According to the Manufactured Housing Institute (MHI), the Texas Manufactured Housing Association (TMHA) is one of their state associations “affiliates.” Texas is the biggest state in the nation for manufactured housing production and shipments, according to the federal data reported by the Manufactured Housing Association for Regulatory Reform (MHARR). After an apparent pause, the monthly Texas Real Estate Research Center (TRERC) announced last week that: “Texas housing manufacturers anticipate increased sales, production over next six months.” While it is absolutely possible that TRERC’s headline could prove to be accurate, their report nevertheless makes some vexing claims that on their surface appear to be demonstrably untrue.

Texas-based manufacturers obviously include several MHI member brands, including, but not limited to, Clayton Homes (BRK), Skyline Champion (SKY), and Cavco Industries (CVCO), which are sometimes referred to in MHVille as the Big Three.

TRERC, following an inquiry by MHProNews, began to add this disclaimer after the end of their monthly report: “This sentiment survey gauges current conditions and expectations surrounding Texas’ manufactured housing industry.” Per left-leaning Bing’s AI powered Copilot: “sentiment surveys provide valuable insights into…feelings” of those being surveyed.

That noted, “feelings” can be factually accurate, or feelings can be factually inaccurate.

Okay, to paraphrase that, a sentiment survey is a measure of the “feelings” or emotions of those being surveyed, correct? In the manufactured housing arena, the Texas Manufactured Housing Association (TMHA) and the Texas Real Estate Research Center (TRERC) produce a ‘monthly’ “sentiment survey.” Is it accurate to say that fact checks by Manufactured Home Pro News (MHProNews) have used known facts to call into question the value of the TRERC-TMHA sentiment surveys?

More will be explored in Part II of this report, fact check, analysis and commentary. But with this preface having established the topic being probed, the text of the most recent TMHA-TRERC release follows.

Part I – TMHA-TRERC release for March 2024.

Texas housing manufacturers anticipate increased sales, production over next six months

COLLEGE STATION, Tex. (Texas Real Estate Research Center) – Housing manufacturers in Texas saw an increase in general business activity for the 13th consecutive month, according to the February Texas Manufactured Housing Survey (TMHS). Extending a year-long expansion, the company-outlook index reached a seven-month high, trending upward with respondents unanimously anticipating more sales and production for the next six months.

“HUD code manufactured housing factories started 2024 with production back up near pre-pandemic levels,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association. “Retailers have trimmed down their aged inventory and are stocking up for the spring and summer buying seasons.”

Manufacturers ramped up hiring activity, extended workweeks, and increased capital expenditures amid robust demand expectations.

“The largest conference in the state for manufactured home community investors, TexCo, held in February in The Woodlands, highlighted several greenfield projects in the Dallas, Houston, San Antonio, and Corpus Christi metro areas along with existing community expansion projects,” said Ripperda.

TRERC Research Economist Harold Hunt, Ph.D., said loan refinancing rates and how inflation behaves are key points to watch.

“Manufacturers at TexCO noted that sales to manufactured home communities have accelerated in the last five years,” said Hunt. “However, one concern is high financing costs. Community owners were advised to contact their lenders well in advance for any loan refinancing. Depending on how inflation evolves over the next few months, the Federal Reserve could cut interest rates, which might boost investment further.”

Respondents expect less uncertainty heading into spring and remain generally optimistic despite some upticks in supply-chain disruptions and higher input costs. These costs may translate into higher prices for finished homes, but the trajectory of economic growth appears capable of offsetting these challenges.

—30—

ABOUT THE SURVEY

This sentiment survey gauges current conditions and expectations surrounding Texas’ manufactured housing industry. All members of the Texas Manufactured Housing Association (TMHA) with manufacturing facilities in the state are invited to participate, and the survey panel represents 89 percent of HUD-code homes produced in Texas. The survey, created as a joint project conducted for the manufactured housing industry by TMHA and TRERC, is updated monthly.

