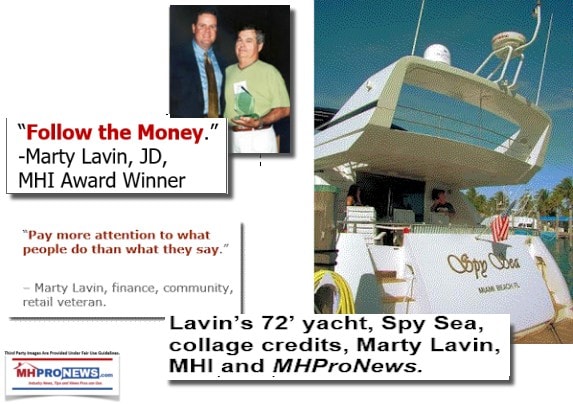

“Regarding the DTS [Duty to Serve]” topic, “What does OleMartyBoy always say, “Don’t pay attention to what they are saying, watch what they are doing,”” said an on-the-record statement from a longtime member and Manufactured Housing Institute (MHI) award-winner Marty Lavin, J.D. in new exclusive comments to MHProNews.

The comments came in the context of the recent FHFA/Fannie Mae/Freddie Mac Listening Sessions that dealt with the implementation to date and the road ahead on the Housing and Economic Recovery Act of 2008 mandated “Duty to Serve” (DTS) manufactured housing, rural housing, and other underserved housing markets.

“A full 22 years after the last industry top, 1998, the known industry model deficiencies (where does one start?) have seen scant improvement, if any,” Lavin’s emailed statement to MHProNews said.

Lavin notes that “As I have said before, the GSEs are strongly influenced by non-profits, and last I looked, nothing has been done to cure the industry problems they decry.” As detail minded industry professionals know “GSE” is an an abbreviation for Government Sponsored Enterprises, which refers to mortgage giants Fannie Mae and Freddie Mac. It should be noted that Lavin has done finance and consulting work with numerous manufactured home lenders over the years, including Fannie Mae, the larger of the two “Enterprises.”

Lavin mocked as wishful thinking the notion that a return to the flawed lending used by “GreenSeco” would return. He said that only sustainable – “survivable” – lending would be done by the GSEs.

Green Tree Financial and Conseco were two of several manufactured home lenders that did chattel or personal property loans in the 1990s, or in some cases into the early 2000s. Some like Lavin generically refer to those lenders as “GreenSeco.” Many of those personal property lenders melted down in a manufactured housing industry preview of the “liar loans” that ended up as a contributing factor to the mortgage/credit/housing crisis circa 2008.

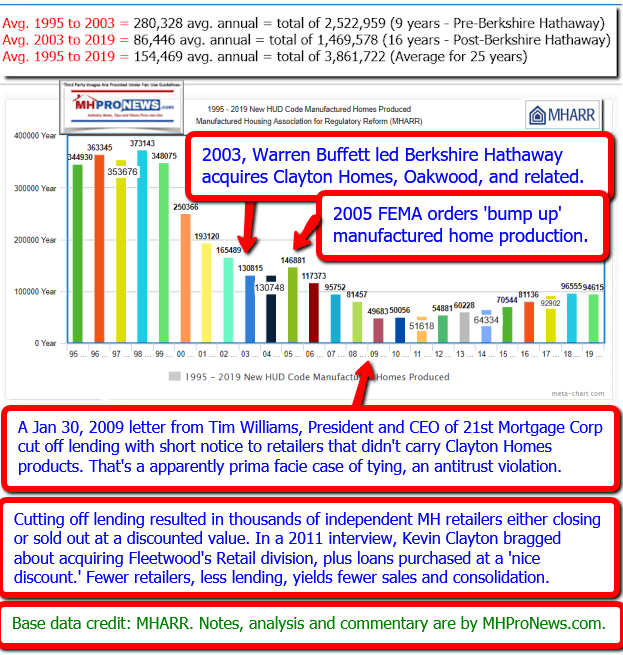

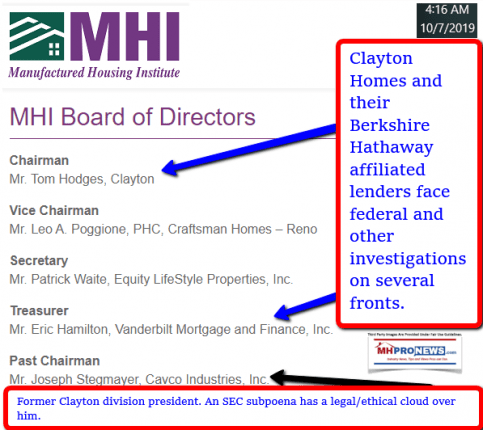

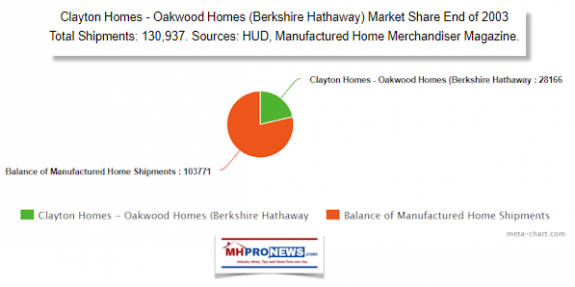

Today, a relatively few national personal property lenders exists in manufactured housing. The two largest are 21st Mortgage Corporation and Vanderbilt Mortgage and Finance (VMF). Both 21st and VMF are owned by Berkshire Hathaway, the parent company to Clayton Homes, Shaw Carpeting, and a range of other brokerage and supply services that includes the manufactured housing industry. Tom Hodges, General Council for Clayton Homes, is currently MHI’s chairman.

Others are Triad Financial Services, which today is part of the ECN Capital out of Canada. Credit Human, Cascade Financial Services are among others, with several other regional lenders that also serve manufactured housing industry interests. Triad, Credit Human, and Cascade are among those who do personal property or chattel lending.

