Readers say this is also quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- White House keeps undermining press briefing

- Warren wants the Wells Fargo board wiped out Trending

- UPS will charge more for Christmas shipments

- Trump’s financial disclosure: 9 things to know

- FTC plans to challenge DraftKings FanDuel merger

- So long, Yahoo. Hello … Altaba?

- Qatar Airways fires back at Arab neighbors

- Could there be a bidding war for Whole Foods?

- Why top tech CEOs are still meeting with Trump

- Baby born on flight gets free plane tickets for life

- The 5 five huge issues Britain and EU must settle

Selected headlines and bullets from Fox Business:

- White House Press Secretary Sean Spicer will take on a new, elevated role in the Trump administration, White House officials said Monday.

- Trump taps tech titans to tackle government waste

- Wall St hits record highs on strong technology, health stocks

- Oil falls to seven-month low on more signs of growing crude glut

- Amazon’s Whole Foods deal could spark bidding war

- Amazon, Whole Foods shares rally as deal pressures broader market

- Oil prices edge up; still near 2017 lows on stubborn glut

- Trump’s Cuba rollback to spare airlines but could hurt demand

- Trump rolls back Obama-era Cuba policy

- White House tackles drug costs

- Amazon CEO Bezos has billions more to give away thanks to Whole Foods deal

- Amazon vs. Walmart: Grocery wars

- Is Costco cheaper than Amazon?

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

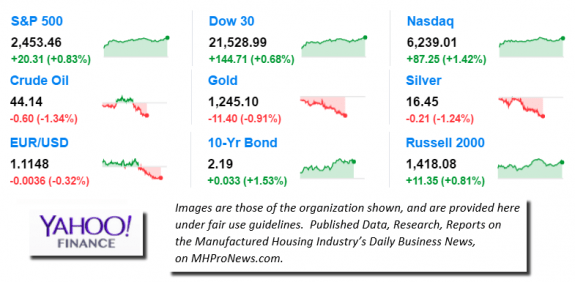

9 key market indicators, ‘at the closing bell…’

S&P 500 2,453.46 +20.31 (+0.83%)

Dow 30 21,528.99 +144.71 (+0.68%)

Nasdaq 6,239.01 +87.25 (+1.42%)

Crude Oil 44.14 -0.60 (-1.34%)

Gold 1,245.10 -11.40 (-0.91%)

Silver 16.45 -0.21 (-1.24%)

EUR/USD 1.1147 -0.0037 (-0.33%)

10-Yr Bond 2.19 +0.033 (+1.53%)

Russell 2000 1,418.08 +11.35 (+0.81%)

