Preface. Someone doesn’t have to be an industry expert or a manufactured home aficionado to recognize the value of this timeless maxim: “Insanity is doing the same thing over and over and expecting different results.” That noted, let’s dive into the following press releases and other pieces of facts and evidence to see what they reveal about Cavco Industries, which is “a proud member” of the Manufactured Housing Institute. On Friday 9.23.2022, Cavco Industries issued an anticipated news release that is provided below that announced a settlement between the Securities and Exchange Commission (SEC) and Cavco (CVCO). That release plus additional details are provided herein that are not found in the recent Cavco media statement. The “Whistleblower” segment of this report will be provided further below and is not part of the Cavco release. Currently at the helm and for years on the Cavco board of directors is William “Bill” Boor. According to WallMine on 6.29.2022– “William Boor is 54, he’s been the President, Chief Executive Officer, and Director of Cavco Industries Inc since 2019.” Boor’s LinkedIn profile, which is typically information provided directly from the profiled professional, says he is a Harvard Business School MBA- Masters in Business Administration – graduate in “general management.”

On September 23, 2022 6:18 PM EDT was the following.

The settlement resolves all claims in the action against the Company. Daniel Urness, its former chief financial officer, is the only remaining defendant in the ongoing action. Mr. Stegmayer settled the SEC claims against him last year.

“After working to resolve this matter for an extended period of time, we are very happy to have reached a settlement on reasonable terms,” said President and Chief Executive Officer Bill Boor.

About Cavco Industries, Inc.

Cavco Industries, Inc., headquartered in Phoenix, Arizona, designs and produces factory-built housing products primarily distributed through a network of independent and Company-owned retailers. We are one of the largest producers of manufactured and modular homes in the United States, based on reported wholesale shipments. Our products are marketed under a variety of brand names including Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood and MidCountry. We are also a leading producer of park model RVs, vacation cabins and factory-built commercial structures. Cavco’s finance subsidiary, CountryPlace Mortgage, is an approved Fannie Mae and Freddie Mac seller/servicer and a Ginnie Mae mortgage-backed securities issuer that offers conforming mortgages, non-conforming mortgages and home-only loans to purchasers of factory-built homes. Our insurance subsidiary, Standard Casualty, provides property and casualty insurance to owners of manufactured homes. Additional information about Cavco can be found at https://www.cavco.com. …

MHProNews Note: The typical “forward looking statements” disclosures were also part of their release. This has been edited for length by MHProNews to focus on some items that could reasonably be considered areas that Cavco has more influence and ability to improve or mitigate the problems in those areas which will be addressed in the following the Additional Information with MHProNews Analysis and Commentary section.

Additional Information with More MHProNews Analysis and Commentary in Brief

Just over a year ago, on September 3, 2021 the SEC issued this statement.

SEC Charges Public Company and Former Executives with Insider Trading, Internal Accounting Control Violations, and Misleading an Auditor

Litigation Release No. 25196 / September 3, 2021

Securities and Exchange Commission v. Cavco Industries, Inc., Joseph Stegmayer, and Daniel Urness, No. 21-cv-01507 (D. Ariz. filed September 2, 2021)

Securities and Exchange Commission v. Robert Scott Parkhurst, No. 21-cv-00657 (N.D. Ind. filed September 2, 2021)

According to the SEC’s complaint, filed in the United States District Court for the District of Arizona, Cavco, at Stegmayer’s direction, used material, non-public information obtained through merger discussions with another public company, Skyline Corp., to trade in Skyline securities. Ultimately, Skyline announced a merger with a different company, which increased Skyline’s stock price by 48% and resulted in alleged gains for Cavco of approximately $260,000. Additionally, the complaint alleges that after Cavco received an SEC subpoena concerning the Skyline trading, Stegmayer sold over 11,000 Cavco shares that he personally owned. After news of the SEC investigation and the Skyline trading came out, Cavco’s share price decreased by 23%. The complaint alleges that by selling stock in advance of this news, Stegmayer avoided losses of over $880,000.

In addition, the SEC’s complaint alleges that Cavco failed to devise a system of internal accounting controls sufficient to provide reasonable assurance that its securities trading would be executed in accordance with its board’s authorization, its corporate investment policy, and its securities trading policy, and that Stegmayer and Urness aided and abetted that failure. The complaint further alleges that Stegmayer circumvented and/or failed to implement the few controls that were in place by causing Cavco to trade in shares of Skyline and of other companies that Cavco was interested in acquiring, all without board knowledge. The SEC also alleges that Urness circumvented and/or failed to implement Cavco’s investment policy by setting up a system to fund the trades without informing the board or ensuring the trades complied with that policy. The complaint further alleges that Stegmayer and Urness knowingly misled Cavco’s auditors with respect to the Skyline trading and an ongoing Financial Industry Regulatory Authority (FINRA) investigation into those trades.