But compared to lenders with clear ties to Berkshire Hathaway, other manufactured housing financing options are limited.

Kevin Clayton, CEO of Clayton Homes, is the son of Jim Clayton, cofounder of Clayton Homes. Kevin was floated for a time by an Berkshire-friendly interviewer as a possible successor to Warren Buffett. See that report linked above, with numerous insights related to Lavin’s statements. It is worth noting that Jim Clayton’s brother Joe was the only person who died in a tragic helicopter accident while Jim was reportedly piloting the ‘copter. The investigation into that is reportedly ongoing, see that related report below.

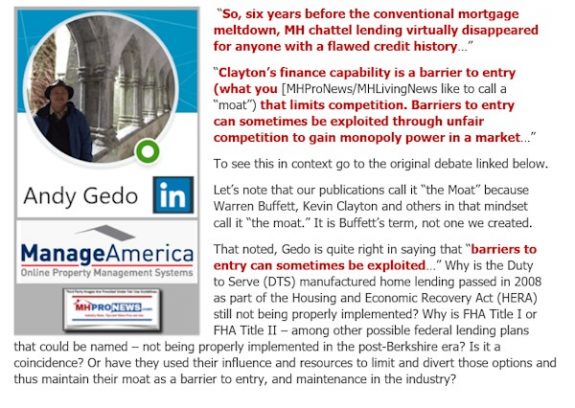

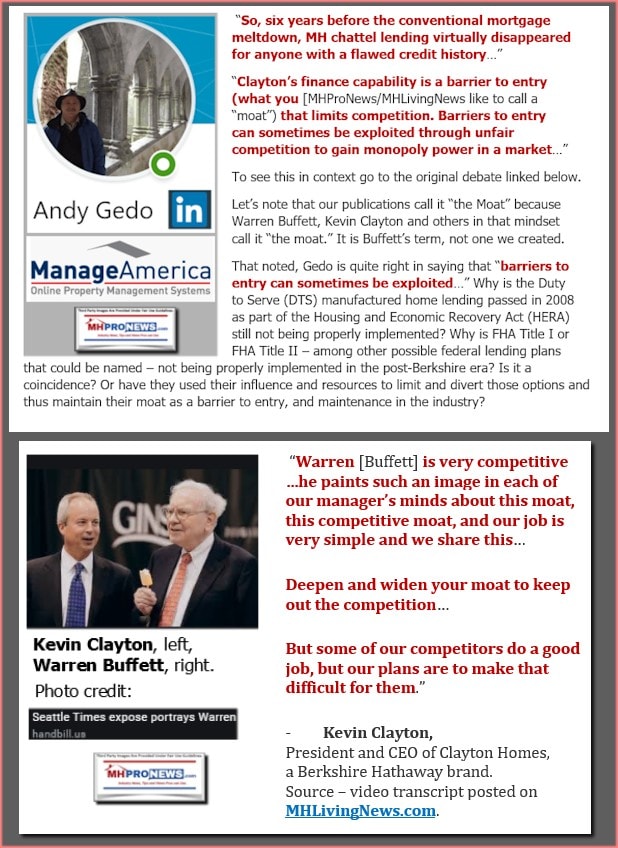

Regarding the manufactured housing lending crisis, Andy Gedo, an MHI member and partner in ManageAmerica previously noted the same meltdown Lavin referee to of personal property or “home only” lending.

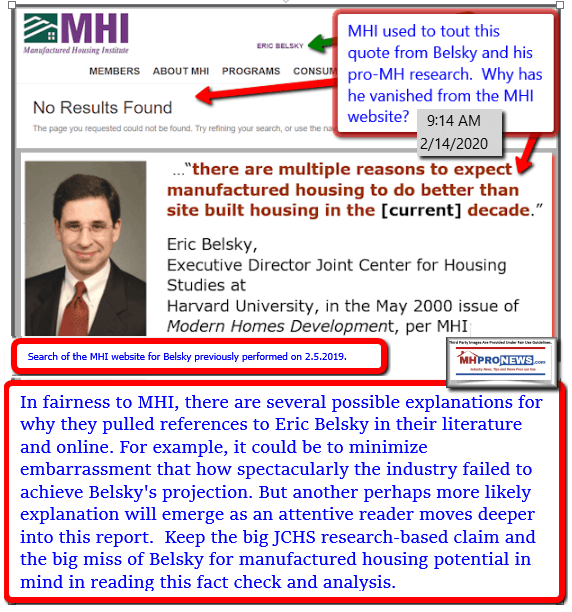

It should also be noted that former Harvard Joint Center on Housing Studies (JCHS) fellow Eric Belsky, who now sits on a Federal Reserve Board, was well aware of the financial meltdown that impacted manufactured housing. Nevertheless, Belsky pointed to what he believed would be a rebound that would cause the manufactured housing industry to surge beyond conventional site built housing.

Lavin’s comments should also be noted in the context of his prior remarks on improvements made in originations and collections of manufactured home lending. See his statements in a video posted below.

Returning to his latest formal statement, Lavin sarcastically observed – “I’ve heard [some manufactured housing] industry members are waiting for that [type of failed lending] to return, on the premise that lenders have short memories and are likely to spawn GreenSeco clones soon again. And the famous “Happy Days are Here Again” will again reverberate the halls of HUDVille.”

Lavin in prior comments to MHProNews said the below, with more from Lavin to follow later.

With those points in mind – because Lavin’s new on the record statement to MHProNews referenced his own prior remarks as well as the industry’s history – he concluded with the following broadside of MHI member companies which nonprofits such as MHAction have called “predatory practices.” Note too that Lavin’s use of the phrase “the industry” is often a kind of code for MHI that MHI members have used, including the example by former MHI Chairman Nathan Smith found below.

