The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks.

By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- Wells Fargo ordered to rehire whistleblower

- Scaramucci sorry for calling Trump a ‘hack’ in 2015

- Tech spent record amounts on lobbying under Trump

- Will stocks plunge if Trump’s tax plan implodes?

- White House press secretary resigns

- One year after Roger Ailes’ departure

- What’s next for online black markets?

- JetBlue considers new JFK terminal

- Spicer’s resignation may mean end of ‘SNL’ character

- Why you should see ‘Dunkirk’ in 70mm

- This credit card offers great rewards if you spend $7,500

Selected headlines and bullets from Fox Business:

- Scaramucci: I don’t like the term ‘fake news’

- Trump picks Anthony Scaramucci as White House communications director

- Wall Street dips as GE, energy shares weigh

- Oil dives about 2.5 percent; OPEC crude output rise forecast

- Sean Spicer resigns as White House press secretary

- Student loan debt up more than 450% since 2003

- Wells Fargo ordered to hire back whistleblower, pay $577K

- Trump cheers ‘record-high optimism’ among US manufacturers

- Trump tweets at Varney & Co

- Union battle: Nissan, UAW fight for votes in Mississippi factory

- 11-year-old invents hot car alert for parents

- Legal deal pulls money to teach tribal kids native language

- US stocks dip with energy prices; European stocks sinkarticle US stocks dip with energy prices; European stocks sink

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

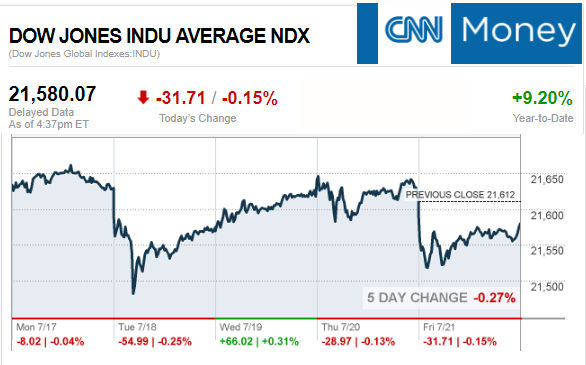

- Today’s markets and stocks, at the closing bell…

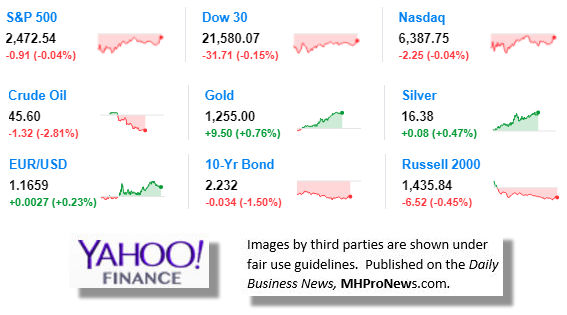

S&P 500 2,472.54 -0.91 (-0.04%)

Dow 30 21,580.07 -31.71 (-0.15%)

Nasdaq 6,387.75 -2.25 (-0.04%)

Crude Oil 45.60 -1.32 (-2.81%)

Gold 1,255.00 +9.50 (+0.76%)

Silver 16.38 +0.08 (+0.47%)

EUR/USD 1.1659 +0.0027 (+0.23%)

10-Yr Bond 2.232 -0.034 (-1.50%)

Russell 2000 1,435.84 -6.52 (-0.45%)

