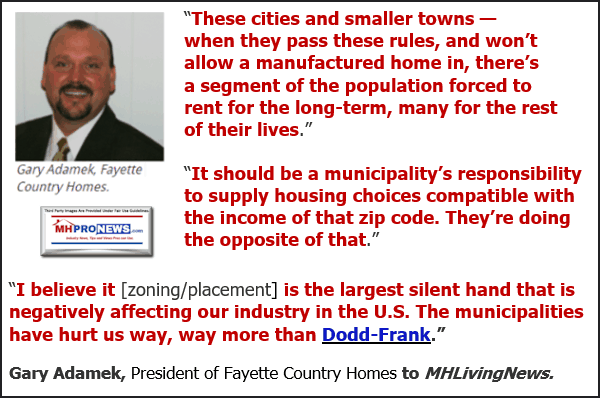

Rephrased, the federal data reveals that conventional housing is rising, even though it is far more costly. Manufactured housing is struggling. Why?

Just the Facts, MHProNews Analysis

Clearly the manufactured housing data doesn’t tell us what the cost of the home site was or will be. Depending on the region, that can be fairly modest to soaring in cost. But turning once more to the research done by Democratic and Republican lawmakers in the report shown below, we know that even factoring in for the cost of land, developing and/or redeveloping using manufactured homes is less costly than multifamily housing is, so it is significantly less costly than developing with manufactured homes.

There are even designs and projects for multi-level manufactured housing.

That’s the problem, then?

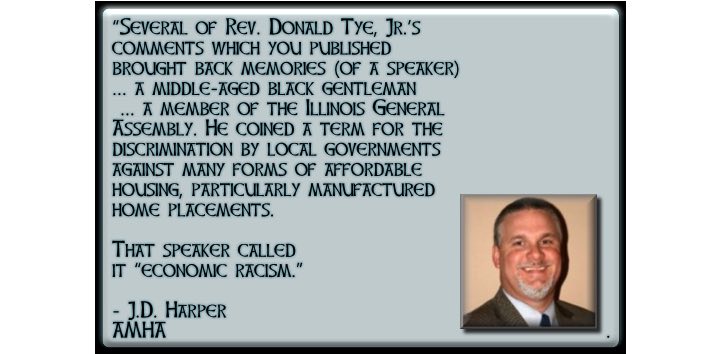

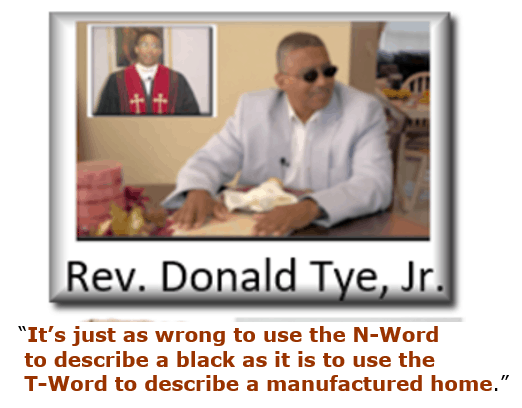

It could be summed up like this. Perception, a lack of information based education, plus a failure to enforce good existing laws. Let’s begin with the ‘image issue.’

Perception – which the research performed by Zillow of shoppers of all kinds of housing – linked below – tells us is going in the wrong direction during that two years snapshot.

