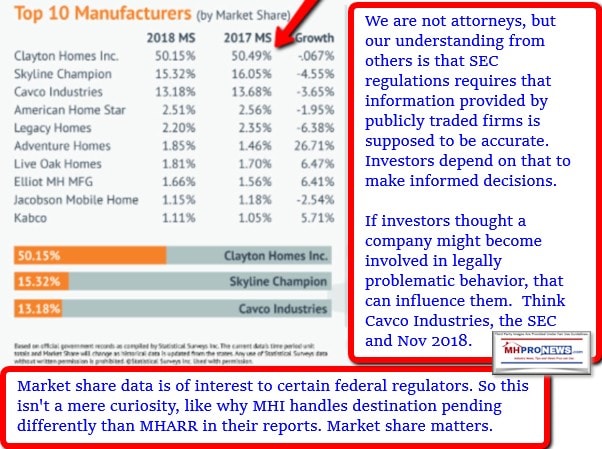

The so-called Big Three in manufactured housing each put out public statements. Clayton Homes is a subsidiary of publicly traded Berkshire Hathaway. Skyline Champion is well behind Clayton in market share but is in the number 2 spot. Cavco Industries is in third, all according to the most recent data known.

Each of those three firms, all Manufactured Housing Institute (MHI) members, have each made data claims that oddly don’t jive with each other. MHI itself puts out infographic of other data that is often demonstrably wrong, why?

First after this preface will come the facts. Then second in this report below are some possible reasons for the errors – including, but not limited to – the possibility that the factual errors are intended. Third, how regardless of the errors or their motivations, why savvy and ethical investors or professionals could benefit from the mistakes being made by the ‘powers that be’ in manufactured housing.

For the sake of our growing numbers of new readers, linked reports are going to shed additional light on a statement or claim, and these routinely site evidence, sources, and provide accurate quotes applied in context to that topic. You decide if it makes more sense to you to read the report first, and circle back to those links to dig deeper into the details.

Note too in this foreword that while we’re the runaway most followed in our industry and delve into issues that others in trade media – not matter how slick or ugly in appearance their respective publications or blogs may be – routinely ignore concerns, deflect from them, or actively give cover for what we’ve dubbed the Omaha-Knoxville-Arlington axis, their allies, and surrogates. Look for yourself and compare, because reality is what it is.

Finally prior to this data snapshot, recognition of the fact that lawmakers and public officials that span the left-right divide are aware of these concerns. They have issued letters asking for specific legal inquiries into issues. The Securities and Exchanges Commission (SEC), along with other federal and state agencies, have proved related matters.

With that backdrop, let’s dive in.

What Skyline-Champion Recently Told Current and Potential Investors

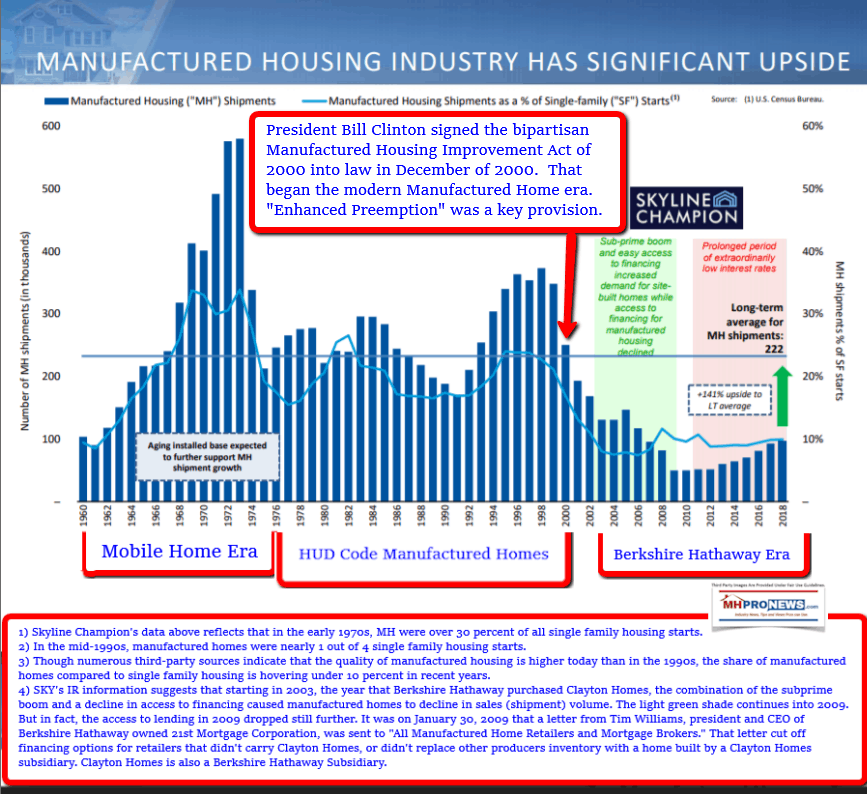

The graphic below is from their most recent investor relations presentation. It makes a specific claim about the market share of each of the big three companies.