ABOUT TRERC

The Texas Real Estate Research Center at Texas A&M University (TRERC) is the nation’s largest publicly funded organization devoted to real estate research. Created by the state legislature in 1971 to meet the data and knowledge sharing needs of many audiences, including the real estate industry, instructors, researchers, legislators, and the public, the Center creates public content, including digital and print documents, publications, and multiple format videos which are available at the Center’s website. Subscribe to TRERC news releases and other publications here.

MHProNews Note: There are two hotlinks in the item above in that final paragraph which have been omitted.

Also, the link to the TRERC website following the location (Collage Station, TX) was omitted.

Part II – Additional Information with More MHProNews Analysis and Commentary

Per TRERC’s remarks above: “Extending a year-long expansion, the company-outlook index reached a seven-month high, trending upward with respondents unanimously anticipating more sales and production for the next six months.” The problems with that are many, but let’s focus on the following ‘pesky facts’ instead of ‘sentiments.’

1) Manufactured housing production nationally was trending down for most of the past year.

2) Not unlike the national trends, Texas itself had ups and downs, but were overall down year-over-year for most of the past year. Notice that the TMHA-TRERC ‘sentiment survey’ stays away from such pesky facts as they spin their narrative?

3) “HUD code manufactured housing factories started 2024 with production back up near pre-pandemic levels,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association.” There are apparently several problems with that remark. Among them is the fact that it is often contradicted by some of the factories which are MHI and TMHA members which have said that they are operating on pared down schedules and at levels well under plant capacities. Is Ripperda and TRERC calling the information being produced by their own members liars? Who is to be believed? The factories in their quarterly remarks which if they are materially incorrect could result in legal consequences? Or given #1 and #2 above, is it TRERC and TMHA that is likely giving ‘sentiments’ that for whatever reasons have little or no connection with clearly contradictory factual realities?

4) Per a fresh Q&A with Bing’s AI powered Copilot on 3.29.2024 at about 2:30 PM ET was the following exchange that used Copilot’s balanced or blue setting.

Fact checks of the Texas Real Estate Research Center (TRERC) monthly reports produced in conjunction with the Texas Manufactured Housing Association have by MHProNews have revealed apparent factually misleading or inaccurate information, isn’t that correct? Can you provide some context to that concern about the TRERC and TMHA ‘sentiment’ surveys seemingly being at odds with known facts??