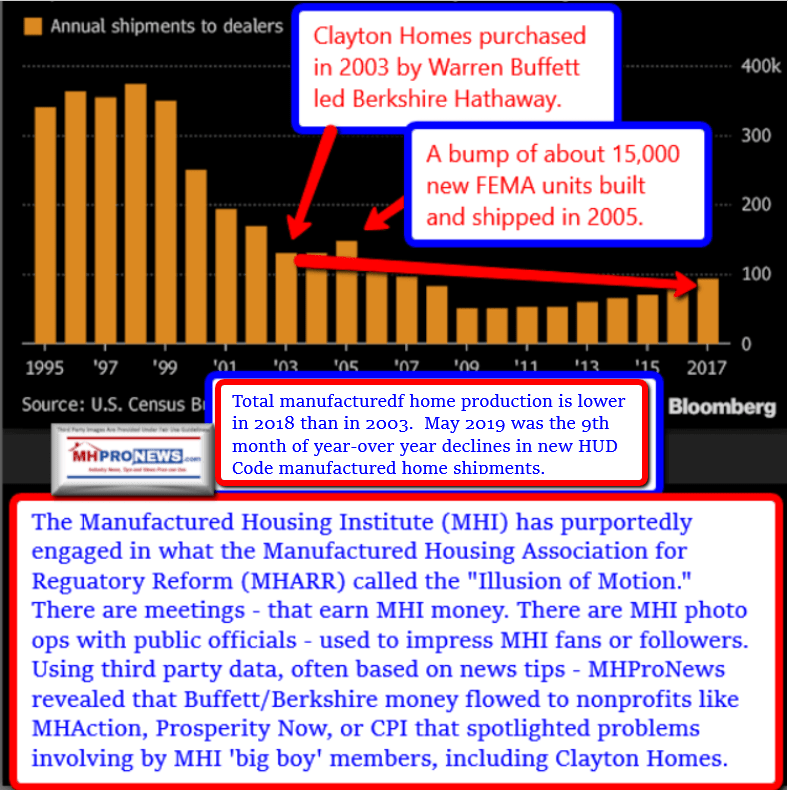

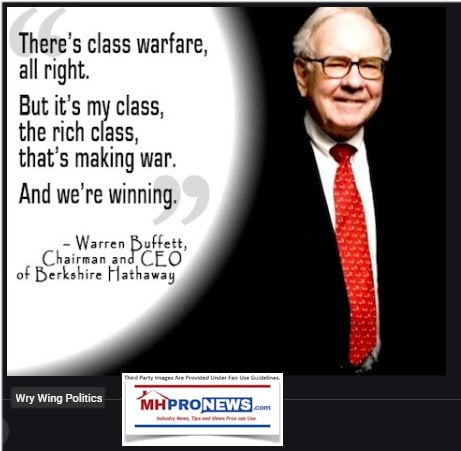

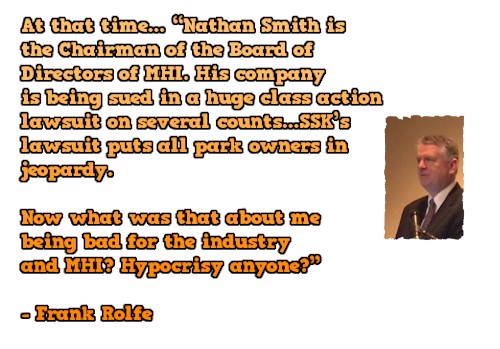

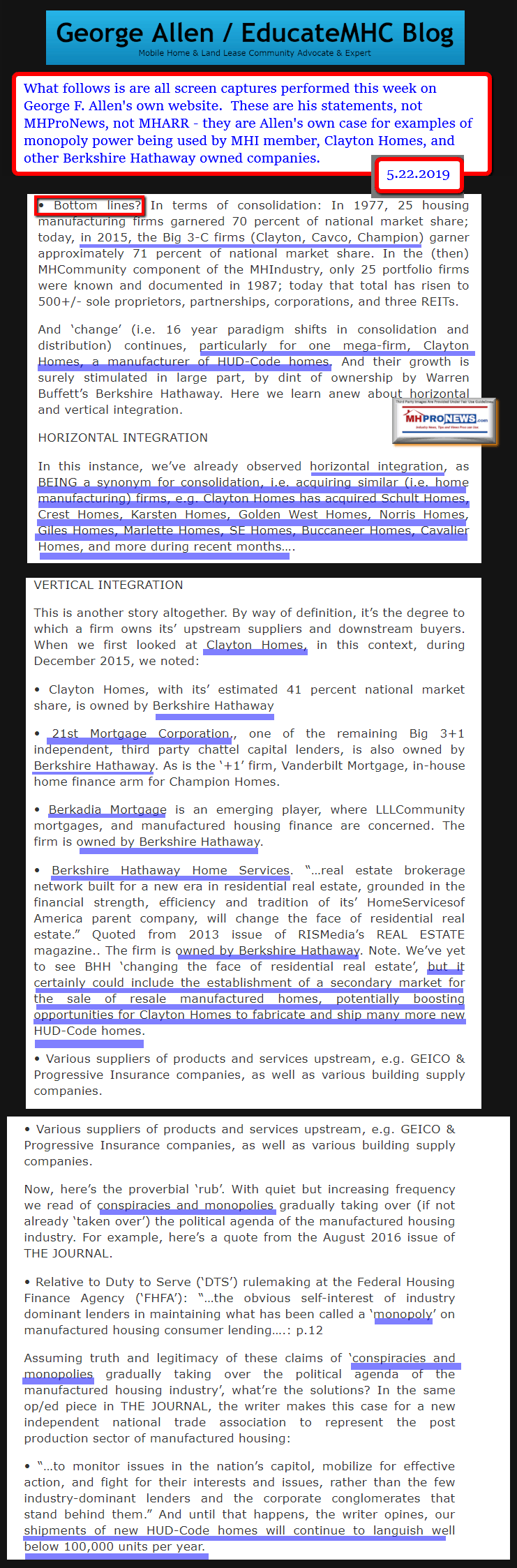

That perception issue is purportedly fostered to a degree by problematic behaviors by so-called predatory firms. Many of those are members of the Manufactured Housing Institute (MHI) or have other ties to the Omaha-Knoxville-Arlington axis. Furthermore, Warren Buffett, through so-called dark money channels, has funded non-profits working with resident-homeowners as well as those working with professionals. These are often pitted against each other in a manner that results in conflict that hits the mainstream media in reports like Last Week Tonight with John Oliver and his viral hit errantly dubbed “Mobile Homes.”

As if to prove that Oliver’s video won’t be the only mainstream media operation that targets manufactured housing in a manner that harms the image, and thus arguably the resale values, of manufactured homes, CBS aired an episode in October of the popular series NCIS. It was seen by nearly double the numbers of Americans that Oliver’s video has been viewed on YouTube. See the report from the linked image and text below. Note to first time readers: routinely such image/text boxes are hot-linked to other related reports that provide additional evidence and details on the issues or points raised from this or other articles on MHProNews or MHLivingNews.

All of these tie into what MHProNews has dubbed the Omaha-Knoxville-Arlington axis and their allies.

Once more, using the principle of separating the wheat from the chaff, once must not think that every black hat operation or organization is made up solely of black hat professionals, that’s demonstrably not true. But MHI de facto admitted the problem above by issuing and holding ‘educational’ discussions on their ‘code of ethical conduct.’