The SEC’s complaint alleges that Cavco violated Sections 10(b) and 13(b)(2)(B) of the Securities and Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5 thereunder; that Stegmayer violated Section 17(a) of the Securities Act of 1933 (“Securities Act”), Sections 10(b) and 13(b)(5) of the Exchange Act, and Rules 10b-5 and 13b2-2(a) thereunder and aided and abetted Cavco’s violation of Section 13(b)(2)(B) of the Exchange Act; and that Urness violated Section 13(b)(5) of the Exchange Act and Rule 13b2-2(a) thereunder and aided and abetted Cavco’s violation of Section 13(b)(2)(B) of the Exchange Act. Without admitting or denying the allegations, Stegmayer consented to the entry of judgment, subject to court approval, that permanently enjoins him from violating the charged provisions, bars him from serving as an officer or director of a public company for 5 years, and orders him to pay a civil penalty of $1.48 million.

The Commission also announced insider trading charges against Robert Scott Parkhurst, an Indiana resident and former national sales manager at Skyline. According to the SEC’s complaint, filed in the United States District Court for the Northern District of Indiana, Parkhurst obtained material, non-public information about Skyline’s merger discussions through his role as national sales manager at Skyline. The SEC alleges that Parkhurst traded on the basis of that material, non-public information and also tipped his father and son. After the merger news was publicly released, Parkhurst had gains of approximately $4,893, and his father and son of $6,210. Without admitting or denying the allegations, Parkhurst consented to the entry of judgment, subject to court approval, that permanently enjoins him from violating the antifraud provisions of Section 10(b) of the Securities and Exchange Act of 1934 and Rule 10b-5 thereunder and orders him to pay a civil penalty of $15,995.

The SEC’s investigation was conducted by Jasmine M. Starr and Lorraine Pearson and supervised by Finola H. Manvelian and Rhoda Chang of the Los Angeles Regional Office. The SEC’s litigation will be led by Daniel O. Blau and supervised by Amy J. Longo. The SEC appreciates the assistance of FINRA in this matter. ##

From its 4.2.2019 press release, Cavco’s William C. “Bill” Boor assumed the role of Chief Executive Officer after having served as an “independent” board member since 2008. So, during the timeframe that the SEC said the Stegmayer drama was playing out, Boor was already on Cavco’s board. Note the same press release thanked Daniel Urness for having served as “President and Acting Chief Executive Office” since 11.2018. Note from the Cavco media release above that Urness is the one person who’s role in the legal controversies involving Cavco Industries with the Securities and Exchange Commission (SEC) has not yet been resolved.

Mr. Boor assumes his new role as CEO with over 10 years of experience with Cavco, most recently serving as non-executive Chairman of the Board for the Company. Mr. Boor joined Cavco as an independent member of the Board in 2008. Several years prior to his service on the Cavco Board, Mr. Boor held the position of Vice President, Corporate Development at Centex Corporation while Cavco was a subsidiary of Centex. During that tenure, Mr. Boor worked on developing and implementing Cavco’s business strategy and participated in its eventual spin-off in 2003.

As CEO, Mr. Boor will be responsible for day-to-day leadership of the Company.

Mr. Boor will remain a member of the Company’s Board of Directors. The Board has named independent Board member Steven Bunger to serve as the Company’s new non-executive Chair of the Board. Richard Kerley has been appointed Chairman of the Audit Committee. Both of these Board appointments are effective immediately.

After thoughtful consideration of options to strengthen the management team, the Board concluded Bill is the right choice to assume the CEO role,” commented Mr. Bunger, new non-executive Chair of Board. “Bill is a strong and proven leader, who has a successful track record of managing large, complex businesses and working across a range of executive roles in public companies. His significant knowledge and insights into Cavco’s business, from his tenure on the Board and previous strategic work with the company, provide the immediate and long-term ability needed to lead the execution of our strategic plan and focus on operational excellence.”

“The Board would like to thank Dan Urness for his leadership and contributions over the last five months as Acting CEO during an important period of transition. We are pleased he will remain an important part of our leadership team,” commented Mr. Boor. “I’ve had the pleasure of working closely with Dan for many years while I was Chairman of the Audit Committee and I look forward to working closely with him in the coming years.”

Mr. Boor added, “Cavco’s strong track record speaks for itself and we remain very well-positioned for the future. I’m excited to have the opportunity to lead the Company’s next chapter, working closely with the Board, and the entire Cavco team, to help the Company deliver value to all stakeholders including customers, employees, partners, and investors.”

