Here is what MHI said in part.

“MHI has been working closely with Congress and the Administration to ensure the interests of the manufactured housing industry are considered in any year-end legislation, especially any federal action in response to COVID-19.”

By contrast, their rival association across the Potomac River, warned their readers and members about a more “punitive regulatory regime” that is looming.

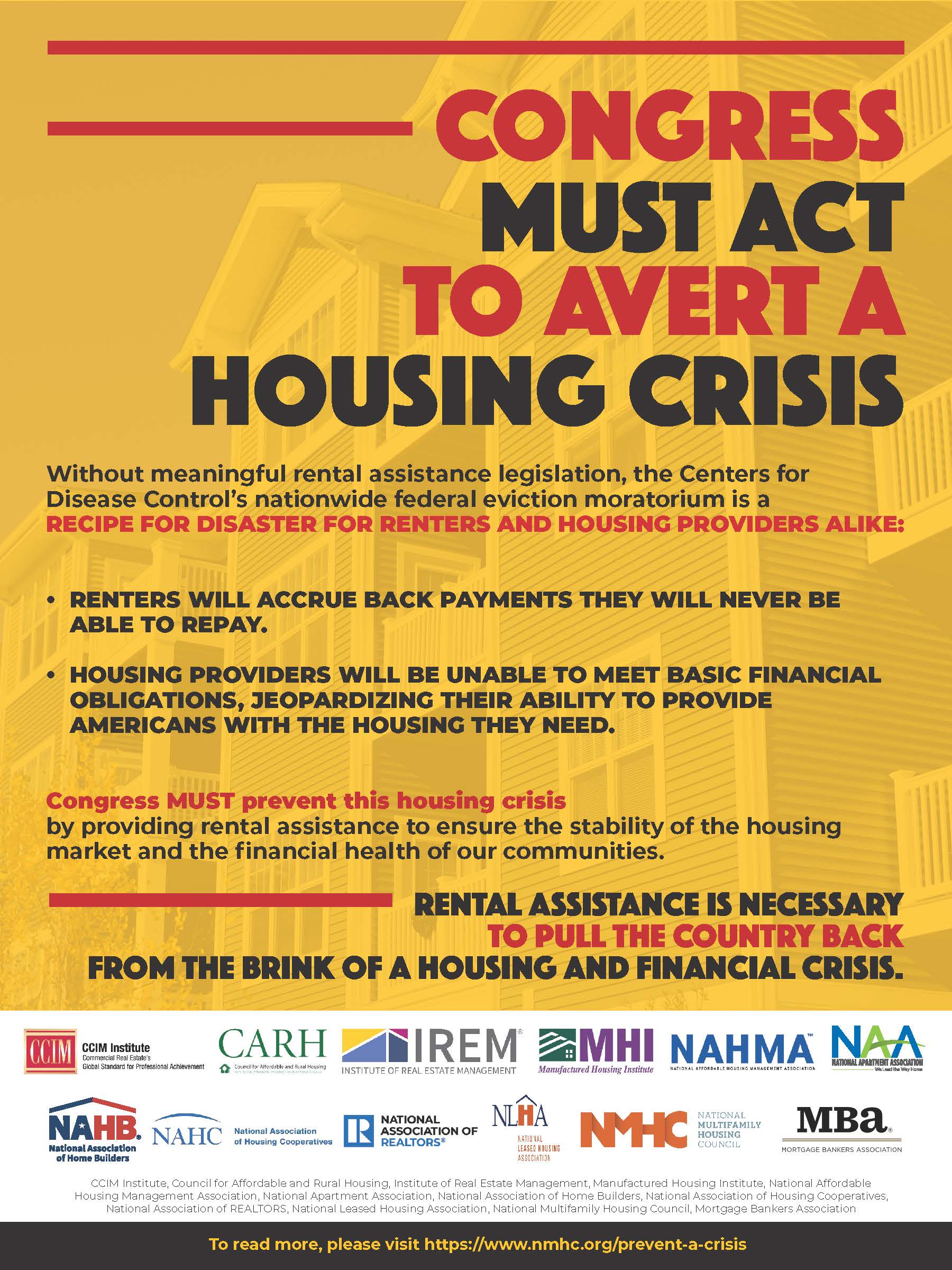

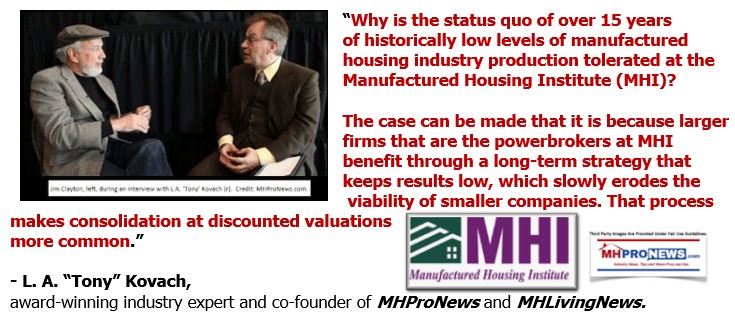

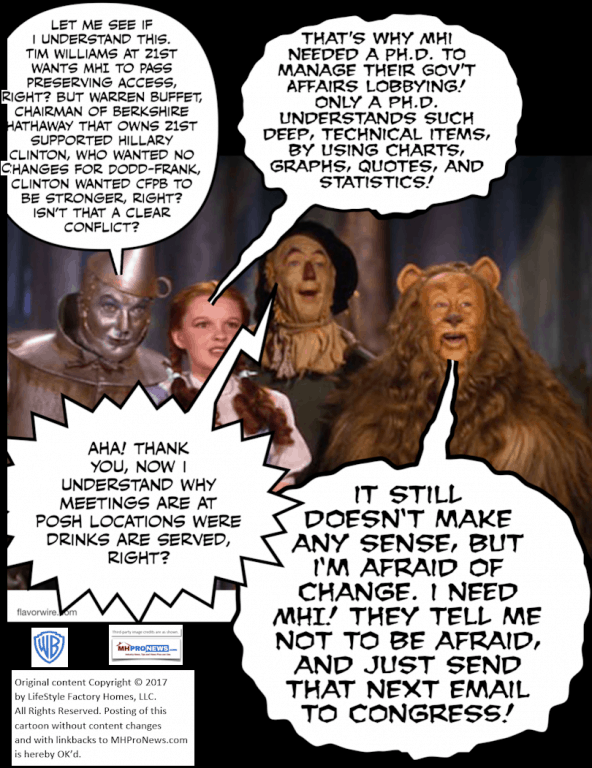

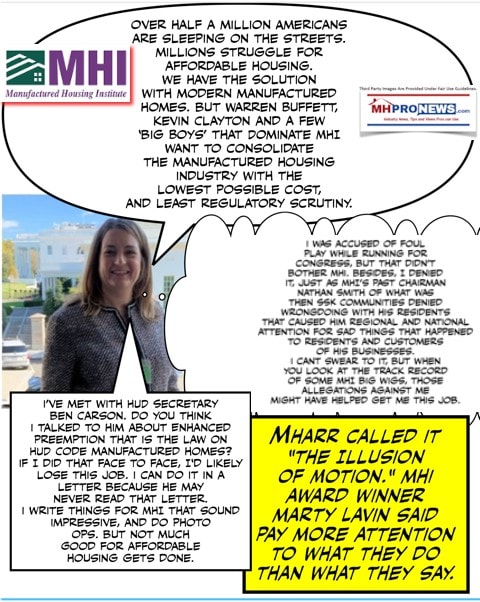

The Manufactured Housing Association for Regulatory Reform – which has no political action committee or PAC – and MHI’s contrast is distinctive. MHI brags about the full-page ads they have taken out ‘with their coalition partners’ in support of the interests of their larger members. MHARR asks, why isn’t MHI simply asking for the enforcement of good federal laws, including the one that the two helped to pass jointly in 2000? How has MHI ‘razzle dazzle’ moved the needle for manufactured housing industry growth?

That seems like a fair question. MHI has not bragged about how they insisted in face to face meetings with lawmakers, bureaucrats, or the White House laws that could open up more manufactured home sales. Where is the MHI logic? Is it because slow or negative growth benefits larger firms at the expense of smaller companies and consumers?