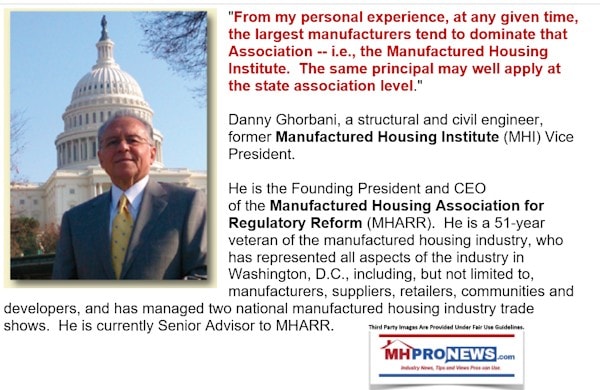

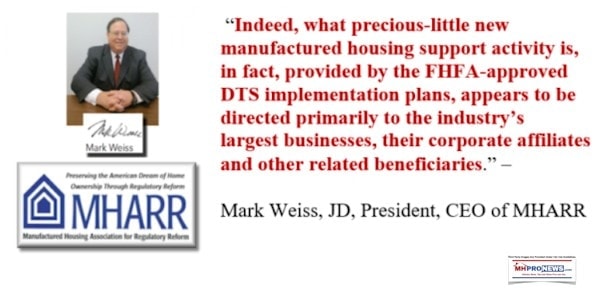

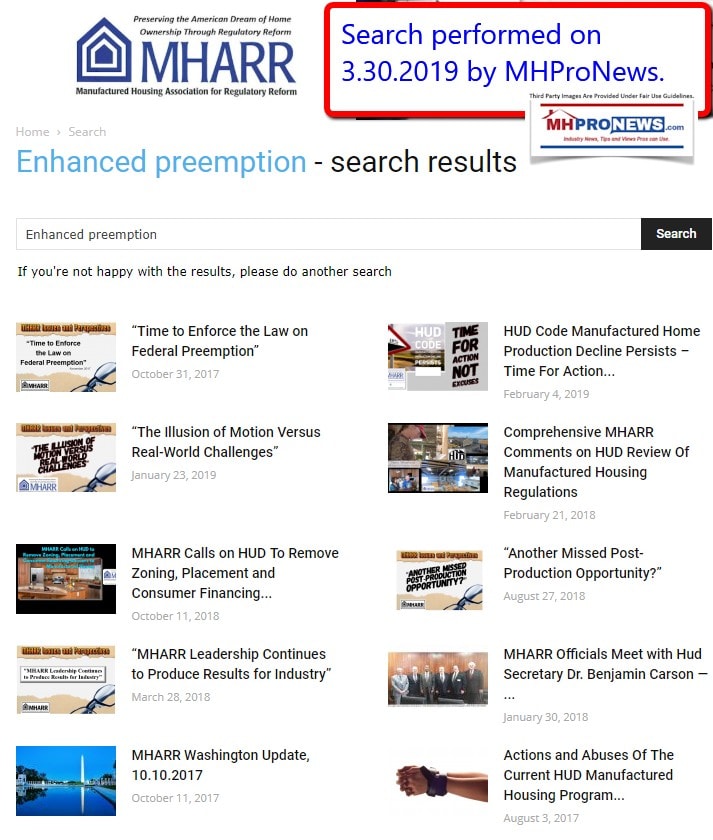

However, as the Manufactured Housing Association for Regulatory Reform (MHARR) said approaching a year ago, MHI engages in what they called the “Illusion of Motion.”

MHProNews and our sister site, Manufactured Home Living News (MHLivingNews), are essentially alone in the manufactured home industry’s trade media in consistently peeling back the causes of the industry’s lack of acceptance, despite very useful third party research that easily dates back for 2 decades and more.

Because of a lack of performance on its stated aims, some communities and their trade groups have broken away from the Manufactured Housing Institute (MHI).

Predating that, MHARR members broke away decades ago from MHI, voicing then and now serious concerns about how the major manufacturers dominate the industry’s trades associations.