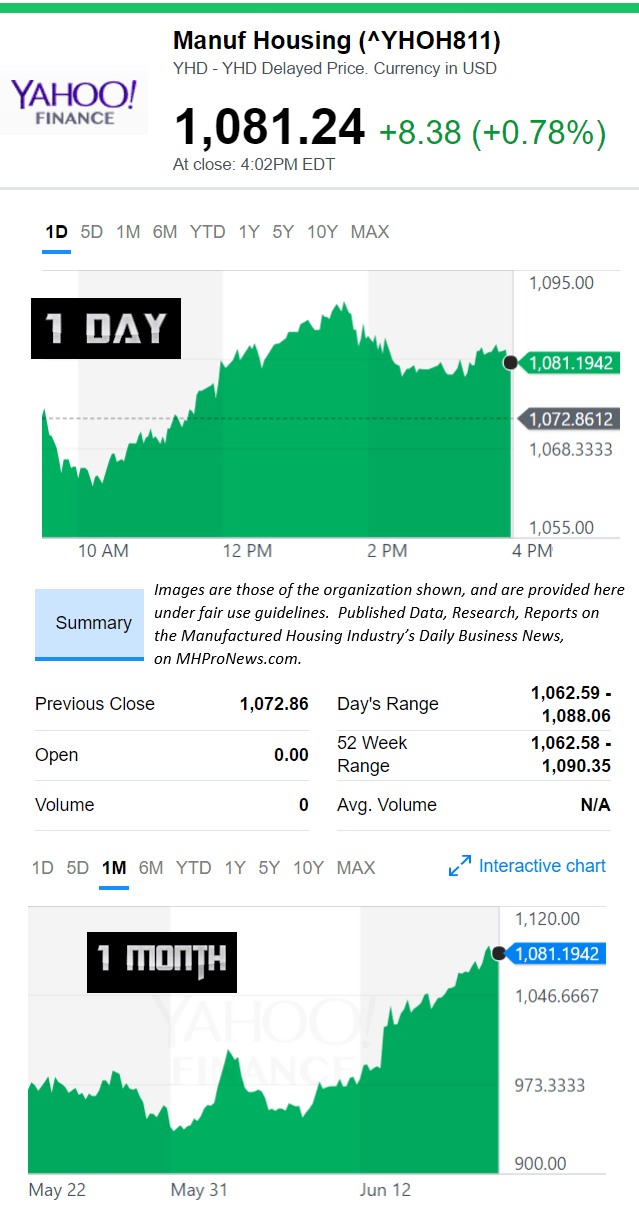

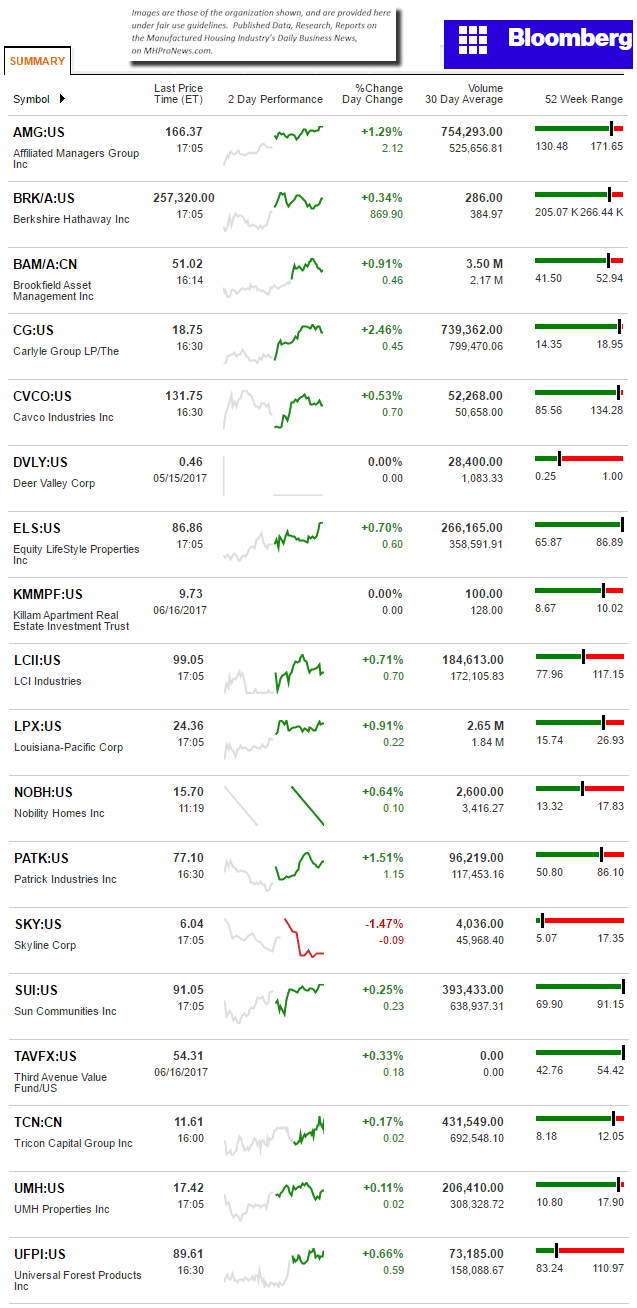

Manufactured Housing Composite Value 6.19.2017

Manufactured Housing Connected Stocks

Today’s Big Movers

Carlyle and AMG lead the gainers. All tracked stocks, save Skyline gained today; which means SKY lead the decliners. See below for all the ‘scores and highlights.’