Tonight’s featured focus is a pre-Christmas news op-ed by Alfredo Ortiz of the Job Creators Network (JCN) who explains a “shameful” change that Congress is trying to make in the yet-unsigned next round of COVID19 relief as it relates to the Paycheck Protection Program or PPP

Tonight, instead of quotable quotes, we’ll share some political cartoons to lighten the mood pre-holiday. MHProNews will plan to pivot back to our quotable quotes feature next week. As normal, the featured focus will follow the left-right headlines, and two of our three market summary graphics at the closing bell. The manufactured home industry connected stocks-at-a-glance graphic information follows the featured focus and related reports.

Political Cartoons That Shed Light – American Social, Industry, National Issues…

Headlines from left-of-center CNN Business

- Off to a roaring start

- WILMINGTON, DE – DECEMBER 22: President-elect Joe Biden speaks prior to the holiday at the Queen theatre on December 22, 2020 in Wilmington, Delaware. Biden spoke ahead of the Christmas holiday and called the $900 billion coronavirus aid bill passed by Congress on Monday a start, insisting on more economic relief after the inauguration.

- Biden’s post-election stock market bump is easily beating the 2016 Trump rally

- Analysis: Brexit is finally done. It will leave the United Kingdom poorer

- Donald Trump is right: $600 is not nearly enough. But $2,000 isn’t, either

- Opinion: Trump must sign the stimulus bill to protect vulnerable renters

- How small business would benefit from the new Covid relief bill

- See how Santa is social distancing this Christmas

- The pandemic is forcing some older workers to retire early

- Rush Limbaugh says he didn’t expect to be alive in an emotional last show of 2020

- Joe Biden holds court with newspaper columnists in ‘old-fashioned’ approach

- Fox News’ Maria Bartiromo thought she was interviewing the CEO of Smithfield Foods. It was an impostor

- China launches antitrust investigation into Alibaba

- Visa continues its ban on Pornhub

- GAL GADOT as Wonder Woman in Warner Bros. Pictures action adventure “WONDER WOMAN 1984” a Warner Bros. Pictures release.

- 2020’s biggest blockbuster battle is on streaming

- Jordan Mills, center, her husband Jonathan Russell and their daughter Valkyrie were evicted from their home in San Antonio despite the CDC order. They still struggle to pay for their smaller, less expensive apartment since her hours have been cut and he left work to be with Valkyrie.

- She thought she did everything right to avoid being evicted. She was wrong

- This might be the most valuable Hot Wheels car in the world

- MARKETS

- CHICKEN WARS

- KFC launches game console that keeps your chicken warm

- This is what the KFC of the future will look like

- KFC is replacing its ‘Finger Lickin’ Good’ sauce

- McDonald’s announces new chicken sandwich

- Popeyes adds chocolate beignets to its menu

- YEAR IN REVIEW

- Store closing signs hang in the window of a Pier 1 imports store on February 18, 2020 in Chicago, Illinois. The struggling retailer announced today that it had filed for bankruptcy and was closing 450 stores.

- All the stores and restaurants that filed for bankruptcy in 2020

- A sad list of the tech we barely touched this year

- It’s OK if you’ve used your phone too much

- The most Googled words and phrases of 2020

- Watch the top YouTube videos of the year

Headlines from right-of-center Newsmax

- Republicans Block $2,000 Virus Checks Despite Trump Demand

- House Republicans shot down a Democratic bid on Thursday to pass President Donald Trump’s longshot, end-of-session demand for $2,000 direct payments to most Americans before signing a long-overdue COVID-19 relief bill.

