If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

Selected headlines and bullets from CNN Money:

- The case for raising the minimum wage keeps getting stronger

- Why Exxon isn’t enjoying America’s big oil party

- How Amazon made Prime into an indispensable product you’d pay anything for

- Ask us your personal finance questions

- US economy grew modestly in the first quarter

- Are women financially prepared to live longer than ever before?

- UK economy grinds to a halt

- Europe ready to hit back if Trump presses ahead with tariffs

- Russian oligarch retreats as sanctions slam his companies

- Why investors are stressed about the bond market

- Coke and Hershey’s costs are going up. Will you pay more?

- Airbus can’t get enough engines for its planes

- This is what’s rattling stocks right now

- US urged Wells Fargo to investigate its 401(k) tactics

- Oil prices could keep rising. Here’s why

- Robot co-workers? 7 cool technologies changing the way we work

- Documentary puts revenge porn in spotlight

- Former NBC News anchor Tom Brokaw faces sexual harassment allegations

- ‘Mass firing’ at conservative site RedState

- $4.4 billion bailout could save GM in South Korea

- China’s biggest tech companies have reason to be worried

- They beat Uber in Southeast Asia. And they’re just getting started

- Starbucks CEO: Arrests haven’t hurt sales

Selected headlines and bullets from Fox Business:

- Amazon is back as No. 2 market cap: Next stop $1 trillion?

- Amazon hikes Prime annual price to $119

- Tech, energy shares in stock market tug of war

- Trump jabs Merkel on defense spending, trade

- Stocks stuck in correction mode for longest stretch in 10 years

- Bill Murray’s Ground Hog Day is playing out on Wall Street.

- Cowboys star Jason Witten would retire as NFL’s highest-earning tight end

- Meet Shahid Khan, the Jaguars owner spearheading NFL’s British invasion

- NFL Draft rookie contract scale: Here’s how much each player will earn

- Amazon taking bite out of Main Street: Alan Patricof

- US consumers confident, but tariffs neutralize tax reform gains

- DocuSign: Your electronic signature is worth billions

- Top New Jersey Democratic lawmaker: Time to fix the Garden State, not tax it

- Wynn Resorts wants to drop ‘Wynn’ from $2.4B Boston Harbor project

- US economy on track, but avoid retail: Blackstone’s Schwarzman

Today’s markets and stocks, at the closing bell…

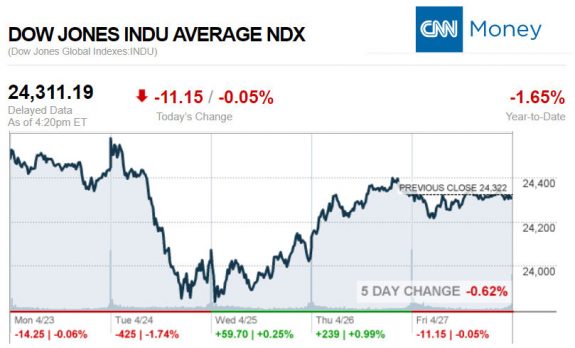

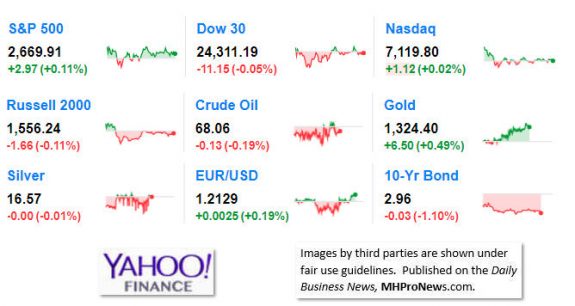

S&P 500 2,669.91 +2.97(+0.11%)

Dow 30 24,311.19 -11.15(-0.05%)

Nasdaq 7,119.80 +1.12(+0.02%)

Russell 2000 1,556.24 -1.66(-0.11%)

Crude Oil 68.06 -0.13(-0.19%)

Gold 1,324.40 +6.50(+0.49%)

Silver 16.57 -0.00(-0.01%)

EUR/USD 1.2129 +0.0025(+0.21%)

10-Yr Bond 2.96 -0.03(-1.10%)