William Boor, Chief Executive Officer

Mr. Boor, Chairman of the Company’s Audit Committee, a member of the Company’s Compensation Committee and an independent member of the Board since July 2008, most recently assumed the role of non-executive Chairman of the Board. Most recently, Mr. Boor held the role of Chief Executive Officer of Great Lakes Brewing Company, a large craft brewery in Cleveland, Ohio, a position he has held since 2015. From 2007 to 2014, Mr. Boor served in various executive positions with Cliffs Natural Resources, Inc. (“Cliffs”), most recently serving as Executive Vice President – Corporate Development and Chief Strategy/Risk Officer and President-Ferroalloys. Among other roles prior to Cliffs, Mr. Boor held the position of Vice President, Corporate Development at Centex Corporation. During that tenure, Cavco was a subsidiary of Centex, and Mr. Boor worked on the Cavco strategy and its eventual spin-off in 2003. Mr. Boor earned an engineering degree from Penn State University and a Master of Business Administration degree from Harvard Business School. He is also a CFA charter holder.

Daniel Urness, Chief Financial Officer

Mr. Urness was Cavco’s Executive Vice President, Chief Financial Officer and Treasurer from April 2015 until August 2018, where he transitioned into the role of President and Acting Chief Executive Officer in November 2018. Mr. Urness also served as Cavco’s Vice President, Chief Financial Officer and Treasurer from January 2006 to April 2015 and as a director and/or officer of certain of Cavco’s major subsidiaries, including Palm Harbor Homes, Inc., Fleetwood Homes, Inc., CountryPlace Acceptance Corp. and Standard Casualty Company. Mr. Urness was also Cavco’s Interim Chief Financial Officer from August 2005 to January 2006, Corporate Controller from May 2005 to August 2005, financial consultant to the Company from June 2002 to May 2005 and Controller from May 1999 to June 2002. Prior to joining Cavco, Mr. Urness served as manager and staff accountant at Deloitte & Touche LLP for approximately six years. …”

MHProNews has provided several reports that ought to be considered in the context of this announced settlement and some of the players involved.

Speaking of players involved, the following.

Joseph H. “Joe” Stegmayer

From the RV MH Hall of Fame is this from the bio of RV MH Hall of Fame inductee Joseph “Joe” Stegmayer:

Despite that glowing bio, there is no update on their website on 9.26.2022 that reflects what has been revealed since his 2016 induction into that body.

Per the SEC:

Ouch. Welcome to surprising world that exists among several of the prominent boards and ‘award winners’ in MHVille. As a disclosure and brief commentary, perhaps it was a good thing that our parent company parted ways with MHI and attendance at the RV MH annual “induction” soiree several years ago as such vexing revelations became apparent?

That said, nor is there any mention by the RV/MH Hall of Stegmayer’s role on the RV MH Hall board, nor his service on the MHI board, including time as chairman. Despite the allegations lodged against him that caused him to step down immediately from Cavco leadership, Stegmayer continued on as MHI’s chairman. The image collage by MHProNews uses elements from the RV MH Hall of Fame website on this date.

With that backdrop a look at William “Bill” Boor is a commonsense next step.

Boor’s support for MHI is reflected in not only the Cavco’s membership in the nonprofit, but also in his personal contributions to the MHI PAC (political action committee).

Note that per the Federal Elections Committee, the maximum contribution to in the 2021 to the 2022 election cycles are $5,000 for the following categories.

Contribution limits for 2021-2022 federal elections

| Recipient | ||

| PAC† (SSF and nonconnected) | ||

| Donor | Individual | $5,000 per year |

| Candidate committee | $5,000 per year | |

| PAC: multicandidate | $5,000 per year |

| William “Bill” Boor – Cavco Industries – per Open Secrets | |||||

| Money to PACs | BOOR, WILLIAM MR | PRESIDENT & CEO | 6/16/2020 | $5,000.00 | Manufactured Housing Institute |

| PHOENIX, AZ 80012 | |||||

| Money to PACs | BOOR, WILLIAM MR | PRESIDENT & CEO | 6/30/2019 | $2,000.00 | Manufactured Housing Institute |

| PHOENIX, AZ 80012 | |||||

| Money to PACs | BOOR, WILLIAM MR | PRESIDENT & CEO | 2/10/2022 | $5,000.00 | Manufactured Housing Institute |

| PHOENIX, AZ 85012 | |||||

| Money to PACs | BOOR, WILLIAM MR | PRESIDENT & CEO | 6/24/2021 | $5,000.00 | Manufactured Housing Institute |