Lavin said, “Let’s not mince words here, any thought the GSEs will ever provide the type of [GreenSeco] lending the industry desires meets insurmountable reality in the halls of their decision making. The industry continues its self-congratulatory emphasis on building inexpensive homes to go into the generous lair of giant home site owners, and the shuck and jive begins. The predictable, increasingly high rents for the home site combined with the financial fragility of many of the homeowners creates quite a witch’s brew of possible poor outcomes. And the non-profits, the GSEs, lenders, and yes, the entire HUDCode [manufactured home] industry know it. I am not sure why the clear message being sent to by the GSEs to the industry falls on such noisy but uncomprehending ears.”

“Shuck and jive” is a phrase that Wikipedia defined to mean: “In African-American culture, Shuckin’ and jivin’ (or shucking and jiving) is joking and acting evasively in the presence of an authoritative figure. Shuckin’ and jivin’ usually involves clever lies and impromptu storytelling, used to one-up an opponent or avoid punishment.”

Rephrased, Lavin is flatly saying that

- the GSEs won’t be doing unsustainable lending in manufactured housing ever.

- But he is also logically implying that the Enterprises of Fannie and Freddie have no intention of doing any serious levels of chattel or personal property lending. That’s made clear by the GSEs behavior, not by their posturing or pretty words. That is at the core of Lavin’s observation – “Don’t pay attention to what they are saying, watch what they are doing,”

After a dozen years of saying that DTS is coming in any meaningful way to manufactured housing, Lavin effectively says – ‘it ain’t happening.’ They’ve had a dozen years to comply with creating chattel lending, or other meaningful support for manufactured home lending and have not done so. See the more detailed report on that topic and how others in the industry have responded in the report linked below.

Lavin doesn’t directly address the point that the GSEs has a lending meltdown that involved mainstream conventional housing. That catastrophe resulted in one of the larger transfers of wealth in the U.S. as foreclosed properties often ended up in the hands of deep pocket private equity firms as single-family rentals. An industry insider told MHProNews that the losses by GreenSeco style lending were a “pimple on an elephant’s ass” compared to the conventional housing and financing crisis circa 2008 that led the U.S. into the so-called Great Recession that swept Senator Barack Obama (IL-D) into the White House and a Democratic majorities into both houses of Congress.

“An Elephant Ass,” Understanding GSEs, Duty to Serve, Manufactured Home Lending

But as the video above reminds new or longer term MHProNews readers, Democratic leaders gave cover to the GSEs. Bush Administration warnings and related attempts, however flaccid, to reign in the GSEs and their big dollar lobbying of Congress and other candidates via millions of dollars annually in campaigns donations fell largely on deaf ears.

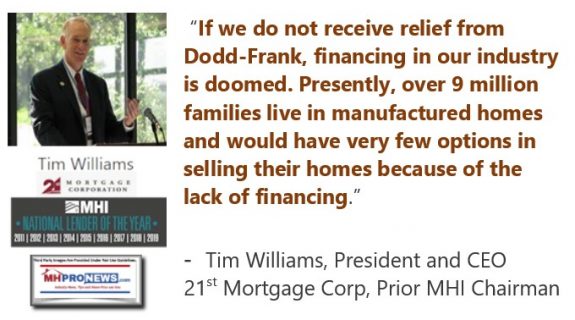

Tim Williams, 21st Mortgage Corporation CEO and Former MHI Chairman

Lavin and Tim Williams at 21st have had what could be described as a comfortable relationship for years. Additionally, Lavin, who is a longtime industry member, observer, and regular reader of MHProNews, is no doubt aware of Williams’ oddly changing comments on DTS over the years.

The flashback to a prior report on 21st sheds added light to the comments made by Lavin and others.

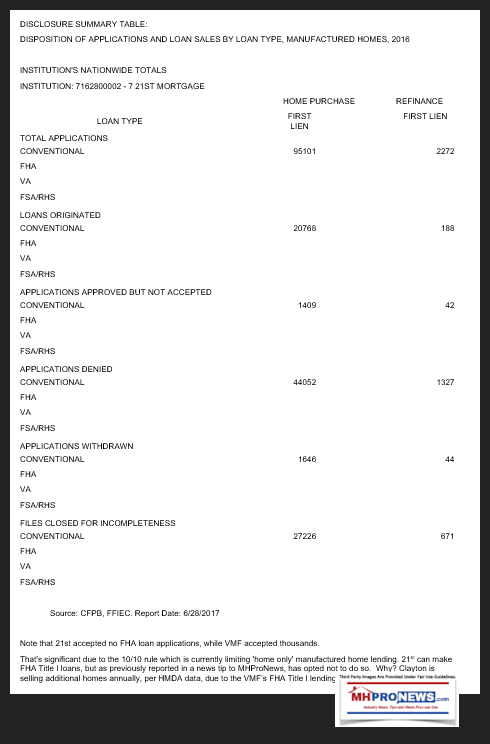

Here is the 21st Mortgage Corporation HMDA data from federal sources noted at the bottom of the graphic.

Note that 21st made no FHA personal property loans, but that their sister brand VMF which exclusively serves Clayton Homes owned retail centers, did made FHA loans.

Rephrased, 21st Mortgage – which works with manufactured housing independents as opposed to Clayton Homes vertically owned retailers – further limited the affordable lending that they are capable of doing.

Paul A. Barretto, formerly with Fannie Mae who has since gone into consulting, previously told MHProNews in response to a publicly asked question at an industry event, that neither 21st or VMF provided Fannie with any data on Berkshire Hathaway owned loan performance.

That lack of data from the Berkshire-owned brands in turn was an excuse used by Fannie and Freddie to continue the slow walk of lending on personal property manufactured home loans.

Clayton Homes, 21st Mortgage, MHVillage, Manufactured Housing Institute Leaders Challenged

A source with ROC USA previously told MHProNews that a GSE was doing some personal property lending in their communities. That was confirmed again this morning. But that may be the only such lending that has occurred, and the numbers are likely to be quite limited, if they are now occurring at all. A follow up with that source is pending.