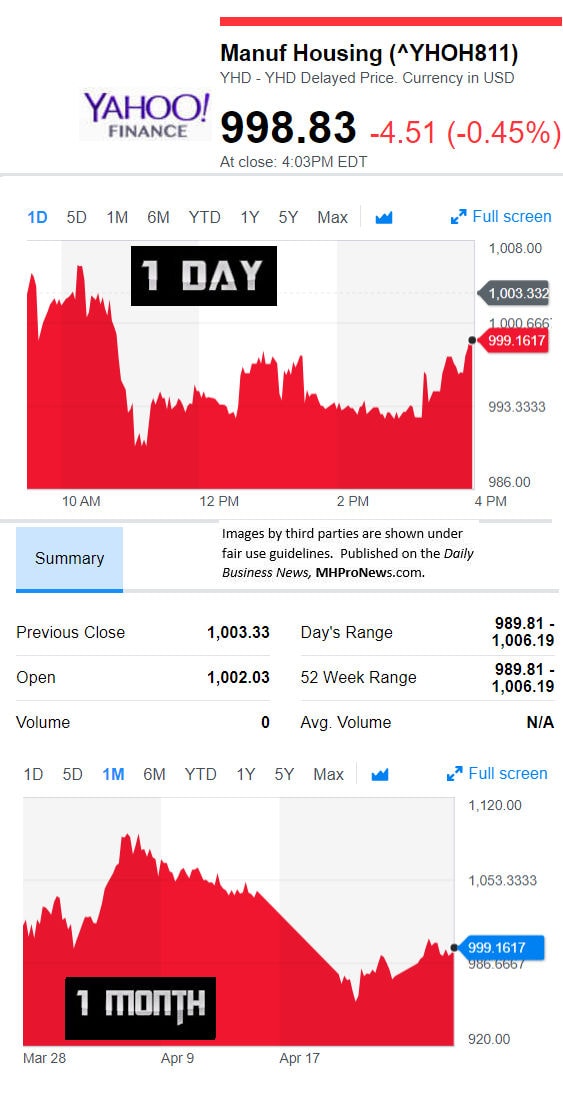

Manufactured Housing Composite Value (MHCV)

Today’s Big Movers

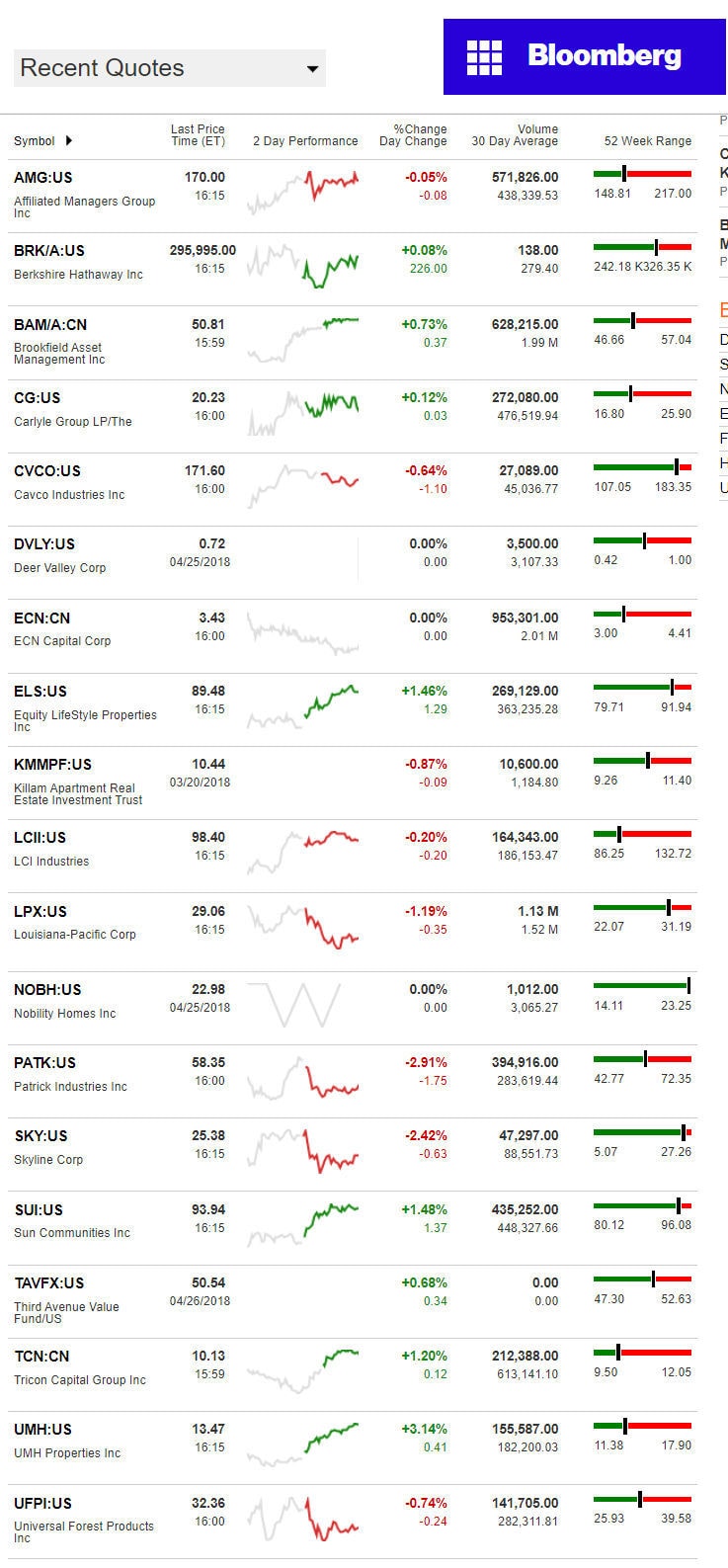

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

“First-quarter indicators showed that while the economy has yet to roar due to all the recent fiscal stimulus, it’s at least starting to purr,” said left-of-center CNBC.

Friday’s GDP reporting “painted a somewhat positive picture. The 2.3 percent growth rate may not have looked like anything spectacular, but it was the first time the first quarter beat economist expectations since 2008, according to Bespoke Investment Group.”

The employment cost index, a metric watched at Fed, of the compensation cost for nongovernment workers was up 2.7 percent, compared with 2.4 percent a year ago.

And several tech and other earnings blowouts “pushed Q1 profit gains up to a glittering 22.9 percent, easily the best quarter in at least seven years.”

“All things considered, the economy still appears to be on a solid footing, supported by a confident consumer sector — one with an optimism that is fueled by growing income and a strong labor market and is well positioned to spend more in the coming quarters,” said Jim Baird, chief investment officer for Plante Moran Financial Advisors.

Bloomberg Closing Ticker for MHProNews…

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)