The recently announced $325 million dollar deal by publicly-traded Brookfield Asset Management (BAM), one of the larger investors in mobile and manufactured home communities (MHCs) in the U.S. and Canada ought to be news with every operation in MHVille trade media. However, several spot checks by MHProNews plus a search using Bing AI powered Copilot on 1.22.2023 found nothing. Per Copilot: “I did not find any [manufactured home industry] specific publications or bloggers that have reported on this sale” by Brookfield. The facts are what they are and will be provided in this report with expert analysis.

Part I

> “What news about Brookfield Asset Management sale of manufactured home communities, any updates since that story first broke?”

I did not find any updates on this story since it was first reported on January 11, 2024 12.”

> “Is Brookfield Asset Management a member of the Manufactured Housing Institute (MHI)?”

If you have any other questions, please let me know!

1 manufacturedhomepronews.com 2 brookfield.com 3 commercialobserver.com 4 therealdeal.com”

Beyond the points noted above, Bisnow and Bloomberg reported that: “The communities total 3,166 home sites, according to Brookfield, and are in seven states. The portfolio is a relatively small slice of Brookfield’s holdings in the sector, which totaled more than 170 communities before the sale.”

The Real Deal also said the following.

The property fund started pivoting away from the sector last summer. In August, Brookfield sold 23 manufactured housing communities. Brookfield held 170 of them prior to that sale.”

As Copilot noted, The Real Deal (TRD) said: “The deal allows the fund to return capital to its investors, Brookfield Real Estate managing partner Swarup Katari said.”

In response to a follow up by MHProNews, Copilot also said the following.

> “Doesn’t Wells Fargo have a relationship with Fannie Mae and Freddie Mac on commercial real estate deals?”

It should be noted that Copilot said could not find any evidence that Duty to Serve (DTS) credits were generated by that refinancing. That noted, the Lincoln Institute for Land Policy is among those who have expressed their concerns that the DTS program has been turned on its head by originating commercial real estate loans for larger portfolio owners that in several instances would then hike site fees for residents. Meaning, a resident living in a manufactured home community (MHC) might find themselves with less affordable housing through an apparent misuse of DTS.

“Commenting on the sale at the time, Katari noted the strength of the sector and noted that manufactured housing was becoming a viable alternative in the housing market,” per TRD, which then cited a report that was fisked and in several ways debunked by MHProNews via the report with analysis found at the link below. Other reports that have shed light on the often-problematic nature of manufactured home industry focused bloggers and trade media are also linked below.

A Brookfield Asset Management property fund sold a large chunk of a manufactured housing portfolio as the company seeks to capitalize on growing demand for the sector. https://t.co/4hHbPpYfoq

— Bloomberg Markets (@markets) January 13, 2024

According to a filing with the Securities and Exchange Commission (SEC), BAM has “over $750 billion of assets under management.”

Among the points not raised by business media?

At about the time the BAM began selling some of their manufactured home communities (MHCs) was during the timeframe that the first of a series of antitrust suits hit the MHC commercial real estate sector. Coincidence? Or did BAM learn of what was coming and their move to exit at least some of their holding represent good planning by BAM? MHPHOA listed BAM as one of their top 100 land lease MHC operators in the U.S.

TRD said: “But the advantage of owning sites is that owners of mobile homes typically cannot afford to relocate them and so are vulnerable to rent increases. About 90 percent of mobile homes never leave their original location.”

This most recent sale by BAM of manufactured home communities follows in the wake of the most recent suits.

According to a dated listing of MHI members, Brookfield Property Group has been a member of the Arlington, VA based trade organization. Several MHI members have featured prominently in the antitrust suits that have been filed. In response to an inquiry, Copilot said the following in response to another inquiry.

Part II – Additional Information with More MHProNews Analysis and Commentary

It is too soon to say if Brookfield Property Group/Brookfield Asset Management is in the early stages of completely exiting the land lease community sector. Notwithstanding the cheerleading by some in the land-lease manufactured home communities’ sector that the antitrust cases are somehow OK to ignore, that ‘all will be well,’ it could be that BAM sees it differently.

TRD indicated that BAM is pivoting away from manufactured home communities. That in itself should send ripples of questions and possible concerns through the sector. It is also one of several possible reasons for this inquiry to Bing Copilot.

> “Brookfield Asset Management has reportedly sold two segments of its portfolio of manufactured home communities in about 6 months. Has there been any formal remarks by BAM or Brookfield Properties Group that they plan to exit the mobile and manufactured home communities business?”

Perhaps a key line in that is this: “The report also mentions that Brookfield’s property fund started pivoting away from the sector last summer and sold 23 manufactured housing communities in August 2023 1.” “Pivoting away” could be construed as either a partial or complete exit by BAM from MHCs.

If BAM is exiting MHCs all together, and they opted to do so all at once, that might roil MHC valuations for a time. What they have done is apparently measured. It is thus less likely to create turbulence for other MHC operators who are consolidation focused.