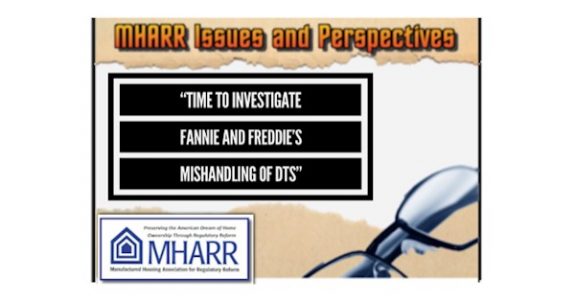

An analysis by the Manufactured Housing Association for Regulatory Reform (MHARR) of available data from the GSEs that was part of their recent public statements to the virtual FHFA/GSE Listening Session came to this conclusion. Fannie and Freddie are doing a limited amount of real estate lending, but all told, some 94 percent of the market they are legally tasked with serving remains underserved.

As an often-overlooked piece of the DTS and manufactured home industry puzzle is the fact that FHFA allowed Fannie and Freddie to get DTS credit for making loans on manufactured home land-lease communities. Members and leadership of MHAction have pointed to those DTS credit loans – which the GSES originated for commercial real estate that are often owned by MHI member brands – are making living in those communities less affordable.

A black business leader who addressed the DTS Listening Session in Washington D.C. last December told attendees he was literally moved to tears by how troubling some of those stories surrounding the problematic implementation of the Duty to Serve “mandate” were being implemented. See the report linked above.

As a disclosure, the problematic history of DTS was addressed by this writer at the same listening session, with top FHFA, Fannie Mae, Freddie Mac, MHI, MHARR, and dozens of other interested parties present. The heavily cross-linked data on that is found in the PDF linked below as part of the broader report that follows it.

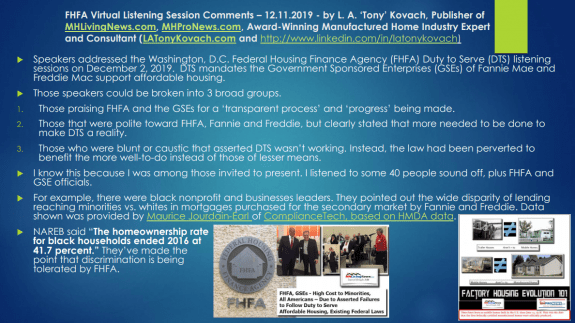

Days later, on December 11, 2019, a virtual listening session was held. The transcript of the various statements made are found at this link here. This writer’s comments are found starting at page 23. The spacing has been changed for clarity of reading, and bullets were added as shown, but the text is per their transcript. As is MHProNews’ custom, quoted text is often turned brown and bold for distinctiveness and emphasis.

“The speakers addressed the Washington DC Federal Housing Finance Agency Duty to Serve listening sessions on December 2nd, 2019. DTS mandates that the government sponsored Enterprises of Fannie Mae and Freddie Mac support affordable housing. Those speakers could be broken into three broad groups:

- those praising FHFA and the GSEs for a transparent process and progress being made;

- those that were polite towards FHFA and Fannie and Freddie, but clearly stated that more needed to be done to make DTS a reality;

- those that were blown or caustic that asserted the DTS wasn’t working. Instead, the law had been perverted to benefit the more well-to-do instead of those of lesser means.

I know this because I was among those invited to present. I listened to some 40 people sound off plus FHFA and the GSE officials. For example, there were black nonprofit and business leaders. They pointed out the wide disparity of lending reaching minorities versus whites and mortgages purchased for the secondary market by Fannie and Freddie. Data shown was provided by Maurice Jourdain-Earl of Compliance Tech based on HMDA data. NAHREB said the homeownership rate for black households ended 2016 at 41.7%. They made the point that discrimination is being tolerated by FHFA.”

MHProNews’ notes the following from the above for added emphasis.

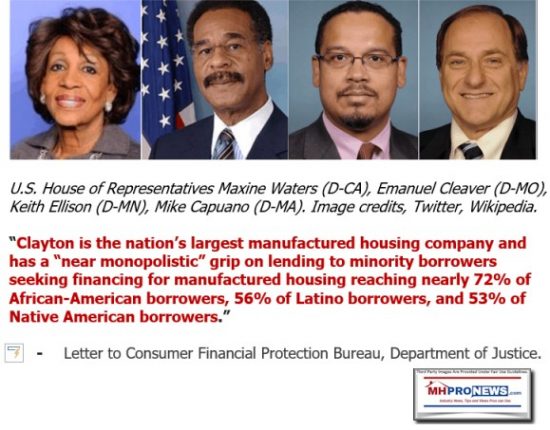

Each of those minority leaders from the finance and real estate sectors used federal data to demonstrate discrimination against Blacks and minorities. While DTS and the GSEs may be viewed as standing apart from Berkshire, both the GSEs and Berkshire Hathaway owned financing brands have oddly been accused of something similar. Namely, mistreatment of minorities.

MHARR, this writer for MHProNews, and others have stressed that GSE failure to engage in lending was harming minorities as well as lower income Anglos. It echoes the research of Dr. Donna Feir who told the Minneapolis Federal Reserve in her report that minorities were being driven into higher cost lending.

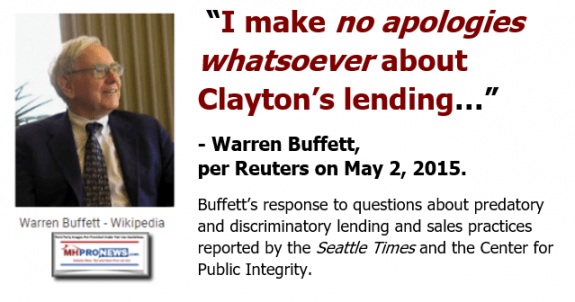

Feir cited the Seattle Times exposes that also alleged lending discrimination. What was Warren Buffett – chairman of Berkshire Hathaway – reply to inquiries about those allegations?