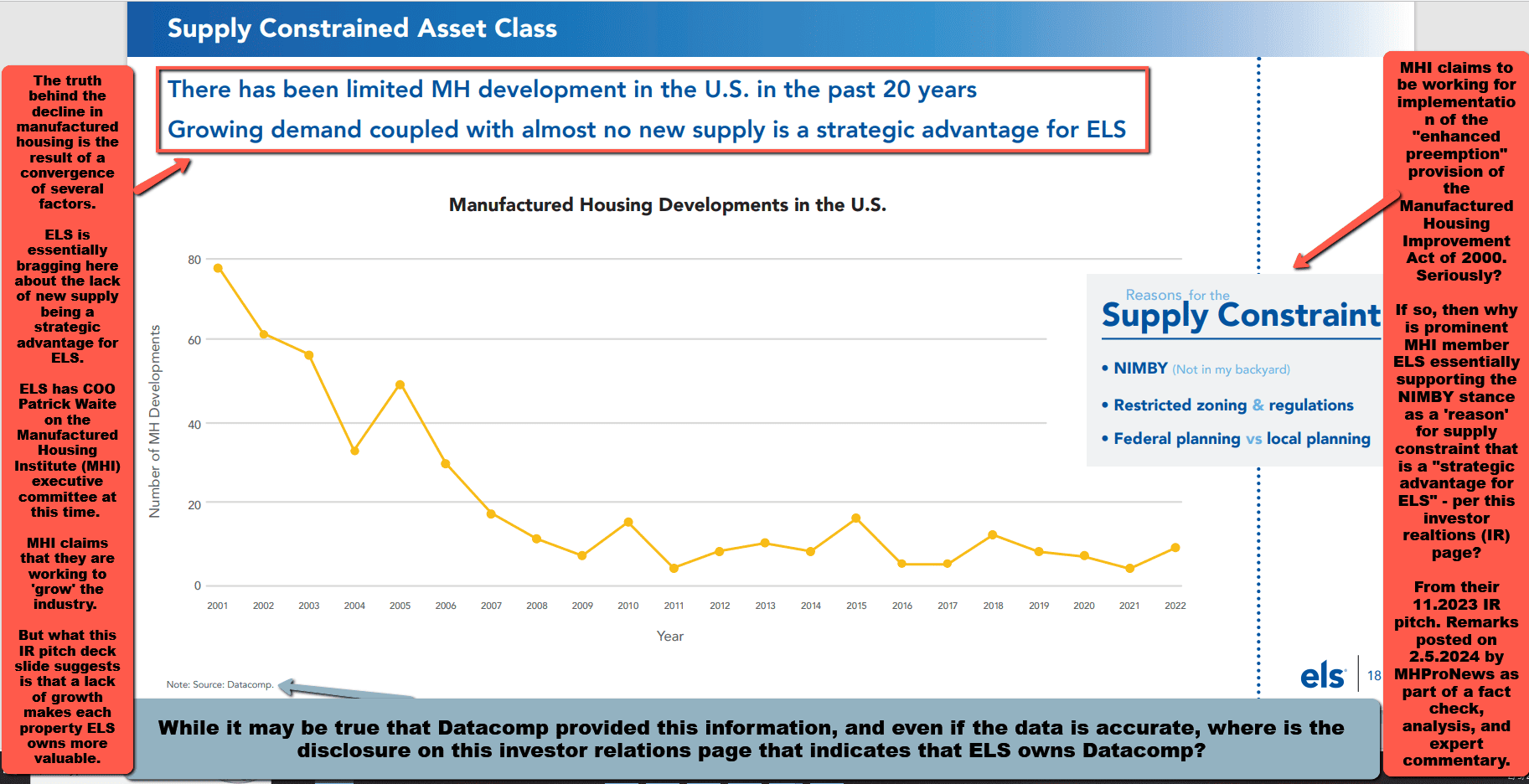

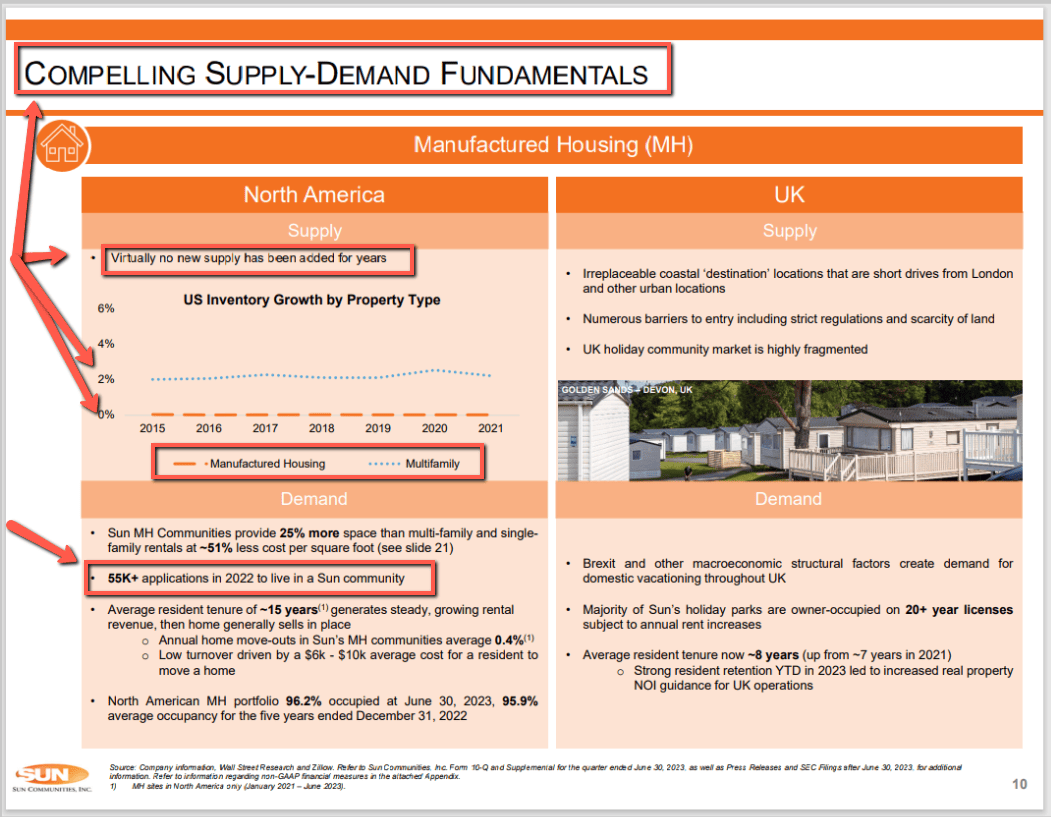

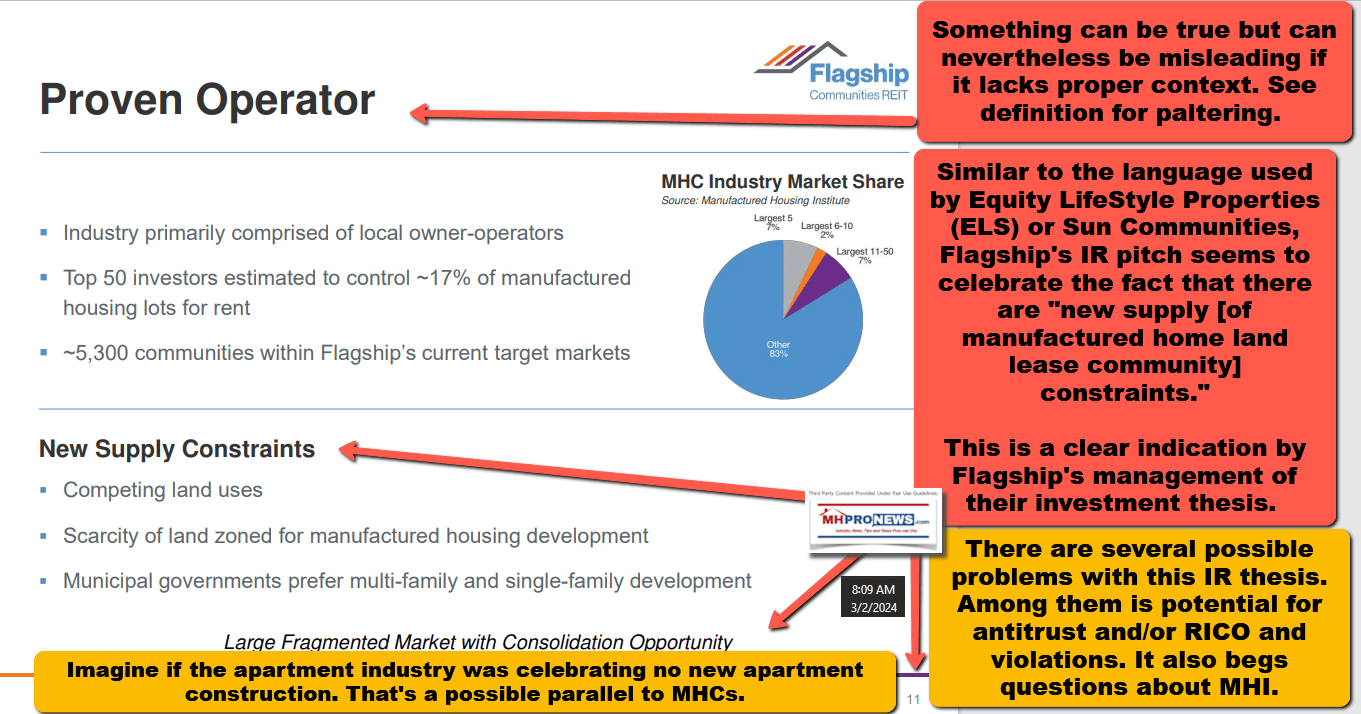

5) One interesting point made by the latest TRERC-TMHA report is this comment. “Manufacturers at TexCO noted that sales to manufactured home communities have accelerated in the last five years,” said Hunt.” While that is not entirely true, because producers such as Cavco and Skyline Champion have said that communities cut back on orders in 2023 (see reports linked above in #3 and previous reports by those firms linked from within those corporate comments), it may be true that for a time the trend has been for production in (for example) 2022 going into those land-lease communities increased. There are several ramifications from that, which include the point made by MHI member UMH Properties in their most recent earnings call. UMH said that land-lease communities nationally are filling up and will at some foreseeable point become effectively full. Per a prior fact check from Copilot found in that report linked below, those remarks have apparently not been published either by MHI or by MHI linked bloggers and trade media. Among the possible takeaways