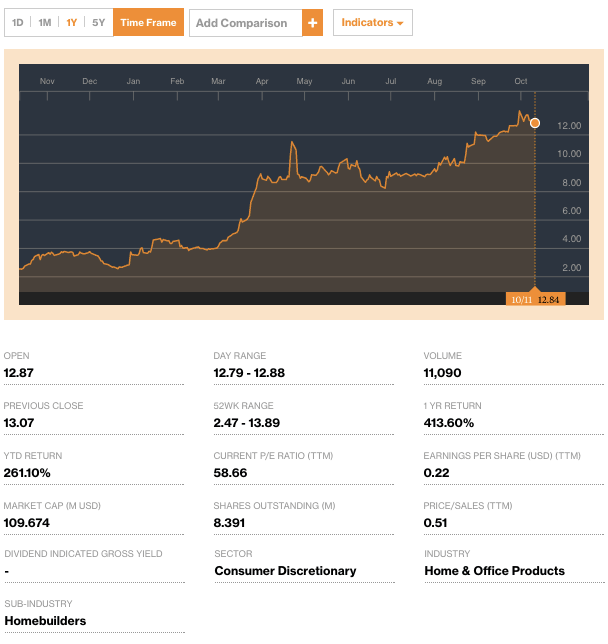

Skyline Corporation (NYSE:SKY) has seen its stock price on the rise recently, hitting a 52-week high of $12.72 last month. Daily Business News readers will recall that we covered the rise of Skyline’s stock in a recent story, here.

According to a story from equities, Skyline’s stock is up 278 percent, year to date.

Shares of Skyline have more than tripled from the $3.50-$4.50 per share range. The company has an average daily volume of 31,395 shares.

Skyline has a market capitalization of $114.37 million and a 52-week range between $2.37 and $13.89 per share.

Equities also notes that in August, Skyline reported its financial results for the fourth quarter and fiscal year that ended May 31, 2016. Net sales from continuing operations for the fourth quarter were $56,651,000, an increase of 14 percent over net sales of $49,605,000 from the same quarter last year.

Net income for the fourth quarter was $1,326,000 or $0.16 per share, compared to a net loss of $200,000 or $0.02 per share in the final quarter of fiscal 2015.

Net sales from continuing operations for fiscal 2016 were $211,774,000, an increase of 13 percent over net sales of $186,985,000 the year before. Net income for fiscal 2016 was $1,678,000 or $0.20 per share, compared to a net loss of $10,414,000 or $1.24 per share in fiscal 2015.

“We are pleased that our progress in the product development and our overall operational improvements have translated to increased revenue and profits for the fourth quarter and the fiscal year,” Skyline President and Chief Executive Officer Richard Florea said in a statement.

“The recent opening of our manufacturing facility in Elkhart, Indiana reflects the increased demand we are seeing for quality-built, value-laden products.”

The next Skyline earnings call is scheduled for October 20th.

As previously reported by the Daily Business News, current SKY stakeholders include:

- Venator Capital Management (524,492 shares),

- Jeffrey Gendell (759,591),

- Robert Robotti (64,700, who also has a hefty stake in Cavco),

- California-based Eam Investors, LLC (0.2% of the stock) and New York-based fund Teton Advisors, Inc. (47,796).

Skyline designs, produces and markets manufactured and modular housing models, as well as park models in the U.S. and Canada. The company has been in the business since 1951. Another recent market report on Skyline is linked here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News, MHProNews.