Returning to this writer’s comments on the 12.11.2019 listening session.

“Several manufactured home community residents from different states said commercial real estate loans made under DTS to community operators who purchased or refinanced manufactured home communities at low rates because of a lack of resident safeguards. They named community park owners like HavenPark Capital and RV Horizons/Impact Communities, both of which are Manufactured Housing Institute members that aggressively raised site fees or lot rent. Economic evictions had or will occur, residents said.

DTS has been perverted and turned on its head. A program designed to provide more affordable housing for lower-income Americans was instead fueling less affordable housing by making loans to wealthy consolidators and others.”

It should be noted that VMF has entered the commercial real estate lending space. They too now use GSE lending made on manufactured home communities under the DTS program.

Returning to comments delivered by L. A. “Tony” Kovach at the DTS Listening Session, skipping down in the transcript, are these points. The bullets are added, but the text is as shown at this link here.

- “One, no person or organization is supposed to be above the law.

- Two, we’ve [MHProNews] spoken with lenders that entered the manufactured housing market after DTS passed. They’re successfully making sustainable loans.

- Three, we’ve spoken with lenders who made manufactured home loans including personal property or chattel loans sustainably for a decade or more.

- Four given that federal law and others have made such loans successfully, why has FHFA tolerated obvious foot-dragging by Fannie and Freddie to fully enforce and comply with federal law?”

To underscore point number two. Some lenders in recent years have been entering the manufactured home lending space, and/or are expanding the mortgage lending into personal property loans. They are reporting sustainable, profitable lending. A top official doing regional manufactured home lending has told MHProNews that they are making loans that mirror the profile of those being originated by 21st Mortgage only they do so at a lower financing rate.

While some of those comments have been off the record, they have been supported by the evidence and fact patterns. Additionally, some – not unlike Marty Lavin – have made video recorded statements for our Inside MH interview series. Two high ranking credit union officials said the following.

Additional Information, MHProNews Analysis and Commentary

Triad Financial and Credit Human officials both told MHProNews that they provided the GSEs with their loan performance data. Nevertheless, Fannie and Freddie have done virtually no new chattel loans, while they have said that they bought some manufactured home loan portfolios in order to gain experience in the servicing side of the industry.

Doug Ryan and Stacey Epperson, with Prosperity Now (previously known as CFED) and Next Step USA, provided the following statement as part of their broader comments to FHFA Director Mel Watt on July 10, 2017.

“Any chattel product, to truly meet the Duty to Serve, must include loan and land lease terms for tenant protections. In addition, to fully meet the needs of the market, effective real estate and 2 chattel products should also facilitate the purchase of existing homes, which will enhance appreciation for the sellers of such homes.”

Rephrased, Ryan and Epperson were fine with providing personal property, home only or chattel lending by the GSEs. They also wanted those loans to extend to existing manufactured homes, not just new home sales. Their letter that pull quote some from is found at this link here.

Ryan and Epperson also said that: “Finally, while not a component of the Plans, we believe the FHFA must address the Enterprises’ ability to retain meaningful mortgage portfolios. Without such a portfolio, it will be extraordinarily difficult for an Enterprise to support innovation in manufactured housing lending, since this market is small and constrained and has long operated outside the standards of a secondary market.” While there are arguably possible flaws in their thinking and follow through, it should be noted that the “I’m Home” coalition previously used loan performance data they had analyzed. That data made the point that manufactured home loan performance was akin to that of conventional lending.

Then, there is this snippet of a video interview where MHI’s then president and CEO, Richard “Dick” Jennison told MHProNews that he favored slow growth. That bizarre statement has certainly been supported by the history before and since. Coincidence?

Why is it important? Because Jennison’s statement arguably makes sense only in the context of the thesis explored further below.

Longtime readers and newcomers should keep in mind that MHProNews organized a meeting at a Louisville Show some years ago to bring on more lending into manufactured housing. Lenders involved in or largely outside of the manufactured home industry told MHProNews that MHI never followed up with them about doing more lending that would be competitive to conventional lending.

Put differently, there is an overwhelming amount of evidence that manufactured home lending – including personal property, home only “chattel” loans – can be made profitably and sustainably. Those loans can be made at interest rates that are lower than those offered by the Berkshire brands to their finance customers.

In the prior video interview with Lavin, shown above, he noted that while the industry had a problematic history in the past, numbers of those short-down payment or poor loan documentation practices have been corrected. The lenders in those programs have said much the same thing.

So, lending by manufactured housing lenders in the “GreenSeco” model is dead and gone. There has in its place arisen a more responsible lending model that has been performing – per a range of sources – for well over a decade.

Thus, there are simply no evidence-based reasons for the GSEs to ignore a robust entry into the personal property a.k.a. “chattel loan” lending market. The GSEs could do so either to facilitate the secondary market and/or in portfolio, as I’m Now suggested may be useful to prove the model works.

There is also no excuse for FHFA not to have mandated the GSEs to comply with the literal and implied intention of the law. Instead, DTS has been spun to encourage loans on a so-called new class of homes that are reportedly failing in the marketplace.

Thus, the logic that MHARR – paraphrasing their words – has argued for some time should cause Congress and the FHFA to investigate the failures to follow the law some twelve years after it was passed.

Following the Money

Who has benefited from the status quo in manufactured housing lending with respect to DTS, or federally supported programs like FHA Title I?

In a phrase, it is consolidators and the Berkshire brands that are routinely members of MHI.