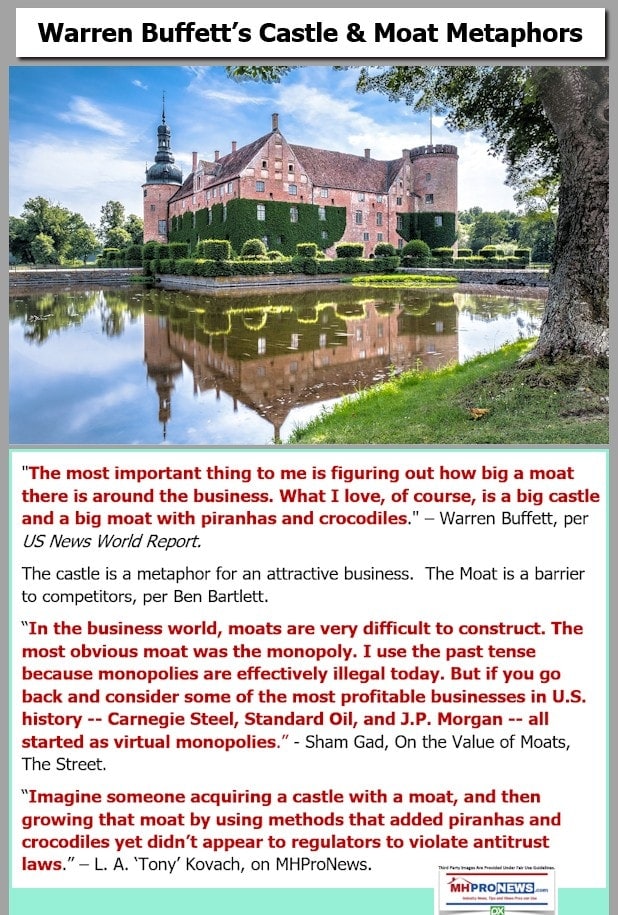

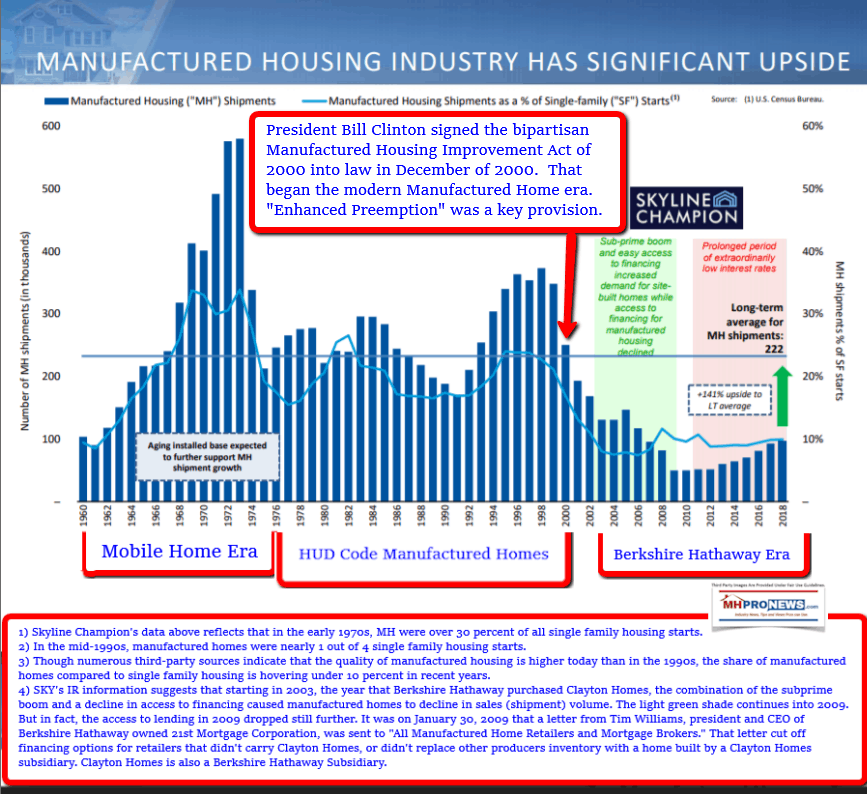

In the era of Berkshire Hathaway’s entry into the manufactured housing industry, there is a demonstrable trend toward sustained lower levels of sales. Is that by accident or design? Hold that thought.

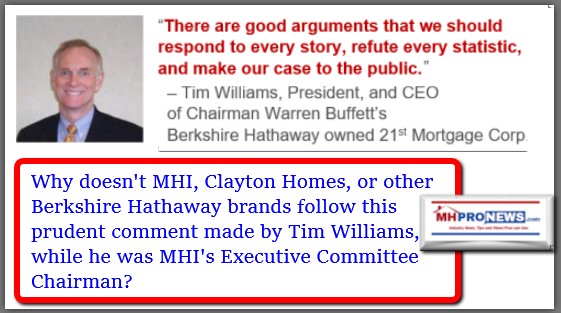

Those facts beg several questions. Are we to believe that with all of Warren Buffett’s, Berkshire Hathaway’s, MHI’s and their affiliates resources, that they don’t know what to do counteract the image problems, or how to do it? Didn’t Berkshire Hathaway brand 21st Mortgage Corporation, whose president and CEO was for a time the chairman of MHI, make it simple to understand what has to be done?

Then why is it that so often we see Berkshire and MHI connected brands behaving in a manner – without apparent consequences from MHI or numbers of state associations – are the very firms that foster the problematic image issues?