from that packed report is that without the development of hundreds of more land-lease communities annually, there could almost inevitably be a point where manufactured housing production will hit a wall if half of the production going into land-leases is suddenly thwarted. UMH’s remarks seem to be the polar opposite of what Sun Communities and ELS have said. And TRERC could have known this, if they were following these remarks either directly from the companies involved and/or if they were following MHProNews and considering the facts they find before they publish their dubious ‘sentiments.’

6) Note that a self-contradictory portion of the reply by Copilot is edited out in the reply that follows. Otherwise, Copilot’s response is as shown.

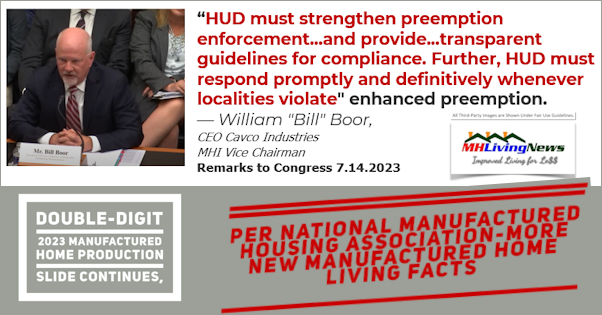

As a recent report on MHLivingNews reminded readers, both Manufactured Housing Institute member firms and Manufactured Housing Association for Regulatory Reform (MHARR) member firms told Congress in hearings that “enhanced preemption” as intended by Congress was not being routinely enforced. Instead, local zoning officials were often creating rules and standards that effectively blocked the placement of HUD Code manufactured homes, the opposite of what the Manufactured Housing Improvement Act of 2000 (MHIA or 2000 Reform Act) were supposed to accomplish with its enhanced preemption language. Confirm, clarify, and elaborate on that and indicate if TRERC has reported on federal preemption as a means of authentically growing production vs. mere sentiments.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Note: to expand this image below to a larger or full size, see the instructions

below the graphic below or click the image and follow the prompts.

There appears to be additional wrinkles that could lead to more litigation against companies that have arguably been manipulating the marketplace to the harm of affordable housing consumers independents, investors, taxpayers, and others. MHProNews signaled the coming wave of national antitrust cases months in advance. Will another wave follow that pull back the troubling veil on how enhanced preemption has been thwarted by MHI insiders? Time will tell, stay tuned to the only source in MHVille trade media that dares shine the light on the facts and evidence. ###

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.’