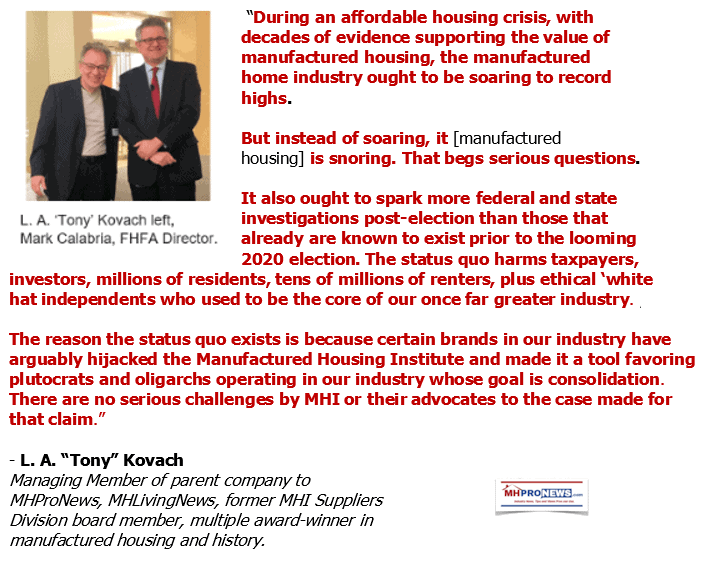

Is it any surprise that Lesli Gooch, Ph.D., and CEO of MHI, has failed to robustly push along side MHARR for a full implementation of good federal laws?

Whistleblower’s Documents on Lesli Gooch – Manufactured Housing Institute CEO – New Discoveries

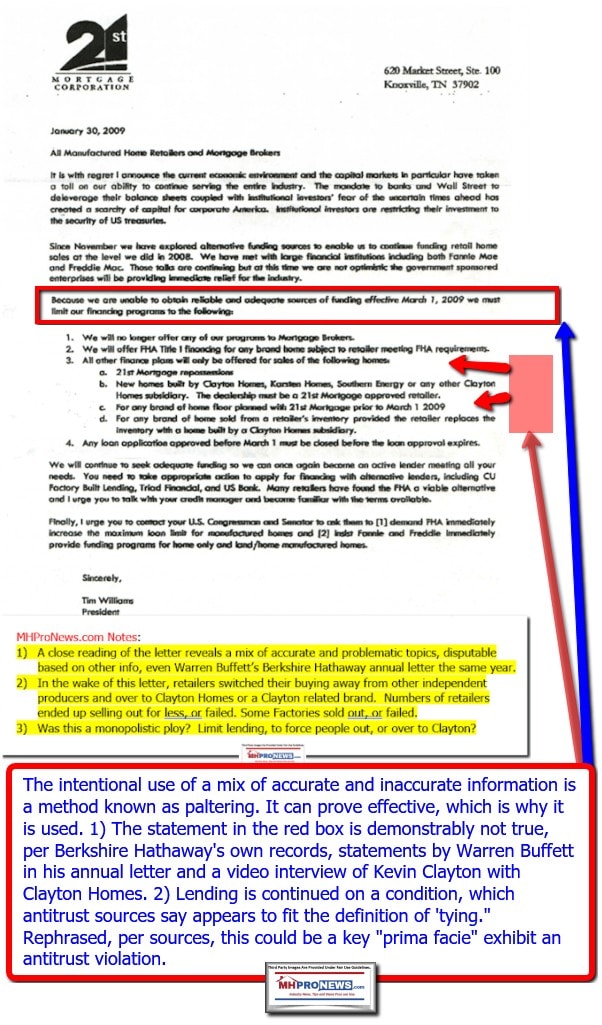

But drilling down deeper, Tim Williams CEO of 21st Mortgage Corporation said in his now infamous letter first published to retailer in early 2009 that the industry should pursue the full implementation of DTS. That was over a decade ago.

Sometime after that controversial Williams/21st letter, which some have alleged is a prima facie example of one or more antitrust law violations, Williams said that pursing DTS was a waste of time.

Rephrased, a series of such self-contradictory comments by Williams/21st could be referenced. Williams has been all over the map on manufactured housing finance, saying among other things that the industry was “doomed” if it failed to get relief from Dodd-Frank.