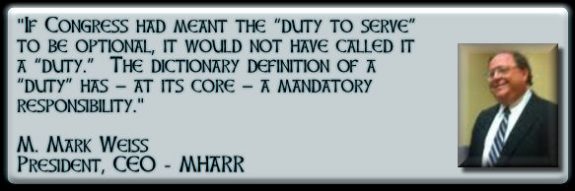

The industry has good laws already on the books. The Manufactured Housing Improvement Act of 2000 (MHIA) and the Duty To Serve Manufactured Housing by the Government Sponsored Enterprises (GSEs) mandated by the Housing and Economic Recovery Act of 2008 (HERA).

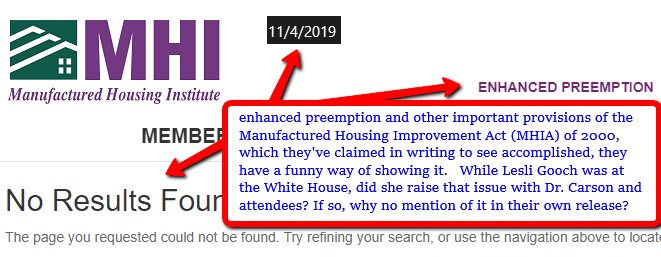

Those are not being fully or properly enforced. An MHI connected attorney, Bill Matchneer – who previously was the administrator for HUD’s Office of Manufactured Housing Programs (OMHP) has said in a public setting that a key provision of the law was the ‘enhanced preemption’ provision. Then why did MHI member and representative Manny Santana vote against a DRC connected to implementation of that, when MHI claims to be for it?

Why does MHI even bother to talk about new legislation, when existing laws are not being fully implemented, and they know it?

Rocket Science?

This isn’t rocket science. It only requires that we discern, using the principle of evidence and common sense reasoning, what Warren Buffett and Kevin Clayton themselves have said and done.

One most know when to take Warren Buffett at his word, and discern when what he is saying is a arguably a head-fake.

The fine MHI video below has only a few dozen views, while the John Oliver video has roughly 7 million views. But that video doesn’t use important points, like the enhanced preemption provision of federal law. Why not? Furthermore, it has become public knowledge that Google, YouTube and Facebook and dither with their algorithms and ‘shadow ban’ or ‘hide’ from many searches relevant results. Is it possible that videos like the one below are deliberately not getting the attention that it might otherwise obtain? Setting aside the shadow banning notion, MHI has a marketing budget. Why haven’t they put out a press release promoting their own videos?

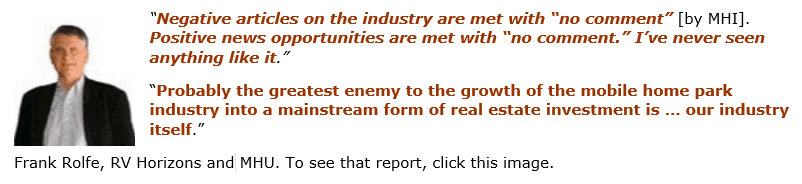

It was some 5 years ago that MHProNews publisher L. A. ‘Tony’ Kovach spelled out that the industry’s low level of performance was harmful to the interests of the industry, and by extension, harmful to the interests of consumers too. But at the time, Tony Kovach self-admittedly didn’t grasp the full picture that has been since developed above. Namely, that MHI postures one thing, but it is illusory, a purported head fake designed to razzle dazzle busy professionals into thinking that something is being done, when in fact what is occurring is consolidation that benefits a favored few companies. Kovach points to events like Lesli Gooch’s recent appearance at the White House and asks, why didn’t Gooch make the case in front of all those officials that HUD Secretary Carson should fully enforce existing federal laws, including the Manufactured Housing Improvement Act of 2000? Specifically, its enhanced preemption clause?

Why is it that MHI hides the words ‘enhanced preemption’ even from its own website?

By contrast, MHARR has long promoted that concept on its website, and in public discussions.