| PHOENIX, AZ 85012 | |||||

| Money to PACs | BOOR, WILLIAM MR | PRESIDENT & CEO | 6/24/2021 | $5,000.00 | Manufactured Housing Institute |

| PHOENIX, AZ 85012 | |||||

| Money to PACs | BOOR, WILLIAM MR | PRESIDENT & CEO | 2/10/2022 | $5,000.00 | Manufactured Housing Institute |

| PHOENIX, AZ 85012 | |||||

Weeks after the public was notified by Cavco Industries on the various Cavco and its prior leadership’s a media release was published on 1.17.2019 by “Hagens Berman Notifies Cavco Industries (CVCO) Investors of the Firm’s Investigation into Possible Securities Law Violations.” It said in part:

“On August 20, 2018, the Company received a subpoena from the SEC’s Division of Enforcement requesting certain documents relating to, among other items, trading in the stock of another public company. On October 1, 2018, the SEC sent a subpoena for documents and testimony to Joseph Stegmayer, the Company’s former Chairman, President and Chief Executive Officer, regarding similar issues. At this time, the Company believes that Mr. Stegmayer traded in certain publicly traded stock in his personal accounts as well as in accounts held by the Company at a time when the Company had agreed to refrain from such trading.”

That same release noted that: “Whistleblowers: Persons with non-public information regarding Cavco should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 510-725-3000 or email CVCO@hbsslaw.com.”

The SEC website seems to suggest that some level of whistleblower awards were involved in the Cavco Industries case. See this screen capture which is a collage of images from the SEC website below. It specifically mentions the Cavco case, but it does not name the amount of the payout or who the payment(s) were made to.

The SEC Whistleblower program and its ‘record’ payouts are detailed in the federal document linked here.

Cavco has stated or alluded to several payouts and related expenses to this case. Some of the cases and other topically related reports are as follows.

Cavco said that the following were examples of problems that could impact their i.e.: “our” below operations.

- A) curtailment of available financing from home-only lenders and increased lending regulations;

- B) … unfavorable zoning ordinances;

- C) extensive regulation affecting the production and sale of manufactured housing;