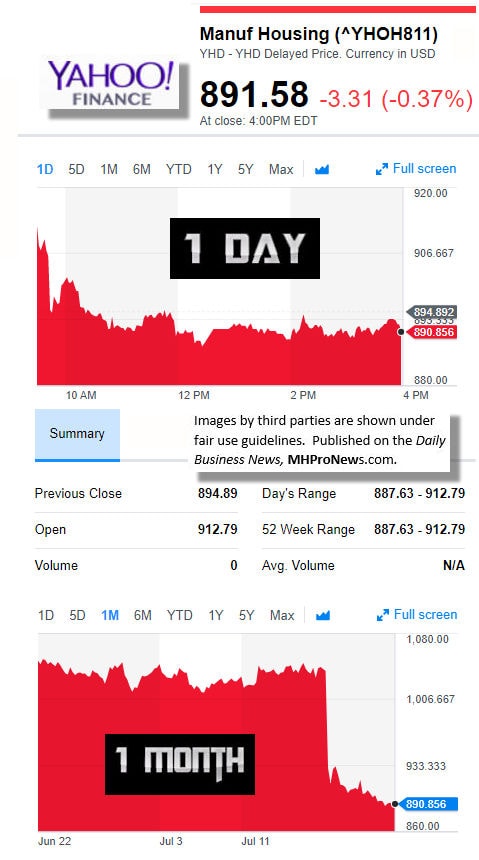

Manufactured Housing Composite Value

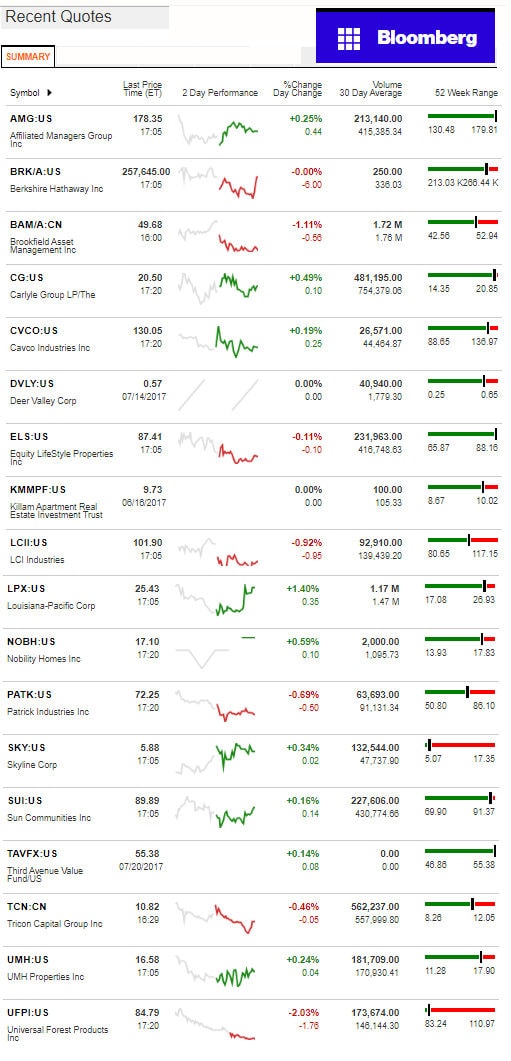

Today’s Big Movers

LPX and CG led the gainers.

UFPI and BAM led decliners.

For all the scores and highlights on tracked stocks today, see the Bloomberg graphic, posted below.