It is worth mentioning that per sources, Warren Buffett advised Kevin Clayton to exit the land-lease MHC sector of the industry. For whatever reasons, Clayton Homes did so, which ended up with the formation of Yes! Communities. The ‘rumors’ at the time included that Buffett didn’t want Clayton to be seen as ‘raising the [site] rents on grandma.’ That ought to be explored by public officials who should get to the bottom of various schemes that occurred in manufactured housing in the 21st century following Berkshire Hathaway’s (BRK) entry into the industry.

- Widely bipartisan legislation, the Manufactured Housing Improvement Act of 2000 (MHIA) and its enhanced preemption clause has effectively been thwarted.

- The Duty to Serve manufactured housing made law as part of the Housing and Economic Recovery Act (HERA) of 2008 has been diverted to serving the poor market performance of Clayton-backed and MHI trademarked CrossMod® homes.

- Development of new MHCs slowed to a trickle in the 21st century. There are reportedly more MHCs closing – typically for redevelopment – than there are new ones opening.

4. Giant Sun Communities (SUI) said that they are pausing development. Sun is one of the MHCs that has been hit by several antitrust class action lawsuits. Gary Shiffman made headlines last year due to evidence-based allegations of a scheme that he and some purported co-conspirators were involved in a plan of insurance fraud involving Shiffman’s own mother. The articles by MHProNews on Shiffman were among the top-read ones for 2023, and yet they were widely ignored by others in MHVille trade media. Why is that so?

5. While it is less than clear what BAM is doing – a partial or complete “pivot” from the MHC sector, it may well spell part of the potential headwinds that MHCs and manufactured housing more broadly are mired in. The self-serving happy talk by people like MHI members Frank Rolfe, Dave Reynolds, and other consolidation focused cheerleaders aside, the blossoming of antitrust suits in the summer and winter of 2023 coupled with other developments may spell more trouble ahead for MHVille. It is past time for more engagement by state and federal officials, who have in some cases already begun probes of the sector.

The following was a search conducted at about 7:30 AM ET on 1.23.2024. The top response was here on MHProNews. When it comes to fluff and agenda-driven spin, you can find that in several places. When it comes to manufactured housing “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide” © there is only one place you can go for “Intelligence for your MHLife.” © You are reading from it. Thanks to all who make our facts, evidence, and common-sense analysis driven reports and analysis possible. You’ve helped make and keep us the runaway #1 in our profession.

> “Scan the internet and see if the Manufactured Housing Institute, or any of the bloggers and trade media that are members of that trade group have reported or commented on the recent sale by Brookfield Asset Management of several of their land lease communities in what the Real Deal described as a “pivot” away from the manufactured home community sector?”