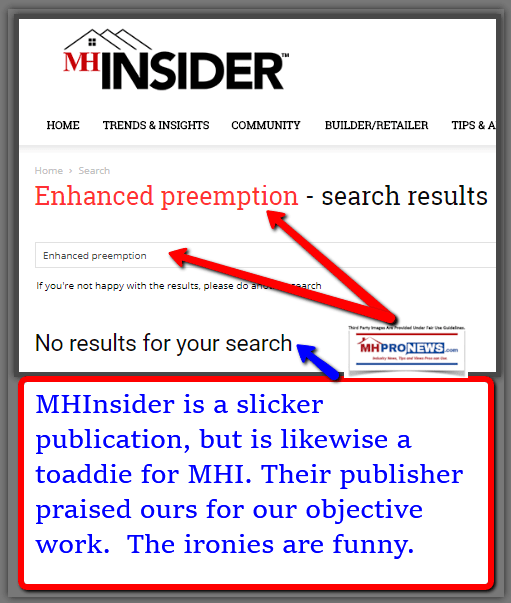

Once again, in contrast, enhanced preemption hasn’t been made an issue on MHI ‘partner’ MHInsider trade media.

There are state association executives who are well aware of these patterns.

Why don’t they speak out directly against MHI? Bluntly, they arguably feel it could cost them their jobs. See the “How Gold Rules” report linked below, to understand how the game played at the national level is also purportedly playing out in many cases at the state level too.

Longtime MHARR president Danny Ghorbani, who is now MHARR’s senior advisor, has said similarly.

These facts, when laid out and dispassionately viewed are the truth hiding in plain sight. Sometimes, the best place to hide is in plain sight.

With these thoughts in mind, knowing that MHLivingNews has laid out these in detailed reports, is it any surprise that relative newcomer and self-proclaimed computer guy Robert ‘Bob’ Van Cleef, after studying these issues, has dubbed it not only insanity, but also has called for federal investigations and the application of good existing laws to end these problematic practices?

Marty Lavin, an MHI award winner, has long cautioned his readers with the following quotes that we periodically reference.

More recently, Lavin was more specific and quite blunt. He pointed at what we’ve dubbed the Omaha-Knoxville-Arlington axis and said that they do only what benefits their own interests, not what benefits the industry at large.

Lavin is not alone, as there are others in the community and other sectors of the industry who may be personally doing well, but they see the problems that are being fostered from inside manufactured housing.

Summing Up

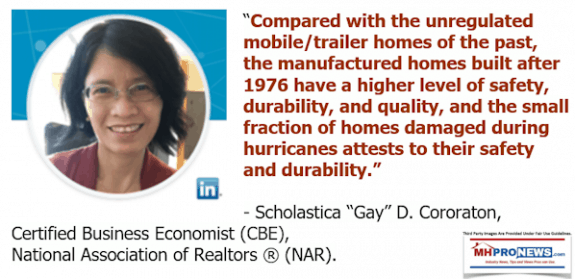

There are millions of Americans who want and need an affordable home. They have been arguably misled to believe things that are demonstrably not true. After doing in depth research for the National Association of Realtors, Certified Business Economist (CBE) Scholastica ‘Gay’ Cororaton came out with research that MHI should be shouting from the rooftops, if they were serious about industry growth. Based on the evidence, Cororaton made statements like this.

The CBE also pointed out that the evidence reveals that millions of renters could potentially own a manufactured home, based upon the fact that owning a manufactured home is routinely less than renting a home.

MHProNews and MHLivingNews made that same point by referencing research in 2014 by the Government Accountability Office.

This information has been made publicly available here and on the MHLivingNews websites for years. Why didn’t MHI do likewise? They are a far larger and better funded organization. It is ‘their job,’ not ours to do this type of work. It isn’t as if they were unaware of our work, their leaders routinely praised it.