- Election 2020

- Trump’s Stimulus Demand Puts Georgia Senators Under Pressure

- Trump: ‘Monstrous Fraud’ Gave Biden Election

- Black Pastors Call Loeffler’s Warnock Criticism ‘Attack Against Black Church’

- Poll: Georgia Women Voters Split Among Senate Runoff Candidates

- Loeffler Open to $2,000 Checks If ‘Wasteful Spending’ Repurposed

- Police Body Cam Footage Shows Warnock Dispute With Ex-Wife

- -elect Marjorie Taylor Greene to Newsmax TV: GOP Sens on Board

- More GOP Lawmakers Join Electoral College Challenge

- The Trump Presidency

- Trump Issues Pardons for Manafort, Stone, Jared Kushner’s Dad

- Pompeo: US Began Work on Consulate in Western Sahara

- Canine Officer Stephanie Mohr ‘Grateful’ for Trump Pardon

- Relative of Blackwater Victim in Iraq: Pardons ‘Unfair’

- US Cyber Agency: Hackers ‘Impacting’ State, Local Govts

- Fully Pardoned Stone Rebukes ‘Soviet-Style Show Trial’

- Trump Warns Iran Over Rocket Strike on Embassy in Iraq

- Central Command Head: ‘Heightened Risk ‘ of Iranian Threat

- Louie Gohmert: Stimulus Boost Has a Caveat

- Trump Vetoes Defense Bill, Setting Up Possible Override Vote

- Newsfront

- UK, EU Reach Historic, Last-Minute Brexit Deal

- Britain clinched a Brexit trade deal with the European Union on Thursday, just seven days before it exits one of the world’s biggest trading blocs in its most significant global shift since the loss of empire.

- WSJ: Hunter Biden Still Owns 10 Percent Stake in Chinese Firm

- Hunter Biden, the son of President-elect Joe Biden whose finances are

- Finance

- Trevor Gerszt: Gold’s Benefits Aren’t Just for Retirees

- It’s no surprise that most customers who purchase gold are older, either nearing retirement or already into retirement.

- Brexit Trade Deal Sealed: EU and UK Clinch Narrow Accord

- COVID Holiday Shopping Signals Rough Start to 2021

- Gift-Card Surge to Provide Much-Needed Retail Boost

- Wall Street’s 6 Painful Lessons From Year of Epic Debt Fights

- As Testing Costs Rise, Neurology Patients May Skip Screening

- Even Winter Carries Skin Cancer Risks for College Students

- Study: Dads’ Health Linked to Partner’s Miscarriage Chances

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

Per Breitbart, Alfredo Ortiz of JCN had this to share on Christmas eve.

Small businesses are being hit hard by the COVID-19 pandemic, as research from Harvard shows small business revenue in November was 32 percent lower than in January. The last thing these struggling businesses need is for the banking industry to capture relief funds meant to help them meet payroll.

Unfortunately, that is what Congress is doing in the latest COVID relief bill, which rewrites the Paycheck Protection Program (PPP) after the fact to help banks at the expense of small businesses. In essence, Section 340 on page 2202 (hidden deep in the bill to avoid scrutiny) shifts paying agent fees from the banks who were supposed to pay small business agents, who help companies obtain and comply with PPP loans, to the small businesses themselves who hadn’t planned for this extra expense.

Previous legislation explicitly tasked the banks with paying these fees, not small businesses, because the loans are meant to reduce small businesses’ costs. Forcing entrepreneurs to pay these loans out of pocket undermines the PPP’s intent and hurts businesses that are barely staying open.

At first, this seems like an insignificant change, but it will cost small businesses $3.7 billion in fees. Congress is being captured at the 11th hour by special interest groups who want to line their pockets at the expense of entrepreneurs who can’t spend millions on lobbying.

Big banks are corrupting the legislative process and are jeopardizing the livelihood of many small business owners. Entrepreneurs who have struggled for the last year to stay afloat because of COVID-19 restrictions may finally be driven under by this shameless legislative change.

It is disgraceful that Congress is disrupting the PPP, which is one of the most successful programs from the CARES Act passed in March. Congress is acknowledging the importance of the PPP, by replenishing the program with $300 billion in additional relief funds to help businesses survive the next few months until COVID-19 vaccines are fully distributed.

This year the PPP allocated over five million forgivable loans worth approximately $500 billion, saving more than 50 million jobs. Research shows that up to 84 percent of small business employees have stayed employed at least in part because of the PPP.

Alfredo Ortiz is president and chief executive officer of Job Creators Network.

###

MHProNews will have a special Christmas report tomorrow morning. From all of us to all of you, Merry Christmas.

Related, Recent, and Read Hot Reports

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

Winter 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.