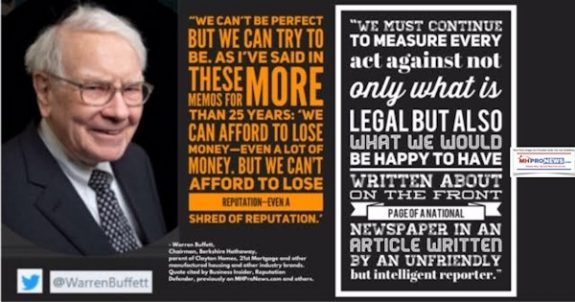

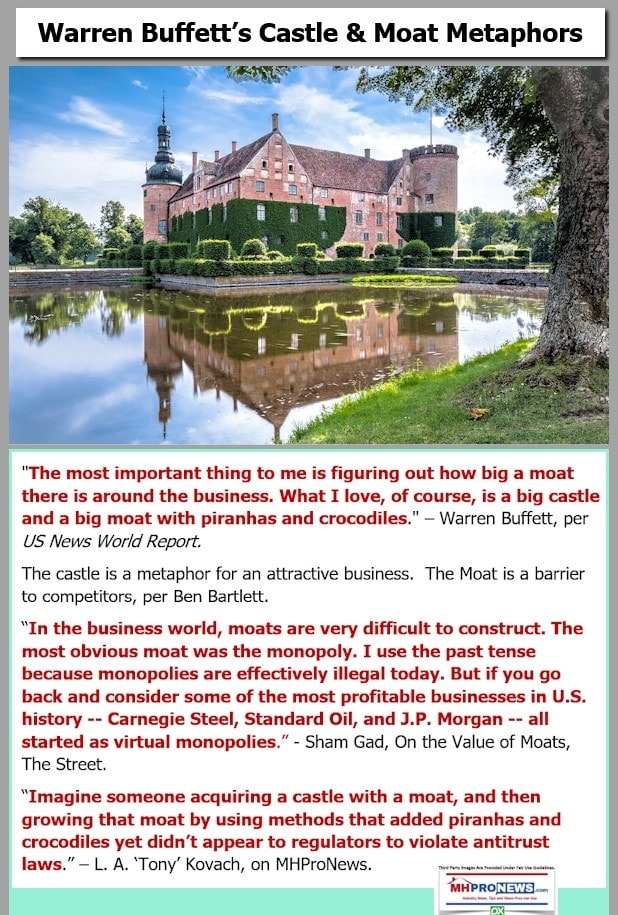

But as MHProNews has previously noted, some of Williams comments have been contradicted by statements made by both Warren Buffett and Kevin Clayton. To see that in detail, click the report and analysis linked below.

What has occurred in the wake of the throttling of manufactured home lending?

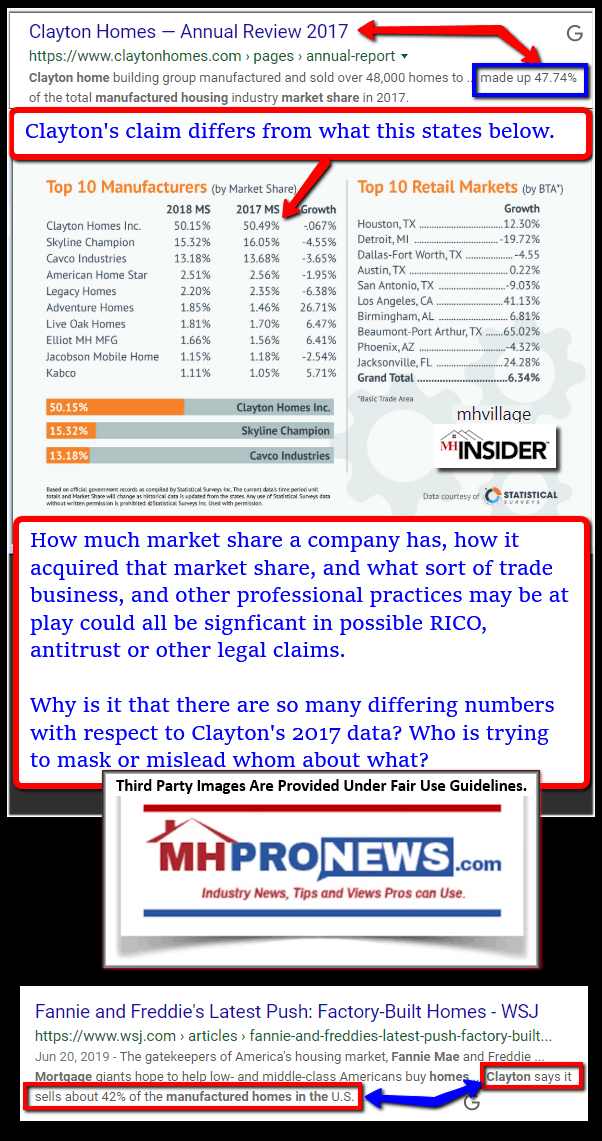

Consolidation by Clayton Homes that sent them from some 21.5 percent market share in 2004 to some 50 percent market share by 2018.

There is evidence that suggests this has occurred with the tacit, if not active support of FHFA, Fannie Mae, and Freddie Mac. See the new and detailed report and analysis linked below.

The Principle of Occam’s Razor

Merriam Webster’s dictionary explains that Occam’s Razor means that “the simplest of competing theories be preferred to the more complex or that explanations of unknown phenomena be sought first in terms of known quantities.” MHI makes much of Dr. Gooch’s degree and credentials. 21st and Clayton Homes are led by intelligent and highly experienced industry professionals. Are we to believe that it is 12 years of bad luck or repeated fumbles that explains DTS not being implemented after a dozen years? That seems highly implausible.

Thus, the more logical conclusion is the one that investigators and journalists have followed for years. Follow the evidence, the facts and follow the money trail, asking cui bono? Who benefits?

Warren Buffett aptly observed some time ago that hindsight is 20-20.

Buffett has also said that habits are often chains.

Someone could make the argument that MHI and their big brands, which includes but is not limited to Berkshire Hathaway owned companies, has fallen into bad habits. But businesses that desire a certain outcome are used to making changes, including changes in leadership, when a desired outcome is not achieved. That happens routinely in business.

When businesses that dominate a trade association are not satisfied with a result, they make changes too.

In the case of Lesli Gooch, she has documented conflicts of interest that MHI insiders have told MHProNews were presumed know by MHI leadership when the occurred. Additionally, if Gooch’s conflicts of interest with mainstream housing while she was working full time for MHI wasn’t known, it certainly was brought to light following the document drop that a whistleblower made possible.

What did MHI’s leadership do following those revelations?

Kevin Clayton and MHI took Gooch on a road trip for a photo opportunity with HUD Secretary Ben Carson to a Clayton Homes facility.

Note that part of the featured image above comes from the Gooch Watch twitter feed, which long predates MHProNews reporting on MHI’s EVP now CEO. That twitter feed was focused on her failed effort to win a seat in Congress, says “Up-to-date monitoring on the fluctuation of Gooch’s friends between Washington and Bangkok.”

Surely, MHI’s search committee knew about these issues prior to her being hired? After all, searching social media has been common practice for companies and nonprofits for some years.

Candidate Lesli Gooch Racks Up $113,000 Debt in 2 Months @CAGOP #CA31 http://t.co/5hmTxMTVLf

— Gooch Watch (@Goochwatch) April 17, 2014

The logical conclusion is that Clayton, 21st, other Berkshire-owned brands, and other top level MHI member firms are okay with the conflicts of interest, the rising billows of smoke, failed or problematic efforts, and her lack of performance.