Learn more

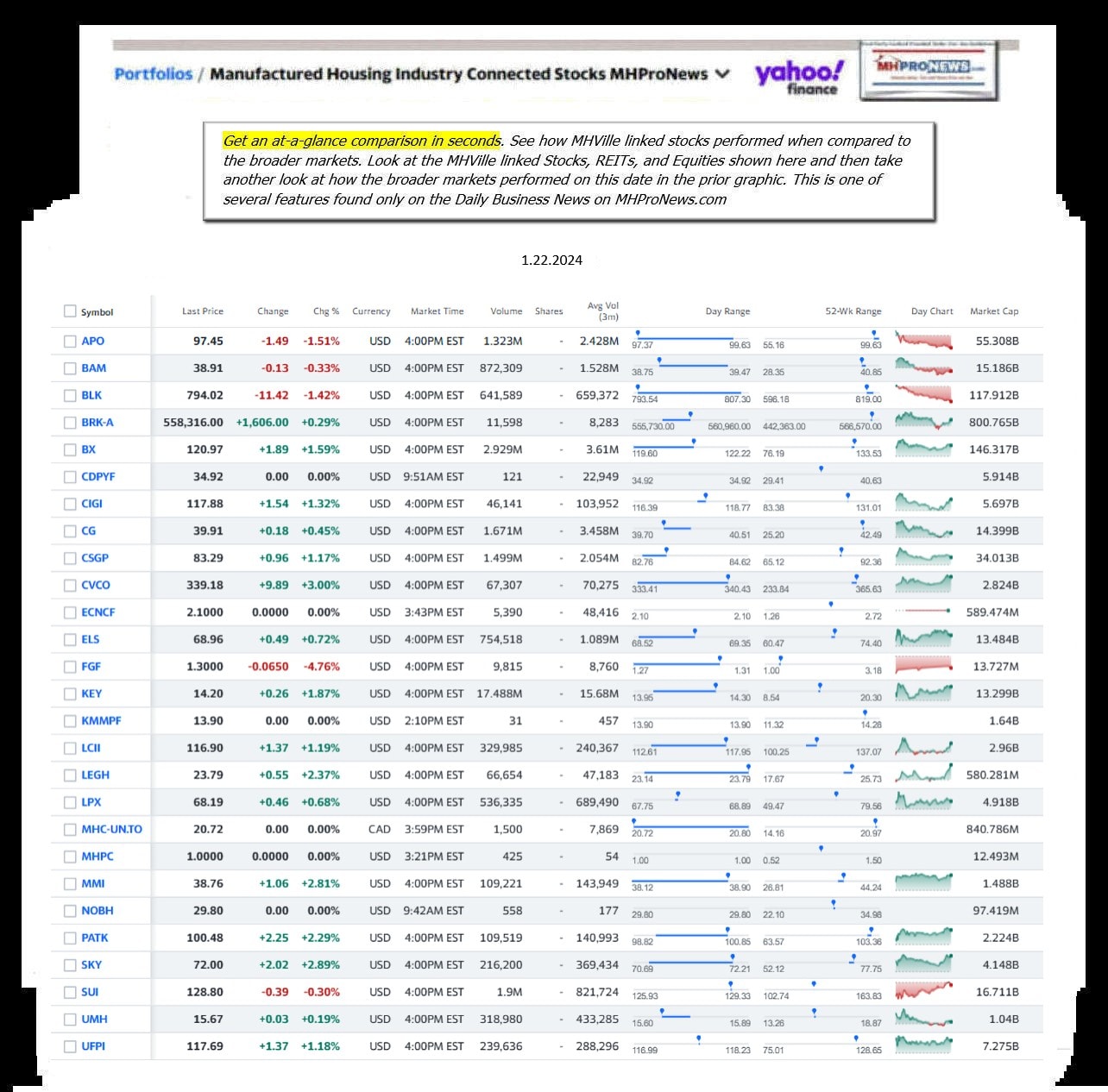

Part III – is our Daily Business News on MHProNews stock market recap which features our business-daily at-a-glance update of over 2 dozen manufactured housing industry stocks.

This segment of the Daily Business News on MHProNews is the recap of yesterday evening’s market report, so that investors can see at glance the type of topics may have influenced other investors. Thus, our format includes our signature left (CNN Business) and right (Newsmax) ‘market moving’ headlines.

The macro market move graphics below provide context and comparisons for those invested in or tracking manufactured housing connected equities. Meaning, you can see ‘at a glance’ how manufactured housing connected firms do compared to other segments of the broader equities market.

In minutes a day readers can get a good sense of significant or major events while keeping up with the trends that are impacting manufactured housing connected investing.

Reminder: several of the graphics on MHProNews can be opened into a larger size. For instance: click the image and follow the prompts in your browser or device to OPEN In a New Window. Then, in several browsers/devices you can click the image and increase the size. Use the ‘x out’ (close window) escape or back key to return.

Headlines from left-of-center CNN Business – from 1.22.2024

- Republican AGs back Texas and Florida social media regulations at US Supreme Court

- Members of the Cal State University (CSU) carry signs as they strike in front of San Francisco State University on January 22, 2024 in San Francisco, California. Tens of thousands of CSU faculty and staff walked off the job today to stage a five day strike at all 23 CSU universities in California. Faculty members are asking for a 12 percent pay increase.

- Thousands of faculty walk off the job at largest university system in US

- Thomas Barkin, president of the Federal Reserve Bank of Richmond, during a Virginia Bankers Association and the Virginia Chamber of Commerce event in Richmond, Virginia, US, on Thursday, Jan. 11, 2024. Barkin last week said the central bank can lower interest rates as the economy normalizes and confidence grows about the downward path of inflation.

- Fed’s Barkin: March rate cut isn’t out of the picture. ‘You make the call when you get to the meeting’

- Prospective buyers attend an open house at a home in San Francisco, California, US, on Saturday, Nov. 4, 2023.

- What broke the American Dream for Millennials

- Larry Summers blasts Harvard over antisemitism: ‘I have lost confidence’

- Chinese stocks are having their worst start to a year since 2016

- The Boeing Co. 737 MAX airplane stands on the production line at the company’s manufacturing facility in Renton, Washington, U.S., on Monday, Dec. 7, 2015. Boeing Co.’s latest 737 airliner is gliding through development with little notice, and that may be the plane’s strongest selling point. The single-aisle 737 family is the company’s largest source of profit, and the planemaker stumbled twice earlier this decade with tardy debuts for its wide-body 787 Dreamliner and 747-8 jumbo jet.

- Boeing faces new safety alert over earlier generation of 737s

- H&M has pulled a school uniform ad after complaints it sexualized children.

- Elon Musk claims X has less antisemitic content than peers, following visit to Auschwitz

- We may not lose our jobs to robots so quickly, MIT study finds

- Kyte Baby under scrutiny for denying mom’s remote work request while newborn was in NICU, CEO walks back ‘terrible decision’

- January’s stock market turnaround could be a good omen for the year

- Macy’s rejects a $5.8 billion unsolicited takeover offer

- ‘A European gaming champion’: FDJ offers to buy online gambling firm Kindred for $2.7 billion

- Sony’s $10 billion India media deal ends in ugly breakup

- China’s largest oil supplier in 2023 was Russia

- Yes, employers can set a mandatory retirement age. What you need to know

- Markets are trying to fight the Fed on rate cuts. It’s not working

- Another Hollywood strike? Musicians union ‘prepared to do whatever it needs’ for AI protections and streaming residuals

- Here’s why it may be harder to find a job online

- Why do we have right-on-red, and is it time to get rid of it?

- Applebee’s is offering a subscription pass for your date nights

- Microsoft says state-sponsored Russian hacking group accessed email accounts of senior leaders