The curiosity or problem is, that claim is contradicted by other investors relations information, and/or public statements made by or on behalf of officials from Berkshire Hathaway owned Clayton Homes, or Cavco Industries.

Furthermore, a Statistical Surveys provide this next graphic summary of information that was published in this report and analysis below which cites the various sources.

After a top official with Statistical Surveys spoke with MHProNews, that official assured our trade news operation that their data is sound. They have no direct ties to others in the industry, beyond supplying data. Statistical Surveys provides data for the larger RV and other industries. There are therefor seemingly good reason to trust their information.

So why does this disconnect matter? We’ll explore that below, but in a phrase, it could go to concerns raised by this trade media, The Nation, Seattle Times, GuruFocus, Forbes, the Atlantic, and the Jacksonville Florida Times Union that a monopolization of manufactured housing is well underway. Related concerns – and links to those mainstream media sources noted – have been made by lawmakers, who are named in the report below.

There are several possibilities that can explain the discrepancies. That noted, one concern that is raised is that the three are okay with deflecting for Berkshire owned Clayton.

A prior report made it clear that Clayton has issued self-contradictory statements. MHVillage and MHInsider have given specific cover to MHI, but when question per about the data discrepancies, they too have declined comments.

Clayton Homes, 21st Mortgage, MHVillage, Manufactured Housing Institute Leaders Challenged

If the big three firms in manufactured housing are working the system to consolidate the industry into ever fewer hands, that could be a violation of antitrust, deceptive trade practices, possible SEC and other laws. So once a line is hypothetically crossed, it is not easy for them to either admit or deny the error, given the level of scrutiny that they are already under from not only public officials, but also by investors and attorneys acting on behalf of shareholders.

Opportunities Flow from Problems

There are few more apparent crisis scenarios facing out nation than the affordable housing crisis. Issues like so-called climate change or healthcare get headlines and are polarizing. Affordable housing gets headlines too, but with a difference.

Every crisis is an opportunity in disguise. That is a bit of ancient wisdom that the Chinese and other cultures have long known. The essence of free enterprise is to find a problem, see if there is a profitable solution, and then do something positive about it.

There is purportedly no good reason for MHI and their ‘big boy’ members to so obviously fail to bring to bear in a robust, sustainable manner what they already know works — manufactured housing. It is like having a goldmine hiding in plain sight.

Motivations Aside, Why this Matters to Investors, Other Professionals, Advocates, Public Officials

The reason antitrust or other laws exist is to protect the public interest. For example, the growing consolidation of the communities sector of manufactured housing has arguably provided the market opportunity for companies that don’t mind aggressive behavior to initiate stiff hikes on site fees (a.k.a. lot rent). Imagine if a condominium owner could abruptly raise their association/member fees. That would be somewhat parallel to what occurs for manufactured homeowners, because the homes are expensive to move. Furthermore, where do you move them to? When zoning boards frown or other land-lease communities are at or near capacity, the result is a dark ability for those who have little concern for residents or negative publicity to behave as they wish.

Clearly, the public interest of current manufactured homeowners is in the mix. But so too the possibly buyers of manufactured homes. For example, there are an estimated 111 million renting, per the Apartment List. There are also downsizers or upsizers seeking a larger, smaller and more affordable dwelling.

Other research in the related reports explains the connection between production, retail, and manufactured home land-lease communities.

Given the quality of manufactured housing today – underscored by reams of third party, homeowner satisfaction, and consumer research – the industry ought to be soaring.

However, for a variety of reasons, data from third party sources such as Zillow makes it clear that interest in manufactured homes has declined during the two year snapshot reflected below.

But that too is opportunity in disguise. As one of the big three recently said in a public statement to investors, they are well aware that all sales come down to local markets.

It is at the local market level that the image of the industry can be positively or negatively impacted. More on that at this link here, because that is where investors pondering opportunities and/or professionals already in the industry could make their marks.

The risk for investors to a significant extent is that opening up against the big three and their allies could potentially bring repercussions. Those willing to face that challenge – and there are some 30 plus independent producers who are doing so, along with hundreds of independent retailers – could begin to tap that affordable housing demand in any number of local markets.

More on this in the related reports and in upcoming ones too.

The bottom line this morning in this first report could be summed up like this. Manufactured housing is underperforming. The big three arguably know that better than anyone, because some say as much in their public statements. When the quality and value proposition are so high, why are they seemingly so unable to move the needle in a robust fashion that could potentially serve millions of Americans?

Simple. They have ulterior motives, what other reason makes sense? After all, these are successful professionals. They know manufactured housing. They know the value proposition.