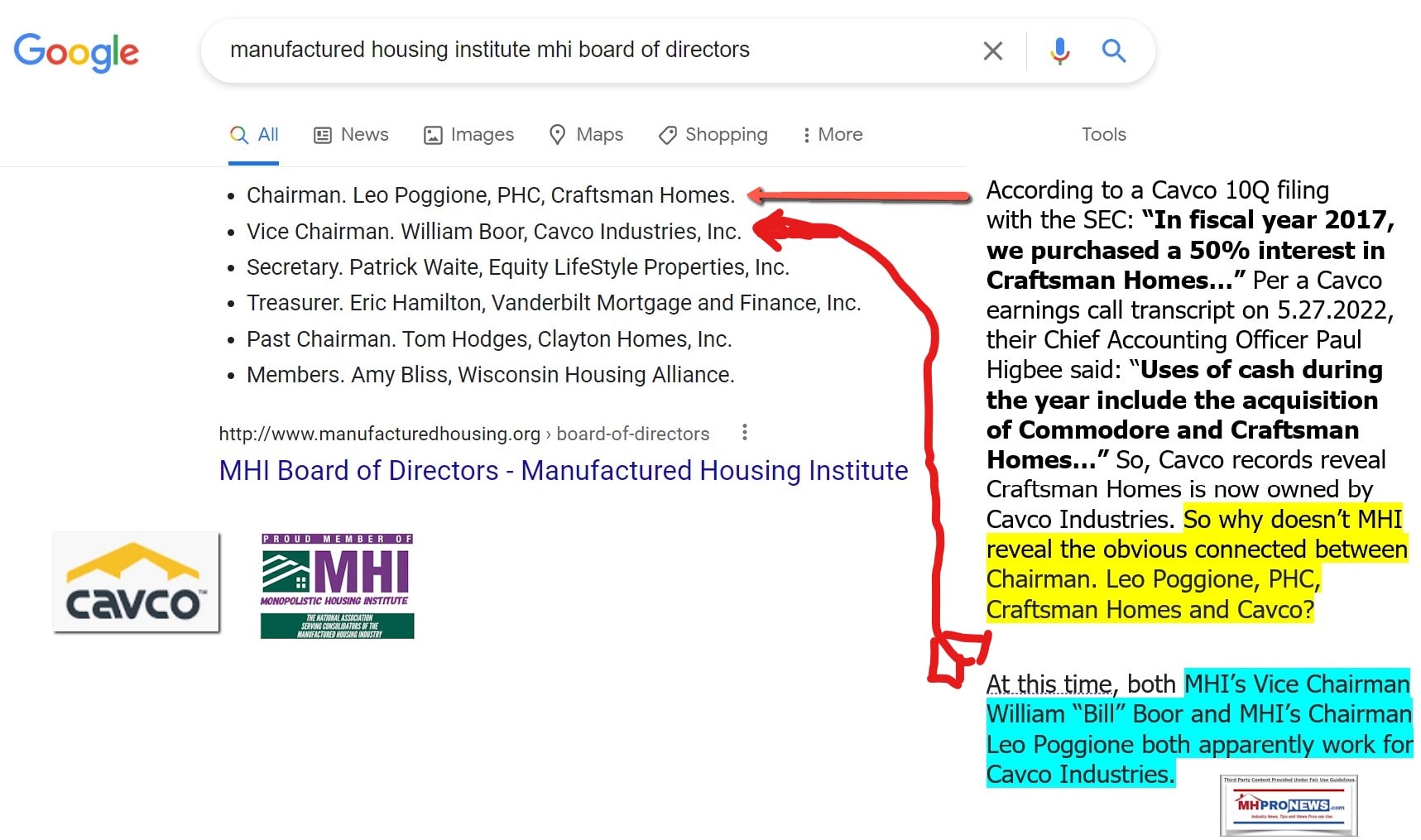

These include issues that MHI claims that they are working to advance on behalf of “all segments” of the manufactured housing industry. Cavco is hardly a bystander on MHI’s behavior. They have essentially two board positions now, and held the Chairman’s role previously during the Stegmayer era.

MHI has had two outside attorneys that have publicly said they monitor critiques and specifically the MHProNews website.

MHI presumably therefore monitors MHARR commentary too.

Cavco presumably has to know all of the above and per a reliable source connected to Cavco, they also have one or more high ranking professionals that regularly read MHProNews articles.

So, they must know the following.

- MHI has said they want HUD to enforce the “enhanced preemption” lawfully made available to HUD Code manufactured homes by the Manufactured Housing Improvement Act of 2000. (MHIA or 2000 Reform Law).

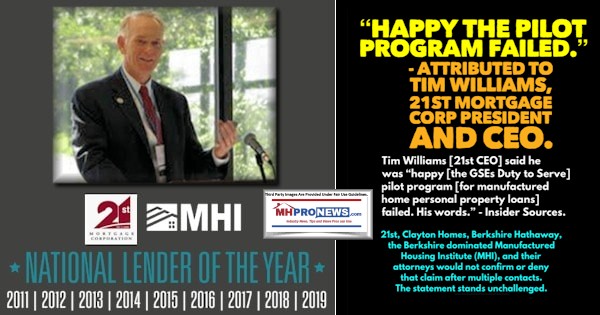

- MHI claims they want more third-party competitive lending. But that is oddly contradicted by Tim Williams, a prior MHI chairman and a long time board member, who said that his Berkshire Hathaway owned firm are happy that the GSEs would not pursue the Housing and Economic Recovery Act (HERA) 2008 mandated “Duty to Serve Manufactured Housing.”

- MHI is warning that manufactured home production could be harmed by the pending regulations from the Department of Energy (DOE) manufactured home energy rule.

But each of these examples above reflect an obvious ability of Cavco Industries to impact these issues through their leadership role at MHI. But instead, Cavco is essentially contradicting themselves. They too warn that these limited lending options, zoning barriers, and DOE energy regulations could harm Cavco’s performance. Yet, they got off with what amounts to a minor slap on the wrist by the SEC? How did that happen?

Furthermore, it is entirely predictable that more bad news is ahead for Cavco’s investors, for reasons that Cavco admits in their forward-looking statements could harm their firm and thus their shareholders.

Put differently, this brings us back to the preface and this maxim: : “Insanity is doing the same thing over and over and expecting different results.” After years of Stegmayer-Urness-Cavco drama, will it be any surprise if more downturns occur for reasons that Cavco admits are risk factors but is doing nothing about fixing?

If MHI was asked by Cavco leaders to address these problems and refused, then why doesn’t Cavco suing to get DTS, “enhanced preemption” or the DOE Energy rule stopped?

The powers that be at MHI and publicly traded firms like Cavco have arguably painted themselves into a corner. They know the problems, they know (or should) the solutions, but continue to do nothing beyond window dressing and posturing to address the underlying issues that are holding manufactured housing back.

To learn more, see the linked reports. Potential industry whistleblower(s)? Why not step up to the plate and help blow open the problems being exposed that might benefit from an insider sounding off? ##

Again, our thanks to free email subscribers and all readers like you, our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.