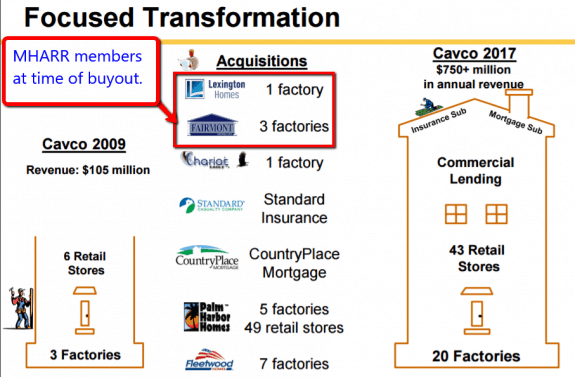

Today’s MH Market Spotlight Report – Cavco Industries

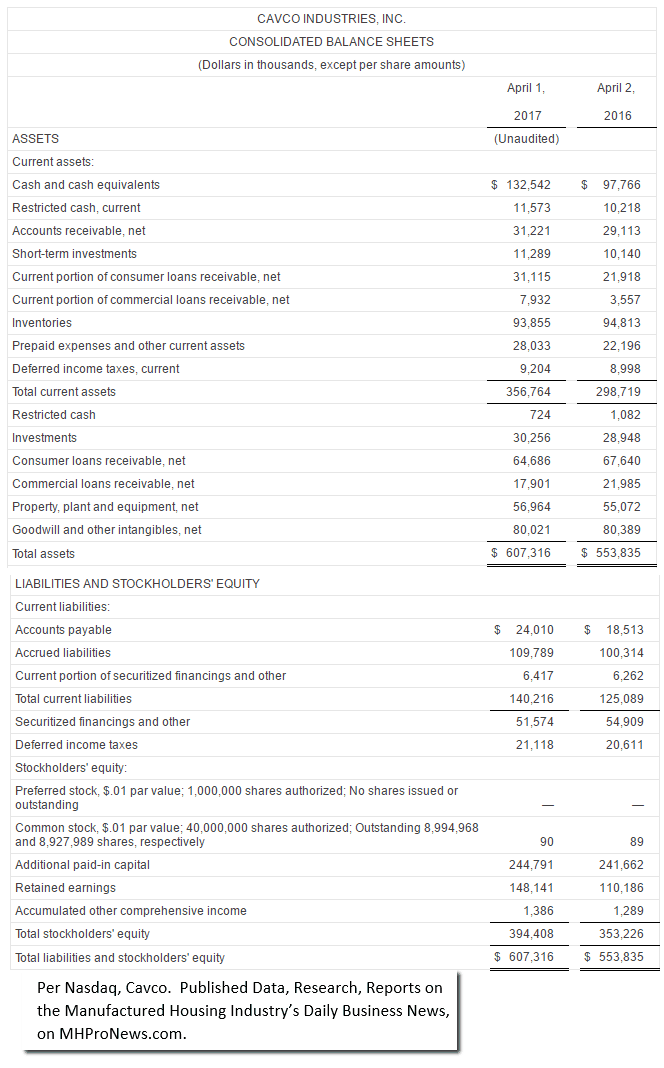

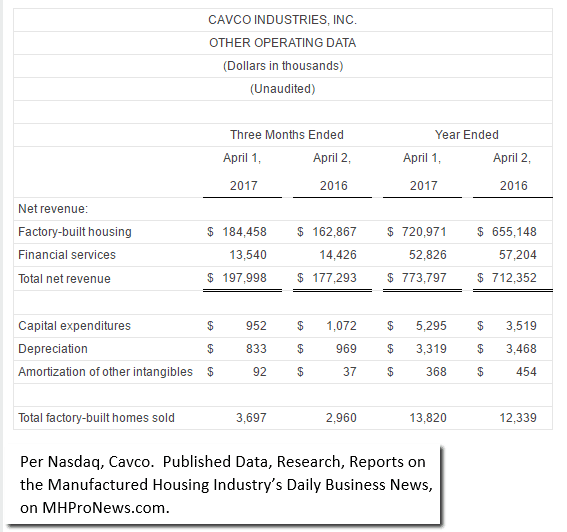

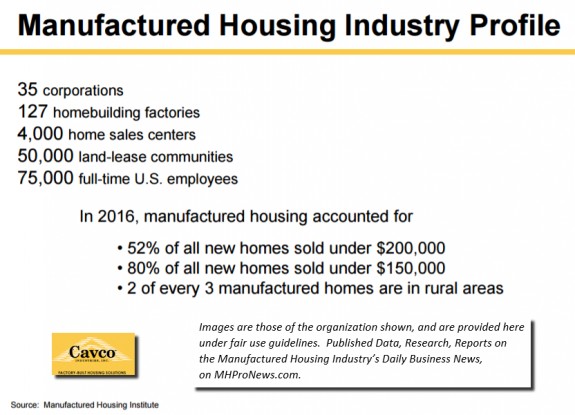

Cavco’s media release on their 2017 fourth quarter – with their year-end results – including their most recent investor presentation (click here for download) are packed with useful insights on the company, and on the industry.