So when concepts like a ‘new class of homes’ now dubbed CrossModTM Homes comes into play, one must ask. Why dilute the value of HUD Code manufactured housing with that type of product? Why tolerate the FHFA, Fannie Mae, or Freddie Mac’s diversion of Duty to Serve (DTS) lending to a project that goes contrary to the interests of current and potential manufactured homeowners?

Award winning Alan Amy said it in a video interview posted below. Manufactured housing is the future of housing in America. Warren Buffett has said that he only gets into industries that make sense.

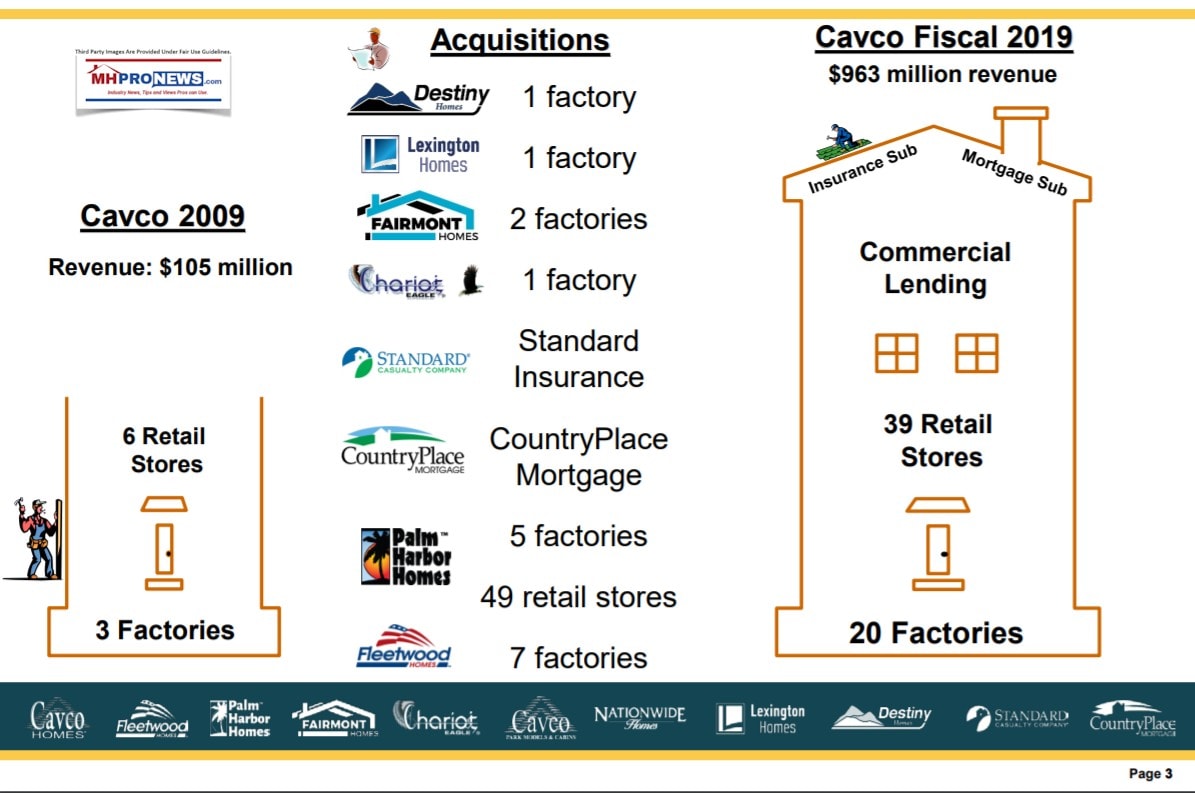

Billionaires and multiple billion dollar companies are slowly consolidating the industry, as Cavco Industries graphic below makes plain. Skyline-Champion and Clayton Homes all have a similar story.

Whether it is a wink and a nod or something more formal, isn’t the nexus of MHI and the steady consolidation of an underperforming industry at reduced valuations precisely the philosophy of Warren Buffett?

For those with the moxie and chutzpah to challenge the system – and there are those in MHVille who have and do – the opportunities are amazing. It can be done in an ethical and legal fashion, instead of through purported market manipulations that harms millions. That’s your food for thought on this first installment of manufactured housing “Industry News, Tips, and Views Pros Can Use,” © from the runaway most-read trade media where hat’s take two of manufactured housing “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, fact-checks, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Smaller, Independent Businesses, Property Ownership, Manufactured Housing Risks and Opportunities

Rent Controls and Manufactured Housing Restrictions Targeted in New Presidential Executive Order

Senator Elizabeth Warren Takes Aim, Blasting Again MHI Member Company in 2020 Campaign Stop

A Tale of Two Cities, Affordable Housing, Manufactured Homes, and You

https://www.manufacturedhomepronews.com/masthead/manufactured-housing-industrys-opportunities-and-obstacles-executive-summary/