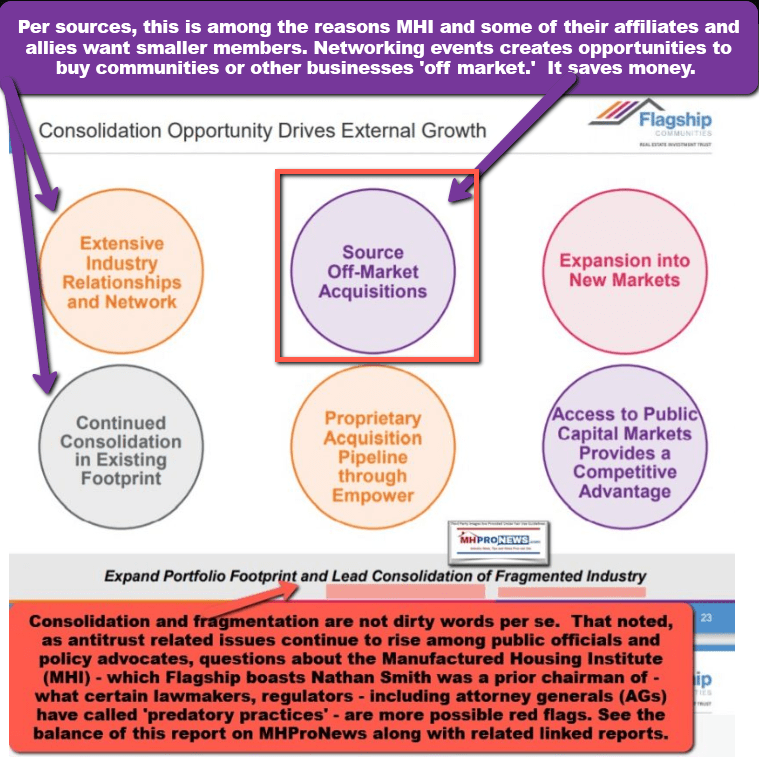

Given the fact that several have said in public statements that their goal is to consolidate what they called the highly fragmented manufactured home industry, isn’t it obvious that a clever set of efforts that throttles manufactured home lending is driving a segment of that consolidation? Note that Flagship’s partner Nathan Smith is a prior MHI chairman.

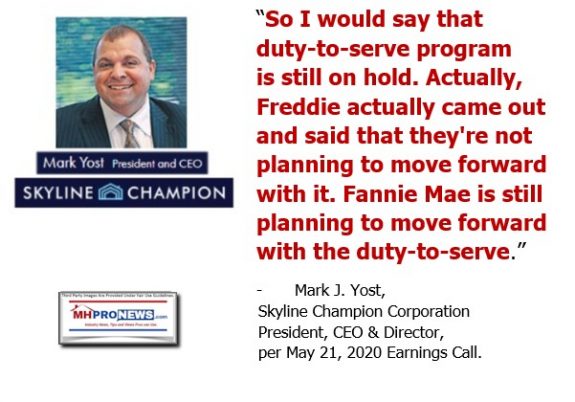

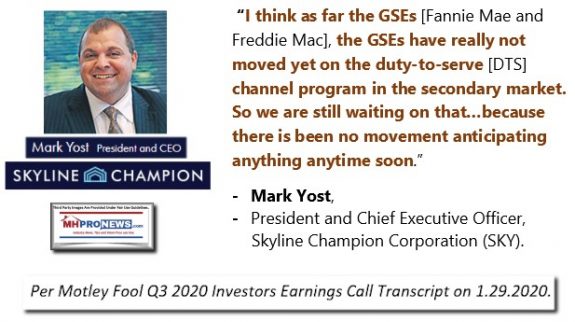

Note too that Skyline Champion has been increasingly used as a face from the manufacturing side of the industry for MHI in events and comments to Congress or other federal agencies.

Skyline Champion stated their satisfaction to MHProNews about MHI’s efforts. When pressed on inconsistencies, they declined making further comments beyond those previously shared with this publication or to their investors.

“Cui bono” – years of following the evidence, documents, and the money trail lead inexorably to the conclusion that MHI – despite their antitrust warning statement – is in fact operating in a fashion that leads to consolidation.

The bottom line could be summed up like this. MHI award-winner Marty Lavin’s most recent on the record comments to MHProNews shed light on the “witch’s brew” that is harming the interests of “fragile” consumers – and also scores of manufactured housing independents – that the DTS law was supposed to remedy. Taken in conjunction with his prior comments to MHProNews – as shown herein and below – it is one more piece of expert evidence that the industry’s drive to obtain more competitive lending is being ignored by the very people who claim to be working to deliver it.

Only by ignoring historic trends and the obvious evidence can someone come to a different conclusion.

Thus, entirely independent of what voices like NAMHCO, MHARR, or others in the industry have raised, the contention of this publication and MHLivingNews that an open defiance of the law is occurring that benefits a few can not be reasonably ignored.

A Berkshire Hathaway board member and their attorneys have been asked to comment on these concerns and have not done so as of this time.

This evidence and fact-pattern presented herein thus remain unchallenged. Indeed, it was de facto confirmed by an MHI defender, Andy Gedo.

It is time for federal officials, elected leaders, and other antitrust investigators to dig into these troubling issues that are causing harm to untold millions of current and potential consumers, which includes, but are not limited to minorities and the low income Anglos who the DTS law was designed to benefit.

Postscript

Perhaps the biggest problem that pro-MHI surrogates have in debunking years of such research and evidence is that they sometimes try to ‘attack the messenger,’ rather than examine the evidence the messenger brings.

But their problem is that for years, MHI leadership routinely praised this publications reporting.

Put differently, on a range of issues, they can’t have it both ways.

To learn more, see the related reports linked above and below.

There is always more to read and more to come. Stay tuned with the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.