Some quotable quotes follow…

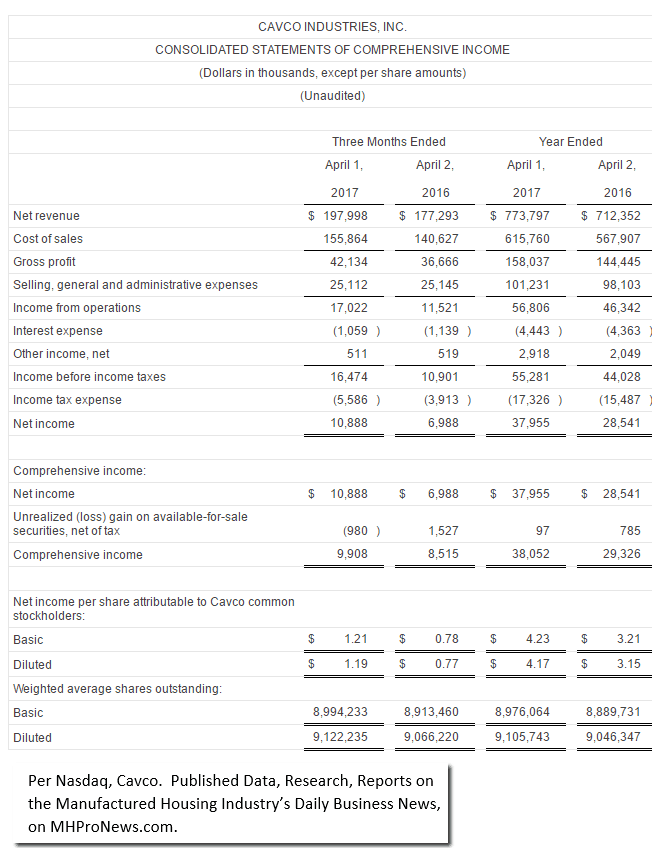

Financial highlights include the following:

- Net revenue for the fourth quarter of fiscal year 2017 totaled $198.0 million, up 11.7% from $177.3 million for the fourth quarter of fiscal year 2016. Net revenue for fiscal year 2017 was $773.8 million, 8.6% higher than $712.4 million for the prior fiscal year.

- Net income was $10.9 million for the fourth quarter of fiscal year 2017, compared to $7.0 million reported in the same quarter of the prior year, a 55.7% increase. For the fiscal year ended April 1, 2017, net income was $38.0 million, up 33.3% from net income of $28.5 million for the year ended April 2, 2016.

- Net income per share for the fourth quarter of fiscal 2017, based on basic and diluted weighted average shares outstanding, was $1.21 and $1.19, respectively, versus $0.78 and $0.77, respectively for the quarter ended April 2, 2016. Net income per share for the year ended April 1, 2017, based on basic and diluted weighted average shares outstanding, was $4.23 and $4.17, respectively, versus basic and diluted net income per share of $3.21 and $3.15, respectively, for the prior year.

Per their release, “Commenting on the results, Joseph Stegmayer, Chairman, President and Chief Executive Officer said, “We are proud to report strong results in what is typically a seasonally slower winter period. This quarter, growing market demand led to improvement across all of our housing product lines. Shipment volume for the manufactured housing industry and the Company was also aided by government orders for disaster relief units, which further enhanced home sales growth.”

Stegmayer said, “We remained focused on increasing core sales and expanding business opportunities in areas with significant affordable housing demand. A recent example of this strategy is the purchase of Lexington Homes in April 2017. This manufacturing facility will serve as our base to build a stronger presence in Mississippi and the surrounding states which are historically good markets for factory built homes.”

“We Provide, You Decide.” ©

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII)

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses. ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)