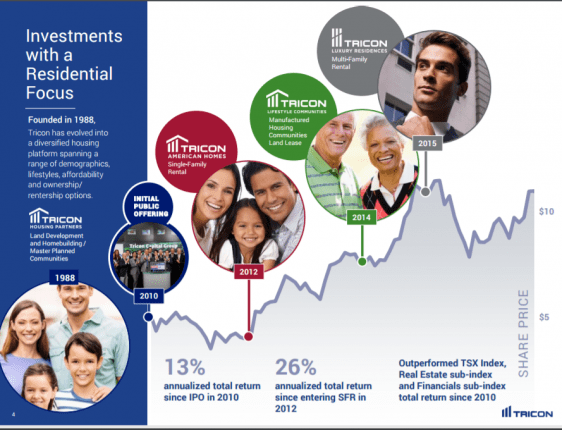

Today’s MH Market Spotlight Report – Tricon

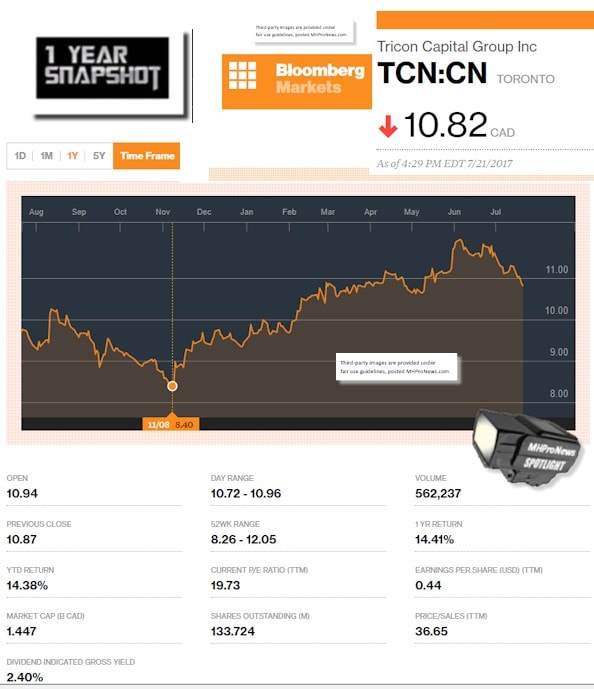

Take a look at the snapshot of the trend for Tricon Capital, parent to Tricon Lifestyle Communities, since we last did a spotlight report on June 30th. As you may recall, we reported on Insider Trades, among other facts. See the date of our last spotlight in the trend line below, and the 30 day trend.

A snapshot of other recent headlines on TCN…

![]()

The most recent report hails from Evergreen Caller, which is the one shared below. Images and graphs inserted and at the end are provided by MHProNews, to keep dry text more interesting…and for first time or new readers researching manufactured housing to better understand this space.

What Kind of Picture Are the Technicals Painting For Tricon Capital Group Inc (TCN.TO)?

Needle moving action has been spotted in Tricon Capital Group Inc (TCN.TO) as shares are moving today on volatility -0.55% or $-0.06 from the open. The TSX listed company saw a recent bid of $10.81 and 119990 shares have traded hands in the session.

There are various factors to examine when looking at what spurs growth in the stock market. Many investors will monitor macro-economic factors that influence the price of shares. Some of these factors include the overall condition of the economy and market sentiment. Following the macro factors, investors may employ a top down approach when viewing the equity markets. This may include starting with a sector poised for growth and filtering down to specific stock that meet the investor’s criteria. Another way to approach the stock market is to view the micro-economic factors that influence stocks. This may include studying company profits, news, and the competence of overall management. Investors will often try to piece together all the different information available in order to select stocks that will have a positive impact on the long-term strength of the portfolio.

Now let’s take a look at how the fundamentals are stacking up for Tricon Capital Group Inc (TCN.TO). Fundamental analysis takes into consideration market, industry and stock conditions to help determine if the shares are correctly valued. Tricon Capital Group Inc currently has a yearly EPS of 0.43. This number is derived from the total net income divided by shares outstanding. In other words, EPS reveals how profitable a company is on a share owner basis.

Another key indicator that can help investors determine if a stock might be a quality investment is the Return on Equity or ROE. Tricon Capital Group Inc (TCN.TO) currently has Return on Equity of 7.60. ROE is a ratio that measures profits generated from the investments received from shareholders.

In other words, the ratio reveals how effective the firm is at turning shareholder investment into company profits. A company with high ROE typically reflects well on management and how well a company is run at a high level. A firm with a lower ROE might encourage potential investors to dig further to see why profits aren’t being generated from shareholder money.

Another ratio we can look at is the Return on Invested Capital or more commonly referred to as ROIC. Tricon Capital Group Inc (TCN.TO) has a current ROIC of 5.40. ROIC is calculated by dividing Net Income – Dividends by Total Capital Invested.

Similar to ROE, ROIC measures how effectively company management is using invested capital to generate company income. A high ROIC number typically reflects positively on company management while a low number typically reflects the opposite.

Turning to Return on Assets or ROA, Tricon Capital Group Inc (TCN.TO) has a current ROA of 5.26. This is a profitability ratio that measures net income generated from total company assets during a given period. This ratio reveals how quick a company can turn it’s assets into profits. In other words, the ratio provides insight into the profitability of a firm’s assets. The ratio is calculated by dividing total net income by the average total assets.

A higher ROA compared to peers in the same industry, would suggest that company management is able to effectively generate profits from their assets. Similar to the other ratios, a lower number might raise red flags about management’s ability when compared to other companies in a similar sector. ##

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Manufactured Home Industry Connected Stock Markets Data

You will find only the very best manufactured home industry coverage, every business day. We’re not perfect, but we are by far the best. No one else in covering our industry even comes close. Which is why you and thousands of others join us here, daily. Thank you for that vote of confidence.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)