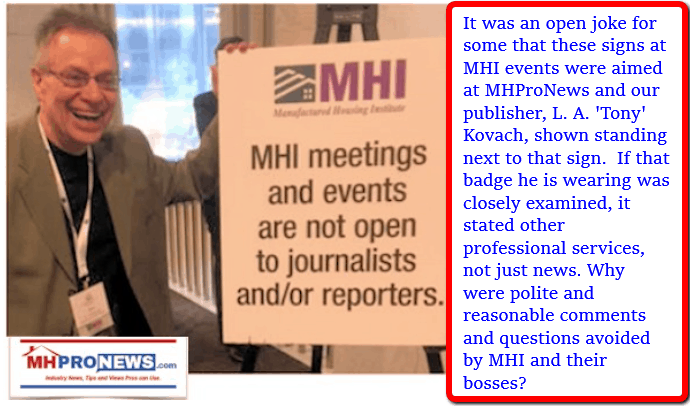

Tony Kovach was elected to serve by his peers on the Suppliers Division board of directors. For some 7 years, he strived to work from inside MHI to do what was necessary to grow the industry. As the reality that the problems were apparently coming from within MHI and some of their key members, in simply asking questions and by politely raising concerns during MHI meetings, what was their response? First, to have him removed from the board, later, to eject Kovach and his organization from membership on the purportedly spurious allegation that they had no membership classification for news media. That MHI letter was unsigned, it came from no named official. A refund of dues for that year was made by MHI, and that was that, but it was clear long before that MHI was uncomfortable with the issues being raised from within.

That sign was made by MHI and posted at their own meetings after serious questions by Kovach were going unanswered. Bear in mind that MHI and members of the axis reveled in attention for years, but when serious questions were asked, they purportedly targeted our organization and tried to get voices like blogger George Allen’s to foster boycotts or efforts to have us silenced, and effectively put out of business. But ironically, Allen has made similar complaints, only he did so before a purported deal between himself and MHI to be their surrogate.

That sort of purported misbehavior – which is arguably a potential violation of antitrust and other laws – hasn’t been without effect. But after a dip, our audience has grown from low points to new highs, why? Because as readers privately and publicly have told us, our trade publications cover the issues with research and answers in a fashion that makes sense to readers.

No matter how many photo opportunities MHI and their leaders try, what MHProNews has step-by-step revealed is that those same photos prove to a serious degree the opposite of what they are trying to claim. How so?

If MHI and their leaders can get face to face meetings with Mick Mulvaney – who is now the White House Chief of Staff – or HUD Secretary Carson, HUD’s Brian Montgomery, and FHFA’s Mark Calabria, then why is it that the full enforcement of the MHIA 2000, enhanced preemption, or the Duty to Serve (DTS) manufactured housing or the underserved markets by the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac aren’t being implemented?

In fairness, Dr. Calabria is still new at FHFA. It is possible that officials at HUD haven’t fully briefed Secretary Carson on the enhanced preemption and MHIA of 2000 related issues. Certainly, Secretary Carson has done more to elevate manufactured housing on the national stage than any of his predecessors of either political party’s administrations in the 21st century.

Dr. Carson has also made the most useful types of statements for national media.

Secretary Carson has provided the most useful types of addresses for manufactured housing at MHI meetings.

So why has MHI hidden much of that away, showing it mainly to their members? Why isn’t MHI promoting it on their own website? Or via their media contacts with the public at large?

The facts are troubling, but are also promising. The potential is great, residents, professionals, renters, and investors could mutually benefit, if people of good will worked together.

Conclusion?

Until more firms – either solo or in conjunction with others – start at the local or regional level to change the narrative, the pattern of consolidation will logically continue for the reasons noted above. A few are getting stronger, in part from regulatory burdens.

But they are also getting stronger because they have media and money often on their side.

MHProNews’ has said that these are the best and worst of times, a reference to Dicken’s Tale of Two Cities.

The facts favor manufactured housing, but the industry has arguably been weaponized from within. There is more to know in reports linked below. That’s your first look on this hump day from the #1 source for manufactured home industry “News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.

https://www.manufacturedhomepronews.com/masthead/expose-darren-krolewski-datacomp-mhvillage-mhinsider-marketing-claims-fact-check-infographic-and-analysis/

CBS Spotlights Manufactured Home Community Leader Video Interview

Site-Builder’s Videos Could Point Way For More Manufactured Home Sales